Académique Documents

Professionnel Documents

Culture Documents

Press Release 1H2015 Net Income Negatively Impacted by Depressed Metal Prices Highlights

Transféré par

JovyEscalanteTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Press Release 1H2015 Net Income Negatively Impacted by Depressed Metal Prices Highlights

Transféré par

JovyEscalanteDroits d'auteur :

Formats disponibles

July 29, 2015

PRESS RELEASE

1H2015 NET INCOME NEGATIVELY IMPACTED BY DEPRESSED METAL PRICES

HIGHLIGHTS

1H2015 REPORTED NET INCOME AT P565 MILLION (1H2014: P600 MILLION)

1H2015 NET INCOME ATTRIBUTABLE TO EQUITY HOLDERS OF PARENT AT P607

MILLION (1H014: P627 MILLION)

1H2015 GOLD AND COPPER PRICES LOWEST IN THE LAST FIVE YEARS; GOLD

DOWN BY 11% AND COPPER BY 16% FROM LAST YEAR

EBITDA MARGIN IMPROVED TO 34% (1H2014: 33%) AMIDST 17% REDUCTION IN

COSTS AND EXPENSES

PROGRESS CONTINUES ON SILANGANS DEFINITIVE FEASIBILITY STUDY

Manila, Philippines The Board of Directors of Philex Mining Corporation (PSE:PX) (the

Company or PX) today announced that its first half 2015 financial and operating

performance delivered a Net Income of P565 million, 6 percent lower than 2014s P600 million,

as global metal prices continued to slump.

Net Income Attributable to Equity Holders of the Parent Company was at P607 million

(1H2014: 627 million) while Core Net Income amounted to P520 million (1H2014: P559

million).

Production and Revenues

Padcal mine operated for 178 days in the first six months of 2015 and milled 4.47 million

tonnes of ore. The tonnage translated to 53,689 ounces of gold produced (1H2014: 52,286

ounces) as grades improved to 0.442 grams/tonne (g/t) (1H2014: 0.436 g/t). Meanwhile,

copper output reached 16.9 million pounds (1H2014: 18.2 million pounds) with copper grades

slightly lower at 0.206% (1H2014: 0.218%).

These resulted in revenues of P2.894 billion for gold (1H2014: P3.088 billion) and P1.870

billion for copper (1H2014: P2.453 billion) as average realized prices for gold were lower by 11

percent at US$1,190 per ounce (1H2014: US$1,341 per ounce) and while copper prices were

lower by 16 percent at US$2.61 per pound (1H2014: US$3.09 per pound). These price levels

were the lowest recorded in the last five years.

Revenues from petroleum and other sources, which were affected by lower output and volatility

in world crude prices, fell to P83.5 million (1H2014: P197.8 million) while revenues from silver

amounted P37.6 million (1H2014: P43.0 million).

Total consolidated revenues for the period amounted to P4.886 billion (1H2014: P5.782 billion).

Costs and Expenses

As the external environment remained extremely challenging, the Company remained

relentless in managing its costs and reducing expenses across all fronts. As a result,

consolidated operating cost and expenses in the first half of 2015 were 17 percent lower yearon-year at P3.728 billion (1H2014: P4.468 billion). Specifically, cash production costs went

down 14 percent to P2.335 billion (1H2014: P2.706 billion) while general and administrative

expenses decreased 33 percent to P363.8 million (1H2014: P540.0 million).

This translated to an improved EBITDA margin of 34 percent (1H2014: 33 percent), with

operating margin maintained at 17 percent (1H2014: 17 percent).

Net other income amounted to P62.5 million in 1H2015 and reversed the P62.3 million in net

other charges reported in 1H2014. In particular, net interest charges were reduced to P8.3

million compared with P153.4 million in the same period last year, attributed to the Companys

debt curtailment strategy started late last year.

As of end-June 2015, Parent Company short-term loans amounted to P3.630 billion from

P4.308 billion as of end-December 2014.

Outlook

As we navigate through the turbulent global developments, we remain focused on maximizing

our operating mine and at the same time setting our sights on the development of the Silangan

project. Right now, we are benefitting from our cost-containment measures and are confident

that the results of these initiatives will be more pronounced in the longer term, Philex President

and CEO Eulalio B. Austin, Jr. said.

Mr. Yulo E. Perez, President of Silangan Mindanao and Mining Co., Inc. (SMMCI), for his part

said, the Silangan project is progressing, with the necessary permits and documentation being

secured to enable the team to proceed with the next critical steps under SMMCIs early works

program.

**************************************

For further information, please contact:

Danny Y. Yu

Chief Financial Officer

Telephone: 631-1381 loc 289

Email: dyyu@philexmining.com.ph

Rolli S. Bondoy

Investor Relations

Telephone: 631-1381 loc 533

Email: rsbondoy@philexmining.com.ph

PHILEX MINING CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF INCOME

FOR THE SIX MONTHS ENDED JUNE 30, 2015 AND 2014

(Amounts in Peso Thousands, except Earnings Per Share)

2015

REVENUE

Gold

Copper

Silver

Petroleum & others

Less: Marketing charges

COSTS AND EXPENSES

Mining and milling costs ( including depletion

and depreciation)

General and administrative expenses

Excise taxes & royalties

Petroleum production costs

Handling, hauling and storage

Cost of coal sales

OTHER INCOME(CHARGES)

Gain on sale of AFS financial assets

Interest income

Interest expense

Foreign exchange gains (losses) - net

Others - net

INCOME BEFORE INCOME TAX

PROVISION FOR INCOME TAX

NET INCOME

NET INCOME ATTRIBUTABLE TO:

Equity Holders of the Parent Company

Non-controlling interests

CORE NET INCOME

BASIC EARNINGS PER SHARE

DILUTED EARNINGS PER SHARE

CORE NET INCOME PER SHARE

2014

2,894,336

1,870,356

37,564

83,452

4,885,708

403,439

4,482,269

3,087,995

2,452,730

43,044

197,754

5,781,523

424,984

5,356,539

3,032,343

363,846

240,671

54,124

36,555

3,727,539

3,514,810

540,032

280,627

87,938

41,830

2,794

4,468,031

107,088

2,640

(10,943)

(27,803)

(8,459)

62,523

817,253

(252,446)

564,807

9,190

(162,614)

94,777

(3,614)

(62,261)

826,247

(225,787)

600,460

606,974

(42,167)

564,807

626,949

(26,489)

600,460

519,728

0.1229

0.1229

0.1052

559,034

0.1270

0.1270

0.1132

PHILEX MINING CORPORATION AND SUBSIDIARIES

CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Amounts in Peso Thousands, except Par Value Per Share)

ASSETS

Current Assets

Cash and cash equivalents

Accounts receivable

Inventories

Derivative assets

Other current assets

Total Current Assets

Noncurrent Assets

Property, Plant and Equipment - net

Available-for-sale (AFS) financial assets

Goodwill

Deferred income tax assets

Deferred exploration costs and other noncurrent assets

Total Noncurrent Assets

TOTAL ASSETS

LIABILITIES AND STOCKHOLDERS' EQUITY

Current Liabilities

Loans payable - current

Accounts payable and accrued liabilities

Income Tax Payable

Dividends payable

Provisions and subscriptions payables

Total Current Liabilities

Noncurrent Liabilities

Deferred income tax liabilities - net

Bonds payable

Pension obligation

Provision for losses and mine rehabilitation costs

Total Noncurrent Liabilities

Total Liabilities

Equity Attributable to Equity Holders of the Parent Company

Capital Stock - P1 par value

Additional paid-in capital

Retained Earnings

Unappropriated

Appropriated

Net unrealized (loss) gain on AFS financial assets

Equity conversion option

Cumulative translation adjustments

Net revaluation surplus

Effect of transactions with non-controlling interests

Non-controlling Interests

Total equity

TOTAL LIABILITIES & EQUITY

June 30

2015

(UNAUDITED)

December 31

2014

(AUDITED)

3,103,435

400,827

1,896,806

10,073

1,581,751

6,992,892

5,231,892

1,055,864

1,858,220

7,766

1,376,741

9,530,483

7,477,094

601,835

1,238,583

8,304

27,617,103

36,942,919

43,935,811

7,138,912

906,681

1,238,583

8,224

25,817,465

35,109,865

44,640,348

3,629,745

1,750,648

102,686

484,850

498,573

6,466,502

4,307,720

1,795,755

47,423

488,818

883,102

7,522,818

3,994,510

6,099,680

23,940

576,618

10,694,748

17,161,250

3,859,141

5,947,366

43,585

225,618

10,075,710

17,598,528

4,940,399

1,138,009

4,940,399

1,117,627

5,218,365

10,000,000

(178,481)

1,225,518

58,362

1,611,397

(12,508)

24,001,061

2,773,500

26,774,561

43,935,811

4,712,032

10,000,000

(64,010)

1,225,518

37,370

1,611,397

19,084

23,599,417

3,442,403

27,041,820

44,640,348

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Ack 20190107Document1 pageAck 20190107JovyEscalantePas encore d'évaluation

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- July 10-2019 MEG-PR WESTERN VISAYAS¡ FIRST PREMIUM P2P BUS SERVICES TO BE LAUNCHED IN ILOILO BUSINESS PARKDocument3 pagesJuly 10-2019 MEG-PR WESTERN VISAYAS¡ FIRST PREMIUM P2P BUS SERVICES TO BE LAUNCHED IN ILOILO BUSINESS PARKJovyEscalantePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- ImportantMessageFromMetrobankCardCorporation 24975108Document1 pageImportantMessageFromMetrobankCardCorporation 24975108JovyEscalantePas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- JJDocument1 pageJJJovyEscalantePas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Address: Lamar Village, Sabang, Lipa City, BatangasDocument2 pagesAddress: Lamar Village, Sabang, Lipa City, BatangasJovyEscalantePas encore d'évaluation

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Cover Sheet: Vitar I CH Co R Porat IonDocument5 pagesCover Sheet: Vitar I CH Co R Porat IoncraftersxPas encore d'évaluation

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Globe BillDocument2 pagesGlobe BillJovyEscalantePas encore d'évaluation

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Requistes of DONATIONS of Road Lots andDocument2 pagesRequistes of DONATIONS of Road Lots andJovyEscalantePas encore d'évaluation

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- GGGDocument114 pagesGGGJovyEscalantePas encore d'évaluation

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- 9M 2018 URC Earnings Disclosure - PSE Press Release - 10.24 - ICLDocument2 pages9M 2018 URC Earnings Disclosure - PSE Press Release - 10.24 - ICLJovyEscalantePas encore d'évaluation

- 3Q18 Press Release - Third-Quarter Revenues Grow by 21% But Income Remains Flat Due To High CostsDocument2 pages3Q18 Press Release - Third-Quarter Revenues Grow by 21% But Income Remains Flat Due To High CostsJovyEscalantePas encore d'évaluation

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- First Metro Securities Brokerage Corp: Buy TransactionDocument1 pageFirst Metro Securities Brokerage Corp: Buy TransactionJovyEscalantePas encore d'évaluation

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- GDocument2 pagesGJovyEscalantePas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Top SecretDocument1 pageTop SecretJovyEscalantePas encore d'évaluation

- Draft Reply in PSE Disclosure Form 4-32 Format 445pmDocument2 pagesDraft Reply in PSE Disclosure Form 4-32 Format 445pmJovyEscalantePas encore d'évaluation

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- 2019 06-04 23B - Statement of Changes in Beneficial Ownership of Securities - DACONDocument4 pages2019 06-04 23B - Statement of Changes in Beneficial Ownership of Securities - DACONJovyEscalantePas encore d'évaluation

- 9mos 2018 Financial HighlightsDocument3 pages9mos 2018 Financial HighlightsJovyEscalantePas encore d'évaluation

- List of Published PN Ce Vacant Plantilla Positions Unit Address Position Title SGDocument6 pagesList of Published PN Ce Vacant Plantilla Positions Unit Address Position Title SGRezy MindoPas encore d'évaluation

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- Globe BillDocument2 pagesGlobe BillJovyEscalantePas encore d'évaluation

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- CS Form No. 9: Series of 2017Document1 pageCS Form No. 9: Series of 2017Anastacio VergaraPas encore d'évaluation

- Call To The Latest Current Version of Jquery in Place. So, Let Me Build Out My Script JavascriptDocument6 pagesCall To The Latest Current Version of Jquery in Place. So, Let Me Build Out My Script JavascriptJovyEscalantePas encore d'évaluation

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- 05 07 19 - Media Release - Petron Corporation Posts P124.6 Billion Consolidated Revenues For Q1 2019Document1 page05 07 19 - Media Release - Petron Corporation Posts P124.6 Billion Consolidated Revenues For Q1 2019JovyEscalantePas encore d'évaluation

- Cover Sheet: Month Day Month DayDocument31 pagesCover Sheet: Month Day Month DayJovyEscalantePas encore d'évaluation

- The Perfect Trading Routin1Document8 pagesThe Perfect Trading Routin1JovyEscalantePas encore d'évaluation

- New Microsoft Word DocumentDocument1 pageNew Microsoft Word DocumentJovyEscalantePas encore d'évaluation

- Lease ContractDocument6 pagesLease ContractJovyEscalantePas encore d'évaluation

- Mortgage Calculator From BankrateDocument6 pagesMortgage Calculator From BankrateJovyEscalantePas encore d'évaluation

- 08 08 16 - Media Release - Petron Posts P5.3 Billion Income in The First Half of 2016 On Stronger Sales.Document3 pages08 08 16 - Media Release - Petron Posts P5.3 Billion Income in The First Half of 2016 On Stronger Sales.JovyEscalantePas encore d'évaluation

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Changes in Working CapitalDocument26 pagesChanges in Working CapitalJovyEscalantePas encore d'évaluation

- TomorrowDocument1 pageTomorrowJovyEscalantePas encore d'évaluation

- Portfolio Write-UpDocument4 pagesPortfolio Write-UpJonFromingsPas encore d'évaluation

- Bahan Ajar Application LetterDocument14 pagesBahan Ajar Application LetterNevada Setya BudiPas encore d'évaluation

- Starbucks Progressive Web App: Case StudyDocument2 pagesStarbucks Progressive Web App: Case StudyYesid SuárezPas encore d'évaluation

- Makerere University Is Inviting Applications For Undergraduate Admissions On Private Sponsorship For Academic Year 2015/2016Document9 pagesMakerere University Is Inviting Applications For Undergraduate Admissions On Private Sponsorship For Academic Year 2015/2016The Campus TimesPas encore d'évaluation

- Eco EssayDocument3 pagesEco EssaymanthanPas encore d'évaluation

- A Sample Script For Public SpeakingDocument2 pagesA Sample Script For Public Speakingalmasodi100% (2)

- CSCU Module 08 Securing Online Transactions PDFDocument29 pagesCSCU Module 08 Securing Online Transactions PDFdkdkaPas encore d'évaluation

- Genie PDFDocument264 pagesGenie PDFjohanaPas encore d'évaluation

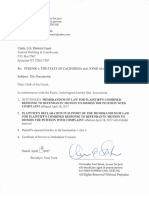

- STRUNK V THE STATE OF CALIFORNIA Etal. NYND 16-cv-1496 (BKS / DJS) OSC WITH TRO Filed 12-15-2016 For 3 Judge Court Electoral College ChallengeDocument1 683 pagesSTRUNK V THE STATE OF CALIFORNIA Etal. NYND 16-cv-1496 (BKS / DJS) OSC WITH TRO Filed 12-15-2016 For 3 Judge Court Electoral College ChallengeChristopher Earl Strunk100% (1)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Brachiocephalic Artery: AnteriorDocument37 pagesBrachiocephalic Artery: AnteriorFarah FarahPas encore d'évaluation

- Letter Writing: An Informative Powerpoint About LetterDocument11 pagesLetter Writing: An Informative Powerpoint About LetterMalik KamranPas encore d'évaluation

- Chapter 10 Planetary Atmospheres: Earth and The Other Terrestrial WorldsDocument27 pagesChapter 10 Planetary Atmospheres: Earth and The Other Terrestrial WorldsEdwin ChuenPas encore d'évaluation

- Material Safety Data Sheet: - AdsealDocument12 pagesMaterial Safety Data Sheet: - Adsealwuhan lalalaPas encore d'évaluation

- Portfolio AdityaDocument26 pagesPortfolio AdityaAditya DisPas encore d'évaluation

- API IND DS2 en Excel v2 10081834Document462 pagesAPI IND DS2 en Excel v2 10081834Suvam PatelPas encore d'évaluation

- Cad32gd - Contactor ManualDocument28 pagesCad32gd - Contactor Manualhassan karimiPas encore d'évaluation

- Present Perfect Tense ExerciseDocument13 pagesPresent Perfect Tense Exercise39. Nguyễn Đăng QuangPas encore d'évaluation

- FMO ESG Toolkit (AutoRecovered)Document149 pagesFMO ESG Toolkit (AutoRecovered)me.abhishekpPas encore d'évaluation

- Korea Times - Korean-EnglishDocument313 pagesKorea Times - Korean-EnglishgyeryongPas encore d'évaluation

- New Compabloc IMCP0002GDocument37 pagesNew Compabloc IMCP0002GAnie Ekpenyong0% (1)

- I. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Document5 pagesI. Objectives:: Semi-Detailed Lesson Plan in Reading and Writing (Grade 11)Shelton Lyndon CemanesPas encore d'évaluation

- Ultrasonic Based Distance Measurement SystemDocument18 pagesUltrasonic Based Distance Measurement SystemAman100% (2)

- Mehdi Semati - Media, Culture and Society in Iran - Living With Globalization and The Islamic State (Iranian Studies)Document294 pagesMehdi Semati - Media, Culture and Society in Iran - Living With Globalization and The Islamic State (Iranian Studies)Alexandra KoehlerPas encore d'évaluation

- Data Structures and Algorithms SyllabusDocument9 pagesData Structures and Algorithms SyllabusBongbong GalloPas encore d'évaluation

- Advanced Methods For Complex Network AnalysisDocument2 pagesAdvanced Methods For Complex Network AnalysisCS & ITPas encore d'évaluation

- What Is An EcosystemDocument42 pagesWhat Is An Ecosystemjoniel05Pas encore d'évaluation

- Javascript NotesDocument5 pagesJavascript NotesRajashekar PrasadPas encore d'évaluation

- Army Watercraft SafetyDocument251 pagesArmy Watercraft SafetyPlainNormalGuy2Pas encore d'évaluation

- The Attachment To Woman's Virtue in Abdulrazak Gurnah's Desertion (2005)Document7 pagesThe Attachment To Woman's Virtue in Abdulrazak Gurnah's Desertion (2005)IJELS Research JournalPas encore d'évaluation

- Kamapehmilya: Fitness Through Traditional DancesDocument21 pagesKamapehmilya: Fitness Through Traditional DancesValeriePas encore d'évaluation

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaD'EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)D'EverandFinance Basics (HBR 20-Minute Manager Series)Évaluation : 4.5 sur 5 étoiles4.5/5 (32)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successD'EverandReady, Set, Growth hack:: A beginners guide to growth hacking successÉvaluation : 4.5 sur 5 étoiles4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSND'Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNÉvaluation : 4.5 sur 5 étoiles4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisD'EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisÉvaluation : 5 sur 5 étoiles5/5 (6)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthD'EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthÉvaluation : 4 sur 5 étoiles4/5 (20)