Académique Documents

Professionnel Documents

Culture Documents

Travelling Allowance - Session 4.1 & 4.2 PDF

Transféré par

Basho HumanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Travelling Allowance - Session 4.1 & 4.2 PDF

Transféré par

Basho HumanDroits d'auteur :

Formats disponibles

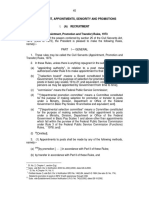

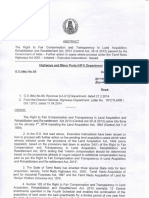

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

SESSION OVERVIEW

A. TRAVELLING ALLOWANCE

Government servants are duty

bound to perform their functions in

place of their posting. Government

service comes with all the social and

economic dislocation experienced by

the employees. This may be in public

interest or on request of the employee,

and accordingly their place of stay is

also subjected to change. In these

circumstances, employees are required

to maintain their primary place of

residence and also incur additional

housing costs in the town where they

have been posted to work. Therefore,

some relief for these additional costs

should be provided.

1.

These provisions of granting

allowance to meet travel and

subsistence expenses are consistent

with the long standing principle that

travel allowances are provided to

ensure that an employee is not

financially disadvantaged as a result of

having to travel on official business.

LEARNING OBJECTIVES

To inform the participants about

Various types of Travelling

Allowances admissible to a

Government servant.

Grades of Government servants

for the purposes of T.A.

The entitlements of different

pay scales to claim T.A.

Rates admissible to different

categories of Government

servant.

Grant of advance T.A. on tour/

transfer and related subjects.

Note 4.1 & 4.2

Meaning

Travelling allowances are intended

to meet the costs necessarily incurred

by employees who are required to

travel away from home/place of work

on official business. Such costs cover

accommodation, meals and incidental

expenses.

Travelling

Allowance

includes a travelling or subsistence

allowance for travel within the work

sphere by the holder of an office.

2.

Grades of Government servant

2.1 For the purpose of Travelling

Allowance, employees are divided into

five grades as indicated below:Basic Pay + NPA + Stagnation

Increment

Rs. 16,400 and above

Rs 8,000-16,399

Rs 6,500- 7,999

Rs 4,100- 6,499

Below Rs 4,100

[GIO (1), SR 17]

The classification is decided by the

employees pay on the post actually

held by him, whether permanent,

temporary, or officiating.

2.2 An employee in transit from one

post to other ranks in the lower of the

two.

[SR 19]

2.3

Gradation of re-employed

pensioner

(i)

If he ceases to draw pension,

the grade depends on the

actual pay received from

time to time.

331

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

(ii)

(iii)

(iv)

3.

If pension is drawn in

addition to pay in the

reemployed post and if on

the basis of the total of

pension and pay. If such

total exceeds that maximum

of the time-scale of the

reemployed post, the grade

will be on the basis of the

maximum of the scale.

The amount of pension

taken into accounts will be

the amount sanctioned

before commutation, if any.

The grade will be decided

on the basis of pay alone in

the case of re-employed

civil

and

military

pensioners whose previous

was ignored while fixing

pay on reemployment.

[GIO (6), SR 17]

Daily Allowance

(given in Rates in

subsequent para) even if it

is through an expensive

locality.

(iii)

For return to HQ on the

same day, D.A. is at

ordinary

rates

only,

irrespective of the fact that

the journey was performed

to an expensive locality.

(iv)

For local journey, D.A. is

only at half the ordinary

rate, irrespective of the

locality.

(v)

For enforced halts en route

treated as duty, due to

breakdown

of

communications caused by

flood, rain, etc. D.A. is

admissible at ordinary rates

only.

(vi)

D.A. is admissible for

period of absence at tour

station

regularised

as

special casual leave due to

disturbances, imposition of

curfew, etc.

(vii)

D.A. is calculated either

with reference to period

spent on journey first and

thereafter for the period

spent in expensive locality

or the other way round,

whichever is beneficial.

[GIOs, SR51]

(viii)

No D.A. for Sundays and

Holidays

unless

the

employee is actually and

not merely constructively

on camp. No D.A. for leave

The allowance granted to meet the

daily expenses of lodging and boarding

when on tour or training is termed as

Daily Allowance.

3.1

Basis for D.A. calculation

(i)

Absence from headquarters

on calendar day basis, i.e,

from midnight to midnight.

Absence not exceeding 6 hours

Nil

Absence exceeding 6 hours but not 70%

exceeding 12 hours

Absence exceeding 12 hours

100%

(ii)

D.A. for journey period is

only at ordinary rates as in

Column (5) of the Table

Note 4.1 & 4.2

332

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

admissible

days.

and restricted holidays

availed while on tour.

[GIO (1), SR 72]

(x)

(ix)

3.2

beyond

180

Tour ends on return to HQ.

Tour to the same place

again is treated as fresh one

and D.A. will be at full

rates.

[GIOs (1) & (2)]

Full D.A. is admissible for

the first 180 days of

continuous halt at a station

on tour/ temporary transfer/

training.

No

D.A.

Rates

Rates of D.A. for halt at various stations/ localities are given in the following

table. The localities of Columns 2 to 4 of the table are specified in FR and SR.

Rates at a glance

Pay range

Rs. 16,400

and above

Rs 8,00016,399

Rs 6,5007,999

Rs 4,1006,499

Below Rs

4,100

3.3

A

B

C

D

A-1 Class cities

A-class cities and

specially expensive

localities

B-class cities and

expensive localities

Other localities

Ordy.

Hotel

Ordy.

Hotel

Ordy.

Hotel

Ordy.

Hotel

260

650

210

525

170

425

135

335

230

505

185

405

150

330

120

225

200

380

160

305

130

250

105

200

170

245

135

195

110

160

90

130

105

125

85

100

70

85

55

65

Eligibility of D.A. in various circumstances

Free boarding and /or lodging charges availed

Free boarding and lodging

Free board alone

Free lodging alone

Stay in office building free of cost

Stay in Govt. / Public Sector Guest House/ rest rooms of

IAII in International Airports or making own arrangement

Lodging charges paid in excess of 25% of normal D.A.

while staying in

Govt./ PS Guest house

Stay in hotel and other establishment including private

lodges, guest houses, YWCA/YMCA hostels.

Note 4.1 & 4.2

25 % of ordinary rate

50% -do75% -do75% -doAt ordinary rates

75% of ordinary rates + lodging

charges restricted to hotel rate.

90% of ordinary rate + lodging

charges restricted to hotel rate.

333

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

B.

ADVANCE OF T.A.

of the first leaving no time for the

employee to prefer his T.A. bill in

respect of the first advance.

[Rule 233]

In its plain meaning the term

advance means before hand. Advance

of T.A. is the amount taken by the

employee on the basis of tentative

calculation of his expenses which he

might incur when on tour or transfer.

1.4 Recovery- By adjustment from

the T.A. bill submitted after

completion of the journey.

1.

2.

Advance of T.A. on Transfer

2.1

Amount

Advance of T.A. on Tour

1.1

Amount

(i)

(ii)

An amount sufficient to

cover the officials personal

travelling expenses for a

month,

viz.,

daily

allowance, road/ rail/ air

fares, for journeys both

ways.

In the case of prolonged tour

in the interior, to places

difficult of access, an

amount sufficient to cover

daily allowance, road/ rail/

air fares and contingent

charges such as for the hire

of conveyance, conveyance

of records, tents, etc., for

six weeks.

[Rules 231 &232]

(i)

One months pay in cases of

normal transfer.

[Rule 233]

(ii)

Two months pay if the

transfer is due to shift of

headquarters as a result of

Government

policy.

Advance of pay can be

taken at the new station, if

so desired.

[Rule 233]

(iii)

In addition to (i) & (ii)

above, advance of T.A. as

admissible under the rules,

for self and family. This

can be drawn either in one

instalment or separately for

self and family in two

instalments.

[Rule 223 & GID (3)]

1.2 Eligibility- All cases where T.A.

is admissible as for a journey on tour.

1.3 Conditions - The advance should

be adjusted within fifteen days of

completion of the tour/ rejoining duty

if gone on leave immediately on

completion of tour. A second advance

cannot be sanctioned until an account

has been given of the first except when

a second journey is required to be

undertaken soon after the completion

Note 4.1 & 4.2

2.2

Eligibility

(i)

Employees under orders of

transfer, including those on

leave.

(ii)

Employees proceeding on

foreign service in India or

334

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

on reversion from such

service.

[Rules 222 & 226, GIO (3)]

(iii)

Not admissible when the

transfer is at officials

request and not in public

interest.

C.

TYPES OF TRAVELLING

ALLOWANCE

Travelling

Allowance

is

admissible to a Government servant on

various occasions as discussed

hereinafter:

1. T.A. on Tour

(iv)

2.3

Not admissible when the

transfer is within the same

station.

Recovery

(i)

Advance of pay of one

month - in not more than

three instalments.

(ii)

Advance of pay of two

months in 24 instalments.

(iii)

Monthly rate of recovery

should be in whole rupee,

the balance being recovered

in the last instalment.

(iv)

Should commence form the

month in which the official

draws a full months pay

and /or leave salary after

joining new appointment.

(v)

Advance T.A. should be

recovered in full from the

T.A. bill.

[Rules 225 & 226]

Note 4.1 & 4.2

T.A. on tour is from duty point/

residence at headquarters to duty point

at the distant station and vice versa. It

comprises-

1.1

Fare for journeys by Road/

Rail/ Air/ Sea.

Road

mileage

for

road

journey otherwise than by bus.

D.A. for the entire period of

absence from headquarters

including

journey

period.

(Discussed in detail under the

subsequent heading Daily

Allowance)

Entitlements for travel by Road

Rate of road mileage

(i)

Actual fare shall be paid for

travel by public bus.

Mileage allowance at 60

p/Km will be admissible for

journey by bicycle/ foot.

(ii)

For journeys by auto

rickshaw/

taxi/

car,

entitlement shall be at the

rates notified by the

concerned

Director

of

Transport.

335

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

Basic

pay+NPA+SI

entitlements

Rs 16,400 and

above

Rs 8,000 -16,399

AC taxi/ Car/any Bus including

AC Bus

Taxi/ Car/any Bus including AC

Bus except AC Taxi

Taxi/ Autorickshaw/ Scooter/

Moped/any Bus except AC Bus

Autorickshaw/

Scooter/

Moped/any Bus except AC Bus

Autorickshaw/

Scooter/

Moped/Ordinary Bus

Rs 6,500 - 7,999

Rs 4,100 - 6,499

Below Rs 4,100

(iii)

If no rates have been

notified/

prescribed,

prevailing rates in the

Metropolitan city of the

State may be adopted. If no

such rates have been fixed,

then the rates for the

neighbouring State shall be

adopted. When no rates

become available even after

this, following rates are

fixed-

For journeys performed in own Rs 8/

Km

car/ taxi

For journeys performed by Rs 4/

Km

autorickshaw/ scooter

Special entitlements of Taxi fare in

Metropolitan cities

For

official

journeys on tour

from

office/

residence

to

Airport/

Railway Station/

Bus Station and

vice versa in

four Metros

Note 4.1 & 4.2

Taxi fare as prescribed by

the respective Director of

Transport plus 25% thereon

OR Actual taxi fare,

whichever is less OR

charges paid under prepaid

taxi charges. If own car

mileage to be limited to

one trip each only at the

time of arrival and

departure, at approved taxi

rates.

Journey by road between places

connected by rail(i)

May travel by car/ taxi/

scooter/ motor cycle.

Entitlement road mileage

restricted to rail fare of

highest entitled class.

(ii)

May travel by any type of

bus in any class.

Entitlement Actual fare

paid restricted to entitled

class.

Journey by road between places not

connected by rail

(i)

1.2

May travel by the entitled

conveyance

or

public

transport system.

Entitlement Road mileage

as per rates above.

Entitlements for journey by Rail

Pay

Range

Shatabdi

Express

Rajdhani

Express

Other Trains

Rs

16,400

Executive

Class

AC

First

Class

AC

Class

Rs

8,00016,399

AC Chair

AC 2-tier

AC 2Car

tier

Rs

6,5007,999

-do-

Rs

4,1006,499

-do-

Below

4,100

-do-

AC

chair*

Car

First

First Class/

AC 3-tier/

AC

Chair

Car

-do-

-doSleeper

Class

-do-

336

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

Those entitled to travel by AC First

Class/ AC 3-tier/ AC Chair Car may

travel on tour/ transfer by AC 2-tier, if

any of the trains connecting the

originating and destination stations by

the direct shortest route do not provide

for any of the class.

*Travel by AC-3 tier permissible in

trains not providing AC chair car

accommodation.

1.3

1.4 Entitlement by Sea/ River Steamer

Pay

A

&

N Others

Range Islands and

Lakshadweep

Islands

Rs

8,000

and

above

Deluxe Class

Highest Class

Rs

6,5007,999

First / A Cabin

Class

If there be two classes only on

the steamer the lower class

Rs

4,1006,499

Second / B

Cabin Class

If there be three classes the

middle or second class. If there

be four classes the third class

Below

4,100

Bunk Class

The lowest class

Entitlements by Air

Entitled Officers

(Basic+NPA+SI)

Not Entitled Officers

Rs. 16,400 and

above

No conditions

attached

Rs 12,300 16,400

May travel by air on

tour/ transfer if the

distance is more

than 500 Km and

the journey cannot

be

performed

overnight (6 pm to 8

am) by a direct

train.

Journey by private airlines

Journey may be performed by private

airlines only in cases where the station

to which the Government servant has

to go on official duty is not connected

at all by Indian Airlines/ Vayudoot.

[SR 48-A]

2.

T.A. on Transfer

Transfer means the movement

of an employee from one headquarter

station in which he is employed to

another such station, either to take up

the duties of a new post, or in

consequence of a change of his

headquarter.

[SR 2(18)]

2.1

AdmissibilityAdmissible

only if the transfer is in the public

interest and not at ones own request.

However, officials transferred after

completion of full tenure are entitled to

T.A. and transit time, even if they are

posted to the place of their choice.

[OM dated 18-12-1995]

2.2

Entitlements in general Transfer T.A. is from residence to

residence and comprises the following

elements-

Note 4.1 & 4.2

337

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

(i)

(ii)

(iii)

A composite transfer grant;

Actual fares for self and

family for journey by rail/

steamer/ air;

Road mileage for journey

by road;

Cost of transportation of

personal effects; and

Cost of transportation of

conveyance possessed by

the employee.

or

No T.A is admissible

(i)

If no change of residence

is involved.

(ii)

If there

residence

Grade of the employee is

determined with reference

to the date of his transfer,

and the fares to be

determined with reference

to the date of journey. No

travelling allowance is

admissible for any member

added to the family after the

date of transfer.

[SR 116 (b) (iii)]

The

employee

will be

entitled for an additional

fare by the entitled class for

self for both onward and

return journeys, if he has to

leave his family behind due

to

non-availability

of

Government ccommodation

at the new place of posting.

[GIO (1), SR 116]

An employee

whose

family does not accompany

him to the new station

while joining on transfer,

has an option to claim for

him

for the journey subsequently

undertaken along with

family members.

[GIO (7), SR 116]

is

change of

Actual cost of conveyance

for self and family limited

to the road mileage and

actual cost of transportation

of

personal

effects

admissible subject to the

prescribed limits, and

Composite transfer grant

equal to one-third of basic

pay.

[GIO (7), SR 116]

When distance between two stations is

not more than 20 Km

(i)

If no change of residence is

involved.

If there is change of

residence

(ii)

Full transfer T.A. will be

allowed

composite transfer grant

equal to one-third of basic

pay.

[GIO (7), SR 116]

either for

the

first journey

undertaken to join the new

post

Note 4.1 & 4.2

338

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

Definition of family- Family includes

(i)

Spouse residing with the

employee. Only one wife is

included in the term

family.

2.3

Entitlements for journeys by

Rail/ Road/ Air/ Steamer as

applicable in case of T.A. on tour.

Journey by road between places

(i)

(ii)

(iii)

(iv)

(v)

Legitimate children and

stepchildren, residing with

and wholly dependent.

Children include major

sons, widowed daughters,

residing with and wholly

dependent. Restriction is up

to two children w.e.f. 1-11996. Restriction does not

apply to existing employees

with more than two

children including those

born up to 31-12-1998.

Restriction does not apply

also to employees with no/

one child on 31-12-1998

but

next

confinement

resulting in multiple births

thereby increasing the

number to more than two.

Married

daughter, if

divorced, abandoned or

separated from her husband

and residing with and

dependent.

Parents,

stepmother,

unmarried sisters and minor

brothers residing with and

wholly dependent.

Widowed sisters residing

with and wholly dependent.

[SR 2 (8) & GIO (1)]

Note 4.1 & 4.2

Not connected by railFor journey by public bus,

actual bus fare for self and

family members. If journey

is performed otherwise than

by public bus, mileage rates

will be

(ii)

One mileage for self/ self &

one additional member;

Two mileages if two

members

of

family

accompany;

Three mileages if more than

two members accompany.

[SR 116]

Connected by railLimited to rail mileage by

the entitled class.

[SR 116 (b)]

Option to the family

The family may travel

From the old HQ to the new

HQ

From any other station to the

new HQ

From the old HQ to any other

station

But the claim will be restricted to that

admissible from the old to the new

HQ.

339

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

2.4 Time limit- The members of the

family should perform the journey not

earlier than one month prior to the

transfer of the official or within six

months thereafter. It can be extended

in deserving cases by the Head of

Department.

[SR 116(iii) (b), GIO (1)]

2.5 Entitlements at a glance

Basic Pay + Composite

NPA

+ Transfer

Stagnation

grant

Increment

Personal effects

By Train/ steamer

Maximum

Rate per Km for transport by road

A-1, A, and Other places

B-1 cities

Rs. P.

Rs. P.

Rs 16,400 and Equal to one Full four wheeler

wagon, or 6,000

months

above

Kg by goods train,

basic pay

or one double

container

Full four wheeler

wagon, or 6,000

Rs

8,000kg by goods train,

-do16,399

or

one

single

container

30.00

18.00

30.00

18.00

Rs 6,500-7,999

-do-

3,000 kg

15.00

9.00

Rs 4,100-6,400

-do-

1,500 kg

7.60

4.60

Rs 3,350-4,099

-do-

1,500 kg

7.60

4.60

Below

3,350

-do-

1,000 kg

6.00

4.00

(i)

Rs

Personal effects should be

transported

by

goods

between places connected

by rail. If transported by

road, the actual expenditure

or 1 and times of the

amount admissible for

transport by goods for the

maximum

admissible

quantity, whichever is less,

will be admissible.

Note 4.1 & 4.2

[SR 116 (a) I (iii) (Notes 1

to 5); and GIOs]

(ii)

The higher rate of road

mileage is admissible for

transport of personal effects

between one place and

another within the limits of

A-1, A, and B-1 class

cities.

340

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

(iii)

The lower rate of road

mileage is admissible for

transport of personal effects

between

stations

not

connected by rail.

[GIO (1), SR 116]

2.6

Transport of conveyance The

possession of the conveyance (either at

the old or at the new station) need not

be in public interest.

[Item VI GIO (1), SR 116]

Basic+

Authorised Scale

NPA + SI

Rs 6,500 One motor car or one

and above motor cycle/Scooter or

one horse

Below

One motor cycle/ scooter/

6,500

bicycle

(i) Transport by rail

Mode

By

Passenger

Rate

Actual freight charged by

Railways

By Goods

Cost

of

packing,

transporting,

crating,

loading, unloading of car/

motor cycle are all

reimbursable restricted to

actual charges.

By

any Second class fare by

other

shortest

route

for

chauffeur or cleaner.

Note 4.1 & 4.2

(ii) Transport by road

Car/ scooter or motor cycle/ moped

Mode

of

transportation

Authorised Scale

Sent loaded on Actual expense as per

truck

rates/

cost

by

passenger

train

whichever is less

Places

not

connected by rail

Actual expenses

limited

to

amount

at

prescribed rate*

Sent under own Amount

at

the Amount

at

propulsion

prescribed rate limited prescribed rate*

to

cost

of

transportation

by

passenger train

*Rate prescribed by Director of Transport

3.

T.A. for Local Journeys

3.1

Definition - Local Journeys

means journeys on duty on any day

beyond 8 Km from the duty point at

Headquarters and within the limits of

suburban or other Municipalities,

Notified areas, in which the duty point

is located. Journeys performed within

the limits of an Urban Agglomeration

within

which

the

employees

headquarter is located will also be

treated as local journey.

3.2 Entitlement

(i)

Mileage allowance for the

journeys performed on all

the days spent on temporary

duty and in addition 50% of

the admissible D.A. Option

is available either to claim

reimbursement

of

conveyance hire charges

under

Delegation

of

Financial Powers Rules or

341

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

to claim normal T.A. as

above.

(ii)

(iii)

(iv)

(v)

(vi)

T.A. for a local journey is

admissible if the temporary

place of duty is beyond 8

km from the normal place

of duty, irrespective of

whether the journey is

performed form residence

or from the normal place of

duty.

Local

journeys should

normally be performed in

the same way as journey to

duty point, i.e., by bus,

local

train,

or

own

conveyance. Where travel

by special means like taxi,

scooter, etc., is considered

necessary, prior permission

of superior authority is

necessary.

The bus/ rail fare/ mileage

allowance should be based

on the actual distance

travelled or the distance

between the normal duty

point and temporary duty

point, whichever is less.

If

free conveyance is

provided, only D.A. will be

admissible.

D.A. for local journeys is

admissible at the ordinary

rates.

[GIO (2), SR 71, GIO (6),

SR 46, GIO (3), SR 51 and

C & AG Cir., dated 5.5.94]

3.3

LimitationAn official

required to perform duty at a

temporary duty point, will be paid

D.A. for the first 180 days only.

Beyond 180 days, no D.A. will be

admissible.

[GIO (8), SR 51]

4.

T.A. when deputed on Training

4.1 An employee deputed to undergo

a course of training in India is entitled

to draw T.A. and D.A as on tour as

follows:-

Facility

When boarding and lodging

not provided

When boarding and lodging

available

at

Training

Institutes

First 30

days

Full

D.A.

Next

150

days

Full

D.A.

Half

D.A.

4.2 If the training exceeds 180 days,

option to draw either T.A. as on

transfer or tour T.A plus D.A for the

first 180 days is available.

4.3 If training and practical training

are given in two different stations,

D.A. in the second station will

commence afresh irrespective of

whether D.A. was drawn for 180 days

or less in the first station.

4.4 An employee on training at a

particular station going on tour to

another station will be entitled to draw

D.A. at full rate for stay in the touring

station, but this period will also be

taken into account for computing 180

days of halt at the training station.

4.5 No T.A. / D.A. is admissible for

training

at

the

headquarters

Note 4.1 & 4.2

342

Beyond

180 days

Nil

Nil

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

irrespective of the distance between

normal duty point and the training

centre.

4.6

An employee drawing D.A.

during training will be entitled to draw

HRA and CCA only at the rates

admissible at his headquarters from

where he has been deputed to the

training.

[SR 164 & GIOs & HRA and CCA

orders]

5.

6.

T.A. on Retirement

6.1 Entitlements

(i)

(a) He is entitled to T.A. same

as on transfer including

lump-sum

Composite

Transfer Grant. Travel by

air is also admissible.

T.A. on Temporary Transfer

(b) The employee and his

family may travel from the

last headquarters to the

declared home town, or to

any other selected place of

residence where he wishes

to settle.

[GIO (1), SR 147]

5.1 For transfers not exceeding 180

days, the journeys from headquarters

to the station of deputation and back

will be treated as on tour and D.A will

be granted for the first 180 days only.

[GIO (2), SR 114]

5.2 Joining time is not admissible.

Only actual transit time as for tour is

allowed.

[Rule 4 (1), Appendix-10, FR, Part I]

5.3 No advance of pay is admissible.

[GIO (2), SR 114]

5.4 If a transfer originally made for a

period more than 180 days is reduced

to 180 days or less later, the T.A. claim

originally allowed should not be

changed to the disadvantage of the

official.

[GIO (2), SR 114]

5.5 If a temporary transfer originally

made for a period of 180 days or less is

later extended beyond 180 days, the

T.A. already drawn shall be adjusted in

the transfer T.A. claim; but D.A. is

admissible up to the date of issue of

the revised orders. [GIO (2), SR 114]

Note 4.1 & 4.2

When the

Government

servant settles down in a

station other than the last

station of duty

(ii)

When the Government

servant settles down in the

last station of duty but with

a change of residence or at

a place not exceeding 20

km

Self & family

Personal effects

Transportation

and coneyance

Composite

Transfer Grant

Actual

cost

of

conveyance but not

exceeding the road

mileage admissible on

transfer

Actual

cost

not

exceeding admissible

on transfer

Allowance

as

prescribed by Director

of Transport

Amount equal to one

third of Basic pay

343

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

Note : The last station of duty means

and includes the areas falling within

the Urban Agglomeration of such

station.

6.2

T.A. not admissible on

resignation, dismissal, etc.The

concession is admissible only to

persons who retire on retiring pension

or on superannuation, invalid or

compensation pension. It is not

admissible to employees who quit

service by resignation or who may be

dismissed or removed from service or

compulsorily retired from service as a

measure of punishment.

[GIO (1), SR 147]

retirement. Advance will be limited to

the amount to which the employee may

be entitled under the rules, and will be

adjusted in full on submission of the

T.A. bill. No advance is admissible

when the journey is performed after

retirement.

[GIO (5), SR 147 & Rule 224 GFRs]

7.

T.A. on Death

7.1

Entitlements Same as for

retirement. And also

(i)

The family of an employee

who dies in service may

travel from the last

headquarters

of

the

employee to the home

town, or to any other place

of residence where the

family wishes to settle

down.

(ii)

If at the time to the death of

the employee any member

of his family happens to be

at the station other then his

headquarters, such member

may travel from that station

to the home town or

selected place of residence.

But the claim will be

restricted to what is

admissible from the last

headquarters to the home

town or selected place of

residence, as the case may

be.

(iii)

If any member of the

family proceeds from the

last headquarters to a place

other then the selected

place of residence, the

6.3

Admissible to temporary

employeesThe concession

will be admissible to temporary

employees who have put in a total

service of not less than ten years under

the Central Government and

(i)

who retire on attaining the

age of superannuation; or

(ii)

who are invalid; or

(iii)

who

are

retrenched

from service without being

offered

alternative

employment.

[GIO (1), SR 147]

6.4 Time limit The concession

should be availed by the employee

during leave preparatory to retirement

or within one year of the date of his

retirement.

6.5 AdvancesAdvances may

be sanctioned only when the journey is

performed during leave preparatory to

Note 4.1 & 4.2

344

Indian Audit and Accounts Department

Courseware on Various Entitlements admissible to a Government Servant

Session 4.1 & 4.2: Travelling Allowance Admissibility, Entitlements and

Types; Grades of Government servant, Daily Allowance

claim will be restricted to

what is admissible from the

last headquarters to the

selected place of residence.

(iv)

The concession is not

admissible to families of a) Employees who die while

on leave preparatory to

retirement;

b) Retired employees who are

re employed; and

c) Temporary employees who

have not rendered three

years of continuous service.

[GIO (1), SR 148]

7.2

(a) Account should be rendered

within one month of the

completion of the journey if

the family travels in one

batch.

(b) If the family travels in more

than one batch, account to

be rendered within one

month of completion of the

journey by the last batch.

(c) In any case, the journey

should be completed within

one year and account

rendered within one month

thereof. Otherwise, the

amount should be refunded.

[GIO (3), SR 148]

Advance

SUMMARY

(i)

Amount Three fourths of

the probable amount of

travelling

expenses

admissible under the rules.

(ii)

Conditions

(a) only one member can

receive on behalf of all

(b)

only

one

admissible.

At the end of the session,

participants will have practical

understanding of the procedures

relating to claim of T. A. under various

circumstances. This will help not only

in making the right claim by the

participants but will also help in fast

disposal of cases presented before

them in this respect.

advance

(c) surety of a permanent

employee necessary.

(d) undertaking to be given by

receiver of the advance to

abide by the conditions for

recovery.

(iii)

Recovery

Note 4.1 & 4.2

345

Vous aimerez peut-être aussi

- Amendment On Travelling Allowance, 2022Document19 pagesAmendment On Travelling Allowance, 2022mahen2020Pas encore d'évaluation

- Attorney and Agent FeesDocument55 pagesAttorney and Agent FeesJimPas encore d'évaluation

- U S D C: Nited Tates Istrict OurtDocument6 pagesU S D C: Nited Tates Istrict OurtMike WilliamsPas encore d'évaluation

- CCS (Conduct) Rules, 1964 - From Website of DoPT As On 07.01.2019Document185 pagesCCS (Conduct) Rules, 1964 - From Website of DoPT As On 07.01.2019अजय चौधरी100% (1)

- Satish FinalDocument79 pagesSatish FinalAnonymous MhCdtwxQIPas encore d'évaluation

- Employment On Compassionate GroundsDocument12 pagesEmployment On Compassionate Groundshimadri_bhattacharjePas encore d'évaluation

- LTC RulesDocument30 pagesLTC RulesmeetsatyajeePas encore d'évaluation

- Declaration of Paxton Attorney in Support of Motion To CompelDocument37 pagesDeclaration of Paxton Attorney in Support of Motion To CompellanashadwickPas encore d'évaluation

- Comptroller & Auditor General's Manual of Standing Orders (Audit)Document53 pagesComptroller & Auditor General's Manual of Standing Orders (Audit)Ashutosh Anil Vishnoi100% (1)

- Pay and AllowancesDocument23 pagesPay and AllowancesRavi KumarPas encore d'évaluation

- Comptroller and Auditor General's (Duties, Powers and Conditions of Service) Amendment Act, 1971Document9 pagesComptroller and Auditor General's (Duties, Powers and Conditions of Service) Amendment Act, 1971Namonarayan SinghalPas encore d'évaluation

- GPRA RulesDocument15 pagesGPRA Rulesvarunendra pandeyPas encore d'évaluation

- Pakistan Water and Power Development Authority Application For Grant of G.P.Fund AdvanceDocument2 pagesPakistan Water and Power Development Authority Application For Grant of G.P.Fund AdvanceHammad Yousaf100% (1)

- F.R - Pay Fixarions-IiDocument38 pagesF.R - Pay Fixarions-IimurapakasrinivasPas encore d'évaluation

- Leave RulesDocument12 pagesLeave RulesVish indianPas encore d'évaluation

- Manual of Office ProcedureDocument279 pagesManual of Office Procedurekavi_prakash6992Pas encore d'évaluation

- Raices Letter To ICEDocument8 pagesRaices Letter To ICEJohn MoritzPas encore d'évaluation

- 2009 HPFR EngDocument70 pages2009 HPFR Engwiweksharma100% (1)

- New Incentive PLI RPLI Structure 07.04.23Document7 pagesNew Incentive PLI RPLI Structure 07.04.23duvaPas encore d'évaluation

- 9-Cca RulesDocument34 pages9-Cca RulesGomathiRachakondaPas encore d'évaluation

- HRA Clarification by High CourtDocument14 pagesHRA Clarification by High CourtRJ LaxmikaantPas encore d'évaluation

- Why Are People Dying of Starvation?: Why Are There No Medicines in The HospitalsDocument24 pagesWhy Are People Dying of Starvation?: Why Are There No Medicines in The HospitalsJyotsna SinghPas encore d'évaluation

- Civil Servant APT Rules 1973 PDFDocument8 pagesCivil Servant APT Rules 1973 PDFbabar100% (1)

- HC Orders Prosection of Officers Under IPC As Sanction Under PCA Act Refused.Document25 pagesHC Orders Prosection of Officers Under IPC As Sanction Under PCA Act Refused.Surendera M. BhanotPas encore d'évaluation

- FAQ - Leave PDFDocument8 pagesFAQ - Leave PDFVIJAY KUMAR HEERPas encore d'évaluation

- The JK Government Employees (Conduct) Rules, 1971 PDFDocument34 pagesThe JK Government Employees (Conduct) Rules, 1971 PDFAbdur Raouf100% (1)

- Clem C in Teer Sample Lawyer Client ContractDocument6 pagesClem C in Teer Sample Lawyer Client ContractHolban AndreiPas encore d'évaluation

- Media Credential Commentary February 2015 ModDocument4 pagesMedia Credential Commentary February 2015 Modheather valenzuelaPas encore d'évaluation

- Leave Rules (1) 20211108071009Document28 pagesLeave Rules (1) 20211108071009Uday GopalPas encore d'évaluation

- Employee's Pension Scheme .Document52 pagesEmployee's Pension Scheme .Sundara VeerrajuPas encore d'évaluation

- SPFG Final Payment FORMAT PDFDocument3 pagesSPFG Final Payment FORMAT PDFMuralitharan Kriahnamoorthy100% (1)

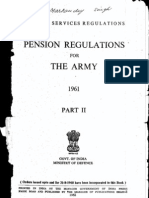

- Pension Regulations For The Army 2008 - Part IIDocument183 pagesPension Regulations For The Army 2008 - Part IIAJEEN KUMAR100% (1)

- G.O.ms - No.59 HighwaysDocument3 pagesG.O.ms - No.59 HighwaysrengasamyPas encore d'évaluation

- Contractor'S Final Payment AffidavitDocument2 pagesContractor'S Final Payment AffidavitFitzgerald PachecoPas encore d'évaluation

- Departmental Promotion CommitteeDocument48 pagesDepartmental Promotion CommitteeHimanshu Shrivastava100% (1)

- DWP 2020Document30 pagesDWP 2020ravisingh85Pas encore d'évaluation

- Deceased Claim Annexures Form Indusind BankDocument6 pagesDeceased Claim Annexures Form Indusind BankPalash RoyChoudhuryPas encore d'évaluation

- Pension Regulations The ArmyDocument254 pagesPension Regulations The ArmyVikrant BhatPas encore d'évaluation

- Rule of ReservationDocument32 pagesRule of Reservationchandra shekharPas encore d'évaluation

- Fundamental RulesDocument5 pagesFundamental RulesSandeep K. JaiswalPas encore d'évaluation

- Sample: (Applicant Letterhead)Document1 pageSample: (Applicant Letterhead)heather valenzuelaPas encore d'évaluation

- The Punjab Budget ManualDocument171 pagesThe Punjab Budget ManualMushahid123456Pas encore d'évaluation

- Ccs (Cca) RulesDocument53 pagesCcs (Cca) RulesRakesh GuptaPas encore d'évaluation

- Audit PointsDocument37 pagesAudit PointsRajaniseer SrinivasanPas encore d'évaluation

- Civil Service Rules 1965Document35 pagesCivil Service Rules 1965Venkatasiva ReddyPas encore d'évaluation

- Visitor's Pass Visitor's Pass: PCG Letter Head PCG Letter HeadDocument1 pageVisitor's Pass Visitor's Pass: PCG Letter Head PCG Letter Headhansomjasonman113 ePas encore d'évaluation

- AP Budget Manual PDFDocument620 pagesAP Budget Manual PDFthematic reviewPas encore d'évaluation

- Government Orders On Postal Employes Welfare and SportsDocument55 pagesGovernment Orders On Postal Employes Welfare and Sportsssmahadevaiah89% (9)

- Syllabus For PS Group BDocument6 pagesSyllabus For PS Group Brakesh kumarPas encore d'évaluation

- KSR 3Document9 pagesKSR 3abhivnairPas encore d'évaluation

- Section 194C: TDS On ContractDocument5 pagesSection 194C: TDS On ContractwaghulePas encore d'évaluation

- APAR - Annual Performance Appraisal ReportDocument2 pagesAPAR - Annual Performance Appraisal Reportarun kumar100% (1)

- Chapter 08 Revised Maintenance - of - Service - BooksDocument14 pagesChapter 08 Revised Maintenance - of - Service - BooksSrigouri ChigateriPas encore d'évaluation

- Central Civil Services (Temporary Service) Rules, 1965Document33 pagesCentral Civil Services (Temporary Service) Rules, 1965Abhishek KumarPas encore d'évaluation

- Section 56 - Decoding Section 56 of The Income-Tax Act, 1961 (ITDocument5 pagesSection 56 - Decoding Section 56 of The Income-Tax Act, 1961 (ITNavyaPas encore d'évaluation

- Allotment Rules and Government Decisions Issued Under Allotment Rules. IndexDocument52 pagesAllotment Rules and Government Decisions Issued Under Allotment Rules. IndexVijay KumarPas encore d'évaluation

- CCS (CCA) RulesDocument76 pagesCCS (CCA) RulesHarsh EnterprisesPas encore d'évaluation

- Government of Andhra Pradesh: Grade & Rate of Daily AllowanceDocument7 pagesGovernment of Andhra Pradesh: Grade & Rate of Daily Allowanceveera chaitanyaPas encore d'évaluation

- FRSR GR.B & C Oct, 21Document20 pagesFRSR GR.B & C Oct, 21Vanlal MuanpuiaPas encore d'évaluation

- Faq PDFDocument103 pagesFaq PDFSukesh Kumar SinghPas encore d'évaluation

- API Score Verification Sheet Revised - 19.05.2015Document6 pagesAPI Score Verification Sheet Revised - 19.05.2015Basho HumanPas encore d'évaluation

- Travelling Allowance - Session 4.1 & 4.2 PDFDocument15 pagesTravelling Allowance - Session 4.1 & 4.2 PDFBasho HumanPas encore d'évaluation

- Plastic Card For Cghs BeneficiariesDocument14 pagesPlastic Card For Cghs BeneficiariesadhityaPas encore d'évaluation

- List of New Hospitals Empanelled Under CGHSDocument2 pagesList of New Hospitals Empanelled Under CGHSYoyo AsdfPas encore d'évaluation

- Agricultural Biosecurity - Legislative BriefDocument4 pagesAgricultural Biosecurity - Legislative BriefBasho HumanPas encore d'évaluation

- Environment (Species)Document18 pagesEnvironment (Species)Johnny DanielPas encore d'évaluation

- Rpa, 1951Document11 pagesRpa, 1951Basho HumanPas encore d'évaluation

- Arts For UpscDocument10 pagesArts For UpscBasho HumanPas encore d'évaluation

- EV CarsDocument4 pagesEV CarsBasho HumanPas encore d'évaluation

- CGL SYLL SyllabusDocument7 pagesCGL SYLL Syllabusrajupat123Pas encore d'évaluation

- Face Recognition TechnologyDocument27 pagesFace Recognition TechnologyabualsPas encore d'évaluation

- GDDocument11 pagesGDquantizer0407Pas encore d'évaluation

- Phrasal VerbsDocument14 pagesPhrasal VerbsBasho HumanPas encore d'évaluation

- The 4 Stroke Diesel CycleDocument19 pagesThe 4 Stroke Diesel CycleBharatiyulamPas encore d'évaluation

- UM Lamborghini Huracan GT3 Evo V2Document25 pagesUM Lamborghini Huracan GT3 Evo V2Fabricio SouzaPas encore d'évaluation

- Railway Technology in Japan - Challenges and Strategies: Hiroumi SoejimaDocument10 pagesRailway Technology in Japan - Challenges and Strategies: Hiroumi Soejimadeepak_gupta_pritiPas encore d'évaluation

- Carlisle 2016TireCatalog PDFDocument80 pagesCarlisle 2016TireCatalog PDFEdwin TtitoPas encore d'évaluation

- How To Install DiagBox v8Document6 pagesHow To Install DiagBox v8beppino_andoPas encore d'évaluation

- CAT - 3100 HEUI Systems - Prefix 1BWDocument7 pagesCAT - 3100 HEUI Systems - Prefix 1BWPhil B.100% (1)

- SL Fuji Escalator and Elevator PDFDocument27 pagesSL Fuji Escalator and Elevator PDFAs'at NeverDiesPas encore d'évaluation

- Dheeraj BaliDocument20 pagesDheeraj BaliDheeraj BaliPas encore d'évaluation

- Motorbike SpecificationsDocument3 pagesMotorbike SpecificationsMaira ShafiqPas encore d'évaluation

- TBC13Document2 pagesTBC13Adhitya IndrawanPas encore d'évaluation

- Crankshaft Deflection MeasurementDocument7 pagesCrankshaft Deflection MeasurementJose OrtizPas encore d'évaluation

- Transport - Lesson NotesDocument10 pagesTransport - Lesson Notesnocivi38Pas encore d'évaluation

- Ordinary Maintenance 100 H Forklift Nissan (YL02A25U and Y1F2A25)Document5 pagesOrdinary Maintenance 100 H Forklift Nissan (YL02A25U and Y1F2A25)ChPas encore d'évaluation

- CAN ID To J1939 - N2K PGN ConverterDocument260 pagesCAN ID To J1939 - N2K PGN Converterdhanssmart100% (1)

- SB 85PT Specs in EnglishDocument4 pagesSB 85PT Specs in Englishwalk666Pas encore d'évaluation

- ISF2.8 CM2220 F117 Wiring Diagram: SpecificationsDocument2 pagesISF2.8 CM2220 F117 Wiring Diagram: SpecificationsMinhQuangPas encore d'évaluation

- Michelin XZY 3 Tire: All-Position Radial Designed For Exceptional Wear and Traction in Mixed On/off Road ApplicationsDocument2 pagesMichelin XZY 3 Tire: All-Position Radial Designed For Exceptional Wear and Traction in Mixed On/off Road ApplicationsDiego Morales Díaz0% (1)

- JURID Friction MaterialsDocument24 pagesJURID Friction MaterialsPuneet BhattPas encore d'évaluation

- Frag Out Magazine 23Document158 pagesFrag Out Magazine 23joniPas encore d'évaluation

- (MAZDA) Manual de Taller Mazda 626 1994Document17 pages(MAZDA) Manual de Taller Mazda 626 1994Adrian ReyesPas encore d'évaluation

- Anti Lock Braking System: Seminar by Anuj GuptaDocument18 pagesAnti Lock Braking System: Seminar by Anuj GuptaAnuj GuptaPas encore d'évaluation

- Section 3 Chassis and Frame PDFDocument46 pagesSection 3 Chassis and Frame PDFThong ChanPas encore d'évaluation

- AhcsDocument17 pagesAhcsVladiPas encore d'évaluation

- Senarai Spare Part SavvyDocument2 pagesSenarai Spare Part SavvyFirdaus JalilPas encore d'évaluation

- 992G Wheel LoaderDocument27 pages992G Wheel LoaderHules FrankPas encore d'évaluation

- (22-03-14) GV350CEU - Supported Car Models and Logistic Parameters (All Vehicles) TableDocument17 pages(22-03-14) GV350CEU - Supported Car Models and Logistic Parameters (All Vehicles) Tablemohamed.khalidPas encore d'évaluation

- Share On Twitter: June 2, 2006Document4 pagesShare On Twitter: June 2, 2006owais kathPas encore d'évaluation

- Warta Ardhia Jurnal Perhubungan UdaraDocument11 pagesWarta Ardhia Jurnal Perhubungan Udarakimtaehyungniel3112Pas encore d'évaluation

- Arun Final ProjectDocument138 pagesArun Final ProjectInkpen studiousPas encore d'évaluation

- Mahindra Scorpio Pik Up 2.5 L. NEF - Catálogo de RepuestosDocument166 pagesMahindra Scorpio Pik Up 2.5 L. NEF - Catálogo de RepuestosAlex Bravo0% (1)