Académique Documents

Professionnel Documents

Culture Documents

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Transféré par

Shyam SunderDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

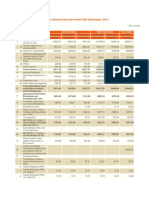

MUKTA ARTS LIMITED

Regd. Office: Mukta House, Behind Whistling Woods Institute, Film City Complex, Goregaon (E), Mumbai-400 065

Part 1 - Statement of un-audited financial results for the quarter and six months ended 30 September 2014

S.No

Particulars

4

5

6

7

8

9

10

11

12

Profit/ (loss) from continuing operation before tax

Tax expenses (including MAT credit entitlement and deferred tax)

Profit/ (loss) from continuing operation after tax

13

14

15

Profit/ (loss) from discontinuing operation before tax (refer Note 4)

Tax expenses (including MAT credit entitlement and deferred tax)

Profit/ (loss) from discontinuing operation after tax

16

17

Net profit/ (loss) from ordinary activities after tax

Extraordinary items (net of tax expenses)

18

19

20

Net profit/ (loss) for the period

Paid-up equity share capital (face value of Rs. 5/- each)

Reserves excluding revaluation reserves

21

Basic and diluted earning per share (EPS) (not annualised) from continuing operation

22

Basic and diluted earning per share (EPS) (not annualised) from discontinuing operation

A

1

Part II

Particulars of shareholdings

Public shareholding

a) Number of shares

b) Percentage of shareholding

Promoter and promoter group shareholding

a) Pledge / encumbered

i) Number of shares

ii) % of shares (as a % of the total shareholding of

promoter and promoter group)

iii) % of shares (as a % of the total share capital of

the Company)

b) Non encumbered

i) Number of shares

ii) % of shares (as a % of the total shareholding of

promoter and promoter group)

iii) % of shares (as a % of the total share capital of

the Company)

Investor complaints

Particulars

Pending at the beginning of the quarter

Received during the quarter

Disposed off during the quarter

Remaining unresolved at the end of the quarter

1

2

3 months ended 30

September 2014

3 months ended

30 June 2014

(Unaudited)

(Unaudited)

Corresponding 3

months ended

30 September

2013

(Unaudited)

(Rs in lacs, except per share data)

6 months ended Corresponding 6

Year ended 31

30 September months ended 30

March 2014

S.No

2014

September 2013

(Unaudited)

(Unaudited)

Particulars

(Audited)

3 months ended

30 September

2014

3 months ended

30 June 2014

(Unaudited)

(Unaudited)

Corresponding 3 6 months ended 30 Corresponding 6

September 2014 months ended 30

months ended

30 September 2013

September 2013

(Unaudited)

2,189.47

205.48

2,394.95

2,308.82

189.73

2,498.55

8,332.04

183.70

8,515.74

4,498.29

395.21

4,893.50

15,305.25

355.07

15,660.32

28,150.55

883.69

29,034.24

(14.28)

71.47

574.08

1.74

153.68

925.78

143.16

518.54

2,374.17

0.06

56.24

2,304.31

41.80

126.53

1,950.10

133.04

361.89

4,973.97

9.10

22.41

7,821.31

30.57

149.87

36.89

91.99

298.47

8,460.61

(14.22)

127.70

2,878.39

43.54

280.21

2,875.88

276.20

880.43

7,348.13

3.80

50.62

14,315.43

48.98

298.29

42.16

182.55

552.82

15,494.65

(0.47)

129.13

26,106.74

171.24

628.42

146.20

420.60

1,575.03

29,176.89

165.67

216.35

382.02

271.92

110.10

110.10

(142.65)

574.83

432.18

618.76

(186.58)

(186.58)

20.78

186.56

207.34

210.66

(3.32)

(3.32)

(2,475.41)

137.85

(2,337.56)

197.84

(2,535.39)

(2,535.39)

55.13

104.07

159.21

139.45

19.76

19.76

(2,454.63)

324.41

(2,130.22)

408.49

(2,538.71)

(2,538.71)

(3.32)

(3.32)

(2,528.64)

(93.99)

(2,434.63)

(37.76)

(9.37)

(28.39)

(2,531.94)

(93.99)

(2,437.95)

(6.77)

20.67

(27.44)

57.51

12.80

44.71

(6.77)

20.67

(27.44)

(5.72)

(4.72)

(1.00)

115.82

24.24

91.58

(406.20)

(123.73)

(282.47)

219.62

89.25

130.37

(3.32)

-

(2,462.07)

-

16.32

-

(2,465.39)

-

90.58

-

(152.10)

-

(3.32)

1,129.06

-

(2,462.07)

1,129.06

-

16.32

1,129.06

-

(2,465.39)

1,129.06

90.58

1,129.06

-

(152.10)

1,129.06

10,789.83

(0.01)

(10.78)

(0.13)

(10.80)

(0.00)

(1.25)

(0.12)

0.20

(0.12)

0.41

0.58

6,691,910

29.63%

6,691,910

29.63%

6,691,910

29.63%

6,691,910

29.63%

6,691,910

29.63%

15,889,290

15,889,290

15,889,290

15,889,290

SEGMENT REVENUE

Software division

Equipment division

Theatrical exhibition division

Others

Total

Less: Inter segment revenue

Net sales/ Income from operation

SEGMENT RESULTS

Profit/(Loss) before tax and finance costs

from each Segment

Software division

Equipment division

Theatrical exhibition division

Others

Total

Less: Finance costs

Other un-allocable expenditure

Net of unallocable income

Total profit/(loss) before tax

1,388.85

9.50

811.41

185.20

2,394.95

2,394.95

1,675.74

5.03

631.78

185.99

2,498.54

2,498.54

32.65

(11.58)

7.20

168.08

196.35

210.66

(2,502.97)

(9.59)

(13.71)

157.42

(2,368.84)

197.84

7,966.75

26.31

352.02

179.00

8,524.08

8.34

8,515.74

34.68

(3.01)

(24.47)

153.75

160.96

139.45

100%

100%

100%

100%

100%

70.37%

70.37%

70.37%

70.37%

70.37%

70.37%

(Segment assets - Segment liabilities)

Software division

Equipment division

Theatrical exhibition division

(42.27)

(2,538.71)

103.97

(8.75)

(16.36)

294.37

373.22

(237.86)

(27.67)

14.95

646.98

396.40

271.92

618.76

(8.79)

110.10

(35.77)

(186.58)

(213.96)

595.39

1,858.77

967.26

658.94

2,005.08

128.12

596.24

136.65

967.26

658.94

2,005.08

2,577.74

612.47

2,336.14

Others

Unallocable

1,425.41

5,791.33

1,396.38

7,134.01

1,309.46

7,239.20

1,396.38

7,134.01

1,363.61

5,029.04

1,309.46

7,239.20

3 Months ended 30 September 2014

2

2

-

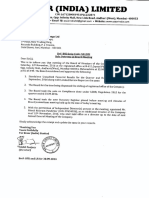

During the year ended 31 March 2013, the Board of Directors approved the formation with another venturer, of a company as a subsidiary of Mukta Arts Limited - the said company was incorporated in June 2013, to conduct the business of exhibition and programming currently being carried out by Mukta Arts Limited. The

business was discontinued during the period and transferred to the subsidiary company and the results of the said business till that date have been disclosed as Discontinuing operations in the results

Other income for the year ended 31 March 2014 includes proceeds from maturity of Keyman policy taken from LIC in an earlier year amounting to Rs 11,900,000.

During the quarter ended 30 September 2014 the Company has commenced its cinemas at Sangli and Hyderabad.

Income from operations includes Rs 35,000,000 relating to sale of certain rights. The Company has recognized revenue based on milestone payments received. As certain conditions precedent are to be fulfilled, the auditors have modified their report in this regard. Management is confident that the said conditions will be

fulfilled in due course

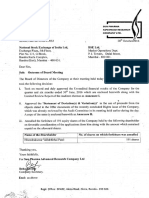

For Mukta Arts Limited

For and on behalf of the Board of directors

PDF processed with CutePDF evaluation edition www.CutePDF.com

408.49

26,587.60

93.91

1,765.22

758.19

29,204.92

150.63

29,054.29

128.12

596.24

136.65

NOTES:

The above financial results have been reviewed by the audit committee and approved by the Board of Directors at the meeting held on 13 November 2014.

In terms of order dated 9.02.2012 passed by the High Court of Judicature at Bombay (High Court), Maharashtra Film Stage and Cultural Development Corporation (MFSCDC) raised net demand of Rs. 591,966,210 and asked WWIL to vacate the premises. The Company's and WWIs Review Petitions were heard by High

Court and a stay was granted on 30 July 2014. However, the High Court has ordered the Company/WWI to pay arrears of rent for the years 2000-01 to 2013-14 aggregating to Rs 100,038,000 by January 2015 and pay rent of Rs 4,500,000 per annum from the financial year 2014-15. As per the terms of the said order, the

Company has paid Rs 32,538,000 by 30 September 2014 and further Rs 18,000,000 in October 2014. During the quarter, the State Government of Maharashtra and MFSCDC challenged the order of the Bombay High Court in the Supreme Court which was dismissed by the court on 22 September 2014. The auditors continue to

modify their report on the said matter

: 13 November 2014

: Mumbai

(2,470.32)

(21.17)

(6.51)

325.50

(2,172.50)

14,559.04

57.51

720.03

350.37

15,686.95

26.63

15,660.32

3 CAPITAL EMPLOYED

15,889,290

100%

3,064.59

14.53

1,443.19

371.19

4,893.50

4,893.50

1.75

19.76

Date

Place

(Audited)

(31.27)

(2,535.41)

Remuneration paid to the erstwhile managing director (including as film director fees) for earlier financial years from 2005-06 to 2013-2014 aggregating to Rs 125,744,747 is in excess of the limits prescribed under Schedule XIII to the Companies Act, 1956. During the year 2011-12, the Company had received approval for part

of the excess remuneration paid (approval received for remuneration aggregating to Rs 25,200,000 for the financial years 2005-06, 2006-07 and 2007-08) and made applications to the authorities requesting reconsideration/ approval for the balance excess remuneration. Through its communication dated 18 June 2014 and 25

July 2014, the Ministry of Corporate Affairs has ordered the Company to recover the excess remuneration paid during the financial years 2008-09 to 2010-11 and 2011-12 respectively. The Company has requested the authorities to reconsider their order for financial years 2008-09 to 2010-11 and request for reconsideration of

the order for financial year 2011-12 is proposed to be made. Pending final communication from the authorities in this regard, no adjustment has been made in these financial results. The auditors continue to modify their report on the said matter.

(Unaudited)

(11.00)

(3.31)

6,691,910

29.63%

15,889,290

5

6

(Unaudited)

Year ended 31

March 2014

Income from operations

(a) Net sales / Income from operations

(b) Other operating income

Total income from operations (net)

Expenses

a) (Increase)/ decrease in stock in trade

b) Purchase of food and beverage

c) Distributor and producer's share

d) Other direct operation expenses

e) Employee benefits expense

f) Amortisation of intangible assets (including films rights)

g) Depreciation of tangible assets

h) Other expenses

Total expenditure

Profit/ (loss) from operations before other income, finance costs

and exceptional items

Other Income

Profit/ (loss) from ordinary activities before finance costs and exceptional items

Finance costs

Profit/ (loss) after finance costs but before exceptional items

Exceptional item

Profit/(loss) from ordinary activities before tax

Segment - wise Revenue, Results and Capital Employed

Parvez A. Farooqui

Executive Director

Vous aimerez peut-être aussi

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document9 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Results Q1FY11 12Document1 pageResults Q1FY11 12rao_gsv7598Pas encore d'évaluation

- Pak Elektron Limited: Condensed Interim FinancialDocument16 pagesPak Elektron Limited: Condensed Interim FinancialImran ArshadPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Year Ended Quarter Ended: 30th June, 2014 UnauditedDocument2 pagesYear Ended Quarter Ended: 30th June, 2014 UnauditedHitesh Pratap ChhonkerPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- KFA - Published Unaudited Results - Sep 30, 2011Document3 pagesKFA - Published Unaudited Results - Sep 30, 2011Chintan VyasPas encore d'évaluation

- Updates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesUpdates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Annual Report Highlights Strong Revenue Growth and ProfitabilityDocument43 pagesAnnual Report Highlights Strong Revenue Growth and ProfitabilityObydulRanaPas encore d'évaluation

- Announces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Document6 pagesAnnounces Q3 Results (Standalone), Limited Review Report (Standalone) & Results Press Release For The Quarter Ended December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Avt Naturals (Qtly 2012 12 31)Document1 pageAvt Naturals (Qtly 2012 12 31)Karl_23Pas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Khaitan Directors ReportDocument6 pagesKhaitan Directors ReportSharukh KhanPas encore d'évaluation

- Bestway Cement Limited Unconsolidated Balance Sheet and Profit & Loss AccountDocument49 pagesBestway Cement Limited Unconsolidated Balance Sheet and Profit & Loss AccountM Umar FarooqPas encore d'évaluation

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Updates On Financial Results For March 31, 2015 (Result)Document3 pagesUpdates On Financial Results For March 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Dabur Balance SheetDocument30 pagesDabur Balance SheetKrishan TiwariPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Avt Naturals (Qtly 2010 03 31) PDFDocument1 pageAvt Naturals (Qtly 2010 03 31) PDFKarl_23Pas encore d'évaluation

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document22 pagesStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Unaudited Financial Results Q2 2014Document4 pagesUnaudited Financial Results Q2 2014Dhruba DebnathPas encore d'évaluation

- Apl 2013Document45 pagesApl 2013Wasif Pervaiz DarPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Document4 pagesAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document4 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Aditya MishraPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- ITC LimitedDocument7 pagesITC LimitedlovemethewayiamPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Document12 pagesStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2015 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document11 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Industrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisD'EverandIndustrial Enterprises Act 2020 (2076): A brief Overview and Comparative AnalysisPas encore d'évaluation

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosD'EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosPas encore d'évaluation

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- F Business Taxation 671079211Document4 pagesF Business Taxation 671079211anand0% (1)

- Project Report PDFDocument13 pagesProject Report PDFAparnaPas encore d'évaluation

- 0823.HK The Link REIT 2008-2009 Annual ReportDocument201 pages0823.HK The Link REIT 2008-2009 Annual ReportwalamakingPas encore d'évaluation

- Buffet Bid For Media GeneralDocument21 pagesBuffet Bid For Media GeneralDahagam Saumith100% (1)

- Instructions for Principal, Associates, and Checklists for DiscussionsDocument20 pagesInstructions for Principal, Associates, and Checklists for DiscussionsAnoushka GuptaPas encore d'évaluation

- Implications of Past Stock Returns on Market EfficiencyDocument10 pagesImplications of Past Stock Returns on Market EfficiencyRB ChannaPas encore d'évaluation

- Relative ValuationDocument26 pagesRelative ValuationRAKESH SINGHPas encore d'évaluation

- THE TIMES BUSINESS - UK - JUNE 13 TH 2021Document14 pagesTHE TIMES BUSINESS - UK - JUNE 13 TH 2021Pepe LuisPas encore d'évaluation

- Axelum Resources Corp Preliminary ProspectusDocument198 pagesAxelum Resources Corp Preliminary ProspectusEmil Victor Medina MasaPas encore d'évaluation

- 2011 Kenya Budget NewsletterDocument9 pages2011 Kenya Budget NewsletterImran OsmanPas encore d'évaluation

- ProjectReport Unilever WWKBDocument83 pagesProjectReport Unilever WWKBEmiria Ferida ShafianandaPas encore d'évaluation

- National Income Models with Government and Net ExportsDocument13 pagesNational Income Models with Government and Net ExportsKratika PandeyPas encore d'évaluation

- T.L.e - maRCH 2013 (Major) With AnswersDocument13 pagesT.L.e - maRCH 2013 (Major) With AnswersYaj Cruzada50% (2)

- FTIL Annual Report 2009Document180 pagesFTIL Annual Report 2009Alwyn FurtadoPas encore d'évaluation

- Political Risk AnalysisDocument6 pagesPolitical Risk AnalysisNazzir Hussain Hj MydeenPas encore d'évaluation

- Corporate Profile and ServicesDocument43 pagesCorporate Profile and Servicesnavaid79Pas encore d'évaluation

- ConclusionDocument3 pagesConclusionAsadvirkPas encore d'évaluation

- Quant Checklist 172 PDF 2022 by Aashish AroraDocument79 pagesQuant Checklist 172 PDF 2022 by Aashish Arorarajnish sharmaPas encore d'évaluation

- Question (Apr 2012)Document49 pagesQuestion (Apr 2012)Monirul IslamPas encore d'évaluation

- CPEC A Game ChangerDocument2 pagesCPEC A Game ChangerAnonymous MFumqOUvz6100% (1)

- Assignment Financial Economics Sem5 (2021)Document2 pagesAssignment Financial Economics Sem5 (2021)shamsuzPas encore d'évaluation

- 2 Partnership Dissolution 0 Liquidation 2022Document16 pages2 Partnership Dissolution 0 Liquidation 2022Kimberly IgnacioPas encore d'évaluation

- Heckscher-Ohlin Model - WikipediaDocument11 pagesHeckscher-Ohlin Model - Wikipediaheh1992Pas encore d'évaluation

- VENTURE CAPITAL IN INDIA: A HISTORYDocument10 pagesVENTURE CAPITAL IN INDIA: A HISTORYraveena_jethaniPas encore d'évaluation

- Topic 1Document59 pagesTopic 1SarannyaRajendraPas encore d'évaluation

- Identifying Profit or LossDocument15 pagesIdentifying Profit or LossStefanne Valdez Aganon33% (6)

- Indian EconomyDocument16 pagesIndian EconomyShashank TiwariPas encore d'évaluation

- Group 7 - FPT - Financial AnalysisDocument2 pagesGroup 7 - FPT - Financial AnalysisNgọcAnhPas encore d'évaluation

- BirlasoftDocument3 pagesBirlasoftlubna ghazalPas encore d'évaluation