Académique Documents

Professionnel Documents

Culture Documents

Set 7753acef

Transféré par

Bouchraya MilitoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Set 7753acef

Transféré par

Bouchraya MilitoDroits d'auteur :

Formats disponibles

FINA 4400 Final Exam Ch.

22

Study online at quizlet.com/_euehr

1.

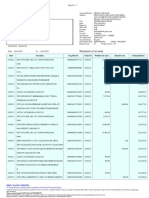

2.

3.

4.

5.

6.

7.

; A bond's price changes 2% when

interest rates drop. The duration

model would predict a price increase

of more than 2%

False

After interest rate and yield curve

changes, a bank's market value of

assets increased $4 million and the

market value of its liabilities fell $6

million. The book value of equity

______ and the market value of

equity _____.

was unchanged;

increased $10

million

A bank has an average asset duration

of 2.25 years, the average duration of

the liabilities is 1.25 years, and the

bank has total assets of $2 billion and

$200 million in equity. The bank has

an ROE of 9.00%. If all interest rates

decrease 50 basis points, the

predicted change in the bank's market

value of equity is ___________.

DGap = DurA kDurL = 2.25 (0.90 x 1.25) =

1.125; %E = 1.125 x (0.005/1.09) x $2

bill/$200 million

= 5.16%;

A bank has a negative duration gap.

Interest rates decline. Which one of

the following best describes the effects

of the interest rate change?

The bank's

market value of

equity goes down

because the

market value of

its liabilities

increases by more

than the market

value of its assets

increases

A bank has a negative duration gap.

Which one of the following statements

is most correct?

8.

9.

If all interest

rates are

projected to

decrease, to limit

a net value

decline, before

rates fall the bank

should increase

the amount of

long-term loans

on the balance

sheet

A bank has a negative repricing gap

and estimates that the spread between

RSAs and RSLs will move inversely

with interest rates. If interest rates

increase, NII will:

fall

A bank has a negative repricing gap.

This implies that:

some RSLs are

financing fixedrate assets

10.

11.

12.

13.

A bank has a negative

repricing gap using a 6-month

maturity bucket. Which one of

the following statements is

most correct if MMDAs are

rate-sensitive liabilities?

If all interest rates are

projected to increase, to

limit a profit decline when

this occurs, the bank

could encourage its retail

deposit customers to

switch from MMDAs to 2year CDs at current rates

A bank has a positive

duration gap. Which one of

the following statements is

most correct?

If all interest rates are

projected to increase, to

limit a net value decline

before rates rise, the bank

should increase shortterm loans and decrease

long-term loans

A bank has a positive

repricing gap and estimates

that the spread between RSAs

and RSLs will move directly

with interest rates. If interest

rates fall, the bank's overall

NII will:

fall

A bank has a positive

repricing gap. This implies

that:

some RSAs are financed

by fixed-rate liabilities

A bank has a positive

repricing gap using a 6-month

maturity bucket. Which one of

the following statements is

most correct?

If all interest rates are

projected to decrease, to

limit a profit decline when

this occurs, the bank

could encourage its retail

loan customers to switch

from 1-month reset

floating rate loans to 3year fixed-rate loans at

current rates

A bank has book value of

assets equal to $800 million

and market value of assets

equal to $1,100 million. The

bank has book value of

liabilities of $700 million and

market value of liabilities

equal to $850 million. The

bank's market-to-book ratio

is:

(1,100 - 850)/(800 - 700)

= 2.5

14.

15.

16.

17.

18.

19.

20.

21.

22.

A bank has three assets. It has $75 million

invested in consumer loans with a 3-year

duration, $39 million invested in T-Bonds

with a 16-year duration, and $39 million in

6-month maturity T-Bills. What is the

duration of the bank's asset portfolio in

years?

[(975/132)

x 3] +

[(39/132) x

16] +

[(18/132) x

0.5] = 6.50

A bank is facing a forecast of rising

interest rates. How should they set the

repricing and duration gap?

Positive

repricing

gap and

negative

duration

gap

A bank's balance sheet is characterized by

long-term fixed-rate assets funded by

short-term, variable-rate liabilities.

Most likely

the bank

has a

negative

repricing

gap and a

positive

duration

gap;

23.

24.

The bank's one-year repricing gap is

(Million $):

RSAs RSLs =

[200 + 225]

- [260 + 25]

= $140;

The cash flow from the interest a bank

receives on a long-term loan that is

normally reinvested is called the runoff

from the loan

True

Convexity arises because a fixed income's

price is a nonlinear function of interest

rates

True

Convexity in bond prices is caused by the:

curvature

around the

bond price

yield

relationship

25.

26.

27.

28.

29.

Due to convexity problems, banks are

actually better off using the simpler

repricing model to manage interest rate

risk rather than the duration model

False

The duration gap model is a more

complete measure of interest rate risk

than the repricing model

True

30.

31.

32.

An FI's balance sheet is characterized

by long-term fixed-rate assets funded

by short-term variable-rate securities.

Most likely the

bank has a

negative

repricing gap

and a positive

duration gap

For a 9-month maturity bucket the

bank has _______ in fixed-rate assets

and _______ in fixed-rate liabilities.

FRA = cash +

LT loans = 35 +

250 = $285;

FRL = Fixedrate deposits +

LT borrow =

240 + 119 =

$359

For a bank with a positive duration

gap, an increase in interest rates will:

increase the

likelihood of

insolvency

For a one-year maturity bucket, the

repricing model assumes that a 9month loan is as equally rate-sensitive

as a 3-month loan

True

For large interest rate declines,

duration _____ the increases in the

bond's price, and for large interest rate

decreases, it ____ the decline in the

bond's price.

underpredicts;

overpredicts

If a bank has a negative repricing gap,

falling interest rates increase

profitability

True

If a bank wishes to have a positive

balance sheet repricing gap and a

negative balance sheet duration gap,

then the bank should predominantly

have short-term rate-sensitive assets

funded by long-term fixed-rate

liabilities

True

If DA > kDL, then falling interest rates

will cause the market value of equity to

rise

True

If interest rates increase 100 basis

points the predicted dollar change in

equity value will equal:

-[2.4 - ((850 82)/850) x 0.9]

x 0.01/1.06 x

850,000,000 =

-$12,724,528

If the spread effect is zero and all

interest rates decline 50 basis points,

the bank's NII will change by ______

over the year.

140 million x 0.0050 = $700,000

33.

34.

35.

36.

37.

38.

39.

40.

41.

42.

43.

In a bank's three-month

maturity bucket, a 30-year ARM

with a rate reset in six months

would be considered a fixed

rate asset, but in its one-year

maturity bucket, this ARM

would be considered a ratesensitive asset

True

Insolvency occurs when an

institution's duration gap

becomes negative

False

A rate-sensitive asset is one that

either matures within the

maturity bucket or one that will

have a payment change within

the maturity bucket if interest

rates change

True

The repricing gap fails to

consider how the value of fixed

income accounts will change

when rates change

True

The repricing gap is the most

comprehensive measure of

interest rate risk used by

financial intermediaries

False

The "runoff" of fixed income

contracts is itself rate-sensitive

True

The structure of a bank's

balance sheet as evidenced by

its repricing gap and its

duration gap affects a bank's

sensitivity to interest rate

changes. Which one of the

following statements about the

two types of gaps is true?

The duration gap

considers all cash flows

up to and including

maturity, whereas the

repricing gap really only

considers how cash

flows will change

within the maturity

bucket

To get DE to equal zero to

protect the equity value in the

event of an interest rate change:

the bank could increase

DL to 2.66 years

Weaknesses of the duration gap

immunization model include all

but which of the following?

Duration measures only

how cash flows change,

not the present value of

those changes

Weaknesses of the repricing

model include the fact that:

I, II, and III

What is the bank's duration gap

in years?

2.4 - ([(850-82)/850] x

0.9) = 1.5868

44.

With a 6-month maturity bucket, a 9-month

fixed rate loan would be considered a

______ asset and a 30-year mortgage with a

rate adjustment in 3 months would be

classified as a _____ asset.

fixedrate;

ratesensitive

Vous aimerez peut-être aussi

- NPV and IRR investment rulesDocument37 pagesNPV and IRR investment rulesBouchraya MilitoPas encore d'évaluation

- Expert Advisor Programming - Creating Automated Trading System in MQL For Metatrader 4Document212 pagesExpert Advisor Programming - Creating Automated Trading System in MQL For Metatrader 4pgeronazzo845098% (40)

- CMA Exam StrategiesDocument3 pagesCMA Exam StrategiesAlthaf AhamedPas encore d'évaluation

- IFRS in Your Pocket 2016 PDFDocument120 pagesIFRS in Your Pocket 2016 PDFPiyush Shah100% (2)

- FIN222 Autumn2015 Lectures Lecture 3Document55 pagesFIN222 Autumn2015 Lectures Lecture 3Bouchraya MilitoPas encore d'évaluation

- CMA Exam StrategiesDocument3 pagesCMA Exam StrategiesAlthaf AhamedPas encore d'évaluation

- CMA Exam StrategiesDocument3 pagesCMA Exam StrategiesAlthaf AhamedPas encore d'évaluation

- ECON101 CPI and Interest (Ch 11Document2 pagesECON101 CPI and Interest (Ch 11Bouchraya Milito75% (4)

- FIN222 Autumn2015 Lectures Lecture 1Document31 pagesFIN222 Autumn2015 Lectures Lecture 1Bouchraya MilitoPas encore d'évaluation

- Fina4400 Final ExamDocument3 pagesFina4400 Final ExamBouchraya MilitoPas encore d'évaluation

- Foreign Direct Investment and Corporate StrategyDocument11 pagesForeign Direct Investment and Corporate StrategyBouchraya Milito100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Directive For The Protection of Critical Information Infrastructure (CII)Document24 pagesDirective For The Protection of Critical Information Infrastructure (CII)Qwame EntwiPas encore d'évaluation

- PERT/CPM Project Planning, Scheduling and ControlDocument58 pagesPERT/CPM Project Planning, Scheduling and ControlJayson J. PagalPas encore d'évaluation

- Competing and Co-Existing Business Models For EV: Lessons From International Case StudiesDocument12 pagesCompeting and Co-Existing Business Models For EV: Lessons From International Case StudiesVishan SharmaPas encore d'évaluation

- White Collar CrimeDocument57 pagesWhite Collar CrimeShashi DasPas encore d'évaluation

- Analisa Revenue Cabang & Depo SBY - Ytd 2021Document52 pagesAnalisa Revenue Cabang & Depo SBY - Ytd 2021sholehudinPas encore d'évaluation

- Strategi Digital Branding Pada Startup Social Crowdfunding: Syahrul Hidayanto & Ishadi Soetopo KartosapoetroDocument15 pagesStrategi Digital Branding Pada Startup Social Crowdfunding: Syahrul Hidayanto & Ishadi Soetopo Kartosapoetrofour TeenPas encore d'évaluation

- Alibaba's Founding and Rapid GrowthDocument3 pagesAlibaba's Founding and Rapid Growthtayyab malikPas encore d'évaluation

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDocument12 pagesStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceChelana JainPas encore d'évaluation

- Purchase Order Accruals-3Document5 pagesPurchase Order Accruals-3bhogaraju ravi sankarPas encore d'évaluation

- B Plan For Café SaharaDocument18 pagesB Plan For Café SaharaPrajwal RahangdalePas encore d'évaluation

- Patent Assignment Cover Sheet: Electronic Version v1.1 Stylesheet Version v1.2Document42 pagesPatent Assignment Cover Sheet: Electronic Version v1.1 Stylesheet Version v1.2OneNation100% (3)

- National Intellectual Property Policy & StrategyDocument78 pagesNational Intellectual Property Policy & StrategyRMPas encore d'évaluation

- Advantages and Disadvantages of Reinforced Brick MasonryDocument1 pageAdvantages and Disadvantages of Reinforced Brick MasonryKamran FareedPas encore d'évaluation

- 59 Sta. Clara Homeowners' Asso. V Sps. Gaston, GR No. 141961, January 23, 2002Document7 pages59 Sta. Clara Homeowners' Asso. V Sps. Gaston, GR No. 141961, January 23, 2002Edgar Calzita AlotaPas encore d'évaluation

- Nism Viii Test 1Document14 pagesNism Viii Test 1Ashish Singh100% (1)

- Capital Receipt Model for Tamil Nadu Highway ProjectDocument7 pagesCapital Receipt Model for Tamil Nadu Highway ProjectdeswalanujPas encore d'évaluation

- Dependency Theory Explains Persistent PovertyDocument4 pagesDependency Theory Explains Persistent PovertyEmily JamioPas encore d'évaluation

- Take Home Midterms Mix 30Document6 pagesTake Home Midterms Mix 30rizzelPas encore d'évaluation

- Central Delhi Court Bar Appl Form-2Document2 pagesCentral Delhi Court Bar Appl Form-2Sanjeev kumar0% (1)

- CV Udpated-Ac-2 PDFDocument4 pagesCV Udpated-Ac-2 PDFTahir SirtajPas encore d'évaluation

- Business Valuation & Deal Structuring (Investment Banking)Document17 pagesBusiness Valuation & Deal Structuring (Investment Banking)MumtazPas encore d'évaluation

- How To Budget Your Money WiselyDocument2 pagesHow To Budget Your Money WiselyBrando Neil SarciaPas encore d'évaluation

- Project Report On Trading FirmDocument5 pagesProject Report On Trading FirmMathan RajPas encore d'évaluation

- Power Point WcasetDocument24 pagesPower Point WcasetFauzan MiraclePas encore d'évaluation

- PNL November 2021Document19 pagesPNL November 2021putripandeanPas encore d'évaluation

- Appendix 19.1 - Certificate of Emergency Purchase (For Supplies - Materials)Document1 pageAppendix 19.1 - Certificate of Emergency Purchase (For Supplies - Materials)PSD OCM-BARMMPas encore d'évaluation

- Assignment 2 - BenchmarkingDocument7 pagesAssignment 2 - BenchmarkingJona D'john50% (2)

- Shareholder equity calculations and entriesDocument7 pagesShareholder equity calculations and entriesMingPas encore d'évaluation

- Marketing Strategy Cases Text Book Midterm CasesDocument31 pagesMarketing Strategy Cases Text Book Midterm CasesThan HuyenPas encore d'évaluation

- Ee Assignment Lu 6Document6 pagesEe Assignment Lu 6NethiyaaRajendranPas encore d'évaluation