Académique Documents

Professionnel Documents

Culture Documents

2015 US Pharmacy Study

Transféré par

MarilynCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

2015 US Pharmacy Study

Transféré par

MarilynDroits d'auteur :

Formats disponibles

J.D.

Power Reports:

Pharmacys Focus on Customer Satisfaction Sets the Bar for the Healthcare Industry

Pharmacy Satisfaction Highest among Healthcare Industry: Good for both Patients and Business

WESTLAKE VILLAGE, Calif.: 24 August 2015 Despite all of the changes in the healthcare

industry, customer satisfaction with pharmacies has remained relatively stable, according to the J.D.

Power 2015 U.S. Pharmacy StudySM released today.

The study, now in its ninth year, measures customer satisfaction with brick and mortarwhich

includes chain drug stores, mass merchandisers and supermarketsand mail order pharmacies.

Satisfaction with brick and mortar pharmacies is measured across five factors: prescription

ordering; store; cost competitiveness; non-pharmacist staff; and pharmacist. Satisfaction with mail

order pharmacies is measured across four factors: cost competitiveness; prescription delivery;

prescription ordering process; and customer service experience. Satisfaction is calculated on a

1,000-point scale.

Overall satisfaction with supermarket pharmacies improves to 851 in 2015, up from 843 in 2014,

while satisfaction with chain drug store pharmacies improves by 2 points to 842. Satisfaction with

mail order pharmacies drops by 2 points to 820, and satisfaction with mass merchandiser

pharmacies drops to 822 from 830.

The healthcare industry has undergone tremendous changes in recent years, and more changes

are coming, so stable customer satisfaction with pharmacies is very positive, said Rick Johnson,

director of the healthcare practice at J.D. Power. Pharmacies serve as a benchmark for other

entities in the healthcare ecosystem, as they continue to have the highest levels of customer

satisfaction in the healthcare industry, demonstrating that focusing on customer satisfaction is

good for both patients and businesses.

Pharmacists and pharmacy staff play a critical role in customer satisfaction. The study finds that the

simple step of asking customers if they would like to speak with a pharmacist causes overall

satisfaction to improve by 54 points. In addition, when customers perceive their conversations are

handled with discretion and a private area for discussions is provided, satisfaction improves by 99

points. Moreover, customers who speak with a pharmacist are significantly more likely to purchase

other items from the pharmacy and demonstrate higher loyalty rates. While 44 percent of

customers who speak with a pharmacist strongly agree they feel loyal to their pharmacy, only 35

percent of those who do not speak with a pharmacist say the same.

KEY FINDINGS

On average, customers of brick-and-mortar pharmacies pay $23 out-of-pocket for prescriptions

in 2015, up slightly from $22 in 2014. Customers of mail order pharmacies pay an average of

$32 for out-of-pocket prescription costs, down from $35 in 2014.

Among customers who use health testing and wellness services at their pharmacy, 63 percent

indicate they definitely will recommend their pharmacy and 46 percent strongly agree they

(Page 1 of 2)

feel loyal to their pharmacy. Among customers who do not use health testing and wellness

services at the pharmacy, only 55 percent definitely will recommend their pharmacy and 37

percent strongly agree they feel loyal to their pharmacy.

Offering health services can increase purchases of non-prescription items, as 60 percent of

customers who use these services buy other merchandise at the pharmacy, while only 37

percent customers who dont use health services do so.

A majority (91%) of customers of brick-and-mortar pharmacies receive their prescription when

or before promised.

Satisfaction for mail order and brick and mortar customers combined declines by 38 points

when customers run out of medication before a refill is available.

Rankings

In the brick and mortar segment, Good Neighbor Pharmacy (876) ranks highest among chain drug

store pharmacies, followed by Health Mart (871) and The Medicine Shoppe Pharmacy (861). Target

(858) ranks highest among mass merchandiser pharmacies, followed by Sams Club (847) and Meijer

(842). Wegmans (887) ranks highest among supermarket pharmacies, followed by Publix (871) and

H-E-B (866).

In the mail order segment, Humana Pharmacy (875) ranks highest, followed by Kaiser Permanente

Mail Pharmacy (866) and Express Scripts (824).

The 2015 U.S. Pharmacy Study is based on responses from 14,914 pharmacy customers who filled a

new prescription or refilled a prescription during the three months prior to the survey period. The

study was fielded in May and June 2015.

Media Relations Contacts

Jeff Perlman; Brandware Public Relations; Woodland Hills, Calif.; 818-598-1115;

jperlman@brandwarepr.com

John Tews; Troy, Mich.; 248-680-6218; media.relations@jdpa.com

About J.D. Power and Advertising/Promotional Rules http://www.jdpower.com/about/index.htm

About McGraw Hill Financial www.mhfi.com

###

(Page 2 of 2)

Note: Four charts follows.

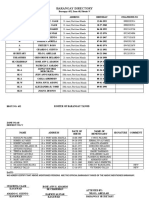

Year / Project / Study Name

J.D. Power

2015 U.S. Pharmacy StudySM

Customer Satisfaction Index Ranking

Brick and MortarChain Drug Store

JDPower.com

Power Circle RatingsTM

for consumers:

(Based on a 1,000-point scale)

Good Neighbor Pharmacy

876

Health Mart

871

The Medicine Shoppe Pharmacy

861

Chain Drug Store

Average

842

Rite Aid Pharmacy

840

CVS/pharmacy

839

Walgreens

835

600

Source: J.D. Power 2015 U.S. Pharmacy StudySM

900

Power Circle Ratings Legend

Among the best

Better than most

About average

The rest

Charts and graphs extracted from this press release for use by the media must be accompanied by a statement identifying

J.D. Power as the publisher and the study from which it originated as the source. Rankings are based on numerical scores,

and not necessarily on statistical significance. No advertising or other promotional use can be made of the information in th is

release or J.D. Power survey results without the express prior written consent of J.D. Power.

Year / Project / Study Name

J.D. Power

2015 U.S. Pharmacy StudySM

Customer Satisfaction Index Ranking

Brick and MortarMass Merchandiser

JDPower.com

Power Circle RatingsTM

for consumers:

(Based on a 1,000-point scale)

Target

858

Sam's Club

847

Meijer

842

Kmart

840

Costco

836

ShopKo

832

Mass Merchandiser

Average

Walmart

600

Included in the study but not ranked due to small sample size is Freds.

Source: J.D. Power 2015 U.S. Pharmacy StudySM

822

805

900

Power Circle Ratings Legend

Among the best

Better than most

About average

The rest

Charts and graphs extracted from this press release for use by the media must be accompanied by a statement identifying

J.D. Power as the publisher and the study from which it originated as the source. Rankings are based on numerical scores,

and not necessarily on statistical significance. No advertising or other promotional use can be made of the information in th is

release or J.D. Power survey results without the express prior written consent of J.D. Power.

Error! Not a valid link.Error! Not a valid link.Error! Not a valid link.Error! Not a valid link.

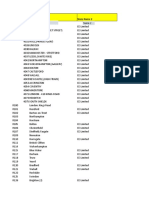

Year / Project / Study Name

J.D. Power

2015 U.S. Pharmacy StudySM

Customer Satisfaction Index Ranking

Brick and MortarSupermarket

JDPower.com

Power Circle RatingsTM

for consumers:

(Based on a 1,000-point scale)

Wegmans

887

Publix

871

H-E-B

866

Kroger

861

Supermarket Average

851

Giant

849

Stop & Shop

841

Hy-Vee

838

ShopRite

832

Albertsons

820

Giant Eagle

818

Safeway

806

600

Included in the study but not ranked due to small sample sizes are A&P, Bi-Lo,

Brookshires Grocery and Vons.

Source: J.D. Power 2015 U.S. Pharmacy StudySM

900

Power Circle Ratings Legend

Among the best

Better than most

About average

The rest

Charts and graphs extracted from this press release for use by the media must be accompanied by a statement identifying

J.D. Power as the publisher and the study from which it originated as the source. Rankings are based on numerical scores,

and not necessarily on statistical significance. No advertising or other promotional use can be made of the information in th is

release or J.D. Power survey results without the express prior written consent of J.D. Power.

Year / Project / Study Name

J.D. Power

2015 U.S. Pharmacy StudySM

Customer Satisfaction Index Ranking

Mail Order

JDPower.com

Power Circle RatingsTM

for consumers:

(Based on a 1,000-point scale)

Humana Pharmacy

875

Kaiser Permanente Mail Pharmacy

866

Express Scripts

824

Walmart Pharmacy Mail Services

822

Mail Order Average

820

OptumRx

802

CVS/caremark

801

Walgreens Mail Service

800

Cigna Home Delivery Pharmacy

785

Aetna Rx Home Delivery

779

Prime Therapeutics

737

*Department of Veterans Affairs

876

600

Included in the study but not ranked due to small sample size is Catamaran.

*The Department of Veterans Affairs pharmacy service is open only to veterans of the

U.S. military and their families and therefore is not included in the official rankings.

Source: J.D. Power 2015 U.S. Pharmacy StudySM

900

Power Circle Ratings Legend

Among the best

Better than most

About average

The rest

Charts and graphs extracted from this press release for use by the media must be accompanied by a statement identifying

J.D. Power as the publisher and the study from which it originated as the source. Rankings are based on numerical scores,

and not necessarily on statistical significance. No advertising or other promotional use can be made of the information in th is

release or J.D. Power survey results without the express prior written consent of J.D. Power.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Company Profile CasinoDocument70 pagesCompany Profile CasinoMiro DeManPas encore d'évaluation

- Assignment For Principles of Marketing - Arcadia GroupDocument8 pagesAssignment For Principles of Marketing - Arcadia Grouprarah123Pas encore d'évaluation

- GCDocument4 pagesGCAndrews SPas encore d'évaluation

- Data CollectionDocument8 pagesData CollectionVasani MilanPas encore d'évaluation

- Shoppers Stop Campus Guru CaseDocumentDocument10 pagesShoppers Stop Campus Guru CaseDocumentumeshPas encore d'évaluation

- JCPenney Case SummaryDocument3 pagesJCPenney Case SummaryRaktim100% (1)

- Nintendo Switch Serial # Patch Check SheetDocument72 pagesNintendo Switch Serial # Patch Check Sheethelberth camposPas encore d'évaluation

- Audio 6: Repetytorium Ósmoklasisty © Pearson Central Europe 2018 PHOTOCOPIABLEDocument4 pagesAudio 6: Repetytorium Ósmoklasisty © Pearson Central Europe 2018 PHOTOCOPIABLETadeusz Much50% (2)

- GAP HistoryDocument16 pagesGAP HistoryFrankie LamPas encore d'évaluation

- Kantar Worldpanel Consumer Insights Asia Q3'20 FINALDocument23 pagesKantar Worldpanel Consumer Insights Asia Q3'20 FINALTiger HồPas encore d'évaluation

- Barangay Directory: Roster of Barangay TanodDocument6 pagesBarangay Directory: Roster of Barangay TanodGerald CaasiPas encore d'évaluation

- Store Master Sample DataDocument6 pagesStore Master Sample DataavijitkumaraichPas encore d'évaluation

- Pro Golf USA Pivot Table DataDocument41 pagesPro Golf USA Pivot Table DataLin SasaPas encore d'évaluation

- PlanogramDocument18 pagesPlanogramAbhishek SinghPas encore d'évaluation

- International Retail Strategy - Tesco - FailureDocument8 pagesInternational Retail Strategy - Tesco - FailureKavish JainPas encore d'évaluation

- Result TSP Generator DorksDocument152 pagesResult TSP Generator Dorksrajesh shettyPas encore d'évaluation

- Bai Tap Tieng Anh Lop 8 Unit 8 Shopping Global SuccessDocument5 pagesBai Tap Tieng Anh Lop 8 Unit 8 Shopping Global SuccessTrần Thị Thủy TiênPas encore d'évaluation

- SupermarketDocument1 pageSupermarketNadia Shahira Bt SaidiPas encore d'évaluation

- Infinox Rebate & CommissionDocument5 pagesInfinox Rebate & Commissionviet122411Pas encore d'évaluation

- Food Wholesaling and RetailingDocument36 pagesFood Wholesaling and RetailingAl ImranPas encore d'évaluation

- 0112 FFL List AlaskaDocument39 pages0112 FFL List AlaskaAlain MisaPas encore d'évaluation

- Retail MarketDocument44 pagesRetail Marketvipul5290Pas encore d'évaluation

- Chapter 6Document46 pagesChapter 6nandish5661Pas encore d'évaluation

- CP Fresh: Strategy For B2C Prawn ProductsDocument24 pagesCP Fresh: Strategy For B2C Prawn ProductsVenkat KalagarlaPas encore d'évaluation

- Bay Ad CenterDocument114 pagesBay Ad CenterFrances CasauayPas encore d'évaluation

- BK GROUP 2024 Presentacion de MarcaDocument13 pagesBK GROUP 2024 Presentacion de MarcamarketingPas encore d'évaluation

- Retailing and WholesailingDocument30 pagesRetailing and WholesailingAnja GuerfalaPas encore d'évaluation

- FMCG Companies in BangaloreDocument6 pagesFMCG Companies in BangaloreJignesh ChandegraPas encore d'évaluation

- Listening Task For ING05. - Nota 10Document3 pagesListening Task For ING05. - Nota 10mai.heart45279Pas encore d'évaluation

- Next ShowroomDocument3 pagesNext ShowroomVRajamanikandanPas encore d'évaluation