Académique Documents

Professionnel Documents

Culture Documents

Nomura - India Banks Errclub - Making Sense of The "Stress"

Transféré par

Rohit ThapliyalTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Nomura - India Banks Errclub - Making Sense of The "Stress"

Transféré par

Rohit ThapliyalDroits d'auteur :

Formats disponibles

India banks

EQUITY: BANKS

Making sense of the stress

Global Markets Research

Stress discounted for private banks; sensitivity

indicates need to remain selective on PSUs

16 September 2015

INR6tn of unrecognised stress Sensitivity analysis

Large unrecognised exposure to stressed metals/infra and other corporates

remains a key investor concern and 5:25 refinancing is providing leeway to

delay recognition and impact on the P&Ls. In this report, we undertake a

analysis of the ultimate loss given default (LGD) relating to these stressed

names and ascertain what is and is not priced in for banks.

We estimate that some INR6tn in stressed assets at metals (INR1.4tn) and

infra SPVs (INR2tn) and infra conglomerates (INR1.6tn) and large

corporates/real estate (INR1tn) is yet to be recognised as impaired, which is

equal to 75% of current systems NPA+restructuring.

We estimate 15-20% of these loans have already been pushed out using

5:25 refinancing and more will likely follow. Thus, we believe adjusting bank

books for the ultimate LGD best assesses the potential impact.

Our LGD assumptions vary from 0% for hydro power and airports to 20-30%

for coal power assets, and a much higher 40-60% for gas power, overseas

coal, steel and infra conglomerate parent debt. Overall, an LGD of ~30%

implies a INR1.7tn hit to banks on these assets.

Large asset quality risks across

metals and infrastructure

conglomerates and corporates

have yet to be recognized. Our

exposure analysis indicates the

risk seems to be priced in for

private corporate banks, but

adjusted valuations for PSUs are

not cheap. Investors need to

remain selective on PSUs.

Anchor themes

How are banks relatively placed?

While there is exposure to stressed non-infra loans, private corporate banks

and PSU banks have similar exposure to large metal/infra names.

We estimate an LGD of 15-23% of net worth for corporate private banks.

ICICIs LGD is higher at ~23% of net worth due to its higher overseas coal

and JPA exposure. LGD for Axis/Yes is lower at 15-18% of net worth.

LGD for PSU banks in these accounts is 15-30% of net worth. BOB is best

placed with LGD of 13%, while PNB and BOI are worst placed. SBI parent is

better placed, but including subs its exposure is only marginally better.

Nomura vs consensus

We are 5-6% below consensus

on FY16/17F PAT estimates.

Research analysts

India Banks

Adarsh Parasrampuria - NFASL

adarsh.parasrampuria@nomura.com

+91 22 4037 4034

Amit Nanavati - NFASL

amit.nanavati@nomura.com

+91 22 4037 4361

Risk discounted in private banks: stay selective on PSUs

For private corporate banks, valuations adjusted for stressed loans are 1015% below mean valuations; hence the concerns seem priced in. ICICI's

higher exposure vs Axis/Yes is reflected in a ~20% discount.

For PSUs, the book adjustment is much larger at 30-55% with a 15-25% hit

from these accounts and a 15-30% book hit from higher coverage on NPA

and restructuring. Adjusting the stress, PSU valuations are not cheap. We

see a need to remain selective and prefer SBI and avoid PNB/BOI.

With the recent correction, we think private banks, especially Axis and ICICI,

offer a good entry opportunity and are our top pick along with HDFCB.

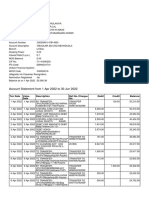

Fig. 1: India banks: Stocks for action

Company

Ticker

Rating

ICICI

Axis

SBI

Yes

BOB

PNB

BOI

ICICIBC IN

AXSB IN

SBIN IN

YES IN

BOB IN

PNB IN

BOI IN

BUY

BUY

BUY

BUY

BUY

Neutral

Neutral

Mcap (USDbn)

23.3

17.3

26.4

4.5

6.1

3.7

1.4

Avg. TO (USDmn)

64.6

62.7

64.1

45.3

14.8

12.8

7.6

Target Price

Current Price

Upside

350

625

290

870

210

140

140

272

496

235

732

187

137

136

28.5%

26.0%

23.3%

18.9%

12.6%

2.2%

2.9%

Source: Bloomberg, Nomura estimates. Pricing as of 14 September 2015.

See Appendix A-1 for analyst certification, important disclosures and the status of non-US analysts.

Nomura | India banks

16 September 2015

Contents

Investment summary ....................................................................................... 3

Our thesis in charts .......................................................................................... 4

Current stress may not be felt by P&Ls soon .................................................. 5

What we consider in our sensitivity and our rationale for loss given defaults

across segments .............................................................................................. 7

Private Banks discounting the hit; need to remain selective on PSU banks . 10

How does it all stack up: Corporate banks factoring in the hit, still need to be

selective on PSUs .......................................................................................... 12

Sector view: Positive on private banks; still remain selective on PSUs: ....... 14

Axis Bank ............................................................................................. 16

ICICI Bank ............................................................................................ 19

Yes Bank .............................................................................................. 23

State Bank of India ............................................................................... 26

Bank of Baroda..................................................................................... 29

Bank of India ........................................................................................ 32

Punjab National Bank ........................................................................... 35

Appendix A-1 ........................................................................................ 38

Nomura | India banks

16 September 2015

Investment summary

While many stressed names have been recognised in the past two to three years, we

believe that some of the larger stressed metal/infra special purpose vehicles (SPVs) and

corporates have yet to be recognised. While the government is trying to resolve project

bottlenecks, weak balance sheets plague many infra conglomerates plus the commodity

downcycle will likely delay the expected recovery in asset quality. That said, in the near

term we expect banks to likely opt to manage some of these accounts through the 5:25

refinancing provided by the regulator. We believe some of these companies have

unsustainable debt levels and so the banks will likely eventually need to take a hit on

these accounts. In this report, we have done our best to estimate:

The part of the stress still not recognised We believe there could be INR6tn of

debt not recognised as NPAs or restructuring. This is 75% of current system NPA and

restructured book.

Loss given default (LGD) While asset classes will differ significantly in ultimate

LGDs, overall we estimate a ~30% LGD in these accounts.

Bank exposure We look at MCA data to find bank exposure to these assets, which

show that private corporate banks have similar exposure as PSU banks.

Bank-wise LGD and how valuations stack after factoring these hits: For private

banks, we estimate the impact to their net worth at 15-25%. For PSUs, the LGD is not

very different (20-25% of net worth), but overall book adjustments will be larger when

factoring in high provisioning for NPAs and restructured loans.

Overall, we expect an elongated credit cost cycle. Private corporate bank

valuations adjusted for the stress are below long-term averages; hence we are

positive on Axis and ICICI particularly following the recent correction. For PSUs,

adjusted valuations are not attractive, so we remain selective, with SBI as our

preferred pick.

Fig. 2: Potential stress seems to be priced in for corporate private banks but adjusted PSU multiples are closer to long-term

averages, indicating that the potential stress is not fully priced in

Book Im pact

ICICI

Axis

Yes HDFCB Kotak

IIB

SBI

PNB

BOB

BOI Union

Reported book FY17F

149

255

382

332

173

336

266

243

212

389

300

Book Im pact on banks

Deep dive sensitivity+SEB

70% NPL coverage+ARC

Restructured book

-22.1% -11.3% -10.9%

-18.2% -11.2% -13.3%

-1.8% 2.0%

3.3%

-2.2% -2.1%

-0.9%

1.4%

-0.6%

2.1%

0.0%

-1.8%

-0.2%

-1.4%

-0.1%

-0.9% -30.2% -55.5% -28.8% -58.6% -40.5%

-1.2% -15.0% -24.0% -12.1% -28.5% -20.1%

0.9%

-5.7% -16.3% -6.1% -16.2% -11.1%

-0.6%

-9.5% -15.2% -10.6% -13.9%

-9.3%

Adjusted book FY17F

116

225

334

336

170

329

178

108

148

115

169

P/B at current price

Reported book - FY17F

Adjusted book - FY17F

1.38

1.78

1.94

2.20

1.92

2.19

3.06

3.03

3.23

3.28

2.60

2.66

0.78

1.17

0.56

1.27

0.88

1.26

0.35

1.19

0.57

1.02

P/B at Target price

Reported book - FY17F

Adjusted book - FY17F

1.90

2.45

2.45

2.77

2.28

2.60

3.61

3.57

3.83

3.90

3.05

3.12

0.99

1.48

0.58

1.30

0.99

1.42

0.36

1.22

0.67

1.18

Long term 1 yr frd P/B (04-now )

2004-07 average 1 yr frd P/B

1.87

2.10

2.16

2.47

2.36

3.21

At current valuation

Reported book FY17 P/B v/s LT average

Adjusted book FY17 P/B v/s 04-07 multiple

-26% -10%

-15.3% -10.9%

At Target m ultiples

Reported book FY17 P/B v/s LT average

Adjusted book FY17 P/B v/s 07-07 multiple

1.8% 13.5%

17.0% 12.3%

3.43

3.65

2.79

2.68

2.13

1.95

1.28

1.20

1.29

1.45

1.04

1.00

1.08

1.16

1.09

1.25

-19%

N/A

-11%

16%

-16.9% 22.5%

22%

36.9%

-39%

-2.0%

-56%

-12.5%

-15%

N/A

-68%

2.5%

-47%

-18.7%

-3.4%

N/A

5.1% 37.5%

-2.0% 45.5%

42.7%

60.3%

-22.6%

23.9%

-55.3%

-10.7%

-4.4%

N/A

-66.8%

5.6%

-39.0%

-5.7%

Source: Bloomberg, Company data, Nomura estimates

Nomura | India banks

16 September 2015

Our thesis in charts

Fig. 3: Plenty of stress yet to be recognised 75% of current

system NPA and restructured book

Fig. 4: We estimate 30% LGD for these assets in the long run

INRbn

Metal exposure to stressed groups

Infra conglomerates (Top-4)

Infra SPVs (ex Infra conglomerates)

Corporates and Real Estate (ex infra)

Total potential stress

Sector

Airports

Pow er - Coal

Pow er -Coal - IPPs

Pow er - Coal international

Pow er - Gas

Pow er - Hydro

Roads

Infra Conglomerate - Parent

Real Estate

Steel

Corporates ex-Steel

Divestments

Total LGD

Exposure % of loans

1,427

2.4%

1,555

2.6%

1,957

3.2%

1,004

1.7%

5,943

9.8%

Banks NPAs

Banks -Restructured book

NPA of Infra Finance com panies

Total recognised stress

3209

4,368

249

7827

Potential stress as a % of current NPA

+ Restructuring

5.3%

7.2%

NA

12.5%

76%

Source: MCA, Nomura research

LGD %

0%

20%

30%

60%

60%

0%

15%

50%

15%

40%

20%

0%

28.8%

Source: Nomura estimates

Fig. 5: Unrecognised stress ~15-30% of banks current net worth

Exposure to

stressed assets

5,943

880

783

96

3,631

507

925

INRbn

Total System

Private banks

ICICI/Axis/Yes

Other private banks

PSUs

IDFC/PFC/REC

Other Institutions

% of FY15 Netw orth

LGD on stressed Total stressed

Infra Ex infra Corp.

Infra

assets

assets conglo

and CRE Corporates Metals

1,709

20.4%

5.1%

2.3%

6.0%

6.8%

280

11.2%

4.5%

1.4%

2.4%

2.6%

248

19.8%

8.4%

2.5%

4.2%

4.0%

33

2.6%

0.6%

0.3%

0.5%

1.1%

1,088

23.4%

5.2%

2.4%

5.8%

9.8%

139

18.7%

5.1%

1.9%

11.8%

0.0%

201

Source: MCA, Nomura research

Fig. 6: Book adjustment much higher for PSU banks after

adequate provisions for NPAs and restructured book

-70%

Deep dive sensitivity+SEB

Restructured book

Fig. 7: Private banks trading at discount after adjusting for

stress, PSUs trading in line with long-term averages

70% NPL coverage+ARC

-60%

-50%

-14%

-15%

-40%

-16%

-16%

-30%

-9%

-20%

-10%

-2%

-2%

-18%

0%

-11%

-6%

-2%

-1%

-11%

-13%

2%

3%

Axis

Yes

-24%

-15%

-6%

-9%

-11%

-28%

-20%

-12%

10%

ICICI

Source: MCA, Nomura research

SBI

PNB

BOB

BOI

Union

ICICI

Axis

Yes

SBI

PNB

BOI

Union

P/B (FY17F P/B (FY17F

Reported Adjusted

book)

book)

1.38

1.78

1.94

2.20

1.92

2.19

0.78

1.17

0.56

1.27

0.35

1.19

0.57

1.02

Reported

book

FY17 P/B

v/s LT

average

-26.3%

-10.0%

-18.8%

-38.8%

-56.2%

-67.8%

-47.4%

Adjusted

book

FY17 P/B

v/s 04-07

multiple

-15.3%

-10.9%

N/A

-2.0%

-12.5%

2.5%

-18.7%

Source: Bloomberg, Nomura estimates

Nomura | India banks

16 September 2015

Current stress may not be felt by P&Ls soon

No material resolution of large asset quality risks: The current government has been

taking steps to improve the investment climate and remove roadblocks to projects across

the value chain, but what we see is that still large risks in Infrastructure SPVs and

conglomerates, metals and now also SEBs remains for the banking system. For metals,

the outlook has deteriorated in the last 12 months given the fall in global commodity

prices and in Infrastructure weak promoter company balance sheets remain a key issue

and leverage ratios of most of the Infra conglomerates has only deteriorated.

1)

Infra conglomerates: Financial position has deteriorated: Interest coverage has

dropped to 0.7x in FY15 from 0.9x in FY14 and debt/equity is up to ~16.5x from

14.5x in FY14. While there has been some success in selling down assets by these

Infra conglomerates, sales are largely of cash generating assets and also

improvement in some of their stressed assets is slower than expected.

Fig. 8: Interest coverage for infra conglomerates has been

deteriorating

7.0

JPA

GMR

6.0

IVRCL

Lanco

GVK

Fig. 9: Debt/Equity ratio also fails to improve despite asset

sales

14.0

JPA

IVRCL

GVK

GMR

12.0

5.0

10.0

4.0

8.0

3.0

6.0

2.0

4.0

1.0

2.0

FY09

(1.0)

FY10

FY11

FY12

FY13

FY14

FY15

FY09

Source: ACE Equity, Nomura research

2)

FY10

FY11

FY12

FY13

FY14

FY15

Source: ACE Equity, Nomura research

Commodity names: Could lead to high a LGD: the global commodity downcycle

is having significant impact on the profitability of most metal companies. In a lowprice commodity regime, longer-term losses given defaults could be high in some of

these names.

Fig. 10: Interest coverage of even large metal names now

challenged

Fig. 11: Debt levels very high of some of the metal

companies could lead to high loss given default (LGD)

Jun-15

Mar-15

Dec-14

Sep-14

Jun-14

Mar-14

Dec-13

Jun-13

Mar-13

Dec-12

Sep-12

Jun-12

Mar-12

Dec-11

Source: ACE Equity, Nomura research

Sep-13

Metals IC - Large companies

Metals IC - Medium companies

Metals IC - Small companies

5.0

4.5

4.0

3.5

3.0

2.5

2.0

1.5

1.0

0.5

0.0

3)

Metal com panies

Bhushan Steel

Bhushan pow er & steel

Monnet Ispat

MSP Steel

Adhunik Metaliks

Concast Group

Loha Ispat

Essar Steel

Total

Total sector's system loans

Total Debt % of sector's

(INRbn) system loans

381

13%

317

11%

98

3%

5

0%

49

2%

34

1%

7

0%

536

19%

1,427

50%

2861

100%

Source: MCA, RBI, Nomura research

Infra SPVs (ex conglomerates): Project-level issues remain on gas plants and

even profitability of coal power plants is a worry after the auctions as pointed out by

IDFC in their 1Q16 results conference call (the company having increased its own

LGD assumptions). Some independent power producer-run power plants will not be

able to receive any balance sheet support from parent.

Nomura | India banks

4)

16 September 2015

Slippage from restructured books: For PSUs, we have highlighted that relapse

risk remains very high, which will keep credit costs elevated in our view. Slippage

from restructured books has increased to ~30% of total slippages in FY15 compared

to ~15% in FY13/14.

Fig. 12: Slippage from restructured books have risen

SBI

PNB

BOB

BOI

Union

Total

Slippages from restructuring (% of loans)

FY13

FY14 1HFY15 2HFY15 FY15

1Q16

0.26% 0.66%

0.49%

0.52% 0.49% 0.37%

0.30% 0.50%

1.64%

2.35% 1.94% 0.89%

0.63% 0.49%

0.62%

0.88% 0.72% 0.34%

0.57% 0.41%

1.13%

1.55% 1.32% 2.33%

0.48% 0.89%

0.71%

0.41% 0.54% 1.00%

% slippages from restructured book

FY13

FY14 1HFY15 2HFY15 FY15

8.7% 19.8%

16.7%

28.7% 21.5%

7.1% 14.6%

44.6%

35.1% 38.4%

30.0% 28.7%

30.9%

40.8% 36.3%

22.6% 17.5%

33.3%

28.2% 30.1%

25.1% 37.0%

26.1%

16.1% 21.1%

13.3% 20.8%

26.7%

30.8% 28.9%

1Q16

16.2%

25.0%

18.3%

35.2%

41.0%

25.6%

Source: Company data, Nomura research

5)

SEB debt: Restructuring related moratorium coming to an end. While SEB debt

carries some sovereign guarantee and is unlikely to become an NPA any time soon,

we believe that a large part of this debt is exiting its moratorium in FY16 and, given

the weak financials of these SEBs, the Reserve bank of India (RBI) may have to

give an exception to prevent these SEBs from becoming NPAs.

Fig. 13: Financial position of SEBs under FRP have not

improved significantly

Fig. 14: Banks do have large exposure to SEBs part of which

they have restructured as well

SEB losses (INRbn)

Haryana

Punjab

Rajasthan

UP

AP

Karnataka

TN

MP

SEB

% of FY15

Of w hich

%

INRbn exposure

Loans

restructured restructured

Union

105

4.1%

57

53.9%

BOI

151

3.7%

40

26.5%

PNB

107

2.8%

58

54.4%

BOB

52

1.2%

35

67.3%

SBI

107

0.8%

38

35.5%

FY10

(15.9)

(13.0)

(110.1)

(52.6)

(36.4)

(4.3)

(103.0)

(33.4)

Source: PFC report, Nomura research

FY11

(10.8)

(16.4)

(213.7)

(39.7)

(21.8)

0.1

(119.1)

(21.6)

FY12

(132.0)

(4.6)

(195.7)

(92.3)

(40.2)

(0.8)

(133.1)

(29.2)

FY13

(36.5)

0.5

(123.5)

(97.8)

(175.2)

(9.1)

(120.6)

(44.5)

Source: Company data, Nomura research

But these stresses may not affect P&Ls in the near term the 5:25 leeway

While our interest coverage analysis indicates stability in overall interest coverage for

corporate India, the assets above have seen a deterioration in their debt servicing that

are large relative to the size of the current stressed book (NPA + restructured book).

While this would imply that incremental stress in the next 12-18 months should not ebb,

the RBIs leeway given to refinance (5:25 restructuring), provides a way to push out

these asset-quality worries for the time being. This will likely shield banks P&Ls in the

interim as well.

Since large part of the stressed book can be re-financed and the P&L in the near

term will not reflect the real asset quality challenges, we believe running

sensitivity on this exposure for their ultimate LGDs is the best way to factor in the

relative stress for banks.

Nomura | India banks

16 September 2015

Fig. 15: 5:25 restructuring announced pushing out some of

the current stress

Fig. 16: The pool of problem assets pretty large

Com pany

Bhushan Steel

Lanco Kondapalli II and III

GMR - Odisha pow er plant

Essar steel

Adani Pow er

Uttam Galva Metallics

Jaypee - Yamuna Expressw ay

Vedanta

RPow er - Butibori and Rosa

Torrent Pow er

Lanco Udupi

Krishnapatnam Port

JSW Energy - JPVL's Hydro plants

Tata pow er - Mundra UMPP

Total referrals under 5:25 schem e

Stressed nam es (%)

INRbn

Metal exposure to stressed groups

Infra conglomerates (Top-4)

Infra SPVs (ex Infra conglomerates)

Corporates and Real Estate (ex infra)

Total potential stress

INR bn

350

24

40

150

150

13

103

102

65

13

49

46

60

100

1,265

88.3%

Source: Media reports (Mint, Financial express, Money control), Nomura research

Banks NPAs

Banks -Restructured book

NPA of Infra Finance com panies

Total recognised stress

Potential stress as a % of current NPA

+ Restructuring

Exposure % of loans

1,427

2.4%

1,555

2.6%

1,957

3.2%

1,004

1.7%

5,943

9.8%

3209

4,368

249

7827

5.3%

7.2%

NA

12.5%

76%

Source: MCA, Nomura research

What we consider in our sensitivity and our rationale for loss

given defaults across segments

The list is INR6trn 75% of banking systems current stressed book (NPAs +

restructured book): We have included debts of ~INR1.4trn form steel; INR1.5trn from

four Infra conglomerates; INR2.0trn from Infra SPVs (ex-Infra conglomerates) and

INR1.0trn from some stressed corporates including some real estate names. This

aggregates to INR6trn and equates to 75% of the FY15 system stressed loans

(Gross NPAs + Restructuring).

We believe this set of exposure largely represents the possible stress remaining to be

recognised for the banking system, and that a large part of it is eligible for 5:25 refinancing and so may not affect P&Ls for now. While we have tried to exclude exposure

that is already part of the restructured book for banks, there may be some overlap but we

believe this to be negligible given the scale of the numbers involved (please see

Appendix 1 for details on what has been included in our stressed list for sensitivity).

Fig. 17: Unrecognised stress still very large - ~75% of system NPA + Restructuring

INRbn

Metal exposure to stressed groups

Infra conglomerates (Top-4)

Infra SPVs (ex Infra conglomerates)

Corporates and Real Estate (ex infra)

Total potential stress

Banks NPAs

Banks -Restructured book

NPA of Infra Finance com panies

Total recognised stress

Potential stress as a % of current NPA +

Restructuring

Exposure % of loans

1,427

2.4%

1,555

2.6%

1,957

3.2%

1,004

1.7%

5,943

9.8%

3209

4,368

249

7827

% of Netw orth

17.0%

18.6%

23.4%

12.0%

70.9%

5.3%

7.2%

NA

12.5%

76%

Source: MCA, Nomura research

Assessing loss given default (LGD) in different asset classes: As discussed above

we thus think that adjusting book value of banks for loss given defaults in this stressed

accounts would be the best adjustment to determine what is priced in and what is not.

Nomura | India banks

16 September 2015

Fig. 18: Loss given default assumptions across asset classes

70%

LGD %

60%

60%

60%

50%

50%

40%

40%

30%

30%

20%

20%

15%

28.8%

20%

15%

10%

0%

0%

0%

0%

Source: Nomura estimates

Fig. 19: Rationale for our loss given default assumptions

Sector

LGD %

Rationale

Airports

0.0%

4 major airports run by GVK/GMR w hose B/S look stretched but its airports assets are

making money and hence can be disposed off even if parent B/S remains stretched

Pow er - Hydro

0.0%

Barring 1-2 hydro assets, most assets are able to service interest - even in case of JPA's

sale of Hydro assets the sale is happening at Equity value of +1x

Divestments

0.0%

Some assets have been divested or process of being divested to better B/S companies and

hence w e assume no w rite-off in those cases

Roads

15.0%

Write offs low as most assets don't have any linkage/ raw material issues like pow er plants Low er interest rates should aid profitability as w ell

Real Estate

15.0%

No large defaults as yet but low real estate volumes a concern - LGD low because of

collateral of property

Pow er - Coal

20.0%

Improving coal availability a positive in the long run but project over-runs and now no pass

through of auction coal cost is an issue - IDFC inched up their LGD expectation from coal

pow er plants recently

Corporates ex-Steel

20.0%

Past LGD for Indian banks is ~40-45% - We assume low er slippages as some corporates

w ill be able to divest or w ould benefit from a recovery

Pow er -Coal - IPPs

30.0%

Higher LGD v/s other coal assets as parent B/S support could be low er in these cases

Steel

40.0%

Longer term debt of some of the steel names like Essar/Bhushan looks unsustainable

w ithout considering a commodity boom again.

Infra Conglomerate - Parent

50.0%

Infra conglomerate parent B/S funding used for cost over-runs, equity funding and hence

asset backing is low er and hence w e assume high Loss given default here.

Pow er - Coal international

60.0%

Most coal acquisitions happened in commodity boom time and asset values have come off

significantly since then. Also debt funding required to scale up and optimise production here

looks difficult to tie-up

Pow er - Gas

60.0%

Near term w e don't see a solution to the gas assets - Govt's solution of pooling gas can

meet only a very small part of interest obligations

Total LGD

28.8%

Source: Nomura research

Nomura | India banks

16 September 2015

We arrive at a LGD of ~30% of this INR6trn of stresses exposure

Based on our above assumptions, on a system level we arrive at a total LGD of ~3035% of the accounts mentioned above, aggregating to a ~INR2trn impact on banks and

non-bank financial companies (NBFCs) from these accounts.

The 30% LGD ratio is lower than the 40-50% Indian banks have faced in the past due

to: 1) the long gestation of these stressed assets (mostly Infra); and 2) divestments that

will reduce the risk profile of some of these assets.

The 30% LGD is not significantly different from the provisioning IDFC has talked about.

Of its ~16% of stressed exposure, there is 2% of equity exposure and ~3.0-3.5% of gas

exposure where write-offs will be larger. Adjusting for these higher LGD, IDFCs

assumed LGD is ~35-40% against 30% in our analysis.

Fig. 20: We arrive at an LGD of ~INR1.7trn in these stressed accounts over time

INRbn

Metal exposure to stressed groups

Infra conglomerates (Top-4)

Infra SPVs (ex Infra conglomerates)

Corporates and Real Estate (ex infra)

Total potential stress

Banks NPAs

Banks -Restructured book

LGD INRbn

571

430

505

196

1,702

LGD (%) % of Netw orth

40.0%

6.8%

27.6%

5.1%

25.8%

6.0%

19.5%

2.3%

28.8%

20.4%

3209

4,368

70%

40%

Source: MCA, Company data, Nomura research

Fig. 21: Longer-term, system-level LGDs have been 40-50%

in the past

Fig. 22: IDFCs provisioning assume a LGD of 45%, excluding

gas and equity it is 30-35%

PSU Banks Ultim ate Loss given

Default (FY02-14) - INRbn

FY02-14 FY02-04 FY12-04

Total Slippages

6,372

498

3,765

Total Reductions

4,637

530

2,236

Estimated Write offs

1,734

237

742

Total Recoveries/Upgrades

2,903

293

1,494

Recoveries/upgrades (% of

Slippages)

45.6%

58.7%

39.7%

Thru cycle loss given default

54.4%

41.3%

60.3%

IDFC's reported stressed book

Provision created

IDFC's total stressed book

Of w hich Equity

Of w hich Gas assets

Other stressed assets

Gross Slippages

Total Reductions

Implied Write offs

Recovery/Upgrades

Net Slippages (ex- Write offs)

Credit Costs (only NPA)

Source: RBI, Nomura research

2.28%

2.04%

0.84%

1.21%

1.07%

1.00%

3.06%

3.21%

1.43%

1.78%

1.27%

1.79%

% of loans

8.50%

9.0%

16.0%

2.5%

3.1%

10.4%

LGD

56%

60%

60%

35%

2.84%

1.68%

0.55%

1.12%

1.72%

1.01%

Source: Company data, Nomura research

Nomura | India banks

16 September 2015

Private Banks discounting the hit; need to remain selective

on PSU banks

We start with a caveat: We base our bank-wise exposure and LGD analysis on detail of

the exposure provided by the ministry of corporate affairs (MCA). While the MCA

reasonably captures consortium-lending exposures, we may miss bilateral exposure

taken by some banks given separate fixed asset charges filed for each of these lendings.

However, overall in the past, the quantum and magnitude of exposure as provided by the

MCA has been not too different from actual bank exposure so analysis based on this

data is useful, in our view.

Exposure analysis to the above names and key observations:

Exposure to some of the Metal/Infra conglomerate names is not dramatically different

between PSU banks and private corporate banks like ICICI/Axis/Yes bank Gross

NPAs + restructuring of Axis/ICICI/Yes is 50-60% lower than PSU banks but their

exposure to the above mentioned assets is only 10-15% lower (as % of net worth) and

LGDs are 5-10% lower (as % of their net worth).

Within the private banks, ICICI Bank has the highest exposure according to the data.

The biggest difference is ICICI Banks large international coal exposure and high

exposure to the JPA group. Excluding these assets, exposure of ICICI Bank is similar

to Axis Bank and Yes Bank.

Among our covered retail banks, their exposure to these stressed names is <0.5% in

the case of HDFCB and Kotak and ING Vysya Bank. IndusInd Banks exposure is also

negligible at ~1% of loans, part of which could have been recognised when it sold down

assets to ARCs (asset reconstruction companies).

Within PSU banks, BOB clearly stacks up as the best, and PNB the worst. For SBI,

exposure of its subsidiaries is higher in these accounts than the parent. Union and BOI

are middle of the pack, but on a relative basis Union is better placed than BOI.

Among non-covered PSU banks, IDBI/ United and UCO are worst placed.

Within NBFCs, IDFCs exposure is similar to the high stressed book disclosure that

IDFC made while IDFC has provided for this in terms of credit cost, the interest

reversal impact of this may be large, in our view.

Fig. 23: Exposure to stressed assets PSU banks have high exposure but even exposure of private banks like ICICI/Axis/Yes

is not very different

INRbn

Total System

Private banks

ICICI/Axis/Yes

Other private banks

PSUs

IDFC/PFC/REC

Other Institutions

Exposure to

stressed assets

5,943

880

783

96

3,631

507

925

Total stressed

assets

7.6%

5.9%

10.5%

1.3%

6.6%

11.3%

% of FY15 loans

Infra

Ex infra Corp.

conglo

and CRE

2.0%

1.3%

2.5%

0.9%

4.7%

1.6%

0.2%

0.2%

1.6%

1.0%

3.5%

1.0%

Infra SPVs

2.5%

1.5%

2.6%

0.4%

1.9%

7.5%

Metals

1.8%

1.1%

1.7%

0.5%

2.1%

0.0%

Source: MCA, Nomura research

Fig. 24: Loss given default for banks in these accounts ICICI Bank similar to PSUs; Axis and Yes Bank lower. Within PSUs

BOB is best, PNB the worst

INRbn

Total System

Private banks

ICICI/Axis/Yes

Other private banks

PSUs

IDFC/PFC/REC

Other Institutions

LGD on stressed

assets

1,709

280

248

33

1,088

139

201

Total stressed

assets

20.4%

11.2%

19.8%

2.6%

23.4%

18.7%

% of FY15 Netw orth

Infra

Ex infra Corp.

conglo

and CRE

5.1%

2.3%

4.5%

1.4%

8.4%

2.5%

0.6%

0.3%

5.2%

2.4%

5.1%

1.9%

Infra

Corporates

6.0%

2.4%

4.2%

0.5%

5.8%

11.8%

Metals

6.8%

2.6%

4.0%

1.1%

9.8%

0.0%

Source: MCA, Nomura research

10

Nomura | India banks

16 September 2015

Fig. 25: Bank-wise LGDs to each segments Corporate private banks have higher exposure to infra conglomerates while

PSUs have higher risks towards the metal sector and infra SPVs

INRbn

Total System

% of FY15 Netw orth

LGD on stressed

Total stressed

Infra

Ex infra Corp.

Infra

assets

assets

conglo

and CRE

Corporates

Metals

1,709

20.4%

5.1%

2.3%

6.0%

6.8%

Corporate Private Banks

Axis

ICICI

Yes

Other Private Banks

IIB

HDFCB

KVB

Federal

Karnataka

SIB

Kotak

ING

J&K

PSUs

SBI+Subs

SBI

BOB

PNB

BOI

Canara

Union

Corp

Andhra

BOM

ALBK

Dena

OBC

Vijaya

Indian

IOB

Syndicate

Central

Uco

United

PSB

IDBI

NBFCs/Institutions

REC

PFC

IDFC

IFCI

68

158

21

15.2%

23.0%

18.1%

3.6%

11.2%

10.4%

1.7%

2.9%

3.2%

4.6%

4.5%

1.1%

5.2%

3.4%

3.2%

2

5

3

3

2

3

1

1

12

2.3%

0.9%

6.0%

4.0%

6.3%

9.0%

0.3%

1.4%

20.1%

0.5%

0.0%

1.5%

0.3%

3.8%

1.4%

0.0%

1.0%

6.2%

0.5%

0.0%

0.0%

0.1%

2.0%

4.1%

0.0%

0.2%

0.9%

0.7%

0.3%

0.9%

1.3%

0.5%

0.8%

0.3%

0.0%

2.1%

0.7%

0.4%

3.6%

2.3%

0.0%

2.7%

0.0%

0.1%

11.0%

292

198

50

98

76

64

38

28

26

17

29

8

26

9

14

38

25

32

43

27

10

136

19.1%

16.4%

12.9%

26.1%

27.4%

24.3%

20.7%

26.4%

27.7%

24.3%

24.9%

11.5%

20.0%

15.7%

10.9%

27.4%

20.6%

20.5%

35.7%

50.9%

21.7%

60.2%

2.1%

1.6%

3.5%

3.6%

9.9%

5.8%

3.2%

7.4%

12.2%

4.6%

5.9%

1.5%

4.0%

1.3%

2.1%

8.2%

2.3%

6.3%

7.4%

18.1%

10.9%

20.4%

1.4%

0.9%

0.8%

2.6%

2.4%

2.0%

1.6%

4.2%

5.0%

5.5%

1.7%

1.7%

3.1%

3.4%

0.5%

1.7%

2.5%

2.0%

5.0%

5.6%

2.0%

8.6%

6.3%

6.2%

3.0%

6.1%

5.2%

4.1%

5.8%

4.8%

4.9%

2.1%

3.3%

1.5%

4.8%

6.3%

3.6%

3.5%

2.2%

3.5%

9.6%

12.3%

3.5%

17.3%

8.9%

7.4%

5.7%

13.5%

9.8%

12.4%

10.2%

10.0%

5.6%

12.2%

13.9%

6.8%

7.9%

5.6%

4.5%

13.6%

13.4%

8.5%

13.6%

14.9%

5.4%

13.0%

54

59

27

13

21.8%

18.2%

15.5%

18.3%

5.1%

2.2%

10.4%

6.5%

2.2%

1.7%

1.9%

3.9%

14.4%

14.3%

3.1%

5.4%

0.0%

0.0%

0.0%

1.8%

Source: MCA, Nomura research

11

Nomura | India banks

16 September 2015

How does it all stack up: Corporate banks factoring in the hit,

still need to be selective on PSUs

We highlight that some the stress identified above will likely impact bank P&Ls in the

long run. We thus adjust book values for the stress already recognised (NPAs +

restructuring) and the stress that remains largely as yet unrecognised.

For NPAs, we increase coverage to ~70% mostly PSUs affected.

For restructured accounts We estimate that ~20% of restructured accounts ex-Air

India and SEBs have turned bad, and we further take a ~20% charge in the

restructured book mostly PSU banks affected again due to high level of restructuring.

SEB exposure While these accounts are less likely to turn bad, we believe there

could be NPV losses and hence take a 15% credit charge on SEB exposures here

also it is mainly PSU banks that are affected.

For unrecognised stress We take our LGD estimate as credit charges that banks

will have to take here the effect is felt by both private and PSU banks.

Key observations:

Corporate private banks: The book impact is between 13-22% of their banking net

worth. The impact is lower for Axis and Yes Bank at 12-13% of their net worth as their

exposure to the unrecognised names is lower than that of ICICI Bank (22%).

PSU banks: The book impact for PSU banks is much higher at 30-55% of their net

worth. In the case of PSU banks >50% of the book effect is from write-downs from

already recognised stress (NPAs + restructuring).

Among PSU banks, the book adjustment is least for BOB and SBI at ~30% of their net

worth, where it is highest for PNB/BOI at ~55%.

For retail private banks, the book adjustment required is negligible at <1% of their net

worth. This was one of the reasons for our recent upgrade of Kotak Bank; the stock

came off ~20% lower after the recent correction.

Fig. 26: Detailed book adjustment and sensitivity

INRm n

Mar-17 Reported book

P/B on reported book

ICICI

149

1.83

Axis

255

2.45

Yes

382

2.28

Im pact from adjusting to 70% NPA coverage:

Gross NPAs (1Q16)

Net NPAs (1Q16)

Coverage (%)

Intended coverage (%)

% impact from 70% coverage adjustment

Mar-17 Price to adj. book

151,376

63,333

58.2%

70%

-2.1%

1.87

42,512

14,613

65.6%

70%

1.8%

2.40

3,683

1,067

71.0%

70%

2.5%

2.22

Im pact from slippages on Restructured book

Restructured book - 1Q16

Restructured book (ex AI +SEBs)

Additional slippgaes (%) - Ex AI +SEBs

Additional slippgaes ex AI +SEB

126,040

126,040

15.0%

18,906

85,150

85,150

15.0%

12,773

SEB exposures - Loans

Additional slippages from SEBs

% impact from restructured book slippages

M ar-17 Price to adj. book

Deep dive sensitivity

Total exposure to stressed names

Hit based on our LGD assumptions

% impact from stressed book

M ar-17 Price to Adj.book

-2.2%

1.91

PNB

243

0.58

BOB

212

0.99

BOI

389

0.36

Union

300

0.67

705,260 253,974

358,364 153,936

49.2%

39.4%

70%

70%

-7.1%

-16.3%

1.07

0.69

172,740

84,700

51.0%

70%

-6.9%

1.06

268,892

157,890

41.3%

70%

-22.2%

0.46

141,436

76,338

46.0%

70%

-12.7%

0.76

5,671 1,023,630 436,340

5,671

973,670 362,340

25.0%

20.0%

20.0%

1,418

194,734

72,468

312,569

253,569

20.0%

50,714

298,830

242,830

20.0%

48,566

191,280

124,650

20.0%

24,930

52,000

7,800

151,000

22,650

105,000

15,750

-2.1%

2.46

-0.9%

2.24

495,109 222,186

158,438

67,894

-18%

-11%

2.36

2.77

66,034

21,189

-13%

2.58

SBI

266

0.99

107,000

16,050

-10.3%

1.20

107,000

16,050

-18.6%

0.89

-12.2%

1.22

-20.5%

0.63

-15.2%

0.92

936,687 331,273

292,409

98,214

-14%

-21%

1.45

1.30

159,077

50,072

-10%

1.41

238,109

76,453

-22%

1.02

133,778

38,022

-14%

1.15

Source: Company data, Nomura estimates

12

Nomura | India banks

16 September 2015

Valuations discount most of the pain for corporate private banks; our sensitivity

suggests a need to remain selective on PSUs:

Corporate banks pricing in the stress

Adjusted for the stress, current valuations of corporate private banks are at a 5-10%

discount to their long-term averages and hence we believe the stress is discounted in

current stock prices, assuming our LGD estimates are accurate.

Our revised TPs imply multiples ~5-10% higher than average long-term multiples for

corporate private banks, mainly because of granularity that the corporate banks have

built in their liability and asset franchise over the last five to seven years.

PSU banks remain selective

While PSU banks are trading at deep discounts of 40-70% to their long-term average

multiples, adjusted for their stress, valuations are trading just below the long-term

average in a few cases and at average valuations in others.

Our revised TPs imply multiples closer to their long-term averages. Since upside in

PSU banks after factoring in the stress is lower, investors need to be selective.

SBI is our preferred PSU pick (trading at 12% below its long-term average multiples).

PNB/BOI (Neutral) remains our least preferred picks, despite their low multiples.

Fig. 27: Potential stress seems to be priced in for corporate private banks but adjusted multiples for PSUs are closer to longterm averages, indicating that the potential stress in not fully priced in

ICICI

Axis

Yes

P/B at current price

Reported book - FY17F

Adjusted book - FY17F

1.38

1.78

1.94

2.20

1.92

2.19

3.06

3.03

P/B at Target price

Reported book - FY17F

Adjusted book - FY17F

1.90

2.45

2.45

2.77

2.28

2.60

3.61

3.57

Long term 1 yr frd P/B (04-now )

2004-07 average 1 yr frd P/B

1.87

2.10

2.16

2.47

2.36

3.21

At current valuation

Reported book FY17 P/B v/s LT average

Adjusted book FY17 P/B v/s 04-07 multiple

-26% -10%

-15.3% -10.9%

At Target m ultiples

Reported book FY17 P/B v/s LT average

Adjusted book FY17 P/B v/s 07-07 multiple

1.8% 13.5%

17.0% 12.3%

HDFCB Kotak

3.43

3.65

IIB

SBI

PNB

BOB

BOI

Union

3.23

3.28

2.60

2.66

0.78

1.17

0.56

1.27

0.88

1.26

0.35

1.19

0.57

1.02

3.83

3.90

3.05

3.12

0.99

1.48

0.58

1.30

0.99

1.42

0.36

1.22

0.67

1.18

2.79

2.68

2.13

1.95

1.28

1.20

1.29

1.45

1.04

1.00

1.08

1.16

1.09

1.25

-19%

N/A

-11%

16%

-16.9% 22.5%

22%

36.9%

-39%

-2.0%

-56%

-12.5%

-15%

N/A

-68%

2.5%

-47%

-18.7%

-3.4%

N/A

5.1% 37.5%

-2.0% 45.5%

42.7%

60.3%

-22.6%

23.9%

-55.3%

-10.7%

-4.4%

N/A

-66.8%

5.6%

-39.0%

-5.7%

Source: Bloomberg, Company data, Nomura estimates

Fig. 28: Private banks valuations pre and post book

adjustment

Fig. 29: PSU bank valuations pre and post book adjustment

At current prices

At current prices

3.5

Reported book - FY17F

Adjusted book - FY17F

3.2 3.3

3.0

1.3

1.9

2.0

2.2

1.0

0.8

1.9

0.9

0.8

0.6

0.6

0.6

1.8

1.2

1.0

2.5

2.2

Adjusted book - FY17F

1.3

1.2

1.2

2.6 2.7

1.5

Reported book - FY17F

1.4

3.1 3.0

0.3

0.4

1.4

0.2

1.0

ICICI

Axis

Yes

HDFCB

Source: Bloomberg, Company data, Nomura estimates

Kotak

IIB

SBI

PNB

BOB

BOI

Union

Source: Bloomberg, Company data, Nomura estimates

13

Nomura | India banks

16 September 2015

Sector view: Positive on private banks; still remain selective

on PSUs:

We revise down (by 5-10%) our target prices for corporate private banks and PSUs to

adjust for the potential stress from accounts not yet recognised.

For corporate private banks we see highest upsides for Axis and ICICI Bank (~30%

upside) to our new TP. While near-term asset quality challenges remain, we believe the

market is factoring in the complete risk as valuations adjusted for stress are 5-10%

lower than long-term averages.

We continue to remain positive on most retail banks. We recently also upgraded Kotak

given the ~20% correction in stock price. Our order of preference is: HDFCB > Kotak >

IndusInd.

While PSU banks are down 25-50% YTD, we still believe investors need to remain

selective. Adjusted for stress levels, SBI is our preferred choice, but for a recovery

theme Axis and ICICI Bank are preferred over the PSUs.

We have factored in the credit cost impact for banks stemming from these as yet

unrecognised stressed names. Provisions on these will also have an impact on net

interest income (NII) which will depend upon the timing of the recognition, and that

remains difficult to predict we provide below a sensitivity of profitability for banks due

to the NII impact of higher stress.

Overall Axis/ICICI/HDFCB is our top pick currently. Within corporate private

banks we prefer Axis/ICICI over Yes bank. Within retail private banks we prefer

HDFCBB over Kotak/IIB. We currently have a BUY on all six private banks we

cover. Within PSU banks, SBI is our preferred pick and we would continue to

avoid PNB/BOI.

Fig. 30: Bank valuations and our revised PTs

P/B

P/E ROE PAT Old (INRbn) PAT New (INRbn)

Change

Company Rating Old PT PT Change Upside FY17F FY17F FY17F FY16F FY17F

FY16F FY17F FY16F FY17F

Axis

BUY

660 625

-5.3%

26% 1.95 11.2 18.8%

86.5 110.4

85.0 105.3

-1.7% -4.7%

HDFCB

BUY

1200 1200

0.0%

18% 3.11 16.9 19.5%

No Change

ICICI

BUY

380 350

-7.9%

28% 1.45

8.6 14.9% 122.7 146.0

122.7 140.3

0.0% -3.9%

Kotak

Buy

750 750

0.0%

16% 2.79 19.4 15.4%

No Change

IndusInd

BUY

1025 1025

0.0%

17% 2.61 17.5 15.9%

No Change

Yes

BUY

960 870

-9.4%

19% 1.93 10.5 19.7%

24.4

30.2

24.4

29.1

0.0% -3.6%

PNB

Neutral

155 140

-9.7%

2% 0.67

5.5 11.1%

40.9

53.1

39.6

48.9

-3.2% -7.9%

BOI

BUY

160 140 -12.5%

3% 0.53

5.1 7.3%

19.8

31.7

16.7

24.0 -15.6% -24.2%

BOB

BUY

210 210

0.0%

13% 0.96

7.3 12.8%

49.1

63.2

43.5

57.4 -11.5% -9.2%

Union

BUY

200 200

0.0%

16% 0.65

5.2 12.1%

No Change

SBI

BUY

335 290 -13.4%

23% 0.83

6.5 12.8% 163.9 208.9

163.9 195.5

0.0% -6.4%

Source: Bloomberg, Nomura estimates

Fig. 31: Higher stress in the long run will have a NII impact as well

INRmn

NII - FY17F

Interest reversal impact

NII post interest reversal

ICICI

Axis

Yes

241,115 201,060 54,632

15,844

6,789

2,119

225,271 194,271 52,513

SBI

PNB

BOB

BOI

Union

886,104 191,232 166,015 139,276 104,379

29,241

9,821

5,007

7,645

3,802

856,863 181,411 161,008 131,631 100,576

Interest reversal % of PBT

7.9%

4.3%

4.9%

8.1%

13.7%

6.1%

22.9%

8.9%

RORWA - FY17F

ROA post interest reversal

2.09%

1.98%

2.22%

2.15%

2.02%

1.95%

1.30%

1.22%

1.07%

0.97%

1.28%

1.23%

0.60%

0.50%

1.01%

0.94%

Source: Nomura estimates

14

Nomura | India banks

16 September 2015

Appendix 1: Names included in our Exposure analysis

Fig. 32: List of companies/projects included in our sensitivity analysis

Metals

Bhushan Steel

Bhushan pow er & steel

Monnet Ispat

MSP Steel

Adhunik Metaliks

Concast Group

Loha Ispat

Essar Steel

Infra conglo

Lanco (Anapara)

Lanco (Kondapalli)

Lanco (Amarkantak)

Lanco (Vidarbha )

Lanco (Teesta)

Lanco (Babandh)

Lanco (Griffin)

Lanco (Parent)

GMR (Ambala-Chandigarh)

GMR (Rajamundry I/II)

GMR (Chattisgarh)

GMR (Kamalanga)

GMR (Emco energy)

GMR (Vemagiri)

GMR (Kakinada)

GMR (Delhi Airport)

GMR (Hyderabad airport)

GMR Infra Parent

GVK (Alkananda -Tehri)

GVK (Goindw al Sahib- Punjab)

GVK (Gautami Pow er- AP)

GVK (Jegurupadu)

JPA (Parent)

JPVL (Vishnuprayag)

JPVL (Karchana)

JPVL (Baspa II)

JPVL (Bina)

JPVL (Bara)

JPVL (Nigre)

Jaypee Infratech

Jaypee sports

JPA (Parent - NCD)

Infra SPVs

Tata (Mundra UMPP)

Lanco/Adani (Udupi Pow er)

Abhijit (MADC Nagpur - Mihan)

Abhijit (Chandw a)

Abhijit (Banka - Bihar)

KSK (Mahanadi - Chattisgarh)

Rpow er (Butibori)

Rpow er (Sasan UMPP)

CESC (Chandrapur - Maha)

Indiabulls (Nashik - Phase I)

Indiabulls (Amravati - Phase I)

Indiabulls (Amravati - Phase II)

Indiabulls (Nashik - Phase II)

Adani (Mundra UMPP)

Adani (Tiroda)

JSW (Ratnagiri)

SKS Ispat pow er (Chattisgarh)

Bajaj Hindustan (Lalitpur Pow er)

Coal and Oil Group (Coastal Energen )

Monnet Ispat (Malibrahmani TPP)

Ind Bharat (Orissa)

Avantha Pow er (Seoni,Madhya Pradesh)

Moser Baer (Anuppur, MP)

RKM pow er gen (Uchpinda TPP)

Visa Pow er (Raigarh TPP(Visa))

DB Pow er (Baradarha TPP)

East Coast Energy (Bhavanpadu TPP)

NCC / Gayathri (NCC Pow er Projects Ltd)

Vizag Bottling Co (Konaseema)

Rpow er (Samalkot -AP)

NTPC & GAIL (Dabhol)

Others (Kashipur CGT)

Others (Beta Infratech)

Torrent Pow er (Sugen - Torrent)

Torrent Pow er (Dahej Pow er)

Soma (Panipat-Jalandhar)

Soma-Maytas-NCC (Silk Rd Jn-Electronic City Jn)

IVRCL (Kumarapalayam-Chengapally)

IVRCL (Salem-Kumarapalayam)

Madhucon (Karur-Dindigul)

Madhucon (Trichy-Thanjavur)

Madhucon (Madurai-Tuticorin)

Reliance Infra (Gurgaon-Faridabad)

HCC (Delhi-Agra Section)

IVRCL (Jalhandar-Amritsar)

HCC (Raiganj-Dalkhola)

HCC (Farakka-Raiganj)

DSC Limited (Delhi-Gurgaon Expressw ay)

DSC Limited (Kundli-Manesar-Palw al)

DSC Limited (Delhi-Gurgaon Expressw ay)

Corporates and Real

Estate (ex infra)

Tecpro Systems

Rcom

Jet Airw ays

Videocon

Empee Sugar

C Mahendra exports

Pipapav Defence

Shriram EPC

Tulsyan NEC

Amtek Auto

Castex

Ramky Infra

Essar pow er

Essar port

Essar shipping

Unitech Ltd

HDIL

DB Realty

Hubtow n

Parasvanath

Omaxe

Ansal Properties

Source: Nomura research

15

Axis Bank AXBK.NS

AXSB IN

EQUITY: BANKS

Remains preferred private bank

Global Markets Research

Relatively lower exposure to stressed names

16 September 2015

Rating

Remains

Action: Stress discounted in the price

Axis Bank remains our preferred private corporate bank for its improving

granularity in assets/liabilities, better growth, and relatively lower exposure in

large stressed names. Our sensitivity indicates a loss given default (LGD) of

11% of the banks FY17 net worth, vs 15-30% for peers. We thus think the

recent ~20-25% correction offers a good opportunity to buy Axis Bank. We

maintain our Buy rating with a revised TP of INR625/share.

Stress test outcome: We estimate a loss given default of INR68bn for Axis

Bank in these stressed accounts, which is ~11% of its FY17F net worth. In

this regard, Axis is better placed than peers, where we estimate a LGD of

13-22% of FY17F net worth. Axis has less exposure in infra conglomerates

than ICICI Bank, and less exposure to stressed metal names and ex-infra

corporates than PSU banks. Also, unlike most other private corporate

banks, Axis has ~INR12.5bn in floating provisions stock, which is about

20% of our estimate of its LGD in these accounts.

Structural improvement in B/S continues and better placed on growth:

1) Axis Banks granularity of assets (more retail), liabilities (higher CASA+

retail term deposit ratio), and fees (increase in retail fee share) has been

improving, aiding overall profitability and lowering the business risk profile,

while CASA momentum has moderated in the past 12-15 months; 2) Axis

will likely continue to deliver better mix of growth given the increase in its

retail mix and lower overseas book mix than most corporate banks.

Currency (INR)

PPOP (mn)

FY15

Actual

FY16F

Old

New

FY17F

Old

New

Closing price

14 September 2015

INR 496

Nomura vs consensus

Our FY16/17F PAT is 1-3%

below consensus.

Research analysts

India Banks

Adarsh Parasrampuria - NFASL

adarsh.parasrampuria@nomura.com

+91 22 4037 4034

Amit Nanavati - NFASL

amit.nanavati@nomura.com

+91 22 4037 4361

FY18F

Old

133,854 159,452 158,965 195,829 190,398

+26%

Large asset quality risks across

metals and infrastructure

conglomerates and corporates

have yet to be recognized. Our

exposure analysis indicates the

risk seems to be priced in for

private corporate banks, but

adjusted valuations for PSUs are

not cheap. Investors need to

remain selective on PSUs.

New

225,788

73,578

86,455

84,980 110,442 105,280

128,352

Normalised net profit (mn)

73,578

86,455

84,980 110,442 105,280

128,352

31.04

36.47

35.85

46.59

44.41

54.15

FD norm. EPS growth (%)

18.3

17.5

15.5

27.7

23.9

21.9

FD normalised P/E (x)

16.0

N/A

13.8

N/A

11.2

N/A

9.2

Price/adj. book (x)

2.6

N/A

2.3

N/A

1.9

N/A

1.6

Price/book (x)

2.6

N/A

2.3

N/A

1.9

N/A

1.6

N/A

Dividend yield (%)

INR 625

Anchor themes

Reported net profit (mn)

FD normalised EPS

Target price

Reduced from 660

Potential upside

Multiples reasonable now adjusted for the stress; maintain Buy

Axis Bank shares are trading at 1.95x FY17F book and look reasonable when

adjusted for our stress test valuation at 2.2x FY17F book (~10-15% discount

to FY04-07 multiple). Hence, we maintain Buy. While growth will certainly lag

the FY04-07 period, Axis Banks profitability has improved significantly to

offset the impact of slower growth. We marginally revise our earnings down by

2-4% and our TP by 6% to factor in part of the impact from our stress test.

Year-end 31 Mar

Buy

0.9

N/A

1.1

N/A

1.2

ROE (%)

17.8

17.9

17.6

19.5

18.8

19.4

1.6

ROA (%)

1.7

1.7

1.7

1.8

1.8

1.7

Source: Company data, Nomura estimates

See Appendix A-1 for analyst certification, important disclosures and the status of non-US analysts.

Nomura | Axis Bank

16 September 2015

Key data on Axis Bank

Relative performance chart

Balance sheet (INRmn)

Source: Thomson Reuters, Nomura research

Notes:

Performance

(%)

Absolute (INR)

Absolute (USD)

Rel to MSCI India

1M 3M 12M

-12.9 -10.0 19.0

-14.6 -13.1 8.8

-5.0 -8.8 23.3

M cap (USDmn)

Free float (%)

3-mth ADT (USDmn)

17,775.3

36.0

64.4

Profit and loss (INRmn)

Year-end 31 Mar

Interest income

Interest expense

Net interest income

Net fees and commissions

Trading related profits

Other operating revenue

Non-interest income

Operating income

Depreciation

Amortisation

Operating expenses

Employee share expense

Pre-provision op profit

Provisions for bad debt

Other provision charges

Operating profit

Other non-op income

Associates & JCEs

Pre-tax profit

Income tax

Net profit after tax

Minority interests

Other items

Preferred dividends

Normalised NPAT

Extraordinary items

Reported NPAT

Dividends

Transfer to reserves

FY14

306,412

-186,895

119,516

53,956

3,276

16,820

74,052

193,569

-3,639

FY15

354,786

-212,545

142,241

61,549

9,949

12,153

83,651

225,892

-4,057

FY16F

426,293

-256,222

170,071

72,012

7,500

14,510

94,023

264,093

-4,462

FY17F

504,744

-303,684

201,060

86,415

7,500

17,403

111,318

312,378

-4,909

FY18F

608,592

-369,800

238,792

103,698

7,500

20,636

131,834

370,627

-5,399

-49,355 -56,831 -66,492 -77,796 -93,355

-26,013 -31,150 -34,174 -39,276 -46,084

114,561 133,854 158,965 190,398 225,788

-17,810 -19,970 -31,252 -32,176 -32,894

-3,261

-3,307

0

0

0

93,490 110,578 127,713 158,221 192,894

93,490 110,578 127,713 158,221 192,894

-31,313 -36,999 -42,733 -52,941 -64,543

62,177

73,578

84,980 105,280 128,352

62,177

0

62,177

-11,011

51,166

73,578

0

73,578

-13,090

60,489

23.6

13.0

17.9

23.1

20.0

19.0

19.0

16.8

16.5

11.7

12.5

11.2

19.0

13.0

15.1

16.8

18.3

18.3

18.3

22.2

21.8

21.4

20.5

14.8

84,980 105,280 128,352

0

0

0

84,980 105,280 128,352

-14,672 -16,872 -19,403

70,308

88,408 108,948

Growth (%)

Net interest income

Non-interest income

Non-interest expenses

Pre-provision earnings

Net profit

Normalised EPS

Normalised FDEPS

Loan growth

Interest earning assets

Interest bearing liabilities

Asset growth

Deposit growth

Source: Company data, Nomura estimates

19.6

12.4

17.0

18.8

15.5

15.5

15.5

21.0

21.0

16.8

16.8

15.6

18.2

18.4

17.0

19.8

23.9

23.9

23.9

22.0

22.0

22.6

22.1

23.7

18.8

18.4

20.0

18.6

21.9

21.9

21.9

23.0

23.0

23.5

23.1

25.5

As at 31 Mar

Cash and equivalents

Inter-bank lending

Deposits with central bank

Total securities

Other int earning assets

Gross loans

Less provisions

Net loans

Long-term investments

Fixed assets

Goodwill

Other intangible assets

Other non IEAs

Total assets

Customer deposits

Bank deposits, CDs,

debentures

Other

int bearing liabilities

Total int bearing liabilities

Non-int bearing liabilities

Total liabilities

Minority interest

Common stock

Preferred stock

Retained earnings

Reserves for credit losses

Proposed dividends

Other equity

Shareholders' equity

Total liabilities and equity

Non-perf assets

FY14

FY15

FY16F

FY17F

FY18F

240,741 318,836 240,882 299,702 375,589

41,647

42,154

49,703

61,840

77,499

2,321,881 2,838,765 3,443,505 4,205,413 5,171,202

-21,214 -27,935 -42,400 -56,065 -67,504

2,300,668 2,810,830 3,401,105 4,149,348 5,103,698

1,135,484 1,323,428 1,559,307 1,903,356 2,340,172

24,102

25,143

26,184

27,225

28,266

89,808

98,932 116,649 145,132 181,881

3,832,449 4,619,324 5,393,830 6,586,603 8,107,104

2,809,446 3,224,419 3,728,439 4,613,805 5,791,912

452,639 656,001 749,218 844,869 942,390

50,270 141,582 221,582 301,582 381,582

3,312,355 4,022,002 4,699,238 5,760,256 7,115,884

137,889 150,557 177,519 220,866 276,791

3,450,244 4,172,559 4,876,757 5,981,122 7,392,675

4,698

4,741

4,741

4,741

4,741

377,506 442,024 512,332 600,740 709,688

382,205 446,765 517,073 605,481 714,429

3,832,449 4,619,324 5,393,830 6,586,603 8,107,104

31,464

41,102

65,231

82,449

99,271

Balance sheet ratios (%)

Loans to deposits

Equity to assets

82.6

10.0

88.0

9.7

92.4

9.6

91.1

9.2

89.3

8.8

1.4

0.77

0.55

67.4

12.8

17.0

1.4

0.70

0.60

68.0

12.1

15.2

1.9

0.91

0.79

65.0

11.7

15.1

2.0

0.77

0.85

68.0

11.3

14.9

1.9

0.64

0.83

68.0

10.9

14.4

26.23

26.23

26.23

4.00

48.33

162.69

162.62

162.69

31.04

31.04

31.04

4.60

56.47

188.47

188.39

188.47

35.85

35.85

35.85

5.29

67.06

218.13

217.83

218.13

44.41

44.41

44.41

6.08

80.32

255.42

255.26

255.42

54.15

54.15

54.15

8.19

95.25

301.38

301.18

301.38

18.9

18.9

18.9

0.8

3.0

3.1

5.49

14.08

5.95

8.13

38.3

40.8

33.5

17.7

17.4

1.72

26.2

2.58

16.0

16.0

16.0

0.9

2.6

2.6

5.48

13.66

5.80

7.86

37.0

40.7

33.5

17.8

17.8

1.74

26.7

2.62

13.8

13.8

13.8

1.1

2.3

2.3

5.40

13.52

5.88

7.65

35.6

39.8

33.5

17.3

17.6

1.70

26.5

2.55

11.2

11.2

11.2

1.2

1.9

1.9

5.25

13.18

5.81

7.37

35.6

39.0

33.5

16.0

18.8

1.76

28.2

2.64

9.2

9.2

9.2

1.6

1.6

1.6

5.08

12.96

5.74

7.22

35.6

39.1

33.5

15.1

19.4

1.75

29.2

2.63

Asset quality & capital

NPAs/gross loans (%)

Bad debt charge/gross

loansreserves/assets

Loss

(%)

(%)

Loss reserves/NPAs (%)

Tier 1 capital ratio (%)

Total capital ratio (%)

Per share

Reported EPS (INR)

Norm EPS (INR)

FD norm EPS (INR)

DPS (INR)

PPOP PS (INR)

BVPS (INR)

ABVPS (INR)

NTAPS (INR)

Valuations and ratios

Reported P/E (x)

Normalised P/E (x)

FD normalised P/E (x)

Dividend yield (%)

Price/book (x)

Price/adjusted book (x)

Net interest margin (%)

Yield on assets (%)

Cost of int bearing liab (%)

Net interest spread (%)

Non-interest income (%)

Cost to income (%)

Effective tax rate (%)

Dividend payout (%)

ROE (%)

ROA (%)

Operating ROE (%)

Operating ROA (%)

Source: Company data, Nomura estimates

17

Nomura | Axis Bank

16 September 2015

Fig. 33: Axis Bank: Key changes to FY16/17F estimates

Old

INRm n

NII

New

FY16F

170,558

FY17F

206,492

FY16F

170,071

Variance%

FY17F

FY16F

FY17F

-0.3%

-2.6%

0bps

201,060

Loan grow th

22.0%

22.0%

21.0%

22.0%

-100bps

Fee grow th

17.3%

20.0%

17.3%

20.0%

0bps

0bps

PPOP

159,452

195,829

158,965

190,398

-0.3%

-2.8%

86,455

110,442

84,980

105,280

PAT

-1.7%

-4.7%

NIM%

3.48%

3.51%

3.49%

3.45%

1bps

-7bps

LLPs

0.95%

0.78%

1.01%

0.85%

6bps

7bps

GNPA%

1.80%

1.80%

1.89%

1.96%

10bps

16bps

Slippages

7.1%

7.9%

ROA

39,743

1.77%

39,902

1.88%

42,581

1.74%

43,044

1.81%

-2bps

-7bps

ROE

17.9%

19.5%

17.6%

18.8%

-28bps

-78bps

Source: Nomura estimates

Valuation: Axis Bank shares are trading at 1.95x FY17F book and look reasonable

when adjusted for our stress test valuation at 2.2x FY17F book (~10-15% discount to

FY04-07 multiple). Hence, we maintain Buy. While growth will certainly lag the FY04-07

period, Axis Banks profitability has improved significantly to offset the impact of slower

growth. We marginally revise our earnings down by 2-4% and our TP by 6% to factor in

part of the impact from our stress test.

Risks: 1) A slower-than-expected recovery in corporate capex execution, and 2) higherthan-expected delinquency.

Fig. 34: Axis Bank: ROA decomposition we expect profitability to improve further with improvement in credit costs

Du-pont table

FY09

FY10

FY11

FY12

FY13

FY14

FY15

FY16F

FY17F

FY18F

Net Interest Income/Assets

2.96%

3.42%

3.39%

3.29%

3.27%

3.46%

3.46%

3.49%

3.45%

3.34%

Fees/Assets

2.11%

2.22%

2.21%

2.18%

2.02%

2.05%

1.80%

1.78%

1.78%

1.74%

Investment profits/Assets

0.23%

0.49%

0.19%

0.04%

0.20%

0.09%

0.24%

0.15%

0.13%

0.10%

Net revenues/Assets

5.30%

6.13%

5.78%

5.51%

5.48%

5.60%

5.50%

5.42%

5.36%

5.18%

Operating Expense/Assets

-2.31%

-2.57%

-2.47%

-2.46%

-2.34%

-2.29%

-2.24%

-2.16%

-2.09%

-2.02%

Provisions/Assets

-0.75%

-0.95%

-0.66%

-0.47%

-0.59%

-0.61%

-0.57%

-0.64%

-0.55%

-0.46%

Taxes/Assets

-0.78%

-0.92%

-0.90%

-0.84%

-0.80%

-0.91%

-0.90%

-0.88%

-0.91%

-0.90%

Total Costs/Assets

-3.84%

-4.44%

-4.03%

-3.77%

-3.73%

-3.80%

-3.71%

-3.68%

-3.55%

-3.39%

ROA

1.46%

1.69%

1.75%

1.74%

1.75%

1.80%

1.79%

1.74%

1.81%

1.79%

Equity/Assets

7.62%

8.97%

9.05%

8.57%

9.45%

10.33%

10.09%

9.89%

9.62%

9.22%

ROE

19.1%

18.9%

19.3%

20.3%

18.5%

17.4%

17.8%

17.6%

18.8%

19.4%

RORWA

1.86%

1.98%

2.01%

1.98%

2.11%

2.28%

2.30%

2.18%

2.22%

2.21%

Source: Company data, Nomura estimates

Fig. 35: Axis Bank: TP of INR625 implies 2.45x Mar-17F book

of INR255

Fig. 36: Axis: Valuation reasonable now adjusting for stress

1yr fwd P/B chart

New

Old

13.3%

13.3%

Terminal grow th

5.0%

5.0%

Normalised ROE

21.1%

21.1%

Stage 2 grow th

20.0%

20.0%

Mar-16 PT

625

660

1.5

Implied Mar-17 P/B

2.45

2.56

1.0

Implied Mar-17 P/E

14.1

14.2

0.5

Valuation assum ptions

3.5

Axis

3.0

2.5

2.0

Apr-05

Aug-05

Dec-05

Apr-06

Aug-06

Dec-06

Apr-07

Aug-07

Dec-07

Apr-08

Aug-08

Dec-08

Apr-09

Aug-09

Dec-09

Apr-10

Aug-10

Dec-10

Apr-11

Aug-11

Dec-11

Apr-12

Aug-12

Dec-12

Apr-13

Aug-13

Dec-13

Apr-14

Aug-14

Dec-14

Apr-15

Aug-15

Cost of Equity

Source: Nomura estimates

Source: Company data, Bloomberg, Nomura estimates

18

ICICI Bank ICBK.NS

ICICIBC IN

EQUITY: BANKS

Higher stress but discounted in price

Global Markets Research

We see risk-reward similar to Axis Bank now

16 September 2015

Rating

Remains

Action: Higher stress but discounted in the price, in our view

ICICI Bank has underperformed its private peers in the past 12 months largely

due to asset quality risks and, to some extent, slower growth. Our sensitivity

analysis does indicate that ICICI Bank has some concentrated exposure to

two to three infra conglomerates and their LGD would be +20% of FY17 net

worth, which is higher than Axis/Yes Bank. The ~30% discount in valuations to

Axis Bank does factor in the extra risk, and adjusted for the stress, valuations

are at a 15% discount and hence we still find relative risk-reward becoming

favourable. We reaffirm our Buy rating, with a revised target price of INR350.

expanded, but with retail growing at ~25% y-y and the corporate book

growing from a lower base, we now believe the growth differential will likely

narrow, though still remain below private peers. 2) ICICI Bank lost CASA

market share in FY09-13 due to lower SME connect. Incremental CASA

market share in the past 12 months has improved and continued

performance on this metric should drive a re-rating, in our opinion.

FY16F

Old

New

FY17F

Old

New

Research analysts

India Banks

Adarsh Parasrampuria - NFASL

adarsh.parasrampuria@nomura.com

+91 22 4037 4034

197,199 218,280 218,280 249,209 246,646 294,750 288,583

Reported net profit (mn)

111,754 122,718 122,718 145,951 140,288 176,892 169,966

Normalised net profit (mn)

111,754 122,718 122,718 145,951 140,288 176,892 169,966

19.15

21.03

21.03

25.01