Académique Documents

Professionnel Documents

Culture Documents

Pinc Weeklytech 09jul10

Transféré par

Nishant P KalaskarTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Pinc Weeklytech 09jul10

Transféré par

Nishant P KalaskarDroits d'auteur :

Formats disponibles

weekly out look from

9 July 2010

Technical Analysis

Stock of the Week

Going fine

IVRCL Infra : Rs191

India Outlook

Trend : Positive

Period 2 - 3 months

Target : Rs225

Equity indices: Indian Equity indices began with volatility but surged strongly

in the later part of the week. The index moves are in line with the view we have

held so far and the target of 5475 remains within reach of the Nifty. We remain

bullish on the prospects of the Nifty. The Mid Cap index has closed at the

highest level since the rally began in March 2009. This clearly underlines the

broad positive consensus in the market.

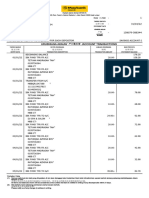

Key Indices

WoW

change

Short-term

outlook

Key

support

Key

resistance

17834

+2.1%

Positive

17400

18250

5352

+2.2%

Positive

5225

5500

Index

Close

BSE Sensex

NIFTY

3967

+2.0%

Positive

3825

4125

BSE CG

CNX Defty

14652

+1.1%

Positive

14200

15000

BSE Bankex

11061

+3.7%

Positive

10650

11400

Global Outlook

Commodities: Metals remained in narrow trading band as we had expected.

But we do expect a positive bias to develop in the near future. Gold has

weakened and faces resistance at $1250. Silver remains volatile and

directionless. Crude is likely to decline further to $70.

Currencies: The USD/INR faces resistance at 47 and can now decline. A move

below 46 can have negative implications. The Euro is recovering as expected

and should rise further. The Yen can bounce to about 90. The DXY has weakened

as expected and further declines are possible.

Global equity indices: Trends of key indices are given below.

Country

Index

USA

S&P500

Closing

1070

Can advance to 1100

2447

Bottoming out

CHINA

Shanghai

HONG KONG

Hang Seng

Japan

Nikkei

9590

MS Emerging Mkt

MSCI

940

Key comments

20300

Wait & watch

Weak over medium term

Positive over medium term.

Index Watch

Index is making a trend channel in its weekly chart: The Nifty has been

NIFTY (5352)

trading in a trend channel since November 2009. The upper line of the channel

Gain/Loss over the week: Up 115 points

(+2.2%)

is indicated at 5575 while the supporting line is reading at 4875.

Moving average crossover: The combination of medium and long term MAs

Outlook for next week: Positive

used for tracking the trend is in a positive position, suggesting that over the

Our tools: We have used a weekly bar chart

along with momentum

medium term the trend is bullish.

Medium term momentum has gained strength: The medium term momentum

(KST) has been bottoming out since the last few weeks. It is also in its positive

zone despite the long sideways correction which indicates additional strength

in the trend.

Support

5325

5300

5225

Resistance

5400

5475

5500

Outlook: The Nifty continues to be in a positive trend in the medium term

charts. We believe that the trend is essentially positive and that it is within

striking distance of our target of 5475. We retain this view.

Index Watch

Index has bounced off its medium term trend line: The Midcap index has

NSE Midcap (8301)

bounced off an important support line in its daily charts (not shown here) and

Gain/Loss over the week: Up 210 points

(+2.6%)

has moved further up. This bullish structure remains intact.

Moving Average cross over: The combination of short and medium term MAs

Outlook for next week: Positive

used for tracking the trend in the weekly charts are in a bullish cross over. This

Our tools: We have used a weekly bar chart

along with momentum

is a bullish signal and indicates that the index is in a positive trend which is

likely to further itself.

Momentum: The ROC indicator used here has started moving up from its zero

line. The indicator is also in its positive zone which is a bullish sign. The indicator

has sustained its positive signal this week too indicating that the bullish

Support

8200

8000

7775

Resistance

8375

8500

8700

undertone remains intact.

Outlook: The Midcap index, in its weekly charts, retains its positive momentum.

Its MAs indicate bullishness ahead. We expect that the index can stay positive

over time and advance further. We are bullish on the prospects of this index.

Stock Monitor

IVRCL INFRA

Price: CMP Rs 191

Moving Averages crossover: The combination of medium and long term

Moving Averages used for tracking the trend are in a bullish position. They had

Outlook: Positive over the medium term.

Target Price: Rs225 in 2-3 months.

turned weak for a short while but are now again in a position of strength. From

a medium / long term perspective this is a positive signal and suggests a positive

trend ahead.

Momentum gains upward bias: The medium / long term momentum (KST)

has started moving up. It has also moved above its trigger line which confirms

a positive trend. This indicator has stayed in its positive zone which is an added

point of strength.

Recommendation: The price of IVRCL has the potential to develop into a

sustained uptrend from here on. Momentum indicators beginning to gain

strength from a medium / long term perspective. We expect the price to reach

Rs225 in the next 2 - 3 months.

Sector Watch

CNX Defty (3967) up 79 points (+2.0%):

CNX Defty

The Defty has closed positive and also above its medium term MA (at 3889

CNX Defty

Supports

3875

3825

presently). The index is consolidating and retains a bullish momentum. We

Resistances

4000

4125

expect the index to rise further.

BSE PSU (9469) up 92 points (+1.0%):

BSE PSU

The PSU index is still within its range. We expect the index to improve over a

BSE PSU

Supports

9300

9000

period of time as overall momentum suggests recovery over the medium term.

Resistances

9500

9700

However, the recovery is turning out to be very slow and sluggish.

BSE Bankex (11061) up 397 points (+3.7%):

BSE Bankex

The Bankex recovered firmly through the week thus confirming our positive

BSE Bankex

Supports

10850

10650

view. We are bullish on the overall prospects of this index. A move below 10650

Resistances

11200

11400

would mark weakness.

BSE IT (5478) up 240 points (+4.6%):

BSE IT

The IT index closed positive but remains trapped in a broad sideways range.

BSE IT

Supports

5400

5200

This consolidation can continue for some more time. A directional thrust cannot

Resistances

5550

5725

be expected in the near future. The bias however,is positive.

BSE Cap Goods (14652) up 158 points (+1.1%):

BSE Cap Goods

The medium term trend in Cap Goods is making a break out of its trading

BSE Cap Goods

Supports

14500

14200

range. The underlying momentum in the trend is firm and we expect the break

Resistances

14725

15000

out to be successful. The medium term prospects of the sector are bullish.

BSE Auto (8369) up 185 points (+2.2%):

BSE Auto

The Auto index has broken above the resistance level of 8000 and has sustained

BSE Auto

Supports

8200

8000

at the level through the week. It has broken out from a consolidating pattern

Resistances

8500

8750

and is seen as a bullish development. We see more upside to the index from

here onwards.

Commodities

Aluminium ($1989)

Aluminium

Aluminium has remained in a steady sideways band this week. It is a wait &

Aluminium

Supports

1900

1860

watch for the next week but we have positive bias now. Possibilities of a recovery

Resistances

2000

2050

look high in the metal at this point.

Zinc ($1855)

Zinc

Zinc remains in a trading range at present. This behaviour can continue for

Zinc

Supports

1800

1750

some more time but the bias is turning to positive. However, for now it is a wait

Resistances

1900

1975

& watch situation.

Copper ($6615)

Copper

The price of Copper has remained below its 200 DMA ($6950). It is failing to

Copper

Supports

6550

6500

Resistances

6675

6800

develop a directional thrust. A phase of volatile two way trends can now follow.

Gold ($1198)

Gold

Gold prices have declined as expected and are near a support level at $1200.

Gold

Supports

1200

1175

The trend is weak and prices can fall further. The next support is seen at $1160

Resistances

1250

1275

- $1150.

Silver ($17.88)

Silver

The price of Silver has remained weak as per our view. We continue to believe

Silver

Supports

17.65

17.25

that a two way consolidation move is playing out in the metal over the medium

Resistances

18.00

18.50

term. The prices can range between $17.50 - 19.50.

Crude Oil ($75.80)

Crude oil

The price of Crude Oil remains below its 200 DMA ($77.25). The trend continues

Crude oil

Supports

74.75

74.00

to look weak. The trend may stabilize for a while but further declines are likely

Resistances

76.50

77.25

to happen. Crude can fall back to $70 in this phase.

Currencies

Dollar/Rupee (46.71)

Dollar/Rupee

The USD/INR has risen last week but has faced strong resistance in the area of

Dollar/Rupee

Supports

46.00

45.70

Resistances

46.75

47.25

47. A decline can ensue from here to about 46.25.

Euro/Dollar (1.2664)

Euro/Dollar

The Euro has risen further in line with our positive bias. The possibility of a

Euro/Dollar

Supports

1.2700

1.2650

further rise remains quite strong at present too. Resistance can be expected in

Resistances

1.2750

1.2775

the area of 1.2850 - 1.2900.

Dollar/Yen (88.50)

Dollar/Yen

USD/JPY sprung up sharply over the last two sessions.This remains in line

Dollar/Yen

Supports

87.50

87.00

with our view. This recovery is likely to gain further ground and can hit the

Resistances

89.25

90.00

level of 90.

Dollar Index DXY (83.85)

Dollar Index - DXY

The DXY has continued to decline as we had expected. Possibilities for a further

Dollar Index - DXY

Supports

83.25

82.75

decline remain open at this point. We expect the slide to continue to 83 or

Resistances

84.00

84.50

slightly lower. The overall trend remains weak at present.

Global Equities

S&P 500 (1070)

S & P 500

In line with our view last week, the S&P500 did make a bounce back and has

S&P 500

Supports

1050

1010

gained substantially in three trading sessions. It does indicates that in the

Resistances

1075

1100

near term the scope for a decline has reduced. An advance to 1100 looks very

much on the cards.

Brazil (63476)

BOVESPA

The Bovespa has begun recovering in line with our view. It is still below its 200

Brazil

Supports

63000

62700

DMA (66000) but can very well advance to 65000 for now. A major directional

Resistances

63750

64000

thrust is not expected in the present circumstances. It is a wait & watch scene

for now. The overall trend remains weak.

China (2471)

Shanghai SE Composite

The SSE has begun recovering. The momentum is quite weak at present, but

China

Supports

2430

2400

the medium / long term charts are showing oversold signals. A recovery appears

Resistances

2475

2500

to have begun in China which may sustain in time. It reached near 2300 as we

expected. This level can now be considered as a base for the expected recovery.

Hong Kong (20378)

Hang Seng

The HSI has not been very responsive to the global surge so far. It is rather

Hong Kong

Supports

20000

19700

difficult to take a clear view on its near term developments at present. We

Resistances

20500

20800

prefer to wait & watch.

Japan (9585)

Nikkei

The Nikkei has bounced up but the trend remains severely volatile. While the

Japan

Supports

9525

9475

present move may gain some more in values, the larger trend remains biased

Resistances

9625

9675

to weakness. We remain bearish on the medium prospects of this index.

United Kingdom (5112)

FTSE

The FTSE has bounced back in line with major global indices. It however

United Kingdom

Supports

4800

4725

remains below its 200 DMA (5321). The present bounce back can face resistance

Resistances

4875

4900

in this area.

MS Emerging Markets (940)

MSCI - EMI

The EMI has advanced during this week after a setback. It can rise back to its

MS Emerging Markets

Supports

925

900

200 DMA (963). However, we would expect erratic two way trends from here. It

Resistances

950

965

is a wait & watch situation from a short term perspective. But the overall trend

can recover over the medium term.

8

BRANCHES

TEAM

RESEARCH

Karan Chimandas

AVP Research & Financial Planning

karan.chimandas@pinc.co.in

91-22-66186743

Dr. Renu Pothen

Manager - Research

renu.pothen@pinc.co.in

91-22-66186747

C.Krishnamurthy

Technical Analyst

krishnamurthy.c@pinc.co.in

91-22-66186744

Kumar Rahul Chauhan

Research Analyst

rahul.chauhan@pinc.co.in

91-22-66186456

Balajee Tirupati

Research Analyst

balajee.tirupati@pinc.co.in

91-22-66186467

Rochak Sethia

Research Associate

rochak.sethia@pinc.co.in

91-22-66186744

MARKETING

Dheeraj Mohan

dheeraj.mohan@pinc.co.in

91-22-66186400

deepak.b@pinc.co.in

91-22-66186468

customer.care@pinc.co.in

1800-209-9989

VP Products

Deepak Balasubramanian

Marketing Manager

Customer Care

Ambala-0171-2631096/4090001 Bangalore-080-25210727/25210725 Baroda-0265-6643508/6455702 Bhopal-0755-4205252/4209696

Bhubaneshwar-0674-6570223/6570224 Chennai-044-43084999/42271300 Coimbatore-0422-4223374/4225100 Davanagere-08192-270044

Dehradun-0135-6453041/6453042 Delhi-011-45634771 Dhanbad-0326-2303829/6551205 Durgapur-0343-2542348/2542349 Guntur-08636646668/6450999 Gurgaon-0124-4516614 Gwalior-0751-4029458 Hubli-0836-4265294/4265280 Hyderabad-040-40174581 Indore-0731-4289890/

4289891 Jabalpur-0761-4033219/4033379 Jaipur-0141-4045201/4045202 Jamshedpur-0657-2321300/2321302 Jodhpur-0291-2641350 Kanpur0512-3069854 Karnal-0184-4023300 Kolkata-033-40132900/40132930 Lucknow-0522-4101024 Madurai-0452-4500802 Mangalore-08244254047/4264164 Mumbai-022-66186400 Mysore-0821-4287672 Navsari-09228022662 Noida-0120-4224437 Panipat-0180-4017301/4017307

Pondicherry-0413-4304319 Ranchi-0651-2216535 Sagar (MP)-07582-222201/222202 Shimoga-08182-403613/403614 Surat-0261-4003990

Trichy-0431-4220291/4220295 Vashi-022-41232452/41234451 Vellore-0416-4202051 Vijayawada-0866-6462220/6462221 Vizag-0891-2730797

Valsad-02632-656501

Disclaimer: This document has been prepared by the Research Desk of PINC and is meant for use of the recipient only and is not for public circulation. Each recipient of this document should

make such investigations as it deems necessary to arrive at an independent evaluation of an investment in the securities of companies referred to in this document (including the merits and

risks involved), and should consult its own advisors to determine the merits and risks of such an investment. The investment discussed or views expressed may not be suitable for all investors

The information contained herein is obtained and collated from sources believed reliable and PINC has not independently verified all the information given in this document. Accordingly,

no representation or warranty, express or implied, is made as to the accuracy, completeness or fairness of the information and opinions contained in this document.

The Disclosures of Interest Statement incorporated in this document is provided solely to enhance the transparency and should not be treated as endorsement of the views expressed in the

report. The opinion expressed or estimates made are as per the best judgement as applicable at that point of time and PINC reserves the right to make modifications and alternations to this

statement as may be required from time to time without any prior approval

PINC, its affiliates, their directors, employees and their dependant family members may from time to time, effect or have effected an own account transaction in, or deal as principal or agent

in or for the securities mentioned in this document. They may perform or seek to perform investment banking or other services for, or solicit investment banking or other business from, any

company referred to in this report. Each of these entities functions as a separate, distinct and independent of each other. The recipient should take this into account before interpreting the

document

This report has been prepared on the basis of information, which is already available in publicly accessible media or developed through analysis of PINC. The views expressed are those of analyst

and the PINC may or may not subscribe to all the views expressed therein

This document is being supplied to you solely for your information and may not be reproduced, redistributed or passed on, directly or indirectly, to any other person or published, copied, in whole

or in part, for any purpose. Neither this document nor any copy of it may be taken or transmitted into the United State (to U.S.Persons), Canada, or Japan or distributed, directly or indirectly,

in the United States or Canada or distributed or redistributed in Japan or to any resident thereof. The distribution of this document in other jurisdictions may be restricted by law, and persons

into whose possession this document comes should inform themselves about, and observe, any such restrictions

Neither PINC, not its directors, employees, agents or representatives shall be liable for any damages whether direct or indirect, incidental, special or consequential including lost revenue or

lost profits that may arise from or in connection with the use of the information.

Copyright in this document vests exclusively with PINC and this document is not to be reported or circulated or copied or made available to others.

Regd. Office:- Infinity.Com Financial Securities Ltd.

1216, Maker Chambers V, Nariman Point, Mumbai - 400 021; Tel.: 91-22-66186633/6400 Fax : 91-22-22049195

Member : Bombay Stock Exchange & National Stock Exchange of India Ltd. : Sebi Reg No: INB 010989331(BSE - Capital Segment), INB 2311850035 (NSE Capital Segment), INF

2311850035 (NSE Derivative Segment)

CDSL Reg. No: IN-DP-CDSL-422-2207

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1091)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Techcombank StatementDocument1 pageTechcombank StatementĐào Văn CườngPas encore d'évaluation

- Sample Option ContractDocument9 pagesSample Option ContractChris Ce100% (1)

- 1 - Investment Banking and BrokerageDocument152 pages1 - Investment Banking and BrokerageLordie BluePas encore d'évaluation

- Trade Finance ManualDocument8 pagesTrade Finance ManualgautamnarulaPas encore d'évaluation

- Rarejob Endorsement Letter For BpiDocument1 pageRarejob Endorsement Letter For Bpiejg26100% (2)

- Quantifiable Edges Subscriber Letter: Market OverviewDocument12 pagesQuantifiable Edges Subscriber Letter: Market OverviewNishant P KalaskarPas encore d'évaluation

- The Case For Surge Funding: Project Syndicate, Feb 17, 2016Document27 pagesThe Case For Surge Funding: Project Syndicate, Feb 17, 2016Nishant P KalaskarPas encore d'évaluation

- 10 KAIZEN PrinciplesDocument1 page10 KAIZEN PrinciplesNishant P KalaskarPas encore d'évaluation

- Sample Report 20130612Document11 pagesSample Report 20130612Nishant P KalaskarPas encore d'évaluation

- Trendstoday Stock Picks140813Document3 pagesTrendstoday Stock Picks140813Nishant P KalaskarPas encore d'évaluation

- Banking Business Models of The Digital Future: The Case of LatviaDocument15 pagesBanking Business Models of The Digital Future: The Case of LatviaSonia AraujoPas encore d'évaluation

- Analysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.Document8 pagesAnalysis by Bernard Patterson On Loan ModIfications in The Helen Galope Case.83jjmackPas encore d'évaluation

- Outgoing Payments Iso 20022 Application GuidelineDocument54 pagesOutgoing Payments Iso 20022 Application Guidelinesri_vas4uPas encore d'évaluation

- 9084 s16 QP 32 PDFDocument4 pages9084 s16 QP 32 PDFAbbas Khan MiraniPas encore d'évaluation

- Jawaban Quiz 1 SimbisDocument6 pagesJawaban Quiz 1 SimbisfatwacahyokusumoPas encore d'évaluation

- 212 Scra 448 RGFMDocument2 pages212 Scra 448 RGFMRhuejane Gay MaquilingPas encore d'évaluation

- A158 PDFDocument170 pagesA158 PDFMitar MiricPas encore d'évaluation

- BOP Asaan Current AccountDocument2 pagesBOP Asaan Current AccountAhmad CssPas encore d'évaluation

- Direct Admission of Students Abroad (DASA) 2016Document23 pagesDirect Admission of Students Abroad (DASA) 2016Ravi Shankar M GPas encore d'évaluation

- Account Statement From 1 Apr 2019 To 12 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument5 pagesAccount Statement From 1 Apr 2019 To 12 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balance9894578721Pas encore d'évaluation

- Bank Alfalah Limited Project of Human Resource DevelopmentDocument39 pagesBank Alfalah Limited Project of Human Resource DevelopmentSyed AlinaPas encore d'évaluation

- Kokan BankDocument20 pagesKokan BankramshaPas encore d'évaluation

- Effect of Cash Management On The Financial Performance of Cooperative Banks in Rwanda: A Case of Zigma CSSDocument11 pagesEffect of Cash Management On The Financial Performance of Cooperative Banks in Rwanda: A Case of Zigma CSSjournalPas encore d'évaluation

- Section C Group II Parameters For Customer SatisfactionDocument6 pagesSection C Group II Parameters For Customer SatisfactionBhartiyam SushilPas encore d'évaluation

- Nse 20140822Document34 pagesNse 20140822Dhawan SandeepPas encore d'évaluation

- William Yeboah SampongDocument62 pagesWilliam Yeboah SampongWilliam TabiPas encore d'évaluation

- Baker Adhesives Foreign Exch PDFDocument6 pagesBaker Adhesives Foreign Exch PDFEmmelinaErnestinePas encore d'évaluation

- Summit - Review - Units 3-5Document4 pagesSummit - Review - Units 3-5raiperei20044369Pas encore d'évaluation

- Rochester FFDocument40 pagesRochester FFThomas Dayton CressmanPas encore d'évaluation

- 7110 s18 QP 23Document24 pages7110 s18 QP 23Shahzaib ShahbazPas encore d'évaluation

- Bankgesellschaft BerlinDocument6 pagesBankgesellschaft Berlinandy_jean_2Pas encore d'évaluation

- Dynamic Incident Response Manager in Chicago IL Resume Patrick McGinnDocument2 pagesDynamic Incident Response Manager in Chicago IL Resume Patrick McGinnPatrickMcGinnPas encore d'évaluation

- THE FINANCIAL PERFORMANCE OF INTEREST (Raw Data)Document5 pagesTHE FINANCIAL PERFORMANCE OF INTEREST (Raw Data)Ahmed Jan DahriPas encore d'évaluation

- Ibs Gerik 1 31/03/22Document36 pagesIbs Gerik 1 31/03/22amjad radziPas encore d'évaluation

- Shriram Transport Finance Company LTD: Customer Details Guarantor DetailsDocument3 pagesShriram Transport Finance Company LTD: Customer Details Guarantor DetailsThirumalasetty SudhakarPas encore d'évaluation