Académique Documents

Professionnel Documents

Culture Documents

A Community Based Flood Insurance Option, Report in Brief

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

A Community Based Flood Insurance Option, Report in Brief

Droits d'auteur :

Formats disponibles

WATER SCIENCE AND TECHNOLOGY BOARD

JULY 2015

A Community-Based Flood Insurance Option

A COMMUNITY-BASED FLOOD INSURANCE OPTION may create new opportunities to reduce

flood losses, but is unlikely to provide the single solution to the nations pressing flood insurance problems.

A community-based flood insurance optioneither as a stand-alone policy option or as part of a suite of

policieswill need to address specific challenges like increasing policy takeup rates, reducing administrative

costs, and enhancing floodplain management.

The National Flood Insurance Program (NFIP) is

administered by FEMA and offers about 5.4 individual

policies nationwide, insuring about $1.3 trillion in

property. The program is confronted with many challengesit is roughly $23 billion in debt, has relatively

low rates of purchase in many flood-prone areas, and

faces issues regarding the affordability of premiums.

To help address some of the challenges within

the NFIP, the U.S. Congress passed the BiggertWaters Flood Insurance Reform Act of 2012, and the

Homeowner Flood Insurance Affordability Act of

2014. Part of the conversation regarding NFIP reform

is the prospect of a community-based flood insurance optiona single insurance policy for an entire

communitywhich may be more effective and less

expensive than administering separate policies for each

property within a given community.

This report identifies key issues and questions

about a community-based flood insurance option as

food for thought for FEMA and Congress as they

weigh both the possible benefits and challenges of a

community-based flood insurance option.

WHAT DID THE COMMITTEE FIND?

The committee developed a conceptual rationale

that helps to identify where a community based

flood insurance option might be desirableand

where it may not. An application of the Coase

Theorem, developed in the economics field,

holds that where partiesboth individuals and

groupsaccount for all costs and benefits,

markets are functional, information is freely and

widely available, and transactions costs are zero,

economically efficient outcomes are reached

irrespective of who holds the property rights.

If the collected economic interests of communities and residents fully coincide and are fully

accounted for, the outcomes of a flood insurance purchase decision do not rely upon which

Flood waters rising in Hannibal, Missouri in 2008. Source:

FEMA/Jocelyn Augustino

partycommunities or residentsbears responsibility for insurance.

Applying the Coase Theorem to community-based

flood insurance, there are at least eight reasons that

explain why the proposition that the outcomes of a

flood insurance purchase decision do not rely upon

which party bears responsibility for insurance may fail

to hold. Two reasons are free riding where some or

all residents choose not to buy insurance because they

expect disaster relief to provide adequate post-flood

aid, and externalitieswhen self-interested parties fail

Box 1. What is Community-Based Flood Insurance?

A community-based flood insurance option could be based

on aggregating the dollar sum of flood loss risks for community structures. Costs could be distributed according to each

individuals assessed flood risk, and premiums could be collected

using mechanisms such as property taxes or utility charges.

FEMA defines a community as a political entity that has the

authority to adopt and enforce floodplain ordinances for the

area under its jurisdiction. This present report does not define

a community or community-based flood insurance; rather, it

cites pertinent past work.

Clear definitions will be important if community-based flood

insurance is to be implemented, and those definitions will be

made based on input from elected officials, FEMA, and citizens.

to account for all the impacts when deciding whether

to buy insurance.

There are circumstances where community-based

flood insurance may be able to help address specific

challenges within the NFIP, for example by reducing

administrative and transaction costs, increasing

take-up rates, and promoting flood mitigation and

floodplain management.

In other circumstances, the prospects for community-based flood insurance may be challenged due to

the lack of community interest and the inability to

implement insurance at the community level.

THE COMMITTEES FRAMEWORK

The committee identified overarching features and

considerations that would require further assessment

when planning for and designing community-based

flood insurance.

Risk Bearing and Sharing.

A community-based flood insurance option could

conceivably shift risk-bearing to communities, private

insurers, or individuals depending on how it is structured, allowing for a reexamination of how some risk

might be transferred or shared.

Responsibilities for Writing Policies and Loss

Adjustments.

Write-your-own (WYO) insurance agents write

policies and collect premiums under the NFIP. FEMA

would need to expand a range of administrative duties

to process policies written at the community level.

Coverage Limits, Standards, and Compliance.

Under community-based flood insurance, deductible choices depend on community size, the type

of flood risk, and other characteristics. A community-based flood insurance option may provide an

opportunity to reconsider flood exposure.

Underwriting, Pricing, and Allocation of Premium

Costs.

Several complex issues fall under this topic,

including the extent of actuarial principles to be used

in setting premiums; the extent to which catastrophic

losses would be reflected in premiums; and the allocation of premium costs in a community.

Administrative Capabilities.

If insurance contracts remain the vehicle for

transferring risk, private insurers likely would remain

as efficient entities for handling their administration.

Some definitions of community include entities that

could effectively and efficiently collect revenue needed

to pay for a community policy through special assessments, property taxes and others.

Confirming Compliance with Mandatory Purchase

Requirements.

Currently, mandatory policy purchase requirements within the NFIP are only for the amount of a

federally backed mortgage. A bundled communitybased option that provides a minimum required

coverage would need to maintain some aspect of

individual coverage insurance and monitoring.

Pricing Expertise, Including Valuation of Mitigation

Measures.

If private insurers were to underwrite risks associated with a community-based flood insurance policy,

they would price them according to actuarial principles. If the NFIP assumed the risk, then it would also

likely assume the pricing of policies. FEMA has expertise in setting premium costs based on flood risk, and

would have to work with communities to communicate individual property coverage costs bundled into a

community policy.

Committee on a Community-Based Flood Insurance Option: Henry J. Vaux (Chair), University of California, Berkeley and

Riverside; Patricia Born, Florica State University, Tallahassee; Jeffrey Czajkowski, University of Pennsylvania, Philadelphia; Lloyd

Dixon, Rand Corporation, Santa Monida, California; Robert Hirsch, U.S. Geological Survey; Roger Kasperson, Clark University,

Worcester, Massacusetts; Robert Klein, Georgia State University, Atlanta; Sandra Knight, University of Maryland, College Park;

David I. Maurstad, OST Inc., McLean, Virginia; Sally McConkey, Illinois State Water Survey, Champaign, Illinois; Tommy Wright,

U.S. Census Bureau, Washington, DC; Richard Zeckhauser, Harvard University, Cambridge, Massachusetts; Ed J. Dunne (Study

Director, Water Science and Technology Board), Jeffrey Jacobs (Director, Water Science and Technology Board), Scott T. Weidman

(Director, Board on Mathematical Science and Their Applications), Brendan McGovern, (Senior Program Assistant, Water Science and

Technology Board), National Academies of Sciences, Engineering, and Medicine.

The National Academies of Sciences, Engineering, and Medicine appointed the above committee of experts to address

the specific task requested by the Federal Emergency Management Agency. The members volunteered their time for

this activity; their report is peer-reviewed and the final product signed off by both the committee members and the

National Academies of Sciences, Engineering, and Medicine. This report brief was prepared by the National Academies

of Sciences, Engineering, and Medicine based on the committees report.

For more information, contact the Water Science and Technology Board at (202) 334-2187 or visit http://dels.nas.edu/wstb. Copies of

A Community-Based Flood Insurance Option areavailable from the National Academies Press, 500 Fifth Street, NW, Washington,

D.C. 20001; (800) 624-6242; www.nap.edu.

Permission granted to reproduce this document in its entirety with no additions or alterations.

Permission for images/figures must be obtained from their original source.

2015 The National Academy of Sciences

Vous aimerez peut-être aussi

- Wendy Garrett - Revisiting Koch's Postulates From A Microbial Community PerspectiveDocument28 pagesWendy Garrett - Revisiting Koch's Postulates From A Microbial Community PerspectiveNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Karen Guillemin - Zebrafish As A Non-Rodent Animal ModelDocument37 pagesKaren Guillemin - Zebrafish As A Non-Rodent Animal ModelNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Herbert "Skip" Virgin - Animal Models and Microbiome ResearchDocument100 pagesHerbert "Skip" Virgin - Animal Models and Microbiome ResearchNational Academies of Science, Engineering, and Medicine0% (1)

- Tracy Bale - Maternal Stress and The MicrobiomeDocument35 pagesTracy Bale - Maternal Stress and The MicrobiomeNational Academies of Science, Engineering, and Medicine100% (1)

- Craig Franklin - Complex Gnotobiology and Next Gen SequencingDocument27 pagesCraig Franklin - Complex Gnotobiology and Next Gen SequencingNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Vincent Young - Organoids As An In-Vitro SystemDocument31 pagesVincent Young - Organoids As An In-Vitro SystemNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Timothy Hand - Establishing A New Gnotobiotic FacilityDocument16 pagesTimothy Hand - Establishing A New Gnotobiotic FacilityNational Academies of Science, Engineering, and Medicine100% (1)

- Federico Rey - Metabolites Produced by The Gut MicrobiotaDocument27 pagesFederico Rey - Metabolites Produced by The Gut MicrobiotaNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Workshop Wrap UpDocument2 pagesWorkshop Wrap UpNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Jeremiah Faith - The Role of Immunologic Variation in ReproducibilityDocument26 pagesJeremiah Faith - The Role of Immunologic Variation in ReproducibilityNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Richard Blumberg - Microbes and Atopic DisordersDocument26 pagesRichard Blumberg - Microbes and Atopic DisordersNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Angela Douglas - Drosophila As A Non-Rodent Animal ModelDocument26 pagesAngela Douglas - Drosophila As A Non-Rodent Animal ModelNational Academies of Science, Engineering, and Medicine100% (1)

- Alexander Chervonsky - The Role of Gender in ReproducibilityDocument61 pagesAlexander Chervonsky - The Role of Gender in ReproducibilityNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Gary Wu - The Role of Diets: Standardization and CharacterizationDocument28 pagesGary Wu - The Role of Diets: Standardization and CharacterizationNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Robert Britton - Bioreactors As An In-Vitro SystemDocument25 pagesRobert Britton - Bioreactors As An In-Vitro SystemNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Chriss J. Vowles - Challenges Related To Managing Mouse Gnotobiotic Husbandry FacilitiesDocument25 pagesChriss J. Vowles - Challenges Related To Managing Mouse Gnotobiotic Husbandry FacilitiesNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Nancy Moran - Effects of The Microbiome On The Behavior of BeesDocument30 pagesNancy Moran - Effects of The Microbiome On The Behavior of BeesNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- R. Balfour Sartor - Evolving An Established Gnotobiotic FacilityDocument33 pagesR. Balfour Sartor - Evolving An Established Gnotobiotic FacilityNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Buck Samuel - C. Elegans As A Non-Rodent Model For Microbiome ResearchDocument19 pagesBuck Samuel - C. Elegans As A Non-Rodent Model For Microbiome ResearchNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Stephen Jameson - Alternatives To GnotobioticsDocument26 pagesStephen Jameson - Alternatives To GnotobioticsNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Aldons "Jake" Lusis - The Role of Host GeneticsDocument34 pagesAldons "Jake" Lusis - The Role of Host GeneticsNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Betty Theriault - Veterinary Management Challenges in Gnotobiotic AnimalsDocument24 pagesBetty Theriault - Veterinary Management Challenges in Gnotobiotic AnimalsNational Academies of Science, Engineering, and Medicine100% (1)

- Andrew Macpherson - Creating Stabilized Microbiomes in Lab AnimalsDocument29 pagesAndrew Macpherson - Creating Stabilized Microbiomes in Lab AnimalsNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Findings and RecommendationsDocument16 pagesFindings and RecommendationsNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

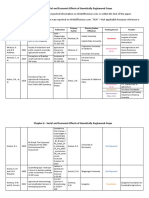

- Genetically Engineered Crops: Experiences and Prospects - Report References Funding - Chapter 6Document72 pagesGenetically Engineered Crops: Experiences and Prospects - Report References Funding - Chapter 6National Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Genetically Engineered Crops: Experience and ProspectsDocument4 pagesGenetically Engineered Crops: Experience and ProspectsNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- The Future of Atmospheric Chemistry Research: Remembering Yesterday, Understanding Today, Anticipating Tomorrow - Report in BriefDocument4 pagesThe Future of Atmospheric Chemistry Research: Remembering Yesterday, Understanding Today, Anticipating Tomorrow - Report in BriefNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Genetically Engineered Crops: Experiences and Prospects - Report in BriefDocument4 pagesGenetically Engineered Crops: Experiences and Prospects - Report in BriefNational Academies of Science, Engineering, and Medicine100% (4)

- Appendix F - Summarized Comments Received From Members of The PublicDocument21 pagesAppendix F - Summarized Comments Received From Members of The PublicNational Academies of Science, Engineering, and MedicinePas encore d'évaluation

- Genetically Engineered Crops: Experiences and Prospects - Report References Funding - Chapter 5Document56 pagesGenetically Engineered Crops: Experiences and Prospects - Report References Funding - Chapter 5National Academies of Science, Engineering, and Medicine100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Surveys For Maint'Ce ClassDocument7 pagesSurveys For Maint'Ce ClassSuhe EndraPas encore d'évaluation

- Leoline Installation and MaintenanceDocument8 pagesLeoline Installation and MaintenanceFloorkitPas encore d'évaluation

- Stanford - Trauma - Guidelines June 2016 Draft Adult and Peds FINALDocument166 pagesStanford - Trauma - Guidelines June 2016 Draft Adult and Peds FINALHaidir Muhammad100% (1)

- DWATCHDocument92 pagesDWATCHFawaz SayedPas encore d'évaluation

- Final Workshop Report On Value Addition and AgroprocessingDocument31 pagesFinal Workshop Report On Value Addition and AgroprocessingBett K. BernardPas encore d'évaluation

- EN Ultra V Mini STP410S C54 UmhDocument2 pagesEN Ultra V Mini STP410S C54 Umhjabt4568Pas encore d'évaluation

- Material Safety Data Sheet Roto-Inject FluidDocument5 pagesMaterial Safety Data Sheet Roto-Inject FluidQuintana JosePas encore d'évaluation

- Thyroid OphthalmopathyDocument59 pagesThyroid OphthalmopathyLavanya MadabushiPas encore d'évaluation

- Supplementary Spec To API Specification 17D Subsea Wellhead and Tree Equipment With Justifications S 561Jv2022 11Document81 pagesSupplementary Spec To API Specification 17D Subsea Wellhead and Tree Equipment With Justifications S 561Jv2022 11maximusala83Pas encore d'évaluation

- Single Conductor 15KV, Shielded, MV-105Document2 pagesSingle Conductor 15KV, Shielded, MV-105henry hernandezPas encore d'évaluation

- Scala: Service InstructionsDocument16 pagesScala: Service Instructionsmario_turbinadoPas encore d'évaluation

- According To India International Coffee Festival in The TitledDocument4 pagesAccording To India International Coffee Festival in The Titledsalman vavaPas encore d'évaluation

- Soil ExplorationDocument42 pagesSoil ExplorationDilipKumarAkkaladevi100% (1)

- PNOZ E1vp EN-23-27Document5 pagesPNOZ E1vp EN-23-27Rachid MoussaouiPas encore d'évaluation

- The Bitter Internal Drive of AppleDocument7 pagesThe Bitter Internal Drive of AppleBon WambuaPas encore d'évaluation

- CAST Optical Smoke Detector: Part NoDocument3 pagesCAST Optical Smoke Detector: Part NoAnis TantoushPas encore d'évaluation

- Nutrition Label ResponseDocument1 pageNutrition Label ResponseZoe JonesPas encore d'évaluation

- The Assignment Vol.4 - The Pain - Mike Murdock PDFDocument168 pagesThe Assignment Vol.4 - The Pain - Mike Murdock PDFEmmanuel Temiloluwa67% (3)

- Healing and Keeping Prayer (2013)Document2 pagesHealing and Keeping Prayer (2013)Kylie DanielsPas encore d'évaluation

- Joey Agustin (Price Tag)Document2 pagesJoey Agustin (Price Tag)AGUSTIN JOENALYN MAE M.Pas encore d'évaluation

- English 1 Reading (CVC)Document27 pagesEnglish 1 Reading (CVC)Angelica ArcangelPas encore d'évaluation

- All Electricity Worksheets For Midterm 22Document22 pagesAll Electricity Worksheets For Midterm 22Maryam AlkaabiPas encore d'évaluation

- Yuasa NPL Range: VRLA BatteriesDocument2 pagesYuasa NPL Range: VRLA BatteriesVuro BegaPas encore d'évaluation

- Exclusively HisDocument129 pagesExclusively HisAngel gargarPas encore d'évaluation

- IFAD Vietnam RIMS Training Workshop 2011 (1 of 7)Document18 pagesIFAD Vietnam RIMS Training Workshop 2011 (1 of 7)IFAD VietnamPas encore d'évaluation

- Eastman Methyl N-Amyl Ketone (MAK) and Eastman Methyl Isoamyl Ketone (MIAK)Document4 pagesEastman Methyl N-Amyl Ketone (MAK) and Eastman Methyl Isoamyl Ketone (MIAK)Chemtools Chemtools100% (1)

- Comparative Study of DEA and MDEADocument4 pagesComparative Study of DEA and MDEAsaleh4060Pas encore d'évaluation

- Thank You For Being A Liberty Mutual Renters Customer Since 2014!Document29 pagesThank You For Being A Liberty Mutual Renters Customer Since 2014!RewaPas encore d'évaluation

- Summary (Adjuncts)Document2 pagesSummary (Adjuncts)Ngọc MinhPas encore d'évaluation

- Plante BatteriesDocument16 pagesPlante Batteriessureshnfcl0% (1)