Académique Documents

Professionnel Documents

Culture Documents

Functions of Islami Banks

Transféré par

Jakir_bnkDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Functions of Islami Banks

Transféré par

Jakir_bnkDroits d'auteur :

Formats disponibles

Introduction

Bangladesh is one of the largest Muslim countries in the

world. The people of this country are deeply committed to

Islamic way of life as enshrined in the Holy Qur'an and the

Sunnah. Naturally, it remains a deep cry in their hearts to

fashion and design their economic lives in accordance with

the precepts of Islam. The establishment of Islami Bank

Bangladesh Limited on March 13, 1983, is the true reflection

of this inner urge of its people, which started functioning with

effect from March 30, 1983. This Bank is the first of its kind

in Southeast Asia. It is committed to conduct all banking and

investment activities on the basis of interest-free profit-loss

sharing system. In doing so, it has unveiled a new horizon

and ushered in a new silver lining of hope towards

materializing a long cherished dream of the people of

Bangladesh for doing their banking transactions in line with

what is prescribed by Islam. With the active co-operation and

participation of Islamic Development Bank (IDB) and some

other Islamic banks, financial institutions, government bodies

and eminent personalities of the Middle East and the Gulf

countries, Islami Bank Bangladesh Limited has by now

earned the unique position of a leading private commercial

bank in Bangladesh.

Aims and Objectives

To conduct interest-free banking.

To establish participatory banking instead of banking on

debtor-creditor relationship.

To invest on profit and risk sharing basis.

To accept deposits on Mudaraba & Al-Wadeah basis.

To establish a welfare-oriented banking system.

To extend co-operation to the poor, the helpless and the

low-income group for their economic upliftment.

To play a vital role in human development and

employment generation.

To contribute towards balanced growth and development

of the country through investment operations particularly

in the less developed areas.

To contribute in achieving the ultimate goal of Islamic

economic system.

Functions

The functions of Islami Bank Bangladesh Limited are as

under:

To maintain all types of deposit accounts.

To make investment.

To conduct foreign exchange business.

To extend other banking services.

To conduct social welfare activities through Islami Bank

Foundation.

Achievements

National and international ratings of IBBL

IBBL's past performances have been evaluated by

Bangladesh Bank, several credit rating agencies home &

abroad and by the local press.

International Press

In the midst of a difficult Banking system known to be

plagued by high non-performing loans (NPLs), one could

easily conclude that it would be difficult to find a bank that

is different from norm. However, IBBL provides a refreshing

change and is, thus, a pleasant surprise. Although it does

not command the market share as the 4 public sector

banks, IBBL, which claims to have little interference in

lending from the government, has nonetheless, managed to

find a niche market of its own-says the BANK ATCH a New

York based international Credit Rating Agency in its

January 30, 1998 issue. As a market leader offering

banking services based on the Islamic rule of Shariah,

IBBL's profitability trend has been quite impressive. The

Bank's ability to keep its return on asset (ROA) well above

the industry's average, reflected its resilience to possible

shocks in the banking system. Concerns over massive

NPLs and under provisioning are common amongst local

banks. But this seems well resolved in IBBL. IBBL's good

performance and solid capital base have indeed provided

refreshing change found within a banking system saddled

and held back by huge NPLs the above agency continued

to comment in the same issue.

National Press

It is one of a few local banks according to CAMEL (Capital,

Assets, Management, Earnings & Liquidity) rating made by

the Bangladesh Bank. It holds the highest amount of

liquidity among all banks and its ability to keep return on

assets at 1.07 percent is well above the banking sector's

average of 0.33 percent- The Financial Express, Dhaka

commented in its issue of May 28,1998.

The Holiday in its 29th August, 1997 issue carried out a

report under the heading Setting a precedence of sound

banking and commented While the country's banking

system is burdened with bad debt portfolios and also

suffers from a liquidity shortage, the Islami Bank

Bangladesh Ltd. (IBBL) has created a unique precedence

by improving its reserve and deposit positions substantially,

making handsome profits, and offering attractive dividends

to its share holders and depositors.

IBBL's World rating

As per Bankers' Almanac (January 2001 edition) published

by the Reed Business Information, Windsor Court,

England, IBBL's world Rank is 1771 among 3000 banks

selected by them. This position was 1902 among 4500

selected banks as on January 1999 edition.

IBBL's country Rank is 5 among 39 banks as per ratings

made by the above Almanac on the basis of IBBL's

Financial Statements of the year 2001.

Award and Prizes: International & National Perspective

IBBL was awarded for several times by international &

national organisations. The Global Finance, a reputed

London based quarterly magazine, awarded IBBL as the

best bank of the country for the year 1999 and 2000.

IBBL has got the 2nd prize of National Export Fare for its

pavilion of Service Organisation in 1985.

Membership of Different Organization / Chamber

Local:

1. Bangladesh Institution of Bank Management (BIBM)

2. The Institution of Bankers Bangladesh (IBB)

3. Bangladesh Association of Banks (BAB)

4. Bangladesh Foreign Exchange Dealers' Association

(BAFEDA)

5. Central Shariah Board for Islamic Banks of

Bangladesh

6. International Chamber of Commerce- Bangladesh

Foreign:

1. International Association of Islamic Banks (IAIB),

Jeddah, K.S.A.

2. Accounting and Auditing Organizations for Islamic

Financial Institutions (AAOIFI), Manama, Bahrain.

3. General Council of Islamic Banks & Financial

Institutions (GCIBFI), Manama, Bahrain (IBBL is a

member of its Executive Council)

4. Society for Worldwide Inter-bank Financial

Telecommunication (SWIFT)

Mission:

To establish Islamic banking through the intriducton of welfare oriented banking

system and also ensure equity and justice in the field of all economic activities ,

achieve balanced growth and equitable development through diversified investment

ooperations particularly in the priority sectors and less developed areas of the

country.

To encourage socio-economic uplft and financial services to the low-income

community particularly in the rural areas.

Vision:

Vous aimerez peut-être aussi

- Modes of Investment of IBBLDocument53 pagesModes of Investment of IBBLMussa Ratul100% (2)

- Banking JournalDocument259 pagesBanking JournalShaheen MahmudPas encore d'évaluation

- Financial Ratio Analysis of United Commercial Bank and South-East Bank LimitedDocument27 pagesFinancial Ratio Analysis of United Commercial Bank and South-East Bank LimitedJakaria Khan100% (5)

- Revised AA1 - Exercises - All ChaptersDocument14 pagesRevised AA1 - Exercises - All ChaptersLinh Khanh TranPas encore d'évaluation

- Audit Case Study AGODocument5 pagesAudit Case Study AGOAlifah SalwaPas encore d'évaluation

- Comprehensive Case-Campbell SoupDocument9 pagesComprehensive Case-Campbell SoupIlham Muhammad AkbarPas encore d'évaluation

- To Take Into Account 2Document12 pagesTo Take Into Account 2Anii HurtadoPas encore d'évaluation

- Problems SAPMDocument4 pagesProblems SAPMSneha Swamy100% (1)

- Beams10e Ch01 Business CombinationsDocument39 pagesBeams10e Ch01 Business CombinationsmegaangginaPas encore d'évaluation

- Internship Report-FuadDocument46 pagesInternship Report-Fuadsourov shahaPas encore d'évaluation

- Tugas C12Document2 pagesTugas C12Yandra FebriyantiPas encore d'évaluation

- 262086378-Internship-Report-on-Loans-and-Advances-of-Pubali-Bank-Limited 01 PDFDocument109 pages262086378-Internship-Report-on-Loans-and-Advances-of-Pubali-Bank-Limited 01 PDFaal linconPas encore d'évaluation

- Financial Performance Analysis of First Security Islami Bank LimitedDocument21 pagesFinancial Performance Analysis of First Security Islami Bank LimitedSabrinaIra50% (2)

- Analyzing Investing Activities: Intercorporate InvestmentsDocument38 pagesAnalyzing Investing Activities: Intercorporate Investmentsshldhy100% (1)

- CH 7 - TAK Soal PDFDocument9 pagesCH 7 - TAK Soal PDFDiny SulisPas encore d'évaluation

- Internship Report - Private and ConfidentialDocument62 pagesInternship Report - Private and ConfidentialShining EyesPas encore d'évaluation

- Audit of Cash BalancesDocument17 pagesAudit of Cash BalancesHoàng VũPas encore d'évaluation

- Financial Accounting and Accounting Standards: Intermediate Accounting, 12th Edition Kieso, Weygandt, and WarfieldDocument31 pagesFinancial Accounting and Accounting Standards: Intermediate Accounting, 12th Edition Kieso, Weygandt, and WarfieldKarunia Utami100% (1)

- Chap 11 - Equity Analysis and ValuationDocument26 pagesChap 11 - Equity Analysis and ValuationWindyee TanPas encore d'évaluation

- Corporate Governance in Islamic Financial Institutions: by M. Umer Chapra and Habib AhmedDocument88 pagesCorporate Governance in Islamic Financial Institutions: by M. Umer Chapra and Habib AhmedmudeyPas encore d'évaluation

- Project On Bank AuditDocument33 pagesProject On Bank AuditShubham utekarPas encore d'évaluation

- Auditing (Arens) 14e Chapter 3 PowerPoint SlidesDocument38 pagesAuditing (Arens) 14e Chapter 3 PowerPoint SlidesMohsin AliPas encore d'évaluation

- Foreword: Financial Auditing 1 - 9 Edition - 1Document37 pagesForeword: Financial Auditing 1 - 9 Edition - 1meyyPas encore d'évaluation

- 4 Completing The Accounting Cycle PartDocument1 page4 Completing The Accounting Cycle PartTalionPas encore d'évaluation

- Chapter 2 (Tan&Lee)Document47 pagesChapter 2 (Tan&Lee)desy nataPas encore d'évaluation

- Internal Auditing As An Aid To ManagementDocument119 pagesInternal Auditing As An Aid To ManagementJohn Bates Blankson100% (3)

- Thesis Report On Pubali Bank LimitedDocument57 pagesThesis Report On Pubali Bank LimitedAtikul Arif100% (1)

- This Report Is To Analysis Credit Risk Management of Eastern Bank LimitedDocument30 pagesThis Report Is To Analysis Credit Risk Management of Eastern Bank Limitedশফিকুল ইসলাম লিপুPas encore d'évaluation

- Week Nine - Strategic Accounting Issues in Multinational CorporationsDocument40 pagesWeek Nine - Strategic Accounting Issues in Multinational CorporationsCoffee JellyPas encore d'évaluation

- International Accounting Choi SMDocument11 pagesInternational Accounting Choi SMelfishsamurai147Pas encore d'évaluation

- Chapter 5 Peter RoseDocument13 pagesChapter 5 Peter RoseRafiur Rahman100% (1)

- Index: Audit of BankDocument63 pagesIndex: Audit of Bankritesh shrinewarPas encore d'évaluation

- Auditing CH 22Document9 pagesAuditing CH 22saruyaPas encore d'évaluation

- Bonus Plan HypothesisDocument2 pagesBonus Plan HypothesisShamsinaz Mat IsaPas encore d'évaluation

- SynopsisDocument7 pagesSynopsisAnchalPas encore d'évaluation

- Financial StatementsDocument35 pagesFinancial StatementsTapish GroverPas encore d'évaluation

- Comprehensive Case Applying Financial Statement AnalysisDocument4 pagesComprehensive Case Applying Financial Statement AnalysisFerial FerniawanPas encore d'évaluation

- WALEED GHILAN - F19401067 The Diamond Model To Analyze TeslaDocument1 pageWALEED GHILAN - F19401067 The Diamond Model To Analyze TeslasalanfPas encore d'évaluation

- DEPOSITED SCHEMES OF SUCO CO-OPERATIVE BANK PampapathiDocument58 pagesDEPOSITED SCHEMES OF SUCO CO-OPERATIVE BANK PampapathiHasan shaikhPas encore d'évaluation

- Chapter 30 BrinkDocument31 pagesChapter 30 BrinkAuliya ZulfatillahPas encore d'évaluation

- Practical 3 - TL Analysis - PGP:25:275Document4 pagesPractical 3 - TL Analysis - PGP:25:275harsh JadhavPas encore d'évaluation

- Audit Report of Axis BankDocument51 pagesAudit Report of Axis BanksangeethaPas encore d'évaluation

- FM 105Document3 pagesFM 105Melzy AgdigosPas encore d'évaluation

- Project Report ON: Foreign Exchange Operation: A Study On Social Islami Bank Limited Submitted ToDocument55 pagesProject Report ON: Foreign Exchange Operation: A Study On Social Islami Bank Limited Submitted ToJannatul FerdousPas encore d'évaluation

- Credit and Distress Analysis For Manufacturing SectorsDocument1 pageCredit and Distress Analysis For Manufacturing SectorsFellicia Ayu NingratPas encore d'évaluation

- Financial Statement Analysis of ICICI Bank and A Comparative Study With Axis BankDocument7 pagesFinancial Statement Analysis of ICICI Bank and A Comparative Study With Axis Banksridharkar06100% (1)

- MACRS Depreciation TablesDocument4 pagesMACRS Depreciation Tablesyea okayPas encore d'évaluation

- Anderson and Zinder, P.C., CpasDocument3 pagesAnderson and Zinder, P.C., CpasJack BurtonPas encore d'évaluation

- Simon Chap. 5Document33 pagesSimon Chap. 5harum77Pas encore d'évaluation

- FSA 8e Ch04 SMDocument63 pagesFSA 8e Ch04 SMmonhelPas encore d'évaluation

- Investment Analysis - Chapter 7Document36 pagesInvestment Analysis - Chapter 7Linh MaiPas encore d'évaluation

- Boynton SM Ch.20Document27 pagesBoynton SM Ch.20Eza R100% (2)

- Audit Sampling For Tests of Details of BalancesDocument4 pagesAudit Sampling For Tests of Details of Balancesmrs leePas encore d'évaluation

- Internship Report On: "General Banking Activities of JANATA Bank LTD."Document50 pagesInternship Report On: "General Banking Activities of JANATA Bank LTD."Tareq AlamPas encore d'évaluation

- LambersCPAReviewAUDIT PDFDocument589 pagesLambersCPAReviewAUDIT PDFjulie anne mae mendozaPas encore d'évaluation

- Chapter 18 States and Local Govermental UnitsDocument14 pagesChapter 18 States and Local Govermental UnitsHyewon100% (1)

- Introduction of Auditing: StructureDocument56 pagesIntroduction of Auditing: Structureanon_696931352Pas encore d'évaluation

- Determinants of Level of Sustainability ReportD'EverandDeterminants of Level of Sustainability ReportPas encore d'évaluation

- Insurance and Risk Management: The Definitive Australian GuideD'EverandInsurance and Risk Management: The Definitive Australian GuidePas encore d'évaluation

- On Service Quality AnalysisDocument1 pageOn Service Quality AnalysisJakir_bnkPas encore d'évaluation

- Report On Credit PerformanceDocument42 pagesReport On Credit PerformanceJakir_bnkPas encore d'évaluation

- American RecessionDocument5 pagesAmerican RecessionJakir_bnkPas encore d'évaluation

- Code of Conduct IBLDocument2 pagesCode of Conduct IBLJakir_bnkPas encore d'évaluation

- Sound Lending PolicyDocument96 pagesSound Lending PolicyJakir_bnkPas encore d'évaluation

- Retail Credit PolicyDocument42 pagesRetail Credit PolicyJakir_bnk100% (1)

- Chapter 1Document5 pagesChapter 1Jakir_bnkPas encore d'évaluation

- Islmai Banking StrategyDocument2 pagesIslmai Banking StrategyJakir_bnkPas encore d'évaluation

- By Variate AnalysisDocument4 pagesBy Variate AnalysisJakir_bnkPas encore d'évaluation

- Short Notes On Public FinanceDocument3 pagesShort Notes On Public FinanceJakir_bnkPas encore d'évaluation

- Project ManagementDocument4 pagesProject ManagementJakir_bnkPas encore d'évaluation

- Project ManagementDocument4 pagesProject ManagementJakir_bnkPas encore d'évaluation

- Foreign ExchangeDocument55 pagesForeign ExchangeJakir_bnkPas encore d'évaluation

- Price To Earnings Ratio: FormulaDocument2 pagesPrice To Earnings Ratio: FormulaJakir_bnkPas encore d'évaluation

- GCR Report - Prime BankDocument6 pagesGCR Report - Prime BankJakir_bnkPas encore d'évaluation

- Report On Eastern Insurance CompanyDocument2 pagesReport On Eastern Insurance CompanyJakir_bnkPas encore d'évaluation

- Crisl Bank RatingDocument1 pageCrisl Bank RatingAnita Rahman LabbyPas encore d'évaluation

- Overall Performance of Islamic BanksDocument13 pagesOverall Performance of Islamic BanksJakir_bnkPas encore d'évaluation

- Overview of Financial Structure of BangladeshDocument7 pagesOverview of Financial Structure of BangladeshJakir_bnkPas encore d'évaluation

- General OperationsDocument43 pagesGeneral OperationsJakir_bnkPas encore d'évaluation

- Islamic Bank's ContributionDocument38 pagesIslamic Bank's ContributionJakir_bnkPas encore d'évaluation

- Report On Eastern Insurance CompanyDocument2 pagesReport On Eastern Insurance CompanyJakir_bnkPas encore d'évaluation

- SMEDocument55 pagesSMEJakir_bnkPas encore d'évaluation

- Uttara Bank FinalDocument82 pagesUttara Bank FinalZishan NiazPas encore d'évaluation

- Rehabilitation of Padma Birdge ProjectDocument5 pagesRehabilitation of Padma Birdge ProjectJakir_bnkPas encore d'évaluation

- Credit ManagementDocument9 pagesCredit ManagementJakir_bnkPas encore d'évaluation

- Corporate GovernanceDocument12 pagesCorporate GovernanceJakir_bnkPas encore d'évaluation

- Summary of Activities of Green Banking: (See Detail Circular)Document5 pagesSummary of Activities of Green Banking: (See Detail Circular)Jakir_bnkPas encore d'évaluation

- Ethical EvaluationDocument5 pagesEthical EvaluationJakir_bnkPas encore d'évaluation

- 06 Advance Islamic EconfinDocument545 pages06 Advance Islamic Econfinapi-292047125Pas encore d'évaluation

- Islamic Financial System Principles and Operations PDF 401 500Document100 pagesIslamic Financial System Principles and Operations PDF 401 500Asdelina R100% (1)

- Islamic Banking Operations-2019Document20 pagesIslamic Banking Operations-2019Sharifah Faizah As SeggafPas encore d'évaluation

- Bank Parikrama - All ArticlesDocument87 pagesBank Parikrama - All ArticlesmackjblPas encore d'évaluation

- Akhuwat Org - 1Document24 pagesAkhuwat Org - 1Taha ZakaPas encore d'évaluation

- Current Issues in The Practice of Islamic Banking: 1. StandardizationDocument7 pagesCurrent Issues in The Practice of Islamic Banking: 1. StandardizationZeshan ChoudhryPas encore d'évaluation

- Individual Report - How Is Takaful Different From Other Insurance - (Nor Khairiyatul Wafa Binti Rosdi)Document10 pagesIndividual Report - How Is Takaful Different From Other Insurance - (Nor Khairiyatul Wafa Binti Rosdi)Nor KhairiyatulPas encore d'évaluation

- CIEF S 13 00234 Mulawarman KamayantiDocument41 pagesCIEF S 13 00234 Mulawarman KamayantiRusman SEPas encore d'évaluation

- Supporting Shariah Concepts: Shariah Resolutions in Islamic FinanceDocument20 pagesSupporting Shariah Concepts: Shariah Resolutions in Islamic FinanceMohd Afif bin Ab RazakPas encore d'évaluation

- AcademicCalendar 2018Document149 pagesAcademicCalendar 2018Khandaker Amir EntezamPas encore d'évaluation

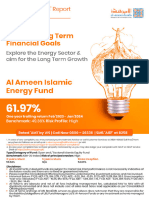

- Al Ameen Funds-Fund Manager Report-Jan-2024Document21 pagesAl Ameen Funds-Fund Manager Report-Jan-2024aniqa.asgharPas encore d'évaluation

- IJARAHDocument37 pagesIJARAHAdnan Rahman100% (1)

- Halal Investing For Beginners How To Start Grow and Scale Your Halal Investment Portfolio 1St Edition Ibrahim Khan Full ChapterDocument52 pagesHalal Investing For Beginners How To Start Grow and Scale Your Halal Investment Portfolio 1St Edition Ibrahim Khan Full Chaptercatherine.jonas226100% (5)

- Fourth Maxim (The Principle of Dharar)Document69 pagesFourth Maxim (The Principle of Dharar)aen_anuar50% (2)

- Idb Establishment Objectives, Aaoifi Objective Structure Bgiib MPBDocument6 pagesIdb Establishment Objectives, Aaoifi Objective Structure Bgiib MPBMD. ANWAR UL HAQUEPas encore d'évaluation

- Finacle Core Banking SolutionDocument8 pagesFinacle Core Banking SolutionInfosysPas encore d'évaluation

- Arab-Malaysian Finance Berhad V Taman Ihsan Jaya SDN BHD - 2008Document3 pagesArab-Malaysian Finance Berhad V Taman Ihsan Jaya SDN BHD - 2008Norkamilah Mohd RoselyPas encore d'évaluation

- Internship Report On Meezan Bank CompleteDocument85 pagesInternship Report On Meezan Bank CompleteJamil AhmedPas encore d'évaluation

- Solution Far618 - Jul 2017Document10 pagesSolution Far618 - Jul 2017E-cHa PineapplePas encore d'évaluation

- Shariah Issues in Islamic Finance - BNMDocument28 pagesShariah Issues in Islamic Finance - BNMAhmad RusydanPas encore d'évaluation

- Islamic Finance: Opportunities, Challenges, and Policy OptionsDocument10 pagesIslamic Finance: Opportunities, Challenges, and Policy OptionsInternational Monetary FundPas encore d'évaluation

- Halal Industry ManangementDocument6 pagesHalal Industry ManangementJMF2020Pas encore d'évaluation

- Last Module Accounting For Securities FinancingDocument12 pagesLast Module Accounting For Securities FinancingShibla RazakPas encore d'évaluation

- From Haqq To Gharar:RibaDocument14 pagesFrom Haqq To Gharar:RibaNughmana MirzaPas encore d'évaluation

- Muhammad Omer Rafique: Shariah Researcher (Mufti), Islamic Fiqh & FinanceDocument1 pageMuhammad Omer Rafique: Shariah Researcher (Mufti), Islamic Fiqh & Financeomer rafiquePas encore d'évaluation

- Global Leasing ToolkitDocument18 pagesGlobal Leasing ToolkitIFC Access to Finance and Financial Markets0% (1)

- Case Analysis Islamic Banking TakafulDocument11 pagesCase Analysis Islamic Banking Takafulshukri ahmad ikramPas encore d'évaluation

- Investment Dar - CI RatingDocument14 pagesInvestment Dar - CI RatingHamad Al SalemPas encore d'évaluation

- IBP Superior Qualification ProspectusDocument7 pagesIBP Superior Qualification ProspectusShuja GhaziPas encore d'évaluation

- Project and Group ProfileDocument48 pagesProject and Group ProfileNoureen MushtaqPas encore d'évaluation