Académique Documents

Professionnel Documents

Culture Documents

Title Iii: Estate Tax

Transféré par

Jennalyn ToloDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Title Iii: Estate Tax

Transféré par

Jennalyn ToloDroits d'auteur :

Formats disponibles

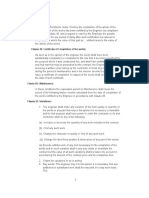

TITLE III

CHAPTER I

ESTATE TAX

SEC. 84. Rates of Estate Tax. - There shall be levied, assessed,

collected and paid upon the transfer of the net estate as determined in

accordance with Sections 85 and 86 of every decedent, whether resident

or nonresident of the Philippines, a tax based on the value of such net

estate, as computed in accordance with the following schedule:

If the net estate is:

chanroblesvirtuallawlibrary

OVER

BUT NOT OVER THE TAX SHALL BE

PLUS

OF THE EXCESS

OVER

P 200,000

Exempt

P 200,000

550,000

5%

P 200,000

500,000

2,000,000

P 15,000

8%

2,000,000

5,000,000

135,000

11%

2,000,000

500,000

5,000,000

10,000,000

465,000

15%

5,000,000

10,000,000

And Over

1,215,000

20%

10,000,000

SEC. 85. Gross Estate. - the value of the gross estate of the decedent

shall be determined by including the value at the time of his death of all

property, real or personal, tangible or intangible, wherever

situated: Provided, however, that in the case of a nonresident decedent

who at the time of his death was not a citizen of the Philippines, only that

part of the entire gross estate which is situated in the Philippines shall be

included

in

his

taxable

estate.

(A) Decedent's Interest. - To the extent of the interest therein of the

decedent

at

the

time

of

his

death;

(B) Transfer in Contemplation of Death. - To the extent of any

interest therein of which the decedent has at any time made a transfer,

by trust or otherwise, in contemplation of or intended to take effect in

possession or enjoyment at or after death, or of which he has at any time

made a transfer, by trust or otherwise, under which he has retained for

his life or for any period which does not in fact end before his death (1)

the possession or enjoyment of, or the right to the income from the

property, or (2) the right, either alone or in conjunction with any person,

to designate the person who shall possess or enjoy the property or the

income therefrom; except in case of a bonafide sale for an adequate and

full

consideration

in

money

or

money's

worth.

(C) Revocable Transfer. (1) To the extent of any interest therein, of which the decedent has at

any time made a transfer (except in case of a bona fide sale for an

adequate and full consideration in money or money's worth) by trust or

otherwise, where the enjoyment thereof was subject at the date of his

death to any change through the exercise of a power (in whatever

capacity exerciseable) by the decedent alone or by the decedent in

conjunction with any other person (without regard to when or from what

source the decedent acquired such power), t o alter, amend, revoke, or

terminate, or where any such power is relinquished in contemplation of

the decedent's death.

(2) For the purpose of this Subsection, the power to alter, amend or

revoke shall be considered to exist on the date of the decedent's death

even though the exercise of the power is subject to a precedent giving of

notice or even though the alteration, amendment or revocation takes

effect only on the expiration of a stated period after the exercise of the

power, whether or not on or before the date of the decedent's death

notice has been given or the power has been exercised. In such cases,

proper adjustment shall be made representing the interests which would

have been excluded from the power if the decedent had lived, and for

such purpose if the notice has not been given or the power has not been

exercised

on

or

before

the

date

of

his

death, such notice shall be considered to have been given, or the power

exercised, on the date of his death.

(D) Property Passing Under General Power of Appointment. - To

the extent of any property passing under a general power of appointment

exercised by the decedent: (1) by will, or (2) by deed executed in

contemplation of, or intended to take effect in possession or enjoyment

at, or after his death, or (3) by deed under which he has retained for his

life or any period not ascertainable without reference to his death or for

any period which does not in fact end before his death (a) the possession

or enjoyment of, or the right to the income from, the property, or (b) the

right, either alone or in conjunction with any person, to designate the

persons who shall possess or enjoy the property or the income

therefrom; except in case of a bona fide sale for an adequate and full

consideration

in

money

or

money's

worth.

(E) Proceeds of Life Insurance. - To the extent of the amount

receivable by the estate of the deceased, his executor, or administrator,

as insurance under policies taken out by the decedent upon his own life,

irrespective of whether or not the insured retained the power of

revocation, or to the extent of the amount receivable by any beneficiary

designated in the policy of insurance, except when it is expressly

stipulated that the designation of the beneficiary is irrevocable.

(F) Prior Interests. - Except as otherwise specifically provided therein,

Subsections (B), (C) and (E) of this Section shall apply to the transfers,

trusts, estates, interests, rights, powers and relinquishment of powers, as

severally enumerated and described therein, whether made, created,

arising, existing, exercised or relinquished before or after the effectivity

of

this

Code.

(G) Transfers of Insufficient Consideration. - If any one of the

transfers, trusts, interests, rights or powers enumerated and described in

Subsections (B), (C) and (D) of this Section is made, created, exercised

or relinquished for a consideration in money or money's worth, but is not

a bona fide sale for an adequate and full consideration in money or

money's worth, there shall be included in the gross estate only the excess

of the fair market value, at the time of death, of the property otherwise

to be included on account of such transaction, over the value of the

consideration received therefor by the decedent.

Vous aimerez peut-être aussi

- Nirc 1997 Transfer Tax Vs Train LawDocument15 pagesNirc 1997 Transfer Tax Vs Train LaweunicemaraPas encore d'évaluation

- TRANSFER TAX, Estate Tax 2Document9 pagesTRANSFER TAX, Estate Tax 2JunivenReyUmadhayPas encore d'évaluation

- Wilmington Trust Irrevocable Trust AgreementDocument14 pagesWilmington Trust Irrevocable Trust Agreementdiversified1100% (2)

- Seizure CasesDocument76 pagesSeizure CasesFinally Home RescuePas encore d'évaluation

- Empower Our Neighborhoods V Guadagno, Docket # L 3148-11Document48 pagesEmpower Our Neighborhoods V Guadagno, Docket # L 3148-11FIXMYLOANPas encore d'évaluation

- Municipality of San Miguel vs. Fernandez - GR No. 61744 - Case DigestDocument1 pageMunicipality of San Miguel vs. Fernandez - GR No. 61744 - Case DigestC S0% (1)

- Norman v. RossDocument86 pagesNorman v. RossTHR100% (1)

- Death of Copyright - Steven T. Lowe (Lowe Law, P.C.)Document10 pagesDeath of Copyright - Steven T. Lowe (Lowe Law, P.C.)lowelawPas encore d'évaluation

- Estate Tax SEC. 84. Rates of Estate Tax. - There Shall Be Levied, AssessedDocument61 pagesEstate Tax SEC. 84. Rates of Estate Tax. - There Shall Be Levied, AssessedEthel DredaPas encore d'évaluation

- Title Iii Estate TaxDocument3 pagesTitle Iii Estate TaxCat SabioPas encore d'évaluation

- Estate Tax CodalDocument7 pagesEstate Tax CodalØbęy HårryPas encore d'évaluation

- SECTION 85, NIRC - Gross EstateDocument3 pagesSECTION 85, NIRC - Gross EstateMarie Danielle Angela Dela CruzPas encore d'évaluation

- Title III Estate and DonorDocument37 pagesTitle III Estate and Donorketty04Pas encore d'évaluation

- NIRC Section 84 To 97Document10 pagesNIRC Section 84 To 97Iris Mikaela P. RamosPas encore d'évaluation

- Estate and Donor's TaxDocument10 pagesEstate and Donor's TaxKarmela ReyesPas encore d'évaluation

- Title Iii Estate and Donor'S Taxes Estate Tax SEC. 84. Rates of Estate TaxDocument15 pagesTitle Iii Estate and Donor'S Taxes Estate Tax SEC. 84. Rates of Estate Taxmiss independentPas encore d'évaluation

- Tax 2 MidtermsDocument30 pagesTax 2 MidtermsJanz SerranoPas encore d'évaluation

- Lesson 6 Gross EstateDocument6 pagesLesson 6 Gross Estateman ibePas encore d'évaluation

- Estate Tax I. Gross Estate A. Sec. 85 - InclusionsDocument14 pagesEstate Tax I. Gross Estate A. Sec. 85 - InclusionsTiff DizonPas encore d'évaluation

- Tax January 20 2021Document36 pagesTax January 20 2021Rae ManarPas encore d'évaluation

- NIRC Estate-TaxDocument5 pagesNIRC Estate-TaxJeanette Baysa GonzalesPas encore d'évaluation

- Title III Estate TaxDocument10 pagesTitle III Estate TaxJonathan UyPas encore d'évaluation

- Title IiiDocument8 pagesTitle IiiErica Mae GuzmanPas encore d'évaluation

- Estate and Donors TaxDocument10 pagesEstate and Donors Taxybbob_11Pas encore d'évaluation

- Estate Tax SEC. 84. Rates of Estate Tax. - There Shall Be Levied, AssessedDocument7 pagesEstate Tax SEC. 84. Rates of Estate Tax. - There Shall Be Levied, AssessedKyla IsidroPas encore d'évaluation

- Title Iii Chapter IDocument11 pagesTitle Iii Chapter IMae CarpilaPas encore d'évaluation

- 03 Estate and Donor's TaxesDocument7 pages03 Estate and Donor's TaxesfelixacctPas encore d'évaluation

- Learning Module - Transfer TaxesDocument24 pagesLearning Module - Transfer TaxesJoshua PeraltaPas encore d'évaluation

- Notes-Business TaxationDocument7 pagesNotes-Business TaxationAthena LouisePas encore d'évaluation

- Taxrev Notes Estate TaxDocument17 pagesTaxrev Notes Estate TaxYette ViPas encore d'évaluation

- Tax 2 Reviewer Estate TaxDocument12 pagesTax 2 Reviewer Estate TaxCookie MasterPas encore d'évaluation

- Estate TaxDocument5 pagesEstate TaxToki BatumbakalPas encore d'évaluation

- Estate Taxes 2Document56 pagesEstate Taxes 2Patrick TanPas encore d'évaluation

- Æ - CCCCC CC CC CCCCCCCCC: CC C CC CDocument4 pagesÆ - CCCCC CC CC CCCCCCCCC: CC C CC CKeisha Zwit De GuzmanPas encore d'évaluation

- Orca Share Media1520856036149Document19 pagesOrca Share Media1520856036149Aybern BawtistaPas encore d'évaluation

- Taxation Ii Atty. Deborah S. Acosta-Cajustin: Over But Not Over The Tax Shall Be Plus of The Excess OverDocument42 pagesTaxation Ii Atty. Deborah S. Acosta-Cajustin: Over But Not Over The Tax Shall Be Plus of The Excess OverRodel Cadorniga Jr.Pas encore d'évaluation

- SEC. 84. Rates of Estate Tax. - There Shall Be Levied, Assessed, Collected and Paid UponDocument10 pagesSEC. 84. Rates of Estate Tax. - There Shall Be Levied, Assessed, Collected and Paid UponJoy Navaja DominguezPas encore d'évaluation

- Taxation Up To VAT Complete With Notes From RR and RMC. Tababa 1Document96 pagesTaxation Up To VAT Complete With Notes From RR and RMC. Tababa 1Val Escobar Magumun100% (1)

- UP 2008 Taxation Law (Taxation 2)Document100 pagesUP 2008 Taxation Law (Taxation 2)CHow Gatchallan100% (1)

- Taxation 2Document112 pagesTaxation 2cmv mendoza100% (7)

- Transfer TaxesDocument20 pagesTransfer Taxesjunnace jopsonPas encore d'évaluation

- Utah Uniform Probate CodeDocument288 pagesUtah Uniform Probate CodeJunnieson BonielPas encore d'évaluation

- Estate and Donors Tax Dela CalzadaDocument12 pagesEstate and Donors Tax Dela CalzadaStephen CabalteraPas encore d'évaluation

- Bustax Assignment 3Document4 pagesBustax Assignment 3Mariel DiazPas encore d'évaluation

- Title Iii Estate and Donor'S Taxes Chapter I - Estate TaxDocument9 pagesTitle Iii Estate and Donor'S Taxes Chapter I - Estate TaxJan P. ParagadosPas encore d'évaluation

- General Provisions and ReciprocityDocument29 pagesGeneral Provisions and ReciprocityIo AyaPas encore d'évaluation

- TSN EstateDocument19 pagesTSN EstateGrace EnriquezPas encore d'évaluation

- Transfer Taxes Estate Tax: Atty. JRS Umadhay's Tax ReviewerDocument9 pagesTransfer Taxes Estate Tax: Atty. JRS Umadhay's Tax ReviewerJunivenReyUmadhayPas encore d'évaluation

- Tax 2 NotesDocument24 pagesTax 2 NotesHezro Inciso CaandoyPas encore d'évaluation

- Tax 2Document103 pagesTax 2emerbmartinPas encore d'évaluation

- Transfer Tax Estate and Donor NotesDocument6 pagesTransfer Tax Estate and Donor NotesFayie De LunaPas encore d'évaluation

- Estate TaxDocument31 pagesEstate TaxMa.annPas encore d'évaluation

- Taxation Law 2 ReviewerDocument34 pagesTaxation Law 2 ReviewerMa. Cielito Carmela Gabrielle G. Mateo100% (1)

- Public Liability InsuranceDocument5 pagesPublic Liability InsurancesampurnaaPas encore d'évaluation

- Tax 2 Module 2Document7 pagesTax 2 Module 2jakePas encore d'évaluation

- 03 - Government Savings Certificate Act, 1959Document5 pages03 - Government Savings Certificate Act, 1959Pitabash KhamariPas encore d'évaluation

- UPC ProvisionsDocument8 pagesUPC ProvisionsJason HootPas encore d'évaluation

- Estate Tax (Revised)Document16 pagesEstate Tax (Revised)najie talonPas encore d'évaluation

- Estate Tax and Donors Tax With TrainDocument12 pagesEstate Tax and Donors Tax With TrainEspregante RosellePas encore d'évaluation

- 602Document2 pages602Raynamae SalayaPas encore d'évaluation

- Posc ActDocument7 pagesPosc ActPrem ChandPas encore d'évaluation

- Constitution of the State of Minnesota — 1960 VersionD'EverandConstitution of the State of Minnesota — 1960 VersionPas encore d'évaluation

- Belo Henares Vs Atty GuevarraDocument18 pagesBelo Henares Vs Atty GuevarraJLPas encore d'évaluation

- The Transformation of City Master Plans Into Spatial ManagementDocument32 pagesThe Transformation of City Master Plans Into Spatial ManagementInoki Ulma TiaraPas encore d'évaluation

- Exempting Circumstances 1Document50 pagesExempting Circumstances 1Micah AtienzaPas encore d'évaluation

- 2023 Criminal Law Book 2 EditedDocument67 pages2023 Criminal Law Book 2 EditedMaurice Mikkelssen Philippe CamposanoPas encore d'évaluation

- Political Parties in The PhilippinesDocument17 pagesPolitical Parties in The PhilippinesDanielPas encore d'évaluation

- CredTrans 2nd Exam TSN 2016 2017Document23 pagesCredTrans 2nd Exam TSN 2016 2017Jennica Gyrl G. DelfinPas encore d'évaluation

- Mo Yuen Tsi V RepublicDocument4 pagesMo Yuen Tsi V RepublicK Dawn Bernal CaballeroPas encore d'évaluation

- Module CDI 4 ANSWERSDocument7 pagesModule CDI 4 ANSWERSJustine MarqPas encore d'évaluation

- Memorandum of UnderstandingDocument3 pagesMemorandum of UnderstandingJeany RamirezPas encore d'évaluation

- Midlands State University: A Dissertation Submitted in Partial Fulfilment of A Bachelor of Laws Honours DegreeDocument50 pagesMidlands State University: A Dissertation Submitted in Partial Fulfilment of A Bachelor of Laws Honours Degreebrighton mahuniPas encore d'évaluation

- Economic - 041 (11 Files Merged)Document12 pagesEconomic - 041 (11 Files Merged)Mahammad YusifPas encore d'évaluation

- Trump MTDDocument450 pagesTrump MTDLaw&Crime100% (1)

- The Canal and Drainage Act 1873Document24 pagesThe Canal and Drainage Act 1873Saleem ShaikhPas encore d'évaluation

- People vs. FuertesDocument17 pagesPeople vs. FuertesGraziella AndayaPas encore d'évaluation

- Shell Vs JalosDocument3 pagesShell Vs JalosJoahnna Paula CorpuzPas encore d'évaluation

- ACJC Directory 2011Document101 pagesACJC Directory 2011Abid AliPas encore d'évaluation

- Trade SecretsDocument17 pagesTrade SecretsMyaPas encore d'évaluation

- Chandra Nicole Savannah: Please Remember, You Are Restricted From Using This Information ForDocument8 pagesChandra Nicole Savannah: Please Remember, You Are Restricted From Using This Information ForRafael KamachiPas encore d'évaluation

- The NEC Engineering and Construction Contract (ECC)Document12 pagesThe NEC Engineering and Construction Contract (ECC)Jibril TauheedPas encore d'évaluation

- Taxation LawDocument11 pagesTaxation LawCee HonasanPas encore d'évaluation

- DE JESUS vs. PPDocument1 pageDE JESUS vs. PPMyra MyraPas encore d'évaluation

- Verify Copy: Bill of Lading For Ocean Transport or Multimodal TransportDocument2 pagesVerify Copy: Bill of Lading For Ocean Transport or Multimodal TransportJuliet GondolaPas encore d'évaluation

- Wimbledon CaseDocument9 pagesWimbledon CaseAsHervea AbantePas encore d'évaluation

- (1976) - Q B - 23Document21 pages(1976) - Q B - 23Cyrus ChanPas encore d'évaluation

- Affidavit of Service TemplateDocument1 pageAffidavit of Service TemplateJejomarie TatoyPas encore d'évaluation