Académique Documents

Professionnel Documents

Culture Documents

Ahspy8053e 2014-15

Transféré par

kzx08110Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Ahspy8053e 2014-15

Transféré par

kzx08110Droits d'auteur :

Formats disponibles

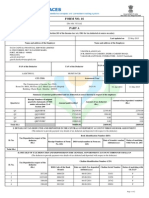

FORM NO.

16

[See rule 31(1)(a)]

PART A

Certificate under Section 203 of the Income-tax Act, 1961 for tax deducted at source on salary

Certificate No. AKOGDPH

Last updated on

Name and address of the Employer

14-Jun-2014

Name and address of the Employee

AMBOSELI PROFESSIONAL ASSOCIATES PRIVATE LIMITED

135 & 136, RAHEJA ARCADE,

KORAMANGALA, BANGALORE - 560095

Karnataka

+(91)-25505348

sari@amboselihr.com

AJAY REDDY YERRI

4-801-A-1, MAHATMA NAGAR, YERRAGUNTLA, KADAPA 516309 Andhra Pradesh

PAN of the Deductor

TAN of the Deductor

AAECA2762J

BLRA11117B

PAN of the Employee

Employee Reference No.

provided by the Employer

(If available)

AHSPY8053E

CIT (TDS)

Assessment Year

The Commissioner of Income Tax (TDS)

Room No. 59, H.M.T. Bhawan, 4th Floor, Bellary Road ,

Ganganagar, Bangalore - 560032

2014-15

Period with the Employer

From

To

01-Apr-2013

31-Mar-2014

Summary of amount paid/credited and tax deducted at source thereon in respect of the employee

Quarter(s)

Receipt Numbers of original

quarterly statements of TDS

under sub-section (3) of

Section 200

Q1

XQEXXEQE

32448.00

468.00

468.00

Q2

EIKXCSCE

122346.00

3055.00

3055.00

Q3

QARCKGDF

122346.00

3055.00

3055.00

Q4

QQQGGIDB

122346.00

7523.00

7523.00

399486.00

14101.00

14101.00

Total (Rs.)

Amount of tax deposited / remitted

(Rs.)

Amount of tax deducted

(Rs.)

Amount paid/credited

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Book Identification Number (BIN)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Receipt Numbers of Form

No. 24G

DDO serial number in Form no.

24G

Date of transfer voucher Status of matching

(dd/mm/yyyy)

with Form no. 24G

Total (Rs.)

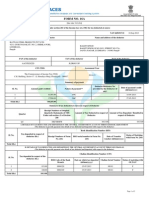

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee)

Sl. No.

Tax Deposited in respect of the

deductee

(Rs.)

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

468.00

0510050

05-07-2013

05034

1018.00

0510050

02-08-2013

02009

1019.00

0510050

03-09-2013

03005

1018.00

0510050

01-10-2013

01003

Page 1 of 2

Certificate Number: AKOGDPH

Sl. No.

TAN of Employer: BLRA11117B

Tax Deposited in respect of the

deductee

(Rs.)

PAN of Employee: AHSPY8053E

Assessment Year: 2014-15

Challan Identification Number (CIN)

BSR Code of the Bank

Branch

Date on which Tax deposited Challan Serial Number

(dd/mm/yyyy)

Status of matching with

OLTAS*

1018.00

0510050

05-11-2013

05048

1018.00

0510050

03-12-2013

03017

1019.00

0510050

03-01-2014

03008

2508.00

0510050

04-02-2014

04007

2508.00

0510050

04-03-2014

04014

10

2507.00

0510050

28-03-2014

28010

Total (Rs.)

14101.00

Verification

I, SARITHA UDAY KODIMANIYANDA, son / daughter of CHINNAPPA THAMMAIAH MULLENGADA working in the capacity of DIRECTOR (designation) do hereby

certify that a sum of Rs. 14101.00 [Rs. Fourteen Thousand One Hundred and One Only (in words)] has been deducted and a sum of Rs. 14101.00 [Rs. Fourteen

Thousand One Hundred and One Only] has been deposited to the credit of the Central Government. I further certify that the information given above is true,

complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records.

Place

BANGALORE

Date

02-Jul-2014

Designation: DIRECTOR

(Signature of person responsible for deduction of Tax)

Full Name:SARITHA UDAY KODIMANIYANDA

Notes:

1. Part B (Annexure) of the certificate in Form No.16 shall be issued by the employer.

2. If an assessee is employed under one employer during the year, Part 'A' of the certificate in Form No.16 issued for the quarter ending on 31st March of the financial year shall contain the details

of tax deducted and deposited for all the quarters of the financial year.

3. If an assessee is employed under more than one employer during the year, each of the employers shall issue Part A of the certificate in Form No.16 pertaining to the period for which such

assessee was employed with each of the employers. Part B (Annexure) of the certificate in Form No. 16 may be issued by each of the employers or the last employer at the option of the assessee.

4. To update PAN details in Income Tax Department database, apply for 'PAN change request' through NSDL or UTITSL.

Legend used in Form 16

* Status of matching with OLTAS

Legend

Description

Definition

Unmatched

Deductors have not deposited taxes or have furnished incorrect particulars of tax payment. Final credit will be reflected only when payment

details in bank match with details of deposit in TDS / TCS statement

Provisional

Provisional tax credit is effected only for TDS / TCS Statements filed by Government deductors."P" status will be changed to Final (F) on

verification of payment details submitted by Pay and Accounts Officer (PAO)

Final

In case of non-government deductors, payment details of TDS / TCS deposited in bank by deductor have matched with the payment details

mentioned in the TDS / TCS statement filed by the deductors. In case of government deductors, details of TDS / TCS booked in Government

account have been verified by Pay & Accounts Officer (PAO)

Overbooked

Payment details of TDS / TCS deposited in bank by deductor have matched with details mentioned in the TDS / TCS statement but the

amount is over claimed in the statement. Final (F) credit will be reflected only when deductor reduces claimed amount in the statement or

makes new payment for excess amount claimed in the statement

Signature Not Verified

Digitally signed by

SARITHA UDAY

Date: 2014.07.02 17:08:58

IST

Page 2 of 2

Vous aimerez peut-être aussi

- Cfupm8774e 2016-17Document2 pagesCfupm8774e 2016-17Sukanta ParidaPas encore d'évaluation

- 255 PartA PDFDocument2 pages255 PartA PDFRamyaMeenakshiPas encore d'évaluation

- Sungf9tIqDhAO64RjsPj Form16 PartADocument2 pagesSungf9tIqDhAO64RjsPj Form16 PartARAJIV RANJAN PRIYADARSHIPas encore d'évaluation

- ADEPJ433Document2 pagesADEPJ433ravibhartia1978Pas encore d'évaluation

- QUA05242 Form16Document5 pagesQUA05242 Form16saurabhPas encore d'évaluation

- PrintTax14 PDFDocument2 pagesPrintTax14 PDFarnieanuPas encore d'évaluation

- ADRPD2454Document2 pagesADRPD2454ravibhartia1978Pas encore d'évaluation

- Form 16 PDFDocument5 pagesForm 16 PDFJoshua Hicks100% (1)

- LetterDocument2 pagesLetterShiv Kiran SademPas encore d'évaluation

- A 40029127 Part-ADocument2 pagesA 40029127 Part-Adeepak_cool4556Pas encore d'évaluation

- 14374752Document2 pages14374752Anshul MehtaPas encore d'évaluation

- Ahrpv0731f 2013-14Document2 pagesAhrpv0731f 2013-14Shiva KumarPas encore d'évaluation

- Form No. 16: Part ADocument5 pagesForm No. 16: Part APunitBeriPas encore d'évaluation

- Form 16Document2 pagesForm 16SIVA100% (1)

- Shashank Kantheti Hyd 12 13Document5 pagesShashank Kantheti Hyd 12 13kshashankPas encore d'évaluation

- PDFDocument5 pagesPDFdhanu1434Pas encore d'évaluation

- Form 16Document6 pagesForm 16anon_825378560Pas encore d'évaluation

- Form 16 by Tcs PDFDocument5 pagesForm 16 by Tcs PDFAnonymous utPqL6jA3i25% (4)

- Form 16Document22 pagesForm 16Ajay Chowdary Ajay ChowdaryPas encore d'évaluation

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToMohammed MohiePas encore d'évaluation

- Form 16Document2 pagesForm 16Mithun KumarPas encore d'évaluation

- Form 16: Jakson Engineers LimitedDocument5 pagesForm 16: Jakson Engineers LimitedAnit SinghPas encore d'évaluation

- FKMPS9021Q Q3 2016-17Document2 pagesFKMPS9021Q Q3 2016-17Hannan SatopayPas encore d'évaluation

- Gopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Document2 pagesGopal G. Trivedi - (108-108) - (2011 - 2012) - Form24Gopal TrivediPas encore d'évaluation

- Samsung India Electronics Pvt. LTD.: Signature Not VerifiedDocument7 pagesSamsung India Electronics Pvt. LTD.: Signature Not VerifiedGajendra Singh RaghavPas encore d'évaluation

- Form 16Document3 pagesForm 16Alla VijayPas encore d'évaluation

- Form 16A: Summary of Tax Deducted at Source in Respect of DeducteeDocument1 pageForm 16A: Summary of Tax Deducted at Source in Respect of DeducteeVinayak BadagiPas encore d'évaluation

- Certificate No.:: Tax Deduction Account No. of The DeductorDocument8 pagesCertificate No.:: Tax Deduction Account No. of The DeductorcmtssikarPas encore d'évaluation

- Form16 - 02 - Fy 2014-15 - 1964Document5 pagesForm16 - 02 - Fy 2014-15 - 1964nrp_rahulPas encore d'évaluation

- Acknowledgement UnlockedDocument1 pageAcknowledgement UnlockedcachandhiranPas encore d'évaluation

- Form 16 Word FormatDocument4 pagesForm 16 Word FormatVenkee SaiPas encore d'évaluation

- XXXPH2966X ITRV - UnlockedDocument1 pageXXXPH2966X ITRV - UnlockedVivek HaldarPas encore d'évaluation

- Tax GoshwaraDocument2 pagesTax GoshwaraasfandjanPas encore d'évaluation

- Form 16: Wipro LimitedDocument5 pagesForm 16: Wipro Limiteddeepak9976Pas encore d'évaluation

- Form 16Document4 pagesForm 16Aruna Kadge JhaPas encore d'évaluation

- XXXPD3353X Itrv PDFDocument1 pageXXXPD3353X Itrv PDFDaljeet KaurPas encore d'évaluation

- Kaushik Sarkar Form 16 DynProDocument5 pagesKaushik Sarkar Form 16 DynProKaushik SarkarPas encore d'évaluation

- Form16Document5 pagesForm16er_ved06Pas encore d'évaluation

- Expense Report 1nov2013Document2 pagesExpense Report 1nov2013KandanPas encore d'évaluation

- 2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFDocument1 page2015 10 16 13 40 48 407 - 1444983048407 - XXXPP3489X - ITRV - Unlocked PDFMadhabi MohapatraPas encore d'évaluation

- Sudha Singh Itr V 13Document1 pageSudha Singh Itr V 13Anurag SinghPas encore d'évaluation

- 212619X Form16Document1 page212619X Form16Ajay KumarPas encore d'évaluation

- FORM16Document5 pagesFORM16sunnyjain19900% (1)

- 1 - Form 16Document5 pages1 - Form 16premsccPas encore d'évaluation

- CP 16523370Document1 pageCP 16523370MaYank AdilPas encore d'évaluation

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Manogya SharmaPas encore d'évaluation

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goPas encore d'évaluation

- Form No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLDocument2 pagesForm No.16A: Tax Information Network of Income Tax Department Certificate No.: GVVIPLcool_rdPas encore d'évaluation

- 2316 JAKEDocument1 page2316 JAKEJM HernandezPas encore d'évaluation

- Income Tax Payment Challan: PSID #: 20391652Document1 pageIncome Tax Payment Challan: PSID #: 20391652Tanvir AhmedPas encore d'évaluation

- DSCN - Shree AutomotiveDocument24 pagesDSCN - Shree AutomotiveNikhilesh BhattacharyyaPas encore d'évaluation

- Form No. 16A: From ToDocument2 pagesForm No. 16A: From ToAstro Shalleneder GoyalPas encore d'évaluation

- Gross Total Income (1+2c) 4: Import Previous VersionDocument4 pagesGross Total Income (1+2c) 4: Import Previous Versionbalajiv_mailPas encore d'évaluation

- FORM16 CLTDocument4 pagesFORM16 CLTrajeevPas encore d'évaluation

- Tax Applicable (Tick One) 2 8 1Document7 pagesTax Applicable (Tick One) 2 8 1Gaurav BajajPas encore d'évaluation

- ST 2013111320791446483Document1 pageST 2013111320791446483engr_saleem3316Pas encore d'évaluation

- Aaaco1111l Form16a 2011-12 Q3Document1 pageAaaco1111l Form16a 2011-12 Q3Pradnesh KulkarniPas encore d'évaluation

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification Formbha_goPas encore d'évaluation

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Document4 pagesForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Kamlesh PatelPas encore d'évaluation

- Meyer-Andersen - Buddhism and Death Brain Centered CriteriaDocument25 pagesMeyer-Andersen - Buddhism and Death Brain Centered Criteriautube forPas encore d'évaluation

- Ens TecDocument28 pagesEns TecBorja CanalsPas encore d'évaluation

- RA ELECTRONICSTECH CEBU Apr2019 PDFDocument12 pagesRA ELECTRONICSTECH CEBU Apr2019 PDFPhilBoardResultsPas encore d'évaluation

- Exercise 6Document2 pagesExercise 6Satyajeet PawarPas encore d'évaluation

- Industrial SpecialtiesDocument103 pagesIndustrial SpecialtiesRahul ThekkiniakathPas encore d'évaluation

- Stepanenko DermatologyDocument556 pagesStepanenko DermatologySanskar DeyPas encore d'évaluation

- Mapagbigay PT1 Group1Document4 pagesMapagbigay PT1 Group1Hazel SarmientoPas encore d'évaluation

- CA500Document3 pagesCA500Muhammad HussainPas encore d'évaluation

- 13 Unit 5 PainDocument4 pages13 Unit 5 PainAndres SalazarPas encore d'évaluation

- CA02 ParchamentoJVMDocument6 pagesCA02 ParchamentoJVMJohnrey ParchamentoPas encore d'évaluation

- ICT ContactCenterServices 9 Q1 LAS3 FINALDocument10 pagesICT ContactCenterServices 9 Q1 LAS3 FINALRomnia Grace DivinagraciaPas encore d'évaluation

- Nfpa Training - Nfpa 72Document107 pagesNfpa Training - Nfpa 72yusuf.ahmediutPas encore d'évaluation

- EV-H-A1R 54C - M - EN - 2014 - D - Heat Detector SalwicoDocument2 pagesEV-H-A1R 54C - M - EN - 2014 - D - Heat Detector SalwicoCarolinaPas encore d'évaluation

- Nepal Health Research CouncilDocument15 pagesNepal Health Research Councilnabin hamalPas encore d'évaluation

- Surgical Management in LeprosyDocument33 pagesSurgical Management in Leprosynsv.epicPas encore d'évaluation

- Fundamental Unit of Life 1-25Document25 pagesFundamental Unit of Life 1-25Anisha PanditPas encore d'évaluation

- Excerpts From Roe v. Wade Majority OpinionDocument2 pagesExcerpts From Roe v. Wade Majority OpinioncatherinewangcPas encore d'évaluation

- Biomedical EngineeringDocument5 pagesBiomedical EngineeringFranch Maverick Arellano Lorilla100% (1)

- B028-Sayli Kapse B029-Surya Teja B030-Taranum Kaur B032-Yashesh Kothari B034-Sathish Kumar B035-ManeeshDocument24 pagesB028-Sayli Kapse B029-Surya Teja B030-Taranum Kaur B032-Yashesh Kothari B034-Sathish Kumar B035-ManeeshTaranum RandhawaPas encore d'évaluation

- Treatment Patterns in Patients With Type 2 Diabetes MellitusDocument9 pagesTreatment Patterns in Patients With Type 2 Diabetes MellitusAF KoasPas encore d'évaluation

- Screenshot 2019-10-30 at 12.44.00Document25 pagesScreenshot 2019-10-30 at 12.44.00Miền VũPas encore d'évaluation

- Pengaruh Pembangunan Center Point of IndDocument11 pagesPengaruh Pembangunan Center Point of IndSumitro SafiuddinPas encore d'évaluation

- Stats Review CH 1-6Document15 pagesStats Review CH 1-6Megha BanerjeePas encore d'évaluation

- Aircraft Noise Management: Graduation Project Defense For The Diploma of Air Traffic Management EngineerDocument46 pagesAircraft Noise Management: Graduation Project Defense For The Diploma of Air Traffic Management Engineerchouchou chamaPas encore d'évaluation

- February 2023 PROGRAM OF THE MPLEDocument8 pagesFebruary 2023 PROGRAM OF THE MPLEDale Iverson LacastrePas encore d'évaluation

- Dolor Postoperatorio y Efectos Secundarios de La Uvulo Palstia Con Radiofrecuencia en Roncopatia Primaria.Document5 pagesDolor Postoperatorio y Efectos Secundarios de La Uvulo Palstia Con Radiofrecuencia en Roncopatia Primaria.Alejandro RuizPas encore d'évaluation

- Lab Safety RulesDocument2 pagesLab Safety RulesChristine ManuelPas encore d'évaluation

- CV Ilham AP 2022 CniDocument1 pageCV Ilham AP 2022 CniAzuan SyahrilPas encore d'évaluation

- Topic: Going To and Coming From Place of WorkDocument2 pagesTopic: Going To and Coming From Place of WorkSherry Jane GaspayPas encore d'évaluation

- Air Pollution Emissions 2008-2018 From Australian Coal Mining: Implications For Public and Occupational HealthDocument11 pagesAir Pollution Emissions 2008-2018 From Australian Coal Mining: Implications For Public and Occupational HealthMaria Stephany CalisayaPas encore d'évaluation