Académique Documents

Professionnel Documents

Culture Documents

Assets Under Management (AUM) of National Pension System (NPS) Cross RS

Transféré par

sreeCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Assets Under Management (AUM) of National Pension System (NPS) Cross RS

Transféré par

sreeDroits d'auteur :

Formats disponibles

21/10/2015

AssetsUnderManagement(AUM)ofNationalPensionSystem(NPS)crossRS.1LacCrore

PressInformationBureau

GovernmentofIndia

MinistryofFinance

08October201518:22IST

AssetsUnderManagement(AUM)ofNationalPensionSystem(NPS)crossRS.1LacCrore

NPShasbeenimplementedforallGovernmentEmployees(exceptarmedforces)joiningCentralGovt.on

or after 01 January 2004. Most of the State/UT Governments have also notified the National Pension System

(NPS)fortheirnewemployees.NPShasbeenmadeavailabletoeveryIndianCitizenfrom01stMay2009ona

voluntarybasis.Further,from1stJune2015,theAtalPensionYojanahasbeenlaunchedwhichhasgiventhe

muchrequiredimpetustothesocialsecurityschemes.Currently,NPSandAPYtogetherhavemorethanOne

CroresubscriberswithtotalAssetsUnderManagement(AUM)ofRs.1,00,275crores.Thesegmentwisestatus

oftheNPSandAPYason03.10.2015isasunder:

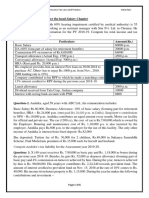

Segment

No.ofSubscribers

Asset

under

Management(Rs.Cr.)

CentralGovernment

15,71,136

42,381

StateGovernments

27,74,459

47,974

NPSPrivateSector

5,24,143

7,943

NPSLite/Swavalamban

44,67,733

1,865

Atal Pension Yojana

7,94,467

112

(APY)

Total

1,01,31,938

1,00,275

PensionFundRegulatoryandDevelopmentAuthority(PFRDA)hastakenvariousstepsatthepolicyas

wellasoperationallevelstomakeNPSmoresubscriberfriendly.Inadditiontothisadditionaltaxbenefitsmade

availableexclusivelytoNPShasgivenafilliptothescheme.Thisisfurtherexpectedtoresultintoasubstantial

increaseinthesubscriberbasebyendMarch2016.

Thefollowingstepshavebeentakenintherecentpastfortheconvenienceofthesubscriber:

The investment guidelines for NPS have been revised to expand the investment avenues for

optimisationofthereturns.

Partialwithdrawalupto25%ofsubscribersowncontributionforspecificpurposeslikehighereducation

ofchildren,marriageofchildren,constructionofhouseandspecifiedillnesshavebeenallowedtothe

NPSsubscribersaftercompletionof10yearsinNPS.

NPSPrivateSectorsubscriberscancontinuecontributingbeyond60yearsupto70yearsofage.

NPSSubscribercandeferthewithdrawaloflumpsumamountuptotheageof70yearsandalsohave

theoptiontodeferpurchaseofannuityupto3yearsfromthedateofsuperannuationor60years.The

fundsduringthisperiodremaininvestedinthesystem.

TheStatementofTransactions(SOT)beingsentbyCRAtotheexistingsubscribershasbeenmodified

toreflectthereturnsoftheindividualsubscribersincethedateofaccountopeningandalsothereturn

generatedduringthelastfinancialyear.

To facilitate and operationalize the deposit of additional contribution of Rs.50,000/ to avail of the

additionaltaxbenefitunderSection80CCD(1B),GovernmentSubscribersalreadycoveredunderNPS

have been provided the facility to deposit voluntary contributions in their Tier I account through any

POPSP.Governmentemployeecoveredunderoldpensionschemecanalsoavailthistaxbenefitby

openingindividualTierIaccountthroughanyPOPSPandcontributingtothesame.

Onlineresetofpasswordandfacilitytochangemobileno.andemailIdhavebeenprovidedtoallthe

NPSsubscribers.

SMS alerts on balances in the NPS account being sent to the subscribers on quarterly basis, in

additiontoregularmonthlyalertsoncontributionandotherchangesinthePRAN.

APYschemeprovidesminimumGovtguaranteedmonthlypensiontosubscribersrangingfromRs1000

toRs5000.Further,Govt.ofIndiaalsococontributes50%ofthetotalcontributionmadebyasubscriberduring

a financial year subject to maximum of Rs 1,000/ per annum for a period of five years, if eligible subscribers

opentheaccountby31stDecember2015.AllIndianCitizens,intheagegroupof1840yearsareeligibletojoin

theschemethroughanybankbranch.About8lakhsubscribershavejoinedAPYtilldate.

http://pib.nic.in/newsite/PrintRelease.aspx?relid=128554

1/2

21/10/2015

AssetsUnderManagement(AUM)ofNationalPensionSystem(NPS)crossRS.1LacCrore

****

VG/KA

http://pib.nic.in/newsite/PrintRelease.aspx?relid=128554

2/2

Vous aimerez peut-être aussi

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5795)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- Form 1040Document2 pagesForm 1040Jessi100% (6)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- CH - 20 - Accounting For Pensions and Postretirement BenefitsDocument58 pagesCH - 20 - Accounting For Pensions and Postretirement BenefitsSamiHadadPas encore d'évaluation

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Taxes in Canada-Final 2011Document145 pagesTaxes in Canada-Final 2011Dayarayan CanadaPas encore d'évaluation

- Exit InterviewDocument3 pagesExit InterviewjohnhenryvPas encore d'évaluation

- The KVB Bank 2013 AnithaDocument6 pagesThe KVB Bank 2013 AnithaSri Thirunav100% (1)

- Chapter 8 Income TaxationDocument7 pagesChapter 8 Income TaxationChristine Joy Rapi MarsoPas encore d'évaluation

- Philconsa VS GimenezDocument2 pagesPhilconsa VS GimenezJhay CarbonelPas encore d'évaluation

- The Furnished Room - My Future WifeDocument2 pagesThe Furnished Room - My Future Wifemiky feristenPas encore d'évaluation

- O.A.766 of 2022Document4 pagesO.A.766 of 2022Tanuja Sawant 50Pas encore d'évaluation

- Sparsh 01Document3 pagesSparsh 01Rakesh Ambasana HPas encore d'évaluation

- 1454758423780Document3 pages1454758423780Deepak MishraPas encore d'évaluation

- Go 120 SoftDocument27 pagesGo 120 SoftgggggPas encore d'évaluation

- Fin e 57 2016Document2 pagesFin e 57 2016IambalaPas encore d'évaluation

- IFS QuestionDocument6 pagesIFS QuestionHdkakaksjsbPas encore d'évaluation

- En 05 10147Document2 pagesEn 05 10147file3323Pas encore d'évaluation

- 7.5 and 7.6 Mortgage, RESP, RRSPDocument3 pages7.5 and 7.6 Mortgage, RESP, RRSPNam NguyenPas encore d'évaluation

- Edu Spring Ltam QuesDocument245 pagesEdu Spring Ltam QuesEricPas encore d'évaluation

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21MaheshPas encore d'évaluation

- Comparative Analysis Between National Pension System and Atal Pension Yojana (APY)Document39 pagesComparative Analysis Between National Pension System and Atal Pension Yojana (APY)Vivek KadamPas encore d'évaluation

- Senior Citizens and Disabled Persons Rate Rebate Application Form EnglishDocument2 pagesSenior Citizens and Disabled Persons Rate Rebate Application Form EnglishGiovanni RossiPas encore d'évaluation

- ITR Form-1 (Sahaj)Document1 pageITR Form-1 (Sahaj)NDTVPas encore d'évaluation

- DVC Service Regulations, 1957Document108 pagesDVC Service Regulations, 1957Latest Laws TeamPas encore d'évaluation

- Final Report - New Jersey Pension and Health Benefit Study Commission - Dec. 6, 2017Document10 pagesFinal Report - New Jersey Pension and Health Benefit Study Commission - Dec. 6, 2017The (Bergen) RecordPas encore d'évaluation

- Income Tax MCQs 2020-21 - Income Tax Laws and Practice MCQs - Objective Questions and AnswersDocument18 pagesIncome Tax MCQs 2020-21 - Income Tax Laws and Practice MCQs - Objective Questions and AnswersSomyaPas encore d'évaluation

- Income From SalaryDocument66 pagesIncome From SalaryShamika LloydPas encore d'évaluation

- Vivint Solar 401 (K) Enrollment Workbook - 528946Document62 pagesVivint Solar 401 (K) Enrollment Workbook - 528946KieraPas encore d'évaluation

- NHRC Chairperson and Members (Salaries, Allowances and Other Conditions of Service) Rules 1993Document4 pagesNHRC Chairperson and Members (Salaries, Allowances and Other Conditions of Service) Rules 1993Latest Laws TeamPas encore d'évaluation

- Format of Income Affidavit For MCM & SC-ST Scholarship (4833) PDFDocument1 pageFormat of Income Affidavit For MCM & SC-ST Scholarship (4833) PDFshubhamPas encore d'évaluation

- Statement of Benefits 30 04 2020Document10 pagesStatement of Benefits 30 04 2020Chris MillsPas encore d'évaluation

- SSGC Final UpdateDocument212 pagesSSGC Final Updateemzeday100% (1)