Académique Documents

Professionnel Documents

Culture Documents

Income Tax Return For Financial Year 2014-2015: Private & Confidential

Transféré par

Shankar ReddyTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Income Tax Return For Financial Year 2014-2015: Private & Confidential

Transféré par

Shankar ReddyDroits d'auteur :

Formats disponibles

5/9/2015

Income Tax Return For

Financial Year 2014-2015

Private & Confidential

Sunil Wadhwani

Sunil Wadhwani

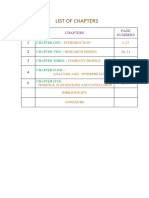

Contents

Various Heads of Income,

Some Deductions allowable,

Deductions for Housing loan,

Clubbing of Income,

Modes of Tax Payment,

Tax rates,

Foreign Asset Reporting,

Advantages of filing Return.

Documents Required,

5/9/2015

Illustrative listlist- Heads of Income

Heads of Income

Illustrative List of Income

Salaries & Perquisites

Salary and allowance (House Rental Allowance, Hardship allowance)

and benefits (such as Rent free accommodation, car, stock options

etc.) provided by employer either free or at a concessional rate

Income from House Property

Rental income from House Property

Profits & Gains of business or

profession

Business Income

Capital Gains

Profit/loss on sale of shares, mutual funds, Property etc.

Income from other sources

Interest on fixed deposit, dividend, Gifts etc.

Sunil Wadhwani

Some Deductions allowable

Professional Tax levied State govt. from salary is deducted,

Transport allowance is deducted from salary upto Rs. 800/- per month,

Children education allowance is deducted from salary upto Rs.100/- per month per child,

Insurance Premium u/s 80C up to 1 lac,

Payment of medical insurance premium. Deduction is available upto Rs.15,000/ for self/ family and

also up to Rs. 15,000/- for insurance in respect of parent/ parents of the assesse,

Donation to certain funds, charitable institutions u/s 80G,

Deduction of up to Rs.10,000/- for interest on savings bank account or post office savings account,

Rebate of Rs. 2000/- is available if Total income is less than Rs. 5 lacs.

Sunil Wadhwani

5/9/2015

Deductions for Housing Loan:

For Principal Repayment:

Deduction of Rs. 1 lac u/s 80C is allowed on Payment Basis if construction of house

property is completed.

For Interest on loan:

If Property is constructed/bought within 3 years thenFor self occupied Property : upto Rs. 2 lacs,

For Let out Property: No limit,

If Property not constructed/bought within 3 years thenDeduction upto Rs. 30,000/- only.

Pre-construction interest is allowed after completion in 5 equal installments without any limit.

Sunil Wadhwani

Clubbing of Income

Concept of joint filing of tax return does not exist.

There exists clubbing provisions for income of minor children and spouse in certain

circumstances.

Source of Income

Illustrative list of clubbing

Salary earned by spouse

Spouse salary from a concern where individual has a

substantial interest ( > 20% stake)- Salary due to

technical/professional expertise excluded).

Transfer of asset to spouse Transfer of asset to spouse for inadequate consideration or

otherwise than in connection with an agreement to live

apart.

All Income of minor child

Exclusion available for manual work and

Activities involving application of skills

Sunil Wadhwani

5/9/2015

Modes of tax payment

Withholding Tax

Tax to be withheld from the remuneration paid by the employer even after departure if income

exceeds maximum threshold limit not chargeable to tax .

Annual certificate to be issued by the employer for salary and benefits.

Withholding at prescribed rates on personal income.

Advance Tax

Advance tax payable on

other income, where it is liable to tax in India. (Tax Limit INR 10,000)

Advance tax payable on personal income in three installments

30 per cent by 15 September

60 per cent by 15 December

100 per cent by 15 March

Sunil Wadhwani

Tax rates for individuals

Tax Rates in respect of income earned during the period

1 April 2014 to 31 March 2015

Slab of Income (Rs.)

Rate of Tax* (%)

Upto Rs. 250,000

Nil

250,001 - 500,000

10

500,001 1,000,000

20

1,000,001 and above

30

* Education cess payable at the rate of 3 per cent of total tax.

- Surcharge at the rate of 10 per cent of the total tax is applicable for the India tax year 2014- 2015, if the taxable

income exceeds INR 10 million.

.

Sunil Wadhwani

5/9/2015

Foreign assets reporting only for ROR

Foreign bank accounts:

Financial interest in any entity:

Immovable Property:

Country name

Country code

Name and address of the bank

Name mentioned in the account

Peak balance during the year ( in rupees)

Country name

Country code

Nature of entity

Name and address of the entity

Total investment at cost ( in rupees)

Country name

Country code

Address of the property

Total investment (at cost) ( in rupees)

Other assets:

Country name

Country code

Nature of asset

Total investment (at cost) ( in rupees)

Details of other accounts with signing

authority:

Name of the institution in which account is held

Address of the institution

Name mentioned in the account

Peak balance / investment during the year ( in

rupees)

Reopening of cases for Tax audit is possible up to 16 years

Sunil Wadhwani

Advantages of filing Return.

Return filing is mandatory for getting any loan,

Return filing is mandatory for getting VISA,

For getting Credit Card,

Standard proof of income,

For quick registration of immovable properties,

If Return is not filed

- Penalty of Rs. 5000/- will be levied & also interest u/s 234A is

required to be paid,

- Losses can not be carried forward to next year,

- No Revise Return can be filed,

- Interest upto 1% per month will be levied.

Sunil Wadhwani

5/9/2015

What do we need from you?

PAN Card Copy,

Form 16 (Provided by Employer),

Form 12 BA (Provided by Employer),

TDS Certificates (if TDS Deducted),

Insurance Premium Receipts,

Bank Statements,

Housing Loan Details (if any) etc..

Sunil Wadhwani

Please note that additional documents may be requested on account of change in the documentation requirements

Contact to get your return filed.

Name

Mobile No.

E-mail id

CA Sunil Wadhwani

+91 0 7709912344

sunilwadhwani11@gmail.com

CA Ajay Wadhwani

+91 0 9765245378

awadhwani1@gmail.com

Why to Us??? Because

Get your Income Tax Return Filed from the professional experts,

Our Motive is to increase the number of income tax return filers so we dont charge hefty fee/charges,

Its simple, easy and fast, just you need to provide the information & all the further steps will be taken by us.

So Dont Worry nowJust Contact us for any query..

Sunil Wadhwani

Vous aimerez peut-être aussi

- 5 Natural Sore Throat RemediesDocument5 pages5 Natural Sore Throat Remedieslisa smithis100% (1)

- K.golden Flower MeditationDocument6 pagesK.golden Flower Meditationamjr1001Pas encore d'évaluation

- Mental Health Activity ProposalDocument2 pagesMental Health Activity ProposalJustin Tagumasi Agustin100% (1)

- 200mm 250mm 300 MM: Project Name Location Bill No. - 00 (Rev. 0) Consultant Contractor Buildiong Name DATEDocument2 pages200mm 250mm 300 MM: Project Name Location Bill No. - 00 (Rev. 0) Consultant Contractor Buildiong Name DATEganesh gundPas encore d'évaluation

- Income Tax Return QuesDocument3 pagesIncome Tax Return QuesTax AdvisoryPas encore d'évaluation

- Present Value TablesDocument2 pagesPresent Value TablesFreelansir100% (1)

- Direct Taxation: CA M. Ram Pavan KumarDocument60 pagesDirect Taxation: CA M. Ram Pavan KumarSravyaPas encore d'évaluation

- Telecommunications GroundingDocument24 pagesTelecommunications GroundingMike FordealsPas encore d'évaluation

- International Taxation In Nepal Tips To Foreign InvestorsD'EverandInternational Taxation In Nepal Tips To Foreign InvestorsPas encore d'évaluation

- Lead in Water: Standard Test Methods ForDocument17 pagesLead in Water: Standard Test Methods ForAMMARPas encore d'évaluation

- How To Save Tax For FY 2013 14Document42 pagesHow To Save Tax For FY 2013 14Deepesh SharmaPas encore d'évaluation

- How To File Return in PakistanDocument5 pagesHow To File Return in PakistanadilPas encore d'évaluation

- Taxation For ASTAitsDocument20 pagesTaxation For ASTAitsKga CreationsPas encore d'évaluation

- Withholding Taxes WHTDocument32 pagesWithholding Taxes WHTAsis KoiralaPas encore d'évaluation

- Personal Income TaxDocument31 pagesPersonal Income TaxRenese LeePas encore d'évaluation

- Income Tax ReturnDocument57 pagesIncome Tax ReturnMalik WasimPas encore d'évaluation

- CMA-How To Save Tax 2013-14Document37 pagesCMA-How To Save Tax 2013-14sunilsunny317Pas encore d'évaluation

- Income TaxDocument11 pagesIncome Taxvikas_thPas encore d'évaluation

- Income Tax - Exemptions and Deductions Procedure For FY 2020-2021 FinalDocument16 pagesIncome Tax - Exemptions and Deductions Procedure For FY 2020-2021 Finalsrikanth100% (1)

- Payment of Bonus ActDocument34 pagesPayment of Bonus ActRishi vardhiniPas encore d'évaluation

- Income From Other SourcesDocument27 pagesIncome From Other Sourcesanilchavan100% (1)

- Tax PPT - DeductionsDocument20 pagesTax PPT - Deductionsjayparekh28Pas encore d'évaluation

- Personal Tax PlanningDocument21 pagesPersonal Tax PlanningDhruv ChhabraPas encore d'évaluation

- Tax Sheltered SchemesDocument13 pagesTax Sheltered SchemesVivek DwivediPas encore d'évaluation

- Regulatory Compliance in India PDFDocument6 pagesRegulatory Compliance in India PDFsherylPas encore d'évaluation

- 1tax Planning For Retirees of IOB 1Document34 pages1tax Planning For Retirees of IOB 1mail2ncPas encore d'évaluation

- Financial Services NewsalertDocument12 pagesFinancial Services NewsalertMilind DhandePas encore d'évaluation

- Tax Saving InstrumentsDocument19 pagesTax Saving Instrumentsharry.anjh3613Pas encore d'évaluation

- DT AmendmentsDocument39 pagesDT AmendmentsMurali GopalakrishnaPas encore d'évaluation

- FAQ S On Income Tax 2022-23Document4 pagesFAQ S On Income Tax 2022-23Ranjan SatapathyPas encore d'évaluation

- Guidelines For Investment Proof PDFDocument2 pagesGuidelines For Investment Proof PDFsamuraioo7Pas encore d'évaluation

- How To Save Tax For FY 2013 14Document42 pagesHow To Save Tax For FY 2013 14duderamPas encore d'évaluation

- Tax Proof Submission Document 2022-23Document7 pagesTax Proof Submission Document 2022-23Jagadeesh DatlaPas encore d'évaluation

- Portal Investment Proof Verification Guidelines 2022 23Document11 pagesPortal Investment Proof Verification Guidelines 2022 23yfiamataimPas encore d'évaluation

- Income Tax Note 02Document4 pagesIncome Tax Note 02Hashani Anuttara AbeygunasekaraPas encore d'évaluation

- Capital GainsDocument6 pagesCapital GainsMuskanDodejaPas encore d'évaluation

- E-Filing of Returns (Income Tax Online Filing)Document23 pagesE-Filing of Returns (Income Tax Online Filing)Prashant Jadhav0% (1)

- Income Tax Return Forms ArdraDocument25 pagesIncome Tax Return Forms ArdraGangothri AsokPas encore d'évaluation

- Form 15G & 15H: Save Tds On Interest On FdsDocument6 pagesForm 15G & 15H: Save Tds On Interest On FdsShreekumarPas encore d'évaluation

- Singapore Tax System#published Article# - 1556967521Document17 pagesSingapore Tax System#published Article# - 1556967521Vaibhav ChoudhryPas encore d'évaluation

- Deloitte Tax Pocket Guide 2014Document20 pagesDeloitte Tax Pocket Guide 2014YHPas encore d'évaluation

- RCA Information Booklet1Document4 pagesRCA Information Booklet1jrladduPas encore d'évaluation

- 7th Term - Legal Frameworks of ConstructionDocument79 pages7th Term - Legal Frameworks of ConstructionShreedharPas encore d'évaluation

- Unit V HR OperationsDocument43 pagesUnit V HR OperationssnehalPas encore d'évaluation

- Heads of IncomeDocument6 pagesHeads of Incomevijay kumarPas encore d'évaluation

- Tax Guide - 2011: Kantilal Patel & CoDocument0 pageTax Guide - 2011: Kantilal Patel & Coanpuselvi125Pas encore d'évaluation

- Complete Tax DetailsDocument23 pagesComplete Tax DetailsAnish GuptaPas encore d'évaluation

- WMPFP - Retirement and Estate PlanningDocument34 pagesWMPFP - Retirement and Estate PlanningNANDINI GUPTAPas encore d'évaluation

- Salary Slip Format in India - Payslip Templates - H&R BlockDocument19 pagesSalary Slip Format in India - Payslip Templates - H&R BlockRangarao GullipalliPas encore d'évaluation

- UntitledDocument5 pagesUntitledsubhajit sahaPas encore d'évaluation

- Doing Business in IndiaDocument43 pagesDoing Business in IndiaSamrat JonejaPas encore d'évaluation

- National Pension SchemeDocument18 pagesNational Pension SchemeNaveen NPas encore d'évaluation

- Income Tax&GSTDocument7 pagesIncome Tax&GSTTania SharmaPas encore d'évaluation

- Srs Booklet Dec 2016Document28 pagesSrs Booklet Dec 2016soe lwinPas encore d'évaluation

- Income Tax Law and Practice: Bba - 5 Sem BBA - 301Document39 pagesIncome Tax Law and Practice: Bba - 5 Sem BBA - 301Aarti Dhanrajani HaswaniPas encore d'évaluation

- Income Tax Law: Business Law Fom, MmuDocument21 pagesIncome Tax Law: Business Law Fom, MmuFaizun SekinPas encore d'évaluation

- Types of ITR Forms For FY 2022-23 (AY 2023-24)Document21 pagesTypes of ITR Forms For FY 2022-23 (AY 2023-24)DRK FrOsTeRPas encore d'évaluation

- Bangladesh Income Tax RatesDocument5 pagesBangladesh Income Tax RatesaadonPas encore d'évaluation

- Project Topic: Income Tax Systems in Pakistan, India & UKDocument53 pagesProject Topic: Income Tax Systems in Pakistan, India & UKAfzal RocksxPas encore d'évaluation

- Tax Amnesty - Said. Redeem. Relieved: PictureDocument4 pagesTax Amnesty - Said. Redeem. Relieved: PictureANGELINA ANGELINAPas encore d'évaluation

- Tax Law & Practice: Arun C. BharatDocument41 pagesTax Law & Practice: Arun C. BharatSöuñdāryà MùnîyásàmỳPas encore d'évaluation

- Taxable Income RahulDocument18 pagesTaxable Income RahulRahul ParitPas encore d'évaluation

- TAXATIONDocument27 pagesTAXATIONDongyeru EdenPas encore d'évaluation

- P Indian Income TaxDocument15 pagesP Indian Income TaxkasifinancePas encore d'évaluation

- Training Key PointsDocument9 pagesTraining Key Pointsstarlegalconsultancy4Pas encore d'évaluation

- UNIFEEDS TaxDocument64 pagesUNIFEEDS TaxRheneir MoraPas encore d'évaluation

- 3056 - Government First Grade College, Halebeedu Internal Marks - Dec 2019Document11 pages3056 - Government First Grade College, Halebeedu Internal Marks - Dec 2019Shankar ReddyPas encore d'évaluation

- Emerging Trends in Digital MarketingDocument18 pagesEmerging Trends in Digital MarketingShankar ReddyPas encore d'évaluation

- National Corporate Governance PolicyDocument25 pagesNational Corporate Governance PolicyNandan MaluPas encore d'évaluation

- Concept of Indirect Tax in IndiaDocument16 pagesConcept of Indirect Tax in IndiaShankar ReddyPas encore d'évaluation

- 2018-19 Feedback ReportsDocument3 pages2018-19 Feedback ReportsShankar ReddyPas encore d'évaluation

- BRM - SyllabusDocument1 pageBRM - SyllabusShankar ReddyPas encore d'évaluation

- 2019-20 FB Report and APDocument18 pages2019-20 FB Report and APShankar ReddyPas encore d'évaluation

- GST - Practice Pointer IssuesDocument58 pagesGST - Practice Pointer IssuesShankar ReddyPas encore d'évaluation

- Calender of EventsDocument89 pagesCalender of EventsShankar ReddyPas encore d'évaluation

- InsuranceDocument58 pagesInsuranceShankar ReddyPas encore d'évaluation

- QP 1Document7 pagesQP 1Shankar ReddyPas encore d'évaluation

- Designing A Global Financing StrategyDocument23 pagesDesigning A Global Financing StrategyShankar ReddyPas encore d'évaluation

- Ifm - TheoremsDocument7 pagesIfm - TheoremsShankar ReddyPas encore d'évaluation

- CTP-5 Ans PDFDocument54 pagesCTP-5 Ans PDFShankar ReddyPas encore d'évaluation

- QP 2 PDFDocument7 pagesQP 2 PDFShankar ReddyPas encore d'évaluation

- Future Value TablesDocument123 pagesFuture Value TablesShankar ReddyPas encore d'évaluation

- Calender of EventsDocument89 pagesCalender of EventsShankar ReddyPas encore d'évaluation

- Capital StructureDocument14 pagesCapital StructureShankar ReddyPas encore d'évaluation

- Future Value TablesDocument123 pagesFuture Value TablesShankar ReddyPas encore d'évaluation

- Syll 2015-16Document40 pagesSyll 2015-16yathishaPas encore d'évaluation

- NPV Versus IrrDocument5 pagesNPV Versus IrrAmitPas encore d'évaluation

- List of Chapters: SL No Chapters NumbersDocument4 pagesList of Chapters: SL No Chapters NumbersShankar ReddyPas encore d'évaluation

- 01Document126 pages01Shankar ReddyPas encore d'évaluation

- HrmsDocument1 pageHrmsShankar ReddyPas encore d'évaluation

- Benefits of GST To The Indian EconomyDocument6 pagesBenefits of GST To The Indian EconomyShankar ReddyPas encore d'évaluation

- BBM Course Curriculum and Syllabus-2014!11!1Document23 pagesBBM Course Curriculum and Syllabus-2014!11!1darshanPas encore d'évaluation

- First Case Law On GSTDocument4 pagesFirst Case Law On GSTShankar ReddyPas encore d'évaluation

- MIS006: Form KFC 62 B: Hosakote 2016-2017 01 - Government FebruaryDocument2 pagesMIS006: Form KFC 62 B: Hosakote 2016-2017 01 - Government FebruaryShankar ReddyPas encore d'évaluation

- Analysis and Interpretation: Table 4.1 Comparative Income Statement For March Ending 2011 and March Ending 2012Document32 pagesAnalysis and Interpretation: Table 4.1 Comparative Income Statement For March Ending 2011 and March Ending 2012Shankar ReddyPas encore d'évaluation

- Qualification Handbook v1-1Document92 pagesQualification Handbook v1-1rafael espinosa semperPas encore d'évaluation

- Zook Rupture Disc URADocument2 pagesZook Rupture Disc URAmd_taheriPas encore d'évaluation

- Punjab National BankDocument4 pagesPunjab National BankShubham RajPas encore d'évaluation

- 9 SolutionsDocument31 pages9 SolutionsLaurertan TavaresPas encore d'évaluation

- Assignment PSDocument2 pagesAssignment PSMohsin Islam RifatPas encore d'évaluation

- Lecture 38Document10 pagesLecture 38Deepak GuptaPas encore d'évaluation

- Expository Cause and Effect OUTLINEDocument2 pagesExpository Cause and Effect OUTLINEAutoDefencePas encore d'évaluation

- ND 0108 SpongeDiver SymiDocument2 pagesND 0108 SpongeDiver SymiPoki MokiPas encore d'évaluation

- 10 Major Sulfuric Acid Industrial Applications - WorldOfChemicalsDocument9 pages10 Major Sulfuric Acid Industrial Applications - WorldOfChemicalsFarhad MalikPas encore d'évaluation

- What Is A Walkable Place The Walkability Debate inDocument20 pagesWhat Is A Walkable Place The Walkability Debate inBADR HAMDAN ALATEBEPas encore d'évaluation

- Final Workshop Report On Value Addition and AgroprocessingDocument31 pagesFinal Workshop Report On Value Addition and AgroprocessingBett K. BernardPas encore d'évaluation

- GS Module 3 ConcessionDocument3 pagesGS Module 3 ConcessionManolachePas encore d'évaluation

- What Is Primary Health Care and Its Relation To Universal Health Care? As A Medical Student, What Impact Can I Create in Implementing PHC and UHC?Document2 pagesWhat Is Primary Health Care and Its Relation To Universal Health Care? As A Medical Student, What Impact Can I Create in Implementing PHC and UHC?Aubrey Unique EvangelistaPas encore d'évaluation

- According To India International Coffee Festival in The TitledDocument4 pagesAccording To India International Coffee Festival in The Titledsalman vavaPas encore d'évaluation

- Gerardus Johannes Mulder: 20 Aug 1779 - 7 Aug 1848Document25 pagesGerardus Johannes Mulder: 20 Aug 1779 - 7 Aug 1848NihalPas encore d'évaluation

- Vocabulary June v22Document2 pagesVocabulary June v22Wiston TonwisPas encore d'évaluation

- Genius 7 On Bill Acceptor ManualDocument10 pagesGenius 7 On Bill Acceptor ManualJose Maria PerezPas encore d'évaluation

- Alix Pelletier Luginbühl - Works / PRINT VERSIONDocument44 pagesAlix Pelletier Luginbühl - Works / PRINT VERSIONJonathan Philippe LEVYPas encore d'évaluation

- Psicologia BuenisimoDocument6 pagesPsicologia BuenisimoSophiePas encore d'évaluation

- Effects of Various Liquid Organic Solvents On Solvent-Induced Crystallization of Amorphous Poly (Lactic Acid) FilmDocument11 pagesEffects of Various Liquid Organic Solvents On Solvent-Induced Crystallization of Amorphous Poly (Lactic Acid) FilmqueteimportaPas encore d'évaluation

- MSDS Industrial MargarineDocument3 pagesMSDS Industrial MargarineAeropaulo14Pas encore d'évaluation

- English 10-1 Personal Response EssayDocument2 pagesEnglish 10-1 Personal Response Essayapi-467840192Pas encore d'évaluation

- LPG PropertiesDocument2 pagesLPG Propertiesvvk557Pas encore d'évaluation

- Artifact 7 - Superannuation Pension Calculator-GuidelinesDocument2 pagesArtifact 7 - Superannuation Pension Calculator-GuidelinesSai RamPas encore d'évaluation