Académique Documents

Professionnel Documents

Culture Documents

Weekly Update 04.09.2015 PDF

Transféré par

Randora LkDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Weekly Update 04.09.2015 PDF

Transféré par

Randora LkDroits d'auteur :

Formats disponibles

Weekly Market Recap

09 September 2015

Local market - Week in review

Level

7,215.11

3,957.83

3,065.35

Index Returns (%)/Market Cap growth (%)

1 Week

YTD

1 Year 2 Yr. Cum

(1.84)

(1.15)

2.19

25.59

(2.26)

(3.21)

1.41

23.26

(1.84)

(1.27)

3.43

29.55

Levels (%)

04/09/2015 28/08/2015 31/12/2014 04/09/2014 04/09/2013

6.79

6.53

5.74 not offered

8.61

7.07

6.87

5.84

6.28

9.64

7.17

6.97

6.00

6.30

10.56

The 91 day Bill led the sprint, reflecting an increase of 26 basis points (bps) to

6.79% whilst the 182 day and 364 day bills both increased by 20 bps each to 7.07%

and 7.17% respectively. The total accepted amount dipped to a 17-month low of CSE Equity Market Performance One year

LKR 3.9 Bn against a total offered amount of LKR 12.0 Bn.

In the primary T-bond auctions on 31st August, the yields continued their upward

trend. A total amount of LKR 31.318 Bn was offered for all three maturities. More

than 75% of the proceeds were accepted on the 01-06-2026 at a w. avg. yield of

10.34%. Meanwhile, the 01-05-2020 was accepted at a 9.35% w. avg. yield and

the maturity of 01-08-2021 was accepted at a 9.71% w. avg. yield. However, the

Monetary Board of CBSL kept the monetary policy rates unchanged in August

2015.

LKR fell over 3% to trade a record low of LKR 137.50 - 138.00 per USD on Friday

after the Central Bank of Sri Lanka (CBSL) effectively floated the currency by

ceasing to quote its own reference rate.

Other Highlights

CBSL Governor confirmed that Sri Lanka will receive the balance USD 1.1 Bn

from the Reserve Bank of India (RBI) to boost foreign reserves under the USD

1.5 Bn swap arrangement. According to CBSL, the realisation of the remaining CSE All Share Sector Returns

proceeds of the currency swap and long term financial flows to the government,

including the planned term loan of USD 500 Mn will support official reserves

and it is expected to stabilize the exchange rate in line with sound

macroeconomic fundamentals.

in June 2015 compared to 17.6% in May 2015. The expansion in private sector

credit in the first half of the year was largely due to higher disbursements of

credit to the industry and services sectors. However, the rapid increase in the

imports of consumer durables including motor vehicles driven by credit

available at low interest rates, among other things, has raised some concerns.

Headline inflation remained in the negative territory for the second consecutive

month, recording (0.2)% YoY in August 2015. Core inflation, which reflects the

underlying inflation in the economy, increased to 3.9% YoY from 3.5% YoY in

August 2015.

(Source: Daily FT/LBO)

Website: www.ndbs.lk

Weekly Data Centre

SL Equities

The weekly average market turnover hit a 21 week low with ASPI and S&P SL20 ASPI

recording weekly losses of 1.84% and 2.26% respectively. The footwear and S&P SL20

textiles sector recorded the highest return for the week of 3.70% whilst the oil

Market Capitalisation (LKR Bn)

palms sector was the second highest, increasing by 0.09%. Meanwhile, the largest

price gain was witnessed in Kalamazoo Systems whilst John Keells Holdings

Warrant 22 recorded the largest price loss. Foreigners remained active and closed

SL Gov Sec Key Rates

as net sellers for the week.

91 Days

The weighted average (w. avg.) yields at T-Bill auction were seen increasing for

the 10th consecutive week to six month highs, with 182 day T-Bill and 364 day T- 182 Days

Bill breaking the 7.00% physiological barriers for the first time since 11 th March. 364 Days

Credit extended to the private sector by commercial banks accelerated to 19.4%

Tel: 0112131000

Currencies

LKR per $

LKR per

LKR Per

04/09/2015

137.75

153.46

1.16

31/12/2014

131.20

158.73

1.10

04/09/2014

130.22

168.53

1.24

Corporate Debt

Urban Development Autority

National Development Bank

Bank of Ceylon

Bank of Ceylon

Commercial Leasing & Finance

Maturity

05/05/2014

29/11/2017

21/09/2019

24/11/2019

21/07/2020

Coupon (%)

11.00

9.40

16.00

8.00

9.75

Spot (LKR)

100.51

100.00

100.00

96.33

100.00

Net Foreign Inflow for the Week

Net Foreign Inflow YTD

Top Five Gainers

Top Five Losers

Global Markets - Week in review

Stock markets had another volatile week amid further worries about the

Global Equities

S&P 500

FTSE 100

NIKKEI 225

Hong Kong Hang Seng

S&P/ASX 200

slowing Chinese economy. The swings in Chinas share indices were less marked

than of late, following speculation that the government had recommenced its

stock purchases through state-owned firms to try to calm the markets. The

authorities are intervening in other ways, parading on television a financial

journalist who confessed to the crime of reporting on the market turmoil by

adding his personal judgment and subjective views to the news. An inquiry

Commodities

also began into alleged market manipulation.

The euro zones unemployment rate dipped to 10.9% in July, the lowest it has

Oil (Brent) USD/bbl

Gold USD/t oz

Aluminium USD/mt

Copper USD/mt

Cotton cents/lb

Chart of the Week

Level

1,951.13

6,074.65

17,792.16

20,840.61

5,040.60

1 Week

(1.90)

(2.77)

(7.02)

(3.57)

(4.24)

YTD

(5.23)

(7.48)

1.96

(11.71)

(6.85)

1 Year

(2.33)

(11.68)

13.50

(17.62)

(10.49)

2 Yr. Cum

18.03

(6.18)

26.60

(6.65)

(2.34)

04/09/2015 28/08/2014 31/12/2014 04/09/2014 04/09/2013

50.46

50.05

64.16

102.64

97.37

1,118.01

1,133.60

1,184.37

1,261.67

1,391.57

1,630.00

1,603.00

1,852.50

2,105.00

1,789.50

5,246.00

5,135.00

6,300.00

6,930.00

7,124.00

62.62

63.00

64.42

68.76

77.14

been since February 2012. Germany had the lowest rate, 4.7%, and Greece had

the highest, 25% (for the month of May), followed by Spain at 22.2%.

Unemployment in France rose slightly to 10.4%. Annual inflation in the euro

zone was unchanged at 0.2%. The uninspiring economic data come despite a big

stimulus package that the European Central Bank launched in March.

Britains Electoral Commission told the government to reword a question in a

referendum, to be held in either 2016 or 2017, that will ask voters whether they Oil Prices

wish to remain in the European Union. The new phrasing will include a

Oil fell the most in two months, paring the biggest three-day rally in 25 years

reference to leaving as well.

as speculation faded that OPEC might coordinate with other nations to curb

After years of rapid growth by the standards of rich countries, Canada slipped supply. After surging 27% in three days, the most since August 1990, the oil

into recession during the first half of 2015. The economy contracted by 0.5% at prices fell to near USD 50 per barrel. Prices fell as Chinese manufacturing

an annualised rate in the second quarter, following a decline of 0.8% in the first. slowed and U.S. crude stockpiles were forecast to have increased. They rose

Lower commodity prices have caused Canadas mining and energy companies on Monday after the U.S. lowered production estimates and OPEC said its

to cut investment. Australia, another commodity-heavy economy, recorded prepared to discuss fair prices with other producers, but the group also said

growth of just 0.2% in the second quarter from the previous three months (or it wont shoulder the burden of propping up prices on its own.

2% on an annual basis), the slowest rate in two years.

(Source: Bloomberg)

Gold Prices

Gold prices were steadied after a two-day dip as traders took to the sidelines

ahead of a U.S. payrolls report on Friday, which is being closely watched for

clues about the timing of a Federal Reserve interest rate rise. A stronger than

forecast number could boost expectations that the Fed is likely to increase

rates in the near term, which could weigh on gold. The metal benefits from

ultra-low interest rates, which cut the opportunity cost of holding bullion

while also putting pressure on the dollar. Expectations for a September rate

rise have been lowered recently due to global market volatility.

(Source: Reuters)

Barack Obama managed to secure the backing of 34 Democratic senators for

the agreement with Iran to limit its nuclear programme, thereby ensuring that

he can veto any Republican threat to alter the accord, which is adamantly

opposed by Israel. The partners to the dealBritain, China, France, Germany

and Russiahave made it clear that they would not want to renegotiate with

Iran if Congress rejects the agreement.

Lower oil prices and a stronger currency were behind a 14.7% plunge in South

Koreas exports in dollar terms in August compared with the same month last

year, the steepest drop in six years. Petroleum products account for a large

share of Korean exports. In addition, a stronger won is battling with a weaker

Japanese yen in export markets. Chinas devaluation of the yuan has not helped;

a quarter of the countrys exports go to China.

(Source: Economist)

Disclaimer

This document is based on information obtained from sources believed to be reliable, but NDB Securities (Pvt) Ltd., (NDBS) accepts no responsibility or makes no warranties or representations, express or implied, as to whether the information provided in this document

is accurate, complete or up-to-date. Furthermore, no representation or warranty is made by NDBS as to the sufficiency, relevance, importance, appropriateness, completeness or comprehensiveness of the information contained herein for any specific purpose. Prices,

opinions and estimates reflect our judgment on the date of original publication and are subject to change at any time without notice. NDBS reserves the right to change their opinion at any point in time as they deem necessary. There is no guarantee that the target

price for the stock will be met or that predicted business results for the company will be met. NDBS accepts no liability whatsoever for any direct or consequential loss or damage arising from any use of these reports or their contents. References to tax are based on

our understanding of current law and Inland Revenue practices, which may change from time to time.

Any recommendation contained in this document does not have regard to the specific investment objectives, financial situation and the particular needs of any specific addressee. This document is for the information of addressee only and is not to be taken as

substitution for the exercise of judgment by addressee. The information contained in any research report does not constitute an offer to sell securities or the solicitation of an offer to buy, or recommendation for investment in, any securities within Sri Lanka or any

other jurisdiction. The information in any research report is not intended as financial advice. Moreover, none of the research reports is intended as a prospectus within the meaning of the applicable laws of any jurisdiction and none of the research reports is directed to

any person in any country in which the distribution of such research report is unlawful. Past results do not guarantee future performance. NDBS cautions that any forward-looking statements in any research report implied by such words as anticipate, believe,

estimate, expect, and similar expressions as they relate to a company or its management are not guarantees of future performance. The investments in undertakings, securities or other financial instruments involve risks. Any discussion of the risks contained herein

should not be considered to be a disclosure of all risks or complete discussion of the risks which are mentioned.

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Wei 20150904 PDFDocument18 pagesWei 20150904 PDFRandora LkPas encore d'évaluation

- ICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCDocument3 pagesICRA Lanka Assigns (SL) BBB-rating With Positive Outlook To Sanasa Development Bank PLCRandora LkPas encore d'évaluation

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkPas encore d'évaluation

- Weekly Foreign Holding & Block Trade Update: Net Buying Net SellingDocument4 pagesWeekly Foreign Holding & Block Trade Update: Net Buying Net SellingRandora LkPas encore d'évaluation

- Daily 01 09 2015 PDFDocument4 pagesDaily 01 09 2015 PDFRandora LkPas encore d'évaluation

- 03 September 2015 PDFDocument9 pages03 September 2015 PDFRandora LkPas encore d'évaluation

- Global Market Update - 04 09 2015 PDFDocument6 pagesGlobal Market Update - 04 09 2015 PDFRandora LkPas encore d'évaluation

- Sri0Lanka000Re0ounting0and0auditing PDFDocument44 pagesSri0Lanka000Re0ounting0and0auditing PDFRandora LkPas encore d'évaluation

- Results Update Sector Summary - Jun 2015 PDFDocument2 pagesResults Update Sector Summary - Jun 2015 PDFRandora LkPas encore d'évaluation

- Press 20150831ea PDFDocument1 pagePress 20150831ea PDFRandora LkPas encore d'évaluation

- Press 20150831ebDocument2 pagesPress 20150831ebRandora LkPas encore d'évaluation

- CCPI - Press Release - August2015 PDFDocument5 pagesCCPI - Press Release - August2015 PDFRandora LkPas encore d'évaluation

- Earnings & Market Returns Forecast - Jun 2015 PDFDocument4 pagesEarnings & Market Returns Forecast - Jun 2015 PDFRandora LkPas encore d'évaluation

- Results Update For All Companies - Jun 2015 PDFDocument9 pagesResults Update For All Companies - Jun 2015 PDFRandora LkPas encore d'évaluation

- Daily - 23 04 2015 PDFDocument4 pagesDaily - 23 04 2015 PDFRandora LkPas encore d'évaluation

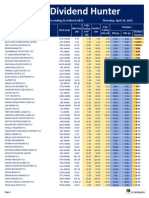

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkPas encore d'évaluation

- Dividend Hunter - Mar 2015 PDFDocument7 pagesDividend Hunter - Mar 2015 PDFRandora LkPas encore d'évaluation

- Earnings Update March Quarter 2015 05 06 2015 PDFDocument24 pagesEarnings Update March Quarter 2015 05 06 2015 PDFRandora LkPas encore d'évaluation

- Dividend Hunter - Apr 2015 PDFDocument7 pagesDividend Hunter - Apr 2015 PDFRandora LkPas encore d'évaluation

- CRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFDocument12 pagesCRL Corporate Update - 22 04 2015 - Upgrade To A Strong BUY PDFRandora LkPas encore d'évaluation

- N D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Document5 pagesN D B Securities (PVT) LTD, 5 Floor, # 40, NDB Building, Nawam Mawatha, Colombo 02. Tel: +94 11 2131000 Fax: +9411 2314180Randora LkPas encore d'évaluation

- Janashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFDocument9 pagesJanashakthi Insurance Company PLC - (JINS) - Q4 FY 14 - SELL PDFRandora LkPas encore d'évaluation

- Chevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFDocument9 pagesChevron Lubricants Lanka PLC (LLUB) - Q4 FY 14 - SELL PDFRandora LkPas encore d'évaluation

- BRS Monthly (March 2015 Edition) PDFDocument8 pagesBRS Monthly (March 2015 Edition) PDFRandora LkPas encore d'évaluation

- The Morality of Capitalism Sri LankiaDocument32 pagesThe Morality of Capitalism Sri LankiaRandora LkPas encore d'évaluation

- Microfinance Regulatory Model PDFDocument5 pagesMicrofinance Regulatory Model PDFRandora LkPas encore d'évaluation

- GIH Capital Monthly - Mar 2015 PDFDocument11 pagesGIH Capital Monthly - Mar 2015 PDFRandora LkPas encore d'évaluation

- Daily Stock Watch 08.04.2015 PDFDocument9 pagesDaily Stock Watch 08.04.2015 PDFRandora LkPas encore d'évaluation

- Weekly Foreign Holding & Block Trade Update - 02 04 2015 PDFDocument4 pagesWeekly Foreign Holding & Block Trade Update - 02 04 2015 PDFRandora LkPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Priority Sector Lending & Doubling Farmer's Income: C.C.S National Institute of Agricultural MarketingDocument33 pagesPriority Sector Lending & Doubling Farmer's Income: C.C.S National Institute of Agricultural MarketingPrathap G MPas encore d'évaluation

- A Guide To Deposit InsuranceDocument7 pagesA Guide To Deposit InsuranceSubrahmanyam PvPas encore d'évaluation

- Opportunity, Not Threat: Crypto AssetsDocument9 pagesOpportunity, Not Threat: Crypto AssetsTrophy NcPas encore d'évaluation

- Demonetisation Essay Download Demonetisation Essay PDF For UPSC PreparationDocument11 pagesDemonetisation Essay Download Demonetisation Essay PDF For UPSC PreparationRahul NimmagaddaPas encore d'évaluation

- Banking LawDocument22 pagesBanking LawRASHIKA TRIVEDIPas encore d'évaluation

- Project On HDFC BankDocument32 pagesProject On HDFC BankJeevan Patel100% (1)

- Ethics & Finance Case of Kavitha KrishnamorthyDocument3 pagesEthics & Finance Case of Kavitha KrishnamorthySaumyadeep BardhanPas encore d'évaluation

- Prozone by StockupdatesDocument181 pagesProzone by Stockupdatesstockupdates2012Pas encore d'évaluation

- Synopsis HDFC BankDocument3 pagesSynopsis HDFC BankRahul DewanPas encore d'évaluation

- Checklist of Compliances For A Non-Deposit Taking NBFC With Reserve Bank of IndiaDocument4 pagesChecklist of Compliances For A Non-Deposit Taking NBFC With Reserve Bank of IndiaIam MdsPas encore d'évaluation

- Chapter II The Companies (Incorporation) Rules, 2014Document116 pagesChapter II The Companies (Incorporation) Rules, 2014Jitendra RavalPas encore d'évaluation

- AFL Loan Application V03052021Document4 pagesAFL Loan Application V03052021SAnjaiPas encore d'évaluation

- Last Moment 1001 QuestionsDocument14 pagesLast Moment 1001 Questionsjoykumar1987Pas encore d'évaluation

- A Comparative Study On Financial Analysis of State Bank of India and Central Bank of IndiaDocument4 pagesA Comparative Study On Financial Analysis of State Bank of India and Central Bank of Indialuthu paduPas encore d'évaluation

- SaharaDocument103 pagesSaharaMahesh TejaniPas encore d'évaluation

- Small Scale Industries in IndiaDocument29 pagesSmall Scale Industries in IndiaLovenish VermaPas encore d'évaluation

- CGBE Bad Governance FinalDocument11 pagesCGBE Bad Governance FinalRushali ParmarPas encore d'évaluation

- Role of Banking Sector in The Development of The Indian Economy in The Context of (Agriculture and Textile) Industry by Yogesh YadavDocument40 pagesRole of Banking Sector in The Development of The Indian Economy in The Context of (Agriculture and Textile) Industry by Yogesh Yadavyogesh0794Pas encore d'évaluation

- PMC ScamDocument9 pagesPMC ScamSneha100% (1)

- RBI Bulletin June 2021Document2 pagesRBI Bulletin June 2021Punjab And Sind Bank Legal CellPas encore d'évaluation

- Fineotex ChemicalDocument216 pagesFineotex ChemicaladhavvikasPas encore d'évaluation

- Federal Bank ValuationDocument8 pagesFederal Bank ValuationPragathi T NPas encore d'évaluation

- Financial Stability Report June 2023Document10 pagesFinancial Stability Report June 2023asdfPas encore d'évaluation

- ANAROCK - India Real Estate Market Viewpoints - Q1 2022Document13 pagesANAROCK - India Real Estate Market Viewpoints - Q1 2022Anushka NaikPas encore d'évaluation

- Demonetization and Digitalization - The Indian Government's Hidden AgendaDocument12 pagesDemonetization and Digitalization - The Indian Government's Hidden AgendaSunil Kumar GaurPas encore d'évaluation

- What Is Barter or A Barter SystemDocument11 pagesWhat Is Barter or A Barter SystemAnikaPas encore d'évaluation

- A Project Report Final 1Document77 pagesA Project Report Final 1KEDARANATHA PADHYPas encore d'évaluation

- BorrowerDocument11 pagesBorrowerShubham TalekarPas encore d'évaluation

- Advanced Accounting - BCOM 5 Sem Ebook and NotesDocument98 pagesAdvanced Accounting - BCOM 5 Sem Ebook and NotesNeha firdosePas encore d'évaluation

- IJCRT2203243Document10 pagesIJCRT2203243Tushar MusalePas encore d'évaluation