Académique Documents

Professionnel Documents

Culture Documents

RMC 13-80

Transféré par

RB Balanay0 évaluation0% ont trouvé ce document utile (0 vote)

40 vues2 pagesbir ruling

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentbir ruling

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

40 vues2 pagesRMC 13-80

Transféré par

RB Balanaybir ruling

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 2

April 10, 1980

REVENUE MEMORANDUM CIRCULAR NO. 13-80

1.

Subject

Treatment of Tax Refunds and Tax Credits When Received.

To

All Internal Revenue Officers and Others Concerned.

Refunds/Tax Credits under Section 295

of the Tax Code.

Taxes previously claimed and allowed as deductions, but

subsequently refunded or granted as tax credit pursuant to Section 295

of the Tax Code, should be declared as part of the gross income of the

taxpayer in the year of receipt of the refund or tax credit. However, the

following taxes, when refunded or credited, are not declarable for

income tax purposes inasmuch as they are not allowable as deductions:

a.

Income tax imposed in Title III of the Tax Code;

b.

Income, war-profit and excess profits taxes imposed by

authority of a foreign country; but this deduction shall be

allowed in the case of a taxpayer who does not signify in his

return his desire to have to any extent the benefits of paragraph

(3) of this subsection (relating to credit for taxes of foreign

countries);

aisa dc

2.

c.

Estate and gift taxes;

d.

Taxes assessed against local benefits of a kind tending to

increase the value of the property assessed;

e.

Stock transaction tax;

f.

Energy tax; and

g.

Taxes which are not allowable as deductions under the law.

Special Tax Credits granted under R.A. 5186;

P.D. 535.

R.A. 6135

and

These tax credits and their tax consequences are as follows:

a.

Copyright 2014

Sales, compensating and specific taxes are paid on supplies and

CD Technologies Asia, Inc. and Accesslaw, Inc.

Philippine Taxation Encyclopedia 2013

raw materials imported by a registered export producer. Said

taxes are given as tax credit to be used in the payment of taxes,

duties, charges and fees due to the national government in

connection with its operations. (Sec. 7(a), R.A. No. 6135)

The tax credits granted should form part of the gross

income to the enterprise in the year of receipt of tax credit as

said taxes paid are considered allowable deductions for income

taxes purposes.

b.

In some cases, a registered BOI and tourism enterprise assumes

payment of taxes withheld and due from the foreign

lender-remittee on interest payments on foreign loans. In such

cases, the enterprise is given a tax credit for taxes withheld

subject to certain conditions. (Sec. 7(f), R.A. No. 5186; Sec.

8(c), P.D. No. 535)

Said taxes assumed by the registered enterprise represent

necessary and ordinary expenses incurred by the enterprise;

hence, deductible from its gross income. Therefore, the tax

credits granted necessarily constitute taxable income of the

enterprise.

casia

It is desired that this Circular be given as wide a publicity as possible.

EFREN I. PLANA

Acting Commissioner

Copyright 2014

CD Technologies Asia, Inc. and Accesslaw, Inc.

Philippine Taxation Encyclopedia 2013

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

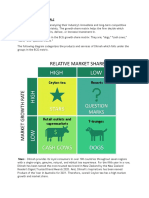

- BCG Matrix For Dilmah PLCDocument4 pagesBCG Matrix For Dilmah PLCHaneesha Teenu100% (5)

- Civil Procedure Syllabus FEU LawDocument20 pagesCivil Procedure Syllabus FEU LawRB Balanay100% (1)

- Scope & Objectives of Engg. Management PDFDocument7 pagesScope & Objectives of Engg. Management PDFCrystal PorterPas encore d'évaluation

- Martin Armstrong Biography May 2011Document63 pagesMartin Armstrong Biography May 2011Kris100% (1)

- CERTIFIED STATEMENT OF INCOMEDocument17 pagesCERTIFIED STATEMENT OF INCOMEArman BentainPas encore d'évaluation

- Essay - Education Should Be FreeDocument2 pagesEssay - Education Should Be FreeRuthie CamachoPas encore d'évaluation

- Credit Suisse Structured Retail ImpactDocument18 pagesCredit Suisse Structured Retail Impacthc87100% (1)

- Appellants BriefDocument3 pagesAppellants BriefAarf YouPas encore d'évaluation

- LEGAL ETHICS BAR EXAM With Suggested Answers.Document5 pagesLEGAL ETHICS BAR EXAM With Suggested Answers.Blake Clinton Y. Dy91% (11)

- Consumer Awareness of Shri Ram Life InsuranceDocument99 pagesConsumer Awareness of Shri Ram Life InsuranceAshish Agarwal100% (1)

- Full Solution Manual For Principles of Supply Chain Management A Balanced Approach 3Rd Edition by Wisner PDF Docx Full Chapter ChapterDocument7 pagesFull Solution Manual For Principles of Supply Chain Management A Balanced Approach 3Rd Edition by Wisner PDF Docx Full Chapter Chapteraxinitestundist98wcz100% (13)

- Bir CGTDocument1 pageBir CGTRB BalanayPas encore d'évaluation

- BIR NO DirectoryDocument48 pagesBIR NO DirectoryRB BalanayPas encore d'évaluation

- BIR NO DirectoryDocument48 pagesBIR NO DirectoryRB BalanayPas encore d'évaluation

- The Script Greatest HitsDocument1 pageThe Script Greatest HitsRB BalanayPas encore d'évaluation

- BIR CGT SummaryDocument18 pagesBIR CGT SummaryRB BalanayPas encore d'évaluation

- MIAA Exempt from Real Property TaxDocument14 pagesMIAA Exempt from Real Property TaxAnonymous Egm4bfnFkiPas encore d'évaluation

- Digimonworld WalkthroughDocument5 pagesDigimonworld WalkthroughRB BalanayPas encore d'évaluation

- Queensland V Thomas George and Global Business V SurecompDocument15 pagesQueensland V Thomas George and Global Business V SurecompRB BalanayPas encore d'évaluation

- Bir CGTDocument1 pageBir CGTRB BalanayPas encore d'évaluation

- Supreme Court Poe DecisionDocument48 pagesSupreme Court Poe DecisionAnonymous w4P4RPPas encore d'évaluation

- International Service Vs Green PeaceDocument91 pagesInternational Service Vs Green PeaceRB BalanayPas encore d'évaluation

- Tenchavez Vs EscanoDocument2 pagesTenchavez Vs EscanoRB BalanayPas encore d'évaluation

- Remedial Law Bar Exam Q&A (1997-2006Document196 pagesRemedial Law Bar Exam Q&A (1997-2006RB BalanayPas encore d'évaluation

- IPL Assignment For May 6,2016Document1 pageIPL Assignment For May 6,2016RB BalanayPas encore d'évaluation

- Political Law & International LawDocument2 pagesPolitical Law & International LawRB BalanayPas encore d'évaluation

- 1santos V McCullough Printing Company, 12 SCRA 324Document6 pages1santos V McCullough Printing Company, 12 SCRA 324RB BalanayPas encore d'évaluation

- Guideline Risk RegisterDocument13 pagesGuideline Risk RegisterantonyPas encore d'évaluation

- Aboitiz Shipping Corp Held Liable for Passenger's DeathDocument1 pageAboitiz Shipping Corp Held Liable for Passenger's DeathRB BalanayPas encore d'évaluation

- Bir-Rulings Income and DeductionsDocument4 pagesBir-Rulings Income and DeductionsRB BalanayPas encore d'évaluation

- CORPOLAW-CIR V ClubFilipino, Valley GolfDocument18 pagesCORPOLAW-CIR V ClubFilipino, Valley GolfRB BalanayPas encore d'évaluation

- 5unilever V Proctor & Gamble, GR 119280Document7 pages5unilever V Proctor & Gamble, GR 119280RB BalanayPas encore d'évaluation

- 1santos V McCullough Printing Company, 12 SCRA 324Document6 pages1santos V McCullough Printing Company, 12 SCRA 324RB BalanayPas encore d'évaluation

- Aboitiz Shipping Corp Held Liable for Passenger's DeathDocument1 pageAboitiz Shipping Corp Held Liable for Passenger's DeathRB BalanayPas encore d'évaluation

- 1santos V McCullough Printing Company, 12 SCRA 324Document6 pages1santos V McCullough Printing Company, 12 SCRA 324RB BalanayPas encore d'évaluation

- CORPOLAW Cases3.Corporate PowersDocument80 pagesCORPOLAW Cases3.Corporate PowersRB BalanayPas encore d'évaluation

- UTEP - 2013 Internal Audit Annual Report (Final)Document74 pagesUTEP - 2013 Internal Audit Annual Report (Final)RB BalanayPas encore d'évaluation

- We Must Not Make A Scarecrow of The LawDocument2 pagesWe Must Not Make A Scarecrow of The LawRB BalanayPas encore d'évaluation

- Interest-The Islamic PerspectiveDocument4 pagesInterest-The Islamic PerspectiveShahinsha HcuPas encore d'évaluation

- Human Resource Management Functions and ModelsDocument45 pagesHuman Resource Management Functions and ModelsMo HachimPas encore d'évaluation

- Entry Level Financial Analyst in New York City Resume Jibran ShahDocument1 pageEntry Level Financial Analyst in New York City Resume Jibran ShahJibranShahPas encore d'évaluation

- Chapter 2 Strategy and ProductivityDocument46 pagesChapter 2 Strategy and ProductivityAngel LyxeiaPas encore d'évaluation

- Air India Brand Identity Case StudyDocument13 pagesAir India Brand Identity Case StudyAnkit JenaPas encore d'évaluation

- 5 Examples of Business-Financial Models in ExcelDocument84 pages5 Examples of Business-Financial Models in ExcelThanh Phu TranPas encore d'évaluation

- International Trade AssignmentDocument7 pagesInternational Trade AssignmentHanamariam FantuPas encore d'évaluation

- Saanika Industries PVT LTDDocument14 pagesSaanika Industries PVT LTDgarimaPas encore d'évaluation

- Circular Business Model CanvasDocument25 pagesCircular Business Model CanvasLeanne Angel Mendones MayaPas encore d'évaluation

- CSR: Microsoft CaseDocument9 pagesCSR: Microsoft CaseNataly LagosPas encore d'évaluation

- Statement of Employment Expenses For Working at Home Due To COVID-19Document2 pagesStatement of Employment Expenses For Working at Home Due To COVID-19Igor GoesPas encore d'évaluation

- Gujarat Gas, GSPC Gas Amalgamation Boosts India's Largest CGD PlayerDocument2 pagesGujarat Gas, GSPC Gas Amalgamation Boosts India's Largest CGD PlayerMedha SinghPas encore d'évaluation

- HUM-4717 Ch-5 Evaluating A Single Project 2020Document47 pagesHUM-4717 Ch-5 Evaluating A Single Project 2020SadatPas encore d'évaluation

- Fauji Cement Company LimitedDocument21 pagesFauji Cement Company LimitedMuneeza Akhtar Muneeza AkhtarPas encore d'évaluation

- Chapter11 - Slides Centralized Vs DecentralizedDocument29 pagesChapter11 - Slides Centralized Vs DecentralizedluisrebagliatiPas encore d'évaluation

- Introduction Lingang Fengxian ParkDocument34 pagesIntroduction Lingang Fengxian ParkmingaiPas encore d'évaluation

- Public Debt Definition Impacts GrowthDocument4 pagesPublic Debt Definition Impacts GrowthHiền LưuPas encore d'évaluation

- Funds Application Form GuidanceDocument6 pagesFunds Application Form GuidanceEmpereur GeorgesPas encore d'évaluation

- Supreme Steel Vs Nagkakaisang Manggagawa Sa SupremeDocument28 pagesSupreme Steel Vs Nagkakaisang Manggagawa Sa SupremeChristle CorpuzPas encore d'évaluation

- Sabmiller AR 2011Document176 pagesSabmiller AR 2011gjhunjhunwala_1Pas encore d'évaluation

- PakistanDocument230 pagesPakistanzahidhussain4uPas encore d'évaluation

- SyllabusDocument42 pagesSyllabusvasudevprasadPas encore d'évaluation