Académique Documents

Professionnel Documents

Culture Documents

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Transféré par

Justia.comTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Notice: Agency Information Collection Activities Proposals, Submissions, and Approvals

Transféré par

Justia.comDroits d'auteur :

Formats disponibles

Federal Register / Vol. 71, No.

203 / Friday, October 20, 2006 / Notices 62045

performance of the functions of the Abstract: Form-T is filed by DEPARTMENT OF THE TREASURY

agency, including whether the individuals and corporations to report

information shall have practical utility; income and deductions from the Internal Revenue Service

(b) the accuracy of the agency’s estimate operation of a timber business. The IRS

of the burden of the collection of Proposed Collection; Comment

uses Form-T to determine if the correct

information; (c) ways to enhance the Request for Form 13362

amounts of income and deductions are

quality, utility, and clarity of the claimed. AGENCY: Internal Revenue Service (IRS),

information to be collected; (d) ways to Treasury.

minimize the burden of the collection of Current Actions: There are no changes

being made to the Form-T at this time. ACTION: Notice and request for

information on respondents, including

Affected Public: Business or other for- comments.

through the use of automated collection

techniques or other forms of information profit organizations. SUMMARY: The Department of the

technology; and (e) estimates of capital Estimated Number of Respondents: Treasury, as part of its continuing effort

or start-up costs and costs of operation, 12,333. to reduce paperwork and respondent

maintenance, and purchase of services burden, invites the general public and

to provide information. Estimated Time Per Respondent: 3

other Federal agencies to take this

hours, 37 minutes.

Approved: October 2, 2006. opportunity to comment on proposed

Glenn Kirkland, Estimated Total Annual Burden and/or continuing information

Hours: 446,208. collections, as required by the

IRS Reports Clearance Office.

[FR Doc. E6–17547 Filed 10–19–06; 8:45 am] The following paragraph applies to all Paperwork Reduction Act of 1995,

of the collections of information covered Public Law 104–13 (44 U.S.C.

BILLING CODE 4830–01–P

by this notice: 3506(c)(2)(A)). Currently, the IRS is

soliciting comments concerning Form

An agency may not conduct or 13362, Consent to Disclosure of Return

DEPARTMENT OF THE TREASURY sponsor, and a person is not required to Information.

respond to, a collection of information

Internal Revenue Service DATES: Written comments should be

unless the collection of information

received on or before December 19, 2006

Proposed Collection; Comment displays a valid OMB control number.

to be assured of consideration.

Request for Form-T Books or records relating to a collection

ADDRESSES: Direct all written comments

of information must be retained as long

AGENCY: Internal Revenue Service (IRS), as their contents may become material to Glenn Kirkland, Internal Revenue

Treasury. Service, room 6512, 1111 Constitution

in the administration of any internal

ACTION: Notice and request for Avenue, NW., Washington, DC 20224.

revenue law. Generally, tax returns and

comments. tax return information are confidential, FOR FURTHER INFORMATION CONTACT:

as required by 26 U.S.C. 6103. Requests for additional information or

SUMMARY: The Department of the copies of the form and instructions

Treasury, as part of its continuing effort Request for Comments: Comments should be directed to Larnice Mack at

to reduce paperwork and respondent submitted in response to this notice will Internal Revenue Service, room 6512,

burden, invites the general public and be summarized and/or included in the 1111 Constitution Avenue, NW.,

other Federal agencies to take this request for OMB approval. All Washington, DC 20224, or at (202) 622–

opportunity to comment on proposed comments will become a matter of 3179, or through the Internet at

and/or continuing information public record. Comments are invited on: Larnice.Mack@irs.gov.

collections, as required by the (a) Whether the collection of

Paperwork Reduction Act of 1995, SUPPLEMENTARY INFORMATION:

information is necessary for the proper Title: Consent to Disclosure of Return

Public Law 104–13 (44 U.S.C. performance of the functions of the

3506(c)(2)(A)). Currently, the IRS is Information.

agency, including whether the OMB Number: 1545–1856.

soliciting comments concerning Form-T, information shall have practical utility;

Forest Activities Schedule. Form Number: 13362.

(b) the accuracy of the agency’s estimate Abstract: The Consent Form is

DATES: Written comments should be of the burden of the collection of provided to external applicant that will

received on or before December 19, 2006 information; (c) ways to enhance the allow the Service the ability to conduct

to be assured of consideration. quality, utility, and clarity of the tax checks to determine if an applicant

ADDRESSES: Direct all written comments information to be collected; (d) ways to is suitable for employment once they are

to Glenn Kirkland, Internal Revenue minimize the burden of the collection of determined qualified and within reach

Service, room 6512, 1111 Constitution information on respondents, including to receive an employment offer.

Avenue, NW., Washington, DC 20224. through the use of automated collection Current Actions: There are no changes

FOR FURTHER INFORMATION CONTACT: techniques or other forms of information being made to the form at this time.

Requests for additional information or technology; and (e) estimates of capital Type of Review: Extension of a

copies of the form and instructions or start-up costs and costs of operation, currently approved collection.

should be directed to Larnice Mack at maintenance, and purchase of services Affected Public: Federal Government.

Internal Revenue Service, room 6512, Estimated Number of Respondents:

to provide information.

1111 Constitution Avenue, NW., 46,000.

Washington, DC 20224, or at (202) 622– Approved: October 1, 2006. Estimated Number of Respondents: 10

3179, or through the Internet at Glenn Kirkland, minutes.

jlentini on PROD1PC65 with NOTICES

Larnice.Mack@irs.gov. IRS Reports Clearance Office. Estimated Total Annual Burden

SUPPLEMENTARY INFORMATION: [FR Doc. E6–17548 Filed 10–19–06; 8:45 am] Hours: 7,664.

Title: Forest Activities Schedule. BILLING CODE 4830–01–P The following paragraph applies to all

OMB Number: 1545–0007. of the collections of information covered

Form Number: Form-T. by this notice:

VerDate Aug<31>2005 15:52 Oct 19, 2006 Jkt 211001 PO 00000 Frm 00100 Fmt 4703 Sfmt 4703 E:\FR\FM\20OCN1.SGM 20OCN1

Vous aimerez peut-être aussi

- Jones Law: The Philippine Autonomy Act of 1916 A Content and Context AnalysisDocument10 pagesJones Law: The Philippine Autonomy Act of 1916 A Content and Context AnalysisJoanna Marie Champo100% (1)

- Ople V TorresDocument3 pagesOple V TorresshelPas encore d'évaluation

- Federal Register-02-28266Document1 pageFederal Register-02-28266POTUSPas encore d'évaluation

- Treasury RFI SOFR FRN3Document3 pagesTreasury RFI SOFR FRN3LaLa BanksPas encore d'évaluation

- Rfi On Transparency 2022 (6.27.22)Document5 pagesRfi On Transparency 2022 (6.27.22)Carlos100% (1)

- Description: Tags: 070307eDocument2 pagesDescription: Tags: 070307eanon-102038Pas encore d'évaluation

- Federal Register-02-28261Document1 pageFederal Register-02-28261POTUSPas encore d'évaluation

- Federal Register-02-28262Document2 pagesFederal Register-02-28262POTUSPas encore d'évaluation

- Description: Tags: 100207aDocument2 pagesDescription: Tags: 100207aanon-574923Pas encore d'évaluation

- Federal Register-02-28382Document1 pageFederal Register-02-28382POTUSPas encore d'évaluation

- Federal Register-02-28384Document1 pageFederal Register-02-28384POTUSPas encore d'évaluation

- Federal Register-02-28385Document2 pagesFederal Register-02-28385POTUSPas encore d'évaluation

- Federal Register-02-28477Document1 pageFederal Register-02-28477POTUSPas encore d'évaluation

- Federal Register-02-28062Document2 pagesFederal Register-02-28062POTUSPas encore d'évaluation

- Description: Tags: 070803bDocument2 pagesDescription: Tags: 070803banon-684735Pas encore d'évaluation

- Description: Tags: 090204aDocument2 pagesDescription: Tags: 090204aanon-670054Pas encore d'évaluation

- Federal Register / Vol. 82, No. 245 / Friday, December 22, 2017 / NoticesDocument18 pagesFederal Register / Vol. 82, No. 245 / Friday, December 22, 2017 / NoticesRoshan NazarethPas encore d'évaluation

- Description: Tags: 100297aDocument1 pageDescription: Tags: 100297aanon-55798Pas encore d'évaluation

- Description: Tags: 100501aDocument2 pagesDescription: Tags: 100501aanon-715421Pas encore d'évaluation

- Treasury Inspector General For Tax AdministrationDocument31 pagesTreasury Inspector General For Tax AdministrationJeffrey DunetzPas encore d'évaluation

- Description: Tags: 100500cDocument2 pagesDescription: Tags: 100500canon-65733Pas encore d'évaluation

- Description: Tags: 100500bDocument1 pageDescription: Tags: 100500banon-722489Pas encore d'évaluation

- (DAILY CALLER OBTAINED) - Telework - 02 - XMLDocument6 pages(DAILY CALLER OBTAINED) - Telework - 02 - XMLHenry RodgersPas encore d'évaluation

- 2020-09801 2 PDFDocument6 pages2020-09801 2 PDFchristianPas encore d'évaluation

- Instructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnDocument6 pagesInstructions For Form 1066: U.S. Real Estate Mortgage Investment Conduit (REMIC) Income Tax ReturnIRSPas encore d'évaluation

- Description: Tags: 070202bDocument2 pagesDescription: Tags: 070202banon-5887Pas encore d'évaluation

- US Internal Revenue Service: 10274002Document7 pagesUS Internal Revenue Service: 10274002IRSPas encore d'évaluation

- Nyse Fet 2020Document96 pagesNyse Fet 2020Pastor VelasquezPas encore d'évaluation

- Description: Tags: 120701bDocument2 pagesDescription: Tags: 120701banon-814387Pas encore d'évaluation

- Federal Register / Vol. 88, No. 45 / Wednesday, March 8, 2023 / Rules and RegulationsDocument8 pagesFederal Register / Vol. 88, No. 45 / Wednesday, March 8, 2023 / Rules and RegulationsScott FryePas encore d'évaluation

- Instructions For Form 990: Internal Revenue ServiceDocument24 pagesInstructions For Form 990: Internal Revenue ServiceIRSPas encore d'évaluation

- Federal Register-02-28263Document1 pageFederal Register-02-28263POTUSPas encore d'évaluation

- Federal Register-02-28042Document2 pagesFederal Register-02-28042POTUSPas encore d'évaluation

- Description: Tags: 060107bDocument2 pagesDescription: Tags: 060107banon-766570Pas encore d'évaluation

- Description: Tags: 060107aDocument2 pagesDescription: Tags: 060107aanon-2265Pas encore d'évaluation

- US Internal Revenue Service: I1120icd - 1993Document16 pagesUS Internal Revenue Service: I1120icd - 1993IRSPas encore d'évaluation

- NFLX 2019 10-KDocument93 pagesNFLX 2019 10-KEilyza AballaPas encore d'évaluation

- GST Ready Reckoner 2020 - 10062020Document240 pagesGST Ready Reckoner 2020 - 10062020P S AmritPas encore d'évaluation

- Instructions For Form 990-T: Paperwork Reduction Act NoticeDocument16 pagesInstructions For Form 990-T: Paperwork Reduction Act NoticeIRSPas encore d'évaluation

- Instructions For Form 1120S: U.S. Income Tax Return For An S CorporationDocument19 pagesInstructions For Form 1120S: U.S. Income Tax Return For An S CorporationIRSPas encore d'évaluation

- BIR Ruling 293-2015 - Productivity Incentive (De Minimis)Document5 pagesBIR Ruling 293-2015 - Productivity Incentive (De Minimis)Jerwin DavePas encore d'évaluation

- Federal Register / Vol. 74, No. 122 / Friday, June 26, 2009 / NoticesDocument4 pagesFederal Register / Vol. 74, No. 122 / Friday, June 26, 2009 / NoticescahutPas encore d'évaluation

- DCN IhRIS Hardware Support For One Year - Edited 12052023Document10 pagesDCN IhRIS Hardware Support For One Year - Edited 12052023d4rrylPas encore d'évaluation

- BIR Ruling DA - C-018 075-10Document2 pagesBIR Ruling DA - C-018 075-10Mark Lord Morales BumagatPas encore d'évaluation

- Disabled Access CreditDocument2 pagesDisabled Access CreditMaro AtakuotorPas encore d'évaluation

- PLDT-v-BelloCA Copy 2 PDFDocument23 pagesPLDT-v-BelloCA Copy 2 PDFPauline CarilloPas encore d'évaluation

- US Internal Revenue Service: I1120ric - 1996Document12 pagesUS Internal Revenue Service: I1120ric - 1996IRSPas encore d'évaluation

- 10-K 2019 AMazonDocument94 pages10-K 2019 AMazonJavier SosaPas encore d'évaluation

- US Internal Revenue Service: I1120rei - 1996Document12 pagesUS Internal Revenue Service: I1120rei - 1996IRSPas encore d'évaluation

- US Internal Revenue Service: p3383Document4 pagesUS Internal Revenue Service: p3383IRSPas encore d'évaluation

- Description: Tags: 090707bDocument2 pagesDescription: Tags: 090707banon-871524Pas encore d'évaluation

- BIR Ruling No. 123-2018Document3 pagesBIR Ruling No. 123-2018AizaPas encore d'évaluation

- Federal Register-02-28273Document1 pageFederal Register-02-28273POTUSPas encore d'évaluation

- DPD NoticeDocument5 pagesDPD Noticenazre.legalntaxPas encore d'évaluation

- Description: Tags: 100102bDocument3 pagesDescription: Tags: 100102banon-391117Pas encore d'évaluation

- Description: Tags: 070207bDocument2 pagesDescription: Tags: 070207banon-633789Pas encore d'évaluation

- Description: Tags: 010301aDocument2 pagesDescription: Tags: 010301aanon-69128Pas encore d'évaluation

- Sample PMS Terms and ConditionsDocument12 pagesSample PMS Terms and ConditionsJosh Qc OngPas encore d'évaluation

- Instructions For Form 1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnDocument16 pagesInstructions For Form 1120-IC-DISC: Interest Charge Domestic International Sales Corporation ReturnIRSPas encore d'évaluation

- Federal Register / Vol. 88, No. 117 / Tuesday, June 20, 2023 / NoticesDocument2 pagesFederal Register / Vol. 88, No. 117 / Tuesday, June 20, 2023 / NoticesKong CreedPas encore d'évaluation

- Description: Tags: 100499aDocument1 pageDescription: Tags: 100499aanon-952417Pas encore d'évaluation

- FBI CartsanDocument20 pagesFBI CartsanmanallmanwPas encore d'évaluation

- Divorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoDocument12 pagesDivorced Husband's $48,000 Lawsuit Over Wedding Pics, VideoJustia.comPas encore d'évaluation

- Stipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareDocument7 pagesStipulation: SAP Subsidiary TomorrowNow Pleading Guilty To 12 Criminal Counts Re: Theft of Oracle SoftwareJustia.comPas encore d'évaluation

- U.S. v. Rajat K. GuptaDocument22 pagesU.S. v. Rajat K. GuptaDealBook100% (1)

- Arbabsiar ComplaintDocument21 pagesArbabsiar ComplaintUSA TODAYPas encore d'évaluation

- Signed Order On State's Motion For Investigative CostsDocument8 pagesSigned Order On State's Motion For Investigative CostsKevin ConnollyPas encore d'évaluation

- U.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftDocument5 pagesU.S. v. TomorrowNow, Inc. - Criminal Copyright Charges Against SAP Subsidiary Over Oracle Software TheftJustia.comPas encore d'évaluation

- USPTO Rejection of Casey Anthony Trademark ApplicationDocument29 pagesUSPTO Rejection of Casey Anthony Trademark ApplicationJustia.comPas encore d'évaluation

- Amended Poker Civil ComplaintDocument103 pagesAmended Poker Civil ComplaintpokernewsPas encore d'évaluation

- Rabbi Gavriel Bidany's Sexual Assault and Groping ChargesDocument4 pagesRabbi Gavriel Bidany's Sexual Assault and Groping ChargesJustia.comPas encore d'évaluation

- Guilty Verdict: Rabbi Convicted of Sexual AssaultDocument1 pageGuilty Verdict: Rabbi Convicted of Sexual AssaultJustia.comPas encore d'évaluation

- Clergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesDocument22 pagesClergy Abuse Lawsuit Claims Philadelphia Archdiocese Knew About, Covered Up Sex CrimesJustia.comPas encore d'évaluation

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDocument22 pagesEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comPas encore d'évaluation

- Deutsche Bank and MortgageIT Unit Sued For Mortgage FraudDocument48 pagesDeutsche Bank and MortgageIT Unit Sued For Mortgage FraudJustia.com100% (1)

- Rabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesDocument3 pagesRabbi Gavriel Bidany's Federal Criminal Misdemeanor Sexual Assault ChargesJustia.comPas encore d'évaluation

- FBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatDocument15 pagesFBI Records: Col. Sanders (KFC - Kentucky Fried Chicken Founder) 1974 Death ThreatJustia.comPas encore d'évaluation

- Supreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionDocument1 pageSupreme Court Order Staying TX Death Row Inmate Cleve Foster's ExecutionJustia.comPas encore d'évaluation

- Van Hollen Complaint For FilingDocument14 pagesVan Hollen Complaint For FilingHouseBudgetDemsPas encore d'évaluation

- Brandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportDocument1 pageBrandon Marshall Stabbing by Wife: Domestic Violence Arrest ReportJustia.comPas encore d'évaluation

- Bank Robbery Suspects Allegedly Bragged On FacebookDocument16 pagesBank Robbery Suspects Allegedly Bragged On FacebookJustia.comPas encore d'évaluation

- Online Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedDocument52 pagesOnline Poker Indictment - Largest U.S. Internet Poker Cite Operators ChargedJustia.comPas encore d'évaluation

- Sweden V Assange JudgmentDocument28 pagesSweden V Assange Judgmentpadraig2389Pas encore d'évaluation

- Wisconsin Union Busting LawsuitDocument48 pagesWisconsin Union Busting LawsuitJustia.comPas encore d'évaluation

- Court's TRO Preventing Wisconsin From Enforcing Union Busting LawDocument1 pageCourt's TRO Preventing Wisconsin From Enforcing Union Busting LawJustia.comPas encore d'évaluation

- Federal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerDocument6 pagesFederal Charges Against Ariz. Shooting Suspect Jared Lee LoughnerWBURPas encore d'évaluation

- 60 Gadgets in 60 Seconds SLA 2008 June16Document69 pages60 Gadgets in 60 Seconds SLA 2008 June16Justia.com100% (10)

- Defamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionDocument25 pagesDefamation Lawsuit Against Jerry Seinfeld Dismissed by N.Y. Judge - Court OpinionJustia.comPas encore d'évaluation

- OJ Simpson - Nevada Supreme Court Affirms His ConvictionDocument24 pagesOJ Simpson - Nevada Supreme Court Affirms His ConvictionJustia.comPas encore d'évaluation

- NY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldDocument6 pagesNY Judge: Tricycle Riding 4 Year-Old Can Be Sued For Allegedly Hitting, Killing 87 Year-OldJustia.comPas encore d'évaluation

- Lee v. Holinka Et Al - Document No. 4Document2 pagesLee v. Holinka Et Al - Document No. 4Justia.com100% (4)

- City of Seattle v. Professional Basketball Club LLC - Document No. 36Document2 pagesCity of Seattle v. Professional Basketball Club LLC - Document No. 36Justia.comPas encore d'évaluation

- The Alberta NDP's Top 100 Donors, AnnotatedDocument2 pagesThe Alberta NDP's Top 100 Donors, AnnotatedMaclean's MagazinePas encore d'évaluation

- Related Documents - CREW: Department of State: Regarding International Assistance Offers After Hurricane Katrina: China AssistanceDocument106 pagesRelated Documents - CREW: Department of State: Regarding International Assistance Offers After Hurricane Katrina: China AssistanceCREWPas encore d'évaluation

- Estrada vs. Desierto Case DigestDocument2 pagesEstrada vs. Desierto Case DigestPJr MilletePas encore d'évaluation

- Republic of The Philippines Professional Regulation Commission ManilaDocument4 pagesRepublic of The Philippines Professional Regulation Commission ManilaReiannePas encore d'évaluation

- Notice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsDocument1 pageNotice: Agency Information Collection Activities Proposals, Submissions, and ApprovalsJustia.comPas encore d'évaluation

- Thread by @WarNuse The Coup D'état. 18 U.S. Code 2384 - Seditious Conspiracy 'TWENTY YEARS.' John Brennan. 18 U.SDocument136 pagesThread by @WarNuse The Coup D'état. 18 U.S. Code 2384 - Seditious Conspiracy 'TWENTY YEARS.' John Brennan. 18 U.Ssfrahm100% (1)

- Cases 2017 2019Document124 pagesCases 2017 2019Keej DalonosPas encore d'évaluation

- SDocument2 pagesSRenz FernandezPas encore d'évaluation

- Crim CasesDocument18 pagesCrim CasesKristine JoyPas encore d'évaluation

- NY B9 Farmer Misc - WH 1 of 3 FDR - 11-19-01 Newsweek Interview of Cheney 450Document22 pagesNY B9 Farmer Misc - WH 1 of 3 FDR - 11-19-01 Newsweek Interview of Cheney 4509/11 Document ArchivePas encore d'évaluation

- Dark Prophecy For The World Future 2050 - BilderbergDocument3 pagesDark Prophecy For The World Future 2050 - BilderbergxmindallxPas encore d'évaluation

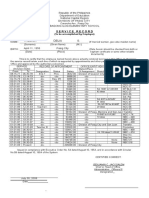

- Service RecordDocument5 pagesService RecordCHARMINE GAY ROQUEPas encore d'évaluation

- DILG - Preparing and Updating The CDPDocument108 pagesDILG - Preparing and Updating The CDPErnest Belmes100% (2)

- Notice: Concession Contracts and Permits: Fish and Wildlife Service, Fort Snelling, MNDocument1 pageNotice: Concession Contracts and Permits: Fish and Wildlife Service, Fort Snelling, MNJustia.comPas encore d'évaluation

- File Made byDocument10 pagesFile Made byClaudiu GherghelPas encore d'évaluation

- SSG PUBMATS 1Document1 pageSSG PUBMATS 1Khim Carmela MagbanuaPas encore d'évaluation

- Individual Anecdotal Record Name of Pupil: Gerald F. Antipala Grade & Section: 6 - Gorgeous Date Incidental Report RemarksDocument3 pagesIndividual Anecdotal Record Name of Pupil: Gerald F. Antipala Grade & Section: 6 - Gorgeous Date Incidental Report RemarksHyacinth Eiram AmahanCarumba LagahidPas encore d'évaluation

- HIVDocument299 pagesHIVJhonrie PakiwagPas encore d'évaluation

- The Spanish PeriodDocument5 pagesThe Spanish Periodbonifacio gianga jrPas encore d'évaluation

- KagawaranDocument4 pagesKagawaranJoen DelariartePas encore d'évaluation

- Government of Andhra PradeshDocument2 pagesGovernment of Andhra PradeshgangarajuPas encore d'évaluation

- First in PakistanDocument8 pagesFirst in PakistanEngr Muhammad Asif JavaidPas encore d'évaluation

- Government of India Act 1919Document3 pagesGovernment of India Act 1919Lavanya TanniruPas encore d'évaluation

- ClintDocument3 pagesClintMary Jane SaladinoPas encore d'évaluation

- U.S. BureaucracyDocument15 pagesU.S. BureaucracyZongyuan Zoe LiuPas encore d'évaluation

- Public Advisory On The Status of Apostille Application and Appointment System (Aaas) and Apostille Verification Site (Avs) DepDocument1 pagePublic Advisory On The Status of Apostille Application and Appointment System (Aaas) and Apostille Verification Site (Avs) DepMc DoPas encore d'évaluation

- Div Memo No. 189 S 2019 Participants For The Regional Teachers Induction Program Tip OrientationDocument7 pagesDiv Memo No. 189 S 2019 Participants For The Regional Teachers Induction Program Tip OrientationNiño Embile DellomasPas encore d'évaluation

- VICE-presidents of USADocument4 pagesVICE-presidents of USAeathan27Pas encore d'évaluation