Académique Documents

Professionnel Documents

Culture Documents

Financial Results With Results Press Release, Investor Update & Limited Review Report For June 30, 2015 (Company Update)

Transféré par

Shyam SunderDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Results With Results Press Release, Investor Update & Limited Review Report For June 30, 2015 (Company Update)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

STERLITE TECHNOLOGIES LIMITED

Q1 2015-16 INVESTOR UPDATE

KEY HIGHLIGHTS

Revenues for the Q1 FY16 were at Rs 975 crores an increase of 73% as compared to the same period

last year. Telecom and Power business contributed Rs 424 crores and Rs 537 crores respectively

EBITDA for the quarter stood at Rs 119 Crores a 67% increase YoY driven by strong performance in the

Telecom business and a recovery in the Power business. The Telecom business continued its robust runrate as it contributed Rs 100 crores while the Power business contributed Rs 19 Crores.

Total order book as of 30th June was at Rs 4,205 crores with the Telecom order book at Rs 2,087

crores and Power at 2,118 crores. Nearly 83% of the order book is domestic focused reflecting the

underlying communication and power infrastructure being built out in India.

Successfully commissioned the final elements of the BDTCL transmission line which will benefit

nearly a million households in the states of Madhya Pradesh, Maharashtra and Gujarat. Sterlite Grid now

has 2 fully operational projects and 4 under various stages of construction in its portfolio. Post the end

of the quarter, we have won our 7th transmission grid project, the Maheshwaram project in

Hyderabad, a 765KV line that should generate Rs55 crores of levelised tariff

Demerger proceedings continuing and expected to close in Q4 2016 subject to approvals by the High

Court, SEBI, shareholders and creditors of STL and other relevant regulatory authorities.

PRODUCTS BUSINESS VOLUME TRENDS

OF including China JV (Million fkm)

OF (Million fkm)

OFC (Million fkm)

Conductors (MT)

Q1 FY 16

4.5

3.2

1.8

30,347

Q4 FY 15

4.9

3.6

2.3

27,396

Q1 FY 15

3.9

3.0

1.8

8,794

FY 15

17.7

13.1

7.7

77,996

Optical fiber and optical fiber cable volumes were at 4.5m fkm and 1.8m fkm down 7% and 23% as

compared to the previous quarter. The decline this quarter was primarily on account of lower offtake in

the first quarter for telcos and Government projects in the country. On a y-o-y basis, optical fiber

volumes increased by 15%, while optical fiber cable sales were flat.

Previously announced optical fiber cable capacity expansion from 8m fkm to 15m fkm continues to

progress well and we expect to complete the expansion during Q4 FY16.

Conductor volumes returned to a more normalized range and were at 30,347MT an increase of 11%

QoQ.

Sterlite Technologies Limited Q1, FY16 Investor Note (July 23, 2015)

Registered office: Survey No. 68/1, Rakholi Village, Madhuban Dam Road, Silvassa - 396 230, Union Territory of Dadra & Nagar Haveli, INDIA

Phone: +91 20 30514000, Fax: +91 20 30514113

www.sterlitetechnologies.com | CIN: L 31300DN2000PLC000340

Page 1 of 5

COMPANY PERFORMANCE (STANDALONE FINANCIALS)

Profit & Loss Statement (INR Cr)

Sales

EBITDA

EBITDA %

Depreciation

EBIT

EBIT %

Interest

PBT

Tax

Effective tax rate

PAT

PAT %

Q1 FY 16

975

119

12%

29

91

9%

62

29

8

29%

20

2%

Q4 FY 15

979

131

13%

27

104

11%

56

48

9

19%

39

4%

Q1 FY 15

564

71

13%

27

45

8%

30

15

5

37%

9

2%

FY 15

3,030

386

13%

108

278

9%

179

99

15

15%

84

3%

Revenue for Q1 FY16 was at Rs 975 crore almost similar levels as Rs 979 crore the previous quarter and

as compared to the same quarter last year they were up 73%. Overall nearly 24% of the revenues

were from export markets

EBITDA for the quarter was at Rs119 crores against Rs 131 crores in the previous quarter, which

included one off other income of Rs.14 crores in the previous quarter. On a y-o-y basis EBITDA grew by

67%. Overall EBITDA margins remain consistent.

The overall net debt for the standalone business was at Rs1,595 crores vs Rs 1,377 crore. The

increase was primarily on account of increased working capital requirements for our services business.

The interest expenses for the quarter were at Rs. 62 crores vs. Rs. 56 crores in the previous quarter due

to this increased borrowing.

Telecom Products and Solutions Segment (INR Cr)

Sales

EBITDA

EBITDA %

Depreciation

EBIT

EBIT %

Capital employed

ROCE %

Q1 FY 16

424

101

24%

19

82

19%

1,283

25%

Q4 FY 15

467

112

24%

19

93

20%

1,179

31%

Q1 FY 15

322

70

22%

19

50

16%

1,097

18%

Sterlite Technologies Limited Q1, FY16 Investor Note (July 23, 2015)

Registered office: Survey No. 68/1, Rakholi Village, Madhuban Dam Road, Silvassa - 396 230, Union Territory of Dadra & Nagar Haveli, INDIA

Phone: +91 20 30514000, Fax: +91 20 30514113

www.sterlitetechnologies.com | CIN: L 31300DN2000PLC000340

FY 15

1,487

345

23%

76

269

18%

1,179

23%

Page 2 of 5

Revenues for the quarter were at Rs 424 crores, up 32% as compared to the same quarter last year and

down 9% as compared to Q4 FY15. Telecom business included nearly Rs 60 crore of services component

from the NFS project.

The EBITDA margins remained stable at 24%

Power Products and Solutions Segment (INR Cr)

Sales

EBITDA

EBITDA %

Depreciation

EBIT

EBIT %

Capital employed

ROCE %

Q1 FY 16

537

19

3%

9

9

2%

415

9%

Q4 FY 15

495

19

4%

8

11

2%

323

14%

Q1 FY 15

229

2

1%

7

(6)

-3%

435

-5%

FY 15

1,473

41

3%

32

9

1%

323

3%

Revenues improved by 8% this quarter on the back of a 11% increase in product volumes sold. In

addition to product sales we have seen good traction on our power solutions business, completing 2 reconductoring projects .

EBITDA for the quarter remained consistent at Rs19 crore

The order book for the power business was at Rs. 2,118 crores, nearly 33% of which is for export

markets

Power Transmission Grid business

The Power transmission grid business generated Rs 88 crore of revenue as compared to Rs 73 crore

the previous quarter and EBITDA of Rs 82 crore against Rs 60 crore. The increase is on account of

progressive commissioning of elements in the BDTCL .

Sterlite Technologies equity commitment into these grid project stood at Rs 1,250 crore vs Rs 1,200

crore as we invested an additional Rs 50 crore as part of the terms and conditions under which Standard

Chartered Private Equity invested in Q1 FY15.

The remaining 4 projects in the portfolio continue to progress as per schedule and we expect to fully

commission JTCL in Q2 FY16.

Post the end of the quarter, we have won our 7th transmission grid project, the Maheshwaram project

in Hyderabad, a 765KV line that should generate Rs55 crores of levelised tariff

Sterlite Technologies Limited Q1, FY16 Investor Note (July 23, 2015)

Registered office: Survey No. 68/1, Rakholi Village, Madhuban Dam Road, Silvassa - 396 230, Union Territory of Dadra & Nagar Haveli, INDIA

Phone: +91 20 30514000, Fax: +91 20 30514113

www.sterlitetechnologies.com | CIN: L 31300DN2000PLC000340

Page 3 of 5

INVESTOR EARNINGS CALL DETAILS

The Company will be hosting an earnings update call on July 23 at 16:00 hrs IST. The conference call login details

are below.

Primary Number: +91 22 3938 1080

Secondary Number: +91 22 6746 5814

Please dial the below number at least 5 minutes prior to the conference schedule to ensure that you are

connected in time

Webcast Link: http://services.choruscall.eu/links/sterlitetech150723.html

INVESTOR RELATIONS CONTACT

Vishal Aggarwal

Sterlite Technologies Limited

Phone: +91.20.30514000

vishal.aggarwal@sterlite.com

ABOUT STERLITE TECHNOLOGIES

Sterlite Technologies Limited (STL) develops & delivers solutions for high speed data communication

and power transmission networks, globally. STL is among the global leaders in all its business areas

through its operations in India, China & Brazil. STL is developing several network projects across India

including secure communication network creation in Jammu & Kashmir for Indian army, enabling

Bharatnet, establishing urban high speed fiber to the home (FTTH) networks and multiple interstate

ultra mega power transmission projects. Listed on Stock Exchanges BSE & NSE in Mumbai, India,

Sterlite Technologies is a public company with broad shareholder base. The company has recently

announced a demerge of its power products and transmission business into a new company. Sterlite

Technologies to remain a pureplay telecom focused company.

Sterlite Technologies Limited Q1, FY16 Investor Note (July 23, 2015)

Registered office: Survey No. 68/1, Rakholi Village, Madhuban Dam Road, Silvassa - 396 230, Union Territory of Dadra & Nagar Haveli, INDIA

Phone: +91 20 30514000, Fax: +91 20 30514113

www.sterlitetechnologies.com | CIN: L 31300DN2000PLC000340

Page 4 of 5

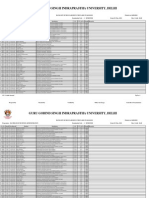

COMPANY PERFORMANCE (CONSOLIDATED FINANCIALS)

Profit &Loss Statement and Segmental breakdown (Rs. in Lacs)

Consolidated numbers for Q1 2015-16 have not been reviewed or audited by statutory auditors.

Particulars

Standalone

Consolidated

Quarter ended

June 15

June 15

(Unaudited)

Incom e from Operations

a) Net Revenue

b) Other Operating Income

Total Incom e from operations (Net)

Total Expenditure

a) Cost of materials consumed

b) Purchase of stock-in-trade

c) (Inc) / Dec in finished goods, stock-in-trade & WIP

d) Staff Cost

e) Depreciation & Impairment

f) Other Expenditure

Operating profit before other income, interest and tax

Other Income

Profit before interest and tax

Interest Cost

Profit / (loss) before tax

Tax Expenses

Net Profit after tax

Adjustment for Minority Interest

Net Profit / (loss) after Tax & Minority Interest

Segm ent Reporting

Segm ent Revenue

Telecom Product and Solutions

Pow er Product and Solutions

Pow er Transmission Grid

Inter-segment elimination

Total

Profit before interest,depreciation and tax

Telecom Product and Solutions

Pow er Product and Solutions

Pow er Transmission Grid

Unallocable

Total

Profit before Interest and Tax

Telecom Product and Solutions

Pow er Product and Solutions

Pow er Transmission Grid

Unallocable

Total

Net Interest Cost

Profit / (loss) before tax

Capital Em ployed (Segm ent Assets- Segm ent Liabilities)

Telecom Product and Solutions

Pow er Product and Solutions

Pow er Transmission Grid

Unallocable

Total

96,092

1,408

97,500

88,856

66,696

811

(2,281)

3,801

2,876

16,952

8,644

415

9,059

6,197

2,862

834

2,028

2,028

(Unaudited /

Unreview ed)

97,072

1,408

98,480

85,752

57,856

811

(2,049)

4,572

6,471

18,091

12,728

614

13,342

13,873

(531)

596

(1,127)

7

(1,134)

Standalone

Consolidated

Quarter ended

June 15

June 15

(Unaudited /

(Unaudited)

Unreview ed)

42,400

53,692

96,092

10,084

1,851

11,935

8,156

903

9,059

6,197

2,862

128,259

41,457

136,526

306,242

Standalone

Consolidated

Year ended

Mar 15

Mar 15

(Audited)

296,023

6,987

303,010

279,661

194,464

4,292

(3,469)

15,095

10,774

58,505

23,349

4,481

27,830

17,928

9,902

1,478

8,424

8,424

302,709

6,997

309,706

282,139

181,176

4,292

(3,097)

17,594

18,498

63,676

27,567

5,134

32,701

32,690

11

369

(358)

(94)

(264)

Standalone

Consolidated

Year ended

Mar 15

Mar 15

(Audited)

45,343

53,692

8,754

(10,717)

97,072

148,726

147,297

10,216

1,404

8,198

(5)

19,813

34,518

4,086

7,730

457

5,167

(12)

13,342

13,873

(531)

26,906

924

138,628

42,574

519,039

23,505

723,746

(Audited)

296,023

38,604

27,830

17,928

9,902

117,939

32,272

143,328

293,539

(Audited)

157,643

147,297

15,387

(17,618)

302,709

34,515

3,519

13,195

(30)

51,199

24,898

380

7,478

(55)

32,701

32,690

11

129,668

34,238

491,171

28,454

683,531

Sterlite Technologies Limited Q1, FY16 Investor Note (July 23, 2015)

Registered office: Survey No. 68/1, Rakholi Village, Madhuban Dam Road, Silvassa - 396 230, Union Territory of Dadra & Nagar Haveli, INDIA

Phone: +91 20 30514000, Fax: +91 20 30514113

www.sterlitetechnologies.com | CIN: L 31300DN2000PLC000340

Page 5 of 5

Sterlite Technologies leads creation of

digital and power infrastructure in the

country

Playing an integral role in Govt. of Indias Digital India initiative with products,

network installation and managed services capabilities

Continues focus on research & development; 10% of telecom business revenues

from new & innovative products

Overall revenue growth of 73% and EBITDA growth of 67% on a YoY basis

NEWS RELEASE

FOR IMMEDIATE PUBLICATION

Pune, India July 23, 2015: Sterlite Technologies Limited Sterlite [BSE: 532374, NSE:STRTECH], a leading

global provider of solutions for the high-speed data transmission and power transmission networks, today

announced its results for the quarter ended June 30, 2015

Industry & Business Highlights

Sterlite Technologies is integrated with Government of Indias Digital India vision of enabling digital

infrastructure as a utility to every citizen. Sterlite today has become a preferred partner to deliver high

speed data based end to end networks with a comprehensive suite of products, network design,

installation and managed services.

Sterlite is building an intrusion proof communication network for the Indian Army in Jammu & Kashmir

under the NFS Project and is deploying highly specialized optical fiber and cable for this network

creation. The NFS installation has witness an increased pace of deployment over the last quarter. Sterlite

has also pioneered last mile connectivity in dense urban centers by connecting more than 160,000

homes in 6 cities with FTTH network capable of handling upto 100 Mbps of speed.

Optical fiber remains as the most viable medium for high speed data communication and even wireless

access will need to have fiber based backhaul networks. While countries like China have installed about

900 Million Kms, US with around 500 million Kms of fiber to enable the data transmission, India today

has only 80 Million Kms. We expect that there will be a large demand of optical fiber over the next

decade in Indias effort towards matching global standards of communication. Keeping these trends in

mind, over the last few years, we have invested in plant capacities. The fiber capacity has been

increased to 20 million km per annum from 12 million. The optical fiber cables capacity is being

doubled to 15 million km per annum with an investment of Rs. 150 Crores in the current fiscal. We

expect to complete this capacity expansion by Q4 of this financial year

The optical fiber and cable infrastructure within the country is growing to keep pace with the demand

while challenges, among them, robust installation continues to be problem areas for service providers.

Sterlite has been focusing on the telecommunications needs of the country and has been investing

in further building research capabilities in products, design & engineering at the state of the art

Center of Excellence. The newly developed "Yogaflex" micromodule cable family and "OH-LITE

NOVA" optical fiber offer superior mechanical flexibility, ease of installation and resistance to extreme

situations of turns, bends and stresses during installation. These innovative designs will play an

important role in the long-distance, metropolitan as well as the upcoming Fiber to the Home markets in

concurrence with the needs of the country

Power industry witnessing revival with increased focus on national projects such as 24x7 Power for All

and thrust on renewable power generation will need T&D capacity to increase manifold. Sterlite Power

business has built unique capabilities that are built on a combination of high specification products

and strong engineering and project management capabilities

Power business has successfully executed two challenging re-conductoring projects in urban areas, in

a very compressed time frame and across congested residential colonies. The business continues to

witness very good demand for such integrated offerings from utility providers.

Financial Highlights for the quarter ended June 30, 2015

Revenues for Q1 FY16 were Rs 975 crore, higher by 73% compared to Revenues of Rs 564 crore in the

same quarter last year nearly 25% of the revenues were from export markets

EBITDA grew by 67% from Rs. 71 crore in Q1FY15 to Rs. 119 crore in the current quarter.

PAT was higher by 122% from Rs. 9 crore in Q1 last year to Rs. 20 crore in Q1FY16

The total order book as of 30th June was at Rs 4,205 crores with the Telecom order book at Rs 2,087

crores and Power at 2,118 crores. Nearly 80% of the order book is domestic focused reflecting the

underlying growth on account of the communication and power infrastructure being built out in India.

In May, 2015 the Company announced that it would demerge its power businesses into a separate

undertaking. The Demerger proceedings are underway and expected to close in Q4 2016 subject to

approvals by the High Court, SEBI, shareholders and creditors of STL and other relevant regulatory

authorities.

Telecom Segment Highlights:

Revenues from the Telecom products and solutions business for the quarter were Rs. 424 Crores with

EBITDA of Rs 101 Crores.

Optical Fibre (OF) Volumes were 4.5 million fiber Kilometers while volumes of Optical Fibre Cables (OFC)

were 1.8 million fiber Kilometers with the fibre-to-cabling mix at 40% during the quarter.

Power Segment Highlights:

Revenues from the Power products & solutions business revenue were Rs. 537 Crores for Q1 FY16, with

EBITDA of Rs. 18 Crores.

Volumes for the conductors for the quarter were 30,347MT compared to 8,794 MT for Q1 FY15.

Revenues for the power transmission business were Rs.88 Cr for Q1 FY16, with EBITDA of 82 Cr. The

increase is on account of progressive commissioning of elements in the BDTCL and JTCL projects.

Post the end of the quarter, the Company has been awarded the Maheshwaram project in Telangana, a

765KV line that is expected to generate Rs55 crores of levelised tariff.

Commenting on the results, Pravin Agarwal, Vice Chairman, Sterlite Technologies Ltd., said, We had a strong

quarter of topline and bottom line growth across our telecom and power verticals during a transformational

time in our business. The telecom business continues to witness strong traction on the back of scaling up of

connectivity infrastructure both domestically and overseas. The quality of growth is heartening given the profile

of customers who appreciate the integrated business model as well as the evolving and pioneering product

portfolio. We are confident of scaling greater heights as the data opportunity unfolds further across the country

and the region. And through it all, we shall continue to remain focused on building sustainable value for all

stakeholders.

STANDALONE FINANCIALS

Net Revenues (INR Cr)

Q1 FY 16

975

Q4 FY 15

979

Q1 FY 15

564

FY 15

3,030

Net Revenues (Mn USD)

152

153

88

473

EBITDA (INR Cr)

119

131

71

386

EBITDA (Mn USD)

19

20

11

60

Net Income (INR Cr)

20

39

84

Net Income (Mn USD)

13

INR to USD at 64

ABOUT STERLITE TECHNOLOGIES

Sterlite Technologies Limited (STL) develops & delivers solutions for high speed data communication and power

transmission networks, globally. STL is among the global leaders in all its business areas through its operations in

India, China & Brazil. STL is developing several network projects across India including secure communication

network creation in Jammu & Kashmir for Indian army, enabling Bharatnet, establishing urban high speed fiber

to the home (FTTH) networks and multiple interstate ultra mega power transmission projects. Listed on Stock

Exchanges BSE & NSE in Mumbai, India, Sterlite Technologies is a public company with broad shareholder base.

The company has recently announced a demerge of its power products and transmission business into a new

company. Sterlite Technologies to remain a pureplay telecom focused company.

CONTACT

Corporate Communications

Manish Ingole

Sterlite Technologies Limited

Phone: +91.20.30514000

Email: manish.ingole@sterlite.com /

communications@sterlite.com

Investor Relations

Vishal Aggarwal

Sterlite Technologies Limited

Phone: +91.20.30514000

Email: vishal.aggarwal@sterlite.com /

investor.relations@sterlite.com

Forward-looking and cautionary statements: Certain words and statements in this release concerning Sterlite Technologies Limited and its prospects, and

other statements relating to Sterlite Technologies expected financial position, business strategy, the future development of Sterlite Technologies

operations and the general economy in India, are forward looking statements. Such statements involve known and unknown risks, uncertainties and other

factors, which may cause actual results, performance or achievements of Sterlite Technologies Limited, or industry results, to differ materially from those

expressed or implied by such forward-looking statements. Such forward-looking statements are based on numerous assumptions regarding Sterlite

Technologies present and future business strategies and the environment in which Sterlite Technologies Limited will operate in the future. The important

factors that could cause actual results, performance or achievements to differ materially from such forward-looking statements include, among others,

changes in government policies or regulations of India and, in particular, changes relating to the administration of Sterlite Technologies industry, and

changes in general economic, business and credit conditions in India. Additional factors that could cause actual results, performance or achievements to

differ materially from such forward-looking statements, many of which are not in Sterlite Technologies control, include, but are not limited to, those risk

factors discussed in Sterlite Technologies various filings with the National Stock Exchange, India and the Bombay Stock Exchange, India. These filings are

available at www.nseindia.com and www.bseindia.com.

Registered office:

Survey No. 68/1, Rakholi Village, Madhuban Dam Road, Silvassa - 396 230

Union Territory of Dadra & Nagar Haveli, INDIA

Phone: +91 20 30514000, Fax: +91.20.30514113

CIN: L 31300DN2000PLC000340

www.sterlitetechnologies.com

STERLITE TECHNOLOGIES LIMITED

STANDALONE FINANCIAL RESULTS FOR THE QUARTER ENDED JUNE 30, 2015

(Rs. in Lacs except per share data)

Quarter ended

Particulars

Income from Operations

a) Net Revenue

b) Other Operating Income

Total Income from operations (Net)

Total Expenditure

a) Cost of materials consumed

b) Purchase of stock-in-trade

c) (Inc) / Dec in finished goods, stock-in-trade & WIP

d) Staff Cost

e) Depreciation & Impairment

f) Other Expenditure

Operating profit before other income, interest and tax

Other Income

Profit before interest and tax

Net Interest Cost

Profit before tax

Tax Expense

Net Profit after tax

Paid-up Equity Capital (Face value Rs.2 per share)

Reserves excluding revaluation reserves

Earning Per Share (Rs.)- Basic

Earning Per Share (Rs.)- Diluted

Aggregate of Public Share Holding

Number of Shares

Percentage of Shareholding

Promoters and promoter group Shareholding

Pledged/Encumbered

Number of Shares

Percentage of Shares (as a % of the total

shareholding of promoter and promoter group)

Percentage of Shares (as a % of the total

share capital of the company)

Non-encumbered

Number of Shares

Percentage of Shares (as a % of the total

shareholding of promoter and promoter group)

Percentage of Shares (as a % of the total

share capital of the company)

June 15

(Unaudited)

March 15

(Audited)

Refer Note 7

Year ended

June 14

(Unaudited)

March 15

(Audited)

96,092

1,408

97,500

88,856

66,696

811

(2,281)

3,801

2,876

16,952

8,644

415

9,059

6,197

2,862

834

2,028

96,230

1,680

97,910

89,206

65,048

388

(581)

4,653

2,699

16,999

8,704

1,678

10,382

5,556

4,826

913

3,913

55,068

1,372

56,440

52,253

36,039

1,419

(3,136)

2,942

2,667

12,322

4,187

274

4,461

2,966

1,495

546

949

296,023

6,987

303,010

279,661

194,464

4,292

(3,469)

15,095

10,774

58,505

23,349

4,481

27,830

17,928

9,902

1,478

8,424

7,881

7,881

7,876

0.51

0.50

0.99

0.98

0.24

0.24

7,881

116,384

2.14

2.12

177,938,400

45.16%

178,031,900

45.18%

178,373,680

45.29%

178,031,900

45.18%

216,120,601

100%

216,027,101

100%

215,450,601

100%

216,027,101

100%

54.84%

54.82%

54.71%

54.82%

Quarter ended

Segment Revenue

Telecom Product and Solutions

Power Product and Solutions

Total

Profit before interest,depreciation and tax

Telecom Product and Solutions

Power Product and Solutions

Total

Profit before Interest and Tax

Telecom Product and Solutions

Power Product and Solutions

Total

Net Interest Cost

Profit before Tax

Capital Employed (Segment Assets- Segment Liabilities)

Telecom Product and Solutions

Power Product and Solutions

Unallocable

Total

2. The above results have been reviewed by the Audit Committee. The Board of

directors at its meeting held on July 23, 2015 approved the above results.

3. The Company is in the process of applying the provisions of para 4(a) under the

heading Notes after Part C in Schedule II of the Companies Act, 2013 and the effect

of the same would be taken in subsequent quarter. Management expects that this

would not have a material impact on depreciation of the current quarter.

4. The Board of directors of the Company on May 18, 2015 had approved the

Scheme of Arrangement under Sections 391 394 of the Companies Act, 1956

(the Scheme) between Sterlite Technologies Limited (STL or Demerged

company), Sterlite Power Transmission Limited (SPTL or Resulting company)

and their respective shareholders and creditors for the demerger of power products

and solutions business (including the investments of STL in power transmission

infrastructure subsidiaries) into its subsidiary SPTL with the appointed date of April

1, 2015 subject to the approval of shareholders and creditors, approvals of the

relevant regulatory authorities and the sanction of the Hble Bombay High Court.

The Scheme inter alia provides for issue of equity shares or redeemable preference

shares of SPTL to the shareholders of STL.The Scheme would become effective

upon receipt of all requisite approvals and filing of the certified copies of the Court

order with the Registrar of Companies. Pending the requisite approvals/filings, no

effect of adjustments (including tax adjustments) arising out of the proposed

demerger has been considered in the above results.

5. Pursuant to proposed demerger as mentioned in note 4 above and in accordance

with Accounting Standard 24, "Discontinuing Operations", the financial results

of the Power Product & Solutions Business (Discontinuing Operations) from

Standalone result perspective is as under :

Quarter ended

Particulars

-

(Rs. in Lacs)

Segment Reporting

Notes

1. In terms of clause 41 of the listing agreement, details of number of investor

complaints for thequarter ended June 30, 2015 : Beginning - 0 , Received - 43,

Disposed off - 43, Pending - 0.

June 15

(Unaudited)

March 15

(Audited)

Refer Note 7

Year ended

June 14

(Unaudited)

March 15

(Audited)

42,400

53,692

96,092

46,712

49,518

96,230

32,160

22,908

55,068

148,726

147,297

296,023

10,084

1,851

11,935

11,167

1,914

13,081

6,954

174

7,128

34,518

4,086

38,604

8,156

903

9,059

6,197

2,862

9,288

1,094

10,382

5,556

4,826

5,034

(573)

4,461

2,966

1,495

26,906

924

27,830

17,928

9,902

128,259

41,457

136,526

306,242

117,939

32,272

143,328

293,539

109,712

43,536

119,527

272,775

Registered office: Sterlite Technologies Limited, Survey 68/1, Rakholi, Madhuban Dam Road, Silvassa, 396230

Union Territory of Dadra & Nagar Haveli, INDIA. www. sterlitetechnologies.com

Net revenue

Other Operating

Income

Income from

operations (net)

Other Income

Expenses (excluding

interest cost)

Profit before interest

and tax

Year ended

June 15

53,692

March 15

49,518

June 14

22,908

March 15

147,297

505

802

452

2,702

54,197

189

50,320

442

23,360

261

149,999

788

53,483

49,668

24,194

149,863

903

1,094

(573)

924

6. During the year 2005-06, the CESTAT had upheld a demand of Rs. 188 Crores

(including penalties thereon and excluding interest) in the pending Excise matter.

The auditors have expressed their qualification on this matter.The Company is

contesting this case and the matter is pending the decision of the Hon'ble

Supreme Court.

7. The figures for the quarter ended March 31, 2015 are balancing figures between

audited figures in respect of the full financial year ended March 31, 2015 and the

unaudited published year-to-date figures up to December 31, 2014, being the date

of the end of the third quarter of the financial year 2014-15, which was subjected to

limited review.

8. Previous period figures have been regrouped / rearranged wherever considered

necessary.

117,939

32,272

143,328

293,539

Place: Pune

Date : July 23, 2015

For Sterlite Technologies Limited

sd/

Anand Agarwal

Chief Executive Officer

Vous aimerez peut-être aussi

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Learning Resource Management Made SimpleDocument12 pagesLearning Resource Management Made SimpleJosenia ConstantinoPas encore d'évaluation

- Nec 2006Document59 pagesNec 2006loots69Pas encore d'évaluation

- Friday Night FightsDocument8 pagesFriday Night Fightsapi-629904068Pas encore d'évaluation

- OkDocument29 pagesOkgouthamlabsPas encore d'évaluation

- Control and On-Off Valves GuideDocument87 pagesControl and On-Off Valves Guidebaishakhi_b90100% (3)

- bbk-lt2614-lt3214 Service Manual PDFDocument42 pagesbbk-lt2614-lt3214 Service Manual PDFrj arcinasPas encore d'évaluation

- TCON300Document722 pagesTCON300DGGPas encore d'évaluation

- Mini System LG-RAD-226B PDFDocument65 pagesMini System LG-RAD-226B PDFAndres Lecaro JarrinPas encore d'évaluation

- Answers About HubSpotDocument1 pageAnswers About HubSpotPrasetyaPas encore d'évaluation

- Method Statement For Cable & TerminationDocument6 pagesMethod Statement For Cable & TerminationRajuPas encore d'évaluation

- Quarter 1 Week 8Document3 pagesQuarter 1 Week 8Geoffrey Tolentino-UnidaPas encore d'évaluation

- PV Design WorksheetDocument4 pagesPV Design WorksheetLarry Walker II100% (1)

- Enclosed Product Catalogue 2012Document24 pagesEnclosed Product Catalogue 2012Jon BerryPas encore d'évaluation

- Form 1 Lesson 88 SpeakingDocument2 pagesForm 1 Lesson 88 Speakinga multifandom fangirlPas encore d'évaluation

- Process Sizing CriteriaDocument91 pagesProcess Sizing CriteriaMohammad BadakhshanPas encore d'évaluation

- Direct Burial Optic Fiber Cable Specification - KSD2019 PDFDocument5 pagesDirect Burial Optic Fiber Cable Specification - KSD2019 PDFjerjyPas encore d'évaluation

- Marco OH Lighting-Business Plan PDFDocument43 pagesMarco OH Lighting-Business Plan PDFsjcoolgeniusPas encore d'évaluation

- PET ImagingDocument54 pagesPET ImagingNana AkwaboahPas encore d'évaluation

- Smart Lighting Market Analysis and Forecast 2025 by Global Marketing InsightsDocument5 pagesSmart Lighting Market Analysis and Forecast 2025 by Global Marketing InsightsEko Hadi Susanto100% (1)

- RCE Unpacking Ebook (Translated by LithiumLi) - UnprotectedDocument2 342 pagesRCE Unpacking Ebook (Translated by LithiumLi) - Unprotecteddryten7507Pas encore d'évaluation

- Builder's Greywater Guide Branched DrainDocument4 pagesBuilder's Greywater Guide Branched DrainGreen Action Sustainable Technology GroupPas encore d'évaluation

- General Ledger Senior Accountant in Charlotte NC Resume Diana ShipeDocument1 pageGeneral Ledger Senior Accountant in Charlotte NC Resume Diana ShipeDianaShipePas encore d'évaluation

- InductorsDocument13 pagesInductorsManish AnandPas encore d'évaluation

- BSC Prospectus 2019-20Document37 pagesBSC Prospectus 2019-20Gaurav VamjaPas encore d'évaluation

- 3095MV Calibration Procedure W QuickCal Merian 4010Document8 pages3095MV Calibration Procedure W QuickCal Merian 4010luisalbertopumaPas encore d'évaluation

- How To Choose Food StarchesDocument20 pagesHow To Choose Food StarchesBoat Tanin100% (3)

- Power Plant Engineering by G.R.nagpalDocument729 pagesPower Plant Engineering by G.R.nagpalGoutham Peri74% (23)

- # 6030 PEN OIL: Grade: Industrial Grade Heavy Duty Penetrating OilDocument3 pages# 6030 PEN OIL: Grade: Industrial Grade Heavy Duty Penetrating OilPrakash KumarPas encore d'évaluation

- Ranking 4Document34 pagesRanking 4Deepti BhatiaPas encore d'évaluation

- Product Data Sheet: Linear Switch - iSSW - 2 C/O - 20A - 250 V AC - 3 PositionsDocument2 pagesProduct Data Sheet: Linear Switch - iSSW - 2 C/O - 20A - 250 V AC - 3 PositionsMR. TPas encore d'évaluation