Académique Documents

Professionnel Documents

Culture Documents

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Transféré par

Justia.comTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Transféré par

Justia.comDroits d'auteur :

Formats disponibles

Federal Register / Vol. 72, No.

76 / Friday, April 20, 2007 / Notices 20013

be summarized and/or included in the or through the internet, at maintenance, and purchase of services

request for OMB approval. All Allan.M.Hopkins@irs.gov. to provide information.

comments will become a matter of SUPPLEMENTARY INFORMATION: Approved: April 13, 2007.

public record. Comments are invited on: Title: TAP Tax Check Waiver. Glenn Kirkland,

(a) Whether the collection of OMB Number: 1545–XXXX. IRS Reports Clearance Officer.

information is necessary for the proper Abstract: Taxpayer Advocacy Panel

performance of the functions of the [FR Doc. E7–7476 Filed 4–19–07; 8:45 am]

(TAP) members must be compliant with BILLING CODE 4830–01–P

agency, including whether the their tax obligations and must undergo

information shall have practical utility; and pass a Tax check in order to be

(b) the accuracy of the agency’s estimate selected as a TAP member. By executing DEPARTMENT OF THE TREASURY

of the burden of the collection of the Tax Check Waiver, the applicant

information; (c) ways to enhance the provides information to facilitate Internal Revenue Service

quality, utility, and clarity of the conduct of the Tax Check and

information to be collected; (d) ways to authorizes the IRS official conducting Proposed Collection; Comment

minimize the burden of the collection of the Check to release the results of the Request for Notice 2007-XX

information on respondents, including Check, which are otherwise

through the use of automated collection AGENCY: Internal Revenue Service (IRS),

confidential, to the Director of TAP to Treasury.

techniques or other forms of information help in determining the suitability of

technology; and (e) estimates of capital ACTION: Notice and request for

the applicant for membership on TAP.

or start-up costs and costs of operation, Current Actions: There are no changes comments.

maintenance, and purchase of services being made to form at this time. SUMMARY: The Department of the

to provide information. Type of Review: Approval of new Treasury, as part of its continuing effort

Approved: April 13, 2007. collection. to reduce paperwork and respondent

Glenn P. Kirkland, Affected Public: Individuals and burden, invites the general public and

IRS Reports Clearance Officer. households. other Federal agencies to take this

[FR Doc. E7–7474 Filed 4–19–07; 8:45 am] Estimated Number of Respondents: opportunity to comment on proposed

110. and/or continuing information

BILLING CODE 4830–01–P

Estimated Time Per Respondent: 20 collections, as required by the

min. Paperwork Reduction Act of 1995,

DEPARTMENT OF THE TREASURY Estimated Total Annual Burden Public Law 104–13 (44 U.S.C.

Hours: 37. 3506(c)(2)(A)). Currently, the IRS is

Internal Revenue Service The following paragraph applies to all soliciting comments concerning Notice

of the collections of information covered 2007–XX, Certain Payments Made

Proposed Collection; Comment by this notice: Pursuant to a Securities Lending

Request for TAP Tax Check Waiver An agency may not conduct or Transaction or Sale-Repurchase

sponsor, and a person is not required to Transaction.

AGENCY: Internal Revenue Service (IRS),

respond to, a collection of information

Treasury. DATES: Written comments should be

unless the collection of information

ACTION: Notice and request for displays a valid OMB control number. received on or before June 19, 2007 to

comments. Books or records relating to a collection be assured of consideration.

of information must be retained as long ADDRESSES: Direct all written comments

SUMMARY: The Department of the

as their contents may become material to Glenn P. Kirkland, Internal Revenue

Treasury, as part of its continuing effort Service, room 6516, 1111 Constitution

to reduce paperwork and respondent in the administration of any internal

revenue law. Generally, tax returns and Avenue, NW., Washington, DC 20224.

burden, invites the general public and

other Federal agencies to take this tax return information are confidential, FOR FURTHER INFORMATION CONTACT:

opportunity to comment on proposed as required by 26 U.S.C. 6103. Requests for additional information or

and/or continuing information Request for Comments: Comments copies of notice should be directed to

collections, as required by the submitted in response to this notice will Allan Hopkins, at (202) 622–6665, or at

Paperwork Reduction Act of 1995, be summarized and/or included in the Internal Revenue Service, room 6516,

Public Law 104–13 (44 U.S.C. request for OMB approval. All 1111 Constitution Avenue, NW.,

3506(c)(2)(A)). Currently, the IRS is comments will become a matter of Washington, DC 20224, or through the

soliciting comments concerning TAP public record. Comments are invited on: internet, at Allan.M.Hopkins@irs.gov.

Tax Check Waiver. (a) Whether the collection of SUPPLEMENTARY INFORMATION:

information is necessary for the proper Title: Certain Payments Made

DATES: Written comments should be

performance of the functions of the Pursuant to a Securities Lending

received on or before June 19, 2007 to agency, including whether the Transaction or Sale-Repurchase

be assured of consideration. information shall have practical utility; Transaction.

ADDRESSES: Direct all written comments (b) the accuracy of the agency’s estimate OMB Number: 1545–XXXX.

to Glenn Kirkland, Internal Revenue of the burden of the collection of Notice Number: Notice 2007–XX.

Service, room 6516, 1111 Constitution information; (c) ways to enhance the Abstract: The IRS need the

Avenue, NW., Washington, DC 20224. quality, utility, and clarity of the information from payor(s) in order to

FOR FURTHER INFORMATION CONTACT: information to be collected; (d) ways to verify the accuracy of withholding,

Requests for additional information or minimize the burden of the collection of reporting, and claims for credits with

sroberts on PROD1PC70 with NOTICES

copies of the form and instructions information on respondents, including regard to substitute payments. The

should be directed to Allan Hopkins, through the use of automated collection likely respondents will be withholding

(202) 622–6665, or at Internal Revenue techniques or other forms of information agents and qualified intermediaries.

Service, Room 6516, 1111 Constitution technology; and (e) estimates of capital Current Actions: There are no changes

Avenue, NW., Washington, DC 20224, or start-up costs and costs of operation, being made to the notice at this time.

VerDate Aug<31>2005 18:52 Apr 19, 2007 Jkt 211001 PO 00000 Frm 00138 Fmt 4703 Sfmt 4703 E:\FR\FM\20APN1.SGM 20APN1

Vous aimerez peut-être aussi

- Federal Register-02-28262Document2 pagesFederal Register-02-28262POTUSPas encore d'évaluation

- Federal Register-02-28261Document1 pageFederal Register-02-28261POTUSPas encore d'évaluation

- Treasury RFI SOFR FRN3Document3 pagesTreasury RFI SOFR FRN3LaLa BanksPas encore d'évaluation

- Federal Register-02-28266Document1 pageFederal Register-02-28266POTUSPas encore d'évaluation

- Description: Tags: 090204aDocument2 pagesDescription: Tags: 090204aanon-670054Pas encore d'évaluation

- Federal Register-02-28062Document2 pagesFederal Register-02-28062POTUSPas encore d'évaluation

- Description: Tags: 070307eDocument2 pagesDescription: Tags: 070307eanon-102038Pas encore d'évaluation

- Description: Tags: 100501aDocument2 pagesDescription: Tags: 100501aanon-715421Pas encore d'évaluation

- JOM No. 69-2020Document2 pagesJOM No. 69-2020balindong.abdul.barryPas encore d'évaluation

- Description: Tags: 060701cDocument2 pagesDescription: Tags: 060701canon-674957Pas encore d'évaluation

- Description: Tags: 090707cDocument1 pageDescription: Tags: 090707canon-561252Pas encore d'évaluation

- Description: Tags: 051403bDocument2 pagesDescription: Tags: 051403banon-173468Pas encore d'évaluation

- Rfi On Transparency 2022 (6.27.22)Document5 pagesRfi On Transparency 2022 (6.27.22)Carlos100% (1)

- Federal Register-02-28477Document1 pageFederal Register-02-28477POTUSPas encore d'évaluation

- Description: Tags: 100500bDocument1 pageDescription: Tags: 100500banon-722489Pas encore d'évaluation

- Description: Tags: 100500cDocument2 pagesDescription: Tags: 100500canon-65733Pas encore d'évaluation

- Description: Tags: 100297aDocument1 pageDescription: Tags: 100297aanon-55798Pas encore d'évaluation

- Description: Tags: 100207aDocument2 pagesDescription: Tags: 100207aanon-574923Pas encore d'évaluation

- Ceibcbic GST Investigation Instruction 2 2021 22Document5 pagesCeibcbic GST Investigation Instruction 2 2021 22KANCHIVIVEKGUPTAPas encore d'évaluation

- Federal Register-02-28263Document1 pageFederal Register-02-28263POTUSPas encore d'évaluation

- US Internal Revenue Service: 10274002Document7 pagesUS Internal Revenue Service: 10274002IRSPas encore d'évaluation

- Sample PMS Terms and ConditionsDocument12 pagesSample PMS Terms and ConditionsJosh Qc OngPas encore d'évaluation

- List of Assets (RMO 26-2010)Document6 pagesList of Assets (RMO 26-2010)d-fbuser-49417072Pas encore d'évaluation

- Federal Register / Vol. 74, No. 122 / Friday, June 26, 2009 / NoticesDocument4 pagesFederal Register / Vol. 74, No. 122 / Friday, June 26, 2009 / NoticescahutPas encore d'évaluation

- Federal Register-02-28385Document2 pagesFederal Register-02-28385POTUSPas encore d'évaluation

- Federal Register-02-28384Document1 pageFederal Register-02-28384POTUSPas encore d'évaluation

- 2020-09801 2 PDFDocument6 pages2020-09801 2 PDFchristianPas encore d'évaluation

- Description: Tags: 010505bDocument2 pagesDescription: Tags: 010505banon-267867Pas encore d'évaluation

- Description: Tags: 060407aDocument1 pageDescription: Tags: 060407aanon-227782Pas encore d'évaluation

- Federal Register / Vol. 67, No. 216 / Thursday, November 7, 2002 / NoticesDocument25 pagesFederal Register / Vol. 67, No. 216 / Thursday, November 7, 2002 / NoticesPOTUSPas encore d'évaluation

- Description: Tags: 060107aDocument2 pagesDescription: Tags: 060107aanon-2265Pas encore d'évaluation

- Description: Tags: 120505aDocument2 pagesDescription: Tags: 120505aanon-850923Pas encore d'évaluation

- Federal Register / Vol. 82, No. 245 / Friday, December 22, 2017 / NoticesDocument18 pagesFederal Register / Vol. 82, No. 245 / Friday, December 22, 2017 / NoticesRoshan NazarethPas encore d'évaluation

- Description: Tags: 100305bDocument4 pagesDescription: Tags: 100305banon-848159Pas encore d'évaluation

- Description: Tags: 100305aDocument1 pageDescription: Tags: 100305aanon-215498Pas encore d'évaluation

- Cta Case 8533Document29 pagesCta Case 8533Leo CastilloPas encore d'évaluation

- Description: Tags: 070302aDocument2 pagesDescription: Tags: 070302aanon-429299Pas encore d'évaluation

- Treasury Inspector General For Tax AdministrationDocument31 pagesTreasury Inspector General For Tax AdministrationJeffrey DunetzPas encore d'évaluation

- TIMTADocument6 pagesTIMTAKarl Anthony Rigoroso MargatePas encore d'évaluation

- CIR Vs Team SualDocument2 pagesCIR Vs Team SualKim Patrick DayosPas encore d'évaluation

- Ra 10963 RRDDocument61 pagesRa 10963 RRDKate EvangelistaPas encore d'évaluation

- Federal Register-02-28382Document1 pageFederal Register-02-28382POTUSPas encore d'évaluation

- Description: Tags: 060903bDocument1 pageDescription: Tags: 060903banon-695469Pas encore d'évaluation

- Description: Tags: 100499aDocument1 pageDescription: Tags: 100499aanon-952417Pas encore d'évaluation

- Federal Register-02-28295Document1 pageFederal Register-02-28295POTUSPas encore d'évaluation

- Federal Register-02-28361Document2 pagesFederal Register-02-28361POTUSPas encore d'évaluation

- Description: Tags: 100500aDocument2 pagesDescription: Tags: 100500aanon-731423Pas encore d'évaluation

- Description: Tags: 070202bDocument2 pagesDescription: Tags: 070202banon-5887Pas encore d'évaluation

- Description: Tags: 120701bDocument2 pagesDescription: Tags: 120701banon-814387Pas encore d'évaluation

- Federal Register / Vol. 75, No. 192 / Tuesday, October 5, 2010 / NoticesDocument6 pagesFederal Register / Vol. 75, No. 192 / Tuesday, October 5, 2010 / NoticespsweetingPas encore d'évaluation

- Description: Tags: 070803bDocument2 pagesDescription: Tags: 070803banon-684735Pas encore d'évaluation

- Federal Register-02-28264Document1 pageFederal Register-02-28264POTUSPas encore d'évaluation

- Federal Register-02-28265Document2 pagesFederal Register-02-28265POTUSPas encore d'évaluation

- Republic Act No. 10963: Summon, Examine, and Take Testimony of Persons. - in Ascertaining TheDocument55 pagesRepublic Act No. 10963: Summon, Examine, and Take Testimony of Persons. - in Ascertaining TheAra LimPas encore d'évaluation

- Ruary: - R 4 N F ! R - R .)Document2 pagesRuary: - R 4 N F ! R - R .)SUDHANSHU SINGHPas encore d'évaluation

- Tax 1Document25 pagesTax 1Princess Janine SyPas encore d'évaluation

- Republic Act No. 10963Document46 pagesRepublic Act No. 10963Wilson MoranoPas encore d'évaluation

- Description: Tags: 061207dDocument1 pageDescription: Tags: 061207danon-812466Pas encore d'évaluation

- Description: Tags: 120302bDocument2 pagesDescription: Tags: 120302banon-180076Pas encore d'évaluation

- Circular 3 of 2024Document3 pagesCircular 3 of 2024rajbirsingh91996Pas encore d'évaluation

- USPTO Rejection of Casey Anthony Trademark ApplicationDocument29 pagesUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comPas encore d'évaluation

- U.S. v. Rajat K. GuptaDocument22 pagesU.S. v. Rajat K. GuptaDealBook100% (1)

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDocument12 pagesDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comPas encore d'évaluation

- Arbabsiar ComplaintDocument21 pagesArbabsiar ComplaintUSA TODAYPas encore d'évaluation

- Signed Order On State's Motion For Investigative CostsDocument8 pagesSigned Order On State's Motion For Investigative CostsKevin ConnollyPas encore d'évaluation

- Stipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareDocument7 pagesStipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareJustia.comPas encore d'évaluation

- Amended Poker Civil ComplaintDocument103 pagesAmended Poker Civil ComplaintpokernewsPas encore d'évaluation

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDocument48 pagesDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Wisconsin Union Busting LawsuitDocument48 pagesWisconsin Union Busting LawsuitJustia.comPas encore d'évaluation

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDocument22 pagesEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comPas encore d'évaluation

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDocument1 pageGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comPas encore d'évaluation

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDocument22 pagesClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comPas encore d'évaluation

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDocument5 pagesU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comPas encore d'évaluation

- Rabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesDocument3 pagesRabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesJustia.comPas encore d'évaluation

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDocument4 pagesRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comPas encore d'évaluation

- Bank Robbery Suspects Allegedly Bragged On FacebookDocument16 pagesBank Robbery Suspects Allegedly Bragged On FacebookJustia.comPas encore d'évaluation

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDocument1 pageBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comPas encore d'évaluation

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDocument15 pagesFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comPas encore d'évaluation

- Van Hollen Complaint For FilingDocument14 pagesVan Hollen Complaint For FilingHouseBudgetDemsPas encore d'évaluation

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDocument25 pagesDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comPas encore d'évaluation

- Supreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionDocument1 pageSupreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionJustia.comPas encore d'évaluation

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDocument52 pagesOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comPas encore d'évaluation

- Court's TRO Preventing Wisconsin From Enforcing Union Busting LawDocument1 pageCourt's TRO Preventing Wisconsin From Enforcing Union Busting LawJustia.comPas encore d'évaluation

- 60 Gadgets in 60 Seconds SLA 2008 June16Document69 pages60 Gadgets in 60 Seconds SLA 2008 June16Justia.com100% (10)

- Lee v. Holinka Et Al - Document No. 4Document2 pagesLee v. Holinka Et Al - Document No. 4Justia.com100% (4)

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDocument6 pagesFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURPas encore d'évaluation

- Sweden V Assange JudgmentDocument28 pagesSweden V Assange Judgmentpadraig2389Pas encore d'évaluation

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDocument6 pagesNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comPas encore d'évaluation

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDocument24 pagesOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comPas encore d'évaluation

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Document2 pagesCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comPas encore d'évaluation

- Quotation 017-2019 - 01-07-2019Document8 pagesQuotation 017-2019 - 01-07-2019Venkatesan ManikandanPas encore d'évaluation

- Final Year Project Proposal in Food Science and TechnologyDocument11 pagesFinal Year Project Proposal in Food Science and TechnologyDEBORAH OSOSANYAPas encore d'évaluation

- سلفات بحري كومنز PDFDocument8 pagesسلفات بحري كومنز PDFSami KahtaniPas encore d'évaluation

- Unit-4 Sewer Appurtenances - Only Introduction (4 Hours) R2Document13 pagesUnit-4 Sewer Appurtenances - Only Introduction (4 Hours) R2Girman RanaPas encore d'évaluation

- Retrato Alvin YapanDocument8 pagesRetrato Alvin YapanAngel Jan AgpalzaPas encore d'évaluation

- United States v. Vincent Williams, 4th Cir. (2014)Document11 pagesUnited States v. Vincent Williams, 4th Cir. (2014)Scribd Government DocsPas encore d'évaluation

- Revised WHD Quiz 2023 Flyer PDFDocument5 pagesRevised WHD Quiz 2023 Flyer PDFDevkesh ByadwalPas encore d'évaluation

- Altered Ego Todd HermanDocument11 pagesAltered Ego Todd HermanCatherine Guimard-Payen75% (4)

- Chapter 4 ProjDocument15 pagesChapter 4 ProjEphrem ChernetPas encore d'évaluation

- FM - Amreli Nagrik Bank - 2Document84 pagesFM - Amreli Nagrik Bank - 2jagrutisolanki01Pas encore d'évaluation

- Java Heritage Hotel ReportDocument11 pagesJava Heritage Hotel ReportنصرالحكمالغزلىPas encore d'évaluation

- CentipedeDocument2 pagesCentipedeMaePas encore d'évaluation

- Wild Edible Plants As A Food Resource: Traditional KnowledgeDocument20 pagesWild Edible Plants As A Food Resource: Traditional KnowledgeMikePas encore d'évaluation

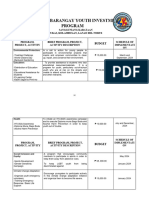

- Annual Barangay Youth Investment ProgramDocument4 pagesAnnual Barangay Youth Investment ProgramBarangay MukasPas encore d'évaluation

- PrecedentialDocument41 pagesPrecedentialScribd Government DocsPas encore d'évaluation

- Heliflex Cable: Situation AnalysisDocument5 pagesHeliflex Cable: Situation AnalysisananyaPas encore d'évaluation

- Comparative Analysis On Renaissance and 20th Century Modern ArchitectureDocument2 pagesComparative Analysis On Renaissance and 20th Century Modern ArchitectureJeriel CandidatoPas encore d'évaluation

- Excerpted From Watching FoodDocument4 pagesExcerpted From Watching Foodsoc2003Pas encore d'évaluation

- Eir TemplateDocument15 pagesEir Templatetran tuan100% (1)

- Implementing OSPF RoutingDocument20 pagesImplementing OSPF RoutingHuỳnh Tấn LợiPas encore d'évaluation

- India's Cultural Diplomacy: Present Dynamics, Challenges and Future ProspectsDocument11 pagesIndia's Cultural Diplomacy: Present Dynamics, Challenges and Future ProspectsMAHANTESH GPas encore d'évaluation

- EEE Assignment 3Document8 pagesEEE Assignment 3shirleyPas encore d'évaluation

- Pangan v. RamosDocument2 pagesPangan v. RamossuizyyyPas encore d'évaluation

- Progress Test 2Document5 pagesProgress Test 2Marcin PiechotaPas encore d'évaluation

- B16. Project Employment - Bajaro vs. Metro Stonerich Corp.Document5 pagesB16. Project Employment - Bajaro vs. Metro Stonerich Corp.Lojo PiloPas encore d'évaluation

- Mollymawk - English (Çalışma)Document8 pagesMollymawk - English (Çalışma)Fatih OguzPas encore d'évaluation

- View of Hebrews Ethan SmithDocument295 pagesView of Hebrews Ethan SmithOlvin Steve Rosales MenjivarPas encore d'évaluation

- Exercise 4Document45 pagesExercise 4Neal PeterosPas encore d'évaluation

- SAHANA Disaster Management System and Tracking Disaster VictimsDocument30 pagesSAHANA Disaster Management System and Tracking Disaster VictimsAmalkrishnaPas encore d'évaluation

- Short Term Rental AgreementDocument5 pagesShort Term Rental AgreementFontainhas PortoPas encore d'évaluation

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsD'EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsÉvaluation : 3 sur 5 étoiles3/5 (2)

- Legal Writing in Plain English: A Text with ExercisesD'EverandLegal Writing in Plain English: A Text with ExercisesÉvaluation : 3 sur 5 étoiles3/5 (2)

- Nolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsD'EverandNolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsÉvaluation : 4 sur 5 étoiles4/5 (18)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersD'EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersÉvaluation : 5 sur 5 étoiles5/5 (4)

- Torts: QuickStudy Laminated Reference GuideD'EverandTorts: QuickStudy Laminated Reference GuideÉvaluation : 5 sur 5 étoiles5/5 (1)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyD'EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyÉvaluation : 5 sur 5 étoiles5/5 (2)

- Federal Income Tax: a QuickStudy Digital Law ReferenceD'EverandFederal Income Tax: a QuickStudy Digital Law ReferencePas encore d'évaluation

- Employment Law: a Quickstudy Digital Law ReferenceD'EverandEmployment Law: a Quickstudy Digital Law ReferenceÉvaluation : 1 sur 5 étoiles1/5 (1)

- How to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!D'EverandHow to Make Patent Drawings: Save Thousands of Dollars and Do It With a Camera and Computer!Évaluation : 5 sur 5 étoiles5/5 (1)

- Flora and Vegetation of Bali Indonesia: An Illustrated Field GuideD'EverandFlora and Vegetation of Bali Indonesia: An Illustrated Field GuideÉvaluation : 5 sur 5 étoiles5/5 (2)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersD'EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersÉvaluation : 5 sur 5 étoiles5/5 (2)

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersD'EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersPas encore d'évaluation

- Admissibility of Expert Witness TestimonyD'EverandAdmissibility of Expert Witness TestimonyÉvaluation : 5 sur 5 étoiles5/5 (1)

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolD'EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolPas encore d'évaluation

- LLC or Corporation?: Choose the Right Form for Your BusinessD'EverandLLC or Corporation?: Choose the Right Form for Your BusinessÉvaluation : 3.5 sur 5 étoiles3.5/5 (4)

- Legal Research: a QuickStudy Laminated Law ReferenceD'EverandLegal Research: a QuickStudy Laminated Law ReferencePas encore d'évaluation

- Legal Writing in Plain English, Third Edition: A Text with ExercisesD'EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesPas encore d'évaluation

- Legal Guide for Starting & Running a Small BusinessD'EverandLegal Guide for Starting & Running a Small BusinessÉvaluation : 4.5 sur 5 étoiles4.5/5 (9)