Académique Documents

Professionnel Documents

Culture Documents

Boom Bma

Transféré par

Sriranga G HCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Boom Bma

Transféré par

Sriranga G HDroits d'auteur :

Formats disponibles

BMA WEALTH CREATORS PVT. LTD.

NBS

2

A stock market or equity market is a public entity (a loose network of economic transactions,

not a physical facility or discrete entity) for thetrading of company stock (shares) and

derivatives at an agreed price;these are securities listed on a stock exchange as well as those

onlytraded privately. The size of the world stock market was estimated at about $38.6

trillionat the start of October 2011. The stocks are listed and traded on stock exchanges

which are entities of a corporation or mutual organization specialized in the business

of bringing buyers and sellers of the organizations to a listing of stocks andsecurities together.

The largest stock market in the United States, bymarket capitalization, is the New York Stock

Exchange (NYSE). InCanada, the largest stock market is the Toronto Stock Exchange.

MajorEuropean examples of stock exchanges include the Amsterdam StockExchange,

London Stock Exchange, Paris Bourse, and the Deutsch Brse(Frankfurt Stock Exchange). In

Africa, examples include Nigerian StockExchange, JSE Limited, etc. Asian examples include

the SingaporeExchange, the Tokyo Stock Exchange, the Hong Kong Stock Exchange,and the

Shanghai Stock Exchange. In Latin America, there are suchexchanges as the BM&F Bovespa

and the BMV.In India Bombay Stock Exchange (BSE) benchmark, Sensex & NationalStock

Exchange (NSE), the 50-stock Nifty

index. The market in which shares are issued and traded, either throughexchanges or overthe-counter markets are also known as the stockmarket. It is one of the most vital areas of a

market economy because itgives

companies

access to capital and investors a slice of ownership in acompany with the potential to realize

gains based on its futureperformance.

BMA WEALTH CREATORS PVT. LTD.

NBS

3

EVOLUTION OF THE INDIAN BROKERAGE MARKET

The Indian broking industry is one of the oldest trading industriesthat had been around even

before the establishment of the BSE in1875. Despite passing through a number of changes in

the postliberalization period, the industry has found its way towardssustainable growth. The e

volution of the brokerage market is explainedin three phases: pre1990, 1990-2000, post 2000.

Early Years

The equity brokerage industry in India is one of the oldest in the Asiaregion. India had an ac

tive stock market for about

150 years thatplayed a significant role in developing risk markets as alsopromoting enterprise

and supporting the growth of industry. The roots of a stock market in India began in

the 1860s during theAmerican Civil War that led to a sudden surge in the demand forcotton

from India resulting in setting up of a number of joint

stockcompanies that issued securities to raise finance. This trend was akinto the rapid growth

of securities markets in Europe and the NorthAmerica in the background of expansion of

railroads andexploration of natural resources and land development.Bombay, at that time, was

a major financial centre having housed31 banks, 20 insurance companies and 62 joint stock

companies.In the aftermath of the crash, banks, on whose building steps sharebrokers used to

gather to seek stock tips and share news, disallowedthem to gather there, thus forcing them to

find a place of theirown, which later turned into the Dalal Street.A group of about

300 brokers formed the stock exchange in Jul 1875,

which led to the formation of a trust in 1887 known as the Native

Share and Stock Brokers Association. A unique feature of the stock

market development in India was that that it was entirely driven bylocal enterprise, unlike the

banks which during the pre -

Vous aimerez peut-être aussi

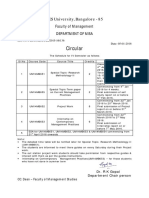

- Circular - Schedule (Revised)Document1 pageCircular - Schedule (Revised)Sriranga G HPas encore d'évaluation

- ChitraDocument5 pagesChitraSruthi BalakrishnanPas encore d'évaluation

- Commodity Market Study at KarvyDocument193 pagesCommodity Market Study at KarvySriranga G HPas encore d'évaluation

- Reliance Life Insurance AwardsDocument1 pageReliance Life Insurance AwardsSriranga G HPas encore d'évaluation

- An Empirical Study On Technical Analysis: GARCH (1, 1) ModelDocument18 pagesAn Empirical Study On Technical Analysis: GARCH (1, 1) ModelSriranga G HPas encore d'évaluation

- Research Paper LRDocument7 pagesResearch Paper LRSriranga G HPas encore d'évaluation

- MPRA Paper 60793Document8 pagesMPRA Paper 60793Sriranga G HPas encore d'évaluation

- Chart No. Particulars Page No.: List of ChartsDocument1 pageChart No. Particulars Page No.: List of ChartsSriranga G HPas encore d'évaluation

- 13841Document13 pages13841Sriranga G HPas encore d'évaluation

- A Study On Technical Analysis of New Private Sector Banking Stocks in IndiaDocument14 pagesA Study On Technical Analysis of New Private Sector Banking Stocks in IndiaSriranga G HPas encore d'évaluation

- Calculate 3-Day Moving Averages in ExcelDocument3 pagesCalculate 3-Day Moving Averages in ExcelSriranga G HPas encore d'évaluation

- TechDocument7 pagesTechSriranga G HPas encore d'évaluation

- Technical Analysis Workshop Series Session One Trend IndicatorsDocument61 pagesTechnical Analysis Workshop Series Session One Trend IndicatorsSriranga G H100% (1)

- Technical indicators A-WDocument4 pagesTechnical indicators A-WSriranga G HPas encore d'évaluation

- Effectiveness of Technical Analysis in Banking Sector of Equity MarketDocument9 pagesEffectiveness of Technical Analysis in Banking Sector of Equity MarketSriranga G HPas encore d'évaluation

- CodDocument2 pagesCodSriranga G HPas encore d'évaluation

- Technical S AnalysisDocument3 pagesTechnical S AnalysisSarvesh SinghPas encore d'évaluation

- MissionDocument1 pageMissionSriranga G HPas encore d'évaluation

- PSM Scientific Instryment CoDocument3 pagesPSM Scientific Instryment CoSriranga G HPas encore d'évaluation

- EpisodesDocument54 pagesEpisodesSriranga G HPas encore d'évaluation

- Bibliography LRDocument2 pagesBibliography LRSriranga G HPas encore d'évaluation

- Reliance Life Insurance AwardsDocument1 pageReliance Life Insurance AwardsSriranga G HPas encore d'évaluation

- Welcome To Prudential FinancialDocument1 pageWelcome To Prudential FinancialSriranga G HPas encore d'évaluation

- Technical indicators A-WDocument4 pagesTechnical indicators A-WSriranga G HPas encore d'évaluation

- Calculate 3-Day Moving Averages in ExcelDocument3 pagesCalculate 3-Day Moving Averages in ExcelSriranga G HPas encore d'évaluation

- Future Outlook of PrudentialDocument1 pageFuture Outlook of PrudentialSriranga G HPas encore d'évaluation

- Speakers From RBIDocument3 pagesSpeakers From RBISriranga G HPas encore d'évaluation

- History of Prudential FinancialDocument1 pageHistory of Prudential FinancialSriranga G HPas encore d'évaluation

- DerivativesDocument39 pagesDerivativesAnuradha ShettyPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Daftar Pustaka: WWW - Bkkbn.go - IdDocument4 pagesDaftar Pustaka: WWW - Bkkbn.go - IdOca DocaPas encore d'évaluation

- Business Plan OutlineDocument2 pagesBusiness Plan OutlineGeryca CarranzaPas encore d'évaluation

- Market MicrostructureDocument15 pagesMarket MicrostructureBen Gdna100% (2)

- Polar Sports X Ls StudentDocument9 pagesPolar Sports X Ls StudentBilal Ahmed Shaikh0% (1)

- INDUSTRIAL MARKETING SYSTEM - Lesson 1 IntroductionDocument11 pagesINDUSTRIAL MARKETING SYSTEM - Lesson 1 IntroductionJhomhel RealesPas encore d'évaluation

- Creative AdvertisingDocument2 pagesCreative AdvertisingVinit GaikwadPas encore d'évaluation

- Navneet Education Ltd. Research Report Prateek - SalampuriaDocument24 pagesNavneet Education Ltd. Research Report Prateek - SalampuriaPrateek Salampuria100% (1)

- 2013 LalPir Power LTD ProspectusDocument84 pages2013 LalPir Power LTD ProspectusMuhammad Usman Saeed0% (1)

- Fundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions ManualDocument36 pagesFundamental Accounting Principles Volume 2 Canadian 15th Edition Larson Solutions Manualalicenhan5bzm2z100% (27)

- Prepare, match and process receipts training (FNSICACC303ADocument4 pagesPrepare, match and process receipts training (FNSICACC303ASintayehu AnimutPas encore d'évaluation

- Working Capital Management ProjectDocument33 pagesWorking Capital Management ProjectJasmeet SainiPas encore d'évaluation

- Recording Process:: ISH3F3 Accounting System and Finance ManagementDocument20 pagesRecording Process:: ISH3F3 Accounting System and Finance ManagementBabang KhaeruddinPas encore d'évaluation

- Mastering Fulfillment by Amazon (PDFDrive)Document29 pagesMastering Fulfillment by Amazon (PDFDrive)Steven RodriguesPas encore d'évaluation

- Google PPC Proposal: Prepared ForDocument5 pagesGoogle PPC Proposal: Prepared ForMansoor AliPas encore d'évaluation

- Marketing Presentation On EtisalatDocument25 pagesMarketing Presentation On EtisalatImaad Ali Khan67% (3)

- Project On Personal Care ProductDocument7 pagesProject On Personal Care Productrishabh guptaPas encore d'évaluation

- AmazonDocument39 pagesAmazonMuhammad Adnan100% (1)

- Posting in AccountingDocument9 pagesPosting in AccountingSanaa MohammedPas encore d'évaluation

- HA3021 Week 9 Lecture 2Document52 pagesHA3021 Week 9 Lecture 2Sheshan Induwara MallawaarachchiPas encore d'évaluation

- Jayabraham XbookDocument392 pagesJayabraham XbookshaqtimPas encore d'évaluation

- Remote Audit Dibandingkan Dengan Onsite Audit Dan Kemampuan Yang Dibutuhkan Dalam Pandangan Praktisi Internal AuditorDocument8 pagesRemote Audit Dibandingkan Dengan Onsite Audit Dan Kemampuan Yang Dibutuhkan Dalam Pandangan Praktisi Internal Auditor0313574826Pas encore d'évaluation

- Balance Sheet QuizDocument2 pagesBalance Sheet Quizvigkar88Pas encore d'évaluation

- Marketing Product StrategyDocument13 pagesMarketing Product StrategyMara Shaira SiegaPas encore d'évaluation

- Multi Brand Retail - Big BazaarDocument24 pagesMulti Brand Retail - Big BazaarAtul Bali50% (2)

- Evans 10e Powerpoint - Chapter 01Document34 pagesEvans 10e Powerpoint - Chapter 01yakup hanPas encore d'évaluation

- Activity-Based Costing SolutionsDocument15 pagesActivity-Based Costing SolutionsBianca LizardoPas encore d'évaluation

- Chapter 2 Strategic Human Resource Planning-1Document8 pagesChapter 2 Strategic Human Resource Planning-1Nathaniel DuranPas encore d'évaluation

- Unit Economics Calculator: Analyzing Profitability and Customer Lifetime ValueDocument1 pageUnit Economics Calculator: Analyzing Profitability and Customer Lifetime Valueaskvishnu7112Pas encore d'évaluation

- FIA FA2 Final Assessment - Questions J13Document18 pagesFIA FA2 Final Assessment - Questions J13Valentina100% (4)

- Cost of Sales & Payment Details - 07022017Document15 pagesCost of Sales & Payment Details - 07022017Go Ki LaPas encore d'évaluation