Académique Documents

Professionnel Documents

Culture Documents

In The Company Law Board Eastern Region Bench at Kolkata

Transféré par

MitheleshDevarajTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

In The Company Law Board Eastern Region Bench at Kolkata

Transféré par

MitheleshDevarajDroits d'auteur :

Formats disponibles

Page 1

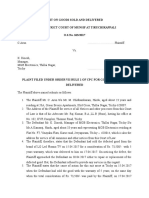

IN THE COMPANY LAW BOARD

EASTERN REGION BENCH AT KOLKATA

Decided On: 12.06.2006

Appellants: Shri Subhas Ghosh

Vs.

Respondent: Happy Valley Tea Co. Pvt. Ltd.

Hon'ble Judges/Coram:

S. Balasubramanian, Chairman

Counsels:

For Appellant/Petitioner/Plaintiff: S.N. Mookherjee, Sr. Adv., R.

Banerjee and T. Aich, Advs.

For Respondents/Defendant: S.K. Majumdar, Adv.

Subject: Company

Acts/Rules/Orders:

Companies Act, 1956 - Sections 111, 111(4) and 113

Cases Referred:

In re: Calcutta Stock Exchange Association Ltd.

MANU/WB/0120/1957 : AIR 1957 Cal. 438

Disposition:

Petition Dismissed

ORDER

S. Balasubramanian, Chairman

Page 2

1. The allegation of the petitioner in this petition, filed under Sections 111 and 113

of the Companies Act, 1956 ("the Act"), is that M/s. Happy Valley Tea Company

Private Limited ("the company"), after allotment of 16,000 equity shares to the

petitioner, did not hand over the share certificate/s in respect of these shares and

has, thereafter, illegally cancelled the allotment and as such, the company should

be directed to restore the allotment and deliver the share certificate in respect of

these shares.

2. A summary of the petition is : The petitioner was appointed as an agent for the

company in September, 2000, authorizing him to sell and/or encourage for sale, of

tea manufactured/to be manufactured by the company on a fee of Rs. 15,000/-per

month. At the behest of the directors of the company, the petitioner also advanced,

at various times, a sum of money aggregating to Rs. 11.00 lakhs to the company

with an interest @ 24% per annum. Since the directors of the company expressed

their desire that the petitioner should become a shareholder, he applied for 16,000

equity shares of Rs. 10/- each at a premium of Rs. 2/- per share.

He remitted Rs. 1,92,000/- as consideration in various installments in the months

of February/March, 2001. The company has acknowledged all these payments by

money receipts indicating clearly that the same was advanced against allotment of

equity shares. By a letter dated 15.3.01, the company informed the petitioner that

in a Board meeting held on 8.3.2001, the Board had decided to enhance the issued

equity shares of the company from 52,000 equity shares to 70,000 equity shares

and that the enhanced equity shares would be issued to the petitioner or his

nominee. It was also indicated in that communication that the company was

convening an Extra-Ordinary General Meeting (EOGM) for getting the

shareholders approval for increasing the issued capital and for the approval of the

draft resolution for allotment of 18,000 equity shares to the petitioner. The

company also filed Form No.2 on 8.3.02 indicating that 16,000 equity shares had

been allotted to the petitioner on 25.2.02. Since the petitioner had not received the

relevant share certificates, he made enquiries from time to time and also wrote to

the company by a letter dated 12.4.03. The petitioner caused an inspection of the

records of the company in the office of the Registrar of Companies, West Bengal

(ROC) and from the Annual Return made upto 30.9.02, filed on 19.2.03, he found

that his name had not been included as a member of the company. Since the

petitioner did not receive any reply to the legal notice issued to the company on

20.9.03 he has filed this petition for a declaration that the petitioner is having a

right, title and interest in respect of 16,000 equity shares of the company and also

for rectification of the register of members to include his name as a shareholder in

Page 3

respect of these charges and also to pass on all benefits to the him like dividend

etc. in respect of these shares including delivery of relevant share certificate/s.

3. In the reply, the company has admitted the fact that the directors of the company

had requested the petitioner to provide funds to tide over the temporary financial

crisis of the company and also the fact that he had lent about Rs. 11.00 lakhs. It

has. also admitted that the company received Rs. 1.92 lakhs for allotment of shares

to the petitioner subject to approval of the shareholders. In the letter dated 15.3.01,

it was specifically mentioned that the allotment of shares to the petitioner would be

subject to the approval of the shareholders in an EOGM. The company also filed

Form No. 2 with the ROC indicating the allotment of shares to the petitioner with

the clear understanding that the allotment would be subject to shareholders

approval and the petitioner was fully aware of the same. In the General Meeting

held on 30.9.02, after due deliberation, the shareholders decided that the petitioner

did not qualify for acquiring any share of the company due to his nefarious

activities and ill motive and declined to allot shares to him. By a letter dated

4.10.02 (Annexure-6), the same was communicated to the petitioner. In view of

this, the company filed a Form 32 canceling the allotment. Accordingly, the

company has sought for dismissal of the petition.

4. Shri Mukherjee, appearing for the petitioner, submitted that every fact averred in

the petition had been admitted by the respondent including receipt of consideration

for the equity shares and allotment of shares in the board meeting held on 8.3.01

and subsequent filing of Form No. 2. In terms of Article 4, shares are at the

disposal of the directors and they have the power to allot shares on such terms and

conditions and by exercising this power, the board had allotted the shares to the

petitioner and the question of obtaining consent of general body thereafter does not

arise. The company has no power to cancel the allotment which would not only

result in reduction of share capital for which procedures as per the Companies Act

has to be followed, it cannot remove the name of the petitioner from the register of

Members without the approval of CLB In re. Calcutta Stock Exchange

Association Ltd. MANU/WB/0120/1957 : AIR 1957 Cal. 438. In view this legal

position, there is no question of filing a Form No.2 canceling allotment already

made. Therefore, the prayers sought for should be granted and the petitioner should

be declared to be the shareholder of 16,000 equity shares and accordingly, the

name of the petitioner should be put in the register of members and the relevant

share certificates should be ordered to be delivered to the petitioner.1

1 http://www.lawyerservices.in/Subhas-Ghosh-Versus-Happy-Valley-Tea-Co-(P)-Ltd-2006-06-12

Page 4

5. Shri Majumdar, appearing for the respondent, submitted that the board did allot

the shares, but it was on the clear understanding that the same would be subject to

the approval by the shareholders. In the letter dated 15.3.01, a copy of the same has

been annexed by the petitioner himself as Annexure-E, the petitioner was

specifically informed that the company would convene an EOGM to increase the

share capital and also allot the shares to the petitioner. However, in the Annual

General Meeting held on 30.9.02, the general body had unanimously decided not to

issue/allot any share to the petitioner. Therefore, Form No.2 filed on 8.3.02

indicating allotment of shares to the petitioner on 25.2.02 was cancelled by filing

another Form 2 on 22.5.03. As soon as the general body decided not to allot any

share to the petitioner, he was also informed of the same by a letter dated 4.10.02,

Since the general body declined to allot shares to the petitioner, the Annual Return

as on 30.9.02, filed on 19.2.03, did not indicate any increase in the share capital

and did not include the name of the petitioner as shareholder of the company.

6. I have considered the pleadings and arguments of the counsel. Since the facts are

all admitted, the only issue for consideration is whether, the Board of the company

was legally entitled to cancel the allotment by way of filing a Form 2 on 8.3.02,

There is nothing on the record to show that after the allotment of the impugned

shares to the petitioner, his name was entered in the Register of Members of the

company. Perhaps it was not. Therefore, the grievance of the petitioner should be

that without sufficient cause his name has been omitted to be entered in the

register, even though shares had been allotted. In terms of Section 111, one can

have a grievance only if the name is omitted to be entered, if he could establish that

it was without sufficient cause. If the omission is with sufficient cause, then, no

cause of action would lie.

7. In the present case, the entire case of the petitioner is rested on the letter dated

15.3.2001 and the Form 2 filed on 8.3.2002. In the letter date 15.3 2001, the

company had specifically stated that the company was calling for an EOGM to get

the approval of the shareholders for allotment of shares to the petitioner, and

therefore, the petitioner was aware that without the approval of the shareholders,

no shares could be allotted to him. Shri Mookerjee contended that since the Board

has full powers to allot shares, there is no need to get the approval of the

shareholders. Article 4 of the Articles of association of the company reads: "The

shares shall be at the disposal of the directors and they may allot or otherwise

dispose of them to such persons at such times and generally on such terms and

conditions as they think proper-----". From this Article, it is evident that the Board

Page 5

has the power to decide to allot shares on such terms and conditions as they think

proper. In the present case, as communicated to the petitioner, the Board had

thought it fit to get the approval of the shareholders for allotment of shares to the

petitioner. Therefore, when the allotment of shares to the petitioner, to his own

knowledge, was subject to the approval of the shareholders, he cannot now claim

that shareholders approval was not necessary. He cannot take advantage of the

allotment made, which has not been approved by the shareholders, whose approval

was a precondition under which the shares were offered to the petitioner. Shri

Mookerjee contended that cancellation of allotment would result in reduction of

share capital, which cannot be done without court's approval. This does not in any

way bestow any right on the petitioner to claim the shares. Need to approach the

CLB for rectification under Section 111(4) would arise only if a member's name is

either omitted from or entered in the register of members without sufficient cause.

In the present case, since the name of the petitioner has been omitted from the

register of members on sufficient cause (even assuming his name was earlier

entered in the register after allotment), i.e., members have not approved allotment

of shares to the petitioner, which was a prerequisite, there is no scope to allow the

petition. However, since no share has been allotted to the petitioner, the amount of

money invested by him for the shares should be refunded to him within a period of

one month of the date of this order. I hereby direct the company to do so within the

said time.2

8. The petition is accordingly dismissed without any order as to costs.

2 http://indiankanoon.org/doc/109623/

Page 6

Share issue is essentially the process by which companies pass on new shares to

shareholders, who may themselves be new or existing shareholders. Companies

can issue shares to both individuals or corporate bodies. Alongside the issue of

shares, you may see the term share allotment used. While there can be subtle

differences between issuing shares and alotting them, for most companies and in

most circumstances they amount to exactly the same process. So well use both

terms to mean the same thing here.

We must, however, distinguish between a share allotment and a share transfer. With

a share allotment, the shares are created and issued by the company to the people

who become the companys shareholders. Shares will generally be issued by the

company at the start of its life and some companies will issue more shares later on.

A share transfer, in contrast, involves existing shares being passed from an existing

shareholder to someone else. That will always take place after the company has

been formed and, although the company may be involved, it is not creating or

allotting those shares. Weve looked at how to transfer shares elsewhere, so well

focus on the allotment of shares here.

The main reason a company will issue new shares is to raise money to finance the

business. Some examples will help to show the different scenarios where an

allotment of shares may be considered. Heres our top 10:

1.

When the company is first incorporated, a number of shares will usually be

issued. This share issue, along with any money that the company may borrow,

enables the company to trade. The initial shareholders are often referred to as

subscribers, because they are said to subscribe to the new companys

Memorandum of Association.

2.

Shares may be issued in order to repay some or all of the companys borrowing.

3.

New funds may simply be required to grow the business organically.

4.

Issuing shares might also fund a particular new development or project, which

will often require significant initial capital with the rewards (hopefully) seen in

later years.

5.

A share issue could be used to fund the purchase of another company. This may

mean raising cash from a share issue and using that cash to buy the other business.

Alternatively, new shares could be issued to the current shareholders of the target

Page 7

company theyd effectively be exchanging their shares in the company being

purchased for shares in the company that is buying it.

6.

To repair a damaged balance sheet. Many companies, large and small, found

themselves needing to allot shares to continue trading in the recent financial crisis.

7.

The company can make a bonus or capitalisation issue of shares to existing

shareholders. Instead of the shareholders needing to pay for the shares themselves,

in this type of share issue the company uses its own profits to fund the allotment

instead. This usually has the effect of reducing the value of the shares in issue,

which may in turn make them more marketable to investors.

8.

If shareholders prefer not to receive a cash dividend, the company may offer

them a scrip dividend instead allotting shares of the same value as the cash

dividend. This is often popular among companies because issuing shares as a

dividend does not impact cashflow in the way a cash dividend does.

9.

If a director or employees exercises a share option that theyve been granted by

the company, they may acquire the shares via an allotment to them.

10.

As part of a new director or senior employee joining the business or an existing

employee becoming a director, they may acquire shares in the company. Often

used by professional companies, this can both demonstrate and cement the

employees commitment to the business theyll have a clear and direct interest in

the companys success. The shares would either be passed to the employee by a

new allotment of shares or via a transfer from existing shareholders.3

3 http://www.informdirect.co.uk/shares/why-issue-shares/

Page 8

Conclusion

The terms "allotting shares" and "issuing shares" are often used interchangeably. In

some cases, particularly when shares are created by a public company, there may

be a difference. Share allotment, strictly, is the allocation of the right to certain

shares to particular applicants for them. Such "allottees" may be sent allotment

letters (which may be renounceable in favour of others), and the actual issue of the

shares occurs later. In most private companies allotment and issue will be the same

process. A company may allot shares when it is first set up or at any time during its

lifetime in order to raise share capital and/or introduce new shareholders.

Vous aimerez peut-être aussi

- Arjun LetterDocument3 pagesArjun LetterMitheleshDevarajPas encore d'évaluation

- Aged 53 Years Son of Mr. Suresh Residing at Bunglow-22, Nehru Nagar, Raipur 492002Document3 pagesAged 53 Years Son of Mr. Suresh Residing at Bunglow-22, Nehru Nagar, Raipur 492002MitheleshDevarajPas encore d'évaluation

- Criminalization of Politics in India - K.M.C. Arunmokan BA0130014Document4 pagesCriminalization of Politics in India - K.M.C. Arunmokan BA0130014MitheleshDevarajPas encore d'évaluation

- Lacunae in Fixation and Revision of Minimum WagesDocument18 pagesLacunae in Fixation and Revision of Minimum WagesMitheleshDevarajPas encore d'évaluation

- 41 CPCDocument12 pages41 CPCMitheleshDevarajPas encore d'évaluation

- ASEAN-An Analysis: Project Submitted ToDocument19 pagesASEAN-An Analysis: Project Submitted ToMitheleshDevarajPas encore d'évaluation

- Vimal Chapter7Document54 pagesVimal Chapter7MitheleshDevarajPas encore d'évaluation

- ADR Problem ArbitrationDocument4 pagesADR Problem ArbitrationMitheleshDevarajPas encore d'évaluation

- Principles of Conflict of LawsDocument509 pagesPrinciples of Conflict of Lawsrackz06100% (12)

- Suit On Goods Sold and Delivered in The District Court of Munsif at Tiruchirappali O.S.No. 263/2017Document2 pagesSuit On Goods Sold and Delivered in The District Court of Munsif at Tiruchirappali O.S.No. 263/2017MitheleshDevarajPas encore d'évaluation

- Project SynopsisDocument3 pagesProject SynopsisMitheleshDevarajPas encore d'évaluation

- Public International LawDocument18 pagesPublic International LawMitheleshDevarajPas encore d'évaluation

- Role and Functions of Depositories in Securities Market: Depository Act, 1996Document2 pagesRole and Functions of Depositories in Securities Market: Depository Act, 1996MitheleshDevarajPas encore d'évaluation

- DV ActDocument105 pagesDV ActMitheleshDevaraj100% (1)

- Central Administrative TribunalsDocument3 pagesCentral Administrative TribunalsMitheleshDevarajPas encore d'évaluation

- What Are The Functions of The BoardDocument1 pageWhat Are The Functions of The BoardMitheleshDevarajPas encore d'évaluation

- Smith Fawcett ReDocument6 pagesSmith Fawcett ReMitheleshDevarajPas encore d'évaluation

- Ani 08 ILDocument14 pagesAni 08 ILMitheleshDevarajPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- From The Details Given Below Prepare Cash Flow StatementDocument5 pagesFrom The Details Given Below Prepare Cash Flow StatementOmkar AdaskarPas encore d'évaluation

- Intermediate Accounting Chapter 4 ProblemsDocument18 pagesIntermediate Accounting Chapter 4 ProblemsPattranitePas encore d'évaluation

- © The Mcgraw-Hill Companies, Inc., 2008 E11.14Document141 pages© The Mcgraw-Hill Companies, Inc., 2008 E11.14Haris Storage1Pas encore d'évaluation

- Luna by Ablatus Ablatus Therapeutics LTD Pitch Uk Investment SummaryDocument8 pagesLuna by Ablatus Ablatus Therapeutics LTD Pitch Uk Investment Summaryhenrismith17Pas encore d'évaluation

- Corporate Finance 9th Edition Ross Test BankDocument53 pagesCorporate Finance 9th Edition Ross Test Bankarnoldmelanieip30l100% (20)

- Chapter 2 - Shares and Share CapitalDocument10 pagesChapter 2 - Shares and Share CapitalDaksh GandhiPas encore d'évaluation

- Examination About Investment 6Document2 pagesExamination About Investment 6BLACKPINKLisaRoseJisooJenniePas encore d'évaluation

- TBChap 010Document19 pagesTBChap 010Tiến Thành TrầnPas encore d'évaluation

- CA5101 Financial Accounting & Reporting Accounting For Stock Corporation Handout No. 01 Problem 1Document5 pagesCA5101 Financial Accounting & Reporting Accounting For Stock Corporation Handout No. 01 Problem 1eyaczPas encore d'évaluation

- Soal Ch. 15Document6 pagesSoal Ch. 15Kyle KuroPas encore d'évaluation

- Indowind Energy LTD vs. ICICI Bank LTDDocument8 pagesIndowind Energy LTD vs. ICICI Bank LTDSandeep SavarkarPas encore d'évaluation

- 165 Fuller v. Krogh (Magsino)Document1 page165 Fuller v. Krogh (Magsino)Frances Angelica Domini KoPas encore d'évaluation

- Financial Statement Analysis and Valuation 4th Edition Easton Test BankDocument44 pagesFinancial Statement Analysis and Valuation 4th Edition Easton Test Bankmrsbrianajonesmdkgzxyiatoq100% (31)

- Tanya 2Document4 pagesTanya 2amir rabiePas encore d'évaluation

- Sol. Man. - Chapter 14 - BVPS - 2021Document11 pagesSol. Man. - Chapter 14 - BVPS - 2021Crystal Rose TenerifePas encore d'évaluation

- Trade DateDocument16 pagesTrade Datecps2502Pas encore d'évaluation

- 162.materials 1.SHE 001Document2 pages162.materials 1.SHE 001jpbluejnPas encore d'évaluation

- Presentation of Acc Limited: Mohammad SulemanDocument18 pagesPresentation of Acc Limited: Mohammad SulemanMohammad SulemanPas encore d'évaluation

- Bam 241: Business Laws and Regulations Second Periodical ExaminationDocument19 pagesBam 241: Business Laws and Regulations Second Periodical ExaminationGiner Mabale StevenPas encore d'évaluation

- FAR-I Mock-2 Spring 2022Document5 pagesFAR-I Mock-2 Spring 2022Bilal ShaikhPas encore d'évaluation

- For Question Numbers 1 To 3Document6 pagesFor Question Numbers 1 To 3Cheveem Grace EmnacePas encore d'évaluation

- Reading 18 Understanding Income StatementsDocument65 pagesReading 18 Understanding Income StatementsAminePas encore d'évaluation

- Practice 4a EPS & Dilutive EPSDocument2 pagesPractice 4a EPS & Dilutive EPSParal Fabio MikhaPas encore d'évaluation

- Company Law (Vol 1) EDITION 8Document235 pagesCompany Law (Vol 1) EDITION 8Harsimran KaurPas encore d'évaluation

- Capital - Table Excel TemplateDocument5 pagesCapital - Table Excel TemplateGolamMostafaPas encore d'évaluation

- Intermediate Accounting Vol 2 Canadian 2nd Edition Lo Solutions ManualDocument49 pagesIntermediate Accounting Vol 2 Canadian 2nd Edition Lo Solutions Manualchristopherbradyxjgdqobpei100% (29)

- Dinshaw Maneckjee CaseDocument33 pagesDinshaw Maneckjee CaseTushar ChoudharyPas encore d'évaluation

- Business As Level Key Terms ListDocument7 pagesBusiness As Level Key Terms Listsbang.alahPas encore d'évaluation

- SF Final ProjectDocument9 pagesSF Final ProjectsanaPas encore d'évaluation

- McGinty v. Zuckerberg, Sandberg - Class Action Complaint PDFDocument28 pagesMcGinty v. Zuckerberg, Sandberg - Class Action Complaint PDFMark JaffePas encore d'évaluation