Académique Documents

Professionnel Documents

Culture Documents

IAM - Risk Mathematics

Transféré par

wirdinaTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

IAM - Risk Mathematics

Transféré par

wirdinaDroits d'auteur :

Formats disponibles

1

2

3

4

5

6

7

8

9

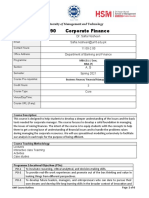

Name of Course: Risk Mathematics For Auditing

Course Code: BMIA 32106

Status: Core

Name of Academic Staff: Ms. Tengku Hizam YM Tengku Izham

Course Rationale:

In this unique course students learn to integrate knowledge and skills from mathematical discipline and apply

them to solve real world problems from various auditing segments. The course's setting mimics a business

environment, where students learn a variety of problem solving techniques for uncertain scenarios, are

presented with problems and are asked to make decisions or recommendations based on a series of

assumptions.

Year and Semester offered: Year 2 Semester 1

Total Student

Face-to-Face (by

Total Guided and Independent Learning

Learning Time

hours)

L = Lecture

L

T

P

I

SLT

T = Tutorial

42

14

64

Learning Activities

(Hours)

P = Practical

1

Lectures

63

O = Others

a Attending Lectures

42

b Pre, Post Preparation and Independent

21

Learning

2 Tutorial/Discussions

36

a Attending Discussions

18

b Preparation for Discussions

18

3 Assignments

12

a Assignment Preparation and

Submission.

12

6 Hours Per Assignment.

2 Assignments

4 Assessments

25

a 3 Continuous Assessment (2 Hour + 3

15

Hours Preparation)

b 1 Final Examination (3 Hours +

10

7 Hours Preparation)

Total

136

3

Subject Credit (136 40 =3.4)

Credit Value: 3

Prerequisite (if any): Nil

Course Outcomes:

Upon successful completion of the course, the student will be able to:

CO1: Understand the mathematical application relates finance and risk management.

CO2: Derive and apply the fundamental formulae of financial mathematics.

CO3: Verifying the mathematical accuracy of companies

CO4: Demonstrate ability to use decision-making processes in making financial decisions

10

Learning Outcome Transferable Skills:

8 MQF Learning Outcomes (LO)

COURSE OUTCOMES

11

12

LO8

Managerial & Entrepreneurial Skills (K/P/A)

Information Management and Life Long Learning Skills (P/A)

Problem Solving and Scientific Skills

Values, Attitudes & Professionalism (A)

Social skills & Responsibility

Practical Skills (P)

Knowledge (K)

CO 8 MQF Learning Outcomes (LO)

Communication, Leadership and Team Skills

LO1 LO2 LO3 LO4 LO5 LO6 LO7

CO1

Understand the mathematical application

/

relates to finance and risk management.

CO2

Derive and apply the fundamental formulae

/

of financial mathematics.

CO3

Verifying the mathematical accuracy of

/

companies

CO4

Demonstrate ability to use decision-making

/

processes in making financial decisions

Transferable skills:

Communication Skills

Critical Thinking and Problem Solving Skills

Teamwork Skills

Lifelong Learning and Management Skills

Managerial & Entrepreneurial Skills

This course is aimed to ensure learners equipped with knowledge that give them the confidence and

skill to determine appropriate management understanding for maximum efficiency.

1. Teaching, Learning and Assessment Strategy:

Lectures and Tutorials

Mid Semester Exam and Final Examination

Report Writing

Written Assessment

Assignments based learning

Assessment of Assignment

Both summative and formative assessments are employed for this course.

1. Continuous Assessment

a. Case Study

b. Assignments

c. Group Projects

2.

14

15

Synopsis:

This course will help students recognize that there is some uncertainty when an auditor provides an opinion

on whether an entity's information are fairly presented. This uncertainty is referred to as audit risk. This

course introduces the audit process within the context of business risk--teaching students why it is important

to first understand the organization's business environment and how students can apply the risk models. It also

prepares students to succeed amidst today's numerous auditing changes with the latest look at audit

regulations, concepts, and practices as they apply in today's technological, systems-oriented environment

based on mathematical models

Mode of Delivery: Lectures and Tutorials.

Assessment Methods and Types:

Mode of

Assessment

AssessmentFormative Summative Assessment

13

d. Mid Semester Exam

Closed Book Final Examination

a. Short answer question

b. Problem based long questions

Essay Question

c. Mid Semester Exam

Total

Percentag

e (%)

Final

Examination

Programme Outcomes

PO PO PO PO

1

2

3

4

C

A

C,P C,P

60%

Mid Semester

Examination

Assignments

Tutorials

PO

5

C,P

PO

6

A

PO

7

C,P

PO

8

A

10

10

PO9

A

PO1

0

A

10

10%

10%

20%

100%

Course Outcomes

Learning

Domains

Marks

Allocation

Total Marks

15

15

1,3

2,3

2,3

Cognitive

25

Affective

55

100 %

20

1,2,3,

4

Psychomotor

20

25

1,2,3,

4

16

Mapping of the Course Outcomes to the Programme Educational Objectives:

LEARNIN

PROGRAMME EDUCATIONAL

G

OBJECTIVES

COURSE

DOMAINS

OUTCOME

PE PE PE PE PE PE PE

C A P

O1 O2 O3 O4 O5 O6 O7

Understand

the

mathematical

application relates to, /

/

/

/

/

/

/

finance

and

risk

management.

Derive and apply the

fundamental formulae

/

/

/

/

/

/

of

financial

mathematics.

TEACHING

ASSESSMEN

METHODOL

T

OGY

Lecture and

Tutorial

Lecture and

Tutorial

Verifying

the

mathematical accuracy /

of companies

Lecture and

Tutorial

Demonstrate ability to

use

decision-making

/

processes in making

financial decisions

Lecture and

Tutorial

Assignment,

Mid Semester

and Final

Exam

Assignment,

Mid Semester

and Final

Exam

Assignment,

Mid Semester

and Final

Exam

Assignments,

Project and

Final Exam

Programme Educational Objectives (PEO)

PEO1

PEO2

PEO3

PEO4

PEO5

PEO6

PEO7

To produce graduates who possess fundamental knowledge, principles and skills in

Internal Auditing and Management.

To produce graduates who have strong analytical and critical thinking skills to solve

problems by applying knowledge, principles and skills in Internal Auditing and

Management.

To produce graduates who possess the ability to exercise judgment, express opinion,

recommend desirable solutions and to recognize the impact of internal auditing on

individuals institutions.

To produce graduates who possess skills to integrate various auditing solutions.

To produce graduates who have communication, teamwork, leadership, interpersonal

skills, and aware of the social, ethical and legal responsibilities.

To produce graduates who possess skills for lifelong learning, research and career

development.

To produce graduates who have entrepreneurial skill and a broad business and real

world perspective.

17

Mapping of the Course Outcomes to the Programme Outcomes:

COURSE

OUTCOME

LEARNIN TEACHING

ASSESSME

G

METHODOLO

NT

DOMAINS

GY

PROGRAMME OUTCOMES

PO PO PO PO PO PO PO PO PO PO

C

1 2 3 4 5 6 7 8 9 10

Understand

the

mathematical

application relates /

to finance and risk

management.

Derive and apply

the fundamental

formulae of

/

financial

mathematics.

Verifying the

mathematical

accuracy of

companies

Demonstrate

ability to use

decision-making

processes in

making financial

decisions

Lecture and

Tutorial

Lecture and

Tutorial

Lecture and

Tutorial

Lecture and

Tutorial

Assignment,

Mid Semester

and Final

Exam

Assignment,

Mid Semester

and Final

Exam

Assignment,

Mid Semester

and Final

Exam

Assignments,

Project and

Final Exam

Programme Outcomes (PO)

Demonstrate knowledge and understanding of essential facts, concepts, principles, and

theories relating to Internal Auditing and Management.

(Cognitive)

Communicate effectively with peers, clients, superiors and maintain and strengthen

PO2

professional relationship with management and external auditors. (Affective)

Exercise judgment, express opinion and recommend desirable changes to existing

PO3

policies. (Cognitive, Psychomotor)

Examine records, processes and documents in order to arrive at reasoned conclusions

PO4

as to adequacy of internal control as a contribution to the proper and effective use of

resources. (Cognitive, Psychomotor)

PO5

Evaluate the institutions financial operation and risk. (Cognitive, Psychomotor)

Determine the level of compliance with rules and procedures of Corporate Governance

PO6

and recommend desirable changes to existing policies. (Affective)

Investigate cases of misappropriation, misconduct and fraud. (Cognitive,

PO7

Psychomotor)

Demonstrate the standard professional practices of internal auditing and code of

PO8

ethics. (Affective)

Apply skills and principles of lifelong learning in academic and career

PO9

development (Affective)

Apply broad business and real world perspectives daily and demonstrate

PO10

entrepreneurial skills. (Affective)

CO

PO

L

T

P

Content Outline as per SLT topic:

PO1

18

(Hours of LLectures, T-Tutorials,

P-Practicals)

Auditing simple risk assessments.

- Probablilities

- Probabilities forecaster

- Calibration & Resolution

- Proper score Function.

- Audit point: Mismatched Interpretations of probability

- Audit point: Ignoring uncertainty about probabilities

- Audit point: Not using data to illuminate probabilities

- Outcomes represented without number and with number

Probability Distribution

- Discrete uniform distribution

- Audit point: Benfords Law

- Non-parametric distribution

- Type of Distributions Bernouli, Binomial, Poisson,

- Multinomial, Pareto, Triangular Distribution

- Audit Point

Auditing the design of business prediction models.

- Process

- Population

- Mathematical Model & Model Structure

Auditing the design of business prediction models.

- Optimization

- Prediction intervals

- Monte Carlo Simulation

- Regression

- Audit Point

Auditing model fitting and validation.

- Bayesian Model

- Hypothesis Testing

- Estimators

- Sampling Distribution

Auditing and Samples

- Sample

- Accessible population

- Sampling frame

- Types of sampling Method

Auditing in the world of high finance

- Extreme Values

- Stress Testing

- Portfolio Models

- Risk Metrics Variance Model

- Hedge

- Black-Scholes

19

1,2,3,4

1,2,3,4

1,2,4

1,2,4

1,2

1,2

1,2,3

1,2,3,4,5

1,2,3,9,

10

1,2,3,9,

10

1,2,3,9,

10

1,2,3,9,

10

9,10

TOTAL 30

18

References

1. Matthew Leitch (2010). A Pocket Guide to Risk Mathematics: Key Concepts Every Auditor Should

Know

Additional References

1.

20

Andrew Chambers & Graham Rand. (2010). The Operational Auditing Handbook: Auditing Business

and IT Processes, 2nd Edition

Others:

Nil

Vous aimerez peut-être aussi

- Course Guide Sem. 1 2011Document6 pagesCourse Guide Sem. 1 2011sir bookkeeperPas encore d'évaluation

- Agw610 Course Outline Sem 1 2013-14 PDFDocument12 pagesAgw610 Course Outline Sem 1 2013-14 PDFsamhensemPas encore d'évaluation

- FINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedDocument7 pagesFINN 400-Applied Corporate Finance-Atif Saeed Chaudhry-Fazal Jawad SeyyedYou VeePas encore d'évaluation

- ACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Document4 pagesACCT201 Corporate Reporting & Financial Analysis: Course Outline 2018/2019 Term 1Hohoho134Pas encore d'évaluation

- SyllabusDocument10 pagesSyllabus임민수Pas encore d'évaluation

- De cuong Tai chính doanh nghiệp 1 (tiếng Anh)Document12 pagesDe cuong Tai chính doanh nghiệp 1 (tiếng Anh)Faith Le100% (1)

- ACCT 411-Applied Financial Analysis-Atifa Arif DarDocument5 pagesACCT 411-Applied Financial Analysis-Atifa Arif Darnetflix accountPas encore d'évaluation

- ACCT 411-Applied Financial Analysis-Arslan Shahid Butt PDFDocument7 pagesACCT 411-Applied Financial Analysis-Arslan Shahid Butt PDFAbdul Basit JavedPas encore d'évaluation

- Lahore University of Management Sciences ACCT-411 Applied Financial AnalysisDocument7 pagesLahore University of Management Sciences ACCT-411 Applied Financial AnalysisusamaPas encore d'évaluation

- Module Handbook Sustainable Business 2018a (4) NEWDocument21 pagesModule Handbook Sustainable Business 2018a (4) NEWTrần ThiPas encore d'évaluation

- MGMT3101 International Business Strategy S22014Document24 pagesMGMT3101 International Business Strategy S22014BonnieBaoPas encore d'évaluation

- Applied Corporate FinanceDocument8 pagesApplied Corporate FinanceSafi Ullah KhanPas encore d'évaluation

- Finn 400 Outline Spring 2020 PDFDocument8 pagesFinn 400 Outline Spring 2020 PDFadam jamesPas encore d'évaluation

- Syllabus Finance Ii Course 2017-18: General InformationDocument4 pagesSyllabus Finance Ii Course 2017-18: General InformationDavidPas encore d'évaluation

- University of Petroleum & Energy Studies School of Business DehradunDocument8 pagesUniversity of Petroleum & Energy Studies School of Business DehradunHarshil JainPas encore d'évaluation

- Business GuideDocument37 pagesBusiness Guidevivi_15o689_11272315Pas encore d'évaluation

- Managerial Accounting-Qazi Saud AhmedDocument4 pagesManagerial Accounting-Qazi Saud Ahmedqazisaudahmed100% (1)

- FINN 400 Outline Fall 2020Document8 pagesFINN 400 Outline Fall 2020Zahra EjazPas encore d'évaluation

- FINS3616 - Course OutlineDocument15 pagesFINS3616 - Course OutlineJulie ZhuPas encore d'évaluation

- POM 102 SyllabusDocument8 pagesPOM 102 SyllabusmarkangeloarceoPas encore d'évaluation

- FINS5513 S2 2013 Course OutlineDocument12 pagesFINS5513 S2 2013 Course OutlineTanya HoPas encore d'évaluation

- ACCT 100-Principles of Financial Accounting - Asad Alam-Ayesha Bhatti-Syed Zain Ul AbidinDocument7 pagesACCT 100-Principles of Financial Accounting - Asad Alam-Ayesha Bhatti-Syed Zain Ul AbidinmuhammadmusakhanPas encore d'évaluation

- FINN 454-Portfolio Management-Salman KhanDocument7 pagesFINN 454-Portfolio Management-Salman KhanManojPas encore d'évaluation

- Course Outline Aacsb Mba 611 Management AccountingDocument6 pagesCourse Outline Aacsb Mba 611 Management AccountingNishant TripathiPas encore d'évaluation

- Course Outline FINS3616Document12 pagesCourse Outline FINS3616Erica DaviesPas encore d'évaluation

- Syllabus Practicum B.ecDocument4 pagesSyllabus Practicum B.ecJoel BellPas encore d'évaluation

- ACCT3583 Management Accounting 2 S2-2015 Course OutlineDocument22 pagesACCT3583 Management Accounting 2 S2-2015 Course OutlineVanessa HuangPas encore d'évaluation

- International Business SyllabusDocument5 pagesInternational Business SyllabusTeguh SulistiyonoPas encore d'évaluation

- Subject OutlineDocument8 pagesSubject OutlineGurrajvin SinghPas encore d'évaluation

- FINN 100-Salman Khan Spring 2019Document8 pagesFINN 100-Salman Khan Spring 2019Qudsia AbbasPas encore d'évaluation

- FINN 400 Outline Fall 2021Document8 pagesFINN 400 Outline Fall 2021Waris AliPas encore d'évaluation

- ACCT 221-Corporate Financial Reporting-Atifa Dar-Waqar AliDocument6 pagesACCT 221-Corporate Financial Reporting-Atifa Dar-Waqar AliDanyalSamiPas encore d'évaluation

- IRLL Course File 2023Document14 pagesIRLL Course File 2023Hema LathaPas encore d'évaluation

- ACCT3114A - Valuation Using Financial Statements - Dr. Jing LiDocument8 pagesACCT3114A - Valuation Using Financial Statements - Dr. Jing LiTheo GalvannyPas encore d'évaluation

- FINS3625 Course OutlineDocument18 pagesFINS3625 Course Outlineriders29Pas encore d'évaluation

- FIN3024 Module Outline Mar 2014Document7 pagesFIN3024 Module Outline Mar 2014Gurrajvin SinghPas encore d'évaluation

- Fin MGT Course Plan 012 FebDocument7 pagesFin MGT Course Plan 012 FebOmkar PandeyPas encore d'évaluation

- SFAD - Course OutlineDocument10 pagesSFAD - Course OutlineMuhammad Shariq SiddiquiPas encore d'évaluation

- FINS5538 Takeovers Restructuring and Corporate Governance S12013Document16 pagesFINS5538 Takeovers Restructuring and Corporate Governance S12013nabil19830% (1)

- Faculty of Economics and Business Universitas Gadjah Mada Undergraduate Program Syllabus Aku 1601 - Introductory AccountingDocument4 pagesFaculty of Economics and Business Universitas Gadjah Mada Undergraduate Program Syllabus Aku 1601 - Introductory Accountingaurelia kaneishaPas encore d'évaluation

- MBA Program Details - London School of CommerceDocument27 pagesMBA Program Details - London School of CommerceKhampa Ngawang PhuntshoPas encore d'évaluation

- Course SpecificationDocument8 pagesCourse SpecificationmohsinameerPas encore d'évaluation

- FINS3641 Course Outline (Part A B Combined) S12014 CurrentDocument18 pagesFINS3641 Course Outline (Part A B Combined) S12014 CurrentDeagle_zeroPas encore d'évaluation

- Middle Managers in Program and Project Portfolio ManagementD'EverandMiddle Managers in Program and Project Portfolio ManagementPas encore d'évaluation

- Wales MBA ModulesDocument163 pagesWales MBA ModulesNada MorisPas encore d'évaluation

- FM 2 and ELECT 2 Financial Analysis and Reporting OBE SyllabusDocument12 pagesFM 2 and ELECT 2 Financial Analysis and Reporting OBE SyllabusJay Bee Salvador83% (6)

- m2015 Iva Espf Salman KhanDocument7 pagesm2015 Iva Espf Salman KhanAffan AliPas encore d'évaluation

- 1 Course Outline - Accounting For Managers - AY - 2022 - 2023Document7 pages1 Course Outline - Accounting For Managers - AY - 2022 - 2023Mansi GoelPas encore d'évaluation

- Standard For HSM UMT (Corporate Finance)Document6 pagesStandard For HSM UMT (Corporate Finance)Ali APas encore d'évaluation

- UoS Outline FINC2011 SEM2 2014 ApprovedDocument6 pagesUoS Outline FINC2011 SEM2 2014 ApprovedericaPas encore d'évaluation

- ACCT1511 Accounting and Financial Management 1B S12015Document16 pagesACCT1511 Accounting and Financial Management 1B S12015Bob CaterwallPas encore d'évaluation

- 5522-Business Policy and StrategyDocument12 pages5522-Business Policy and Strategyیاسر محمود ملکPas encore d'évaluation

- Finm3401 Ecp 2013Document14 pagesFinm3401 Ecp 2013dmscott10Pas encore d'évaluation

- Financial Reporting Accounting MBA SyllabusDocument4 pagesFinancial Reporting Accounting MBA SyllabusMohammed NaderPas encore d'évaluation

- LATEST A191 BWFF2043 SyllabusDocument7 pagesLATEST A191 BWFF2043 SyllabusVaradan K RajendranPas encore d'évaluation

- Management Accounting PDFDocument6 pagesManagement Accounting PDFSukalp MittalPas encore d'évaluation

- Unit Outline FINS1612 Sem2 2015Document17 pagesUnit Outline FINS1612 Sem2 2015nooguPas encore d'évaluation

- ENT 302 Feasibilities and Business PlanningDocument243 pagesENT 302 Feasibilities and Business PlanningKaviPas encore d'évaluation

- The Power of Project ManagementDocument53 pagesThe Power of Project ManagementWinson PhuaPas encore d'évaluation

- IMP-DH44ISB-1 Integrated Business Project K44 FINALDocument12 pagesIMP-DH44ISB-1 Integrated Business Project K44 FINALThu Hiền KhươngPas encore d'évaluation

- Ica Ca2Document1 pageIca Ca2wirdinaPas encore d'évaluation

- Buss TechDocument5 pagesBuss TechwirdinaPas encore d'évaluation

- IT Auditing in SDLC Part IIDocument15 pagesIT Auditing in SDLC Part IIwirdinaPas encore d'évaluation

- 0319 WTA Lab10Document3 pages0319 WTA Lab10wirdinaPas encore d'évaluation

- IT Audit Exercise 2Document1 pageIT Audit Exercise 2wirdinaPas encore d'évaluation

- DB Tut5Document2 pagesDB Tut5wirdinaPas encore d'évaluation

- Icn Supp Exam QuestionDocument7 pagesIcn Supp Exam QuestionwirdinaPas encore d'évaluation

- IT Auditing in SDLC Part IDocument44 pagesIT Auditing in SDLC Part IwirdinaPas encore d'évaluation

- AuditingDocument1 pageAuditingwirdinaPas encore d'évaluation

- 0319 Wta T6Document1 page0319 Wta T6wirdinaPas encore d'évaluation

- IT Audit ControlDocument54 pagesIT Audit ControlwirdinaPas encore d'évaluation

- WTA Lab RubricsDocument1 pageWTA Lab RubricswirdinaPas encore d'évaluation

- IT Audit ExerciseDocument1 pageIT Audit ExercisewirdinaPas encore d'évaluation

- Mms ProjectDocument3 pagesMms ProjectwirdinaPas encore d'évaluation

- Toc Umar FypDocument14 pagesToc Umar FypwirdinaPas encore d'évaluation

- 0319 Wta T7Document3 pages0319 Wta T7wirdinaPas encore d'évaluation

- 0319 WTA Lab1Document2 pages0319 WTA Lab1wirdinaPas encore d'évaluation

- WTA Lab RubricsDocument1 pageWTA Lab RubricswirdinaPas encore d'évaluation

- 04PMDocument18 pages04PMwirdinaPas encore d'évaluation

- VB L1Document6 pagesVB L1wirdinaPas encore d'évaluation

- Institution One Name, City, Country, Institution Two Name, City, CountryDocument1 pageInstitution One Name, City, Country, Institution Two Name, City, CountrywirdinaPas encore d'évaluation

- 00PMDocument6 pages00PMwirdinaPas encore d'évaluation

- Curriculum Vitae: My Career ObjectiveDocument2 pagesCurriculum Vitae: My Career ObjectivewirdinaPas encore d'évaluation

- 05PMDocument43 pages05PMwirdinaPas encore d'évaluation

- 01PMDocument35 pages01PMwirdinaPas encore d'évaluation

- Faculty of Business and Management Industrial Training LogbookDocument3 pagesFaculty of Business and Management Industrial Training LogbookwirdinaPas encore d'évaluation

- 02PMDocument46 pages02PMwirdinaPas encore d'évaluation

- 03PMDocument18 pages03PMwirdinaPas encore d'évaluation

- FBM Itn Appendix A l1Document1 pageFBM Itn Appendix A l1wirdinaPas encore d'évaluation

- 0216 - WT CoDocument4 pages0216 - WT CowirdinaPas encore d'évaluation

- Writing Style AssignmentDocument2 pagesWriting Style AssignmentAlaka rajeev.Pas encore d'évaluation

- Phrase Cloze: A Better Measure of Reading?Document19 pagesPhrase Cloze: A Better Measure of Reading?Ever After BeautiquePas encore d'évaluation

- Writing ObjectivesDocument22 pagesWriting ObjectiveswintermaePas encore d'évaluation

- ELS 133 - ApproachesDocument64 pagesELS 133 - ApproachesRJEREEPas encore d'évaluation

- For D.R. S.I.M.O.N.S.O.N DiEiMIiRiAiY About Mieitia CioimimiuiniiiciaitiiioiiniDocument324 pagesFor D.R. S.I.M.O.N.S.O.N DiEiMIiRiAiY About Mieitia CioimimiuiniiiciaitiiioiiniJk McCreaPas encore d'évaluation

- KHDA - Dubai British School 2016-2017Document26 pagesKHDA - Dubai British School 2016-2017Edarabia.comPas encore d'évaluation

- A Corpus-Based Analysis of Errors in Spanish EFL WritingsDocument14 pagesA Corpus-Based Analysis of Errors in Spanish EFL WritingsElla Mansel (Carmen M.)Pas encore d'évaluation

- Double Your Brain PowerDocument5 pagesDouble Your Brain PowerURVAAPas encore d'évaluation

- Cae Speaking ExpressionsDocument8 pagesCae Speaking ExpressionsVerónica CastroPas encore d'évaluation

- Types of Speech ContextDocument14 pagesTypes of Speech ContextArianne SagumPas encore d'évaluation

- TKT Young Learners Worksheets: With Trainer NotesDocument92 pagesTKT Young Learners Worksheets: With Trainer NotesThu NaingPas encore d'évaluation

- Martha Rogers: Presented By: Lyndsi Byers, Geena Griffin, Chelsea Hoy and Mallory ShepardDocument18 pagesMartha Rogers: Presented By: Lyndsi Byers, Geena Griffin, Chelsea Hoy and Mallory ShepardChelsea Hoy100% (2)

- Lecture 11 May VygotskyDocument20 pagesLecture 11 May VygotskyAx RyuxPas encore d'évaluation

- Mastering Word and ExcelDocument17 pagesMastering Word and ExceladrianoedwardjosephPas encore d'évaluation

- True 3 Little Pigs LPDocument4 pagesTrue 3 Little Pigs LPapi-384512330Pas encore d'évaluation

- Human Amygdala Activity During The Expression of Fear ResponsesDocument9 pagesHuman Amygdala Activity During The Expression of Fear ResponsesIoana MacariePas encore d'évaluation

- Sensory Integration and Praxis Patterns in Children With AutismDocument9 pagesSensory Integration and Praxis Patterns in Children With AutismadriricaldePas encore d'évaluation

- Department of Education: Proposed Guidance Program For S.Y. 2022-2023Document3 pagesDepartment of Education: Proposed Guidance Program For S.Y. 2022-2023Jomelle Ann Pasol ValdezPas encore d'évaluation

- Alfred North WhiteheadDocument5 pagesAlfred North WhiteheadVEEJAY SAULOGPas encore d'évaluation

- Evans Dual Processing 2008Document27 pagesEvans Dual Processing 2008PatrickBrown1100% (1)

- Essay Technology ImportanceDocument3 pagesEssay Technology ImportanceCyrah CapiliPas encore d'évaluation

- English Unit 4 Draft TG PDFDocument94 pagesEnglish Unit 4 Draft TG PDFAnime AddictPas encore d'évaluation

- English Language Learning Difficulty of Korean Students in A Philippine Multidisciplinary UniversityDocument10 pagesEnglish Language Learning Difficulty of Korean Students in A Philippine Multidisciplinary UniversityMatt ChenPas encore d'évaluation

- SecondLanguageAcademicWriting PDFDocument338 pagesSecondLanguageAcademicWriting PDFRaiza Basatan CanillasPas encore d'évaluation

- IsiNdebele For Beginners. Northern Ndebele Language in Africa LessonsDocument1 pageIsiNdebele For Beginners. Northern Ndebele Language in Africa LessonsMimy MurengaPas encore d'évaluation

- Ipcrf-Development-Plan-2023-2024 1Document3 pagesIpcrf-Development-Plan-2023-2024 1Gloria Tolentino100% (48)

- A Basic Modern Russian GrammarDocument4 pagesA Basic Modern Russian GrammarkktuaPas encore d'évaluation

- Resumen Unit 1 Unit 2Document6 pagesResumen Unit 1 Unit 2brunoblinkPas encore d'évaluation

- First Class English For It 1° ClassDocument19 pagesFirst Class English For It 1° ClassPame WernliPas encore d'évaluation

- Values-Based Holistic Approach - OutlineDocument3 pagesValues-Based Holistic Approach - OutlineLara Sabunod - Pallo100% (3)