Académique Documents

Professionnel Documents

Culture Documents

AT ch16

Transféré par

xxxxxxxxxCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

AT ch16

Transféré par

xxxxxxxxxDroits d'auteur :

Formats disponibles

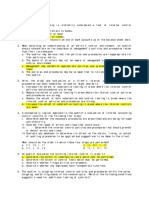

Operational and Governmental Compliance Auditing

MULTIPLE CHOICE:

1.

In a broad sense, society benefits from internal auditing

because the internal auditor

a.

Encourages corporate compliance with standards of

public policy.

b.

Promotes the efficient and effective use of resources.

c.

Evaluates financial data against professional

standards.

d.

Ensures that operations respond to the demands of the

marketplace.

ANSWER:

2.

Which of the following factors are essential to an

effective internal auditing organization?

I.

II.

III.

IV.

Operating responsibility

Organizational status

Objectivity

Authority over operations

a.

b.

c.

d.

I and II.

II and III.

III and IV.

I and IV.

ANSWER:

3.

The primary difference between operational auditing and

financial auditing is that in operational auditing

a.

The auditor is not concerned with whether the audited

activity is generating information in compliance with

financial accounting standards.

b.

The auditor is seeking to help management use

resources in the most effective manner possible.

c.

The auditor starts with the financial statements of an

activity being audited and works backward to the basic

processes involved in producing them.

d.

The auditor can use analytical skills and tools that

are not necessary in financial auditing.

ANSWER:

270

Chapter 16 Operational and Governmental Compliance Auditing

4.

The internal audit staff has been asked to conduct an audit

of the purchasing department. Top management feels that

there have been some production bottlenecks recently

because of out-of-stock situations. What is the primary

objective of the auditors in this assignment?

a.

b.

c.

d.

ANSWER:

5.

To appraise the economy with which resources are

employed.

To review the reliability and integrity of financial

and operating information.

To review the means of safeguarding assets and

verifying the existence of such assets.

To ascertain whether results are consistent with

established objectives and whether operations are

being carried out as planned.

D

Which of the following would be the most appropriate role

for the internal auditor in the cash budgeting process?

a.

b.

c.

d.

ANSWER:

6.

Reviewing budget policies and the design and

functioning of the budget process.

Working with the controller to prepare the budget.

Approving the budget before its implementation.

Analyzing monthly budget reports.

A

An internal auditor is performing an audit of the receiving

department to determine if only authorized purchases are

being accepted. Which of the following documents should

the auditor examine?

a.

b.

c.

d.

A bill of lading.

A blind (no quantities shown) copy of the purchase

order received directly from the purchasing

department.

An invoice.

A note documenting a telephone conversation with a

purchasing agent.

ANSWER:

7.

271

An auditor is attempting to determine whether or not

inventory is excessive. The inventory turnover rate was

4.7 this year as compared to 6.0 the prior year. The

272

Chapter 16 Operational and Governmental Compliance Auditing

average rate for the industry over the past three years was

6.2. From these facts, the auditor should conclude

a.

b.

c.

d.

ANSWER:

8.

b.

c.

d.

ANSWER:

Vouch payments made on the investment to the

controllers approval.

Review minutes of board of directors meetings for

investment approval.

Compliance test the functioning of the internal

controls over expenditures.

Confirm details of the purchase with the vendor.

B

Which of the following is not usually a part of the

preliminary survey phase of an audit?

a.

b.

c.

d.

ANSWER:

10.

Which of the following would be the most appropriate test

to determine if a major investment in a fixed asset was

properly authorized?

a.

9.

An inventory turnover rate this much lower than

normal suggests the possibility of excess inventory.

There is definitely an excess inventory problem

because the turnover rate is 1.5 times less than the

industry average.

The turnover rate differences are immaterial and thus

do not indicate a problem.

The possibility of excess inventory is not apparent

from these figures.

Touring operations.

Conducting audit inquiries.

Performing analytical review.

Developing the audit program.

D

An auditor decides to test the effectiveness and efficiency

of the short-term strategy being employed to market product

X. Which of the following would be the most appropriate

audit procedure?

a.

Discuss the effectiveness and the strategy with the

director of marketing.

Chapter 16 Operational and Governmental Compliance Auditing

b.

c.

d.

ANSWER:

11.

b.

c.

d.

ANSWER:

Determine the dates of unpaid accounts payable

invoices.

Compare dates of selected purchase orders with those

of purchase requisitions.

Select a block of used purchase order numbers and

account for all numbers in the block.

Discuss processing procedures with operating personnel

and observe actual processing of purchases.

B

In an audit of the transportation function, which of the

following tests is most appropriate to determine if there

is favoritism to individual carriers?

a.

b.

c.

d.

ANSWER:

13.

Discuss the effectiveness of the strategy with sales

supervisors and individual salespersons.

Compare sales of product X prior to and after

implementation of the short-term marketing strategy.

Evaluate performance goals incorporated into the

short-term strategy, and whether those goals are being

met.

Which of the following would be the most appropriate test

to determine whether purchase orders are being processed on

a timely basis?

a.

12.

273

Investigate selected demurrage charges to determine if

they were appropriate.

Determine if the selection of carriers is reviewed and

approved by a higher-ranking member of the traffic

department.

Determine whether freight bills have received a postaudit by the transportation department or an outside

specialized freight auditor.

Determine that the amount of freight billed to the

customer on the sales invoice is equal to the amount

actually charged your company by the carrier.

B

In the performance of an audit, audit risk is best defined

as the risk that an internal auditor

274

Chapter 16 Operational and Governmental Compliance Auditing

a.

b.

c.

d.

ANSWER:

14.

The role of the internal auditor with respect to a

purchasing department audit is to

a.

b.

c.

d.

ANSWER:

15.

Might not select documents that are in error as part

of the examination.

May not be able to properly evaluate an organization

because of its poor internal accounting controls.

May unknowingly fail to recognize appropriately a

material error or weakness in an examined

organization.

May not have the expertise to adequately audit a

specific entity.

Evaluate the adequacy of purchasing policies and

procedures and determine the extent of compliance.

Review and appraise the adequacy of controls over the

creation of all types of company obligations.

Review and appraise the conditions by which notes

payable come into existence and the control exercised

over them.

Establish that the purchasing department is

independent of receiving, inspection, stores, and

accounts payable activities.

A

In examining whether or not an auditee is conforming with

the companys affirmative action policy, the internal

auditor has found that:

1)

2)

Five percent of the employees are from minority

groups.

No one from a minority group has been hired this year.

The most appropriate conclusion the internal auditor should

draw is

a.

b.

c.

d.

Insufficient evidence exists of compliance with the

affirmative action policy.

The auditee is violating the companys policy.

The companys policy is unauditable and hence

unenforceable.

The auditee is complying with the affirmative action

policy.

Chapter 16 Operational and Governmental Compliance Auditing

ANSWER:

16.

b.

c.

d.

ANSWER:

To provide a final quality control review of the

accuracy of findings and reasonableness of conclusions

included in the report.

To inform the board of directors and top management

concerning major problems encountered.

To give auditee managers an advance start on solving

the problems outlined in the report.

To provide the auditor an opportunity to sell

auditee management on the benefits of implementing

recommendations.

A

The primary audience for the written report issued by the

internal auditor at the completion of an audit should be

a.

b.

c.

d.

ANSWER:

18.

Which of the following is the most important purpose of a

closing conference?

a.

17.

275

The external auditors when they intend to rely on the

internal auditors work.

Managers outside the area of audit so as to inform

them of what is going on in other areas of the

organization.

The audit committee who needs to be kept informed on

the risks to which the organization is exposed.

The management inside or outside the audited area who

can take corrective action.

D

An internal auditor determines that actual procedures

differ from prescribed control procedures. The auditor

should

1.

2.

3.

4.

a.

Require operating personnel to conform to prescribed

procedures.

Document the discrepancies and make any appropriate

recommendations to management.

Expand all aspects of the audit to determine other

differences from prescribed procedures.

Modify the audit plan as warranted by the differences

noted.

1 and 3

276

Chapter 16 Operational and Governmental Compliance Auditing

b.

c.

d.

ANSWER:

19.

c.

d.

ANSWER:

What the auditor found, the status, or condition.

The effect that implementing a recommendation is

expected to achieve.

The standard of performance, or what should be.

The cause or reason why the reported condition

occurred.

C

Follow-up activities by the internal auditor may be

terminated, even though corrective action has not been

taken, when the

a.

b.

c.

d.

ANSWER:

21.

One of the elements of a standard audit finding is

criteria. Which of the following best describes this

element of an audit finding?

a.

b.

20.

2 and 3

1 and 4

2 and 4

Recommendations concern activities not included in the

scope of the original audit program.

Board of directors or management has assumed the risk

of not taking corrective action.

Auditor has not convinced operating personnel of the

soundness of the audit recommendations.

Auditor has no authority or responsibility to

prescribe or direct the corrective action.

B

An internal auditor is preparing a final audit report to

management. There is, however, disagreement between the

auditor and the auditee on one finding which details the

auditees violation of corporate purchasing policy. The

auditee believes the purchasing policy is open to

interpretation and that there was no violation. The

auditor believes that the policy is clearly stated and that

the auditees actions were a violation. In this

circumstance, the auditor should

a.

b.

Delete the finding from the audit report.

Present only those facts, which support the audit

finding and ignore those which detract from it.

Chapter 16 Operational and Governmental Compliance Auditing

c.

d.

ANSWER:

22.

Present both the auditors and auditees positions in

the report.

Not issue the audit report until the auditor and

auditee agree on all audit findings and

recommendations.

C

A governmental audit may extend beyond an examination

leading to the expression of an opinion on the fairness of

financial presentation to include

Program

results

Yes

Yes

No

Yes

a.

b.

c.

d.

ANSWER:

23.

277

Compliance

Yes

Yes

Yes

No

Economy &

efficiency

No

Yes

Yes

Yes

Chevez is auditing an entitys compliance with requirements

governing a major federal financial assistance program in

accordance with the Single Audit Act. Chevez detected

noncompliance with requirements that have a material

effect on that program. Chevez report on compliance

should express a(an)

a.

b.

c.

d.

ANSWER:

Unqualified opinion with a separate explanatory

paragraph.

Qualified opinion or an adverse opinion.

Adverse opinion or a disclaimer or opinion.

Limited assurance on the items tested.

B

24. A companys new president meets the director of internal

audit for the first time, and asks the director to briefly

describe his departments overall responsibility. The

director states that internal audits overall responsibility

is to:

a.

b.

Act as an independent appraisal function to review

operations as a service to management by measuring and

evaluating the effectiveness of controls.

Review the means of safeguarding assets and, as

appropriate, verify the existence of such assets.

278

Chapter 16 Operational and Governmental Compliance Auditing

c.

Ensure compliance with policies, plans, procedures,

laws, and regulations, which could have a significant

impact on operations and reports.

Review the reliability and integrity of financial and

operating information and the means used to identify,

measure, classify, and report such information.

d.

ANSWER:

25.

According to the Standards, the internal audit director

should ensure follow-up of prior audit findings and

recommendations:

a.

To determine if corrective action was taken and is

achieving the desired results.

Unless management rejected the recommendation in their

initial response.

Unless the audit schedule does not allow time for

follow-up.

Unless management has accepted the recommendation.

b.

c.

d.

ANSWER:

26.

Internal auditing has been a dynamic profession. Which of

the following best describes the scope of internal auditing

as it has developed to date?

a.

b.

c.

d.

ANSWER:

27.

Internal auditing involves appraising the economy and

efficiency with which resources are employed.

Internal auditing involves evaluating compliance with

policies, plans, procedures, laws, and regulations.

Internal auditing has evolved to verifying the

existence of assets and reviewing the means of

safeguarding assets.

Internal auditing has evolved to more of an

operational orientation from a strictly financial

orientation.

D

You have been selected to develop an internal auditing

department for your company. Your approach would most

likely be to hire:

a.

Internal auditors each of whom possesses all the

skills required to handle all audit assignments.

Chapter 16 Operational and Governmental Compliance Auditing

b.

c.

d.

ANSWER:

28.

b.

c.

d.

ANSWER:

State the auditors position because the report is

designed to provide the auditors independent view.

State the auditees position because management is

ultimately responsible for the activities reported.

State both positions and identify the reasons for the

disagreement.

State neither position. If the disagreement is

ultimately resolved, there will be no reason to report

the previous disagreement. If the disagreement is

never resolved, the disagreement should not be

reported, because there is no mechanism to resolve it.

C

A charter is being drafted for a newly formed internal

auditing department. Which of the following best describes

the appropriate organizational status that should be

incorporated into the charter?

a.

b.

c.

d.

ANSWER:

30.

Inexperienced personnel and train them the way the

company wants them trained

Degreed accountants since most audit work is

accounting related.

Internal auditors who collectively have the knowledge

and skills needed to complete all internal audit

assignments.

Which of the following is the most appropriate method of

reporting disagreement between the auditor and the auditee

concerning audit findings and recommendations?

a.

29.

279

The director of internal auditing should report to the

chief executive officer but have access to the board

of directors.

The director of internal auditing should be a member

of the audit committee of the board of directors.

The director of internal auditing should be a staff

officer reporting to the chief financial officer.

The director of internal auditing should report to an

administrative vice president.

A

A primary concern of an operational audit of the family

welfare department of a governmental unit would be

280

Chapter 16 Operational and Governmental Compliance Auditing

a.

b.

c.

d.

ANSWER:

31.

b.

c.

d.

ANSWER:

The director reports directly to an independent audit

committee of the board of directors.

The director of internal auditing is not assigned any

operational responsibilities.

A director of internal auditing may not be appointed

or approved without concurrence of the board of

directors.

The directors annual bonuses are based on dollar

recoveries or recommended future savings as a result

of audits.

D

The president wants to know whether the purchasing function

is properly meeting its charge to: purchase the right

material at the right time in the right quantities. Which

of the following types of audits addresses the presidents

request?

a.

b.

c.

d.

ANSWER:

33.

Which of the following could be an organization factor that

might adversely affect the ethical behavior of the director

of internal auditing?

a.

32.

Determining that proper measures of performance are

used.

Generating an adequate return on investment.

Adhering to Generally Accepted Accounting Principles.

Ensuring that persons with direct client contact have

at least a bachelors degree.

A financial audit of the purchasing department.

An operational audit of the purchasing department.

A compliance audit of the purchasing function.

A full-scope audit of the manufacturing operation.

B

Which of the following audit techniques would be most

persuasive in determining that significant inventory values

on the books of a comp[any being acquired are correctly

stated?

a.

Obtain a management representation letter stating that

inventory values are correctly stated.

Chapter 16 Operational and Governmental Compliance Auditing

b.

c.

d.

ANSWER:

34.

ANSWER:

Schedule a follow-up review.

Implement corrective action indicated by the findings.

Examine further the data supporting the findings.

Assemble new data to support the findings.

A

Recommendations in audit reports may, or may not,. Actually

be implemented. Which of the following best describes

internal auditings role in follow-up on audit

recommendations?

Internal auditing:

a.

b.

c.

d.

ANSWER:

36.

Flowchart the inventory and warehousing cycle and form

an opinion based on the quality of internal controls.

Conduct a physical inventory and bring in an

independent expert if necessary to value inventory

items.

Interview purchasing and materials control personnel

to ascertain the quality of internal controls over

inventory.

After an audit report with adverse findings has been

communicated to appropriate auditee personnel, proper

action is to:

a.

b.

c.

d.

35.

281

Has no role; follow-up is managements responsibility.

Should be charged with responsibility for implementing

audit recommendations.

Should follow up to ascertain that appropriate action

is taken on audit recommendations.

Should request that independent auditors follow up on

audit recommendations.

C

The purpose of governmental effectiveness or program

results auditing is to determine if the desired results

of a program are being achieved. The first step in

conducting such an audit should be to:

a.

b.

c.

Evaluate the system used to measure results.

Determine the time frame to be audited.

Collect quantifiable data on the programs success or

failure.

282

Chapter 16 Operational and Governmental Compliance Auditing

d.

ANSWER:

37.

b.

c.

d.

ANSWER:

Allow the auditee to participate in development of

recommendations for improvement.

Emphasize the personal responsibility of the auditee

management.

Document the adverse finding with a complete list of

all operational deficiencies.

Submit a draft copy of the final report to higherlevel management.

A

A major difference between operational auditing and

financial auditing is

a.

b.

c.

d.

ANSWER:

39.

An operational audit resulted in a finding regarding

efficiency of operations. Select the best approach to gain

the auditees cooperation in this situation.

a.

38.

Identify the legislative intent of the program being

audited.

Operational auditing focuses on activities rather than

financial statement assertions.

Operational auditing extends beyond the entity to

analysis of industry and economic data.

Unlike financial auditing, operational auditing does

not generally culminate in a formal audit report.

Operational auditing is narrower than financial

auditing in its breadth of coverage.

A

In conducting an operational audit, the following steps are

generally recommended:

A.

B.

C.

D.

E.

F.

G.

H.

Develop the audit program

Perform the audit

Identify audit objectives

Evaluate the findings and develop conclusions

and recommendations

Establish evaluation criteria

Report findings and recommendations

Conduct a preliminary survey of the activity

Appraise the efficiency and effectiveness of the

activity

Chapter 16 Operational and Governmental Compliance Auditing

283

The proper sequence for applying the above steps is:

a.

b.

c.

d.

ANSWER:

40.

c.

d.

ANSWER:

Assessing the goal setting process.

Determining the extent to which goals are being

achieved and the degree of coal congruence.

Assessing the financial stability of the unit.

Appraising the effectiveness of resource utilization

within the unit or activity.

C

The primary difference between an operational audit report

and an independent financial audit report is

a.

b.

c.

d.

ANSWER:

42.

A major part of an operational audit involves appraising

the efficiency and effectiveness of the activity or unit

being audited. Efficiency and effectiveness appraisal

include all but the following steps:

a.

b.

41.

D,H,B,F,E,G,A,C

C,E,G,A,H,B,D,F

E,C,A,G,D,H,B,F

C,E,G,A,B,H,D,F

The operational audit report makes no mention of

internal control.

The operational audit report is not constrained to a

single standard reporting format.

The operational audit report stresses consistency

among accounting periods.

Unlike the independent auditor, the internal auditor

generally does not discuss the audit findings and the

nature of the audit report with the auditee.

B

Which of the following is not a source of responsibility

for an independent auditor conducting a governmental

compliance audit?

a.

b.

Governmental auditing standards as set forth in the

General Accounting Offices yellow book.

Standards for the Professional Practice of Internal

Auditing.

284

Chapter 16 Operational and Governmental Compliance Auditing

c.

d.

ANSWER:

Generally Accepted Auditing Standards as promulgated

by the Auditing Standards Board of the AICPA.

Federal Single Audit Act of 1984 (as amended in 1996).

B

COMPLETION:

43.

Management auditing concentrates more on ____________ than

efficiency.

ANSWER:

44.

Efficiency is __________ oriented, whereas effectiveness is

__________ oriented.

ANSWER:

45.

EVALUATION CRITERIA

The __________ __________ consists of those procedures

necessary to satisfy the audit objectives and produce

sufficient and competent evidence to corroborate or refute

the auditors preliminary findings.

ANSWER:

48.

RISK-BASED

In conducting an operational audit, identification of

___________ __________ is necessary if the auditor is to

ultimately determine the cause of discovered

inefficiencies.

ANSWER:

47.

INPUT OUTPUT

Until recently, operational auditing performed recurring

efficiency and effectiveness audits on different functions

or units in a company. The emphasis has now begun to shift

away from recurring audits to focus more on managements

special problems. This latter approach is referred to as

________- __________ operational auditing.

ANSWER:

46.

EFFECTIVENESS

AUDIT PROGRAM

In drafting an operational audit report, the difference

between actual and expected conditions should be presented

as to _______ and _______.

ANSWER:

CAUSE EFFECT

Chapter 16 Operational and Governmental Compliance Auditing

49.

When auditing state and local governmental entities that

are recipients of federal financial assistance, auditors

must, in addition to generally accepted auditing standards,

comply with governmental auditing standards, as defined in

the GAOs _________ _________.

ANSWER:

50.

285

YELLOW BOOK

In addition to GAAS and yellow book standards, an auditee

that receives $300,000 or more in federal financial

assistance in a single fiscal year, must be audited in

accordance with the ________ ________ _______ __ ____.

ANSWER:

SINGLE AUDIT ACT OF 1984

MATCHING:

51.

Select the term that best fits the listed definition.

A. Circular A-133

B. Effectiveness

C. Efficiency

D. Evaluation criteria

E. Yellow book

F. Risk-based operational auditing

G. Percentage-of-coverage rule

H. Operational auditing

I. Management auditing

J. General Accounting Office

K. Foreign Corrupt Practices Act of 1977

L. Single Audit Act of 1984 (as amended in 1996)

M. Governmental compliance auditing

____1.

A subset of internal auditing that reviews an entitys

activities for efficiency and effectiveness.

____2.

A subset of operational auditing that attempts to

measure the effectiveness with which an organizational

unit is administered.

____3.

May be viewed as an input measure.

____4.

May be viewed as an output measure.

____5.

Requires companies to develop and implement internal

controls that permit preparation of financial

286

Chapter 16 Operational and Governmental Compliance Auditing

statements in accordance with GAAP and to maintain

accountability over assets.

____6.

An audit approach that focuses on managements special

problems and means for solving them.

____7.

Define the process or activity being audited.

____8.

Auditing that concentrates on testing and reporting on

conformity with laws and regulations relating to

recipients of federal financial assistance.

____9.

A GAO document that sets forth governmental auditing

standards.

____10.

A federal law that establishes audit requirements for

state and local governmental bodies and other not-forprofit entities receiving federal financial

assistance.

____11.

Requires that at least 50% of federal expenditures be

encompassed by the independent audit.

____12.

The document that interprets and explains the major

provisions of the Single Audit Act of 1984 (as amended

in 1996).

SOLUTION:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10.

11.

12.

H

I

C

B

K

F

D

M

E

L

G

A

Chapter 16 Operational and Governmental Compliance Auditing

287

Vous aimerez peut-être aussi

- Audit Risk Alert: General Accounting and Auditing Developments 2018/19D'EverandAudit Risk Alert: General Accounting and Auditing Developments 2018/19Pas encore d'évaluation

- Ch16 - Operational and Governmental Compliance AuditingDocument18 pagesCh16 - Operational and Governmental Compliance AuditingStychri AlindayoPas encore d'évaluation

- Irector's First Task Is To Develop A Charter. Identify The Item That Should BeDocument105 pagesIrector's First Task Is To Develop A Charter. Identify The Item That Should BeNICELLE TAGLEPas encore d'évaluation

- Questions Chapter 1Document84 pagesQuestions Chapter 1May Kim100% (1)

- Operations Auditing Quiz #2: IndependenceDocument6 pagesOperations Auditing Quiz #2: IndependenceCharleene GutierrezPas encore d'évaluation

- Aud 1.1.1Document3 pagesAud 1.1.1Marjorie BernasPas encore d'évaluation

- 92-FIRST PB-AUD ExamDocument11 pages92-FIRST PB-AUD ExamReynaldo corpuzPas encore d'évaluation

- Aaconapps2 00-C92pb1aDocument14 pagesAaconapps2 00-C92pb1aJane DizonPas encore d'évaluation

- Govt AuditDocument6 pagesGovt AuditVenus B. MacatuggalPas encore d'évaluation

- Tuguegarao CPA Review HandoutsDocument35 pagesTuguegarao CPA Review HandoutsICPA ReviewPas encore d'évaluation

- Questionnaires Aud Theory FinalDocument18 pagesQuestionnaires Aud Theory FinalRandy PaderesPas encore d'évaluation

- Aud-90 PWDocument17 pagesAud-90 PWElaine Joyce GarciaPas encore d'évaluation

- Audit Assessment True or False and MCQ - CompressDocument8 pagesAudit Assessment True or False and MCQ - CompressHazel BawasantaPas encore d'évaluation

- Quiz in Audit Overview Name: Section DIRECTION: Write The CAPITAL LETTER of Your Best Answer On The Space Provided Before Each NumberDocument4 pagesQuiz in Audit Overview Name: Section DIRECTION: Write The CAPITAL LETTER of Your Best Answer On The Space Provided Before Each NumberExequielCamisaCrusperoPas encore d'évaluation

- AUDITTHEODocument13 pagesAUDITTHEOAlisonPas encore d'évaluation

- Auditing Theory - 1Document9 pagesAuditing Theory - 1Kageyama HinataPas encore d'évaluation

- ACCTG 14 Final Exam ReviewDocument8 pagesACCTG 14 Final Exam ReviewErinePas encore d'évaluation

- 91-Aud First Pb-AudDocument12 pages91-Aud First Pb-Audjohn paulPas encore d'évaluation

- CPA Review School Philippines First Preboard ExamDocument17 pagesCPA Review School Philippines First Preboard ExamJane DizonPas encore d'évaluation

- Quiz 2 Set ADocument3 pagesQuiz 2 Set AShiela RengelPas encore d'évaluation

- Chapter 1 - Audit: An OverviewDocument78 pagesChapter 1 - Audit: An OverviewMarnelli CatalanPas encore d'évaluation

- At.02 Introduction To Audit of Historical Financial InformationDocument4 pagesAt.02 Introduction To Audit of Historical Financial InformationAngelica Sanchez de VeraPas encore d'évaluation

- Reviewer For Auditing TheoryDocument10 pagesReviewer For Auditing TheoryMharNellBantasanPas encore d'évaluation

- Chapter 1 QuestionsDocument7 pagesChapter 1 QuestionsAyame MalinaoPas encore d'évaluation

- AuditingDocument8 pagesAuditingNan Laron ParrochaPas encore d'évaluation

- Audit TheoryDocument17 pagesAudit TheoryFrancis Martin100% (2)

- Consideration of Internal ControlDocument4 pagesConsideration of Internal ControlMary Grace SalcedoPas encore d'évaluation

- AUD reviewerDocument9 pagesAUD reviewerMhaybelle JovellanoPas encore d'évaluation

- MPC kiểm toánDocument9 pagesMPC kiểm toánDANH LÊ VĂNPas encore d'évaluation

- Second Preboards in Auditing - FinalDocument9 pagesSecond Preboards in Auditing - FinalROMAR A. PIGAPas encore d'évaluation

- Second Preboards in Auditing - Answer KeyDocument15 pagesSecond Preboards in Auditing - Answer KeyROMAR A. PIGAPas encore d'évaluation

- Audit TheoDocument6 pagesAudit TheoVillapando GemaPas encore d'évaluation

- CPAR 1stPBDocument12 pagesCPAR 1stPBMae Danica CalunsagPas encore d'évaluation

- At 93 PWDocument16 pagesAt 93 PWPrinces Joy De GuzmanPas encore d'évaluation

- Far Eastern University - Manila: Open Using Adobe Reader and PCDocument5 pagesFar Eastern University - Manila: Open Using Adobe Reader and PCKristine TiuPas encore d'évaluation

- True / False QuestionsDocument19 pagesTrue / False QuestionsRizza OmalinPas encore d'évaluation

- Prelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearDocument10 pagesPrelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearJeremae Ann Ceriaco100% (1)

- Chapter 1 Salosagcol PDF FreeDocument20 pagesChapter 1 Salosagcol PDF Freeforentertainment purposesPas encore d'évaluation

- Understanding Audit Types and ObjectivesDocument20 pagesUnderstanding Audit Types and ObjectivesgingerootPas encore d'évaluation

- Module DDocument10 pagesModule DRich B EzPas encore d'évaluation

- Long Quiz 2Document8 pagesLong Quiz 2KathleenPas encore d'évaluation

- UntitledDocument5 pagesUntitledKriztel Loriene TribianaPas encore d'évaluation

- Chapter 10 - MCQ With AnswerDocument11 pagesChapter 10 - MCQ With AnswerGerlie0% (1)

- Auditing Theory - Quiz 1Document5 pagesAuditing Theory - Quiz 1MA ValdezPas encore d'évaluation

- AT - Material4 Audit Planning-2Document10 pagesAT - Material4 Audit Planning-2Zach RiversPas encore d'évaluation

- Audit 1stDocument10 pagesAudit 1stFrie NdshipMaePas encore d'évaluation

- CPA Review School Philippines Preboard Exam QuestionsDocument12 pagesCPA Review School Philippines Preboard Exam QuestionsAmeroden AbdullahPas encore d'évaluation

- 2012 Planning - ExamDocument21 pages2012 Planning - ExamLaura McCubbinPas encore d'évaluation

- Acctg 204A Final ExamDocument7 pagesAcctg 204A Final ExamJERROLD EIRVIN PAYOPAYPas encore d'évaluation

- At 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerDocument6 pagesAt 01 - Introduction To Assurance and Related Services (Incl. Intro To Audit) - QuizzerRei-Anne Rea100% (1)

- Auditing QuestionsDocument22 pagesAuditing QuestionsRhett Sage100% (1)

- AT Preweek B93 - QuestionnaireDocument16 pagesAT Preweek B93 - QuestionnaireSilver LilyPas encore d'évaluation

- RESA AT PreWeek (B43)Document7 pagesRESA AT PreWeek (B43)MellaniPas encore d'évaluation

- Auditing Theory SalosagcolDocument4 pagesAuditing Theory SalosagcolYuki CrossPas encore d'évaluation

- 94-Final PB-AUD - UnlockedDocument13 pages94-Final PB-AUD - UnlockedJessaPas encore d'évaluation

- Auditing Theory Auditing ConceptsDocument15 pagesAuditing Theory Auditing ConceptsEllah MaePas encore d'évaluation

- Assurance Principles Midterm QuizDocument5 pagesAssurance Principles Midterm Quizjovelyn labordoPas encore d'évaluation

- Codes of Conduct and Audit QuestionsDocument5 pagesCodes of Conduct and Audit QuestionsRinajean Masisado RaymundoPas encore d'évaluation

- Audit Risk Alert: General Accounting and Auditing Developments, 2017/18D'EverandAudit Risk Alert: General Accounting and Auditing Developments, 2017/18Pas encore d'évaluation

- NFJPIA Mockboard 2011 Auditing TheoryDocument6 pagesNFJPIA Mockboard 2011 Auditing TheoryKathleen Ang100% (1)

- Business Law Preboard FinalDocument7 pagesBusiness Law Preboard Finalxxxxxxxxx100% (1)

- At AnswerKeyDocument9 pagesAt AnswerKeyRosalie E. BalhagPas encore d'évaluation

- Auditing Theory 250 QuestionsDocument39 pagesAuditing Theory 250 Questionsxxxxxxxxx75% (4)

- Relevant Costing CPARDocument13 pagesRelevant Costing CPARxxxxxxxxx100% (2)

- Taxation With AnswersDocument8 pagesTaxation With AnswersMarion Tamani Jr.50% (2)

- Cost of CapitalDocument10 pagesCost of CapitalCharmaine ChuPas encore d'évaluation

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Practical Accounting 2 With AnswersDocument11 pagesPractical Accounting 2 With Answerskidrauhl0767% (6)

- At AnswerKeyDocument9 pagesAt AnswerKeyRosalie E. BalhagPas encore d'évaluation

- Theory of Accounts Mockboard 2013 With AnswersDocument9 pagesTheory of Accounts Mockboard 2013 With AnswersxxxxxxxxxPas encore d'évaluation

- Business Law Preboard FinalDocument7 pagesBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Practical Accounting 1 With AnswersDocument10 pagesPractical Accounting 1 With Answerslibraolrack50% (8)

- Financial Statement Analysis - CPARDocument13 pagesFinancial Statement Analysis - CPARxxxxxxxxx100% (2)

- Business Law Preboard FinalDocument7 pagesBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Auditing Problems With AnswersDocument12 pagesAuditing Problems With Answersaerwinde79% (34)

- Audit of Cash and Cash EquivalentsDocument38 pagesAudit of Cash and Cash Equivalentsxxxxxxxxx86% (81)

- MAS With Answers PDFDocument13 pagesMAS With Answers PDF蔡嘉慧100% (1)

- Correction of ErrorsDocument37 pagesCorrection of Errorsxxxxxxxxx75% (36)

- Business Law Preboard FinalDocument7 pagesBusiness Law Preboard Finalxxxxxxxxx100% (1)

- Taxation With AnswersDocument8 pagesTaxation With AnswersMarion Tamani Jr.50% (2)

- CHAPTER 7 Caselette - Audit of PPEDocument34 pagesCHAPTER 7 Caselette - Audit of PPErochielanciola60% (5)

- Psa 800 PDFDocument20 pagesPsa 800 PDFshambiruarPas encore d'évaluation

- Audit of Stockholders EquityDocument25 pagesAudit of Stockholders Equityxxxxxxxxx87% (39)

- Audit of LiabilitiesDocument33 pagesAudit of Liabilitiesxxxxxxxxx96% (28)

- Audit of ReceivablesDocument32 pagesAudit of Receivablesxxxxxxxxx96% (55)

- Audit of InventoryDocument32 pagesAudit of Inventoryxxxxxxxxx92% (48)

- Psa 720Document8 pagesPsa 720shambiruarPas encore d'évaluation

- Psa 700 RevDocument86 pagesPsa 700 RevDave RamirezPas encore d'évaluation

- Psa 710Document18 pagesPsa 710xxxxxxxxxPas encore d'évaluation

- Exercises (Time Value of Money) : TH TH THDocument2 pagesExercises (Time Value of Money) : TH TH THbdiitPas encore d'évaluation

- P5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cDocument28 pagesP5 CA INTER ADV ACC 30 SA Nov23 - 1693888431316 - F69cf621cc65824d1d5a8d2c336e6cAkshat ShahPas encore d'évaluation

- CEO CFO CertificationDocument30 pagesCEO CFO CertificationAbhishek GhoshPas encore d'évaluation

- 2016pk Panels8-17Document18 pages2016pk Panels8-17pkconferencePas encore d'évaluation

- 3-Import ExportDocument13 pages3-Import ExportStephiel SumpPas encore d'évaluation

- ObjectionDocument10 pagesObjectionMy-Acts Of-SeditionPas encore d'évaluation

- Engineering Economic Analysis 11th Edition EbookDocument61 pagesEngineering Economic Analysis 11th Edition Ebookdebra.glisson665100% (48)

- 1 Partnership FormationDocument7 pages1 Partnership FormationJ MahinayPas encore d'évaluation

- Travel Agency Business Plan: Adventure Excursions Unlimited Executive SummaryDocument33 pagesTravel Agency Business Plan: Adventure Excursions Unlimited Executive SummaryjatinPas encore d'évaluation

- 8 Fair Value Measurement 6/12: 7.5 Capital DisclosuresDocument9 pages8 Fair Value Measurement 6/12: 7.5 Capital Disclosuresusman aliPas encore d'évaluation

- Transfer Register All: Bangladesh Krishi BankDocument13 pagesTransfer Register All: Bangladesh Krishi Bankabdul kuddusPas encore d'évaluation

- Leuthold Group - From August 2015Document10 pagesLeuthold Group - From August 2015ZerohedgePas encore d'évaluation

- Three Innate Powers of the StateDocument30 pagesThree Innate Powers of the StateayasuePas encore d'évaluation

- Ifrs Framework PDFDocument23 pagesIfrs Framework PDFMohammad Delowar HossainPas encore d'évaluation

- Tugas Kelompok 6 Bahasa Inggris Niaga Economic Started With GDocument10 pagesTugas Kelompok 6 Bahasa Inggris Niaga Economic Started With GrizkyPas encore d'évaluation

- Director Service Agreement Free SampleDocument3 pagesDirector Service Agreement Free Sampleapi-235666177Pas encore d'évaluation

- © The Institute of Chartered Accountants of IndiaDocument3 pages© The Institute of Chartered Accountants of IndiaDeepak KumarPas encore d'évaluation

- Solutions To Derivative Markets 3ed by McDonaldDocument28 pagesSolutions To Derivative Markets 3ed by McDonaldRiskiBiz13% (8)

- Green Bonds Getting The Harmony RightDocument82 pagesGreen Bonds Getting The Harmony RightLía Lizzette Ferreira MárquezPas encore d'évaluation

- Enseval Putera Megatrading - Billingual - 31 - Des - 2017 - ReleasedDocument105 pagesEnseval Putera Megatrading - Billingual - 31 - Des - 2017 - Releasedahmad yaniPas encore d'évaluation

- Treehouse Toy Library Business PlanDocument16 pagesTreehouse Toy Library Business PlanElizabeth BartleyPas encore d'évaluation

- Arbaminch University College of Business and Economics Department of Accounting and FinancDocument8 pagesArbaminch University College of Business and Economics Department of Accounting and FinancbabuPas encore d'évaluation

- FINS2624 Problem Set 5Document3 pagesFINS2624 Problem Set 5IsyPas encore d'évaluation

- Ismatullah Butt: Curriculum VitaeDocument4 pagesIsmatullah Butt: Curriculum VitaebuttismatPas encore d'évaluation

- Gillette Case Submission Group 1 Section BDocument14 pagesGillette Case Submission Group 1 Section BShruti Pandey100% (2)

- Project IdentificationDocument89 pagesProject Identificationtadgash4920100% (3)

- 6939 - Cash and Accruals BasisDocument5 pages6939 - Cash and Accruals BasisAljur SalamedaPas encore d'évaluation

- BAM 026 Group 1Document8 pagesBAM 026 Group 1Maureen SanchezPas encore d'évaluation

- The California Fire Chronicles First EditionDocument109 pagesThe California Fire Chronicles First EditioneskawitzPas encore d'évaluation

- MPKJDocument36 pagesMPKJJoshua Capa FrondaPas encore d'évaluation