Académique Documents

Professionnel Documents

Culture Documents

SRS For Atm

Transféré par

kabhinavDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

SRS For Atm

Transféré par

kabhinavDroits d'auteur :

Formats disponibles

SOFTWARE REQUIREMENT SPECIFICATION

ATM

SYSTEM

1. Introduction

1.1.

Purpose

To develop software required for supporting computerized banking network.

1.2.

Document conventions

a. Account

A single account at a bank against which transactions can be applied. Accounts may be of

various types with at least checking and savings. A customer can hold more than one acc

ount.

b. Max Daily Withdrawal

The maximum amount of cash that a customer can withdraw from an account in a day

via ATMs.

c. PIN

It refers to Personal Identification Number. Used to identify and validate the login of an A

TM user.

1.3.

Intended audience and reading suggestions

Software designers

Software developers

Software testers

Customers

1.4.

Product scope

The ATM identifies a customer by a cash card and password. It collects

information about a simple account transaction (example deposit, withdrawal,

transfer, bill payment), communicates the transaction information to the

customers bank, and dispenses cash to the customer.

1.5.

References

2. Overall description

2.1.

Product perspective

An automated teller machine (ATM) is a computerized telecommunications device that

Provides the customers of a financial institution with access to financial trnsactions in a

Public space without the need for a human clerk or bank teller. On most modern ATMs,

The customer is identified by inserting a plastic ATM card with a magnetic stripe or a

Plastic smartcard with a chip that contains a unique card number and some security

Information, such as an expiration date or CVC (CVV). Security is provided by the customer ent

ering a personal identification number (PIN).

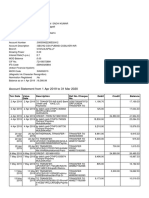

Figure showing ATM network

2.2.

Product functions

Using an ATM, customers can access their bank accounts in order to make cash withdrawals (or

credit card cash advances) and check their account balances.

The functions of the system are:

1. Login

2. Get Balance Information

3. Withdraw Cash

4. Generate receipt

2.3.

User classes and characteristics

No classes

2.4.

Operating environment

Any standard format like

Ability to read the ATM card

Ability to count currency notes

Ability to connect to bank

Ability to take input from user

Touch screen convenience

2.5.

Design and implementation constraints

2.6.

NA

User Documentation

NA

2.7.

Assumptions and dependencies

Hardware never fails

Limited amount of money per transaction

3. External interface requirements

3.1.

User interfaces

The customer user interface should be intuitive, such that 99.9% of all new ATM users

Are able to complete their banking transactions without any assistance.

3.2.

Hardware interfaces

The hardware should have following specifications:

Ability to read the ATM card

Ability to count the currency notes

Touch screen for convenience

Keypad (in case touchpad fails)

Continuous power supply

Ability to connect to banks network

Ability to take input from user

Ability to validate user.

3.3.

Software interfaces

The software requirements at the user end are:

1. Operating system: windows 98/2000/xp/Vista

2. Languages supported: java (Front end)

3. Database: Microsoft Access (Back end)

4. MS-Office

3.4.

Communication interfaces

These are protocols that are needed to directly interact with the customers. Apart from

these protocols, to maintain a healthy relationship with the customer, both formal and

informal meetings, group discussions and technical meetings will be conducted

frequently.

3. System features

3.1. Authorization

The authorization starts after a customer has entered his card in the ATM, The ATM has to

check if the entered card is a valid cash card

Input

Customer enters the cash card

Processing

Check if it is a valid cash card It will be valid if

1. the information on the card can be read

2. it is not expired

Output

Display error message and return cash card if it is invalid Functional.

3.2. Issue money

The client enters inserts into the ATM machine. It asks for PIN and checks authorization,

If the client has enough credit in his account, he will be permitted to carry out a valid

transaction. The momentary value of the transaction will be deducted from his system. Then

ATM will issue the currency notes and thus transaction is completed.

3.3. Transaction Summery

After a complete transaction, the client will get receipt, if the client request details about his

last transaction and current balance in the account.

3.4.

Value Added Services

Other value added services include transact money from one ATM to another ATM.

4. Other Non-functional Requirements

4.1. Performance Requirements:

It must be able to perform in adverse conditions like high/low temperature etc.

Uninterrupted Interrupted connections

High Data transfer rate

4.2. Safety requirements:

Must be safe kept in physical aspects, say in a cabin

Must have emergency phone outside the cabin

The cabin door must have a TM card swipe slot

4.3. Security requirements

Users accessibility is censored in all the ways

Users are advised to change their PIN in first issue

Users are advised not to tell their PIN to anyone

The maximum number of attempts to enter PIN will be 3

Software quality attributes: NA

Vous aimerez peut-être aussi

- Hacking Point of Sale: Payment Application Secrets, Threats, and SolutionsD'EverandHacking Point of Sale: Payment Application Secrets, Threats, and SolutionsÉvaluation : 5 sur 5 étoiles5/5 (1)

- Creditcardprocessing SEprojectDocument12 pagesCreditcardprocessing SEprojectMalla Abhinaya100% (2)

- ATM Management SystemDocument2 pagesATM Management SystemKanu Priya100% (1)

- ATM CasestudyDocument74 pagesATM Casestudycool61994% (18)

- Credit Card Processing: Problem StatementDocument48 pagesCredit Card Processing: Problem StatementAravind Duda100% (3)

- Srs Credit Card Version2Document11 pagesSrs Credit Card Version2Ciddarth Viswanathan63% (8)

- ATM System Problem StatementsDocument2 pagesATM System Problem StatementsMD BIKASH SK0% (1)

- SRS of ATMDocument7 pagesSRS of ATMZulfiquar Hadi80% (44)

- ATM Simulation Full DoCumEntary With CodeDocument114 pagesATM Simulation Full DoCumEntary With CodeDeepak Kumar Rajak76% (34)

- ATM Documentation DOCUMENTDocument122 pagesATM Documentation DOCUMENTSuhan Dheer67% (3)

- Mini Project On Atm MachineDocument5 pagesMini Project On Atm Machinemalvikakishor71% (7)

- 1 Passport Automation System PDFDocument22 pages1 Passport Automation System PDFganesh0% (1)

- 2.book Bank Management SystemDocument68 pages2.book Bank Management SystemSuriyan Raveendiran Rajeswari67% (6)

- DFD For ATM SystemDocument15 pagesDFD For ATM Systemiyerveena08100% (2)

- Srs of Bank Management SystemDocument34 pagesSrs of Bank Management Systemhello moto0% (1)

- SRS DocumentDocument6 pagesSRS DocumentHarikesh MauryaPas encore d'évaluation

- Foreign Trading System ReportDocument45 pagesForeign Trading System Reportabinsha78% (9)

- Project Report: Atm Management SystemDocument47 pagesProject Report: Atm Management SystemRohit Kumar100% (2)

- Passport Automation SystemDocument14 pagesPassport Automation SystemBoova Ragavan20% (5)

- ATM SynopsisDocument22 pagesATM Synopsissudhakar kethana100% (4)

- Online Course Reservation SystemDocument56 pagesOnline Course Reservation SystemAisha Saran80% (5)

- Atm Management SystemDocument19 pagesAtm Management SystemSrini Vasan kp100% (1)

- E-Book MaanagementDocument12 pagesE-Book MaanagementSangeethRaj PS100% (1)

- Bank Management SystemDocument25 pagesBank Management Systemsonabeta07100% (2)

- Credit Card Management SystemDocument2 pagesCredit Card Management Systemprathikfrndz50% (2)

- HDFC Software Requirement Specification SrsDocument24 pagesHDFC Software Requirement Specification SrsAshish Roushan100% (1)

- Atm SystemDocument6 pagesAtm SystemJaydip PatelPas encore d'évaluation

- Srs Document For Tour Guide SystemDocument4 pagesSrs Document For Tour Guide Systemsibhat mequanintPas encore d'évaluation

- SRS On PDFDocument12 pagesSRS On PDFPankaj67% (3)

- Credit Card ProcessingDocument64 pagesCredit Card ProcessingRaj Praveen100% (1)

- Foreign Trading System Project ReportDocument42 pagesForeign Trading System Project ReportAnonymous SwS8ipxbd80% (5)

- ATM Simulator: PHP ProjectDocument22 pagesATM Simulator: PHP ProjectBhushan TalwarePas encore d'évaluation

- Project Report On ATM SystemDocument54 pagesProject Report On ATM Systemdavidcooper0250% (1)

- Bank Management SystemDocument16 pagesBank Management SystemDarade AkankshaPas encore d'évaluation

- Conference Management System (UML Sequence and Collaboration Diagram)Document12 pagesConference Management System (UML Sequence and Collaboration Diagram)Siva siva100% (2)

- OOAD Project - Book Bank Management SystemDocument14 pagesOOAD Project - Book Bank Management SystemTorfe RaajPas encore d'évaluation

- ATM Simulator SynopsisDocument12 pagesATM Simulator SynopsisVatsal Pathak100% (2)

- ATM Management SystemDocument13 pagesATM Management SystemDarshan Chindarkar50% (2)

- Passport Automation SystemDocument16 pagesPassport Automation Systempranav0% (1)

- Atm Simulation Final ReportDocument102 pagesAtm Simulation Final ReportPratiyushJuyal33% (9)

- Online Crime RepotingDocument125 pagesOnline Crime RepotingKrishna Nand Nagavelli100% (1)

- Software Requirement Specification For Banking SystemDocument24 pagesSoftware Requirement Specification For Banking SystemDhawal Bhatia83% (6)

- SRS Student ManagementDocument16 pagesSRS Student ManagementShuja Shabbir100% (1)

- Atm System PDFDocument19 pagesAtm System PDFmani100% (1)

- Credit Card Processing System: CS8582-Object Oriented Analysis and Design LabDocument16 pagesCredit Card Processing System: CS8582-Object Oriented Analysis and Design LabGANESHKARTHIKEYAN V100% (4)

- Bank Management System CDocument105 pagesBank Management System CManish Kumar100% (3)

- SE Lab Manual R18Document60 pagesSE Lab Manual R18Sai Krishna100% (1)

- Passport Automation System Srs PDFDocument5 pagesPassport Automation System Srs PDFPadmanaban MPas encore d'évaluation

- Software Requirements Specification: For Foreign Trading SystemDocument12 pagesSoftware Requirements Specification: For Foreign Trading SystemS ThavasumoorthiPas encore d'évaluation

- ATM Project DescriptionDocument2 pagesATM Project Descriptionpayal_mehra21100% (3)

- SRS For ATM SystemDocument21 pagesSRS For ATM SystemUrja DhabardePas encore d'évaluation

- Embed Ed SystemDocument9 pagesEmbed Ed SystemEminaTopalovićPas encore d'évaluation

- Product Design Specification: Automatic Teller Machine (Atm)Document10 pagesProduct Design Specification: Automatic Teller Machine (Atm)EminaTopalovićPas encore d'évaluation

- ATM DescriptionDocument8 pagesATM DescriptionKomal SrivastavPas encore d'évaluation

- Software Requirements SpecificationDocument10 pagesSoftware Requirements Specificationvarun sagarPas encore d'évaluation

- SRS and Design For Banking MGT SystemDocument16 pagesSRS and Design For Banking MGT Systemiboy TechPas encore d'évaluation

- Software Engineering Project November 2011 Developer TeamDocument25 pagesSoftware Engineering Project November 2011 Developer TeamHamza MasoodPas encore d'évaluation

- Pranjal SEDocument39 pagesPranjal SEHarry potterPas encore d'évaluation

- SRS Atm FinalDocument4 pagesSRS Atm FinalArmaanPas encore d'évaluation

- Cloud AtmDocument24 pagesCloud AtmNagesh Lakshminarayan100% (1)

- RtiDocument14 pagesRtiPRAMOD PANDITPas encore d'évaluation

- Secure Atm Using Card Scan....... ProjectDocument8 pagesSecure Atm Using Card Scan....... ProjectCH Abdul RahmanPas encore d'évaluation

- MozillaDocument1 pageMozillaDonkada Mohana vamsiPas encore d'évaluation

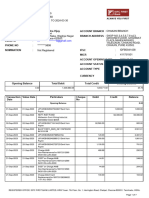

- Account Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument7 pagesAccount Statement From 1 Apr 2019 To 31 Mar 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSadhi KumarPas encore d'évaluation

- Report Atmmachine1Document8 pagesReport Atmmachine1Isse Essi100% (2)

- HSBC Personal Banking Hotline User Guide (2233 3000) : Please Select Language Cantonese English PutonghuaDocument3 pagesHSBC Personal Banking Hotline User Guide (2233 3000) : Please Select Language Cantonese English PutonghuaSaxon ChanPas encore d'évaluation

- Nokia 1680Document61 pagesNokia 1680kor_m8Pas encore d'évaluation

- HIPLA - Visitor Management SystemDocument32 pagesHIPLA - Visitor Management SystemFuture NetwingsPas encore d'évaluation

- Atm - Screen - Flow STD Chrted BankDocument11 pagesAtm - Screen - Flow STD Chrted BankJayavant MaliPas encore d'évaluation

- User Manual 2383622Document62 pagesUser Manual 2383622Mohammad Abdullah BawtagPas encore d'évaluation

- EMVDocument29 pagesEMVrajainfosysPas encore d'évaluation

- Idfc Bank 4160Document7 pagesIdfc Bank 4160manishasurywanshi91Pas encore d'évaluation

- MTP850说明书Document254 pagesMTP850说明书1012268087Pas encore d'évaluation

- Rational Cloze ExerciseDocument44 pagesRational Cloze ExerciseAzie Karim33% (3)

- CM-4G-GPS Quick Guide: Short Guide How To Start Using CM-GPRS ModuleDocument4 pagesCM-4G-GPS Quick Guide: Short Guide How To Start Using CM-GPRS Modulezakki ahmadPas encore d'évaluation

- EMV SWG NH20r2a Issuer Security Guidelines For 1st Gen August2018Document78 pagesEMV SWG NH20r2a Issuer Security Guidelines For 1st Gen August2018This FPas encore d'évaluation

- Tender Document - PCI PIN - QRDocument6 pagesTender Document - PCI PIN - QRAbu Sufian MahiPas encore d'évaluation

- Nokia 6610 Manual PDFDocument141 pagesNokia 6610 Manual PDFaasdcdcPas encore d'évaluation

- HUAWEI HG533 User Manual (02, English, General Version)Document40 pagesHUAWEI HG533 User Manual (02, English, General Version)Nicolás Daza AlzatePas encore d'évaluation

- Artificial Intelligence AI Security: Preventative Measures 1)Document5 pagesArtificial Intelligence AI Security: Preventative Measures 1)Ajin PaulPas encore d'évaluation

- Password Based Door Lock System: International Research Journal of Engineering and Technology (IRJET)Document4 pagesPassword Based Door Lock System: International Research Journal of Engineering and Technology (IRJET)Pankaj KumarPas encore d'évaluation

- Bank Alfala HCBFDocument59 pagesBank Alfala HCBFNaaz SikandarPas encore d'évaluation

- Modular AzkoyenDocument21 pagesModular AzkoyenfrankvcPas encore d'évaluation

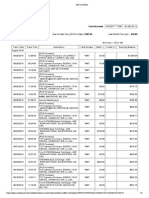

- Account Statement From 1 Apr 2020 To 13 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument2 pagesAccount Statement From 1 Apr 2020 To 13 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePraveen Kumar pkPas encore d'évaluation

- CMPIC 3 Library DataDocument39 pagesCMPIC 3 Library DatabuturcasPas encore d'évaluation

- Internal Revenue Service Office of SafeguardsDocument47 pagesInternal Revenue Service Office of Safeguardsmabkhout aliwiPas encore d'évaluation

- My Card Place PDFDocument3 pagesMy Card Place PDFDIGITAL PATRIOTSPas encore d'évaluation

- Face Recognition Technology 4U9Document18 pagesFace Recognition Technology 4U9nikhilacha9177Pas encore d'évaluation

- Mallareddy Institute of Engineering & TechnologyDocument15 pagesMallareddy Institute of Engineering & TechnologyMeghana YerraPas encore d'évaluation

- Usage Guide - Rewards Plus PDFDocument8 pagesUsage Guide - Rewards Plus PDFHemant JainPas encore d'évaluation