Académique Documents

Professionnel Documents

Culture Documents

Chapter 16 Cost Audit

Transféré par

Karan PanchalCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Chapter 16 Cost Audit

Transféré par

Karan PanchalDroits d'auteur :

Formats disponibles

16

Cost Audit

16.1 Concept of Cost Audit

According to the Institute of Cost and Management Accountants of England, cost audit

represents the verification of cost accounts and a check on the adherence to cost accounting

plan. Cost audit, therefore, comprises:

(a) verification of the cost accounting records such as the accuracy of the cost accounts,

cost reports, cost statements, cost data and costing techniques, and

(b) examination of these records to ensure that they adhere to the cost accounting

principles, plans, procedures and objectives.

It, therefore, means that the cost auditors attention and approach should be to see that the

cost accounting plan is in consonance with the objectives set by the organisation and the

system of accounting is geared towards the attainment of the objectives. A cost accounting

system designed to exercise control over cost may be different from the one if the objective is

to fix price. The cost auditor should examine whether the methods laid down for ascertaining

expenses as direct or indirect are cases in point. The cost auditor should also establish the

correctness or otherwise of the figures by the processes of vouching verification, reconciliation

etc.

The origin of the concept of cost audit could be traced to the Second World War period when

the practice of assigning cost plus contracts started. However, probably India is the only

country in the free world where cost audit is statutorily prescribed. Cost audit can offer

valuable assistance to the management in its decision making process since it ensures

reliable cost accounting data and information. The management will be in a position to know

what price is to be fixed for a product, whether the wastages are avoidable, whether to reorganise purchase or sales or inventory systems to make the work more efficient and so on.

Existence of such a system of audit will also be of great use for maintaining internal control

and internal check and can be an advantageous even to the statutory financial auditor. Cost

audit, apart from having all the normal ingredients of audit namely vouching, verification etc.

has within its compass elements of efficiency audit.

16.2 Types of Cost Audit

Cost audit is basically carried out at the instance of the management for obvious advantages.

Apart from this, different other circumstances also sometimes occasion audit of cost accounts.

The different types of cost audit that we come across may be the following:

The Institute of Chartered Accountants of India

16.2

Advanced Auditing and Professional Ethics

16.2.1 Cost audit on behalf of the management : The principal object of this audit is to see that

the cost data placed before the management are verified and reliable and they are prepared in

such detail as will serve the purpose of the management in taking appropriate decisions. The

detailed objectives include:

(a) Establishing the accuracy of the costing data, as for example, cost of material used,

allocation of wages into direct and indirect and on different products, functions and cost

centres.

(b) Ensuring that the objectives of cost accounting are being achieved through appropriate

collection, segregation, analysis and compilation of data.

(c)

Ascertaining abnormal losses and gains along with the relevant causes, expressed in

financial terms in a manner that the person responsible for such loss or gain is identified.

(d) Determination of the unit cost of production in a precise but practicable manner.

(e) Establishing proper overhead rates for absorption of overheads by various units of costs

so that the cost is properly ascertained and there is no significant over or under recovery

of expenses.

(f)

Fixation of contract price and the determination of the additional or

charge that can be raised against customers for alterations, etc.

supplementary

(g) Improving the quality of cost accounting system by obtaining the audit observations and

suggestions of cost auditor.

16.2.2 Cost audit on behalf of a customer: In case of cost plus contracts, often the buyer or the

contractee insists on a cost audit to satisfy himself about the correct ascertainment of cost.

More often than not, the provision, for a cost audit in such a circumstance is put in the relevant

contract with the stipulation that the supplier or the contractor will extend all co-operation to

the cost auditor. The cost of production arrived at for this purpose may differ from the cost of

production ascertained for internal purposes.

16.2.3 Cost audit on behalf of Government: Sometimes, government is approached with requests

for subsidies, protection, etc. Before taking a decision the government may prefer to have the

cost of production of the product determined on the basis of cost audit to satisfy itself whether

the need is genuine or the industry seeking assistance is generally efficiently run. The

government, of its own also may initiate cost audit, in public interest to establish the fair price

of any product.

16.2.4 Cost audit by trade association : Where activities of a trade association include maintenance

of a price of the products manufactured by the member units or where there is pooling or

contribution arrangements, the trade association may require the accuracy of costing

information submitted by the member-units checked. The trade association may seek full

information on the costing system, level of efficiency, utilisation of capacity, etc.

16.2.5 Statutory cost audit : This is covered by the provisions of Section 233B of the Companies Act.

Thank you for using www.freepdfconvert.com service!

Only two pages are converted. Please Sign Up to convert all pages.

https://www.freepdfconvert.com/membership

Vous aimerez peut-être aussi

- Chat 2Document1 pageChat 2Karan PanchalPas encore d'évaluation

- Upi TXN Count April 2022 BankwiseDocument143 pagesUpi TXN Count April 2022 BankwiseKaran PanchalPas encore d'évaluation

- PC FinalDocument3 pagesPC FinalKaran PanchalPas encore d'évaluation

- Process COmplaince Form Signed 2Document1 pageProcess COmplaince Form Signed 2Karan PanchalPas encore d'évaluation

- Annexures I IIDocument1 pageAnnexures I IIKaran PanchalPas encore d'évaluation

- RFP No. TMD/3/22-23 DT 30/09/2022 For UPI Switch and Mobile & Internet Banking SolutionDocument4 pagesRFP No. TMD/3/22-23 DT 30/09/2022 For UPI Switch and Mobile & Internet Banking SolutionKaran PanchalPas encore d'évaluation

- TNGB TMD RFP 3 22-23 30092022Document95 pagesTNGB TMD RFP 3 22-23 30092022Karan PanchalPas encore d'évaluation

- National Payments Corporation of India NACH Project: June, 2020Document10 pagesNational Payments Corporation of India NACH Project: June, 2020Karan Panchal100% (2)

- Scope Annexure As Per RFPDocument15 pagesScope Annexure As Per RFPKaran PanchalPas encore d'évaluation

- Scope of WorkDocument13 pagesScope of WorkKaran PanchalPas encore d'évaluation

- NDA - Signed - Mobile BankingDocument7 pagesNDA - Signed - Mobile BankingKaran PanchalPas encore d'évaluation

- Amendment RFP 3 22-23 30-09-2022Document14 pagesAmendment RFP 3 22-23 30-09-2022Karan PanchalPas encore d'évaluation

- Legal ClausesDocument10 pagesLegal ClausesKaran PanchalPas encore d'évaluation

- Integrity Pact & SLADocument21 pagesIntegrity Pact & SLAKaran PanchalPas encore d'évaluation

- Ima Icici AccontsDocument79 pagesIma Icici AccontsKaran PanchalPas encore d'évaluation

- Mahanagar CO OP BANKDocument28 pagesMahanagar CO OP BANKKaran PanchalPas encore d'évaluation

- SHRADDocument6 pagesSHRADKaran PanchalPas encore d'évaluation

- SHRADDocument6 pagesSHRADKaran PanchalPas encore d'évaluation

- Thakur Institute of Management Studies and ResearchDocument19 pagesThakur Institute of Management Studies and ResearchKaran PanchalPas encore d'évaluation

- University of Mumbai Project On Co-Operative SocietyDocument6 pagesUniversity of Mumbai Project On Co-Operative SocietyKaran PanchalPas encore d'évaluation

- B M Locations FY 2012-2013 List On Location As Per Register (PSD) Location Name Location NoDocument5 pagesB M Locations FY 2012-2013 List On Location As Per Register (PSD) Location Name Location NoKaran PanchalPas encore d'évaluation

- Irctcs E Ticketing Service Electronic Cancellation Slip (Personal User)Document1 pageIrctcs E Ticketing Service Electronic Cancellation Slip (Personal User)Karan PanchalPas encore d'évaluation

- Can We Trust Consumers' Survey Answers When Dealing With Insurance Fraud? - Evidence From An ExperimentDocument37 pagesCan We Trust Consumers' Survey Answers When Dealing With Insurance Fraud? - Evidence From An ExperimentKaran PanchalPas encore d'évaluation

- Planning Project Business: A SWOT Analysis, With Its Four Elements in A 2×2 MatrixDocument10 pagesPlanning Project Business: A SWOT Analysis, With Its Four Elements in A 2×2 MatrixKaran PanchalPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Far110 Quiz 1 Inventory & Suspense Ac January 2022 QDocument2 pagesFar110 Quiz 1 Inventory & Suspense Ac January 2022 QINTAN NOOR AMIRA ROSDIPas encore d'évaluation

- Unit - II Module IIIDocument7 pagesUnit - II Module IIIpltPas encore d'évaluation

- Module 2Document13 pagesModule 2Mimi OlshopePas encore d'évaluation

- At 4Document2 pagesAt 4Christopher PricePas encore d'évaluation

- Lcci Finance Quantative Qualification BrochureDocument38 pagesLcci Finance Quantative Qualification BrochureLuckygo GohappyPas encore d'évaluation

- IFRS 14 - Regulatory Deferral AccountsDocument3 pagesIFRS 14 - Regulatory Deferral AccountsMarc Eric Redondo100% (1)

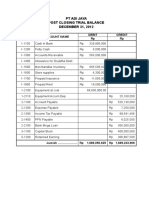

- Jawaban Silus Adijaya 2015Document15 pagesJawaban Silus Adijaya 2015natsu dragnelPas encore d'évaluation

- Cash Flow Statement - Indirect MethodDocument5 pagesCash Flow Statement - Indirect MethodBimal KrishnaPas encore d'évaluation

- DDT - Chapter 1Document47 pagesDDT - Chapter 1Suba ChaluPas encore d'évaluation

- Overview of AccountingDocument27 pagesOverview of AccountingMGaylican AccountingPas encore d'évaluation

- Answer All Questions. Each Question Carries 2 MarksDocument3 pagesAnswer All Questions. Each Question Carries 2 MarksAthul RPas encore d'évaluation

- MATIAS Marcelo Transport ServicesDocument3 pagesMATIAS Marcelo Transport ServicesPaulene Abegail MatiasPas encore d'évaluation

- The Code of Ethics For Professional Accountants in The PhilippinesDocument4 pagesThe Code of Ethics For Professional Accountants in The PhilippinesKimberly LimPas encore d'évaluation

- Judith 2022 MidTerm Examinations Auditing II SEC BDocument6 pagesJudith 2022 MidTerm Examinations Auditing II SEC BAstika Tamala Br TinjakPas encore d'évaluation

- FA 2 Chapter 11 Manufacturing AccountsDocument20 pagesFA 2 Chapter 11 Manufacturing AccountsMhd AminPas encore d'évaluation

- Chapter 2 Plant Assets WubexDocument20 pagesChapter 2 Plant Assets WubexBirhanu FelekePas encore d'évaluation

- Revision f8 NotesDocument104 pagesRevision f8 NotesRanie Syafiqah JafferiePas encore d'évaluation

- Laporan Keuangan 31 Desember 2017 PDFDocument89 pagesLaporan Keuangan 31 Desember 2017 PDFNadia Rahmi ZalaliPas encore d'évaluation

- Penjualan Hotel: I G N A Wiryanata, SE, M.Si, Ak.,CA Christina Susanti, SE., Ak., CADocument17 pagesPenjualan Hotel: I G N A Wiryanata, SE, M.Si, Ak.,CA Christina Susanti, SE., Ak., CADewa Ayu Ade'SukraeniiPas encore d'évaluation

- 15 Company Law Notes From Kalpesh Classes For CA FinalDocument259 pages15 Company Law Notes From Kalpesh Classes For CA FinalKaustubh BasuPas encore d'évaluation

- Flash - Memory - Inc From Website 0515Document8 pagesFlash - Memory - Inc From Website 0515竹本口木子100% (1)

- Case Walker and CompanyDocument3 pagesCase Walker and CompanyfazatiaPas encore d'évaluation

- Topic 1 - Financial Regulatory Framework in MalaysiaDocument11 pagesTopic 1 - Financial Regulatory Framework in MalaysiaA2T5 Haziqah HousnaPas encore d'évaluation

- Internal ControlDocument105 pagesInternal ControljnfebrinaPas encore d'évaluation

- Course Outline: ACCT406 Accounting Information SystemsDocument10 pagesCourse Outline: ACCT406 Accounting Information SystemsAsteraye WakaPas encore d'évaluation

- Name Muhammad Ibrahim Submitted To Sir Shoaib Hassan Semester 5 320006 Project Financial Statement Company Allied Bank LTDDocument28 pagesName Muhammad Ibrahim Submitted To Sir Shoaib Hassan Semester 5 320006 Project Financial Statement Company Allied Bank LTDraja farhanPas encore d'évaluation

- Long Term Construction ContractsDocument16 pagesLong Term Construction ContractsLorena Joy Aggabao100% (3)

- Ias38 Q8Document2 pagesIas38 Q8Abdul jumaPas encore d'évaluation

- Validity and Reliability in Case Study Research in Accounting: A Review and ExperienceDocument27 pagesValidity and Reliability in Case Study Research in Accounting: A Review and ExperienceNooni nasserPas encore d'évaluation

- Important Terms in ManagementDocument51 pagesImportant Terms in ManagementAdnan AliPas encore d'évaluation