Académique Documents

Professionnel Documents

Culture Documents

Sungf9tIqDhAO64RjsPj Form16 PartA

Transféré par

RAJIV RANJAN PRIYADARSHIDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Sungf9tIqDhAO64RjsPj Form16 PartA

Transféré par

RAJIV RANJAN PRIYADARSHIDroits d'auteur :

Formats disponibles

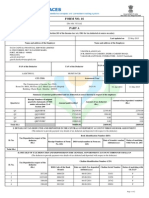

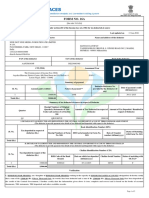

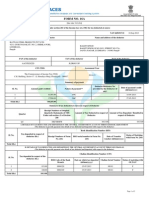

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. ATNPUYH

Last updated on

Name and address of the Employer

27-May-2014

Name and address of the Employee

ATOS INDIA PRIVATE LIMITED

5, GODREJ COMPOUND, PIROJSHAHNAGAR,

LBS MARG VIKHORLI(W), MUMBAI - 400079

Maharashtra

+(91)22-67333647

ARULARASAN.ML@ATOS.NET

KHUSHBOO DUNGDUNG

21, KAVERI HOSTEL, PONDICHERRY UNIVERSITY,

PONDICHERRY - 605014 Pondicherry

PAN of the Deductor

TAN of the Deductor

AAACO2461J

MUMA19784C

PAN of the Employee

Employee Reference No.

provided by the Employer

(If available)

CMRPK5124L

CIT (TDS)

Assessment Year

The Commissioner of Income Tax (TDS)

Room No. 900A, 9th Floor, K.G. Mittal Ayurvedic Hospital

Building, Charni Road , Mumbai - 400002

2014-15

Period with the Employer

From

To

01-Apr-2013

31-Mar-2014

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Q1

IPOXBGWF

68586.00

1674.00

1674.00

Q2

IPOXDLKA

88330.00

2995.00

2995.00

Q3

QASQNRFB

95202.00

3701.00

3701.00

Q4

QQQHBABB

145714.00

8761.00

8761.00

397832.00

17131.00

17131.00

Total (Rs.)

Amount of tax deposited / remitted

(Rs.)

Amount of tax deducted

(Rs.)

Amount paid/credited

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher Status of matching

(dd/mm/yyyy)

with Form no. 24G

Total (Rs.)

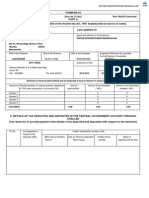

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

0.00

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

07-05-2013

596.00

6910333

07-06-2013

21649

1078.00

6910333

06-07-2013

22322

830.00

6910333

06-08-2013

20843

Page 1 of 2

Certificate Number: ATNPUYH

Sl. No.

TAN of Employer: MUMA19784C

Tax Deposited in respect of the

deductee

(Rs.)

PAN of Employee: CMRPK5124L

Assessment Year: 2014-15

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

1335.00

6910333

07-09-2013

18421

830.00

6910333

04-10-2013

18972

2042.00

6910333

07-11-2013

23593

829.00

6910333

06-12-2013

21345

830.00

6910333

07-01-2014

23866

10

349.00

6910333

06-02-2014

21998

11

8069.00

6910333

06-03-2014

22310

12

343.00

6910333

30-04-2014

22380

Total (Rs.)

17131.00

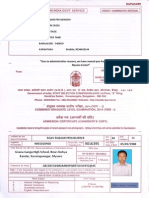

Verification

I, MUNISWAMY LOGAN ARULARASAN, son / daughter of MUNISWAMY LOGAN working in the capacity of GROUP MANAGER HRM (designation) do hereby certify

that a sum of Rs. 17131.00 [Rs. Seventeen Thousand One Hundred and Thirty One Only (in words)] has been deducted and a sum of Rs. 17131.00 [Rs. Seventeen

Thousand One Hundred and Thirty One Only] has been deposited to the credit of the Central Government. I further certify that the information given above is true,

complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place

Mumbai

Date

28-May-2014

Designation: GROUP MANAGER HRM

(Signature of person responsible for deduction of Tax)

Full Name:MUNISWAMY LOGAN ARULARASAN

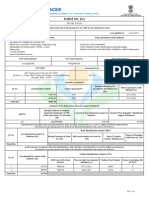

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend

Description

Definition

Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Digitally signed by

MUNISWAMY ARULARASAN

Date: 2014.05.29 14:32:29 IST

Reason: Form 16

Location: Pune

Page 2 of 2

Vous aimerez peut-être aussi

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaPas encore d'évaluation

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiPas encore d'évaluation

- Ahspy8053e 2014-15Document2 pagesAhspy8053e 2014-15kzx08110Pas encore d'évaluation

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556Pas encore d'évaluation

- Form 16Document2 pagesForm 16SIVA100% (1)

- ADEPJ433Document2 pagesADEPJ433ravibhartia1978Pas encore d'évaluation

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978Pas encore d'évaluation

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhPas encore d'évaluation

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- LetterDocument2 pagesLetterShiv Kiran SademPas encore d'évaluation

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuPas encore d'évaluation

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarPas encore d'évaluation

- PDFDocument5 pagesPDFdhanu1434Pas encore d'évaluation

- Form 16Document6 pagesForm 16anon_825378560Pas encore d'évaluation

- 14374752Document2 pages14374752Anshul MehtaPas encore d'évaluation

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriPas encore d'évaluation

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankPas encore d'évaluation

- Form 16Document22 pagesForm 16Ajay Chowdary Ajay ChowdaryPas encore d'évaluation

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohiePas encore d'évaluation

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayPas encore d'évaluation

- Form 16Document2 pagesForm 16Mithun KumarPas encore d'évaluation

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavPas encore d'évaluation

- Form 16: Jakson Engineers LimitedDocument5 pagesForm 16: Jakson Engineers LimitedAnit SinghPas encore d'évaluation

- Form 16Document3 pagesForm 16Alla VijayPas encore d'évaluation

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediPas encore d'évaluation

- Form16 - 02 - Fy 2014-15 - 1964Document5 pagesForm16 - 02 - Fy 2014-15 - 1964nrp_rahulPas encore d'évaluation

- ST 2013111320791446483Document1 pageST 2013111320791446483engr_saleem3316Pas encore d'évaluation

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976Pas encore d'évaluation

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- StoriesDocument1 pageStoriesZAKPas encore d'évaluation

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalPas encore d'évaluation

- TdsDocument4 pagesTdsSahil SheikhPas encore d'évaluation

- Bir 2013Document1 pageBir 2013karlycorePas encore d'évaluation

- Tax GoshwaraDocument2 pagesTax GoshwaraasfandjanPas encore d'évaluation

- 1 - Form 16Document5 pages1 - Form 16premsccPas encore d'évaluation

- Gadiano 2316Document2 pagesGadiano 2316Jypy Torrejos100% (1)

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiPas encore d'évaluation

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiPas encore d'évaluation

- Form16Document5 pagesForm16er_ved06Pas encore d'évaluation

- ViewDocument2 pagesViewVenkat JvsraoPas encore d'évaluation

- BSNL Salary Slip 1Document1 pageBSNL Salary Slip 1empirecot50% (2)

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailPas encore d'évaluation

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarPas encore d'évaluation

- 15 G Form (Pre-Filled)Document8 pages15 G Form (Pre-Filled)pankaj_electricalPas encore d'évaluation

- 2316 (1) 2Document2 pages2316 (1) 2jonbelzaPas encore d'évaluation

- Kotaka Form16 41970Document4 pagesKotaka Form16 41970sai_gsrajuPas encore d'évaluation

- Fill in The Data Below: 0706764 B. Sankar SinghDocument24 pagesFill in The Data Below: 0706764 B. Sankar SinghMurali Krishna VPas encore d'évaluation

- "Pay Bill Particulars" Mention Below: (Enter Your Details)Document38 pages"Pay Bill Particulars" Mention Below: (Enter Your Details)rajbharath300Pas encore d'évaluation

- Acknowledgement UnlockedDocument1 pageAcknowledgement UnlockedcachandhiranPas encore d'évaluation

- Statutory Compliances - Geeco - From Dec'15 To Feb'16Document10 pagesStatutory Compliances - Geeco - From Dec'15 To Feb'16JitendraPas encore d'évaluation

- 2316 JAKEDocument1 page2316 JAKEJM HernandezPas encore d'évaluation

- Income Tax Payment Challan: PSID #: 20391652Document1 pageIncome Tax Payment Challan: PSID #: 20391652Tanvir AhmedPas encore d'évaluation

- Form16fy10 11Document3 pagesForm16fy10 11atishroyPas encore d'évaluation

- eFPS Home - Efiling and Payment SystemDocument2 pageseFPS Home - Efiling and Payment SystemElie Morales76% (33)

- 2014-15 Form 16Document4 pages2014-15 Form 16om shanker soniPas encore d'évaluation

- TAMIL NADU GOVERNMENT - CONTRIBUTORY PENSION SCHEME - FAQsDocument4 pagesTAMIL NADU GOVERNMENT - CONTRIBUTORY PENSION SCHEME - FAQsDr.Sagindar100% (1)

- Computerised Payroll Practice Set Using MYOB AccountRight: Australian EditionD'EverandComputerised Payroll Practice Set Using MYOB AccountRight: Australian EditionPas encore d'évaluation

- Computerised Accounting Practice Set Using Xero Online Accounting: Australian EditionD'EverandComputerised Accounting Practice Set Using Xero Online Accounting: Australian EditionPas encore d'évaluation

- Java Basics To Refer Java-8Document3 pagesJava Basics To Refer Java-8RAJIV RANJAN PRIYADARSHIPas encore d'évaluation

- What Is Sqlprovider ?Document4 pagesWhat Is Sqlprovider ?RAJIV RANJAN PRIYADARSHIPas encore d'évaluation

- Due To Administrative Reasons, We Have Moved You From Bangalore To Mysore CenterDocument1 pageDue To Administrative Reasons, We Have Moved You From Bangalore To Mysore CenterRAJIV RANJAN PRIYADARSHIPas encore d'évaluation

- AAP MembershipDocument1 pageAAP MembershipRAJIV RANJAN PRIYADARSHIPas encore d'évaluation

- Call Centre RDocument2 pagesCall Centre RRAJIV RANJAN PRIYADARSHIPas encore d'évaluation

- GK QuestionsDocument9 pagesGK QuestionssrshelkePas encore d'évaluation

- Jsteg: Steganography and SteganalysisDocument7 pagesJsteg: Steganography and SteganalysisRAJIV RANJAN PRIYADARSHIPas encore d'évaluation

- 93 - Ion To The Mundaka UpanishadDocument5 pages93 - Ion To The Mundaka UpanishadRAJIV RANJAN PRIYADARSHIPas encore d'évaluation

- French NumbersDocument4 pagesFrench NumbersRAJIV RANJAN PRIYADARSHI100% (1)

- Consumer Buying Behaviour of Vikram SeedsDocument27 pagesConsumer Buying Behaviour of Vikram SeedsvorabhaveshPas encore d'évaluation

- Cash Flow Statement Format Direct MethodDocument4 pagesCash Flow Statement Format Direct MethodvishalkulthiaPas encore d'évaluation

- Challenges Faced and Roles Played by Women Entrepreneurs in India EconomyDocument70 pagesChallenges Faced and Roles Played by Women Entrepreneurs in India Economyacademic researchPas encore d'évaluation

- Domain Property Guide 2013Document56 pagesDomain Property Guide 2013El RuloPas encore d'évaluation

- PTCL ReportDocument19 pagesPTCL Reportkashif aliPas encore d'évaluation

- Supply and Demand: Managerial Economics: Economic Tools For Today's Decision Makers, 4/e by Paul Keat and Philip YoungDocument42 pagesSupply and Demand: Managerial Economics: Economic Tools For Today's Decision Makers, 4/e by Paul Keat and Philip YoungGAYLY ANN TOLENTINOPas encore d'évaluation

- Business Organizations 2001 IShafferDocument131 pagesBusiness Organizations 2001 IShaffersophiebg100% (1)

- Chapter 3Document12 pagesChapter 3mohammed alqurashiPas encore d'évaluation

- Entrepreneurship All Definations For FinalzDocument5 pagesEntrepreneurship All Definations For FinalzYaseen SaleemPas encore d'évaluation

- Sports and Entertainment Marketing 4th Edition Kaser Test BankDocument8 pagesSports and Entertainment Marketing 4th Edition Kaser Test Bankvernier.decyliclnn4100% (17)

- Report 1Document8 pagesReport 1Jude Vincent MacalosPas encore d'évaluation

- Acquisition of Nepal Bangladesh Bank by Nabil Bank: Bachelor of Business AdministrationDocument16 pagesAcquisition of Nepal Bangladesh Bank by Nabil Bank: Bachelor of Business AdministrationSujan ShahPas encore d'évaluation

- Letter of Intent To Purchase Property - TemplateDocument4 pagesLetter of Intent To Purchase Property - Templatemichael lumboyPas encore d'évaluation

- Tong Hop T.anh Chuyen NganhDocument23 pagesTong Hop T.anh Chuyen NganhVi PhươngPas encore d'évaluation

- Applied Governance Risk and Compliance June 2020 Marking GuideDocument6 pagesApplied Governance Risk and Compliance June 2020 Marking Guideguavana enterprisesPas encore d'évaluation

- Lesson 1.1 Introduction To Applied EconomicsDocument31 pagesLesson 1.1 Introduction To Applied EconomicsJohnpaul FaustinoPas encore d'évaluation

- Ministry of Education: English ExamDocument17 pagesMinistry of Education: English ExamisaPas encore d'évaluation

- Marketing EthicsDocument46 pagesMarketing EthicsBhupesh B Yadav100% (1)

- ECONOMY: Ecological EconomicsDocument18 pagesECONOMY: Ecological EconomicsPost Carbon Institute100% (2)

- Assignment2 - ICMB319Document13 pagesAssignment2 - ICMB319CHANBOON WATAWANITKULPas encore d'évaluation

- Lecture Chapter 10 Determination of Vat Still DueDocument24 pagesLecture Chapter 10 Determination of Vat Still DueChristian PelimcoPas encore d'évaluation

- Trading-Stocks 20220220 Retail-Research R-37864540398152263f2af127280e 1676851266Document4 pagesTrading-Stocks 20220220 Retail-Research R-37864540398152263f2af127280e 1676851266ngPas encore d'évaluation

- Internship Report On: J & L Fashion LTDDocument38 pagesInternship Report On: J & L Fashion LTDSabari SabariPas encore d'évaluation

- KPMG Report On Direct-Selling PDFDocument94 pagesKPMG Report On Direct-Selling PDFRahul Gupta100% (2)

- IT Governance Mod 5Document40 pagesIT Governance Mod 5Asmita Bhagdikar100% (1)

- Business Strategy SimulationDocument16 pagesBusiness Strategy SimulationMohit OstwalPas encore d'évaluation

- Philippine Long Distance Telephone Company vs. Henry EstraneroDocument2 pagesPhilippine Long Distance Telephone Company vs. Henry EstraneroLara DellePas encore d'évaluation

- AMG RobotDocument33 pagesAMG RobotShanPas encore d'évaluation

- Logistics Management PJT GLS VS VRJDocument20 pagesLogistics Management PJT GLS VS VRJSHABNAMH HASANPas encore d'évaluation

- Business Blueprint Controlling: Synokem Pharmaceuticals LTDDocument53 pagesBusiness Blueprint Controlling: Synokem Pharmaceuticals LTDGudia Sharma100% (2)