Académique Documents

Professionnel Documents

Culture Documents

Mandatory Compliance With CAO No. 8 2007 As Implemented by CMO No. 28 2007

Transféré par

PortCallsTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Mandatory Compliance With CAO No. 8 2007 As Implemented by CMO No. 28 2007

Transféré par

PortCallsDroits d'auteur :

Formats disponibles

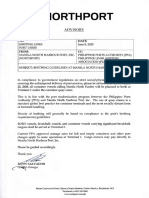

MASTER COpy~

~

Republic of the Philippines

Department of Finance

Bureau of Customs

1099 Manila

26 June 2015

MEMORANDUM:

TO

DEPUTY COMMISSIONER,

AOCG

DIRECTOR, IMPORT ASSESSMENT SERVICE

ALL DISTRICT IPORT COLLECTORS

ALL OTHERS CONCERNED

SUBJECT

Mandatory Compliance with CAO No. 8-2007

Implemented by CMO No. 28-2007

as

All officers concerned are enjoined to strictly comply with the provisions of

Customs Administrative Order (CAO) No. 8-2007, "Description of Imported

Articles in Tariff Terms and Customs Memorandum Order (CMO) No. 28-2007,

"Implementing CAO No. 8-2007 entitled Description of Imported Articles in Tariff

Terms" mandating the mandatory compliance with the proper description of

imported goods or that imported articles should' be specifically described

pursuant to the conventions provided therein.

This Office has verified reports that numerous imported goods were

declared in general manner to avoid proper classification and valuation or that

description of articles in the import declarations were not sufficient in detail to

enable the article to be identified for tariff classification, valuation and other

statistical purposes. This will adversely impact the efforts of the Bureau of

Customs in the establishment and/or publication of values. Likewise, this will

render the Bureau ineffective in its mandate to collect proper duties and taxes of

imported goods.

The Deputy Commissioner, AOCG, is directed to conduct or direct the

conduct of 100% examination of entries containing generally described goods

and recommend to the Commissioner of Customs appropriate penalty for

habitual violators or persisting to declare their importation in a general manner

as provided in the abovementioned Orders.

For strict compliance.

U)~,

ALBERTO D. LINA

Commissioner A

.

8

1111111111111111111111111111111

i'

"-J

BU~IU Of.Custom,

ALBERTO 0, UNA

Ccmmunener

15-00685

Ju

[j

'I :Zl:~'~

Vous aimerez peut-être aussi

- Circular No.28/2020-Customs outlines 1st phase of Faceless AssessmentDocument3 pagesCircular No.28/2020-Customs outlines 1st phase of Faceless AssessmentemailgmailPas encore d'évaluation

- Instruction No 9 Customs DT 5th June 2020Document11 pagesInstruction No 9 Customs DT 5th June 2020emailgmailPas encore d'évaluation

- Post Clearance Audit Group Pcag Group 1Document12 pagesPost Clearance Audit Group Pcag Group 1Jv DesConPas encore d'évaluation

- Circular No.32/2020-Customs: Initiatives For Contactless CustomsDocument3 pagesCircular No.32/2020-Customs: Initiatives For Contactless CustomsPrashant BharthiPas encore d'évaluation

- Revenue Ctrcular: MemorandumDocument12 pagesRevenue Ctrcular: Memorandumnathalie velasquezPas encore d'évaluation

- Taxation and Revenue Administration: Abugan, Rainilyn A. Villanueva, Ayrah S. MPA - 622Document21 pagesTaxation and Revenue Administration: Abugan, Rainilyn A. Villanueva, Ayrah S. MPA - 622Carmela LimPas encore d'évaluation

- Mandatory One-Time Submission of Inventory List of All Machines Generating Sales Invoice/receiptsDocument1 pageMandatory One-Time Submission of Inventory List of All Machines Generating Sales Invoice/receiptsabbellePas encore d'évaluation

- Iii. Trade Policies and Practices by Measure (1) I: The Philippines WT/TPR/S/149Document40 pagesIii. Trade Policies and Practices by Measure (1) I: The Philippines WT/TPR/S/149rain06021992Pas encore d'évaluation

- Revenue Memorandum Order No. 22-2007: SUBJECT: Prescribing Additional Procedures in The Audit of Input TaxesDocument2 pagesRevenue Memorandum Order No. 22-2007: SUBJECT: Prescribing Additional Procedures in The Audit of Input Taxesjames luzonPas encore d'évaluation

- Fulltext RMC No 82-2014Document1 pageFulltext RMC No 82-2014Gedan TanPas encore d'évaluation

- BIR MonitorDocument9 pagesBIR MonitorCandiceCocuaco-ChanPas encore d'évaluation

- Philippines Transfer Pricing GuidelinesDocument1 pagePhilippines Transfer Pricing GuidelinesEumell Alexis PalePas encore d'évaluation

- BIR clarifies audit program and tax agent responsibilitiesDocument2 pagesBIR clarifies audit program and tax agent responsibilitiesCkey ArPas encore d'évaluation

- 5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncDocument7 pages5 Features of Economic Zones Under PEZA in The Philippines - Tax and Accounting Center, IncMartin MartelPas encore d'évaluation

- CMO No.14 2015 RevReg BOC AccreditationPEZA LocatorsDocument2 pagesCMO No.14 2015 RevReg BOC AccreditationPEZA Locatorsskylark74Pas encore d'évaluation

- The Perspective of Vat Concessions Regime in Tanzania PDFDocument32 pagesThe Perspective of Vat Concessions Regime in Tanzania PDFHandley Mafwenga SimbaPas encore d'évaluation

- Revenue Memorandum Circular No. 026-08: March 24, 2008Document1 pageRevenue Memorandum Circular No. 026-08: March 24, 2008abi_demdamPas encore d'évaluation

- Lecture 2 - Tax Administration 1-1Document64 pagesLecture 2 - Tax Administration 1-1Ekua Baduwaa KyeraaPas encore d'évaluation

- Memorandum Summary of CAO CMO CMC CSO COO and Unnumbered Memoranda Jan 1 2015 To June 30 2015 PDFDocument16 pagesMemorandum Summary of CAO CMO CMC CSO COO and Unnumbered Memoranda Jan 1 2015 To June 30 2015 PDFMIA KRYSTEL AMBULOPas encore d'évaluation

- For IMMEDIATE RELEASE PEZA Export Enterprises Appeal For Suspension of The Implementation of BIR R.R. No. 9 2021Document2 pagesFor IMMEDIATE RELEASE PEZA Export Enterprises Appeal For Suspension of The Implementation of BIR R.R. No. 9 2021Jake Aseo BertulfoPas encore d'évaluation

- Introduction To FTPDocument18 pagesIntroduction To FTPdipesh shahPas encore d'évaluation

- Boc NarrativeDocument7 pagesBoc NarrativeLAIDEN MARASIGANPas encore d'évaluation

- FTP Icai MaterialDocument61 pagesFTP Icai MaterialsubbuPas encore d'évaluation

- IM ACCO 20173 Business and Transfer Taxes Module 4 PDFDocument40 pagesIM ACCO 20173 Business and Transfer Taxes Module 4 PDFMakoy BixenmanPas encore d'évaluation

- Fort Bonifacio Development Corp. v. CIRDocument20 pagesFort Bonifacio Development Corp. v. CIRsamaral bentesinkoPas encore d'évaluation

- Scheme 1Document19 pagesScheme 1Jayesh ValwarPas encore d'évaluation

- 2008 Nov n2 Evasion PDFDocument162 pages2008 Nov n2 Evasion PDFerikaPas encore d'évaluation

- RMC No. 92-102-2020Document5 pagesRMC No. 92-102-2020nathalie velasquezPas encore d'évaluation

- SAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.Document56 pagesSAR On Withhholding Taxes Deducted by Mobile Phone Companies, PTA, Banks Etc.imran mughalPas encore d'évaluation

- Scheme of Taxation of Undisclosed Income: Published by Taxmann in Blog, Income Tax On April 28, 2021, 9:37 AmDocument9 pagesScheme of Taxation of Undisclosed Income: Published by Taxmann in Blog, Income Tax On April 28, 2021, 9:37 Amsnsoni 89Pas encore d'évaluation

- Coa C2006-003Document2 pagesCoa C2006-003Russel SarachoPas encore d'évaluation

- RGP 2009-04Document159 pagesRGP 2009-04maanyag6685Pas encore d'évaluation

- RMC No 24-2019 Submission of Bir Form 2316Document2 pagesRMC No 24-2019 Submission of Bir Form 2316joelsy100100% (1)

- Politica Regională A ArgentineiDocument13 pagesPolitica Regională A ArgentineiJohnPas encore d'évaluation

- Saeed Ahmed and Saeed Ahmed Sheikh: Tax Reforms in Pakistan (1990-2010)Document9 pagesSaeed Ahmed and Saeed Ahmed Sheikh: Tax Reforms in Pakistan (1990-2010)Syed Faisal HassanPas encore d'évaluation

- Digest of 1998 Revenue Memorandum OrdersDocument15 pagesDigest of 1998 Revenue Memorandum OrdersTenten ConanPas encore d'évaluation

- 02-2004 Vat Philippine Port Authority PpaDocument3 pages02-2004 Vat Philippine Port Authority Ppaapi-247793055Pas encore d'évaluation

- Decision 36.2008.Qd - BTC enDocument2 pagesDecision 36.2008.Qd - BTC enPham Thuy TrangPas encore d'évaluation

- SMEDA Business Guide Series: Procedure For Claiming Duty DrawbacksDocument27 pagesSMEDA Business Guide Series: Procedure For Claiming Duty DrawbacksAnas AnsariPas encore d'évaluation

- Policy Brief Presscon - CMTADocument3 pagesPolicy Brief Presscon - CMTAArangkada PhilippinesPas encore d'évaluation

- Circular No 55 2020Document13 pagesCircular No 55 2020Sarika JainPas encore d'évaluation

- Economics Assign.Document10 pagesEconomics Assign.Katty DaytiquezPas encore d'évaluation

- BIR Circular Sugar Price Week Ending November 22 2015Document1 pageBIR Circular Sugar Price Week Ending November 22 2015firstPas encore d'évaluation

- RMC No. 3-2022Document2 pagesRMC No. 3-2022Shiela Marie MaraonPas encore d'évaluation

- Foreign Storage Charges at Cebu International PortDocument3 pagesForeign Storage Charges at Cebu International PortPortCallsPas encore d'évaluation

- Chapter 9Document19 pagesChapter 9Nigussie BerhanuPas encore d'évaluation

- Bureau of Internal Revenue: Shall No Longer Be Assessed Nor Be Collected"Document2 pagesBureau of Internal Revenue: Shall No Longer Be Assessed Nor Be Collected"api-247793055Pas encore d'évaluation

- R.A. 10863 Title 2. Bureau of Customs PresentationDocument22 pagesR.A. 10863 Title 2. Bureau of Customs PresentationResti JovenPas encore d'évaluation

- Circular-No-22-2020 For The Marketing CompaniesDocument1 pageCircular-No-22-2020 For The Marketing CompaniesAnkit SharmaPas encore d'évaluation

- 1998 RR DigestDocument16 pages1998 RR DigestJeremeh PenarejoPas encore d'évaluation

- Methods of ResearchDocument8 pagesMethods of ResearchMherick VersozaPas encore d'évaluation

- CE,/vwfr: RE/rEI (UE Memorandum Circular IIDocument1 pageCE,/vwfr: RE/rEI (UE Memorandum Circular IIMel GaneloPas encore d'évaluation

- Prakas On Authorization of Foreign Auditors To Sign On Auditing ReportDocument2 pagesPrakas On Authorization of Foreign Auditors To Sign On Auditing ReportLona CheePas encore d'évaluation

- Eo 463, 805, 160Document8 pagesEo 463, 805, 160Chisa MamowalasPas encore d'évaluation

- 2 Ratiyah1398-1405Document8 pages2 Ratiyah1398-1405Hiras NomensenPas encore d'évaluation

- Jllois: in ToDocument2 pagesJllois: in ToA2 ZPas encore d'évaluation

- REVENUE OFFICE OPERATIONS MANUAL GUIDEDocument107 pagesREVENUE OFFICE OPERATIONS MANUAL GUIDEKatherinePas encore d'évaluation

- Issues of Taxation in Pakistan and Its SolutionsDocument40 pagesIssues of Taxation in Pakistan and Its Solutionsعمر محمود100% (3)

- South Asia Subregional Economic Cooperation: Trade Facilitation Strategic Framework 2014-2018D'EverandSouth Asia Subregional Economic Cooperation: Trade Facilitation Strategic Framework 2014-2018Pas encore d'évaluation

- Impact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesD'EverandImpact assessment AAK: The impact of Tax on the Local Manufacture of PesticidesPas encore d'évaluation

- Draft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021Document10 pagesDraft Implementing Operational Guidelines of Philippine Ports Authority Administrative Order No. 04-2021PortCallsPas encore d'évaluation

- Bureau of Customs Customs Memorandum Order 28-2021Document2 pagesBureau of Customs Customs Memorandum Order 28-2021PortCalls100% (1)

- Bureau of Internal Revenue Revenue Regulations 15-2021Document1 pageBureau of Internal Revenue Revenue Regulations 15-2021PortCallsPas encore d'évaluation

- Bureau of Customs - Customs Administrative Order 12-2020Document5 pagesBureau of Customs - Customs Administrative Order 12-2020PortCallsPas encore d'évaluation

- BOC AOCG Memo Dated September 11Document1 pageBOC AOCG Memo Dated September 11PortCallsPas encore d'évaluation

- Philippine Ports Authority Administrative Order No. 02-2021Document8 pagesPhilippine Ports Authority Administrative Order No. 02-2021PortCallsPas encore d'évaluation

- Bureau of Customs Customs Memorandum Order No. 09-2021Document32 pagesBureau of Customs Customs Memorandum Order No. 09-2021PortCallsPas encore d'évaluation

- Philippine Ports Authority Administrative Order No. 11 - 2020Document4 pagesPhilippine Ports Authority Administrative Order No. 11 - 2020PortCallsPas encore d'évaluation

- Civil Aviation Authority of The Philippines Memorandum Circular No. 03 2021Document3 pagesCivil Aviation Authority of The Philippines Memorandum Circular No. 03 2021PortCallsPas encore d'évaluation

- Joint Memorandum Circular No. 2021-01Document3 pagesJoint Memorandum Circular No. 2021-01PortCallsPas encore d'évaluation

- Philippine Ports Authority Administrative Order No. 13-2020Document3 pagesPhilippine Ports Authority Administrative Order No. 13-2020PortCallsPas encore d'évaluation

- Bureau of Customs Memo Activating The Orange LaneDocument1 pageBureau of Customs Memo Activating The Orange LanePortCallsPas encore d'évaluation

- Ds Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedDocument33 pagesDs Boc-ppa-dti-Arta JMC No. 1 S. 2020 - SignedPortCallsPas encore d'évaluation

- PortCalls (September 7, 2020)Document14 pagesPortCalls (September 7, 2020)PortCalls100% (1)

- BOC AOCG Memo Dated September 11Document2 pagesBOC AOCG Memo Dated September 11PortCalls100% (1)

- NorthPort Advisory - June 8, 2020Document1 pageNorthPort Advisory - June 8, 2020PortCallsPas encore d'évaluation

- Shippers' Protection Office Rules of ProceduresDocument10 pagesShippers' Protection Office Rules of ProceduresPortCallsPas encore d'évaluation

- Philippine Ports Authority Administrative Order No. 05-2020Document5 pagesPhilippine Ports Authority Administrative Order No. 05-2020PortCallsPas encore d'évaluation

- Department of Transportation Department Order No. 2020-009Document4 pagesDepartment of Transportation Department Order No. 2020-009PortCallsPas encore d'évaluation

- MC DS-2020-01Document3 pagesMC DS-2020-01PortCallsPas encore d'évaluation

- SBMA Seaport Memorandum On Anti Pilferage SealDocument1 pageSBMA Seaport Memorandum On Anti Pilferage SealPortCallsPas encore d'évaluation

- Department of Trade and Industry Advisory No. 20-02Document1 pageDepartment of Trade and Industry Advisory No. 20-02PortCallsPas encore d'évaluation

- Ppa MC 23-2020Document1 pagePpa MC 23-2020PortCallsPas encore d'évaluation

- Department of Transportation Department Order No. 2020-008Document6 pagesDepartment of Transportation Department Order No. 2020-008PortCallsPas encore d'évaluation

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsPas encore d'évaluation

- Now Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuideDocument12 pagesNow Available Now Available Now Available Now Available: The Philippines' Only Shipping and Transport GuidePortCallsPas encore d'évaluation

- Department of Transportation Department Order No. 2020-007Document4 pagesDepartment of Transportation Department Order No. 2020-007PortCallsPas encore d'évaluation

- PortCalls April 27 IssueDocument13 pagesPortCalls April 27 IssuePortCallsPas encore d'évaluation

- The Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020Document14 pagesThe Philippines' Only Shipping and Transport Guide: Forex Rate As of Thursday, 30 April 2020PortCallsPas encore d'évaluation

- Department of Trade and Industry Memorandum Circular No. 20-22 Series of 2020Document8 pagesDepartment of Trade and Industry Memorandum Circular No. 20-22 Series of 2020PortCalls0% (2)