Académique Documents

Professionnel Documents

Culture Documents

CH40

Transféré par

bhandya07Description originale:

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

CH40

Transféré par

bhandya07Droits d'auteur :

Formats disponibles

40

Bills of exchange

Objectives

After you have studied this chapter, you should:

understand what is meant by the term bill of exchange, how they are used, and by

whom

know how to make the entries in the accounts for a bill of exchange

40.1 Nature of bills of exchange

When goods are supplied to someone on credit, or services performed for him, then that

person becomes a debtor. The creditor firm would normally wait for payment by the

debtor. Until payment is made the money owing is of no use to the creditor firm as it is

not being used in any way. This can be remedied by factoring the debtors, which

involves passing the debts over to a finance firm. They will pay an agreed amount for the

legal rights to the debts.

Another possibility is that of obtaining a bank overdraft, with the debtors accepted as

part of the security on which the overdraft has been granted.

Yet another way that can give the creditor effective use of the money owing to him is

for him to draw a bill of exchange on the debtor. This means that a document is drawn

up requiring the debtor to pay the amount owing to the creditor, or to anyone

nominated by him at any time, on or by a particular date. He sends this document to the

debtor who, if he agrees to it, is said to accept it by writing on the document that he

will comply with it and appends his signature. The debtor then returns the bill of

exchange to the creditor. This document is then legal proof of the debt. The debtor is not

then able to contest the validity of the debt except for any irregularity in the bill of

exchange itself.

40.2 How bills of exchange are used

The creditor can now act in one of three ways:

1

2

He can negotiate the bill to another person in payment of a debt. That person may

also renegotiate it to someone else. The person who possesses the bill at maturity, i.e.

the date for payment of the bill, will present it to the debtor for payment.

He may discount it with a bank. Discount here means that the bank will take the

bill of exchange and treat it in the same manner as money deposited in the bank

account. The bank will then hold the bill until maturity when it will present it to the

debtor for payment. The bank will make a charge to the creditor for this service,

known as a discounting charge.

The third way open to the creditor is for him to hold the bill until maturity when he

Bills of exchange

413

will present it to the debtor for payment. In this case, apart from having a document

which is legal proof of the debt and could therefore save legal costs if a dispute

arose, no benefit has been gained from having a bill of exchange. However, action 1

or 2 could have been taken if the need had arisen.

40.3 The parties to a bill of exchange

The creditor who draws up the bill of exchange is known as the drawer. The debtor on

whom it is drawn is the drawee, when accepted he becomes the acceptor, while the

person to whom the bill is to be paid is the payee. In fact, it may be recognised that a

cheque is a special type of bill of exchange where the drawee is always a bank and, in

addition, is payable on demand. This chapter, however, refers to bills of exchange other

than cheques.

To the person who is to receive the money on maturity of the bill of exchange the

document is known as a bill receivable, while to the person who is to pay the sum due

on maturity it is known as a bill payable.

40.4 Dishonoured bills

When the debtor fails to make payment on maturity the bill is said to be dishonoured. If

the holder is someone other than the drawer then he will have recourse against the

person who has negotiated the bill to him, that person will then have recourse against

the one who negotiated it to him, and so on until final recourse is had against the drawer

of the bill for the amount of money due on the bill. The drawers right of action is then

against the acceptor.

On dishonour, a bill is often noted. This means that the bill is handed to a lawyer acting

in his capacity as a notary public, who then re-presents the bill to the acceptor. The

notary public then records the reasons for it not being discharged. The notary publics

fee is known as a noting charge. With a foreign bill, in addition to the bill being noted, it

is necessary to protest the bill in order to preserve the holders rights against the drawer

and previous endorsers. Protest is the term which covers the legal formalities needed.

The action to be taken by the drawer depends entirely upon circumstances. Often the

lack of funds on the acceptors part is purely temporary. In this case the drawer will

negotiate with the acceptor and agree to draw another bill, or substitute several bills of

smaller amounts with different maturity dates, for the amount owing, frequently with an

addition for interest to compensate for the extended period of credit. Negotiation is the

keynote; it must not be thought that acceptors are always sued when they fail to make

payment. They are customers, and where future dealings with them are expected to be

profitable harsh measures are certainly to be avoided. Legal action should be the last

action to be considered. Any interest charged to the acceptor would be debited to his

account and credited to an Interest Receivable Account.

40.5 Discounting charges and noting charges

From the acceptors point of view the discounting of a bill is a matter wholly for the

drawer or holder to decide. He, the acceptor, has been allowed a term of credit and will

pay the agreed price on the maturity of the bill. Therefore the discounting charge is not

one that he should suffer; this should be borne wholly by the person discounting the bill.

" "

Business Accounting 1

On the other hand, the noting charge has been brought about by the acceptors default.

It is equitable that his account should be charged with the amount of the expense of

noting and protesting.

40.6 Retired bills

Instead of waiting until maturity, bills may be retired, i.e. not allowed to run until

maturity. They may be paid off before maturity, in which case a rebate is often allowed

because the full term of credit has not been taken; or else renewed by fresh bills being

drawn and the old ones cancelled. The new bills often include interest because the term

of credit has been extended.

40.7 Examples of bookkeeping entries

Exhibit 40.1

1 Drawers Books

Goods had been sold by D Jarvis to J Burgon on 1 January 19X6 for 400. A bill of

exchange is drawn by Jarvis and accepted by Burgon on 1 January 19X6, the date of

maturity being 31 March 19X6. The following accounts show the entries necessary:

(a) If the bill is held by the drawer until maturity when the drawee makes payment.

J Burgon

19X6

Jan

1 Sales

400

19X6

Jan

1 Bill receivable

400

Bills Receivable

19X6

Jan

1 J Burgon

400

19X6

Mar 31 Bank

400

Bank

19X6

Mar 31 Bills receivable

400

(b) Where the bill is negotiated to another party by the drawer, in this case to IDT Ltd

on 3 January 19X6.

J Burgon

19X6

Jan

1 Sales

400

19X6

Jan

1 Bill receivable

400

Bills Receivable

19X6

Jan

1 J Burgon

400

19X6

Jan

3 IDT Ltd

400

Bills of exchange

415

(c) If the bill is discounted with the bank, in this case on 2 January 19X6, the

discounting charges being 6.

J Burgon

19X6

Jan

1 Sales

400

19X6

Jan

1 Bill receivable

400

Bills Receivable

19X6

Jan

1 J Burgon

400

19X6

Jan

2 Bank

400

Bank

19X6

Jan

2 Bills receivable

400

19X6

Jan

2 Discounting charges

Discounting Charges

19X6

Jan

2 Bank

2 Acceptors Books

The instances (a), (b) and (c) in the drawers books will result in similar entries in the

acceptors books. From the acceptors point of view two things have happened, first the

acceptance of the bill, and second its discharge by payment. The fact that (a), (b) and (c)

would result in different payees is irrelevant so far as the acceptor is concerned.

D Jarvis

19X6

Jan

1 Bills payable

400

19X6

Jan

1 Purchases

400

Bills Payable

19X6

Mar 31 Bank

400

19X6

Jan

1 D Jarvis

400

19X6

Mar 31 Bill payable

400

Bank

40.8 Dishonoured bills and accounting entries

These can be illustrated by reference to Exhibit 40.2.

Exhibit 40.2

On 1 April 19X7 A Grant sells goods for 600 to K Lee, a bill with a maturity date of

30 June 19X7 being drawn by Grant and accepted by Lee on 2 April 19X7. On 30 June

" $

Business Accounting 1

19X7 the bill is presented to Lee, but he fails to pay it and it is therefore dishonoured.

The bill is noted, the cost of 2 being paid by Grant on 7 July 19X7.

The entries needed will depend on whether or not the bill had been discounted by

Grant.

1 Drawers Books

Where the bill had not been discounted or renegotiated:

K Lee

19X7

Apr 1 Sales

600

Jun

Jul

600

2

30 Bill receivable dishonoured

7 Bank: Noting charge (a)

19X7

Apr 2 Bills receivable

600

Bills Receivable

19X7

Apr 2

K Lee

600

19X7

Jun 30 K Lee bill dishonoured

600

Bank

19X7

Jul

7 Noting charges K Lee (a)

Note:

(a) As the noting charges are directly incurred as the result of Lees default, then Lee

must suffer the cost by his account being debited with that amount.

Where the bill has been discounted with a bank:

The entries can now be seen as they would have appeared if the bill had been discounted

on 5 April 19X7, discounting charges being 9.

K Lee

19X7

Apr 1 Sales

600

Jun

Jul

600

2

30 Bank bill dishonoured (c)

7 Bank: Noting charge

19X7

Apr 2 Bill receivable

600

Bills Receivable

19X7

Apr 2 K Lee

600

19X7

Apr 5 Bank

600

19X7

Apr 5 Discounting charges (b)

Jun 30 K Lee bill dishonoured (c)

Jul

7 Noting charges K Lee

9

600

2

Bank

19X7

Apr 5 Bills receivable

600

Bills of exchange

417

Discounting Charges

19X7

Apr 5 Bank (b)

Notes:

(b) The discounting charges are wholly an expense of A Grant. They are therefore

charged to an expense account. Contrast this with the treatment of the noting

charges.

(c) On maturity the bank will present the bill to Lee. On its dishonour the bank will

hand the bill back to Grant, and will cancel out the original amount shown as being

deposited in the bank account. This amount is then charged to Lees personal

account to show that he is still in debt.

2 Acceptors Books

The entries in the acceptors books will not be affected by whether or not the drawer has

discounted the bill.

A Grant

19X7

Apr 1 Bill payable

600

19X7

Apr 1 Purchases

600

Jun

Jul

600

2

30 Bill payable dishonoured

7 Noting charge (d)

Bills Payable

19X7

Jun 30 A Grant bill dishonoured

600

19X7

Apr 1 A Grant

600

Noting Charges

19X7

Jul

7 A Grant (d)

Note:

(d) The noting charges will have to be reimbursed to A Grant. To show this fact A

Grants account is credited while the Noting Charges Account is debited to record

the expense.

40.9 Bills receivable as contingent liabilities

The fact that bills had been discounted, but had not reached maturity by the balance

sheet date, could give an entirely false impression of the financial position of the business

unless a note to this effect is made on the balance sheet. That such a note is necessary

can be illustrated by reference to the following balance sheets.

" &

Business Accounting 1

Balance Sheet as at 31 December 19X7

Fixed assets

Current assets:

Stock

Debtors

Bills receivable

Bank

Less Current liabilities

Working capital

(a)

3,500

1,000

1,200

1,800

500

1,000

1,200

2,300

4,500

3,000

4,500

3,000

1,500

5,000

Financed by:

Capital

5,000

(b)

3,500

1,500

5,000

5,000

Balance sheet (a) shows the position if 1,800 of bills receivable were still in hand.

Balance sheet (b) shows the position if the bills had been discounted, ignoring

discounting charges. To an outsider, balance sheet (b) seems to show a much stronger

liquid position with 2,300 in the bank. However, should the bills be dishonoured on

maturity the bank balance would slump to 500. The appearance of balance sheet (b) is

therefore deceptive unless a note is added, e.g. Note: There is a contingent liability of

1,800 on bills discounted at the balance sheet date. This note enables the outsider to

view the bank balance in its proper perspective of depending on the non-dishonour of the

bills discounted.

New terms

Bill of exchange (p. 412): A document drawn up by the drawer which requires his debtor, the

drawee, to accept the bill, agreeing to pay a specified sum to the person called the payee on the

due date specified.

Acceptor (p. 413): The drawee, when he accepts the bill, becomes the acceptor, thereby accepting

liability to pay the debt.

Dishonoured bill (p. 413): Where the acceptor fails to pay his debt on the due date.

Contingent liability (p. 417): Until the acceptor pays his debt owing on the bill, the drawer will

have a liability for the contingency that the bill will be dishonoured.

Factoring (p. 412): Passing the legal right to debts to a finance firm for an agreed amount.

Main points to remember

1

Bills of exchange enable businesses to obtain money owing to them in advance of the

date when the debtor is expected to clear his debt.

They are also a form of evidence should the amount due be disputed later.

Bills of exchange are not a guarantee that a debt will be honoured.

Bills of exchange

419

Review questions

40.1 N Gudgeon sells goods to two companies on July 1 19X7.

To R Johnson Ltd

To B Scarlet & Co Ltd

2,460

1,500

He draws bills of exchange on each of them and they are both accepted.

He discounts both of the bills with the bank on July 4 19X7, and suffers discounting charges of

80 on Johnsons bill and 65 on Scarlets bill. On September 1 19X7 the bills mature and

Johnson Ltd meets its liability. Scarlets bill is dishonoured and is duly noted on September 4, the

noting charge being 6.

Show the above in the necessary accounts:

(a) In the books of Gudgeon.

(b) In the books of Scarlet Ltd and of Johnson Ltd.

40.2A P Cummings buys goods from T Victor Ltd on January 21 19X7 for 2,900 and from C

Bellamy & Co for 4,160. Bills are drawn on him and he accepts them.

T Victor Ltd discount their bill with their bank on January 29, the discounting charge being 110.

C Bellamy & Co simply keep their bill waiting for maturity.

On maturity of the bills on April 21 19X7, Cummings duly meets (pays) Bellamys bill. He is

unable to pay Victors bill and it is accordingly dishonoured. Victor duly has it noted on April 28

19X7, the noting charge being 10.

Show the entries necessary in:

(a) The books of P Cummings.

(b) The books of T Victor Ltd.

(c) The books of C Bellamy & Co.

40.3 KC owed TM 960. KC accepted a bill of exchange at three months date for this amount.

TM discounted it for 948.

Before the due date of the bill TM was informed that KC was unable to meet the bill and was

offering a composition of 37.5 per cent of each to his creditors. This offer was accepted and cash

equivalent to the composition was received.

Show the ledger entries to record the above in TMs ledger.

40.4 Draw up a sales ledger control account for the month of August 19X6 from the following:

19X6

Aug 1

Aug 31

Balances (Dr)

Balances (Cr)

Totals for the month:

Sales journal

Returns inwards journal

Cheques received from customers

Bills receivable accepted

Cash received from customers

Bad debts written off

Cash discounts allowed

Bill receivable dishonoured

Balances (Cr)

Balances (Dr)

Note: This question is being asked because it contains entries for bills of exchange.

12,370

105

16,904

407

15,970

1,230

306

129

604

177

88

?

"

Business Accounting 1

40.5 A purchases ledger control account should be drawn up for February 19X7 from the

following:

19X7

Feb

1

Feb 28

Balances (Dr)

Balances (Cr)

Totals for month:

Purchases journal

Returns outwards journal

Bills payable accepted by us

Cheques paid to suppliers

Cash paid to suppliers

We were unable to meet a bill payable on maturity and it was

therefore dishonoured

We agreed to suffer noting charge on dishonoured bill

Balances (Dr)

Balances (Cr)

33

8,570

11,375

568

1,860

9,464

177

800

20

47

?

Note: This question is being asked because it contains entries for bills of exchange.

40.6A Prepare journal entries to indicate how the following would appear in the ledger accounts

of (a) Noone, (b) Iddon.

19X8

Jan

1

,,

Feb 29

Apr

,,

,,

May

9

7

Iddon sells goods 420 to Noone, and Noone sends to Iddon a three months acceptance

for this amount.

Iddon discounts the acceptance with the Slough Discount Co. Ltd, receiving its cheque

for 412.

One-third of Noones stock, valued at 3,600, is destroyed by fire. Noone claims on the

underwriters at Lloyds with whom he is insured.

The underwriters admit the claim for 3,000 only as the total stock was only insured for

9,000.

In view of Noones difficulties Iddon meets the acceptance due today by giving his

cheque for 420 to the Slough Discount Co. Ltd; he draws on Noone a further bill for

one month for 430 (to include 10 interest) which Noone accepts.

Noone receives cheque from the underwriters in settlement of the admitted claim.

Noones bank honours the acceptance presented by Iddon as due today.

40.7A Enter the following in the appropriate ledger accounts of R Smith:

19X9

Jan

5

,,

Apr

,, 14

May 18

R Smith sold goods to P Thomas, 320, and Thomas accepted Smiths bill for three

months for this amount.

R Smith discounted Thomass bill at the London Discount Co. for 304, and pays this

amount into his account at the bank.

The London Discount Co. notified Smith that Thomass bill had been dishonoured.

Smith at once sent a cheque to the London Discount Co. for the full amount of the bill

plus 3 charges.

Smith agreed that Thomass bankers should accept a further bill for one month for the

total amount owing plus 10 interest, and received the new acceptance.

Smiths bank informed him the new bill had been paid.

Bills of exchange

421

40.8A

On 1 June 19X8, X purchased goods from Y for 860 and sold goods to Z for 570.

On the same date, X drew a bill (No. 1) at three months on Z for 400 and Z accepted it.

On 12 June 19X2, Z drew a bill (No. 2) at three months on Q for 150 which Q accepted.

On 14 June, Z endorsed bill No. 2 over to X and, on 16 June, X endorsed this bill over to Y.

On 20 June, X accepted a bill (No. 3) at three months for 720 drawn by Y in full settlement

of his account, including interest. On 23 June, Y discounted bill No. 3 at his bank.

On 17 September, Y informed X that Qs acceptance had been dishonoured and X sent a

cheque for 150 to Y. The other bills were paid on the due dates.

On 20 September, X received a cheque from Z for half the amount due from him.

Required:

Show the entries to record these transactions in the ledger and cash book of X.

40.9A Balances and transactions affecting a companys control accounts for the months of May

19X8 are listed below:

Balances at 1 May 19X8:

Sales ledger

Purchases ledger

Transactions during May 19X8:

Purchases on credit

Allowances from suppliers

Receipts from customers by cheque

Sales on credit

Discounts received

Payments to creditors by cheque

Contra settlements

Allowances to customers

Bills of exchange receivable

Customers cheques dishonoured

Cash receipts from credit customers

Refunds to customers for overpayment of accounts

Discounts allowed

Balances at 31 May 19X8:

Sales ledger

Purchases ledger

9,123

211

4,490

88

(debit)

(credit)

(credit)

(debit)

18,135

629

27,370

36,755

1,105

15,413

3,046

1,720

6,506

489

4,201

53

732

136

67

(credit)

(debit)

Required:

(a) Explain the purposes for which control accounts are prepared.

(b) Post the sales ledger and purchases ledger control accounts for the month of May 19X2 and

derive the respective debit and credit closing balances on 31 May 19X8.

Note: This question is being asked because it contains entries for bills of exchange.

(Association of Chartered Certified Accountants)

Vous aimerez peut-être aussi

- Structured Settlements: A Guide For Prospective SellersD'EverandStructured Settlements: A Guide For Prospective SellersPas encore d'évaluation

- Assignment 2Document9 pagesAssignment 2Muhammad Ahsan IrshadPas encore d'évaluation

- Ca$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondD'EverandCa$h is Fact: Implementing a Credit and Collections Policy From Application to Payment and BeyondPas encore d'évaluation

- Consumer CreditDocument12 pagesConsumer CreditDrpranav SaraswatPas encore d'évaluation

- The Law (in Plain English) for Small Business (Sixth Edition)D'EverandThe Law (in Plain English) for Small Business (Sixth Edition)Pas encore d'évaluation

- Petitioner vs. vs. Respondents Agcaoili & Associates Valenzuela Law Center, Victor Fernandez Ramon M. GuevaraDocument14 pagesPetitioner vs. vs. Respondents Agcaoili & Associates Valenzuela Law Center, Victor Fernandez Ramon M. Guevaraaspiringlawyer1234Pas encore d'évaluation

- Business Tax Credit For Research And Development A Complete Guide - 2020 EditionD'EverandBusiness Tax Credit For Research And Development A Complete Guide - 2020 EditionPas encore d'évaluation

- 10000001667Document79 pages10000001667Chapter 11 DocketsPas encore d'évaluation

- The Declaration of Independence: A Play for Many ReadersD'EverandThe Declaration of Independence: A Play for Many ReadersPas encore d'évaluation

- Brief Sample - SJM Debt Buyer Collection Case PDFDocument6 pagesBrief Sample - SJM Debt Buyer Collection Case PDFAndyPas encore d'évaluation

- 0 Ebook 8 Templates 3Document12 pages0 Ebook 8 Templates 3Glenn MozleyPas encore d'évaluation

- ACC101 Chapter7new PDFDocument23 pagesACC101 Chapter7new PDFJana Kryzl DibdibPas encore d'évaluation

- Secured Borrowing and A Sale of ReceivablesDocument1 pageSecured Borrowing and A Sale of Receivableswarsidi100% (1)

- Assignment 4Document11 pagesAssignment 4QAISAR IQABALPas encore d'évaluation

- SCL I Letters of CreditDocument4 pagesSCL I Letters of CreditTerence Valdehueza100% (1)

- Applicability of NilDocument14 pagesApplicability of NilIan Ray PaglinawanPas encore d'évaluation

- Cardholder Dispute Form V3Document1 pageCardholder Dispute Form V3ShangHidalgoPas encore d'évaluation

- CFPB Foreclosure Avoidance ProceduresDocument2 pagesCFPB Foreclosure Avoidance ProceduresunapantherPas encore d'évaluation

- PrintableDocument2 pagesPrintableapi-309082881Pas encore d'évaluation

- Via This: Q1: Define A Contract and Describe The Essentials of A Valid ContractDocument14 pagesVia This: Q1: Define A Contract and Describe The Essentials of A Valid ContractchangumanguPas encore d'évaluation

- Different Contracts in Legal Aspect of BankingDocument7 pagesDifferent Contracts in Legal Aspect of Bankingdrishya3Pas encore d'évaluation

- The Negotiable Instruments Act, 1881Document33 pagesThe Negotiable Instruments Act, 1881Atul JhariyaPas encore d'évaluation

- Bankruptcy Act 2004Document80 pagesBankruptcy Act 2004Anonymous Th1S33Pas encore d'évaluation

- Module 1 Credit FundamentalsDocument24 pagesModule 1 Credit FundamentalsCaroline Grace Enteria Mella100% (1)

- Estate Planning - Rushin SavaniDocument27 pagesEstate Planning - Rushin Savanikumarprasoon99Pas encore d'évaluation

- ConsiderationDocument22 pagesConsiderationcwangheichanPas encore d'évaluation

- Commercial Banking in IndiaDocument32 pagesCommercial Banking in IndiaShaifali ChauhanPas encore d'évaluation

- Identification of Debt InstrumentsDocument12 pagesIdentification of Debt InstrumentsXPas encore d'évaluation

- Module 2 Credit - CollectionDocument14 pagesModule 2 Credit - CollectionAicarl JimenezPas encore d'évaluation

- Explain Fraudulent Transfer - Sec 53 With Decided Cases of Property ActDocument1 pageExplain Fraudulent Transfer - Sec 53 With Decided Cases of Property Actjaivik_ce7584Pas encore d'évaluation

- Lending Regulation TableDocument5 pagesLending Regulation TableThaddeus J. CulpepperPas encore d'évaluation

- Business Law Unit - IVDocument9 pagesBusiness Law Unit - IVKaran Veer SinghPas encore d'évaluation

- Compensation From FundsDocument3 pagesCompensation From FundsylessinPas encore d'évaluation

- Dodd-Frank Wallstreet Finance ReformDocument17 pagesDodd-Frank Wallstreet Finance ReformStad Ics100% (1)

- Central Bank & Monetary Policy - 1Document30 pagesCentral Bank & Monetary Policy - 1Dr.Ashok Kumar PanigrahiPas encore d'évaluation

- Presentation On Financial InstrumentsDocument20 pagesPresentation On Financial InstrumentsMehak BhallaPas encore d'évaluation

- Foreclosure Defenses ChecklistDocument5 pagesForeclosure Defenses ChecklistSachin DarjiPas encore d'évaluation

- Price FixingDocument1 pagePrice FixingMerryshyra MisagalPas encore d'évaluation

- Recent Trends in Tila and State Unfair and Deceptive Trade Practices Act Claims and Servicing LitigationDocument21 pagesRecent Trends in Tila and State Unfair and Deceptive Trade Practices Act Claims and Servicing LitigationCairo AnubissPas encore d'évaluation

- Used Auto BankDocument6 pagesUsed Auto Bankfabio2006Pas encore d'évaluation

- Powell and Powell v. Greenleaf CurrierDocument5 pagesPowell and Powell v. Greenleaf CurrierCristelle Elaine ColleraPas encore d'évaluation

- Collection Defense Edelman 062407Document40 pagesCollection Defense Edelman 062407jsquitieri100% (1)

- Banking & Financial Markets: Bülent ŞenverDocument73 pagesBanking & Financial Markets: Bülent ŞenverjamesburdenPas encore d'évaluation

- Advantages of Trade CreditDocument22 pagesAdvantages of Trade CredityadavgunwalPas encore d'évaluation

- SBI LIFE INSURANCE - Smart Wealth Brochure New VersionDocument12 pagesSBI LIFE INSURANCE - Smart Wealth Brochure New VersionBabujee K.NPas encore d'évaluation

- Letter # 2 9.12.16 Short VisionDocument3 pagesLetter # 2 9.12.16 Short Visionboytoy 9774Pas encore d'évaluation

- PAPER 2 Paper On Credit TransactionsDocument11 pagesPAPER 2 Paper On Credit TransactionsPouǝllǝ ɐlʎssɐPas encore d'évaluation

- Weintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Document12 pagesWeintraub v. QUICKEN LOANS, INC, 594 F.3d 270, 4th Cir. (2010)Scribd Government DocsPas encore d'évaluation

- Chpater 5 - Banking SystemDocument10 pagesChpater 5 - Banking System21augustPas encore d'évaluation

- Media RentHelpMN Dec 2021Document12 pagesMedia RentHelpMN Dec 2021Lindsey PetersonPas encore d'évaluation

- Template Guarantee DeedDocument26 pagesTemplate Guarantee DeedZahed IbrahimPas encore d'évaluation

- All About DebenturesDocument27 pagesAll About DebenturesAbhay DangashPas encore d'évaluation

- DL Standard Terms of Engagement at 1 Nov 22Document6 pagesDL Standard Terms of Engagement at 1 Nov 22Juliet DewhirstPas encore d'évaluation

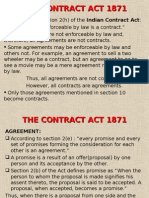

- The Contract Act 1871 (R)Document55 pagesThe Contract Act 1871 (R)manishparipagar100% (2)

- Credit Markets1Document45 pagesCredit Markets1David Raju GollapudiPas encore d'évaluation

- Petitioner Respondents Agcaoili & Associates Valenzuela Law Center, Victor Fernandez Ramon M. GuevaraDocument15 pagesPetitioner Respondents Agcaoili & Associates Valenzuela Law Center, Victor Fernandez Ramon M. GuevaraLiene Lalu NadongaPas encore d'évaluation

- HofR Challenge To ACA DCT 5-12-16Document38 pagesHofR Challenge To ACA DCT 5-12-16John HinderakerPas encore d'évaluation

- 35 Motion For More Definite StatementDocument18 pages35 Motion For More Definite StatementSamuelPas encore d'évaluation

- Arctica Ice Cream Street Miami, FL 33179: 500 NE 185thDocument3 pagesArctica Ice Cream Street Miami, FL 33179: 500 NE 185thChapter 11 DocketsPas encore d'évaluation

- Order - Bank CaseDocument28 pagesOrder - Bank CaseAllenStanfordPas encore d'évaluation

- CHAPTER - 3 - Creating Responsive Supply ChainDocument23 pagesCHAPTER - 3 - Creating Responsive Supply Chainsyazwani aliahPas encore d'évaluation

- The History of Land Use and Development in BahrainDocument345 pagesThe History of Land Use and Development in BahrainSogkarimiPas encore d'évaluation

- Revision of Future TensesDocument11 pagesRevision of Future TensesStefan StefanovicPas encore d'évaluation

- Clothing Blog Posts, For Both Modern and Historic GarmentsDocument93 pagesClothing Blog Posts, For Both Modern and Historic GarmentsJeffrey HopperPas encore d'évaluation

- Basic Accounting Equation Exercises 2Document2 pagesBasic Accounting Equation Exercises 2Ace Joseph TabaderoPas encore d'évaluation

- List of Departed Soul For Daily PrayerDocument12 pagesList of Departed Soul For Daily PrayermorePas encore d'évaluation

- EnglishDocument3 pagesEnglishYuyeen Farhanah100% (1)

- 99 Names of AllahDocument14 pages99 Names of Allahapi-3857534100% (9)

- PTE GURU - Will Provide You Template For Following SST, SWT, RETELL, DI and ESSAY and at The End Some Good Knowledge of Scoring SystemDocument6 pagesPTE GURU - Will Provide You Template For Following SST, SWT, RETELL, DI and ESSAY and at The End Some Good Knowledge of Scoring Systemrohit singh100% (1)

- RwservletDocument2 pagesRwservletsallyPas encore d'évaluation

- Final Seniority List of HM (High), I.s., 2013Document18 pagesFinal Seniority List of HM (High), I.s., 2013aproditiPas encore d'évaluation

- Civil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Document6 pagesCivil Law 2 Module 1 Case #008 - Andamo vs. IAC, 191 SCRA 195Ronald MedinaPas encore d'évaluation

- Developing A Business Plan For Your Vet PracticeDocument7 pagesDeveloping A Business Plan For Your Vet PracticeMujtaba AusafPas encore d'évaluation

- CT 1 - QP - Icse - X - GSTDocument2 pagesCT 1 - QP - Icse - X - GSTAnanya IyerPas encore d'évaluation

- How Beauty Standards Came To BeDocument3 pagesHow Beauty Standards Came To Beapi-537797933Pas encore d'évaluation

- Pineapples Export's To Copenhagen, DenmarkDocument13 pagesPineapples Export's To Copenhagen, DenmarkMuhammad SyafiqPas encore d'évaluation

- FRA - Project - NHPC - Group2 - R05Document29 pagesFRA - Project - NHPC - Group2 - R05DHANEESH KPas encore d'évaluation

- SDM Case Analysis Stihl IncorporatedDocument17 pagesSDM Case Analysis Stihl Incorporatedmahtaabk100% (5)

- Essentials of Economics 3Rd Edition Brue Solutions Manual Full Chapter PDFDocument30 pagesEssentials of Economics 3Rd Edition Brue Solutions Manual Full Chapter PDFsilas.wisbey801100% (11)

- C1 Level ExamDocument2 pagesC1 Level ExamEZ English WorkshopPas encore d'évaluation

- Q1Document16 pagesQ1satyamPas encore d'évaluation

- 10.4324 9781003172246 PreviewpdfDocument76 pages10.4324 9781003172246 Previewpdfnenelindelwa274Pas encore d'évaluation

- Jurnal SejarahDocument19 pagesJurnal SejarahGrey DustPas encore d'évaluation

- Quiet Time Guide 2009Document2 pagesQuiet Time Guide 2009Andrew Mitry100% (1)

- WFP AF Project Proposal The Gambia REV 04sept20 CleanDocument184 pagesWFP AF Project Proposal The Gambia REV 04sept20 CleanMahima DixitPas encore d'évaluation

- 5 15 19 Figaro V Our Revolution ComplaintDocument12 pages5 15 19 Figaro V Our Revolution ComplaintBeth BaumannPas encore d'évaluation

- Report of Apple Success PDFDocument2 pagesReport of Apple Success PDFPTRPas encore d'évaluation

- An Introduction: by Rajiv SrivastavaDocument17 pagesAn Introduction: by Rajiv SrivastavaM M PanditPas encore d'évaluation

- Nuclear Power Plants PDFDocument64 pagesNuclear Power Plants PDFmvlxlxPas encore d'évaluation

- Contemporary World Reflection PaperDocument8 pagesContemporary World Reflection PaperNyna Claire GangePas encore d'évaluation

- A Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsD'EverandA Simple Guide for Drafting of Conveyances in India : Forms of Conveyances and Instruments executed in the Indian sub-continent along with Notes and TipsPas encore d'évaluation

- The Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorseD'EverandThe Small-Business Guide to Government Contracts: How to Comply with the Key Rules and Regulations . . . and Avoid Terminated Agreements, Fines, or WorsePas encore d'évaluation

- Legal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersD'EverandLegal Guide to Social Media, Second Edition: Rights and Risks for Businesses, Entrepreneurs, and InfluencersÉvaluation : 5 sur 5 étoiles5/5 (1)

- How to Win Your Case In Traffic Court Without a LawyerD'EverandHow to Win Your Case In Traffic Court Without a LawyerÉvaluation : 4 sur 5 étoiles4/5 (5)

- Contract Law for Serious Entrepreneurs: Know What the Attorneys KnowD'EverandContract Law for Serious Entrepreneurs: Know What the Attorneys KnowÉvaluation : 1 sur 5 étoiles1/5 (1)

- The Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterD'EverandThe Perfect Stage Crew: The Complete Technical Guide for High School, College, and Community TheaterPas encore d'évaluation

- Legal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreD'EverandLegal Forms for Everyone: Leases, Home Sales, Avoiding Probate, Living Wills, Trusts, Divorce, Copyrights, and Much MoreÉvaluation : 3.5 sur 5 étoiles3.5/5 (2)

- Law of Contract Made Simple for LaymenD'EverandLaw of Contract Made Simple for LaymenÉvaluation : 4.5 sur 5 étoiles4.5/5 (9)

- Profitable Photography in Digital Age: Strategies for SuccessD'EverandProfitable Photography in Digital Age: Strategies for SuccessPas encore d'évaluation

- Learn the Essentials of Business Law in 15 DaysD'EverandLearn the Essentials of Business Law in 15 DaysÉvaluation : 4 sur 5 étoiles4/5 (13)

- Digital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetD'EverandDigital Technical Theater Simplified: High Tech Lighting, Audio, Video and More on a Low BudgetPas encore d'évaluation

- How to Win Your Case in Small Claims Court Without a LawyerD'EverandHow to Win Your Case in Small Claims Court Without a LawyerÉvaluation : 5 sur 5 étoiles5/5 (1)

- Contracts: The Essential Business Desk ReferenceD'EverandContracts: The Essential Business Desk ReferenceÉvaluation : 4 sur 5 étoiles4/5 (15)

- What Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreD'EverandWhat Are You Laughing At?: How to Write Humor for Screenplays, Stories, and MoreÉvaluation : 4 sur 5 étoiles4/5 (2)

- Technical Theater for Nontechnical People: Second EditionD'EverandTechnical Theater for Nontechnical People: Second EditionPas encore d'évaluation

- The Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityD'EverandThe Business of Broadway: An Insider's Guide to Working, Producing, and Investing in the World's Greatest Theatre CommunityPas encore d'évaluation