Académique Documents

Professionnel Documents

Culture Documents

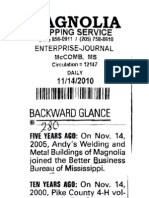

#280 BBB 01-28-10 10

Transféré par

bmoakCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

#280 BBB 01-28-10 10

Transféré par

bmoakDroits d'auteur :

Formats disponibles

MAGNOLIA

CLIPPING SERVICE

(601) 856·0911 I (205) 758·8610

OXFORD EAGLE

OXFORD, MS

Circulation: 5032

DAilY

12/11/2009

1111111I11111111111111 III! 11111111111

~

~tate "

.~ J )

---

State: Charities balance costs

keeps eye Contirfue'd{rom Page lA

'-. .

"We are completing our

Local nonprofits' expenses

on local annual audit

by an inde

pendent firm

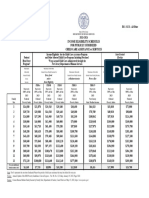

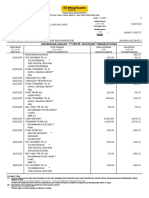

Here's how the Mississippi Secretary of State's Office breaks down the way charities spend

donations between their program purposes and their administrative and fundraising costs.'

which will

Program purpose Administrative

charities consist

us complet

of

356 Ministries, Inc.

9 Lives Cat Rescue

Angel Ranch Inc.

No revenue reported

77.39 percent

69.82 percent

22.61 percent

30.18 percent

ing, not only

Report examines state forms, Exchange Club Center for the Prevention of Child Abuse 90.40 percent 9.60 percent

Andrews Friends of the North Mississippi Regional Center 73.65 percent 26.35 percent

bu t ensuring

gifts, expenses that we are

Fund Democracy Inc. 89.55 percent 10.45 percent

Health Services In-Action Inc. (Oxford Medical Ministries) 23.88 percent 76.12 percent

following federal charitable Interfaith Compassion Ministry 80.73 percent 19.27 percent

By ALYSSA ScHNUGG gUidelines," Andrews said. Lafayette County Literacy Council 34.47 percent 65.53 percent

Slaff Writer "Although our charitable reg Leap Frog Program Inc. 100 percent o percent

istration has lapsed and is in LOU-Home Inc. 100 percent o percent

Each year, charities are the process of being submit Mississippi Women's Law Enforcement Association No revenue reported

required to file a report with

ted, we are still a registered National Center for Open Source Policy and Research Inc. o percent 100 percent

the Mississippi Secretary of 501c3 organization with the Oxford Ballet Association Inc. 85.41 percent 14.59 percent

State's Office that shows IRS." Oxford Charger Athletic Booster Club 70.60 percent 29.40 percent

'how much of their revenue The Council of Better Oxford Lafayette Habitat for Humanity 95.81 percent 4.19 percent

goes toward their stated pur Pantry of Oxford and Lafayette County 90.97 percent 9.03 percent

Business B,ureaus ~ecom

pqse and how much.. g gqes to mends that at le'~st 65 per

Pathways Family Life Center 100 percent o percent

adlnin/ss'lKive,-dJund nij,. Pieceworks Inc. o percent 100 percent

cent of total expenses should Sav-A-Life of Lafayette County Inc. 62.66 percent 37.34 percent

ing costs. be spent on program activities United Way of Oxford and Lafayette County 84.03 percent 15.97 percent

During a lunch meeting of directly related to the organi Yocona International Folk Festival 56.98 percent 43.02 percent

the Oxford Rotary Club on zation's purpose. Fundraising Family Crisis Services of Northwest Mississippi, Inc. 90 percent 10 percent

Tuesday, Service Coordinator costs by the organization

Jeremy A. Martin spoke to the should not exceed 35 percent Not listed on the report but are registered non-proflts with 'the IRS were: Oxford Film Festival (Filed its

club about the 2009 Charity of related contributions. report flfter the deadline) and Yoknapatawpha Arts Council Inc. (Applied for an extension after· hiring a

Report that was released two new -auditor): . .

"However, there are some

weeks ago by $esretary of instances when a departure

State Delbert Hosemann. from these standards would

The report shows how be reasonable," Hosemann 65 .53 spent on non-chari- of contributions on average ance, said Marlene Bishop,

much of donations go toward states in the report. table purposes. The council being lower, we do have to executive director of Medical

a charity's stated purpose reported $49,116 in revenue reach more donors to meet Ministries. The organization

"For example, a newly cre

and how much goes toward with $40,051 in total expens- o~r program expenses," she often receives grants that are

ated organizations may have

expenses for· non-charitable es, which includes $25,293 said. "On a positive note, for specific purposes, such as

higher administrative expens

purposes, such as fundraising for administrative purposes. even though the average its obesity and diabetes clinic

es due to start-up costs and

and administrative costs. "As a small not-for-profit donation is lower, we have which received a $9,000 grant

larger gifts or donor restric

"It's good to have handy with a total budget under more donors and thus more earlier this year.

tions on the use of contrib

when someone calls you and $50,000, our fixed operating people are getting involved in "We have one paid full

uted funds could skew an

asks for a donation," Martin organization's apparent man expenses occupy a larger per- fighting illiteracy in our com- time employee and two part-

said. "You can scroll down agement of funds in either centage of our total budget munity." time employees," she said.

and look and see if you want a favorable or unfavorable than some larger organiza- ... . "Everything else is donated.

to give to that charity." light." tions," said Susan Phillips, MinimiZing expenses We do have some monthly

director of the Literacy Oxford Medical Ministries utility expenses."

Defining the group Looking forward Council. "As our operating started seemg patients m When it comes to giving

Martin said not every non The Lafayette County budget in'creases, the amount 2005. The mformatlOn m the to charities, the Secretary of

profit is a charity. Literacy Council and Oxford we spend on programs will report was ftled for .Its 2006 State's Office recommends

"We have nonprofits that lAedical Ministries fall into account for a much larger fIscal year where It raIsed donors do the follOWing: know

never solicit for funds," he me or more of those catego percentage of the total." $360,731 durmg Its fmt year the charity they are giving to;

said. "If a nonprofit is solicit ·ies. Phillips said fundraising has and spent $54,982 on expens- avoid pressure tactics; watch

ing for money, in any matter, The Literacy Council, been more difficult in the past

be it letter writing, phone calls es. . . for "same names;" be wary of

vhich offers reading pro year although they have had The medIcal chanty offers telephone calls; verify mail

or television ads, they IllIJ't :rams to children and adults, more actual donors than pre- free medIcal servIces and pre- solicitations; and always gel

register with our office." eports 34.4 7 percent is spent vious years. scnptlons to the workmg pub- receipts.

Also exempt from register m charitable purposes with "With

. th~~ d.QU'M _~ount hc wh.a h~ve no he~lt~

_ msU[- I · ' ~ygsa@o~JiagJ';:~OTT

ing are charities raising less I \ ? ,~"~ \;1 f» ~ ~ 1 ~~ - ~- _,. . ' .1 l~ t: -" ~ ~~h1" l' ~-·-:, ./ "If 1\ f\

t.,\ " ,\-'>. ~.'~

_ .

than $25,000 or duly consti

tuted reiigioils institutions.

"Our job is not to make

life harder for that 98 or 99

percent of charities doing the

right thing," Martin said. "It's

to weed out those 1 or 2 per

cent that Q\ay try to spoil the

whole basket of good deeds

done by others."

The report shows all chari

ties that do fund raising in

Mississippi. The report pro

vides a summary of financial

information on file with the

Secretary of State as of March

3 r, 2008, so soine of the infor

mation may have changed,

including those charities list

ed as "expired," like the very

much alive Yoknapatawpha

Arts Council. .

Wayne Andrews, director

of the Arts Council, said YAC

filed for an extension after it

had to change auditors.

See STA,:T-E on Page SA

Vous aimerez peut-être aussi

- Case 28 UVa Hospital System The Long Term Acute Care Hospital ProjectDocument6 pagesCase 28 UVa Hospital System The Long Term Acute Care Hospital Projecthnooy50% (2)

- Alistair R. Mowbray The Development of Positive Obligations Under The European Convention On Human Rights by The European Court of Human Rights Human Rights Law in Persp PDFDocument256 pagesAlistair R. Mowbray The Development of Positive Obligations Under The European Convention On Human Rights by The European Court of Human Rights Human Rights Law in Persp PDFArihant RoyPas encore d'évaluation

- 2021 KY Legislative ScorecardDocument14 pages2021 KY Legislative ScorecardKentucky Scorecard100% (1)

- Hood, (1991) A Public Management For All SeasonsDocument18 pagesHood, (1991) A Public Management For All SeasonsTan Zi Hao0% (1)

- Deconcentrating Poverty - NHUACDocument33 pagesDeconcentrating Poverty - NHUACWestSeattleBlogPas encore d'évaluation

- Mueller ReportDocument448 pagesMueller ReportFox News95% (304)

- Excel Financial Report 2013.v2Document34 pagesExcel Financial Report 2013.v2Douglas MaishPas encore d'évaluation

- Présentation Sem - EnglishDocument20 pagesPrésentation Sem - EnglishEREV2010Pas encore d'évaluation

- Munis StressedDocument2 pagesMunis StressedNick ReismanPas encore d'évaluation

- Our System'S Effectiveness: 86,303 Michiganders, 500 Michigan Works! StaffDocument2 pagesOur System'S Effectiveness: 86,303 Michiganders, 500 Michigan Works! StaffWLUCTV6Pas encore d'évaluation

- Milk 1018Document1 pageMilk 1018Brittany EtheridgePas encore d'évaluation

- HC Animal Shelter Statistics 2021 UnlockedDocument14 pagesHC Animal Shelter Statistics 2021 UnlockedLww LwwPas encore d'évaluation

- Tata Trusts Annual Report 2021 22Document100 pagesTata Trusts Annual Report 2021 22Shubham BeheraPas encore d'évaluation

- This Spreadsheet Supports STUDENT Analysis of The Case "University of Virginia Health System: The Long-Term Acute Care Hospital Project" (UVA-F-1676)Document6 pagesThis Spreadsheet Supports STUDENT Analysis of The Case "University of Virginia Health System: The Long-Term Acute Care Hospital Project" (UVA-F-1676)Adeel RazaPas encore d'évaluation

- CARN SeveranceTaxPolicyRecommendationsDocument2 pagesCARN SeveranceTaxPolicyRecommendationspetersoe0Pas encore d'évaluation

- Community Survey Results PresentationDocument32 pagesCommunity Survey Results PresentationLivewire Printing CompanyPas encore d'évaluation

- Galesburg 2022 Community Survey FindingsDocument57 pagesGalesburg 2022 Community Survey FindingsWGIL RadioPas encore d'évaluation

- 2016 Una Fact Sheet FinalDocument1 page2016 Una Fact Sheet FinalCasie ForbesPas encore d'évaluation

- May 2013 Project Connect Report-FinalDocument17 pagesMay 2013 Project Connect Report-Finalapi-218293468Pas encore d'évaluation

- 2019-05-02 Mid Yr. LunchDocument65 pages2019-05-02 Mid Yr. LunchC.A.R. Research & EconomicsPas encore d'évaluation

- Income Eligibility ScheduleDocument1 pageIncome Eligibility Scheduleannyrodriguez1695Pas encore d'évaluation

- Nine Facts About Family and Work Real 2014Document20 pagesNine Facts About Family and Work Real 2014Raisa S.Pas encore d'évaluation

- Jewish Family Services San AntonioDocument6 pagesJewish Family Services San AntonioKierstenPas encore d'évaluation

- Kalamazoo Public Schools Negotiate 2017-18 Contract With Teachers UnionDocument22 pagesKalamazoo Public Schools Negotiate 2017-18 Contract With Teachers UnionMalachi BarrettPas encore d'évaluation

- 2021 Alice County Profile - United Way of Bay CountyDocument7 pages2021 Alice County Profile - United Way of Bay CountyCaleb HollowayPas encore d'évaluation

- FogartybrochuresdusdDocument2 pagesFogartybrochuresdusdapi-468868635Pas encore d'évaluation

- ABR-MSUE County Portrait ClareDocument16 pagesABR-MSUE County Portrait ClareDavePas encore d'évaluation

- IZC-NGO Conference 2023Document11 pagesIZC-NGO Conference 2023AMP ACE IndiaPas encore d'évaluation

- Status of KEA Negotiations 8 17 17Document22 pagesStatus of KEA Negotiations 8 17 17Kyle SparksPas encore d'évaluation

- Menasha Community Health AssessmentDocument48 pagesMenasha Community Health AssessmentJonathan KrausePas encore d'évaluation

- Community Health ProfileDocument8 pagesCommunity Health ProfilemiePas encore d'évaluation

- DCYF Data Book 2019Document27 pagesDCYF Data Book 2019JasonPas encore d'évaluation

- Ch3-02 Riley BrunsDocument5 pagesCh3-02 Riley BrunsRi BPas encore d'évaluation

- Needs AssessmentDocument16 pagesNeeds Assessmentapi-435216191Pas encore d'évaluation

- 2020 RY HCQR Appendix - MH ScreeningDocument49 pages2020 RY HCQR Appendix - MH ScreeningNick SalzwedelPas encore d'évaluation

- On CSR Expenditure of 7334 Companies For F.Y 2014 15Document14 pagesOn CSR Expenditure of 7334 Companies For F.Y 2014 15suneelmanage09Pas encore d'évaluation

- Linking The National Social Register To The VulnerableDocument15 pagesLinking The National Social Register To The Vulnerablesani shituPas encore d'évaluation

- State Corporate Income Tax Rates and Brackets For 2021: Fiscal FactDocument5 pagesState Corporate Income Tax Rates and Brackets For 2021: Fiscal FactAnuragAgarwalPas encore d'évaluation

- Weechi FundingDocument1 pageWeechi FundingpegspiratePas encore d'évaluation

- Presented By: Patrick M. Bowen, President Bowen National Research April 2021Document18 pagesPresented By: Patrick M. Bowen, President Bowen National Research April 2021Johanna Ferebee StillPas encore d'évaluation

- Performance Measurement Framework PresentationDocument10 pagesPerformance Measurement Framework PresentationPutra Blacknikon TeaPas encore d'évaluation

- Pop EstimatesDocument12 pagesPop EstimatesSpectrum MediaPas encore d'évaluation

- 2012 Pets For Life ReportDocument18 pages2012 Pets For Life ReportaooooePas encore d'évaluation

- Introduction To Nonprofit ManagementDocument43 pagesIntroduction To Nonprofit ManagementMera HejjoPas encore d'évaluation

- Reports - Gender Mainstreaming Monitoring SystemDocument22 pagesReports - Gender Mainstreaming Monitoring SystemKate MoncadaPas encore d'évaluation

- Website Analysis Overview Report: March 2019Document4 pagesWebsite Analysis Overview Report: March 2019Krutika RaoPas encore d'évaluation

- Running Head: An Economic Analysis of Florida Farm Size in 2007 and 2017 1Document7 pagesRunning Head: An Economic Analysis of Florida Farm Size in 2007 and 2017 1Cee Jay CentenoPas encore d'évaluation

- Asset Ownership in IllinoisDocument22 pagesAsset Ownership in IllinoisTerrance HarringtonPas encore d'évaluation

- Economic Impact On Charities of The 2017 Tax ActDocument9 pagesEconomic Impact On Charities of The 2017 Tax ActZacharyEJWilliamsPas encore d'évaluation

- Sponsorship Package May30thsDocument7 pagesSponsorship Package May30thshafsa48Pas encore d'évaluation

- Household Income and Expenditures AnalysisDocument5 pagesHousehold Income and Expenditures AnalysisJan Matthew VargasPas encore d'évaluation

- FPL Chart For All Programs 04.01.2023Document1 pageFPL Chart For All Programs 04.01.2023ERIC HubbardPas encore d'évaluation

- Ceo2023 Crosstabs Final All 1Document14 pagesCeo2023 Crosstabs Final All 1Karlin RickPas encore d'évaluation

- Preferensi Muzakki Dalam Memilih Membayar Zakat Di Lembaga Zakat FormalDocument20 pagesPreferensi Muzakki Dalam Memilih Membayar Zakat Di Lembaga Zakat Formalkamilah rafaPas encore d'évaluation

- STG - Management - Presentation 2Document27 pagesSTG - Management - Presentation 2Mark SamrajPas encore d'évaluation

- Unrsc 11 Appendix I PDFDocument14 pagesUnrsc 11 Appendix I PDFChristen Alice CaliboPas encore d'évaluation

- Talakayan 2017 Powerpoint - Session 1 (For Old Munis)Document45 pagesTalakayan 2017 Powerpoint - Session 1 (For Old Munis)Charles Emmanuel CuriosoPas encore d'évaluation

- Micro Finance Contribution in Poverty AlleviationDocument22 pagesMicro Finance Contribution in Poverty AlleviationFaisal ImtiazPas encore d'évaluation

- Activity Report On Llins Pre and Post Distribution Campaign Busiu Sub-Country Mbale DistrictDocument9 pagesActivity Report On Llins Pre and Post Distribution Campaign Busiu Sub-Country Mbale DistrictserwartePas encore d'évaluation

- SF Acc / SF Spca: 2015 Year in ReviewDocument11 pagesSF Acc / SF Spca: 2015 Year in ReviewAysha AbdulsalamPas encore d'évaluation

- Description: Tags: 04SpringDLWkshopReducingDLDefaultsLSDADocument21 pagesDescription: Tags: 04SpringDLWkshopReducingDLDefaultsLSDAanon-684400Pas encore d'évaluation

- Extract From 2013 Housing Needs AssessmentDocument8 pagesExtract From 2013 Housing Needs Assessment3x4 ArchitecturePas encore d'évaluation

- Regional Well-Being Across Kazakhstan: Harnessing Survey Data for Inclusive DevelopmentD'EverandRegional Well-Being Across Kazakhstan: Harnessing Survey Data for Inclusive DevelopmentPas encore d'évaluation

- #280 BBB 12-30-10 21Document1 page#280 BBB 12-30-10 21bmoakPas encore d'évaluation

- #280 BBB 12-30-10 59Document1 page#280 BBB 12-30-10 59bmoakPas encore d'évaluation

- #280 BBB 04-29-10 188Document1 page#280 BBB 04-29-10 188bmoakPas encore d'évaluation

- #280 BBB 12-30-10 67Document1 page#280 BBB 12-30-10 67bmoakPas encore d'évaluation

- #280 BBB 12-30-10 99Document1 page#280 BBB 12-30-10 99bmoakPas encore d'évaluation

- #280 BBB 12-30-10 100Document1 page#280 BBB 12-30-10 100bmoakPas encore d'évaluation

- #280 BBB 12-30-10 141Document1 page#280 BBB 12-30-10 141bmoakPas encore d'évaluation

- #280 BBB 12-30-10 215Document1 page#280 BBB 12-30-10 215bmoakPas encore d'évaluation

- #280 BBB 12-30-10 218Document1 page#280 BBB 12-30-10 218bmoakPas encore d'évaluation

- Personal Data Sheet CS Form No. 212 Revised 2017Document5 pagesPersonal Data Sheet CS Form No. 212 Revised 2017Jay ArPas encore d'évaluation

- Attachment and Sale of Property Under Civil Procedure CodeDocument17 pagesAttachment and Sale of Property Under Civil Procedure CodeRajesh BazadPas encore d'évaluation

- Syllabus of Fourth Year B.A. LL.B., Fourth Year B.B.A. LL.B. and Second Year LL.BDocument12 pagesSyllabus of Fourth Year B.A. LL.B., Fourth Year B.B.A. LL.B. and Second Year LL.BAzak ShaikhPas encore d'évaluation

- Unclassified Released in FullDocument24 pagesUnclassified Released in FullglennallynPas encore d'évaluation

- DPWH Disaster and Incident Coordination and Management ManualDocument18 pagesDPWH Disaster and Incident Coordination and Management ManualSharr Danelle SalazarPas encore d'évaluation

- Project Report On GST-2018Document32 pagesProject Report On GST-2018Piyush Chauhan50% (6)

- Handbook of Information 2009 - 2Document68 pagesHandbook of Information 2009 - 2Shivu HcPas encore d'évaluation

- Certified List of Candidates For Congressional and Provincial Positions For The May 13, 2013 2013 National, Local and Armm ElectionsDocument2 pagesCertified List of Candidates For Congressional and Provincial Positions For The May 13, 2013 2013 National, Local and Armm ElectionsSunStar Philippine NewsPas encore d'évaluation

- Unit-31 - Advantages Disadvantages Affirmative Action - EgyangoshDocument15 pagesUnit-31 - Advantages Disadvantages Affirmative Action - EgyangoshIndumathi SPas encore d'évaluation

- Midterm Exam GEC 18 EthicsDocument2 pagesMidterm Exam GEC 18 Ethicslxap2023-6821-74342Pas encore d'évaluation

- Grade Math TleDocument256 pagesGrade Math TleSunshine GarsonPas encore d'évaluation

- City Council Agenda Jun 22Document2 pagesCity Council Agenda Jun 22Anonymous 56qRCzJRPas encore d'évaluation

- By: Toni Fontanilla: Challenges To Spanish Authority (1560-1820)Document20 pagesBy: Toni Fontanilla: Challenges To Spanish Authority (1560-1820)Craig JacksonPas encore d'évaluation

- Constitutional Development of India and Historical UnderpinningsDocument29 pagesConstitutional Development of India and Historical UnderpinningsD-sumanPas encore d'évaluation

- Pasco vs. GuzmanDocument2 pagesPasco vs. GuzmanMarianne AndresPas encore d'évaluation

- Ibs Sri Petaling 1 31/03/20Document10 pagesIbs Sri Petaling 1 31/03/20muhammad zulharifPas encore d'évaluation

- British Rule in IndiaDocument11 pagesBritish Rule in IndiablabberPas encore d'évaluation

- UCOLDocument2 pagesUCOLSaif ShahriarPas encore d'évaluation

- CH 31 L1 - Guided ReadingDocument2 pagesCH 31 L1 - Guided ReadingEdward FosterPas encore d'évaluation

- Var Case StudyDocument12 pagesVar Case Studyvarun v sPas encore d'évaluation

- Federal Government Appoints Principal Officers Governing Councils For New Polytechnics Colleges of EducationDocument9 pagesFederal Government Appoints Principal Officers Governing Councils For New Polytechnics Colleges of EducationIsrael AdegboyegaPas encore d'évaluation

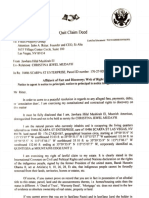

- Quit Claim Deed - FOCUS PROPERTY GROUP Et Alia 30jan2020Document4 pagesQuit Claim Deed - FOCUS PROPERTY GROUP Et Alia 30jan2020empress_jawhara_hilal_el100% (1)

- J.S.mill - of NationalityDocument4 pagesJ.S.mill - of NationalityIleanaBrâncoveanuPas encore d'évaluation

- WARNING EXPLICIT CONTENT: Henderson Officer's Battery CitationDocument6 pagesWARNING EXPLICIT CONTENT: Henderson Officer's Battery CitationLas Vegas Review-JournalPas encore d'évaluation

- Reiigen Bridgehead Offensive Hasty Assault River CR Leavenw - Orth Ks Comba M Oyloe Et Al 23 May 84Document86 pagesReiigen Bridgehead Offensive Hasty Assault River CR Leavenw - Orth Ks Comba M Oyloe Et Al 23 May 84Luke WangPas encore d'évaluation

- Mikwendaagoziwag - Memorial at Sandy Lake. Mikwendaagoziwag in Ojibwe Means: We Remember Them.Document2 pagesMikwendaagoziwag - Memorial at Sandy Lake. Mikwendaagoziwag in Ojibwe Means: We Remember Them.Sarah LittleRedfeather KalmansonPas encore d'évaluation