Académique Documents

Professionnel Documents

Culture Documents

Assignl

Transféré par

Anil Singh BishtCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assignl

Transféré par

Anil Singh BishtDroits d'auteur :

Formats disponibles

1} How the Indian banks are leveraging the technology in addressing

the future generations without compromising on traditional paper

based transactions?

Ans)-Indian Bank has come up with different technologies in banking sector

more making banking easy and familiar to common people.

The most important point for introducing technology is that customer wants to

do is work faster within seconds without moving anywhere he would be

interested towards technology to do any transactions.

Indian Banks have come up with different technologies like mentioned below.

ATM

INTERNET BANKING

MOBILE BANKING

PHONE BANKING

IMPS

CARDLESS CASH FACILITY

CASH DEPOSIT MACHINE

CHEQUE DEPOSIT MACHINE

VIDEO CALLING

Account Opening Tablet

Banks has given different opportunity to customer without coming to bank and

wasting their time.

More the usage of technology less will be the paper work .As right said India

average population will be of age 29 this matters a lot for banking sector.

More the banks bring new technology more will be the customer as they show

interest to wards technology.

Banks has given different modes to transact to the cutomer according to their

convinent.

2)Explain the internet and mobile banking process and its merits and

demerits. And discuss the measures taken by banks to protect safety

and security of online transactions?

Ans)

Merits:The major merit of these two technology is customer is not needed to

come from a long distance from his home to the bank to do the

transaction .

He can sit at his home and can transact what ever he like.

No usage of paper customer need to verify himself by logging into

internet banking with his credentials

Customer has different options.

He can transfer money from ICICI to ICICI

He can transfer money from ICICI to other bank

He can transfer money to abroad

He can place any kind of request

He can see his statement

He can different investment which suits him the best

(FD,RD,Insurance,Mutualfund etc)

And many more options bill payment/ecs/recharge etc.

Any problem he can contact to customer care 24*7

Demerits:Due to more fraud in online customer need to be careful regarding fishing

Most of the data is hacked by hackers and are used against you

The money will be deducted from the account

Never to share any credentials with any one

Bank need to provide more secured site for customer there must be different

level of verification like mentioned below.

OTP should be send to registered mobile number

GRID Values should be asked present on back of the card

CVV number must be asked

Pin must be asked

3D secure pin must be asked

At last the transaction password must be asked

If all the process is successfully verified then only transaction must be happen

so no frauds can be done

Vous aimerez peut-être aussi

- Role of MediaDocument18 pagesRole of MediaAnil Singh BishtPas encore d'évaluation

- LT E-BillDocument2 pagesLT E-BillAnil Singh BishtPas encore d'évaluation

- India's Demographic Dividend: AnnexureDocument4 pagesIndia's Demographic Dividend: AnnexureAnil Singh BishtPas encore d'évaluation

- Final Survey ReportDocument21 pagesFinal Survey ReportAnil Singh BishtPas encore d'évaluation

- FOIR CalculatorDocument9 pagesFOIR CalculatorAnil Singh Bisht0% (1)

- Demographic DividendDocument13 pagesDemographic DividendAnil Singh BishtPas encore d'évaluation

- PSB Clerical Challan 2012-13Document1 pagePSB Clerical Challan 2012-13prasannalakshmi_gurralaPas encore d'évaluation

- MB0049 Summer Drive Assignment 2012Document2 pagesMB0049 Summer Drive Assignment 2012Anil Singh BishtPas encore d'évaluation

- Air Force Common Admission Test (Afcat) : Scheme of Syllabus & Example of QuestionsDocument6 pagesAir Force Common Admission Test (Afcat) : Scheme of Syllabus & Example of QuestionsUma ShankarPas encore d'évaluation

- Figure - 1: Measurement in Inches:-A: Length B: Chest C: Shoulder D: Sleeve Length E: NeckDocument11 pagesFigure - 1: Measurement in Inches:-A: Length B: Chest C: Shoulder D: Sleeve Length E: NeckAnil Singh BishtPas encore d'évaluation

- February 2011 Master of Computer Application (MCA) - Semester 2 MC0066 - OOPS Using C++Document9 pagesFebruary 2011 Master of Computer Application (MCA) - Semester 2 MC0066 - OOPS Using C++Anil Singh BishtPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

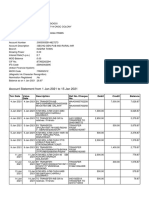

- Account Statement From 1 Jan 2021 To 15 Jan 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Jan 2021 To 15 Jan 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balanceabhijit gogoiPas encore d'évaluation

- Lecture 9 TVM (Practical Applications)Document22 pagesLecture 9 TVM (Practical Applications)Devyansh GuptaPas encore d'évaluation

- FM3 Midterm Exam ReviewerDocument5 pagesFM3 Midterm Exam ReviewerXa ShionPas encore d'évaluation

- Bank Al Habib BestDocument74 pagesBank Al Habib BestAbdul Ghafoor100% (1)

- Acct Statement XX7809 31032023Document6 pagesAcct Statement XX7809 31032023harshal jagtapPas encore d'évaluation

- List of RTGS ParticipantsDocument3 pagesList of RTGS ParticipantsBharti Mittal GargPas encore d'évaluation

- Multiple Choice: Tomas Claudio CollegesDocument5 pagesMultiple Choice: Tomas Claudio CollegesRouise GagalacPas encore d'évaluation

- Current Account 052019 PDFDocument4 pagesCurrent Account 052019 PDFkertana Annanda KumarPas encore d'évaluation

- PY Catalogue 100k Second Item - MenDocument8 pagesPY Catalogue 100k Second Item - MenNurinaAyuningtyasPas encore d'évaluation

- ListDocument6 pagesListalonsoPas encore d'évaluation

- Your Order#2048467 On Https://nimi - Gov.in Is Successful.: Sat, Sep 11, 2021 at 3:32 PMDocument1 pageYour Order#2048467 On Https://nimi - Gov.in Is Successful.: Sat, Sep 11, 2021 at 3:32 PMRANJAN KUMARPas encore d'évaluation

- Macroeconomics: Money Supply and Money DemandDocument7 pagesMacroeconomics: Money Supply and Money DemandSharhie RahmaPas encore d'évaluation

- Chapter 1 Monetary Policy IntroductionDocument53 pagesChapter 1 Monetary Policy IntroductionBrian Ferndale Sanchez GarciaPas encore d'évaluation

- PDF Translator 1588574241507Document2 pagesPDF Translator 1588574241507Isabelle12Pas encore d'évaluation

- TVR Format - Shrikrushn Namdev Kavar - TF4343554Document19 pagesTVR Format - Shrikrushn Namdev Kavar - TF4343554Nikhil MohanePas encore d'évaluation

- Types of Advances by MCBDocument7 pagesTypes of Advances by MCBGhulam AbbasPas encore d'évaluation

- Promissory Note Vs Bill PF ExchangeDocument2 pagesPromissory Note Vs Bill PF ExchangelexscribisPas encore d'évaluation

- Indemnity Letter For Idbi Bank Debit CardDocument1 pageIndemnity Letter For Idbi Bank Debit CardFebin PaulPas encore d'évaluation

- Admission Form: A Unit of Swabhiman Education Society Regd. by NCT Govt - of DelhiDocument2 pagesAdmission Form: A Unit of Swabhiman Education Society Regd. by NCT Govt - of DelhiSanjeev KhatriPas encore d'évaluation

- TenNhom Lab8Document15 pagesTenNhom Lab8Mẫn ĐứcPas encore d'évaluation

- Accounting For Musyarakah FinancingDocument16 pagesAccounting For Musyarakah FinancingHadyan AntoroPas encore d'évaluation

- ThirdPartyRetrieveDocument - Asp 3Document4 pagesThirdPartyRetrieveDocument - Asp 3Elizabeth HilsonPas encore d'évaluation

- Quiz 1Document5 pagesQuiz 1natasha100% (1)

- LoadCentral Payment SolutionsDocument5 pagesLoadCentral Payment SolutionsJacques Andre Collantes BeaPas encore d'évaluation

- Simple InterestDocument25 pagesSimple InterestRJRegio25% (4)

- Top 60 Bank Interview QuestionsDocument12 pagesTop 60 Bank Interview QuestionsRamojeevaPas encore d'évaluation

- Análise Fundamentalista de Ações Por SetorDocument30 pagesAnálise Fundamentalista de Ações Por SetorLuiz Felipe Ribeiro Monteiro de PaulaPas encore d'évaluation

- Bonnie Lundbohm - 2025Document5 pagesBonnie Lundbohm - 2025Peter MariluchPas encore d'évaluation

- Chapter 27bDocument32 pagesChapter 27bibna zubaerPas encore d'évaluation

- Oliva Customer Registration FormDocument10 pagesOliva Customer Registration FormRama UmbaraPas encore d'évaluation