Académique Documents

Professionnel Documents

Culture Documents

Comparative Study Between Two Co-Opertive Bank

Transféré par

Parag MoreTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Comparative Study Between Two Co-Opertive Bank

Transféré par

Parag MoreDroits d'auteur :

Formats disponibles

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 1

INTRODUCTION TO CO-OPERATIVE BANK

Cooperative banking institutions takes DEPOSITS and LEND

MONEY in most parts of the world.

It differs from STOCKHOLDERS BANK.

Follows all PRUDENTIAL banking regulation.

It provides FINANCIAL ASSISTANCES to the people with small

means to protect them from the debt trap of the money lenders.

Its a financial entity which belongs to its members, who are at

the

same time the OWNERS and the MEMEBERS of the bank.

Its often created by person belonging to the same local or personal

community or sharing a common interest.

Wide range of banking and financial services

banking accounts etc)

( loans, deposits, and

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 2

CO-OPERATIVE BANKING IN INDIA

A co-operative bank is a financial entity which belongs to its members, who are

at the same time the owners and the customers of their bank.

Co-operative banks are often created by persons belonging to the same

local or professional community or sharing a common interest.

Co-operative banks generally provide their members with a wide range

of banking and financial services (loans, deposits, banking accounts etc.).

Co-operative banks differ from stockholder banks by their organization,

their goals, their values and their governance.

In most countries, they are supervised and controlled by banking

authorities and have to respect prudential banking regulations, which put

them at a level playing field with stockholder bank.

Depending on countries, this control and supervision can be implemented

directly by state entities or delegated to a co-operative federation or

central body.

Co-operative banking is retail and commercial banking organized on a

co-operative basis.

Co-operative banking institutions take deposits and lend money in most

parts of the world.

Co-operative banking, includes retail banking, as carried out by credit

unions, mutual savings and loan associations, building societies and cooperatives, as well as commercial banking services provided by manual

oganizations (such as co-operative federations) to co-operative

businesses.

The structure of commercial banking is of branch-banking type; while the cooperative banking structure is a three tier federal one.

2

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

- A State Co-operative Bank works at the apex level (ie. works at state level).

- The Central Co-operative Bank works at the Intermediate Level.

(ie. District Co-operative Banks ltd. works at district level)

- Primary co-operative credit societies at base level (At village level)

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

DEFINATION

A co-operative bank is a financial entity which belongs to its members, who

areat the same time the owners and the customers of their bank. Co-operative

banks are often created by persons belonging to the same local or

professional community or sharing a common interest. Co-operative banks

generally provide their members with a wide range of banking and financial

services (loans, deposits, banking accounts) A co-operative bank is a

financial entity which belongs to its members, who areat the same time the

owners and the customers of their bank. Co-operative banks are often created

by persons belonging to the same local or professional community or sharing

a common interest. Co-operative banks generally provide their members

with a wide range of banking and financial services (loans, deposits, banking

accounts).

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 3

HISTORY OF CO-OPERATIVE BANK IN INDIA

For the co-operative banks in India, co-operatives are organized groups of

people and jointly managed and democratically controlled enterprises. They

exist to serve their members and depositors and produce better benefits and

services for them.

Professionalism in co-operative banks reflects the co-existence of high level of

skills and standards in performing, duties entrusted to an individual.

Co-operative bank needs current and future development in information

technology. It is indeed necessary for cooperative banks to devote adequate

attention for maximizing their returns on every unit of

resources through effective services. Co-operative banks have completed 100

years of existence in India. They play a very important role in the financial

system. The cooperative banks in India form an integral part of our money

market today. Therefore, a brief resume of their development should be taken

into account. The history of cooperative banks goes back to the year 1904. In

1904, the co-operative credit society act

was enacted to encourage co-operative movement in India. But the development

of cooperative banks from 1904 to 1951 was the most disappointing one.The

first phase of co-operative bank development was the formation and regulation

of cooperative society.

The constitutional reforms which led to the passing of the Government of India

Act in 1919 transferred the subject of Cooperation from Government of India

to the Provincial Governments. The Government of Bombay passed the first

State Cooperative Societies Act in 1925 which not only gave the movement, its

5

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

size and shape but was a pace setter of co-operative activities and stressed the

basic concept of thrift, self help and mutual aid. This marked the beginning of

the second phase in the history of Co-operative Credit Institutions.

There was the general realization that urban banks have an important role to

play in economic construction. This was asserted by a host of committees. The

Indian Central Banking Enquiry Committee (1931) felt that urban banks have a

duty to help the small business and middle class people. The Mehta-Bhansali

Committee (1939) recommended that those societies which had fulfilled the

criteria of banking should be allowed to work as banks and recommended an

Association for these banks. The Co-operative Planning Committee (1946) went

on record to say that urban banks have been the best agencies for small people

in whom Joint stock banks are not generally interested. The Rural Banking

Enquiry Committee (1950), impressed by the low cost of establishment and

operations recommended the establishment of such banks even in places smaller

than taluka towns. The real development of co-operative banks took place only

after the recommendations of All India Rural Credit Survey Committee

(AIRCSC), which were made with the view

to fasten the growth of co-operative banks. The co-operative banks are expected

to perform some duties, namely, extend all types of credit facilities to customers

in cash and kind, advance consumption loans, extend banking facilities in rural

areas, mobilize deposits, supervise the use of loans etc. The needs of cooperative bank are different. They have faced a lot of problems, which has

affected the development of co-operative banks. Therefore it was necessary to

study this matter.

The first study of Urban Co-operative Banks was taken up by RBI in the year

1958-59. The Report published in 1961 acknowledged the widespread and

financially sound framework of urban co-operative banks; emphasized the need

to establish primary urban co-operative banks in new centers and suggested that

State Governments lend active support to their development.

6

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

In 1963, Varde Committee recommended that such banks

should be organised at all Urban Centers with a population of 1 lakh or more

and not by any single community or caste. The committee introduced the

concept of minimum capital requirement and the criteria of population for

defining the urban centre where UCBs were incorporated.

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 4

FEATURES

Even if co-operative banks organizational rules can vary according to their

respective national legislations, co-operative banks share common features as

follows:

Customer-owned entities:

In a co-operative bank, the needs of the customers meet the needs of the

owners, as co-operative bank members are both. As a consequence, the

first aim of a co-operative bank is not to

maximize profit but to

provide the best possible products and services to its members.

Some

co-operative banks only operate with their members but most of them

also admit non-member clients to benefit from their banking and financial

services.

Democratic member control:

Co-operative banks are owned and controlled by their members, who

democratically elect the board of directors. Members usually have equal

voting rights, according to the co-operative principle of one person, one

vote.

Profit allocation:

In a co-operative bank, a significant part of the yearly profit, benefits or

surplus is usually allocated to constitute reserves.

A part of this profit can also be distributed to the co-operative members,

with legal or statutory limitations in most cases.

Profit is usually allocated to members either through a patronage

dividend, which is related to the use of the co-operatives products and

services by each member, or through an interest or a dividend, which is

8

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

related to the number of shares subscribed by each member.Co-operative

banks are deeply rooted inside local areas and communities.They are

involved in local development and contribute to the sustainable

development of their communities, as their members and management

board usually belong to the communities in which they exercise their

activities.

By increasing banking access in areas or markets where other banks are less

present, farmers in rural areas, middle or low income households in urban areas

- co-operative banks reduce banking exclusion and foster the economic ability

of millions of people. They play an influential role on the economic growth in

the countries in which they work in and increase the efficiency of the

international financial system. Their specific form of enterprise, relying on the

above38mentioned principles of organization, has proven successful both in

developed and developing countries.

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 5

FUNCTIONS OF CO-OPERATIVE BANK

Co-operative Banks are organised and managed on the principal of cooperation, self-help, and mutual help. They work on the basis of no

profit no loss. Profit maximization is not their goal.

Co-operative bank do banking business mainly in the agriculture and

rural sector. However, UCBs, SCBs, and CCBs operate in sub-urban,

urban, and metropolitan areas also.

Co-operative banks also perform the basic banking functions of banking but

they differ from commercial banks in the following respects

Commercial banks are joint-stock companies under the companies act of

1956, or public sector bank under a separate act of a parliament whereas

co-operative banks were established under the co-operative societys acts

of different states.

Commercial bank structure is branch banking structure whereas co0operative Banks have a three tier setup, with state co-operative bank at

apex level, central /district co-operative bank at district level, and primary

co-operative societies at rural level.

Only some of the sections of banking regulation act of 1949 (fully applicable to

commercial banks), are applicable to co-operative banks, resulting only in

partial control by RBI of co-operative banks and Co-operative banks function

on the principle of cooperation and not entirely on commercial parameters.

10

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

TYPES OF CO-OPERATIVE BANK

The co-operative banks are small-sized units which operate both in urban and

non-urban centers. They finance small borrowers in industrial and trade sectors

besides professional and salary classes. Regulated by the Reserve Bank of India,

they are governed by the Banking Regulations Act 1949 and banking laws (cooperative societies) act, 1965. The co-operative banking structure in India is

divided into following 5 components:

Primary Co-operative Credit Society

The primary co-operative credit society is an association of borrowers and nonborrowers residing in a particular locality. The funds of the society are derived

from the share capital and deposits of members and loans from central cooperative banks. The borrowing powers of the members as well as of the society

are fixed. The loans are given to members for the purchase of cattle, fodder,

fertilizers, pesticides, etc.

Central co-operative banks

These are the federations of primary credit societies in a district and are of two

typesthose having a membership of primary societies only and those having a

membership of societies as well as individuals. The funds of the bank consist of

share capital, deposits, loans and overdrafts from state co-operative banks and

joint stocks. These banks provide finance to member societies within the limits

of the borrowing capacity of societies. They also conduct all the business of a

joint stock bank.

11

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

State co-operative banks

The state co-operative bank is a federation of central co-operative bank and acts

as a watchdog of the co-operative banking structure in the state. Its funds are

obtained from share capital, deposits, loans and overdrafts from the Reserve

Bank of India. The state cooperative banks lend money to central co-operative

banks and primary societies and not directly to the farmers.

Land development banks

The Land development banks are organized in 3 tiers namely; state, central, and

primary level and they meet the long term credit requirements of the farmers for

developmental purposes. The state land development banks oversee, the primary

land development banks situated in the districts and tehsil areas in the state.

They are governed both by the state government and Reserve Bank of India.

Recently, the supervision of land development banks has been assumed by

National Bank for Agriculture and Rural development (NABARD). The sources

of funds for these banks are the debentures subscribed by both central and state

government. These banks do not accept deposits from the general public.

Urban Co-operative Banks

The term Urban Co-operative Banks (UCBs), though not formally defined,

refers to primary co-operative banks located in urban and semi-urban areas.

These banks, till 1996, were allowed to lend money only for non-agricultural

purposes. This distinction does not hold today. These banks were traditionally

centered on communities, localities, work place groups. They essentially lend to

small borrowers and businesses. Today, their scope of operations has widened

considerably. The origins of the urban co-operative banking movement in India

can be traced to the close of nineteenth century. Inspired by the success of the

experiments related to the cooperative movement in Britain and the co-operative

credit movement in Germany, such societies were set up in India. Co-operative

12

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

societies are based on the principles of cooperation, mutual help, democratic

decision making, and open membership. Cooperatives represented a new and

alternative approach to organization as against proprietary firms, partnership

firms, and joint stock companies which represent the dominant form of

commercial organization. They mainly rely upon deposits from members and

non-members and in case of need, they get finance from either the district

central co-operative bank to which they are affiliated or from the apex cooperative bank if they work in big cities where the apex bank has its Head

Office. They provide credit to small scale industrialists, salaried employees, and

other urban and semi-urban residents.

13

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

ADVANTAGES OF CO-OPERATIVE BANK

1. Easy to form:

The formation of a cooperative society is very simple as compared to the

formation of any other form of business organisations. Any ten adults can join

together and form a cooperative society. The procedure involves in the

registration of a cooperative society is very simple and easy. No legal

formalities are required for the formation of cooperative society.

2. No obstruction for membership:

Unless and otherwise specifically debarred, the membership of cooperative

society is open to everybody. Nobody is obstructed to join on the basis of

religion, caste, creed, sex and colour etc. A person can become a member of a

society at any time he likes and can leave the society when he does not like to

continue as ; member.

3. Limited liability:

In most cases, the liabilities of the members of the society is limited to the

extent of capital contributed by them. Hence, they are relieved from the fear of

attachment of their private property, in case of the society suffers financial

losses.

4. Service motive:

In Cooperative society members are provided with better good and services at

reasonable prices. The society also provides financial help to its members < the

concessional rates. It assists in setting up production units and marketing of

produces c small business houses so also small farmers for their agricultural

products.

14

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

5. Democratic management:

The cooperative society is managed by the elected members from and among

themselves. Every member has equal rights through its single vote but can take

active part in' the formulation of the policies of the society. Thus all member are

equally important for the society.

6. Stability and continuity:

A cooperative society cannot be dissolved by the death insolvency, lunacy,

permanent incapability of the members. Therefore, it has stable life are

continues to exist for a longer period. It has got separate legal existence. New

members m< join and old members may quit the society but society continues

to function unless are otherwise all members unanimously decided to close the

same.

7. Economic operations:

The operation carried on by the cooperative society economical due to the

eliminations of middlemen. The services of middlemen are provided by the

members of the society with the minimum cost. In the case of cooperative

society, the recurring and non-recurring expenses are very less. Further, the

economies of scale-ma production or purchase, automatically reduces the

procurement price of the goods, thereby minimises the selling price.

8. Surplus shared by the members:

The society sells goods to its members on a nominal profit. In some cases, the

society sells goods to outsiders. This profit is utilised for meeting the day-to-day

administration cost of the society. The procedure for distribution of profit that

some portion of the surplus is spent for the welfare of the members, some

portion kept reserve whereas the balance shared among the members as

dividend on the basis of this purchases.

15

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

9. State patronage:

Government provides special assistance to the societies to enable them to

achieve their objectives successfully. Therefore, the societies are given financial

loan at lower rates. Government also extends many type of subsidies to

cooperative societies strengthening their financial stability and sustainable

growth in future.

DISADVANTAGES OF CO-OPERATIVE BANK

16

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

Despite many an advantages, the cooperative society suffer from certain

limitations c drawbacks. Some of these limitations, which a cooperative form of

business has are as follows:

1. Limited resources:

Cooperative societies financial strength depend on the cap contributed by its

members and loan raising capacity from state cooperative banks. The

membership fee is limited for which they are unable to raise large amount of

resources as their members belong to the lower and middle class. Thus,

cooperative^ are not suitable for the large scale business which require huge

capital.

2. Inefficient management:

A cooperative society is managed by the members only. They do not possess

any managerial and special skills. This is considered as major drawback of this

sector. Inefficiency of management may not bring success to the societies.

3. Lack of secrecy:

The cooperative society does not maintain any secrecy in business because the

affairs of the society is openly discussed in the meetings. But secrecy is very

important for the success of a business organisation. This paved the way for

competitors to compete in more better manner.

4. Cash trading:

The cooperative societies sell their products to outsiders only in cash. But, they

are usually from the poor sections. These persons require to avail credit

facilities which is not possible in the case of cooperatives. Hence, marketing is a

shortcoming for the cooperatives.

17

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

5. Excessive Government interference:

Government put their nominee in the Board of management of cooperative

society. They influence the decision of the Board which may or may not be

favourable for the interest of the society. Excessive state regulation, interference

with the flexibility of its operation affects adversely the efficiency of the

management of the society.

6. Absence of motivation:

The members may not feel enthusiastic because the law governing the

cooperatives put some restriction on the rate of return. Absence of relationship

between work and reward discourage the members to put their maximum effort

in the society.

7. Disputes and differences:

The management of the society constitutes the various types of personnel from

different social, economical and academic background. Many a times they

strongly differs from each other on many important issues. This becomes

detrimental to the interest of the society. The different opinions and disputes

may paralyses the effectiveness of the management.

CHAPTER 6

COMPANY PROFILE

SARASAWAT BANK

18

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

Saraswat Bank pronunciation (helpinfo) is an urban co-operative banking

institution based in Maharashtra, India and operating as a co-operative bank

since 1918.[2]

In 1988, the Bank was conferred with "Scheduled" status by Reserve Bank of

India. The Bank is the first co-operative bank to provide Merchant Banking

services. The Bank got a permanent license to deal in foreign exchange in 1978.

Presently the Bank is having correspondent relationship in 45 countries

covering 9 currencies with over 125 banks. In 1992, the Bank completed 75

years. Platinum Jubilee Celebrations were inaugurated on 14 September 1992

and the Bank also crossed the business level of Rs. 700 Crores. It has 267

branches nationwide.

The beginning of the 21st century has been a giant leap forward for the Bank.

The Bank chose a path of organic/inorganic growth and its pace of growth

accelerated .The Bank's total business which was around Rs.4000 Crore in 2000

almost tripled to Rs.15295 Crore in 2007.

In the year 2008, the Bank launched a Branding Initiative . The purpose of such

an exercise was to reconfirm the thrust of the Bank on its core values, which can

be summed up as a "Sense of Belonging".

In the last two decades the Bank has witnessed a steady growth in business and

also taken several Strategic Business Initiatives such as undertaking Business

Process Reengineering initiative, merging seven Cooperative Banks and then

consciously nurturing them. The Bank tied up with VISA International for

issuance of Debit Cards. The Bank has also successfully launched RuPay EMV

Debit Card during the year 2013-14. The Bank was the first to achieve this mile

stone in respect of RuPay EMV Card along with Bank of Baroda.

19

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

In 2011, the Bank was granted permission for All India Area of Operation by

Reserve Bank of India. The Bank has an ambitious business expansion plan in

place to have a presence in all major cities of the country, and to reach a

business levels of Rs. 50,000 Crores by 2016 and Rs. 1,00,000 Crores by 2018

respectively.

The Bank has a network of 267 fully computerized branches as on 31 March

2014 covering six states viz. Maharashtra, Gujarat, Madhya Pradesh, Karnataka,

Goa and Delhi. The Bank provides 24-hour service through ATMs at 205

locations.

As on 31 March 2014 the Bank's business had surpassed Rs. 39,000 Crores. The

Bank has retained its coveted position as ZERO NET NPA Bank for the tenth

successive year.

ABOUT US

The Bank has a very humble but a very inspiring beginning. On 14th

September 1918, "The Saraswat Co-operative Banking Society" was founded.

Mr. J.K. Parulkar became its first Chairman, Mr. N.B. Thakur, the first Vice20

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

Chairman, Mr. P.N. Warde, the first Secretary and Mr. Shivram Gopal

Rajadhyaksha, the first Treasurer. These were people with deep and abiding

ideals, faith, vision, optimism and entrepreneurial skills. These dedicated men

in charge of the Society had a commendable sense of service and duty imbibed

in them. Even today, our honorable founders inspire a sense of awe and respect

in the Bank and amongst the shareholders.

The Society was initially set up to help families in distress. Its objective was to

provide temporary accommodation to its members in eventualities such as

weddings of dependent members of the family, repayment of debt and

expenses of medical treatment etc. The Society was converted into a fullfledged Urban Co-operative Bank in the year 1933.

The Bank has the unique distinction of being a witness to history. The Bank,

which was originally founded in 1918, i.e. close on the heels of the Russian

Revolution, also witnessed as a Society and as Bank - the First World War, the

Second World War, India's freedom Movement and the glorious chapter of

post-independence India. During this cataclysmic cavalcade of history, the

Bank as a financial institution and its members could not of course remain

unaffected by the economic consequences of the major events. The two wars in

particular brought in their wake, paucities of all kinds and realities and stand

by its members in distress as a solid bulwark of strength. The Founder

Members and the later-day managements of the Bank continued to demonstrate

their unwavering faith in the destiny of the common man and the co-operative

movement and they encouraged the shareholders to save despite all odds.

Thanks to these sustained and assiduous efforts over 25 years after its

inception, the Bank had gained a strong foundation in terms of its membership,

resources, assets and profits. By 1942, the Bank was fulfilling all the banking

21

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

needs of its customers.

During the late fifties, the Bank grew from strength to strength. The Bank had

established five branches within the city of Mumbai and one each at Pune and

Belgaum. In its 50th year, the Bank chose a bee motif to symbolise the Bank's

emblem - a fitting and appropriate characteristic of a Bank that believed in

hard work, a search for all that is good, a team spirit to achieve its objectives

and selfless service to its members and customers. The Bank had grown in

stature, progressed in its social and economic objectives and produced an

image of what an ideal bank should be. Resultantly, in the year 1977-78, the

Bank's gross income crossed the Rs.3.00 crore mark for the first time.

In 1988, the Bank was conferred with "Scheduled" status by Reserve Bank of

India. The Bank is the first co-operative bank to provide Merchant Banking

services. The Bank got a permanent license to deal in foreign exchange in

1978. Presently the Bank is having correspondent relationship in 45 countries

covering 9 currencies with over 125 banks. In 1992, the Bank completed 75

years. Platinum Jubilee Celebrations were inaugurated on 14th September,

1992 and the Bank also crossed the business level of Rs. 700 Crores.

The beginning of the 21st century has been a giant leap forward for the Bank.

The Bank chose a path of organic/inorganic growth and our pace of growth

accelerated .The Bank's total business which was around Rs.4000 Crore in

2000 almost tripled to Rs.15295 Crore in 2007.

In the year 2008, the Bank launched a Branding Initiative . The purpose of

such an exercise was to reconfirm the thrust of the Bank on its core values,

which can be summed up as a "Sense of Belonging". The name of the Bank

should always inspire a Sense of Belonging in all its stakeholders and the Bank

continues to fulfill the changing needs and expectations of the customer with

22

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

unflinching gusto and aplomb.

MISSION STATEMENT

"To emerge as one of the premier and most preferred banks in the country by

adopting the highest standards of professionalism and excellence in all the

areas of working"

MILESTONES

In the last two decades the Bank has witnessed a steady growth in business and

also taken several Strategic Business Initiatives such as undertaking Business

Process Reengineering initiative, merging seven Cooperative Banks and then

consciously nurturing them.

The Bank tied up with VISA International for

issuance of Debit Cards.

In 2011, the Bank was granted permission for All India Area of Operation by

Reserve Bank Of India.The Bank has an ambitious business expansion plan in

place to have a presence in all major cities of the country, reach a business

level of Rs.50000 Crores by 2016 and Rs.100000 crores by 2021.

The Bank has a network of 267 fully computerized branches as on 31st

March, 2015 covering six states viz. Maharashtra, Gujarat, Madhya Pradesh,

Karnataka, Goa and Delhi. The Bank is providing 24-hour service through

ATMs at 219 locations. As on 31st March, 2015 the Bank's business had

surpassed Rs. 44000 Crores.

It is a matter of immense pride for the Bank that its new Corporate Office at

Prabhadevi,Mumbai has become operational. The office establishes our strong

presence in the financial capital of the country. The massive edifice in crystal

glass in the heart of Mumbai gently reminds everyone of the NumeroUno position which the Bank holds in the Cooperative Sector. The usage of

23

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

state of art technology coupled with personal ambience to make everybody

comfortable once again reiterates the Bank's adherence to "Think Global, Act

Local". The address of our new Corporate Office is as under:

PROFILE

"Service to the Common Man" has been the motto of Saraswat Bank for the

last 96 years. Bank in spite of its growth in size has been able to offer to the

customers the dual advantage of "Ability of Big Banks and Agility of Small

24

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

Banks"

The Bank still continues to function with the glorious tradition in public

services Besides being the largest Urban Co-operative Bank in India, Saraswat

Bank has now become the largest in Asia. Saraswat Bank has now 267 fully

computerized branches as of 31st March 2015, 4 Zonal Offices and departments

located across 6 States viz. Maharashtra, Goa, Gujarat, Madhya Pradesh,

Karnataka and Delhi.

Saraswat Bank attributes this success to its undying spirit to serve the common

man and to the sharpening of its competitive edge by constantly upgrading

technology to match international standards. The Bank is fully computerised

and offers convenient working hours.

Saraswat Bank has introduced a wide range of credit schemes at attractive

interest rates, which has become very popular, especially among the middleclass in view of the easy repayment plans. Bank offers attractive interest rates

on deposits and also various add on features at very market competitive rates.

CHAPTER 7

TYPES OF DEPOSITS OFFERED BY SARASWAT

BANK

25

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

SAVING DEPOSIT

A Savings Account for everyone to inculcate the habit of saving and avoid thrift.

Bank offers you a host of convenient features and banking channels to transact

through. Personalized service coupled with technology enabled products is the

hallmark of our service.

Types of saving deposits are:o Regular Savings Account

o Akshay Salary Account

o CUBS Account for Kids

o Suvidha Savings Account

o My Money Savings Account

o Janhit Account

o CAMPUS Account for College

o Pradhan Mantri Jan Dhan

students

Yojana

Elite Savings Account

Elite Silver Savings Account

Elite Gold Savings Account

CURRENT DEPOSIT

Fasten your pace with a current account which offers you out of the world

service experience by combining personalized service with many appropriately

priced features. Our customer friendly staff will not leave any stone unturned to

26

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

make your experience a memorable one. Internet Banking, SMS Banking all

will allow you to Bank from the comfortable confines of your home and office.

Types of current deposit: Elite Current Account

Premium Current Account

Platinum Current Account

FIXED DEPOSIT

Lumpsum amount is deposited at one time for specific period. Higher rate of

interest is paid, which varies with the group of deposit. Withdrawals are not

allowed before the expiry of the period. Those who have surplus funds go for

fixed deposits.

RECURRING DEPOSIT

You can invest in small amounts every month and see the drop become an

ocean. Through this account you can invest small amounts of money every

month and end up with a large kitty on maturity. Bank also allows you facility

to give standing instructions by which the amount is debited from your account

every month.

LOANS

27

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

It is normally for short term say a period of one year or medium term say a

period of five years. Nowadays, banks do lend money for longer term.

repayment of money can be in the form of installments spread over a period of

time or in a lumpsum amount. interest is charged on actual amount sanctioned,

whether withdrawn or not. The rate of interest may be slightly lower than what

is charged on overdraft and cash credits. Loans are normally secured against

tangible assets of the company.

TYPES OF LOANS OFFERED BY SARSWAT BANK

28

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

PERSONAL LOANS

These are given to individual customers for meeting their personal

requirements. These loans are repayable in monthly installments. Saraswat cooperative bank offers various loans to its customers. Bank takes care of its

customers by offering comprehensive loan packages at extremely competitive

rates, without any hidden cost. Our personalized service coupled with state of

the art technology at absolutely market competitive rates shall make your

banking experience truly memorable one. The types of personal loans are as

follows:

Privilege loan: privilege loan is for personal expenses and only

individuals employed with reputed public limited companies and

repayment can be done maximum in 60 months

Samruddhi scheme: samruddhi scheme is to meet urgent financial needs

of individuals and overdraft facility is subject to renewal every year.

Multi-purpose loan: multi-purpose loan is for purchase of consumer

durables, computer, two wheelers, house repairs, medical/ travels/

education/ other expenses. maximum loan amount is Rs 2 lakhs

EDUCATION LOAN

The purpose of this loan is for studies in India or abroad. The applicant of

this loan is the parent of the student. student will be the co-applicant. The

amount of loan for education in India is maximum Rs 10 lakhs and

maximum amount is Rs 20 lakhs for education abroad. the period for

29

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

repayment of such loan is maximum 144 months inclusive of moratorium

period of maximum 36 months. The rate of interest charged on such loan is

14.5% p.a. Atleast two guarantures are required for application of loan up to

Rs 2 lakhs. The security of Rs 2 lakhs and two gurantures for the application

of loan above Rs 2 lakhs and upto Rs 5 lakhs for application of loan above

Rs 5 lakhs and upto Rs 20 lakhs securities required are Tangible security like lic, nsc, kbp, gold, rbi bonds or fd's with the

bank .

Mortgage of un encumberad .

one or more personal gurantes depending on the merits of the proposal.

0.5% of the loan amount is charged as processing fees for studies in

abroad.

documents required for application of education loan are

duly filed application form

admission related documents such as.

offer letter from universities/ college/ institue stating details of

course and admission procedure

in case of students going to usa than admission letter is required

passport copy ( in case of education abroad) or identify proof.

latest academic marksheet.

work experince proof if any.

loan related documents such as

30

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

KYC documents of applicants and guranters such as pancard ,

address proof, photograph

for salaried persons copies of salaries slip for last three months,

bank account statement for last six months, itr in form 16 for

last three years.

for businessman/ professionals copies of last three years audited

profit and loss and balance sheet, itr with computation for last

three years.

bank account statement for last 6 months.

VEHICLE LOAN

The purpose of this type of loan is for purchase of new cars .The eligibility

for such type of loan is

salaried person with one year confirmed sevice.

Businessman, professionals and commerical organisation.

The repayment for salaried class for this loan is maximum up to 84 months

and the repayment for business class is maximum up to 60 months.

The security for this loan is hypothecation of vehicle and gurantor depending

on merits of the proposal.

The processing fees for this loan is 0.5% of the loan amount.

31

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 8

COMPANY PROFILE

ABHUDAYA BANK

Abhyudaya Co-op. Bank Ltd., one of the leading Urban Co-operative Banks

in India, in its outlook and approach, has the objective of progress and

prosperity of all. From a humble beginning in January 1964 as a Cooperative Credit society with a share capital of a merely Rs.5,000/- held by

83 members, today Abhyudaya Co-op bank has become one of the large

Urban Co-operative Banks with a "Scheduled Bank" status. The bank has

been converted into a Multi-State Scheduled Urban Co-op. Bank w.e.f.

11th January, 2007. The area of operation which was restricted to the State of

Maharashtra has now been extended to Karnataka State. Currently, the

capital base of the bank stands at Rs. 45.78 crores and Reserves and

surpluses at Rs.671.95 crores as on 31.03.2009. The bank has 1, 23,011

members and more than 12 lakhs depositors. The Bank has seen a

tremendous growth in deposits. The deposits of the bank are over Rs.

3174.81 crores as on 31.03.2009, which were Rs. 2625.51 crores as at the

end of the financial year 2008. The loans and advances stood at Rs. 1856.39

crores as on 31.03.2009. The bank had posted a net income of Rs. 92.36

crores as on 31.03.2009. The growth rate of the bank compares well with

that of others in the sector. The Bank has maintained a steady growth. The

bank has been paying dividend @ 15% to its members which is maximum

permissible as per the MCS Act.

The Bank has launched different loan schemes tailor-made to suit the needs

32

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

of various customers. The schemes aim at providing loans for purchase or

construction of residential premises, repair/renovation of house property,

purchase of car, seeking higher education and for purchase of household

consumer durable. One of the loan schemes, viz. "Udyog Vikas Yojana" is

specially designed for the benefit of small entrepreneurs and businessmen.

The procedure for sanctioning of loans under the schemes has been

simplified and relaxed with a view to attract new customers and facilitating

speedy sanction of loans. The Bank has total 75 branches including a Mobile

Bank at Navi Mumbai. Bank is committed to spread network of branches

throughout the State and provide much needed banking services to the

population, which has been deprived of the banking facilities.

Innovative Banking is another area of operation that Abhyudaya is currently

focusing on for a sustainable long term growth. The Bank has always

endeavored for providing satisfactory customer service with the help of the

latest technology. The Bank has provided fully computerised services to its

valued clients. Bank is offering 11 Hours fully computerised services at 15

branches and 24 hours ATM service at 42 branches.

Milestones:

1964- Established as Co-operative Credit Society.

1965- Converted into a Bank with one Branch at Abhyudaya Nagar.

1985-Inauguration of Banks own Building, Staff Training College and

Auditorium at

Vashi, RBI Permitted the Bank to open and maintain NRI Accounts.

1986 - Instituted Educational Prizes to the children of Members and Employees.

33

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

Became 3rd Biggest Urban Co-op. Bank in India.

1988 - Became Scheduled Bank.

1990 - Inauguration of Banks own Building at New Panvel.

1995- Decision to set up Development Reserve Fund to undertake special

schemes.

1997- All Branches fully computerized.

1999- Eleven Hours & Sunday Banking started in 16 Branches.

2000- ATM installed at 3 branches.

2003- Opened 40th Branch with ATM Facility & 11 hours and Sunday banking

At Lokmanya Nagar (Thane).

2004- Started RTGS and NDS Facilities.

2006- Merger of Citizen Co-operative Bank Ltd., with 13 branches.

2007- Registration of the Bank under Multi-State Co-Op Societies Act on

11th Jan., 2007.

2008- Merger of Shri Krishna Co-operative Bank Ltd, Vadodara

- Merger of Janata Sahakari Bank, Udupi

- Foreign Exchange Department we inaugurated

2009 - Opened Bhayander branch And Dahisar branch

Opened recovery call centre at Parel

34

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 9

SERVICES PROVIDED BY ABHYUDAYA BANK

Deposit:Domestic Deposit:Saving Deposit

Current Deposit

Term Deposit

Abhyudaya Banks other Saving Bank account Products:1.Abhyudaya Zero Balance Saving Bank Account for Salaried Person

(SBZROBAL):

An individual working in Govt. Org., Semi Govt. Org., Agents of Life &

General Insurance, employees of Educational Institutions & Public ltd.

Companies. Accounts can also be opened of the employees of Business

Concerns/ Private/ Industrial units (Min 20 Employees) & whose company

accounts are with our bank branches.

2. Abhyudaya SB Youth Accounts :

for School /College going Students.

3.Basic Saving Bank Accounts (BSB). :

No introduction required & zero minimum balance.

35

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

4.Abhyudaya Small Saving Accounts (SSB): suitable for people of low

means. Zero minimum Balance.

5.Savings Bank Account with Zero Balance to MID/QID Deposit

Holders:

MID/QID depositors having minimum Term Deposit of Rs.10,000/- will be

allowed to open Savings Bank Account with Zero balance

Types of Loans and Credit Facilities Given by Banks

The entire operations of the banking industry revolve around obtaining deposits

and granting loans and different credit facilities to its customers for viable

projects.

The different types of loans and credit facilities given by the banks can be

broadly classified into two types.

Retail Lending

Commercial lending

Retail Lending:

Retail finance has become the preferred business of banks because of its higher

spreads and low risk of delinquency. The Indian consumer is fast changing his

habits, borrowing money to buy the product he wants, not content with buying

what he can afford. The resultant consumer boom is what market strategists

explain as the key to the access of the Indian retail finance market. Retail

finance today is a win-win system in which everyone stands to gain. For the

Indian consumer, it is an opportunity to upgrade his standard of living right now

instead of waiting for years for his savings to accumulate. For manufacturers, it

stimulates demand and lowers inventory. For middlemen, its a sales boosting

36

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

device. For players of consumer finance i.e. banks and lending institutions, its a

means of profit generation.

There are a number of retails loans given by banks to its customers, which

would suite their requirements. They are stated as under:

Housing Loan

Education loan

Mortgage loan

Personal loan

Senior citizen pension scheme

Rent scheme

Consumer durables loan

Auto finance loan

Trade finance loan

Loan against National savings certificate (NSC)

Loan against Kisan Vikas patra (KVP)

Loan against fixed deposit receipt (FDR)

Loan against RBI bonds

Loan against LIC

Loan against FCNR

Overdraft against FD/NSC/KVP

Commercial Lending:

The entire commercial lending can be broadly classified as fund based

commercial credit facility and non-fund based commercial credit facility.

37

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

Fund Based Bank Facilities:

Term Loans:

Term loan is an installment credit repayable over a period of time in

monthly/quarterly/half yearly / yearly installments. Term loan is generally

granted for creation of fixed assets required for long-term use by the unit. Term

loans are further classified in three categories depending upon the period of

repayment as under:

Short term repayable in less than 3 years.

Medium term loans repayable in a period ranging from 3 years to 7 years.

Long-term loans repayable in a period over 7 years.

Cash Credit Facility:

A major part of working capital requirement of any unit would consist of

maintenance of inventory of raw materials, semi finished goods, finished good,

stores and spares etc. In trading concern the requirement of funds will be to

maintain adequate stocks in trade. Finance against such inventories by banks is

generally granted in the shape of cash credit facility where drawing will be

permitted against stocks of goods. It is a running account facility where deposits

and withdrawals are permitted. Cash credit facility is of two types (depending

upon the type of charge on goods taken as security by bank)

(i)

Cash credit pledge:

When the possession of the goods is with the bank and drawings in the

account are linked with actual movement of goods from / to the possession of

the bank. The bank exercises the physical control of the goods.

38

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

(ii) Cash credit hypothecation:

When the possession of the goods remains with the borrower and a

floating charge over the stocks is created in favour of the bank. The borrower

has complete control over the goods and the drawings in the account are

permitted on the basis of stock statements submitted by the borrower.

Overdraft Facility:

Overdrawing permitted by the bank is current account is termed as an

overdraft facility. Overdraft may be permitted without any security as clean

overdraft for temporary periods to enable the borrower to tide over some

emergent financial difficulty. Secured overdraft facility is against fixed

deposits, NSC, and other securities.

Bill Finance:

This facility is against bills of sales raised or book debts.

Export Finance / Packing Credit:

Bank grants export credit on very liberal terms to meet all the financial

requirements of exporters. The bank credit for exports can broadly be divided in

two groups as under:

Pre Shipment advances / packing credit advances:

39

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

Financial assistance sanctioned to exporters to enable them to

manufacture / procure goods meant for export and arrange for their eventual

shipment to foreign countries is termed as per shipment credit.

Post shipment credit:

The bills purchase / discount facility granted to exporters is grouped as

post shipment advance.

Non Fund Based Bank Facilities:

Credit facilities, which do not involve actual deployment of funds by banks

but help the obligations to obtain certain facilities from third parties, are termed

as non-fund based facilities. These facilities include issuance of letter of credit,

issuance of guarantees, which can be performance guarantee / financial

guarantee.

40

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

LETTER OF CREDIT (LC)

A LC represents a commitment of a bank to pay the seller of goods or

services a certain amount provided he resents stipulated documents evidencing

the shipment of goods or the performance of services within a prescribed period

of time. LC can be of two types:

Inland

Foreign

In other words LC is the undertaking of a bank to make payment on behalf of a

person to a third party with a conditional undertaking. There are four principle

parties to the LC. They are stated as under.

Applicant (opener): He is the buyer of the goods. LC is opened at

the request of the buyer, as per his instructions.

Issuing Bank (opening bank): The bank (buyers bank) that issues

the LC and undertakes conditional payment, at the request of the

opener / buyer / importer customer.

Beneficiary: He is the seller of the goods. LC is issued in his

favour enabling him to obtain payment on submission of stipulated

documents / compliance with the terms and conditions of LC.

Advisory bank: This is the bank which a normally located in the

country of the seller that advises the credit to the beneficiary,

establishes the genuineness of the credit.

41

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

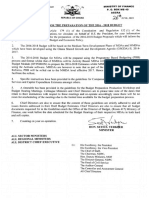

COMPARISON OF FINANCIAL RATIO

CAPITAL

BANKS IN RS.

(BILLION)

2015

2014

% change

SARASWAT BANK

1676877980

1269092940

132.13

ABHYUDAYA BANK

1014453000

886129000

114.48

BANKS IN RS. (CRORE) 2015

2014

% change

SARASWAT BANK

2393951034

43

2114433164

05

113.21

ABHYUDAYA BANK

9330896800

8036398900

116.10

BANKS IN RS. (CRORE) 2015

2014

% change

SARASWAT BANK

1547005019

78

1502341505

95

102.97

ABHYUDAYA BANK

5700471200

5108885500

111.57

DEPOSITS

ADVANCES

INVESTMENT

BANKS IN RS. (CRORE) 2015

2014

% change

SARASWAT BANK

7804742067

5

6443998335

3

121.11

ABHYUDAYA BANK

3696828722

3150096700

117.35

42

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 10

RBI POLICIES FOR CO-OPERATIVE BANK

The RBI appointed a high power committee in May 1999 under the

chairmanship of Shri . K. Madhava Rao, Ex-Chief Secretary, Government of

Andhra Pradesh to review the performance of Urban Co-operative Banks

(UCBs) and to suggest necessary measures to strengthen this sector. With

reference to the terms given to the committee, the committee identified five

broad objectives:

To preserve the co-operative character of UCBs

To protect the depositors interest

To reduce financial risk

To put in place strong regulatory norms at the entry level to sustain the

operational efficiency of UCBs in a competitive environment and evolve

measures to strengthen the existing UCB structure particularly in the

context of ever increasing number of weak banks

To align urban banking sector with the other segments of banking sector

in the context of application or prudential norms in to and removing the

irritants of dual control regime

RBI has extended the Off-Site Surveillance System (OSS) to all nonscheduled urban co-operative banks (UCBs) having deposit size of Rs.

100 Crores and above.

43

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

PROBLEMS OF CO-OPERATIVE BANK

Duality of control system of co-operative banks

However, concerns regarding the professionalism of urban co-operative banks

gave rise to the view that they should be better regulated. Large co-operative

banks with paid-up share capital and reserves of Rs.1 lakh were brought under

the purview of the Banking Regulation Act 1949 with effect from 1st March,

1966 and within the ambit of the Reserve Banks supervision. This marked the

beginning of an era of duality of control over these banks. Banking related

functions (viz. licensing, area of operations, interest rates etc.) were to be

governed by RBI and registration, management, audit and liquidation, etc.

governed by State Governments as per the provisions of respective State Acts.

In 1968, UCBs were extended the benefits of deposit insurance. Towards the

late 1960s there was debate regarding the promotion of the small scale

industries. UCBs came to be seen as important players in this context. The

working group on industrial financing through Co-operative Banks, (1968

known as Damry Group) attempted to broaden the scope of activities of urban

co-operative banks by recommending these banks should finance the small and

cottage industries. This was reiterated by the Banking Commission in 1969.

The Madhavdas Committee (1979) evaluated the role played by urban cooperative banks in greater details and drew a roadmap for their future role

recommending support from RBI and Government in the establishment of such

banks in backward areas and prescribing viability standards. The Hate Working

Group (1981) desired better utilization of banks surplus funds and that the

percentage of the Cash Reserve Ratio (CRR) & the Statutory Liquidity Ratio

(SLR) of these banks should be brought at par with commercial banks, in a

44

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

phased manner. While the Marathe Committee (1992) redefined the viability

norms and ushered in the era of liberalization, the Madhava Rao Committee

(1999) focused on consolidation,

control of sickness, better professional standards in urban co-operative banks

and sought to align the urban banking movement with commercial banks. A

feature of the urban banking movement has been its heterogeneous character

and its uneven geographical spread with most banks concentrated in the states

of Gujarat, Karnataka, Maharashtra, and Tamil Nadu. While most banks are unit

banks without any branch network, some of the large banks have established

their presence in many states when at their behest multi-state banking was

allowed in 1985. Some of these banks are also Authorized Dealers in Foreign

Exchange.

45

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 11

CONCLUSION

Almost all the Banks offer similar features and facilities with their Savings

accounts. There are certain reasons for existing customers of Saving Account

of any Bank to shift to another Bank.

The level of service in terms of delivering whatever is promised, fast

response in case of problems, is the most important benefit that the

customers seek, from the Bank they have a Saving Account with.

1. Network reach and visibility of a Bank is a very important criterion for

the customer while opening a Saving Account. We can also conclude

from our analysis that network reach in terms of Branches and ATMs is

directly proportional to the market share in case of Private Players.

2. In case of a new customer, if a bank approaches it first for opening a

Saving Account with them, then there is a good chance for the bank of

getting many future businesses and cross sales from the deal.

3. Aggressive Marketing is the key to increasing the market share in this

area, since the market has a lot of potential both in terms of untapped

market .

46

COMPARITIVE STUDY BETWEEN TWO CO-OPERATIVE BANKS

CHAPTER 12

WEBILOGRAPHY

www.moneycontrol.com

www.saraswatbank.com

www.abhyudayabank.com

www.rbi.org.in

47

Vous aimerez peut-être aussi

- Export and ImportDocument98 pagesExport and ImportGeetika MalhotraPas encore d'évaluation

- Bank GuaranteeDocument2 pagesBank GuaranteeFaridul Alam100% (1)

- Fco (Full Corporate Offer) For Type B Thermal Coal Fob ModalityDocument3 pagesFco (Full Corporate Offer) For Type B Thermal Coal Fob ModalityJuliana Iru100% (1)

- Debt InstrumentsDocument43 pagesDebt InstrumentsSiddhi Kadakia88% (16)

- Feed Contract - AcDocument90 pagesFeed Contract - AcSenthil Nathana100% (3)

- Letter of CreditDocument19 pagesLetter of CreditAmarjeet Singh0% (1)

- UCP 600 Overview of Articles ListedDocument5 pagesUCP 600 Overview of Articles ListedRamakrishnan NatarajanPas encore d'évaluation

- Project Report BobDocument30 pagesProject Report Bobmegha rathore100% (1)

- Comparative Study of Life InsuranceDocument61 pagesComparative Study of Life InsuranceParinShah83% (6)

- Travel InsuranceDocument81 pagesTravel InsuranceParag MorePas encore d'évaluation

- Universal Banks, Commercial Banks, and Risk-Based Capital RulesDocument26 pagesUniversal Banks, Commercial Banks, and Risk-Based Capital RulesZsa-shimi FranciscoPas encore d'évaluation

- Cargo Insurance ProjectDocument63 pagesCargo Insurance ProjectParag More100% (2)

- Financial Performance Analysis of Co-Operative BanksDocument43 pagesFinancial Performance Analysis of Co-Operative Bankskkccommerceproject100% (3)

- Punjab State Cooperative Bank 1 (Repaired)Document60 pagesPunjab State Cooperative Bank 1 (Repaired)DeepikaSaini75% (4)

- Project On Indian Financial MarketDocument44 pagesProject On Indian Financial MarketParag More85% (13)

- Gousia - A Study On Loans and Advances - Axis BankDocument25 pagesGousia - A Study On Loans and Advances - Axis BankMOHAMMED KHAYYUMPas encore d'évaluation

- Jamals Black Book PDFDocument82 pagesJamals Black Book PDFShaikh awais100% (6)

- Project On LICDocument54 pagesProject On LICHament Singh71% (38)

- Cooperative Bank Project ReportDocument71 pagesCooperative Bank Project ReportLakshmi Suresh60% (5)

- A2013 Law 101 Cases Reviewer (Obligations and Contracts) EALabitagDocument11 pagesA2013 Law 101 Cases Reviewer (Obligations and Contracts) EALabitagJanz SerranoPas encore d'évaluation

- Project On Claims Management in Life InsuranceDocument60 pagesProject On Claims Management in Life Insurancepriya_1234563236986% (7)

- Final Project On Health InsuranceDocument61 pagesFinal Project On Health InsuranceYatriShah50% (14)

- Cooperative Bank Whole InfoDocument9 pagesCooperative Bank Whole Infoyatin patilPas encore d'évaluation

- Role of Moenetary and Fiscal Policies in Economic DevelopmentDocument16 pagesRole of Moenetary and Fiscal Policies in Economic Developmentprof_akvchary85% (13)

- Saraswat BanK ORIGINALDocument57 pagesSaraswat BanK ORIGINALSudama EppiliPas encore d'évaluation

- Blackbook Project On Consumer Perception About Life Insurance PoliciesDocument80 pagesBlackbook Project On Consumer Perception About Life Insurance PoliciesMohit Kumar89% (28)

- Micro Insurance ProjectDocument56 pagesMicro Insurance ProjectParag More50% (4)

- Comparative Study of The Public Sector Amp Private Sector BankDocument70 pagesComparative Study of The Public Sector Amp Private Sector BankSetuAgrawalPas encore d'évaluation

- Axis Bank (Black Book) (1) TejuDocument55 pagesAxis Bank (Black Book) (1) TejuTEJASHVINI PATEL0% (2)

- Regional Rural Banks of India: Evolution, Performance and ManagementD'EverandRegional Rural Banks of India: Evolution, Performance and ManagementPas encore d'évaluation

- 3 International Commercial Sale of GoodsDocument31 pages3 International Commercial Sale of GoodsPranav GhabrooPas encore d'évaluation

- "COMPARATIVE STUDY OF CUSTOMER SATISFACTION TOWARDS HDFC BANK AND STATE BANK OF INDIA"-FinalDocument37 pages"COMPARATIVE STUDY OF CUSTOMER SATISFACTION TOWARDS HDFC BANK AND STATE BANK OF INDIA"-Finalshraddha singhPas encore d'évaluation

- A Study On Lending and Recovery Project-1Document96 pagesA Study On Lending and Recovery Project-1Cenu Roman67% (3)

- Summer Internship Project On BankDocument76 pagesSummer Internship Project On BankReema Negi100% (3)

- Budget Offer PASS M0S 245 KVDocument14 pagesBudget Offer PASS M0S 245 KVPradip Naik0% (1)

- Introduction of Bank of BarodaDocument47 pagesIntroduction of Bank of BarodaKrutika Sawant61% (23)

- Project Report-Saraswat Co-Op Bank LTD PDFDocument127 pagesProject Report-Saraswat Co-Op Bank LTD PDFPRALHAD33% (3)

- Project Report PNBDocument60 pagesProject Report PNBa_blackeyed86% (21)

- Social Media in Banking - ProjectDocument29 pagesSocial Media in Banking - ProjectHiraj KotianPas encore d'évaluation

- Co Operative Banking ProjectDocument55 pagesCo Operative Banking Projectamit9_prince91% (11)

- Project On Co-Operative Banks and Rural DevelopmentDocument52 pagesProject On Co-Operative Banks and Rural DevelopmentDileep94% (17)

- Role of Urban Cooperative BanksDocument60 pagesRole of Urban Cooperative BanksbluechelseanPas encore d'évaluation

- Co Operative Banking Final ProjectDocument65 pagesCo Operative Banking Final ProjectYogi525Pas encore d'évaluation

- Cooperative Banking ProjectDocument53 pagesCooperative Banking ProjectselvamPas encore d'évaluation

- Co Operative Banking ProjectDocument55 pagesCo Operative Banking ProjectlizamandevPas encore d'évaluation

- COMPARISON OF COMMERCIAL & CO-OP BANKSDocument39 pagesCOMPARISON OF COMMERCIAL & CO-OP BANKSSoundari Nadar100% (3)

- Understanding NPAs of Varachha Co-operative BankDocument79 pagesUnderstanding NPAs of Varachha Co-operative BankSatish Prajapati33% (3)

- Saran Blackbook FinalDocument78 pagesSaran Blackbook FinalVishnuNadar100% (3)

- Urban Co-Operative BankDocument96 pagesUrban Co-Operative BankAshutoshSharma0% (1)

- State Co-Operative Bank LatestDocument29 pagesState Co-Operative Bank LatestAhana SenPas encore d'évaluation

- Industry ProfileDocument15 pagesIndustry ProfileP.Anandha Geethan80% (5)

- Summer Training Project Report COPERATIVE BANKDocument53 pagesSummer Training Project Report COPERATIVE BANKkaushal24420% (1)

- Major Project (Akhil.k)Document116 pagesMajor Project (Akhil.k)Vinoth Vkr75% (4)

- The Surat Dist. Co-Op BankDocument94 pagesThe Surat Dist. Co-Op BankVijay Gohil0% (3)

- Black Book ProjectDocument4 pagesBlack Book ProjectSwapnil HengadePas encore d'évaluation

- Chapter-2 Review of Literature: Bhatia (1978), in His Study Titled, "Banking Structure and Performance A CaseDocument28 pagesChapter-2 Review of Literature: Bhatia (1978), in His Study Titled, "Banking Structure and Performance A CaseApoorvaPas encore d'évaluation

- Introduction of SbiDocument10 pagesIntroduction of SbieshuPas encore d'évaluation

- ConclusionDocument2 pagesConclusionezekiel50% (2)

- Union Bank of IndiaDocument53 pagesUnion Bank of IndiaSonu DhangarPas encore d'évaluation

- Merger Impact and Synergies of Bank of Baroda, Dena Bank and Vijaya BankDocument6 pagesMerger Impact and Synergies of Bank of Baroda, Dena Bank and Vijaya BankAnkit KumarPas encore d'évaluation

- Project On Foreign BanksDocument68 pagesProject On Foreign BanksPawan Gurhani100% (1)

- Project Cooperative BankDocument33 pagesProject Cooperative BankPradeepPrinceraj100% (1)

- Siddheswar Co-Operative Bank LTD, BijapurDocument63 pagesSiddheswar Co-Operative Bank LTD, Bijapurarunsavukar100% (2)

- Internship Report On Cooperative Bank PawanDocument49 pagesInternship Report On Cooperative Bank Pawanlovely86% (7)

- Project Union Bank of IndiaDocument31 pagesProject Union Bank of Indiaswadesh100% (1)

- Priyankur SynopsisDocument26 pagesPriyankur SynopsisMukesh SharmaPas encore d'évaluation

- Co-operative Banking System SectionDocument20 pagesCo-operative Banking System SectionAman SinghPas encore d'évaluation

- Banking Law SaloniDocument14 pagesBanking Law SaloniNikunj Adrian PokhrelPas encore d'évaluation

- Avinash ProjectDocument58 pagesAvinash ProjectSonali Pawar100% (1)

- Introduction To Co-Operative Banking: DefinationDocument9 pagesIntroduction To Co-Operative Banking: DefinationHelloprojectPas encore d'évaluation

- A Study of Banking Procedures at Citizens Urban Co-Op BankDocument55 pagesA Study of Banking Procedures at Citizens Urban Co-Op BankSpUnky Rohit100% (1)

- 11 Chapter 4Document7 pages11 Chapter 419UEI014 , PRITAM DebPas encore d'évaluation

- Banking System and Co-operative Banking ExplainedDocument50 pagesBanking System and Co-operative Banking Explainedjkpatel221Pas encore d'évaluation

- Co-operative Banks Regulatory FrameworkDocument22 pagesCo-operative Banks Regulatory Frameworksimran yadavPas encore d'évaluation

- Full Info of Coperative BanksDocument15 pagesFull Info of Coperative BanksAkash ShirsatPas encore d'évaluation

- A Study of Citizens Urban Co-Op Bank's Banking ProceduresDocument55 pagesA Study of Citizens Urban Co-Op Bank's Banking ProceduresAnkitPas encore d'évaluation

- Co-Operative Banks in IndiaDocument9 pagesCo-Operative Banks in Indiachaitali jadhavPas encore d'évaluation

- New Project - Doc2Document80 pagesNew Project - Doc2Minal ThakurPas encore d'évaluation

- Co-Operative Bank: Sr. No. Topic NameDocument66 pagesCo-Operative Bank: Sr. No. Topic NameAmey DalviPas encore d'évaluation

- Ms. Reeti Bora Mondal Aarzoo, Anubhav, Ashwani, Bhawna, Keshav, TariniDocument16 pagesMs. Reeti Bora Mondal Aarzoo, Anubhav, Ashwani, Bhawna, Keshav, TariniAditi MondalPas encore d'évaluation

- Comparative Study of Saraswat Co-Operative Bank and Abhudaya Co-Operative BankDocument74 pagesComparative Study of Saraswat Co-Operative Bank and Abhudaya Co-Operative BankAakash SonarPas encore d'évaluation

- Ch. 1. Introduction To Co-Operative Banking: DefinationDocument54 pagesCh. 1. Introduction To Co-Operative Banking: DefinationBinoy MehtaPas encore d'évaluation

- HRM in Banking (100 Marks Project)Document62 pagesHRM in Banking (100 Marks Project)Shekhar Nm85% (13)

- Project On Mutual FundsDocument75 pagesProject On Mutual FundsParag MorePas encore d'évaluation

- Chapter 1: Corporate GovernanceDocument60 pagesChapter 1: Corporate Governancesteffibiswas2006Pas encore d'évaluation

- Recruitment Project On Life Insurance Co.Document87 pagesRecruitment Project On Life Insurance Co.Devpratapsinh Bilkha100% (1)

- Lucky 08bs0001551 Insurance Law ThesisDocument29 pagesLucky 08bs0001551 Insurance Law Thesisluckyproject100% (2)

- Swot Analysis in Bancassurance.Document50 pagesSwot Analysis in Bancassurance.Parag More100% (2)

- Rural InsuranceDocument45 pagesRural InsuranceAmeySalaskarPas encore d'évaluation

- Metlife InsuranceDocument73 pagesMetlife InsuranceParag More100% (1)

- CSR Project On InsuranceDocument69 pagesCSR Project On Insurancedhwani0% (1)

- Aviavtion InsuranceDocument75 pagesAviavtion InsuranceParag MorePas encore d'évaluation

- Role of Merger Acquisition in BankingDocument113 pagesRole of Merger Acquisition in BankingParag MorePas encore d'évaluation

- Corporate BankingDocument100 pagesCorporate BankingParag MorePas encore d'évaluation

- Role of Banking Sector in IndiaDocument75 pagesRole of Banking Sector in IndiaOna JacintoPas encore d'évaluation

- Impact of Fiscal Policy On Indian EconomyDocument24 pagesImpact of Fiscal Policy On Indian EconomyAzhar Shokin75% (8)

- Role of Advertising in BankingDocument49 pagesRole of Advertising in BankingParag MorePas encore d'évaluation

- Corporate BankingDocument122 pagesCorporate Bankingrohan2788Pas encore d'évaluation

- Project On Merchant BankingDocument71 pagesProject On Merchant Bankingmandar_1381% (32)

- Recent Trends in BankingDocument8 pagesRecent Trends in BankingAdalberto MacdonaldPas encore d'évaluation

- Chapter 13 Exporting, Importing, and CountertradeDocument7 pagesChapter 13 Exporting, Importing, and CountertradeThế TùngPas encore d'évaluation

- Bank Guarantees in International TradeDocument4 pagesBank Guarantees in International TradeMohammad Shahjahan SiddiquiPas encore d'évaluation

- India's foreign exchange rate system and letter of credit benefitsDocument4 pagesIndia's foreign exchange rate system and letter of credit benefitsParidhiPas encore d'évaluation

- Summer Internship Project ReportDocument36 pagesSummer Internship Project ReportManan Sharma71% (7)

- Credit Policy GuidelinesDocument46 pagesCredit Policy GuidelinesRabi Shrestha100% (1)

- NCC Bank-A New LookDocument31 pagesNCC Bank-A New LookNazmulBDPas encore d'évaluation

- Guide to Understanding Letters of CreditDocument54 pagesGuide to Understanding Letters of CreditGreeshma SinghPas encore d'évaluation

- Notes On Letter of CreditDocument17 pagesNotes On Letter of CreditDileep MainaliPas encore d'évaluation

- 7 King Mau Wu Vs SycipDocument2 pages7 King Mau Wu Vs SycipHarris CamposanoPas encore d'évaluation

- Arrieta vs. National Rice and Corn Corporation 10 SCRA 79, January 31, 1964 PDFDocument12 pagesArrieta vs. National Rice and Corn Corporation 10 SCRA 79, January 31, 1964 PDFJohnPas encore d'évaluation

- Hanil Vs BNIDocument2 pagesHanil Vs BNIashrizas100% (1)

- Proforma Invoice CopraDocument1 pageProforma Invoice Copravinas kusdinar0% (1)

- 2016 Budget Guidelines PDFDocument136 pages2016 Budget Guidelines PDFNYAMEKYE ADOMAKOPas encore d'évaluation

- Internship Report of Jamuna Bank About Loans & AdvanceDocument60 pagesInternship Report of Jamuna Bank About Loans & AdvanceMd. Shahnaj Kader100% (3)

- International Trade Operational and Financial RIsksDocument51 pagesInternational Trade Operational and Financial RIskslifePas encore d'évaluation

- ICPODocument4 pagesICPOMok HoiPas encore d'évaluation

- DLF KonkarDocument33 pagesDLF KonkarRaka ChatterjeePas encore d'évaluation

- Dutch Bangla Bank ReportDocument72 pagesDutch Bangla Bank ReportMahamudul Farid0% (1)

- Bussnes ManagmentDocument949 pagesBussnes ManagmentMd FaridujjamanPas encore d'évaluation

- Cash Management ReportDocument88 pagesCash Management Reportnikita50% (2)