Académique Documents

Professionnel Documents

Culture Documents

Microsoft Stock Analysis Report

Transféré par

InvestingSidekickCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Microsoft Stock Analysis Report

Transféré par

InvestingSidekickDroits d'auteur :

Formats disponibles

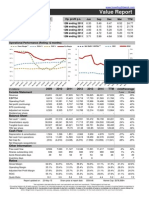

Microsoft Corporation

www.InvestingSidekick.com

MSFT

Value Report

I.S.Q. Score: 7/10

TTM EPS:

Next year EPS estimate:

Net cash* / (debt) p.s:

Net debt EBITDA:

Net debt Equity:

2.47

2.76

7.86

-

Op. profit p.s.

Jun

Sep

Dec

Mar

TTM

12M ending 2015

12M ending 2014

12M ending 2013

12M ending 2012

12M ending 2011

0.79

0.73

0.02

0.74

0.68

0.71

0.76

0.63

0.86

0.83

0.95

0.96

0.93

0.95

0.97

0.82

0.84

0.91

0.76

0.68

3.26

3.29

2.49

3.31

3.16

Operational Performance (Rolling 12 months)

Gross Margin**

SG&A %

R&D %

Net Debt / EBITDA**

Op Margin

90%

45%

80%

40%

ROE

ROIC

180%

1.2

160%

1.0

140%

35%

70%

60%

30%

50%

25%

120%

0.8

100%

0.6

40%

20%

30%

15%

20%

10%

80%

60%

0.4

40%

0.2

10%

5%

0%

0%

2009

$ millions

2010

2011

20%

0%

2012

2013

2014

TTM

Income Statement

Revenue

CAGR/average

5 year

10 year

58,437

21,677

20,363

14,569

1.64

14,569

0.52

62,484

26,994

24,098

18,760

2.16

18,760

0.52

69,943

30,232

27,161

23,150

2.76

23,150

0.64

73,723

24,814

21,763

16,978

2.03

23,171

0.80

77,849

30,559

26,764

21,863

2.63

21,863

0.92

86,833

32,746

27,759

22,074

2.68

22,227

1.12

94,782

32,916

26,696

20,000

2.47

22,133

1.21

8%

9%

6%

9%

10%

9%

17%

9%

12%

12%

10%

14%

11%

21%

25,701

39,558

25,296

2.84

30,849

46,175

32,623

3.76

40,851

57,083

43,758

5.22

51,096

66,363

49,741

5.93

61,422

78,944

61,206

7.35

63,064

89,784

62,676

7.61

63,570

90,132

61,441

7.60

20%

18%

20%

22%

0%

2%

-1%

2%

2,562

19,037

(3,119)

(868)

2,673

24,073

(1,977)

(245)

2,766

2,967

26,994

31,626

(2,355)

(2,305)

(71) (10,112)

3,755

28,833

(4,257)

(1,584)

5,212

32,231

(5,485)

(5,937)

6,206

31,778

(5,493)

-

15%

11%

12%

47%

16%

8%

11%

108%

15,918

8,908

70

22

22,096

8,668

76

22

24,639

8,376

78

32

29,321

8,381

78

24

24,576

8,328

82

35

26,746

8,239

82

36

26,285

8,090

48

27

11%

-2%

79

30

7%

-3%

77

34

Gross Margin

79.2%

80.2%

77.7%

76.2%

74.0%

69.0%

65.0%

75.4%

78.3%

Operating Margin

34.8%

38.6%

38.8%

29.5%

34.4%

32.0%

28.2%

34.7%

35.5%

EBITDA

Operating Profit

Net profit (continuing)

EPS (continuing)

Adjusted net income

Dividend per share

Balance Sheet

Net cash* / (debt)

Shareholders equity

Tangible book value

TBV per share

Cash Flow

Depreciation & amortization

Net cash from operations

Net Cap Ex

Net Disposals (acquisitions)

Other Information

Free cash flow

Shares outstanding (mil)

Accts Receivable days

Inventory days

Ratios

Adjusted Net Profit Margin

ROIC

Quick Ratio

24.9%

30.0%

33.1%

31.4%

28.1%

25.6%

23.4%

29.6%

28.9%

101.4%

119.0%

139.5%

109.1%

123.6%

81.8%

74.9%

114.6%

131.1%

2.3

2.0

1.6

Report updated on:

23-May-15

1.9

2.4

2.4

Share price at report date:

2.5

$47.31

2.3

2.6

Market Cap: $382,718m

*Net cash/debt is total debt offset by cash, cash equivalents and short term investments. **Plotted against Left hand axis

Investing Sidekick Ltd. All rights reserved. This report is for information purposes only and accuracy is not guaranteed. Certain financial information included in Investing Sidekick is proprietary to

Mergent, Inc. (Mergent) Copyright 2015. Reproduction of such information in any form is prohibited. Because of the possibility of human or mechanical error by Mergents sources, Mergent or

others, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results obtained from the use of such information.

Microsoft Corporation

www.InvestingSidekick.com

MSFT

Value Report

EV/OP trading range

Conservative model value

Aggressive model value

Current EV/OP (TTM)

Current EV/OP 12.0

(Enterprise Value / Operating Profit)

Return on Invested Capital

29.5

Free Cash ROIC

114.6%

142.0%

(5 year average)

24.5

Free Cash Flow Operating Profit

99%

15 years

94%

10 years

100%

5 years

19.5

% spending of FCF on

14.5

Net Acquisitions/(divestitures)

Dividends

9.5

Share buybacks / (issues)

Decrease/(increase) of net debt

4.5

Other spending/(asset sales)

14%

41%

57%

1%

(13%)

(cumulative last 10 years)

P/B trading range

P/B = 1

Book value p.s. 11.14

Current P/B

8.9

Average annual change in

Book Value p.s.

TBV p.s.

11.3%

9.4%

15 years

15 years

6.7%

4.4%

10 years

10 years

19.8%

22.5%

5 years

5 years

6.9

4.9

Compounded annual growth in

Book Value p.s.

TBV p.s.

7.6%

4.9%

15 years

15 years

10.3%

7.0%

10 years

10 years

19.6%

19.2%

5 years

5 years

0.9

Book Value per share

Quick Ratio (Acid test)

Accounts receivable days

35,000

12

30,000

10

25,000

20,000

6

15,000

4

10,000

5,000

Quick Ratio

Free Cash Flow

Tangible Book Value per share

Book Value per share ($)

Operating Income

Inventory days

350%

70.0

300%

60.0

250%

50.0

200%

40.0

150%

30.0

100%

20.0

50%

10.0

0%

0.0

Inventory/Accounts receivable days

2.9

Operating Profit / FCF ($mil)

7.60

3.94

7.86

Tangible Book (TBV) p.s.

Net Net Curr. Assets p.s.

Net cash* / (debt) p.s.

10.9

(Seasonally adjusted data)

Report updated on: 23-May-15

Share price at report date:

$47.31

Market Cap: $382,718m

*Net cash/debt is total debt offset by cash, cash equivalents and short term investments.

Investing Sidekick Ltd. All rights reserved. This report is for information purposes only and accuracy is not guaranteed. Certain financial information included in Investing Sidekick is proprietary to

Mergent, Inc. (Mergent) Copyright 2015. Reproduction of such information in any form is prohibited. Because of the possibility of human or mechanical error by Mergents sources, Mergent or

others, Mergent does not guarantee the accuracy, adequacy, completeness, timeliness or availability or for the results obtained from the use of such information.

Vous aimerez peut-être aussi

- QuizDocument3 pagesQuizInvestingSidekickPas encore d'évaluation

- Cisco Stock Analysis ReportDocument2 pagesCisco Stock Analysis ReportInvestingSidekickPas encore d'évaluation

- Berkshire Hathaway Equity ResearchDocument2 pagesBerkshire Hathaway Equity ResearchInvestingSidekickPas encore d'évaluation

- IBM Stock Analysis ReportDocument2 pagesIBM Stock Analysis ReportInvestingSidekick100% (1)

- Oracle Stock Analysis ReportDocument2 pagesOracle Stock Analysis ReportInvestingSidekickPas encore d'évaluation

- Johnson Johnson Stock Analysis ReportDocument2 pagesJohnson Johnson Stock Analysis ReportInvestingSidekickPas encore d'évaluation

- Verizon Stock Analysis ReportDocument2 pagesVerizon Stock Analysis ReportInvestingSidekickPas encore d'évaluation

- Apple Stock Analysis ReportDocument2 pagesApple Stock Analysis ReportInvestingSidekickPas encore d'évaluation

- Customer Solutions ModelDocument8 pagesCustomer Solutions ModelInvestingSidekick0% (1)

- Google Stock Analysis ReportDocument2 pagesGoogle Stock Analysis ReportInvestingSidekickPas encore d'évaluation

- Netflix Stock Analysis ReportDocument2 pagesNetflix Stock Analysis ReportInvestingSidekickPas encore d'évaluation

- House Buying Vs RentingDocument14 pagesHouse Buying Vs RentingInvestingSidekickPas encore d'évaluation

- Boeing Stock Analysis ReportDocument2 pagesBoeing Stock Analysis ReportInvestingSidekick100% (1)

- EAM Solar ProspectusDocument178 pagesEAM Solar ProspectusInvestingSidekickPas encore d'évaluation

- EAM Solar ProspectusDocument178 pagesEAM Solar ProspectusInvestingSidekickPas encore d'évaluation

- IBM 10 Year FinancialsDocument1 pageIBM 10 Year FinancialsInvestingSidekickPas encore d'évaluation

- Gencorp Annual Report 2013Document177 pagesGencorp Annual Report 2013InvestingSidekickPas encore d'évaluation

- The Washington Post Company 1971 Annual ReportDocument33 pagesThe Washington Post Company 1971 Annual ReportInvestingSidekickPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Tablet-Case-SpreadsheetDocument138 pagesTablet-Case-SpreadsheetdynaPas encore d'évaluation

- Merger Analysis APV MethodDocument22 pagesMerger Analysis APV MethodPrashantKPas encore d'évaluation

- 2021 Mocks Instructions For Students: Download The Zip FileDocument23 pages2021 Mocks Instructions For Students: Download The Zip FileAnna SokolovaPas encore d'évaluation

- Jaguar Land Rover: Bond Valuation: Report Submitted By: Muhammad Fahad SohailDocument5 pagesJaguar Land Rover: Bond Valuation: Report Submitted By: Muhammad Fahad SohailRuchi SharmaPas encore d'évaluation

- Safal Niveshak Stock Analysis Excel GuideDocument49 pagesSafal Niveshak Stock Analysis Excel GuideRamesh ReddyPas encore d'évaluation

- Genting Malaysia Berhad 110220Document51 pagesGenting Malaysia Berhad 110220BT GOHPas encore d'évaluation

- Module 3 - Going Concern Asset Based Valuation - DCFDocument5 pagesModule 3 - Going Concern Asset Based Valuation - DCFLiaPas encore d'évaluation

- Tonka Corporation: Name Student IdDocument17 pagesTonka Corporation: Name Student IdMd. Mustakim Uddin MishuPas encore d'évaluation

- KGAR21 Financial ReviewDocument8 pagesKGAR21 Financial ReviewJhanvi JaiswalPas encore d'évaluation

- Book Summary - Investment BankingDocument44 pagesBook Summary - Investment BankingabcdefPas encore d'évaluation

- Basics of Valuation: Unit Two-6 HoursDocument12 pagesBasics of Valuation: Unit Two-6 HoursAjay ShahPas encore d'évaluation

- Risk Free: Special Dividend Effect On Beta: Chrysler, The Automotive Manufacturer, Had ADocument18 pagesRisk Free: Special Dividend Effect On Beta: Chrysler, The Automotive Manufacturer, Had AAshutosh TulsyanPas encore d'évaluation

- U.S. Composite Corporation Financial StatementsDocument28 pagesU.S. Composite Corporation Financial StatementsMercedes Figueroa HilarioPas encore d'évaluation

- Financial valuation of 3 public companiesDocument3 pagesFinancial valuation of 3 public companiesFatinPas encore d'évaluation

- Quiz 2 SolDocument56 pagesQuiz 2 SolVikram GulatiPas encore d'évaluation

- Kellogg Valuation HelpDocument56 pagesKellogg Valuation HelpJames WrightPas encore d'évaluation

- Lupin Ltd Equity Research AnalysisDocument14 pagesLupin Ltd Equity Research AnalysisRohan AgrawalPas encore d'évaluation

- Meerut Adventure Company CV1Document9 pagesMeerut Adventure Company CV1Ayushi GuptaPas encore d'évaluation

- Live Nation Entertainment IncDocument15 pagesLive Nation Entertainment Incmk1pvPas encore d'évaluation

- Group Assignment: Subject: Financial Report AnalysisDocument21 pagesGroup Assignment: Subject: Financial Report Analysisk21clca1 hvnhPas encore d'évaluation

- 3M Equity ResearchDocument63 pages3M Equity ResearchKai YangPas encore d'évaluation

- Chapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceDocument19 pagesChapter 13. Tool Kit For Corporate Valuation, Value-Based Management and Corporate GovernanceHenry RizqyPas encore d'évaluation

- Duke Fuqua CaseBook-2013Document177 pagesDuke Fuqua CaseBook-2013Zouhairi TalaPas encore d'évaluation

- Corporate RestructuringDocument46 pagesCorporate RestructuringMilu Mathew MoorkkattilPas encore d'évaluation

- Financial Analysis of Pakistan State Oil For The Period July 2017-June 2020Document25 pagesFinancial Analysis of Pakistan State Oil For The Period July 2017-June 2020Adil IqbalPas encore d'évaluation

- AEC 6 - Financial ManagementDocument6 pagesAEC 6 - Financial ManagementRhea May BalutePas encore d'évaluation

- Hind. UnileverDocument37 pagesHind. UnileveradasdasPas encore d'évaluation

- Solution_to_Ch14_P13_Build_a_ModelDocument6 pagesSolution_to_Ch14_P13_Build_a_ModelALI HAIDERPas encore d'évaluation

- Cash Flow Statement For AAPLDocument2 pagesCash Flow Statement For AAPLEzequiel FriossoPas encore d'évaluation

- Tutorial 06 Solution For Additional ProblemsDocument6 pagesTutorial 06 Solution For Additional ProblemsTrung ĐàmPas encore d'évaluation