Académique Documents

Professionnel Documents

Culture Documents

C3A April 2008 Exam

Transféré par

Owen TongCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

C3A April 2008 Exam

Transféré par

Owen TongDroits d'auteur :

Formats disponibles

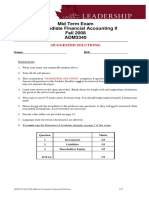

2008 PART III EXAMINATIONS

Subject Title: Course 3A General Insurance

Date: Wednesday 30th April

Time: 9:15 am to 12:30 pm

Time allowed:

Three (3) hours plus fifteen (15) minutes of reading time

Instructions:

Each new question (but not each section of a question)

must be commenced in a new answer book.

Number of Questions:

Six (6)

Question

1

2

3

4

5

6

Total

Marks

19

17

13

17

18

16

100

Candidates are required to answer ALL questions.

This paper has 15 pages (excluding this page and the blank back page).

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

QUESTION 1

(19 marks)

a) Your friend is about to open a florist store. She knows you are studying to be an

actuary so asks what insurance she should obtain before opening her outlet. She

will have a shop, a van to visit the flower markets and also to make deliveries.

She shall rent premises and employs an assistant.

Advise your friend on the types of general insurance she should obtain, what is

covered by each type, and where she can obtain them from.

(5 marks)

b) You are an actuarial analyst at TigerTough Insurance. The marketing manager

has three-month-old twin daughters, as well as an older son. She has noticed the

extra expense associated with two babies compared to one baby and is proposing a

new product. Women would pay a premium, and then if they gave birth to more

than one baby from a single pregnancy, they would be entitled to a lump sum

payment for each additional child.

Draft a report to the marketing manager, including in your response:

(i)

(ii)

(iii)

(iv)

(v)

(vi)

an assessment of the product based on the insurability criteria,

any restrictions which you may impose,

the likely level of benefit and premium,

the sort of investments that should back the product,

the types of reinsurance you may use (if at all),

possible distribution channels.

(8 marks)

c) The CFO at TigerTough is concerned about the capital required to support the

new product. Explain to the CFO:

(i)

(ii)

Why capital is required to support the product?

How the capital will differ if the number of policies written is 100 vs 10,000

in the first year?

(3 marks)

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 1 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

d) TigerTough decides to commence writing the new product and you are assisting

the CFO with preparing the budget for the year to 30 June 2009. Gross written

premium for the year is forecast to be $200,000, which is expected to be written

uniformly over the year. The forecast profit margin is 15% of gross written

premium.

Ignoring reinsurance and expenses, provide estimates of:

(i)

(i)

The expected central estimate of outstanding claims liabilities at 30 June

2009; and

The expected central estimate of premium liabilities at 30 June 2009.

(3 marks)

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 2 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

QUESTION 2

(17 marks)

The following tables show analysis which forms part of the outstanding claims

valuation for Cajun Insurance Company as at 31 December 2007. The tables are

shown for the Industrial Special Risks portfolio. All accident years shown correspond

to calendar years.

Cumulative paid

Accident year

2003

2004

2005

2006

2007

Development year

0

38,500

45,000

40,000

38,000

42,000

1

98,200

96,200

88,000

89,000

2

104,000

102,500

94,000

3

104,000

106,800

106,400

Case estimates

Accident year

2003

2004

2005

2006

2007

Development year

0

46,200

44,600

40,000

51,400

48,100

Paid chain ladder

Development year

Accident year

0

2003

2004

2005

2006

2007

Total

Total excl last

CL ratios

Selected

3,500

2,100

2,800

3

3,500

6,000

98,200

96,200

88,000

89,000

96,587

104,000

102,500

94,000

94,704

102,778

104,000

106,800

95,957

96,676

104,918

106,400

108,402

97,397

98,127

106,492

203,500

161,500

371,400

282,400

300,500

206,500

210,800

104,000

106,400

Incurred chain ladder

Development year

Accident year

0

Total

Total excl last

8,200

7,400

6,800

5,900

38,500

45,000

40,000

38,000

42,000

CL ratios

Selected

2003

2004

2005

2006

2007

5

107,464

109,486

98,371

99,108

107,556

6

108,001

110,033

98,863

99,603

108,094

2.300

2.300

1.064

1.064

1.021

1.021

1.023

1.015

1.01

1.005

84,700

89,600

80,000

89,400

90,100

106,400

103,600

94,800

94,900

104,780

107,500

104,600

96,800

96,177

106,190

104,000

110,300

97,804

97,174

107,291

112,400

110,852

98,293

97,660

107,828

433,800

343,700

399,700

304,800

308,900

212,100

214,300

104,000

112,400

1.163

1.163

1.013

1.013

1.010

1.010

1.081

1.005

112,625

111,073

98,490

97,855

108,043

112,737

111,184

98,588

97,953

108,151

1.002

1.001

a) What data checks should be performed on the payment and case estimate data?

(2 marks)

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 3 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

b) The data amounts shown are in historical dollars. What does this imply for the

valuation results produced by:

(i) the paid chain ladder method?

(ii) the incurred chain ladder method?

(2 marks)

c) Using a discount rate of 7% per annum, calculate the discounted value of the

outstanding claims for the 2005 accident year using the paid chain ladder method.

State any assumptions that you make.

(3 marks)

d) Using the same discount rate of 7% per annum, calculate the discounted value of

outstanding claims for the 2005 accident year using the incurred chain ladder

method. State any assumptions that you make.

(4 marks)

e) The undiscounted estimate of outstanding claims using the paid chain ladder

method for the 2003 accident year is $1,601, which is significantly lower than the

case estimates of $6,000 at 31 December 2007.

What does this imply about the paid chain ladder method for older accident years?

Should the method be adopted for such accident periods?

(3 marks)

f) A manager at Cajun asks the following question

You cant use these methods for the latest accident year. There must be IBNR

claims at the valuation date, but the payments and case estimates only reflect

reported claims at that date

Prepare a response to the manager.

(3 marks)

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 4 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

QUESTION 3

(13 marks)

Bubble Insurance Company is a privately owned multi-line General Insurer. Bubble

has operated in Australia for many years, predominantly distributing its policies via

brokers. Bubble has written annual policies for a range of commercial and personal

products with both short and long tailed lines. The policies are written evenly through

the year.

Bubble has decided to leave the insurance business, and will no longer accept

premiums after 30 June 2007. Rather than transfer its liabilities to another insurer, it

shall continue to administer claims.

You are provided with the following information for Bubble as at 30 June 2007. It

comes from Bubbles financial statements and its APRA returns. For many years,

Bubble has adopted a claims provision in its balance sheet at an 80% Probability of

Adequacy.

Deferred Acquisition Costs

$m

0.167

Unearned Premium Liability

0.822

Central Estimate of Claims Liability

Risk margin to provide 75% PoA (14%)

Risk margin to provide 80% PoA (16%)

3.629

0.508

0.581

Central Estimate of Premium Liability

Risk Margin to provide 75% PoA (21%)

Risk Margin to provide 80% PoA (24%)

0.428

0.090

0.103

Note: Claims liabilities are calculated using a discount rate of 7% per annum

In the period from 1 July 2007 to 30 June 2008, Bubble has no policy cancellations. It

makes the following payments

for Accident years up to 30 June 2007

$1.387m

for Accident periods from 1 July 2007

$0.167m

The central estimate of claims liabilities at 30 June 2008 is $2.611m.

a) What do the Deferred Acquisition Costs represent, and how are they recognised

for accounting purposes?

(1 marks)

b) At 30 June 2008, provide your estimate of Deferred Acquisition Costs with

reasons.

(1 marks)

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 5 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

c) At 31 December 2007, Bubble is producing half-yearly accounts. An analyst

claims that no amount is required for Premium Liabilities, using the following

reasoning, At 30 June 2007, there was on average half a years premium

exposure remaining. Its now half a year later so the Premium Liabilities have

expired.

Explain the flaw in the reasoning of this comment, and provide an estimate of the

Central Estimate of Premium Liability at 31 December 2007 with reasons.

(2 marks)

d) The claims liabilities at 30 June 2007 used a risk margin of 14% (75% PoA) and

16% (80% PoA). In the year since then, payments were close to expected. At 30

June 2008, appropriate risk margins are 14.5% (75% PoA) and 17% (80% PoA).

Given that Bubble is in run-off, why would the percentage risk margins increase

over the year?

(1 marks)

e) Calculate the accounting claims incurred figure for the 07/08 financial year

assuming Bubble maintains reserves at an 80% PoA.

(2 marks)

f) Bubbles CFO wants to increase the probability of adequacy of the claims liability

estimate at 30 June 2008, and seeks advice. He argues that since Bubble is no

longer writing business, it does not have the support of inflows of premium. This

increases the uncertainty, so it is prudent to increase the probability of sufficiency

of the claims provision.

He also claims that increasing the claims provision will have the advantage of

suppressing profit, which in turn shall reduce the tax that Bubble shall pay for

2007/08.

Prepare a report for the CFO addressing his idea. Your report should consider the

effect of his proposal in both 2007/08, and future years.

(6 marks)

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 6 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

QUESTION 4

(17 marks)

Playdar is an insurer of Public Liability in the fictional state of Botanica. In Botanica

the government changed the policy for the settlement of Public Liability claims for all

incidents occurring after 1 July 2004. For incidents which occurred after that date,

claimants now use a different system of lodgement; this had produced significant

delays while plaintiff lawyers become used to the new system.

The following tables have been extracted from Playdars valuation analysis as at 30

June 2007. The tables show the reporting, payment (inflation-adjusted) and

finalisation pattern for Playdar. For the purposes of this question you may assume that

claims are never re-opened once they are finalised.

Accident year Cumulative claims reported

ending 30 June Development year

0

1

2

1999

382

488

516

2000

458

595

635

2001

477

616

661

2002

468

608

649

2003

490

641

689

2004

488

641

685

2005

509

673

726

2006

503

670

719

2007

516

685

735

3

527

653

682

671

708

702

747

740

756

4

533

662

691

681

719

712

758

751

767

5

537

667

698

687

725

719

764

758

774

Accident year

Payments ($'000 - current values @ 30 June 2007)

ending 30 June Development year

0

1

2

3

4

5

1999

1,238

2,411

3,424

3,330

1,139

3,680

2000

1,702

3,158

4,066

5,124

6,860

2,806

2001

1,734

3,659

4,927

7,477

10,237

11,658

2002

1,945

3,758

4,660

4,818

13,042

8,369

2003

2,026

4,370

5,982

8,120

4,230

2004

2,248

4,340

5,805

5,527

2005

843

2,380

4,359

2006

831

4,361

2007

1,740

Accident year

Claims finalised

ending 30 June Development year

0

1

1999

45

59

2000

47

92

2001

53

83

2002

52

88

2003

51

95

2004

55

92

2005

22

49

2006

19

81

2007

37

2

67

70

100

83

100

96

68

3

63

75

115

66

132

80

4

20

97

135

158

53

5

66

43

153

122

6

539

669

702

690

728

722

768

761

777

7

541

672

705

693

731

725

771

764

781

8

542

673

706

694

733

726

772

765

782

6

5,763

8,962

1,543

7

6,744

4,859

8

3,301

6

86

132

19

7

77

52

8

36

9

545

677

710

698

736

730

776

769

786

Playdar uses a Payments Per Claim Finalised (PPCF) model. The tables below show

extracts from the PPCF (ordinary time analysis) as at 30 June 2007

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 7 of 15

Ultimate

545

677

710

698

736

730

776

769

786

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

Accident year

Payments per claim finalised ($'000

ending 30 June Development year

0

1

2

41

51

1999

28

2000

36

34

58

44

49

2001

33

43

56

2002

37

2003

40

46

60

2004

41

47

60

2005

38

49

64

2006

44

54

2007

47

- current values @ 30 June 2007)

3

53

68

65

73

62

69

4

57

71

76

83

80

5

56

65

76

69

6

67

68

81

7

88

93

8

92

Average last 2

Average last 3

Average all

46

44

38

52

50

45

62

61

57

64

66

65

82

80

77

73

72

69

70

69

69

90

90

92

Selected

45

50

60

65

80

75

75

90

100

3

293

369

331

382

330

379

4

279

281

205

234

288

5

217

243

59

118

6

133

113

44

7

58

64

8

23

3

18.0%

17.2%

26.4%

15.1%

29.2%

17.8%

4

6.8%

26.0%

40.2%

40.8%

15.8%

5

23.5%

15.2%

73.4%

51.5%

6

39.4%

54.1%

31.1%

7

57.5%

45.4%

8

61.5%

51.9%

Accident year

Claims outstanding at end of year

ending 30 June Development year

0

1

2

1999

337

384

345

2000

411

456

426

2001

424

480

425

2002

416

468

426

2003

439

495

443

2004

433

494

442

2005

487

602

587

2006

484

570

2007

479

Accident year

Probability of Finalisation

ending 30 June Development year

0

1

2

1999

23.6%

15.1%

16.8%

2000

20.5%

19.2%

14.7%

2001

22.2%

16.8%

19.9%

2002

22.2%

18.1%

17.0%

2003

20.8%

18.5%

19.3%

2004

22.5%

18.1%

18.6%

2005

8.6%

8.6%

10.8%

2006

7.6%

14.3%

2007

14.3%

Average last 2

Average last 3

Average all

Selected

11.0%

10.2%

17.8%

22.5%

135

11.4%

13.5%

15.9%

18.5%

14.3%

15.9%

16.6%

18.5%

23.5%

20.7%

20.7%

21.0%

29.2%

32.7%

26.8%

27.0%

61.7%

43.6%

38.0%

40.0%

49.5%

45.3%

45.3%

45.0%

51.9%

50.0%

61.5%

55.0%

100.0%

Accident year

Claims finalised

ending 30 June Development year

0

1

1999

45

59

2000

47

92

2001

53

83

2002

52

88

2003

51

95

2004

55

92

2005

22

49

2006

19

81

2007

37

104

2

67

70

100

83

100

96

68

110

105

3

63

75

115

66

132

80

125

109

105

4

20

97

135

158

53

104

132

115

111

5

66

43

153

122

116

115

146

128

123

6

86

132

19

54

81

80

101

89

86

7

77

52

23

A

51

50

63

56

54

8

36

36

14

B

29

29

36

32

31

9

24

31

14

C

26

26

32

29

28

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 8 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

Accident year

Payments ($'000 - current values @ 30 June 2007)

ending 30 June Development year

0

1

2

3

4

1999

1,238

2,411

3,424

3,330

1,139

2000

1,702

3,158

4,066

5,124

6,860

2001

1,734

3,659

4,927

7,477

10,237

2002

1,945

3,758

4,660

4,818

13,042

2003

2,026

4,370

5,982

8,120

4,230

2004

2,248

4,340

5,805

5,527

8,297

5

3,680

2,806

11,658

8,369

8,735

8,660

6

5,763

8,962

1,543

4,031

6,055

6,003

7

6,744

4,859

2,045

D

4,577

4,537

8

3,301

3,554

1,366

E

2,917

2,892

a) In the claims finalised table, there are three missing amounts, marked A, B, and C.

Calculate these three values, showing your workings.

(3 marks)

b) In the payments table, there are three missing amounts, marked D, E, and F.

Calculate these three values, showing your workings.

(1.5 marks)

c) For the accident year ended 30 June 2005, calculate an inflated and discounted

outstanding claims cost. You may assume that the appropriate future inflation rate

is 4% per annum, and the appropriate discount rate is 7% per annum.

(2.5 marks)

In the table of finalised claims the slowdown of finalisations is apparent. The

Appointed Actuary of Playdar has decided to supplement the other models by using a

Payments per Claim Finalised model in Operational time. The following tables show

extracts of this analysis.

The first table shows PPCF values by accident year, and by quintile of finalisation.

The second table shows an assumed pattern of finalisations. For the three most recent

accident years, the pattern of finalisation has been adjusted to account for the delay

(and later catch-up) induced by the change to legislation.

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 9 of 15

9

3,288

4,237

1,835

F

3,561

3,530

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

Accident year

Payments per claim finalised ($'000 - current values @ 30 June 2007)

ending 30 June Band of finalisation

0-20% 21-40% 41-60% 61-80% 81-100%

1999

36

52

56

71

2000

35

63

68

74

2001

38

62

70

75

2002

40

64

76

75

2003

43

61

2004

43

63

2005

2006

2007

Average last 2

Average last 3

Average all

43

42

40

62

63

61

73

71

68

75

75

74

Selected

42

63

71

75

120

Accident year

Claims finalised

ending 30 June Development year

0

1

1999

45

59

2000

47

92

2001

53

83

2002

52

88

2003

51

95

2004

55

92

2005

22

49

2006

19

81

2007

37

91

2

67

70

100

83

100

96

68

92

99

3

63

75

115

66

132

80

94

103

137

4

20

97

135

158

53

104

114

147

108

5

66

43

153

122

116

115

138

125

120

6

86

132

19

54

81

80

125

89

83

7

77

52

23

A

51

50

79

56

52

d) In the table for claims finalised, the values G and H have been omitted. Calculate

these values, showing workings.

(2 marks)

e) Using the operational time method, calculate an inflated and discounted claims

cost for the accident year ended 30 June 2005. You should use the same inflation

and discount rates as in c) above.

(6 marks)

f) Which of the two results would you adopt and why?

(2 marks)

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 10 of 15

8

36

36

14

B

29

29

45

32

30

9

24

31

14

C

26

26

43

G

H

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

QUESTION 5

(18 marks)

You are the Appointed Actuary for CAZAJ Insurance Company, which is a multi-line

General Insurer. CAZAJ operates in all states and territories of Australia. As part of

the valuation of Claims and Premium Liabilities under GPS 310 at 31 December

2007, you are deciding on appropriate risk margins.

You are analysing the Household portfolio in an attempt to decide on a stand-alone

risk margin to provide 75% Probability of Adequacy for both Claims and Premium

Liabilities. CAZAJ has no reinsurance on its Household portfolio. Your analyst,

Archie Archerson, has produced the following tables.

Householders

Central estimate of outstanding claims

Central estimate of premium liabilities

$m (Inflated &Discounted,

incl expenses)

62.3

84.6

Method using data for accident years

2002-2007

Bootstrap method

Stochastic Chain Ladder

Mack Method

Accident year

2002

2003

2004

2005

2006

2007

Coefficient of variation

12%

14%

14%

Loss ratio

146%

68%

62%

71%

74%

76%

Average 2002-2007

St dev 2002-2007

83%

31%

Average 2003-2007

St dev 2003-2007

70%

5%

a) You have checked Archies work on the Bootstrap, Stochastic Chain Ladder, and

Mack Method, and concur with his results. Each method has relied on the use of a

chain ladder model. Archie is uncomfortable using the three methods as the

central estimate of outstanding claims did not rely on a chain ladder model (it used

the PPCI and Bornheutter Ferguson models).

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 11 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

Explain to Archie the basic workings of the three methods, including an

explanation if his concern is valid.

(4 marks)

b) Following Archies analysis, you decide that an appropriate coefficient of

variation for outstanding claims for Household is 17%. Archie wants to know why

your choice is greater than the results of any of the individual methods.

Why would you choose a higher coefficient of variation than indicated by the

models?

(2 marks)

c) Having decided that 17% is an appropriate coefficient of variation for outstanding

claims for Household, describe how you would calculate a stand-alone risk margin

to provide a 75% probability of adequacy. You do not have to make actual

calculations.

(2 marks)

d) Archie notes that the adopted risk margin is significantly lower than the standalone risk margin calculated using the Tillinghast method.

Why would your choice be lower than the Tillinghast method? Does this

indicate your choice should be revised upwards?

(2 marks)

e) Archie is now assisting with an appropriate risk margin for CAZAJs Premium

Liabilities. In calculating the central estimate, a loss ratio method was adopted.

He argues that an appropriate stand-alone coefficient of variation is 7%,

representing the calculated CoV using the loss ratio experience from 2003 to

2007. He has excluded 2002 from the calculations as its a long time ago now,

and it was a poor year as we had a couple of natural catastrophes in that year.

What are the shortcomings of basing the coefficient of variation on the loss ratios?

Assess Archies reasoning, and provide with reasons an appropriate coefficient of

variation for the stand-alone risk margin for the premium liabilities.

(4 marks)

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 12 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

f) With your guidance, Archie has calculated stand-alone risk margins for premium

liabilities for all of CAZAJs different lines of insurance. He has also produced a

correlation matrix; an extract is shown below.

Householders

Householders

Domestic Motor

Commercial Motor

CTP

(i)

100%

30%

15%

3%

Domestic

Motor

30%

100%

70%

30%

Commercial

Motor

15%

70%

100%

20%

CTP

3%

30%

20%

100%

Briefly explain how Archie would have produced this matrix.

(1 mark)

(ii)

Give reasons explaining the correlation between

Domestic Motor and Commercial Motor

Householders and Compulsory Third Party

Householders and Domestic Motor

(3 marks)

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 13 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

MAY 2008 EXAMINATIONS

QUESTION 6

(16 marks)

You are the Appointed Actuary to Greyvan Insurance Company. Greyvan is a niche

insurer which provides travel and motor insurance to retirees who travel around

Australia by car with or without caravans. Greyvan has been very successful in

targeting this market it has mainly sold its business through motoring organisations

as well as advertising in publications aimed at such travellers.

Greyvan has always adopted a simple aggregate reinsurance policy. It has changed the

retention each year in line with inflation.

The following table represents output from the outstanding claims calculation at 30

June 2008. All the dollar figures have been adjusted for inflation, so are in equivalent

dollars of 30 June 2008.

Accident year

end 30 June

1999

2000

2001

2002

2003

2004

2005

2006

2007

2008

2009

Total 99-08

Gross

premium

Net

premium

Gross claim

payments

Net claim

payments

$'000

1,624

1,479

1,567

1,564

1,485

1,503

1,458

1,377

1,272

1,164

1,364

$'000

1,267

1,170

1,233

1,196

1,163

1,167

1,139

1,096

1,014

935

1,042

$'000

1,032

961

1,624

900

874

2,045

806

647

564

281

$'000

1,032

961

983

900

874

807

806

647

564

281

14,493

11,379

9,734

7,855

Gross

outstanding

claims

$'000

9

46

302

131

182

304

439

1,413

Net

outstanding

claims

$'000

9

46

90

131

182

304

439

Gross Loss

Ratio

64%

65%

104%

58%

62%

156%

64%

60%

68%

62%

82%

82%

80%

76%

79%

77%

82%

76%

86%

77%

77%

80%

1,201

The bold figures are estimates of the premium amounts which are estimated to attach

to the accident year ended 30 June 2009. They have been calculated with the help of

the marketing department with assistance from the manager responsible for placing

Greyvans reinsurance policies.

It may be observed from the table above that Greyvan has only triggered its

reinsurance policies in two years; these correspond to experience of weather related

catastrophes.

You are required to calculate a central estimate of Greyvans premium liabilities as at

30 June 2009. The methodology shall use an assumed loss ratio multiplied by an

appropriate measure of unexpired risk, together with adjustments. The estimate should

be in accordance with the requirements of GPS310.

The following information shall assist you in your calculations:

Greyvan writes six-month policies only

Due to weather and travel pattern variations, the percentage of policies sold in

each quarter follow this pattern

2008 Institute of Actuaries of Australia 3A Sem1 08

Net Loss

Ratio

Page 14 of 15

INSTITUTE OF ACTUARIES OF AUSTRALIA

GENERAL INSURANCE PART A

Date of commencement

of policy

Jul Sep

Oct Dec

Jan Mar

Apr Jun

MAY 2008 EXAMINATIONS

Proportion of policies

50%

15%

10%

25%

Approximately 7% of policies result in cancellation two weeks after

commencement, and for these policies a refund of 60% is given (provided no

claim is made). No refund is provided for other cancellations. (The figures in

the table above for the 2009 accident year dont allow for cancellations, but

previous accident years do allow for cancellations).

The table above includes all claims handling expenses, but does not include

other expenses of 8% of gross premium. Half of these other expenses relate to

acquisition and are incurred for all policies (including those cancelled).

a) Using the information above, calculate the unearned premium at 30 June 2009,

allowing for cancellations. Show all calculations, and state any assumptions you

make.

(5 marks)

b) What gross and net loss ratio would you adopt for use in the calculation of

Premium Liabilities? Give reasons, showing calculations (if any), and stating any

assumptions that you make.

(3 marks)

c) Calculate a central estimate of Net Premium Liabilities using your answers from

a) and b) above, as well as any other calculations or adjustments you require.

Show all calculations, and state any assumptions you make.

(6 marks)

d) Using the information provided, explain, with reasons, whether you would expect

Greyvans accounts at 30 June 2009 to require an Unexpired Risk Reserve.

(2 marks)

END OF PAPER

2008 Institute of Actuaries of Australia 3A Sem1 08

Page 15 of 15

Vous aimerez peut-être aussi

- Sample Exam Questions (FINC3015, S1, 2012)Document5 pagesSample Exam Questions (FINC3015, S1, 2012)Tecwyn LimPas encore d'évaluation

- Financial Management June 13 Exam Paper ICAEW PDFDocument6 pagesFinancial Management June 13 Exam Paper ICAEW PDFMuhammad Ziaul Haque50% (2)

- CMA 2013 SampleEntranceExam Revised May 15 2013Document77 pagesCMA 2013 SampleEntranceExam Revised May 15 2013Yeoh MaePas encore d'évaluation

- Financial Management September 2013 Exam Paper ICAEWDocument8 pagesFinancial Management September 2013 Exam Paper ICAEWMuhammad Ziaul HaquePas encore d'évaluation

- 125.230 Mid-Term Test & Solutions - (1001)Document13 pages125.230 Mid-Term Test & Solutions - (1001)Tong Pan0% (1)

- CSSA Trial PaperDocument16 pagesCSSA Trial PaperOwen Tong0% (1)

- Workshop 2 Qs As Introduction To A FDocument18 pagesWorkshop 2 Qs As Introduction To A FYeoh Tze ShinPas encore d'évaluation

- Mock 1 - Afternoon - AnswersDocument27 pagesMock 1 - Afternoon - Answerspagis31861Pas encore d'évaluation

- Đề 1Document2 pagesĐề 1Anh TrầnPas encore d'évaluation

- Corporate Finance - PRACTICE EXAM: (1 Point) Future Value of Annuity FVA 377 006Document4 pagesCorporate Finance - PRACTICE EXAM: (1 Point) Future Value of Annuity FVA 377 006Yuge FanPas encore d'évaluation

- MGMT 2023 Examination - Question - Paper S2 - 2012Document10 pagesMGMT 2023 Examination - Question - Paper S2 - 2012Lois AlfredPas encore d'évaluation

- Review For Exam 3: 11:30 AM - 2:30 PMDocument14 pagesReview For Exam 3: 11:30 AM - 2:30 PMCindy MaPas encore d'évaluation

- ACC701 Mid Exam - Question PaperDocument5 pagesACC701 Mid Exam - Question PaperSALESHNI LALPas encore d'évaluation

- Role of International Financial InstitutionsDocument26 pagesRole of International Financial InstitutionsSoumendra RoyPas encore d'évaluation

- IandF ST8 201709 ExamDocument9 pagesIandF ST8 201709 ExamJia SyuenPas encore d'évaluation

- ASC569Document7 pagesASC569Anisah NiesPas encore d'évaluation

- 2012 EE enDocument76 pages2012 EE enDiane MoutranPas encore d'évaluation

- FIN2001 Exam - 2021feb - FormoodleDocument7 pagesFIN2001 Exam - 2021feb - Formoodletanren010727Pas encore d'évaluation

- Quizesfm 2Document2 pagesQuizesfm 2Prince MalabaPas encore d'évaluation

- Exam 2022 SeptemberDocument11 pagesExam 2022 Septembergio040700Pas encore d'évaluation

- C2A April 2012 Questions PDFDocument6 pagesC2A April 2012 Questions PDFJeff GundyPas encore d'évaluation

- Accounting Feb 2021Document11 pagesAccounting Feb 2021TAQQI JAFFARIPas encore d'évaluation

- PL S18 FM WebDocument7 pagesPL S18 FM WebIQBAL MAHMUDPas encore d'évaluation

- BUS 306 Exam 1 - Spring 2011 (B) - Solution by MateevDocument10 pagesBUS 306 Exam 1 - Spring 2011 (B) - Solution by Mateevabhilash5384Pas encore d'évaluation

- Examination: Subject SA3 General Insurance Specialist ApplicationsDocument265 pagesExamination: Subject SA3 General Insurance Specialist Applicationsscamardela79Pas encore d'évaluation

- MainExam 2018 PDFDocument12 pagesMainExam 2018 PDFAnonymous hGNXxMPas encore d'évaluation

- Subject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsDocument8 pagesSubject Title: Course 2A Life Insurance: 2006 Part Iii ExaminationsJeff GundyPas encore d'évaluation

- Accounting Theory and Current Issues PDFDocument5 pagesAccounting Theory and Current Issues PDFTahir MaqsoodPas encore d'évaluation

- FR MJ23 Examiner's Report - FINALDocument24 pagesFR MJ23 Examiner's Report - FINALdeepshikhagupta514Pas encore d'évaluation

- Sample Final Exam, FinalDocument11 pagesSample Final Exam, Finaldennis.matienzo29Pas encore d'évaluation

- Actuarial CT5 General Insurance, Life and Health Contingencies Sample Paper 2011Document11 pagesActuarial CT5 General Insurance, Life and Health Contingencies Sample Paper 2011ActuarialAnswers50% (2)

- P2 Financial Management June 2012Document9 pagesP2 Financial Management June 2012Subramaniam KrishnamoorthiPas encore d'évaluation

- Additional QuestionsDocument3 pagesAdditional QuestionsHotel Bảo LongPas encore d'évaluation

- Tutorial Solution Week 04Document5 pagesTutorial Solution Week 04itmansaigonPas encore d'évaluation

- FRM Test 9Document13 pagesFRM Test 9Kamal BhatiaPas encore d'évaluation

- Group AssignmentDocument4 pagesGroup AssignmentLinh Le Thi ThuyPas encore d'évaluation

- QUIZDocument5 pagesQUIZNastya MedlyarskayaPas encore d'évaluation

- Year CF To Equity Int (1-t) CF To Firm: Variant 1 A-MDocument5 pagesYear CF To Equity Int (1-t) CF To Firm: Variant 1 A-MNastya MedlyarskayaPas encore d'évaluation

- Kuis Pararel Kuispar - Financial Team Management 12345Document4 pagesKuis Pararel Kuispar - Financial Team Management 12345Gistima Putra JavandaPas encore d'évaluation

- ACCT 301B - CH 13 In-Class ExercisesDocument10 pagesACCT 301B - CH 13 In-Class ExercisesJudith Garcia0% (1)

- FFA FA S22-A23 Examiner's ReportDocument11 pagesFFA FA S22-A23 Examiner's ReportM.Huzaifa ShahbazPas encore d'évaluation

- 2002 8I Fall (PAK LPM)Document20 pages2002 8I Fall (PAK LPM)Noura ShamseddinePas encore d'évaluation

- Problems To Be Solved in ClassDocument4 pagesProblems To Be Solved in ClassAlp SanPas encore d'évaluation

- Mid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340Document12 pagesMid Term Exam Intermediate Financial Accounting II Fall 2008 ADM3340yoonPas encore d'évaluation

- Interest Rate Risk ManagementDocument8 pagesInterest Rate Risk ManagementEdga WariobaPas encore d'évaluation

- 04 Comm 308 Final Exam (Winter 2009) SolutionDocument18 pages04 Comm 308 Final Exam (Winter 2009) SolutionAfafe ElPas encore d'évaluation

- Acc 501 Midterm Preparation FileDocument22 pagesAcc 501 Midterm Preparation FilesephienoorPas encore d'évaluation

- BBA07Final09 Marking SchemeDocument4 pagesBBA07Final09 Marking SchemeKamal AkzPas encore d'évaluation

- 2013 ACTL1101 Week 5 Lecture Discussion SolutionsDocument4 pages2013 ACTL1101 Week 5 Lecture Discussion Solutionsleolau2015Pas encore d'évaluation

- The Institute of Actuaries of Australia Life Insurance 1999 Examinations Paper One Answer All 7 Questions QUESTION 1 (10 Marks)Document6 pagesThe Institute of Actuaries of Australia Life Insurance 1999 Examinations Paper One Answer All 7 Questions QUESTION 1 (10 Marks)Jeff GundyPas encore d'évaluation

- Institute of Actuaries of India Examinations: 08 November 2007Document4 pagesInstitute of Actuaries of India Examinations: 08 November 2007YogeshAgrawalPas encore d'évaluation

- Mock Exam - Section ADocument4 pagesMock Exam - Section AHAHAHAPas encore d'évaluation

- Famba6e Quiz Mod07 032014Document4 pagesFamba6e Quiz Mod07 032014aparna jethaniPas encore d'évaluation

- CF Assignment 1Document4 pagesCF Assignment 1Kashif KhurshidPas encore d'évaluation

- CF Assignment 1 PDFDocument4 pagesCF Assignment 1 PDFKashif KhurshidPas encore d'évaluation

- Suppose A Stock Had An Initial Price of 83 Per ShareDocument8 pagesSuppose A Stock Had An Initial Price of 83 Per ShareDoreenPas encore d'évaluation

- Financial MGMNT Sample Final ExamDocument4 pagesFinancial MGMNT Sample Final ExamJonty0% (1)

- Karma Company Sells Televisions at An Average Price of P7Document1 pageKarma Company Sells Televisions at An Average Price of P7Nicole AguinaldoPas encore d'évaluation

- P1 Sept 2013Document20 pagesP1 Sept 2013Anu MauryaPas encore d'évaluation

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionD'EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionPas encore d'évaluation

- Asia’s Fiscal Challenge: Financing the Social Protection Agenda of the Sustainable Development GoalsD'EverandAsia’s Fiscal Challenge: Financing the Social Protection Agenda of the Sustainable Development GoalsPas encore d'évaluation

- Financial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesD'EverandFinancial Soundness Indicators for Financial Sector Stability: A Tale of Three Asian CountriesPas encore d'évaluation

- Super Fund Questions To AskDocument1 pageSuper Fund Questions To AskOwen TongPas encore d'évaluation

- ONUW RulesDocument8 pagesONUW Ruleske7enPas encore d'évaluation

- Captivate - Test PDFDocument6 pagesCaptivate - Test PDFOwen TongPas encore d'évaluation

- Captivate - Test PDFDocument6 pagesCaptivate - Test PDFOwen TongPas encore d'évaluation

- ProTracker Tennis PDFDocument2 pagesProTracker Tennis PDFOwen TongPas encore d'évaluation

- Sgs 2u 2013 PDFDocument15 pagesSgs 2u 2013 PDFOwen TongPas encore d'évaluation

- Quick NotesDocument18 pagesQuick NotesOwen TongPas encore d'évaluation

- Year 9 Drill #1Document10 pagesYear 9 Drill #1Owen TongPas encore d'évaluation

- Success PosterDocument1 pageSuccess PosterOwen TongPas encore d'évaluation

- Ux51vz User ManualDocument104 pagesUx51vz User ManualOwen TongPas encore d'évaluation

- Year 9 Drill #1Document10 pagesYear 9 Drill #1Owen TongPas encore d'évaluation

- SJ Ring Size GuideDocument3 pagesSJ Ring Size GuideOwen TongPas encore d'évaluation

- RestaurantsDocument1 pageRestaurantsOwen TongPas encore d'évaluation

- HSC General Mathematics Seminar WorkbookDocument21 pagesHSC General Mathematics Seminar WorkbookOwen TongPas encore d'évaluation

- 2004 HSC Notes From The Marking Centre Mathematics Extension 1Document27 pages2004 HSC Notes From The Marking Centre Mathematics Extension 1Owen TongPas encore d'évaluation

- Banking Awareness Questions With AnswersDocument3 pagesBanking Awareness Questions With AnswersarunkumarraviPas encore d'évaluation

- Presentation of Financial Statements PDFDocument16 pagesPresentation of Financial Statements PDFalabwala100% (1)

- ProjectDocument111 pagesProjectGanesh KumarPas encore d'évaluation

- AnnualGlobalTransactionStatement 2020 2021 - SUMMARYDocument4 pagesAnnualGlobalTransactionStatement 2020 2021 - SUMMARYVijaykumar D SPas encore d'évaluation

- Notes in Acstr14Document3 pagesNotes in Acstr14Gray JavierPas encore d'évaluation

- Business Finance 1ST Chunk 1Document52 pagesBusiness Finance 1ST Chunk 1Mary Ann EstudilloPas encore d'évaluation

- HSRO 2 Performance 050822Document15 pagesHSRO 2 Performance 050822noattaPas encore d'évaluation

- Swap Seminar 1695006544Document30 pagesSwap Seminar 1695006544Jaehyun KimPas encore d'évaluation

- Debit: Cash / Bank Account Credit: Share Capital AccountDocument2 pagesDebit: Cash / Bank Account Credit: Share Capital AccountAkram HussainPas encore d'évaluation

- Session 3 - ACLO - Lecture PDFDocument9 pagesSession 3 - ACLO - Lecture PDFQamber AliPas encore d'évaluation

- In-Depth Analysis of The Insolvency and Bankruptcy Code, 2016 and The Frdi Bill, 2017Document276 pagesIn-Depth Analysis of The Insolvency and Bankruptcy Code, 2016 and The Frdi Bill, 2017Venkat Deepak SarmaPas encore d'évaluation

- The Financial Sector and The Role of Banks in Economic DevelopmentDocument6 pagesThe Financial Sector and The Role of Banks in Economic Developmentpravas ranjan beheraPas encore d'évaluation

- Credit Union in The PhilippinesDocument4 pagesCredit Union in The PhilippinesJoyce-An Nicole MercadoPas encore d'évaluation

- BBA - VI Sem. Fundamentals of Banking ImportanceDocument2 pagesBBA - VI Sem. Fundamentals of Banking ImportanceAnswering WAITPas encore d'évaluation

- Partnership Resolution Account Opening As of 02.2021Document4 pagesPartnership Resolution Account Opening As of 02.2021Cristopher NacinoPas encore d'évaluation

- Account Statement From 1 Aug 2023 To 4 Dec 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument15 pagesAccount Statement From 1 Aug 2023 To 4 Dec 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancePraveen SainiPas encore d'évaluation

- Tugas Resume Chapter 2 Dan Chapter 3Document3 pagesTugas Resume Chapter 2 Dan Chapter 3sri wahyuniPas encore d'évaluation

- 201FIN Tutorial 3 Financial Statements Analysis and RatiosDocument3 pages201FIN Tutorial 3 Financial Statements Analysis and RatiosAbdulaziz HPas encore d'évaluation

- Off Balance Sheet RiskDocument23 pagesOff Balance Sheet RiskCamille de JesusPas encore d'évaluation

- Unit I - INTRODUCTION TO ACCTGDocument7 pagesUnit I - INTRODUCTION TO ACCTGJudy Mar Valdez, CPAPas encore d'évaluation

- Management of Non Performing Assets - A Current Scenario: Chandan Chatterjee Jeet Mukherjee DR - Ratan DasDocument11 pagesManagement of Non Performing Assets - A Current Scenario: Chandan Chatterjee Jeet Mukherjee DR - Ratan DasprabindraPas encore d'évaluation

- Oct 182018 BRPD 13 eDocument1 pageOct 182018 BRPD 13 eMehedi IqbalPas encore d'évaluation

- Soal Praktek Myob Perusahaan JasaDocument4 pagesSoal Praktek Myob Perusahaan Jasahani ramadiyantiPas encore d'évaluation

- 119 Jasmine Tirkey PDFDocument30 pages119 Jasmine Tirkey PDFDinki ChouhanPas encore d'évaluation

- A. Chart of Accounts Artful Dodger Supply Chain DateDocument26 pagesA. Chart of Accounts Artful Dodger Supply Chain DateYungkee ChowPas encore d'évaluation

- 2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Document8 pages2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Nadilla NurPas encore d'évaluation

- Financial Tools Week 5 Block BDocument9 pagesFinancial Tools Week 5 Block BBelen González BouzaPas encore d'évaluation

- Profitability NPL Analysis of United Commercial BankDocument12 pagesProfitability NPL Analysis of United Commercial BankImtiaz Mahmud EmuPas encore d'évaluation