Académique Documents

Professionnel Documents

Culture Documents

Fogelson vs. American Woolen Co

Transféré par

Shirley Marie Cada - CaraanDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Fogelson vs. American Woolen Co

Transféré par

Shirley Marie Cada - CaraanDroits d'auteur :

Formats disponibles

Fogelson vs. American Woolen Co.

FACTS: Two stockholders of the American Woolen Co. wants to enjoin that the proposed plan of four of

its directors in fixing a retirement income or pension to be paid annually by the corporation to an

employee after his retirement. The plan is to be administered by means of a pension trust and it is

proposed to pay into this trust at once $4, 657,292 to fund that part of the pensions based on past

services of employees. The president of the corporation will be eligible for retirement on June 1, 1949 and

thereafter be entitled to receive an annual pension of $54,220. The plaintiffs alleges that pensions is

excessive and unconscionable; that the purpose of funding service benefits by a single payment is to

insure that he will receive such pension irrespective of business vicissitudes which may hereafter

overtake the corporation; and that the proposal to fund past service benefits by a single payment, instead

of installments over a term of years, disregards the custom and usage of other companies with respect to

retirement income plans, and disregards the inadequate cash position of said defendant corporation that

still remains unpaid. The district judge, promulgating a summary judgment after it was appealed to him by

the defendant, said that there was no colorable reason to disturb the exercise by the directors of their

judgment and discretion in the discharge of their duties. Hence, the present case.

ISSUES:

1. WON the proposal to fund past service benefits by a single payment instead of by installment

payments extending over a term of years constitute a waste of corporate assets

2. WON the failure to set a reasonable ceiling in dollars, limiting the maximum pension payable

annually to any one individual is allowed

3. WON the proposal to pay the president so large an annual pension after his retirement is proper

HELD:

1. The affidavits of both parties are not yet conclusive and thus preclude any trial of this issue.

Defendants in their answer, supported by affidavits of the directors argued that each director who

voted for the plan exercised his best business judgment. This denial would be refuted if the

plaintiffs were able to prove that the real purpose was as alleged. Therefore, a triable issue of

facts exists as to whether the directors did exercise their best business judgment or were

motivated by the alleged purpose of favoring the president.

2. Plaintiffs assert that such a limitation is customary, but defendant states that the present trend of

corporate pension plans is away from the fixing of low maximums on retirement incomes and

cites instances where the operation of the percentage formula results in retirement incomes for

particular individuals in excess of $50,000 per year. The practice of other companies is not

conclusive, but it is relevant, and thus obviously cannot be tried out upon affidavits.

3. A retirement plan which provides a very large pension to an officer who has served to within one

year of the retirement age without any expectation of receiving a pension, would seem analogous

to a gift or a bonus. The size of a bonus may thus raise a justifiable inquiry as to whether it

amounts to spoliation or waste of corporate property. The court does not say that a pension of

$54,220 to such an officer cannot be justified, but, if justified, it must be because it is in the

interest of the employer to insure to even those who receive so high a salary that they may retire

on a pension computed upon the same percentage formula as the lowest salaried employees.

Because of this, the Court is not prepared to say that providing a pension whose present value,

as we compute it, is more than $450,000, is so clearly the exercise of proper business judgment

that courts may not even allow the issue to be tried. The Court intimates no opinion as to how it

should be decided; but the Court submits, that nothing would more tend to weaken confidence in

the courts than to hold that the decision of a board of directors to give to a retiring president so

large a sum beyond the reach of any scrutiny whatever.

Vous aimerez peut-être aussi

- 128 Fogelson v. American Woolen Co. (REYES)Document2 pages128 Fogelson v. American Woolen Co. (REYES)AlexandraSoledadPas encore d'évaluation

- 155 Ellingwood v. Wolf's Head Oil Refining (Acido)Document2 pages155 Ellingwood v. Wolf's Head Oil Refining (Acido)Jovelan EscañoPas encore d'évaluation

- 133 Irving Trust V Deutsch (Tiglao)Document1 page133 Irving Trust V Deutsch (Tiglao)Angelo TiglaoPas encore d'évaluation

- 160 Wallace vs. Eclipse Pocahontas (DAYOS)Document1 page160 Wallace vs. Eclipse Pocahontas (DAYOS)Jovelan EscañoPas encore d'évaluation

- Merritt-Chapman & Scott Corp. v. New York Trust Co. stock dividend case digestDocument3 pagesMerritt-Chapman & Scott Corp. v. New York Trust Co. stock dividend case digestStradivariumPas encore d'évaluation

- 167 Ross Transport, Inc. V Crothers (Pagcaliwagan)Document2 pages167 Ross Transport, Inc. V Crothers (Pagcaliwagan)Jovelan EscañoPas encore d'évaluation

- Fuller v. KroghDocument1 pageFuller v. KroghkitakatttPas encore d'évaluation

- 115 Walker v. Man (Acido)Document2 pages115 Walker v. Man (Acido)ASGarcia24Pas encore d'évaluation

- de Los Santos v. Republic & McGrathDocument2 pagesde Los Santos v. Republic & McGrathRuth TenajerosPas encore d'évaluation

- Corpo Finals OT 1Document5 pagesCorpo Finals OT 1Anonymous VQ4CjQBTePas encore d'évaluation

- Republic Planters Bank Vs AganaDocument2 pagesRepublic Planters Bank Vs AganaLeica Jayme100% (1)

- 159 Utah Hotel Co. v. Madsen (Consing)Document1 page159 Utah Hotel Co. v. Madsen (Consing)Jovelan EscañoPas encore d'évaluation

- 109 Gottschalk, Et Al. v. Avalon Realty Co. (S A Y O)Document3 pages109 Gottschalk, Et Al. v. Avalon Realty Co. (S A Y O)ASGarcia24Pas encore d'évaluation

- Heirs of Pedro Escanlar vs. Court of AppealsDocument19 pagesHeirs of Pedro Escanlar vs. Court of AppealsRheacel LojoPas encore d'évaluation

- Case Digest on Validity of Stock IssuanceDocument8 pagesCase Digest on Validity of Stock Issuancebatusay575Pas encore d'évaluation

- E.K. Buck Retail Stores V HarkertDocument2 pagesE.K. Buck Retail Stores V HarkertTrxc MagsinoPas encore d'évaluation

- Chinabank V MichelinDocument2 pagesChinabank V MichelinLeslie LernerPas encore d'évaluation

- Cebu Port Labor Union Vs States Marine Co PDFDocument13 pagesCebu Port Labor Union Vs States Marine Co PDFDexter CircaPas encore d'évaluation

- Digests 7Document10 pagesDigests 7SuiPas encore d'évaluation

- 124 Piccard v. Sperry Corporation (Garcia)Document1 page124 Piccard v. Sperry Corporation (Garcia)ASGarcia24Pas encore d'évaluation

- UP Law SLR OutlineDocument7 pagesUP Law SLR OutlineEins BalagtasPas encore d'évaluation

- Hartford Accident & Indemnity Co. v. W.S. Dickey; 24 A. 2d 315 (1942Document2 pagesHartford Accident & Indemnity Co. v. W.S. Dickey; 24 A. 2d 315 (1942Karen Selina AquinoPas encore d'évaluation

- Corp - San Miguel Corp Vs Kahn Case DigestDocument3 pagesCorp - San Miguel Corp Vs Kahn Case DigestDyannah Alexa Marie RamachoPas encore d'évaluation

- 26 Garrett V Southern Railway Company (Pagcaliwagan)Document2 pages26 Garrett V Southern Railway Company (Pagcaliwagan)ASGarcia24Pas encore d'évaluation

- Heirs of Domongo Valientes v. RamasDocument8 pagesHeirs of Domongo Valientes v. RamasAiyla AnonasPas encore d'évaluation

- Munn V IllinoisDocument4 pagesMunn V IllinoisFrancis Kyle Cagalingan SubidoPas encore d'évaluation

- Lich v. US Rubber (1941)Document3 pagesLich v. US Rubber (1941)Amber AncaPas encore d'évaluation

- Bank of the Philippines Islands and National Book Store dispute real estate contractDocument14 pagesBank of the Philippines Islands and National Book Store dispute real estate contractMary Licel RegalaPas encore d'évaluation

- Advance Paper Corporation Vs Arma Traders Corporation, GR. No. 176897, December 11, 2013Document3 pagesAdvance Paper Corporation Vs Arma Traders Corporation, GR. No. 176897, December 11, 2013Maryluz CabalongaPas encore d'évaluation

- Railroad Companies Cannot Use Charter Violations as a Shield from Injury LiabilityDocument2 pagesRailroad Companies Cannot Use Charter Violations as a Shield from Injury LiabilityReina HabijanPas encore d'évaluation

- Phil Trust Co Vs RiveraDocument2 pagesPhil Trust Co Vs RiveraCheng Kee100% (1)

- Batch 6 Consolidated Case DigestDocument74 pagesBatch 6 Consolidated Case DigestASGarcia24100% (1)

- 142 Slay V Polonia Pub (DELFIN)Document2 pages142 Slay V Polonia Pub (DELFIN)AlexandraSoledadPas encore d'évaluation

- Walker V ManDocument7 pagesWalker V ManJai HoPas encore d'évaluation

- 04 Ermitano V Paglas - RSJDocument3 pages04 Ermitano V Paglas - RSJJet SiangPas encore d'évaluation

- Perlas Madrigal Co. vs. ZamoraDocument2 pagesPerlas Madrigal Co. vs. ZamoraAllenPas encore d'évaluation

- BPI V. BPI EMPLOYEES DigestDocument1 pageBPI V. BPI EMPLOYEES DigestRobertPas encore d'évaluation

- Rural Bank of Salinas Vs CADocument1 pageRural Bank of Salinas Vs CAXing Keet LuPas encore d'évaluation

- Gottschalk v. Avalon RealtyDocument1 pageGottschalk v. Avalon RealtyMiw CortesPas encore d'évaluation

- Salvatierra Vs GarlitosDocument2 pagesSalvatierra Vs GarlitosChilzia RojasPas encore d'évaluation

- 9) Bergeron Vs HobbsDocument11 pages9) Bergeron Vs HobbsVictoria EscobalPas encore d'évaluation

- Insuranshares vs. Northern FiscalDocument2 pagesInsuranshares vs. Northern FiscalClark Edward Runes Uytico100% (1)

- 16 Aladdin Hotel Co V BloomDocument7 pages16 Aladdin Hotel Co V BloomlabellejoliePas encore d'évaluation

- Garett V Southern RailwayDocument1 pageGarett V Southern RailwayPB AlyPas encore d'évaluation

- De Silva Vs AboitizDocument1 pageDe Silva Vs Aboitizgianfranco0613Pas encore d'évaluation

- Central Textile Mills, Inc. v. NWPC, 260 SCRA368 (1996)Document4 pagesCentral Textile Mills, Inc. v. NWPC, 260 SCRA368 (1996)inno KalPas encore d'évaluation

- Atrium Management Corp vs. CAvvvvvvvvDocument2 pagesAtrium Management Corp vs. CAvvvvvvvvMonikkaPas encore d'évaluation

- Augusta Trust Co. v. Augusta, Et Al.Document3 pagesAugusta Trust Co. v. Augusta, Et Al.Kevin HernandezPas encore d'évaluation

- 112 Otis - Co. V Pennsylvania R. Co. (Tan)Document3 pages112 Otis - Co. V Pennsylvania R. Co. (Tan)AlexandraSoledadPas encore d'évaluation

- PC Javier & Sons vs CA 462 SCRA 36 Change of Bank Name NotificationDocument1 pagePC Javier & Sons vs CA 462 SCRA 36 Change of Bank Name NotificationLea AndreleiPas encore d'évaluation

- McCarty cannot escape liability for promissory note used to purchase stockDocument1 pageMcCarty cannot escape liability for promissory note used to purchase stockCindee YuPas encore d'évaluation

- San Miguel Corporation v. Khan (85339, August 11, 1989Document1 pageSan Miguel Corporation v. Khan (85339, August 11, 1989Joshua RiveraPas encore d'évaluation

- J.F. Ramirez v. The Orientalist CorporationDocument2 pagesJ.F. Ramirez v. The Orientalist CorporationRafaelPas encore d'évaluation

- Retirement Benefits Based on Notional SalaryDocument3 pagesRetirement Benefits Based on Notional SalaryGrey Orbs100% (1)

- 205 Monserrat vs. CeronDocument1 page205 Monserrat vs. CeronMlaPas encore d'évaluation

- Peza V Alikpala Remedial LawDocument2 pagesPeza V Alikpala Remedial LawMigen SandicoPas encore d'évaluation

- PNB Vs Bitulok Sawmill DigestDocument1 pagePNB Vs Bitulok Sawmill DigestMarry LasherasPas encore d'évaluation

- LIM TAY Vs CADocument2 pagesLIM TAY Vs CAStella LynPas encore d'évaluation

- 170 F.2d 660 (1948) FOGELSON Et Al. v. American Woolen Co, Inc., Et AlDocument4 pages170 F.2d 660 (1948) FOGELSON Et Al. v. American Woolen Co, Inc., Et AlClauds GadzzPas encore d'évaluation

- 5.6.a Producers Bank of The Philippines VS NLRCDocument2 pages5.6.a Producers Bank of The Philippines VS NLRCRochelle Othin Odsinada Marqueses100% (2)

- Recommendation On WoHD and WoA 2Document1 pageRecommendation On WoHD and WoA 2Shirley Marie Cada - CaraanPas encore d'évaluation

- Limitations WoA and WoHD 1Document1 pageLimitations WoA and WoHD 1Shirley Marie Cada - CaraanPas encore d'évaluation

- Recommendation On WoHD and WoA 4Document1 pageRecommendation On WoHD and WoA 4Shirley Marie Cada - CaraanPas encore d'évaluation

- Civil Law Review 2- Preference of Credits in Bankruptcy ProceedingsDocument23 pagesCivil Law Review 2- Preference of Credits in Bankruptcy ProceedingsShirley Marie Cada - CaraanPas encore d'évaluation

- Recommendation On WoHD and WoA 4Document1 pageRecommendation On WoHD and WoA 4Shirley Marie Cada - CaraanPas encore d'évaluation

- Recommendation On WoHD and WoA 1Document1 pageRecommendation On WoHD and WoA 1Shirley Marie Cada - CaraanPas encore d'évaluation

- Recommendation On WoHD and WoA 3Document1 pageRecommendation On WoHD and WoA 3Shirley Marie Cada - CaraanPas encore d'évaluation

- Recommendation On WoHD and WoA 4Document1 pageRecommendation On WoHD and WoA 4Shirley Marie Cada - CaraanPas encore d'évaluation

- Recommendation On WoHD and WoA 4Document1 pageRecommendation On WoHD and WoA 4Shirley Marie Cada - CaraanPas encore d'évaluation

- Petition Letter SuccessionDocument1 pagePetition Letter SuccessionShirley Marie Cada - CaraanPas encore d'évaluation

- Recommendation On WoHD and WoADocument1 pageRecommendation On WoHD and WoAShirley Marie Cada - CaraanPas encore d'évaluation

- Limitations of WoHD and WoADocument10 pagesLimitations of WoHD and WoAShirley Marie Cada - CaraanPas encore d'évaluation

- Presidential Immunity On WoA and WoHDDocument21 pagesPresidential Immunity On WoA and WoHDShirley Marie Cada - CaraanPas encore d'évaluation

- Limitations of WoHD and WoADocument10 pagesLimitations of WoHD and WoAShirley Marie Cada - CaraanPas encore d'évaluation

- Air Services Agreement - Counter Measures PDFDocument80 pagesAir Services Agreement - Counter Measures PDFShirley Marie Cada - CaraanPas encore d'évaluation

- Affidavit of Loss of Driver's LicenseDocument2 pagesAffidavit of Loss of Driver's LicenseShirley Marie Cada - Caraan100% (2)

- RULE 130 EvidDocument2 pagesRULE 130 EvidShirley Marie Cada - CaraanPas encore d'évaluation

- Maramag v. MaramagDocument5 pagesMaramag v. MaramagShirley Marie Cada - CaraanPas encore d'évaluation

- Rule 130Document54 pagesRule 130Shirley Marie Cada - CaraanPas encore d'évaluation

- Domingo v. RayalaDocument1 pageDomingo v. RayalaShirley Marie Cada - CaraanPas encore d'évaluation

- Rule 130Document54 pagesRule 130Shirley Marie Cada - CaraanPas encore d'évaluation

- Domingo v. RayalaDocument1 pageDomingo v. RayalaShirley Marie Cada - CaraanPas encore d'évaluation

- Domingo v. RayalaDocument1 pageDomingo v. RayalaShirley Marie Cada - CaraanPas encore d'évaluation

- Nirc Chapter III - Protesting An Assessment, Refund, Etc.Document3 pagesNirc Chapter III - Protesting An Assessment, Refund, Etc.Shirley Marie Cada - CaraanPas encore d'évaluation

- Navarro v. Ermita 613 SCRA 131 2010 and 648 SCRA 400 2011Document18 pagesNavarro v. Ermita 613 SCRA 131 2010 and 648 SCRA 400 2011Shirley Marie Cada - CaraanPas encore d'évaluation

- Domingo v. RayalaDocument1 pageDomingo v. RayalaShirley Marie Cada - CaraanPas encore d'évaluation

- Tax 2 - VATDocument37 pagesTax 2 - VATShirley Marie Cada - CaraanPas encore d'évaluation

- Revenue Regulation No. 16-2005Document0 pageRevenue Regulation No. 16-2005Kaye MendozaPas encore d'évaluation

- Log Gov I. IntroductionDocument68 pagesLog Gov I. IntroductionShirley Marie Cada - CaraanPas encore d'évaluation

- Mandate for voluntary contribution to Canara Bank welfare fundDocument1 pageMandate for voluntary contribution to Canara Bank welfare fundamanatdablaPas encore d'évaluation

- M-09-05 Actuarial Mathematics ExamDocument223 pagesM-09-05 Actuarial Mathematics ExamStelios VafeasPas encore d'évaluation

- Apply Leave FormDocument1 pageApply Leave FormAnuranjan KumarPas encore d'évaluation

- Complete ITR12 Tax ReturnDocument24 pagesComplete ITR12 Tax Returnmalshang9039Pas encore d'évaluation

- Answers Exercises 1 PDFDocument6 pagesAnswers Exercises 1 PDFKobe BullmastiffPas encore d'évaluation

- Salary Details2Document2 pagesSalary Details2Mahesh MeenaPas encore d'évaluation

- Federal Worksheet Tax DetailsDocument8 pagesFederal Worksheet Tax DetailsPragya ParmarPas encore d'évaluation

- The FIRE Movement Financial Independence Retire EarlyDocument14 pagesThe FIRE Movement Financial Independence Retire EarlyjohnPas encore d'évaluation

- Lopez v Constantino Life Pension Building DestructionDocument2 pagesLopez v Constantino Life Pension Building DestructionMik ZeidPas encore d'évaluation

- Supplemental Early Retirement Plans (SERP)Document5 pagesSupplemental Early Retirement Plans (SERP)jaue87retirePas encore d'évaluation

- 10 Perez vs. Comparts IndustriesDocument1 page10 Perez vs. Comparts Industriesmei atienzaPas encore d'évaluation

- BGVB Apy PDFDocument1 pageBGVB Apy PDFSHUBHAJIT NANDIPas encore d'évaluation

- Nomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Document2 pagesNomisma Mobile Solutions Pvt. LTD Tax Payslip For December - 2018Dinesh SahuPas encore d'évaluation

- AnnuitiesDocument12 pagesAnnuitiesRishi CharanPas encore d'évaluation

- Topic 9 - Tax AdministrationDocument46 pagesTopic 9 - Tax AdministrationPrince RyanPas encore d'évaluation

- Reward Management My Combined NotesDocument23 pagesReward Management My Combined Notesshalarachel100% (1)

- Form 16 - Vijaya Raja SelvanDocument4 pagesForm 16 - Vijaya Raja SelvansadhanaPas encore d'évaluation

- ACC WagesDocument4 pagesACC WagesAshish NandaPas encore d'évaluation

- Implementation of A Negative Income Tax. Estimation of Net Cost and Poverty and Inequality EffectsDocument2 pagesImplementation of A Negative Income Tax. Estimation of Net Cost and Poverty and Inequality EffectsGarrett BergPas encore d'évaluation

- Compensation and Benefits of ABUL KHAIR GroupDocument21 pagesCompensation and Benefits of ABUL KHAIR GroupJabid BilalPas encore d'évaluation

- A Project Report On Recruitment and Selection At: HDFC Standard Life Insurance CompanyDocument68 pagesA Project Report On Recruitment and Selection At: HDFC Standard Life Insurance CompanysiarockstarPas encore d'évaluation

- Module 2 Concepts and Pervasive Principles Version 2013Document63 pagesModule 2 Concepts and Pervasive Principles Version 2013Kathy CeracasPas encore d'évaluation

- 10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Document1 page10th Bipartite at A Glance: Clerk - 700,600,450 & Sub-Staff - 500,400,250Kuldeep KushwahaPas encore d'évaluation

- EU Blue Card ApplicationDocument4 pagesEU Blue Card ApplicationsabareePas encore d'évaluation

- Frfinbref 237011 enDocument3 pagesFrfinbref 237011 enPatrik Svensson100% (1)

- Employer'S Guide To Pay As You Earn (PAYE)Document20 pagesEmployer'S Guide To Pay As You Earn (PAYE)Curter Lance LusansoPas encore d'évaluation

- Government of India Act 1858Document20 pagesGovernment of India Act 1858Ashish RanjanPas encore d'évaluation

- Wattana Korampai - Employment ContractDocument19 pagesWattana Korampai - Employment ContractJunior MiicPas encore d'évaluation

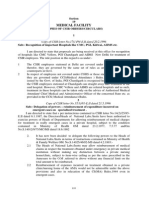

- Medical Facility: Section 19 (Copies of Csir Orders/Circulars) 1Document7 pagesMedical Facility: Section 19 (Copies of Csir Orders/Circulars) 1hariom guptaPas encore d'évaluation

- ICMAP Business Law Past PapersDocument5 pagesICMAP Business Law Past Papersmuhzahid786Pas encore d'évaluation