Académique Documents

Professionnel Documents

Culture Documents

DIY For Cars - Advance Auto Parts Inc.

Transféré par

sommer_ronald5741Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

DIY For Cars - Advance Auto Parts Inc.

Transféré par

sommer_ronald5741Droits d'auteur :

Formats disponibles

Measured Approach

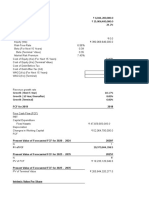

ADVANCE AUTO PARTS INC. (NEW YORK: AAP) Data as of: 03/12/2010

Industry: Retail (Specialty Non-Apparel)

Current Data

Current Price $42.18 PEG 1.3X

Market Cap ($M) $3,891.6 EPS TTM ($) $2.83

Shares Outstanding (M) 9.38 P/E TTM 14.9X

Institutional Holdings % 95.0% EPS Est. 2010 ($) $3.26

Insider Holdings % 0.2% P/E Est. EPS 13.0X

Beta 0.66 Target Value ($) $54.7

0

Latest Quarter Reported 01/02/201 Dividend Yield % 0.6%

0

My wife drives a nine-year old car and mine is six years old. Both are in

good shape, requiring only periodic maintenance and minor repairs.

Like many other Americans, I am holding to my cars. To meet my

needs, I go to Advance Auto Parts, Inc., (AAP) stores for parts.

The Company is a specialty retailer of automotive aftermarket parts,

accessories, batteries and maintenance items primarily operating

within the United States. Their stores carry an extensive line of product

for cars, vans, sport utility vehicles and light trucks. AAP serves both

Do-It-Yourself and commercial customers. At the close of the reporting

quarter, then Company operated 3,420 stores throughout 39 states,

Puerto Rico and the Virgin Islands. The Company also sells product

over the internet.

The poor economy is the Company’s biggest and most intractable risk.

It hits them at both ends of their operations in that Advance Auto Parts

suppliers are at risk and customers are affected by inflation,

unemployment, credit issues, etc.

By The Numbers

Total sales for FY09 increased 5.3% over FY08 to $5.412 billion from

$4.844 billion. Sales growth was primarily due to a comparable store

sales increase of 5.3% and sales from the net addition of 52 total

stores opened within the reporting year. For the quarter ending 01/09,

sales totaled $1,143.6 million. This provided a Q-O-Q decline of 4.0%

from 4Q08. Historically, sales have been growing at 5.3%, 5.4%, 7.5%

and 7.8% for the past 1-year, 3-year, 5-year and 7-year periods,

respectively. This suggests a fairly stable and predictable history.

In FY09, net income increased by 13.4% over the prior year. Net

income for FY09 totaled $269.0 million and compared to $237.1 million

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

in FY08. Similarly, EPS (Diluted) increased to $2.83 from $2.49

providing a 14.1% Y-O-Y increase. For the quarter ending 01/10, EPS

was $0.36 as compared to $0.26 in the year ago quarter. However,

quarterly EPS was substantially below analyst expectations.

Management has provided some guidance for FY10. They project

earnings in the $3.20 to $3.40 range. Analyst estimates are more

conservative. They range from $3.00 to $3.37 and average $3.26.

Many analysts are revising their estimates down based on the

disappointing results from the last quarter. Measured Approach is

estimating EPS (basic) at $3.06.

The Company’s gross profit margin remains strong and consistent. It

increased by 2.2% in FY09 from 46.7% to 48.9%. Operating margins

remain strong at 8.4%. These margins are an improvement over FY08

margin of 8.1%. Historically, operating margins have ranged from a

high of 9.6% to a low of 8.1%.

AAP has not increased its dividend since it started paying a dividend in

2006. The current dividend rate is $0.24 per share per year. The

current yield is a paltry 0.6%. The payout ratio is about 8.4%.

The Company is a consistent producer of free cash flow. For the most

recent twelve month period, free cash flow totaled $5.09 per share.

The Consistent increase in free cash flow is a reflection of increases in

cash flow rather than reductions in CapEx.

The balance sheet is strong. AAP reported Cash and ST Investments of

$100.0 million at the close of FY09 and Long Term Debt of $202.9

million. Total Liabilities to Total Assets is a manageable 58.3% and less

than the industry median. Long Term Debt to Capital is 13.7% and

Long Term Debt to Equity is 15.8%.

Return on Equity for the year ending 01/10 is 22.8%. The average ROE

for the past seven years is a robust 21.7%.

Price Target

The Wall Street Journal reports that 20 analyst price targets range from

a low of $36 to a high of $55. The mean price target is about $46.

Measured Approach has a price target of $54.70 based on a PE of 17X

on $3.26 EPS and a DCF estimate of $52.

DISCLOSURE: Author is long AAP.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Please visit http://measuredapproach.wordpress.com for important disclosures.

© Copyright 2009 Ronald Sommer. All Rights Reserved.

Vous aimerez peut-être aussi

- Paper & Paper Products Industry SummaryDocument1 pagePaper & Paper Products Industry Summarysommer_ronald5741Pas encore d'évaluation

- Semiconductor Automated Test Equipment SummaryDocument1 pageSemiconductor Automated Test Equipment Summarysommer_ronald5741Pas encore d'évaluation

- Semiconductor Automated Test Equipment SummaryDocument1 pageSemiconductor Automated Test Equipment Summarysommer_ronald5741Pas encore d'évaluation

- 2010 Win Some Lose SomeDocument2 pages2010 Win Some Lose Somesommer_ronald5741Pas encore d'évaluation

- DIY InvestingDocument2 pagesDIY Investingsommer_ronald5741Pas encore d'évaluation

- Global Telecom Opportunities SummaryDocument1 pageGlobal Telecom Opportunities Summarysommer_ronald5741Pas encore d'évaluation

- The Best in Coal SummaryDocument1 pageThe Best in Coal Summarysommer_ronald5741Pas encore d'évaluation

- Starting Lineup For 2011Document3 pagesStarting Lineup For 2011sommer_ronald5741Pas encore d'évaluation

- LubrizolDocument2 pagesLubrizolsommer_ronald5741Pas encore d'évaluation

- Dialing For Dollars in ArgentinaDocument2 pagesDialing For Dollars in Argentinasommer_ronald5741Pas encore d'évaluation

- The Long Term Case For HumanaDocument2 pagesThe Long Term Case For Humanasommer_ronald5741Pas encore d'évaluation

- Inter Digital ProfileDocument2 pagesInter Digital Profilesommer_ronald5741Pas encore d'évaluation

- GT SolarDocument2 pagesGT Solarsommer_ronald5741Pas encore d'évaluation

- A Small Cap Healthcare PickDocument1 pageA Small Cap Healthcare Picksommer_ronald5741Pas encore d'évaluation

- Brinker International: Challenge For Casual DiningDocument2 pagesBrinker International: Challenge For Casual Diningsommer_ronald5741Pas encore d'évaluation

- Tractor SupplyDocument2 pagesTractor Supplysommer_ronald5741Pas encore d'évaluation

- Profit From Western DigitalDocument3 pagesProfit From Western Digitalsommer_ronald57410% (1)

- Fuqi International: Finding Gold in ChinaDocument3 pagesFuqi International: Finding Gold in Chinasommer_ronald5741Pas encore d'évaluation

- Astrazeneca SummaryDocument1 pageAstrazeneca Summarysommer_ronald5741Pas encore d'évaluation

- Core Laboratories: An Oil Patch OpportunityDocument3 pagesCore Laboratories: An Oil Patch Opportunitysommer_ronald5741Pas encore d'évaluation

- Stryker Corporation: Opportunity or Trap?Document6 pagesStryker Corporation: Opportunity or Trap?sommer_ronald5741100% (1)

- ComTech Telecom SummaryDocument3 pagesComTech Telecom Summarysommer_ronald5741Pas encore d'évaluation

- The Game Is Not Over For GameStop Corp.Document4 pagesThe Game Is Not Over For GameStop Corp.sommer_ronald5741Pas encore d'évaluation

- Hawkins IncDocument2 pagesHawkins Incsommer_ronald5741Pas encore d'évaluation

- Navigate With GarminDocument2 pagesNavigate With Garminsommer_ronald5741Pas encore d'évaluation

- Endo Pharmaceuticals - Steady GrowthDocument3 pagesEndo Pharmaceuticals - Steady Growthsommer_ronald5741Pas encore d'évaluation

- Oracle Corporation: The Road To RecoveryDocument7 pagesOracle Corporation: The Road To Recoverysommer_ronald5741Pas encore d'évaluation

- Sorl Auto Parts Inc. - No Stopping HereDocument2 pagesSorl Auto Parts Inc. - No Stopping Heresommer_ronald5741Pas encore d'évaluation

- In Hog Heaven With Hormel FoodsDocument3 pagesIn Hog Heaven With Hormel Foodssommer_ronald5741Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- NissanDocument31 pagesNissanRomilio CarpioPas encore d'évaluation

- Lupin Ltd Equity Research AnalysisDocument14 pagesLupin Ltd Equity Research AnalysisRohan AgrawalPas encore d'évaluation

- CFA Level I Revision Day IIDocument138 pagesCFA Level I Revision Day IIAspanwz SpanwzPas encore d'évaluation

- Credit Suisse (Incl. NPV Build Up)Document23 pagesCredit Suisse (Incl. NPV Build Up)rodskogjPas encore d'évaluation

- PT Pupuk Kaltim valuation reportDocument55 pagesPT Pupuk Kaltim valuation reportLevy APas encore d'évaluation

- Security Valuation: Learning OutcomesDocument38 pagesSecurity Valuation: Learning OutcomesRaja1234Pas encore d'évaluation

- Is Participant - Simplified v3Document7 pagesIs Participant - Simplified v3Ritvik SharmaPas encore d'évaluation

- Ashok LeylandDocument37 pagesAshok LeylandBandaru NarendrababuPas encore d'évaluation

- Numerical Valuation Part 1Document3 pagesNumerical Valuation Part 1NareshPas encore d'évaluation

- Ratios HW 1 Template-5 Version 1Document14 pagesRatios HW 1 Template-5 Version 1api-506813505Pas encore d'évaluation

- Equity ValuationDocument78 pagesEquity ValuationReshma UdayPas encore d'évaluation

- Fatima Fertilizer CompanyDocument8 pagesFatima Fertilizer Companyalee irshadPas encore d'évaluation

- Delta Air Lines Valuation pg14Document52 pagesDelta Air Lines Valuation pg14krisPas encore d'évaluation

- Presentation To Investor / Analyst (Company Update)Document51 pagesPresentation To Investor / Analyst (Company Update)Shyam SunderPas encore d'évaluation

- New Venture Creation Entrepreneurship For The 21st Century 10th Edition Spinelli Solutions Manual DownloadDocument27 pagesNew Venture Creation Entrepreneurship For The 21st Century 10th Edition Spinelli Solutions Manual DownloadRichard Smithson100% (23)

- Dixon's Purchase On Collinsville: The Victory of LaminateDocument9 pagesDixon's Purchase On Collinsville: The Victory of LaminateJing LuoPas encore d'évaluation

- The Ursinus College Student Managed Investment Fund HandbookDocument17 pagesThe Ursinus College Student Managed Investment Fund HandbookYeraldinePas encore d'évaluation

- Cash Flow StaementDocument14 pagesCash Flow StaementKhizar Hayat JiskaniPas encore d'évaluation

- Kompre 78 HalamanDocument78 pagesKompre 78 HalamanCenxi TVPas encore d'évaluation

- Iridium Fact SheetDocument4 pagesIridium Fact Sheetmathis.dumenilPas encore d'évaluation

- DCF ModelDocument7 pagesDCF ModelSai Dinesh BillePas encore d'évaluation

- Cash Flow.Document39 pagesCash Flow.JAPPas encore d'évaluation

- Tax Rate Calculation and WACC for SignifyDocument9 pagesTax Rate Calculation and WACC for SignifyShivam GoelPas encore d'évaluation

- Investment Banking Interview Questions - The Definitive GuideDocument34 pagesInvestment Banking Interview Questions - The Definitive GuideRohan SaxenaPas encore d'évaluation

- Zomato ValuationDocument24 pagesZomato ValuationABHISHEK YADAVPas encore d'évaluation

- Financial Report On Apple Stock - Jan 2020Document13 pagesFinancial Report On Apple Stock - Jan 2020Adam LeclatPas encore d'évaluation

- Persistent With Historic Data UnsolvedDocument58 pagesPersistent With Historic Data UnsolvedShantanu BhagwatPas encore d'évaluation

- M&A Problms - ClassDocument14 pagesM&A Problms - ClassSeemaPas encore d'évaluation

- Bank of America Global Equity ValuationDocument56 pagesBank of America Global Equity Valuationrichard100% (1)