Académique Documents

Professionnel Documents

Culture Documents

Week 5 - Operating Segments Paper ACC /541

Transféré par

Brian GivensCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Week 5 - Operating Segments Paper ACC /541

Transféré par

Brian GivensDroits d'auteur :

Formats disponibles

RunningOperatingSegmentsPaper

TeamB

Operating Segments

Team B

Brian Givens, Katherine Cranston,

Kristina Coggin, Marshawn Pettes,

Melissa DiPlacido, Shady Moussa-Youakim

ACC/541

Dec 22, 2014

Kenneth Burton

RunningOperatingSegmentsPaper

TeamB

Introduction

Under international financial reporting standards, an operating segment is a component

of an entity that is a profit center, that has discrete financial information available, and whose

results are reviewed regularly by the entity's chief operating decision maker for purposes of

performance assessment and resource allocation (Schroeder, Clark, & Cathey, 2011). A goal of

the guidance contained at FASB ASC 280 is to use the enterprises internal organization in such a

way that reportable operating segments will be readily evident to the financial statement

preparer. The resulting management approach to identifying operating segments is based on

the manner in which management organizes the segments for making operating decisions and

assessing performance (Schroeder, Clark, & Cathey, 2011).

Many of the bigger companies we know about contain these very operating segments.

One such company, that we can all recognize, is the Walt Disney Company. Even though some

of us may have grown up thinking Disney was all theme parks and cartoons, there is much more

to its business operations than that. Disney is a massive entertainment and media empire that

stretches across the globe and touches on many areas of business. The Walt Disney Company

divides its operations into five business segments: Media Networks, Parks & Resorts, Studio

Entertainment, Consumer Products, and Disney Interactive. We will go over each operating

segment below.

Media Networks

Median networks includes Disney ABC TV Group, ESPN, ABC

entertainment Group, ABC news and TV stations, ABC Family, and Disney

Channels the segment includes Cable Networks which operating income

increased by 7% on September 27, 2014 in comparison with 2013 and

RunningOperatingSegmentsPaper

TeamB

revenue increased by 5% in a addition Quarter Ended September 27, 2014

Cable Networks decreased $10 million to $1.3 billion for the quarter. Lower

operating income was driven by a decrease at ESPN and the international

Disney Channels, partially offset by an increase at the domestic Disney

Channels (Walt Disney Company, 2014) and Broadcasting which operating

income increased by 11% on Sept 27 2014 in comparison with 2013 and

revenue increased by 2% in a addition Quarter Ended Sep 27 2014 Operating

income at Broadcasting increased $5 million to $163 million The increase in

operating income was due to affiliate revenue growth and higher income

from program sales, partially offset by higher primetime programming costs

and lower advertising revenue. Higher affiliate revenues were driven by

contractual rate increases and new contractual provisions. Increased

operating income from program sales was due to current year sales of Shark

Tank, America's Funniest Home Videos, My Wife and Kids, and lower costs

due to the cancellation of Katie, partially offset by higher sales of Home

Improvement and Grey's Anatomy in the prior-year quarter. The increase in

primetime programming costs was driven by higher programming write-offs

and higher cost programming including a contractual rate increase for

Modern Family. Lower advertising revenue was due to fewer units sold at the

ABC Television Network. (Walt Disney Company, 2014)

Parks and Resorts

RunningOperatingSegmentsPaper

TeamB

In 2013, Parks and Resorts revenues increased 9%, to $14.1 billion,

and segment operating income increased 17%, to $2.2 billion. The growth

reflected increases at the companys domestic parks and resorts, Disney

Vacation Club, and Hong Kong Disneyland Resort, partially offset by a

decrease at Disneyland Paris and higher pre-opening costs at Shanghai

Disney Resort.

Under the parks and resorts segment, Disney owns and operates the

Walt Disney World Resort in Florida, the Disneyland Resort in California,

Aulani (a Disney Resort & Spa in Hawaii), the Disney Vacation Club, the

Disney Cruise Line, and Adventures by Disney. The company manages and

has effective ownership interests of 51% in Disneyland Paris and 48% in

Hong Kong Disneyland Resort. The company also licenses the operations of

the Tokyo Disney Resort in Japan. The companys Walt Disney Imagineering

unit designs and develops new theme park concepts and attractions as well

as resort properties.

The businesses in the Parks and Resorts segment generate revenues

predominately from the sale of admissions to theme parks, sales of food,

beverage, and merchandise, charges for room nights at hotels, sales of

cruise vacation packages, and sales and rentals of vacation club properties.

Significant costs include labor, depreciation, costs of merchandise, food and

beverage sold, marketing and sales expenses, repairs and maintenance,

utilities, information technology, and cost of vacation club units (Nielson,

2014).

4

RunningOperatingSegmentsPaper

TeamB

Studio Entertainment

Walt Disney Studios is the operating segment responsible for Disneys

movies, music and plays. There are multiple banners under which these are

released; Walt Disney Animation Studios and Pixar Animation Studios;

Disneynature; Marvel Studios; Lucasfilm; Touchstone Pictures; DreamWorks

Studios; Walt Disney Records; Hollywood Records; Disney Music Publishing;

Disney on Broadway, Disney On Ice and Disney Live (Walt Disney Company,

2014). In the fourth quarter of 2014 Studio Entertainment revenues rose

18% to $1,778 million, while operating income of $254 million increased over

twofold. Walt Disney Studios recent success is due to Frozen. It brought in

over $1.2 billion in box office sales and related merchandise is also having

great success. Another successful venture of Studios was the acquisition of

Marvel studios in 2009. They have had numerous hits since the acquisition

(Zacks.com, 2014).

Consumer Products

DisneyConsumerProducts(DCP)isthebusinesssegmentofTheWaltDisney

Companyanditsaffiliatesthatdeliversinnovativeandengagingproductexperiencesacross

thousandsofcategoriesfromtoysandappareltobooksandfineart.(DisneyConsumer

Products,2014).DCPbroughtin8.16percentofthetotalcompanyrevenueinfiscalyear2014

andendedupwith$3,985billioninrevenueforitssegment.Thiswasa12percentincreasefrom

the2013fiscalyear.AlotoftheincreasewasduetothepopularityofFrozenandSpiderMan

products.

RunningOperatingSegmentsPaper

TeamB

Thissegmentofthecompanyhas3businessunitsofitsown.TheyconsistofDisney

Licensing,DisneyPublishingWorldwide,andtheDisneyStore.DCPistheworldslargest

licenserofconsumerproducts.Thisisduetothepopularityoftheirbrandsandthefactthattheir

brandsaremadeavailableforpurchasing.DCPisalsothelargestpublisherofchildrensbooks,

magazines,andapplications.Theypublishtheirbooksin75differentlanguagesandin85

countries.

TheDisneyStorewascreatedin1987.Itsgoalisfortheproductlinesthataresoldto

supportmediainitiatives.Today,therearemorethan200DisneystoresinNorthAmerica.They

alsohaveover40inJapanand80inothermultiplecountries.Thereonlinesitestobuy

merchandisehastakenoffaswell.TheyhavecreatedtheirmainsitefortheUnitedStatesplus

additionalsitesforcountriesworldwide.

Disney Interactive

In 1988, Disney created the operating segment called, Disney

Interactive Studios. Disney Interactive Studios represents Disneys smallest

segment accounting for 3% of Disneys total revenue and .64% of net

income, last year (Businesswire, 2014). This segment is a Worldwide

American video game company. It self-publishes and distributes multiplatform video games and interactive entertainment worldwide. The

Interactive Media develops branded online services in the United States and

Internationally. Products and content released and operated by Disney

Interactive include blockbuster mobile, and console games, online virtual

6

RunningOperatingSegmentsPaper

TeamB

worlds, and #1 ranked web destinations Disney.com and the Moms and

Family network websites. Disney Interactive also develops, publishes and

distributes interactive family content through a portfolio of platforms, outside

of Disney.com, in which includes Disney on YouTube and Babble.com. The

Interactive Media also provides website maintenance and design for other

Company businesses (Walt Disney Company, 2014).

Conclusion

As you can see, the Walt Disney Company is much more than roller

coasters and Its a Small World. The companys business spans across

many continents across the globe as it strives to be one of the worlds leader

in entertainment and media. Currently, Disney only contains the five

operating segments discusses above. But it wouldnt surprise anyone if they

continued to expand their brand to cover more industries and thus add more

operating segments somewhere in the future.

References

Businesswire. (2014). The Walt Disney Company Reports Fourth Quarter and Full Year

Earnings for Fiscal 2013. Retrieved December 20, 2014, from Businesswire:

http://www.businesswire.com/news/home/20131107006810/en/Walt-Disney-Company-ReportsFourth-Quarter-Full#.VJYx6F6AA

RunningOperatingSegmentsPaper

TeamB

Nielson, S. (2014). Market Realist. Retrieved from http://marketrealist.com/2014/01/walt-disneycompany/

Walt Disney Company. (2014). Company Overview. Retrieved December 20, 2014, from Walt

Disney Company: http://thewaltdisneycompany.com/about-disney/company-overview

Zacks.com. (2014, November 7). Disney's Q4 Earnings Beat on Studio Entertainment and Parks

- Analyst Blog. Retrieved December 20, 2014, from Nasdaq:

http://www.nasdaq.com/article/disneys-q4-earnings-beat-on-studio-entertainment-andparks-analyst-blog-cm411608#/ixzz3MJmSJe4O

The Walt Disney Company Reports Fourth Quarter and Full Year Earnings For Fiscal 2014.

(2014, November 6). Retrieved December 21, 2014, from

http://thewaltdisneycompany.com/sites/default/files/reports/q4-fy14-earnings.pdf

Disney Consumer Products. (2014). Retrieved December 21, 2014, from

https://www.disneyconsumerproducts.com/Home/display.jsp?

contentId=dcp_home_ourbusinesses_company_overview_us&forPrint=false&language=

en&preview=false&imageShow=0&pressRoom=US&translationOf=null®ion=0

Schroeder, R. G., Clark, M. W., & Cathey, J. M. (2011). Financial accounting theory and

analysis: Text readings and cases (10th ed.). Hoboken, NJ: Wiley.

Vous aimerez peut-être aussi

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- In-Appstore Freedom IndexDocument244 pagesIn-Appstore Freedom Indexrenan_r1250% (2)

- Top 200 (Or So) MN Media & Contributors On TwitterDocument5 pagesTop 200 (Or So) MN Media & Contributors On TwitterLars LeafbladPas encore d'évaluation

- QuoraDocument6 pagesQuoraValleyWag100% (4)

- SQL Database Developer Resume SampleDocument2 pagesSQL Database Developer Resume SampleBranZzZzZPas encore d'évaluation

- Amateur Photographer - 19 December 2015Document116 pagesAmateur Photographer - 19 December 2015stamenkovskibPas encore d'évaluation

- Skyrim - The City Gates - Sheet MusicDocument2 pagesSkyrim - The City Gates - Sheet Musiciliketoeatbreadand100% (1)

- Tweak Buid - PropDocument3 pagesTweak Buid - Prophadie_rein100% (2)

- English Vocabulary Booster: FriendshipDocument2 pagesEnglish Vocabulary Booster: FriendshipPháp Sư Giấu MặtPas encore d'évaluation

- Chapter 01Document45 pagesChapter 01gttrans111Pas encore d'évaluation

- Female Escort Service in Mumbai 07901766394 Location of The Hotel Is Marine DriveDocument3 pagesFemale Escort Service in Mumbai 07901766394 Location of The Hotel Is Marine DrivekrshPas encore d'évaluation

- How To Have My Player With 99 OVERALL in 2k14 From The Very Start of The Game!!!Document3 pagesHow To Have My Player With 99 OVERALL in 2k14 From The Very Start of The Game!!!Leogem UyPas encore d'évaluation

- National Stakeholder Relations For The Public Services ForumDocument4 pagesNational Stakeholder Relations For The Public Services ForumArk GroupPas encore d'évaluation

- O Udpd H Únd. M%Yak M %: 02& Fn!Oao Úkh Ud .H Yd MD, S Ndid MSSPH'Document23 pagesO Udpd H Únd. M%Yak M %: 02& Fn!Oao Úkh Ud .H Yd MD, S Ndid MSSPH'Jalani GurugePas encore d'évaluation

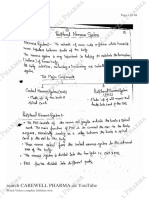

- U4, Hap-1, Carewell - PharmaDocument48 pagesU4, Hap-1, Carewell - PharmaAman0% (1)

- Firmware 3Document1 pageFirmware 3خالد ابوسريعPas encore d'évaluation

- Compendio Ingles - 1ero PrimariaDocument20 pagesCompendio Ingles - 1ero PrimariaMadeleyne Melina Anaya MejiaPas encore d'évaluation

- In The Horsegate' Hotseat: Our Experts Score The CeosDocument1 pageIn The Horsegate' Hotseat: Our Experts Score The Ceosapi-205873997Pas encore d'évaluation

- A La Zaga. Decadencia y Fracaso de Las Vanguardias Del Siglo XX - Eric HobsbawmDocument26 pagesA La Zaga. Decadencia y Fracaso de Las Vanguardias Del Siglo XX - Eric HobsbawmMónica GruberPas encore d'évaluation

- Month Sun Mon Tue Wed Thu Fri SatDocument4 pagesMonth Sun Mon Tue Wed Thu Fri SatDaniel EduPas encore d'évaluation

- Clan-Battle Rules PDFDocument2 pagesClan-Battle Rules PDFMelanie ClarkPas encore d'évaluation

- How To Install CubaseDocument2 pagesHow To Install CubaseAlex MihailPas encore d'évaluation

- Clarissa Schmidt ResumeDocument1 pageClarissa Schmidt ResumeClarissa SchmidtPas encore d'évaluation

- מערכות הפעלה- תרגיל בית 2 - 2012Document2 pagesמערכות הפעלה- תרגיל בית 2 - 2012RonPas encore d'évaluation

- Unit Editor For WBC III ReadmeDocument2 pagesUnit Editor For WBC III ReadmeVlad PadinaPas encore d'évaluation

- PreferDocument3 pagesPrefervanda_mataPas encore d'évaluation

- English Q2, Week5, Day1 - Selection - Social MediaDocument1 pageEnglish Q2, Week5, Day1 - Selection - Social MediaNova Penera EscobarPas encore d'évaluation

- Relm MP08Document2 pagesRelm MP08Ryan SullivanPas encore d'évaluation

- Warder's Pali Exercises Answer Key by Bhikkhu BrahmaliDocument88 pagesWarder's Pali Exercises Answer Key by Bhikkhu BrahmalisqueakymalletPas encore d'évaluation

- JEE Questions DeterminantsDocument10 pagesJEE Questions DeterminantsParth2197Pas encore d'évaluation

- Title Analysis AmelieDocument4 pagesTitle Analysis AmelieACovi95Pas encore d'évaluation