Académique Documents

Professionnel Documents

Culture Documents

Tiefenbacher Olbrich Increasing Customer Orientation

Transféré par

DanijelBaraCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Tiefenbacher Olbrich Increasing Customer Orientation

Transféré par

DanijelBaraDroits d'auteur :

Formats disponibles

INCREASING THE LEVEL OF CUSTOMER ORIENTATION

A BIG DATA CASE STUDY FROM INSURANCE INDUSTRY

Research in Progress

Tiefenbacher, Katja, University of Duisburg-Essen, Duisburg, Germany,

katja.tiefenbacher@uni-due.de

Olbrich, Sebastian, University of Duisburg-Essen, Duisburg, Germany,

sebastian.olbrich@uni-due.de

Abstract

The paper positions Big Data as a challenge of information integration into existing analytical

infrastructures. The presented arguments have been derived by means of a case study. The case is

selected from the domain of insurance industry that intends to leverage the potential of Big Data for

the purpose of increased customer orientation. Particularly the application of advanced analytics on a

broader information base, i.e. include data that has been collected by the distributed sales force,

promised to be a fruitful approach. Yet, we can mainly learn from areas in which the project initially

failed. It will become obvious that the ability of a cross-functional process alignment is prerequisite to

providing a consolidated view of customer information. It also seems to be essential for integrating

external data sources. As a key take away, this paper will provide first heuristics and drafts a maturity

model on how these challenges of integration will manifest themselves when applying Big Data

techniques.

Keywords: Big Data, CRM, maturity, RBV, case study.

1 Introduction

The need for a sound understanding of the customer base has been in the center of discussion for quite

a while and IS support has been vividly discussed under the term CRM Analytics (Bhattacharya,

Godbole, Gupta, Verma, Achtermann and English, 2009; Lehmann, 2003; Nemati, Barko and Moosa,

2003). Yet, recent developments in terms of availability of user data and the technological means to

access and analyze them, has added a new quality to the discussion. The reason might be a change in

social behavior (i.e. people become more inclined to provide and share personal behavior on social

media sites or to be involved in corporate communication or even in product development) combined

with the capability to access, store and analyze these data (enabled mostly by innovations in database

technologies e.g. in parallel data storage and processing). However, web analysis and text analysis

(which has been a major investment in previous time) seems to be quite feasible for many organizations today. Most of these analyses belong to the field of Big Data analytics (Chen, Chiang and Storey,

2012). Applying Big Data analytics can increase the organizations ability to create a complete picture

of its customers preferences and demands being essential for effective customer orientation

(Manyika, Chui, Brown, Bughin, Dobbs, Roxburgh and Byers, 2011; Watson, 2014). Yet, there is an

obvious gap between the expectations of managers in applying Big Data and what is currently leveraged (Manyika et al., 2011). To date, the properties to be considered to gain the expected value of Big

Data have not yet been clearly identified (Gartner, 2011; Snijders, Matzat and Reips, 2012).

Tiefenbacher, Olbrich /Increasing customer orientation

Big Data can be considered to be a strategic resource of the organization (Wade and Hulland, 2004;

Wernerfelt, 1984), and leveraging it can be regarded as the capability to ensure competitive advantage

(Helfat and Peteraf, 2003; Teece et al., 1997; Winter, 2003). Therefore, our overall research agenda

follows the Resource-Based View of the firm (RBV) and aims to shed light on the role of Big Data in

the resulting nexus of capabilities enhancing customer orientation. Thereby we focus on companies

applying a market-oriented business strategy. In order to derive tangible conclusions, we further investigate the following question in detail: What is the impact of Big Data on the capabilities that enable

customer orientation? To investigate this question, we closely examine a German cross-segment insurance group that intends to apply Big Data for the purpose of increase in its cross- and up-selling

rate. In order to produce viable results in the rather explorative nature of the study, we make use of a

case study approach (Gibbert, Ruigrok and Wicki, 2008; Lee, 1989; Yin, 2008). We describe obstacles

to be overcome in the context of the insurers customer relationship management (CRM) strategy and

provide a clearer picture of the role of Big Data in the context of customer orientation.

In the next sections we provide the background and the methodology for our research. The case study

is introduced in the fourth section followed by the presentation of our first results and an outlook to

our future research agenda.

2 Background

2.1

The integration challenge of Big Data

In order to gain competitive advantage in a volatile business environment, large organizations

increasingly face the need to maintain and analyze large amounts of structured and unstructured data

(Davenport and Harris, 2007; Laney, 2001). These data are derived from inside and outside a

companys organizational borders. The sheer volume, variety and velocity of these data combined

represent a phenomenon that is usually summarized by the term Big Data (Laney, 2001). Our own

definition of Big Data also refers to these three properties volume, variety and velocity (three Vs) and

emphasizes the importance of all three Vs being combined in order to speak of a new phenomenon. In

previous studies we could identify a crucial difference between Big Data applications incorporating all

three properties and those incorporating less (Tiefenbacher and Olbrich, 2015). For the former a new

phenomenon arises through the incorporation of new unstructured and heterogeneous data sources. All

other Big Data applications focus on the optimization of current business processes. We consider those

Big Data use cases as some kind of reincarnation of Business Intelligence (BI) and Analytics as they

seem to be a logical development building on a large base of knowledge grounded in these fields

(Baars, Funke, Mller and Olbrich, 2014).

Speaking of the variety of data we distinguish between structured and unstructured data as well as

between data generated by machines, i.e. sequence, format and possible content are primarily predetermined by mechanical systems (Manyika et al., 2011), and data that is generated by human beings,

thus representing the outcome of the users behavior, e.g. web logs, reviews, tweets, GPS data, blogs,

click streams etc. (Chen et al., 2012; Watson, 2014). Applications incorporating all three Vs, i.e. Big

Data, focus much more on unstructured data as well as those generated by human beings, than applications considering only one or two of the three Vs (Tiefenbacher and Olbrich, 2015). The current scope

of Business Analytics still relies on mostly structured data sources from within the organization; which

accounts for only a fraction of the actual information flow within an organization (Hilbert and Lpez,

2011). Big Data expands this scope with a variety of additional data sources that may lie inside the

organizational borders, e.g. employees call center notes, phone calls, e-mails etc., as well as outside,

e.g. blogs, social media platforms, newsgroups etc. The ability to embrace a bigger variety of data

through the incorporation of unstructured as well as human generated data offers the opportunity to

gain better insights into the market, e.g. these data often contain rich information about customer opinions and consumer behavior (Chen et al., 2012; Schroeck and Smart, 2012). Integrating all these aspects into an information system (IS) is a challenging (big) task. On top of that, further compliance

Twenty-Third European Conference on Information Systems (ECIS), Mnster, Germany, 2015

Tiefenbacher, Olbrich /Increasing customer orientation

restrictions apply, in particular when processing personalized data. Hence, we hypothesize that the

success of Big Data depends largely on the maturity of existing IS that Big Data analytics has to be

integrated into.

2.2

The Resource-Based View of the firm

The term Resource-Based View of the firm (RBV) was coined by Wernerfelt (1984) and builds upon

earlier work (Learned, Christensen, Andrews and Guth, 1969; Penrose, 1959). RBV is commonly used

to articulate corporate strategy in order to gain competitive advantage. The RBV is widely and

increasingly used in the IS domain to explain how information systems relate to the strategy and

performance of an organization (Wade and Hulland, 2004). Accordingly, we consider Big Data as a

strategic resource of the organization.

In the eyes of the RBV, an organization is a collection of resources, i.e. capabilities or assets. In this

study, we share Wernerfelts (1984, p.172) understanding of resources as anything which could be

thought of as a strength or weakness of a given firm. Resources embrace both capabilities and assets

(Wade and Hulland, 2004) while the term capabilities refers to the ability of an organization to

perform a coordinated set of tasks (processes) for the purpose of achieving a particular end result

(Helfat and Peteraf, 2003). Assets, on the other hand, are defined as anything tangible or intangible the

firm can use in these processes (Wade and Hulland, 2004). Capabilities can thus be viewed as

repeatable patterns of actions (Wade and Hulland, 2004) or coordinated set of tasks (Helfat and

Peteraf, 2003) or both i.e. processes that utilize assets as input (Amit and Shoemaker, 1993; Helfat

and Peteraf, 2003). Accordingly, we speak of processes as being designed to manage the continuous

adjustment of an organization to its environmental context.

2.3

Customer orientation and customer analytics

Access to market information has been a key success factor for market orientation in businesses for

many years (Porter, 1980). Market orientation is defined as a corporate culture that is systematically

and entirely committed to the continuous creation of superior customer value (Slater and Narver,

1994). It allows a firm to respond rapidly to external environmental change (e.g., shifts in customer

preference and change in competitors strategies), thereby enhancing firm performance (Day, 1994;

Narver and Slater, 1990). One of the major components of market orientation is customer orientation,

i.e. the understanding of a firms potential customers preferences as they are today and as they might

be in the future (Narver and Slater, 1990). The information about each customers preferences of

several attributes of a product can be utilized to provide more individualized offers through the

development of new products and services, i.e. (mass) customization, or through cross-selling, i.e.

selling an additional product or service to an existing customer (Li, Sun and Montegomery, 2011).

The creation of improved shareholder value through the development of appropriate relationships

with key customers and customer segments is the core concern of CRM (Payne and Frow, 2005).

Hence, the implementation of CRM demonstrates a firms customer-orientated behavior.

Classification of activities in CRM can be derived by looking at the scope of strategy, process and IT.

Based on Payne and Frows (2005) conceptual framework for CRM strategy development, Iriana and

Buttle (2006) introduced a differentiation between three forms of CRM: Strategic, Operational and

Analytical (SOA). Strategic CRM mainly depends on an organizations business strategy and its

customer strategy. In this way, strategic CRM follows a top-down approach that supports relationship

building through more individualized offers in order to enhance revenues (Iriana and Buttle, 2006).

Operational CRM focuses on the management of physical and virtual channels through which

customers and organizations communicate and transact. The goal of operational CRM is to improve

the efficiency and accuracy of customer contacts including sales, marketing and service functions

across various channels to capture cost savings (Iriana and Buttle, 2006). Analytical CRM follows a

bottom-up approach that focuses on the analysis of data to enhance customer understanding, enable

appropriate cross-selling attempts or better targeting of offers (Iriana and Buttle, 2006).

Twenty-Third European Conference on Information Systems (ECIS), Mnster, Germany, 2015

Tiefenbacher, Olbrich /Increasing customer orientation

3 Methodology

3.1

Theoretical foundation and research model

By following the RBV that describes organizations as collections of distinct resources and procedures

we aim to investigate the impact of Big Data on the capabilities that enable customer orientation. As

our research question is related to the context of customer orientation, for us, leveraging Big Data

requires a set of capabilities that are interrelated with CRM. For the development of our research

model we referred to the differentiation of strategic, operational and analytical CRM as introduced in

section 2.3. This is pretty much in line with previous studies that introduce a set of capabilities from

analytical, operational and strategic CRM as well as their interaction that determine the success of

CRM, e.g. a cross-functional integration of strategy, processes and people that is enabled through a

consolidated IS-infrastructure etc., (Coltman, Devinney and Midgley, 2011; Payne and Frow, 2005;

Plakoyiannaki and Tzokas, 2002). Our resulting research model is depicted in Figure 1.

Big Data

Volume

Strategic

CRM

Variety

Operational

CRM

Analytical CRM

Figure 1.

Velocity

Customer

Orientation

Research model

Yet, a clear picture of the capabilities that are interrelated with Big Data is still missing in our research

model. We can derive known capabilities from existing literature, e.g. the capabilities of analytical

CRM seem to be related to the field of BI particular since the domain of CRM is an overall integrative

challenge: The integration of large data sets in order to prepare them for analysis and visualization

(Moss and Atre, 2003; Olbrich, Niehaves and Pppelbu, 2011; Turban, Sharda, Delen and Aronson,

2011; Watson, 2010; Wixom and Watson, 2001). Therefore, existing concepts of Data Governance

(Aiken and Gorman, 2013; Logan, 2010) or of Data Quality Management (Ballou and Tayi, 1999;

Strong, Lee and Wang, 1997; Work, 2002) might be applied to a certain extent. Also, the capability to

manage the success factors of current analytics software (Hawking and Sellitto 2010; Olbrich et al.,

2011; Wixom and Watson, 2001; Yeoh and Koronios, 2010) might be still relevant in the context of

Big Data. Yet, due to further expansion of the availability of information, also from beyond

organizational borders, these concepts should be extended for Big Data. Hence, in order to

successfully leverage Big Data there is a delta required that represents the extension of well-known

capabilities, thus resulting in new capabilities. These new capabilities have not yet been clearly carved

out in existing literature. Therefore, it is part of our research agenda to identify these new capabilities

and to map them to known capabilities from existing literature in order to investigate dependencies

and interrelationships.

3.2

Case study design

In the context of different case studies we will explore these new capabilities in our future research. In

order to produce viable results in the rather explorative nature of our study, we make use of a case

study approach (Gibbert et al., 2008; Lee, 1989; Yin, 2008). Part of our previous research has been

already an analysis of more than 100 Big Data success stories covering several industries and

functional areas (Tiefenbacher and Olbrich, 2015). To present the difference in capabilities that are

Twenty-Third European Conference on Information Systems (ECIS), Mnster, Germany, 2015

Tiefenbacher, Olbrich /Increasing customer orientation

needed to leverage Big Data we go into more detail and therefore make use of a specific case study

from the insurance industry. Our research model ends with customer orientation although we are well

aware that customer orientation can be utilized for different purposes, e.g. mass customization.

However, in the presented case study the focus is on unleashing the potential of existing products

through increased cross-selling. One of the authors was involved in the presented case study when the

investigated company faced several challenges posed in the improvement of cross-selling campaigns

in a Big Data context. The observations described in the following are derived from interviews as well

as the authors own participation in the role of a sub-project leader.

According to Lee (1989), it is part of our research to add a brief analysis in order to address the

questions of repeatability and generalizability of our case study. First of all, we will refer to the first of

four core questions in case study research: What is the initial setting in the case study and is it bound

to specific situational and historical circumstances? The investigated company is one of Germanys

largest mutual insurance groups. The companys business portfolio is broadly diversified and its

premium income is split into the segments of non-life, life and health. The groups portfolio gets

complemented by a direct insurer providing products in the segments of life, health and property

insurance to private clients throughout Germany. Because of the regulatory requirement that different

insurance segments must be operated financially independent, the administration of the insurers

customer base is rather heterogeneous in the initial setting. Moreover, the groups sales force and the

central marketing department operate locally and independently. Therefore our case is specific to

organizational structures with high complexity. Due to the transaction- and customer-intensive nature

of the industrial sector of insurance the case study provides a high potential to benefit very strongly

from Big Data. However, this might also apply to other industrial sectors, e.g. the financial sector. It is

for these reasons that Big Data offers a high potential for insurance companies such as optimizing their

CRM efficiency through improved customer segmentation and analysis in near real time or the

development of new products and services that are tailored to individual customer needs (Cusano,

2014; Manyika et al., 2011).

4 Case Study: Insurance Group

In the presented case study, the insurance group has launched a strategic CRM initiative that aims to

enhance revenues through improved cross- and up-selling campaigns. Earlier, marketing and sales

activities have been focused on a specific segment only. With the new initiative the insurance group

wants to improve this situation in order to enhance revenues. Cross-selling is rather challenging for the

group because of its diversified insurance segments. Taking into account this objective the insurer

intends to achieve central analytical capabilities based on near real time analyses of its customers

preferences, its behavioral patterns as well as relations between customers like the identification of

households for customer profiling and segmentations along the specific service offering of the

insurance group, i.e. enhanced customer orientation.

The data for these analyses shall be derived from structured data sources, i.e. various portfolios and

claims systems as well as operational CRM applications, and from new unstructured data sources (variety), e.g. e-mails, sales force notes and data from call centers that are continuously generated (velocity). All these internal data sources together generate massive amounts of data (volume). To complete

the picture of its customers preferences and demands the insurance group also intended to incorporate

external data sources, e.g. social media, geographical information, socio-demographic data etc. These

internal and external data sources volume, variety and velocity combined provide a challenge of Big

Data. From leveraging these Big Data the insurer expects to receive synergy effects through the combination of the individualized sales forces know-how, as he has gained specific information about his

customers through personal contact, and the groups centralized support. For example, the central

marketing department might provide the decentralized sales force with up-to-date customer information gained from social media platforms right before the respective customer gets contacted.

Twenty-Third European Conference on Information Systems (ECIS), Mnster, Germany, 2015

Tiefenbacher, Olbrich /Increasing customer orientation

Central marketing

department

Partly

decentralized

Exclusive sales force

Final decision on customer selection process

An alignment of existing and new internal and external data sources is rather challenging as the underlying processes of the direct insurer, the central marketing department and the exclusive sales force

differ in scope and context. The groups sales activities are accomplished by the groups exclusive

sales force as well as the central marketing department. Hence, these activities are rather decentralized

as depicted in Figure 2.

Completely

decentralized

Partly

decentralized

Exclusive

sales force

Central marketing

department

Fully centralized

(by marketing

department)

Diversified

insurance

segments

Triggering of marketing measure

Figure 2.

Alignment of sales force and central marketing department

While defining customers to be contacted for a respective marketing measure, the customer selection

process can be accomplished by the central marketing department alone, thus providing the sales forces with the final list, or the sales force might be involved in this process (see upper and lower half of

Figure 2). Besides, the actual triggering of the particular marketing measure can be either determined

by the exclusive sales force (left half in Figure 2) or by the marketing department itself (right half in

Figure 2). The activities are completely decentralized if the central marketing department proposes a

customer selection in the first place that gets adjusted by the sales force agent who also triggers the

respective marketing measure (see lower left cluster in Figure 2). Moreover, the entities for each of the

different insurance segments operate separately resulting in compartmentalized processes and a heterogeneous IS landscape which ultimately results in a non-homogenous administration of the customer

base. In the initial setting, the insurers corporate Data Warehouse (DWH) provided different data

marts specific to each of the groups diversified insurance segments only and therefore it was not possible to provide cross-segment customer information, e.g. numbers of contracts or premiums per customer. As the groups direct insurer has its independent market appearance, it also applies its own

sales model. Hence, the insurance group was simply not able to provide an integrated view of its diverse business processes in the first instance. Consequently, it was unable to handle the increased data

volume that was derived from the execution of these processes.

As a counter measure, the insurer started an integration initiative to align these processes together with

the implementation of a Big Data analytics solution. An important measure for the alignment between

the central marketing department, the sales force and the direct insurer was the definition of an overall

campaign management process (operational CRM). Another measure was the implementation of a

central and consolidated front office CRM application. This application is a multi-channel software

that offers all important functions and features in an integrated manner (operational CRM). Therefore

the sales force as well as the central marketing department and the direct insurer can access all information that is relevant to their operational CRM activities involving direct interface with customers

through a single application. Finally, the new Big Data analytics solution provides an overall, integrated view of the insurers internal customer data (analytical CRM). The integration of data from external

sources stays part of the groups future planning. It is for this reason that the insurer could not yet real-

Twenty-Third European Conference on Information Systems (ECIS), Mnster, Germany, 2015

Tiefenbacher, Olbrich /Increasing customer orientation

ize the full potential of Big Data. However, the success of the groups cross-selling campaigns could

already be improved.

According to Lee (1989), we will refer to the second of four core questions in case study research:

Which (design) conclusions are drawn from the case study data and are these conclusions bound to

specific situational and historical circumstances? The case study could derive first implications that

depend on the organizational structure and the analytical context. The case of the insurance group

depicts that in a Big Data context it is essential to achieve a cross-functional alignment of internal

processes first, namely the cross-segment sales and marketing activities as well as those of the direct

insurer, in order to enhance customer orientation.

5 Tentative conclusion and outlook

As part of our research agenda we aim to identify new capabilities that are required to leverage Big

Data in the context of customer orientation, and map these to known capabilities from existing literature in order to investigate dependencies and interrelationships. Specifically, we argue that Big Data

can increase cross-selling by enhancing capabilities of customer orientation. With the presentation of a

major mutual insurance group and its challenges in introducing Big Data, we already derived some

valuable insights for research and practice. Our first results point out that the success of Big Data

largely depends on the cross-functional alignment of processes and the level of integration with distributed data. With an increased focus on data, organizational structures will be encouraged to collaborate more closely.

Typical Use Cases

Maturity

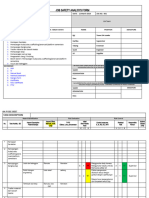

In the presented case we did not receive any insights as regarding specific analytical nor technological

capabilities (especially regarding the integration of external data sources) that will be required to leverage Big Data. However, the reason of failure was not an issue of technological capabilities; instead it

was a problem of information integration due to a misalignment of the underlying processes. This

points out that in order to leverage Big Data a certain degree of analytical maturity is required in the

first place. Hence, we intend to develop a Big Data maturity model in the field of CRM analytics. Our

first proposal of the maturity model is depicted in Figure 3.

Stage A:

Analytical

Projects

Financial reporting

Regulatory /

compliance reporting

Dashboards for

management

reporting

Performance

measurement via key

performance

indicators/metrics

Stage B:

Functional

excellence

Experimenting /

Selective adoption

Figure 3.

Smart pricing

Targeted mailings

Customer

segmentation

Customer value

analysis

Choice analysis

Loyalty schemes

Customer

satisfaction

Churn & Crime

Stage D:

Business Model

Transformation

Stage C:

Value Proposition

Targeted advertising

Cross-Selling / Data

Monetization

Online telematics

services

Personalization of

customer

experience

Customization of

products

Selling of data to open

new revenue pools

Data-centric business

models

Quantitative

management of

investment funds

Crowdsourcing to

augment internal data

Fully integrated / largeScale implementation

Proposed maturity model for Big Data and CRM analytics

The model suggests different stages of analytical maturity that are indicated by typical use cases. It

proposes to move stepwise from one stage to another, i.e. from less mature selective use cases (stage

A) through functional excellence (stage B) and value proposition (stage C) towards a fully integrated

analytical IS infrastructure (stage D). There are different capabilities required in order to move forward. The presented case study of the insurance group can be mapped to stage A in its initial setting.

According to the groups CRM strategy it tries to achieve stage C. Getting directly from stage A to C

Twenty-Third European Conference on Information Systems (ECIS), Mnster, Germany, 2015

Tiefenbacher, Olbrich /Increasing customer orientation

failed in the presented case as the corresponding capabilities were still missing. First, the insurer had

to develop the capability to align its cross-segment sales and marketing activities as well as those of

the direct insurer as baseline for information integration. By this, the groups functional excellence in

customer segmentation, targeted mailings etc. could be improved and the insurance group managed to

reach stage B with regard to our proposed maturity model. Yet, the group needs to develop new capabilities for the integration of data from external sources to improve its value proposition and finally

reach stage C. This situation is not atypical for the current state of Big Data use cases as most of the

organizations are still experimenting with technology or only selectively adopting certain aspects of

Big Data, while only a few companies invested in developing new capabilities (Tiefenbacher and

Olbrich, 2015). However, in order to work towards a large scale customer orientation, it seems essential to push the first substantial Big Data use cases (stage A) towards a fully integrated analytical IS

(stage D). We have made this observation due to major challenges in the presented case study. Conceptually this leads us to conclude that there might be valuable learning from failed Big Data projects.

As opposed to a current over-emphasis of Big Data success stories that might be motivated by marketing strategies of vendors and consultants.

As our study is of preliminary nature, we are well aware of the fact that we are not able to provide a

completed analysis. However, we would like to discuss first indications from our case study by referring to the last two questions of repeatability and generalizability (Lee, 1989), i.e.:

Do other settings show similar features and, thus, can the case study setting be generalized? Other

domains that are less regulated in their business model might already be ahead when it comes to process alignment and data integration. Therefore, the observations are of particular value for the ones

that face equally strong compliance requirements. Talking about regulations the handling personalized

(customer) data concerns multiple settings.

Are the (design) conclusions made in the case study setting transferable to other organizational settings? Some implications can be derived from the studys results that seem to be applicable in other

organizational settings, too. As indicated above, the value of data seems to be strongly depended on

integration and therefore the availability of information within the organization through process

alignment. Hence, Big Data might require a certain level of analytical maturity to deliver the promised

value. We acknowledge however that resolving the integration challenge within the organizational

borders might be less necessary in different settings as isolated data analysis might be sufficient (e.g.

in production of factory), even more efficient (e.g. sentiment analysis or market research which is

mostly conducted by specialized agencies) or even required (e.g. forensics). The case study is of preliminary nature in a way that the analysis is not yet complete and further interviews have to be conducted to explore further obstacles that may arise, especially while incorporating external data sources.

Also, the results were not yet transferred to other organizational environments. Next, we will further

investigate which capabilities are required to integrate Big Data and we will also carve out when integration is needed and under which circumstances Big Data can be sourced altogether.

Twenty-Third European Conference on Information Systems (ECIS), Mnster, Germany, 2015

Tiefenbacher, Olbrich /Increasing customer orientation

References

Aiken, P. and Gorman, M. M. (2013). The Case for the Chief Data Officer: Recasting the C-Suite to

Leverage Your Most Valuable Asset, Morgen & Kaufmann.

Amit, R. and Shoemaker, P. (1993). Strategic assets and organizational rent, Strategic Management

Journal, 14 3346.

Baars, H., Funke, K., Mller, P. A. and Olbrich, S. (2014). Big Data als Katalysator fr die Business

Intelligence Das Beispiel der informa Solutions GmbH, HMD Praxis der

Wirtschaftsinformatik, 51 (4), pp. 436-446.

Ballou, D. P. and Tayi, G. K. (1999). Enhancing data quality in data warehouse environments,

Communications of the ACM, 42 (1), pp. 73-78.

Bhattacharya, I., Godbole, S., Gupta, A., Verma, A., Achtermann, J. and English, K. (2009). Enabling

analysts in managed services for CRM analytics, Proceedings of the 15th ACM SIGKDD

international conference on Knowledge discovery and data miningACM, Paris, France, pp.

1077-1086.

Chen, H., Chiang, R. and Storey, V. (2012). Business Intelligence and Analytics: From Big Data to

Big Impact, MIS Quarterly Executive, 36 (4), pp. 1165-1188.

Coltman, T., Devinney, T. M. and Midgley, D. F. (2011). Customer Relationship Management and

Firm Performance, Journal of Information Technology, 26 (3), pp. 205-219.

Cusano, J. M. (2014). Insurance Isnt Safe from Digital Upheaval, HBR Blog Network, Vol. 2014

Harvard Business Review.

Davenport, T. H. and Harris, J. G. (2007). Competing on Analytics: The New Science of Winning,

Mcgraw-Hill Professional, Massachusetts.

Day, G. S. (1994). The Capabilities of Market-Driven Organizations, Journal of Marketing, 58 (4), pp.

3753.

Gartner (2011). Gartner Says Solving 'Big Data' Challenge Involves More Than Just Managing

Volumes of Data, Vol. 2012 Gartner, Inc.

Gibbert, M., Ruigrok, W. and Wicki, B. (2008). What passes as a rigorous case study?, Strategic

Management Journal, 29 (13), pp. 1465-1474.

Hawking, P. and Sellitto , C. (2010). Business Intelligence (BI) Critical Success Factors, Australasian

Conference on Information Systems (ACIS), Vol. Paper 4, Brisbane, Australia.

Helfat, C. E. and Peteraf, M. A. (2003). The dynamic resource-based view: capability lifecycles,

Strategic Management Journal, 24 (10), pp. 9971010.

Hilbert, M. and Lpez, P. (2011). The World's Technological Capacity to Store, Communicate, and

Compute Information, Science 332 (6025), pp. 60-65.

Iriana, R. and Buttle, F. (2006). Strategic, Operational, and Analytical Customer Relationship

Management: Attributes and Measures, Journal of Relationship Marketing, 5 (4), pp. 23-34.

Laney, D. (2001). 3D Data Management: Controlling Data Volume, Velocity and Variety, Vol. File

949 META Group.

Learned, E. P., Christensen, R., Andrews, K. R. and Guth, W. D. (1969). Business Policy, Irwin,

Home-wood, IL.

Lee, A. S. (1989). A Scientific Methodology for MIS Case Studies, MIS Quarterly, 13 (1), pp. 3252.

Lehmann, P. (2003). CRM-Analytics im Fokus von Business Intelligence, In Customer Knowledge

Management: Erste Ergebnisse des Projektes Customer Knowledge Management

Integration und Nutzung von Kundenwissen zur Steigerung der Innovationskraft (Ed, IRB,

F.) Bungard, W., Fleischer, J., Nohr, H., Spath, D., Zahn, E., Stuttgart, pp. 71-78.

Li, S., Sun, B. and Montegomery, A. L. (2011). Cross-selling the right product to the right customer at

the right time, JOURNAL OF MARKETING RESEARCH, 48 (4), pp. 683-700.

Logan, D. (2010). What is Information Governance? And Why is it So Hard?, Gartner Research.

Twenty-Third European Conference on Information Systems (ECIS), Mnster, Germany, 2015

Tiefenbacher, Olbrich /Increasing customer orientation

Manyika, J., Chui, M., Brown, B., Bughin, J., Dobbs, R., Roxburgh, C. and Byers, A. (2011). Big

data: The next frontier for innovation, competition, and productivity, (Ed, Institut, M. G.)

McKinsey & Company.

Moss, T. L. and Atre, S. (2003). Business Intelligence Roadmap: The Complete Project Lifecycle for

Decision-support Applications, Addison-Wesley, Boston.

Narver, J. C. and Slater, S. F. (1990). The Effect of a Market Orientation on Business Profitability

Journal of Marketing, 54 (4), pp. 20-35.

Nemati, H. R., Barko, C. D. and Moosa, A. (2003). E-CRM Analytics: The Role of Data Integration,

Journal of Electronic Commerce in Organizations (JECO), 1 (3), pp. 73-89.

Olbrich, S., Niehaves, B. and Pppelbu, J. (2011). BI Systems Managers Perception of Critical

Contextual Success Factors: A Delphi Study, International Conference on Information

Systems (ICIS), Shanghai, China.

Payne, A. and Frow, P. (2005). A Strategic Framework for Customer Relationship Management,

Journal of Marketing, 69 (4), pp. 167-76.

Penrose, E. (1959). The Theory of Growth of the Firm, Blackwell, Oxford.

Plakoyiannaki, E. and Tzokas, N. (2002). Customer relationship management: A capabilities portfolio

perspective, Journal of Database Marketing, 9 (3), pp. 228-237.

Porter, M. E. (1980). Industry Structure and Competitive Strategy: Keys to Profitability, Financial

Analysts Journal, 36 (4), pp. 30-41.

Schroeck, M. J. and Smart, J. (2012). Analytics: The real-world use of big data, How innovative

enterprises extract value from uncertain data, (Ed, Oxford, I. I. f. B. V. a. S. B. S. a. t. U. o.).

Slater, S. F. and Narver, J. C. (1994). Market Orientation, Customer Value, and Superior

Performance, Business Horizons, 37 (2), pp. 2228.

Snijders, C., Matzat, U. and Reips, U.-D. (2012). "Big Data": Big gaps of knowledge in the field of

Internet Science, International Journal of Internet Science, 7 (1), pp. 1-5.

Strong, D. M., Lee, Y. W. and Wang, R. Y. (1997). Data quality in context, Communications of the

ACM, 40 (5), pp. 103-110.

Teece, D. J., Pisano, G. and Shuen, A. (1997). Dynamic capabilities and strategic management,

Strategic Management Journal, 18 (7), pp. 509533.

Tiefenbacher, K. and Olbrich, S. (2015). Increasing the Value of Big Data Projects Investigation of

Industrial Success Stories, 48th Hawaii International Conference on System Sciences

(HICSS), Kauai, Hawaii, January 5-8, 2015.

Turban, E., Sharda, R., Delen, D. and Aronson, J. E. (2011). Decision support and business

intelligence systems, Pearson, Upper Saddle River, NJ.

Wade, M. and Hulland, J. (2004). Review: The Resource-Based View and Information Systems

Research: Review, Extension, and Suggestions for Future Research, MIS Quarterly, 28 (1),

pp. 107142.

Watson, H. J. (2010). BI-based Organizations, Business Intelligence Journal, 15 (2), pp. 4-6.

Watson, H. J. (2014). Tutorial: Big Data Analytics: Concepts, Technologies, and Applications,

Communications of the Association for Information Systems, 34 (1), pp. 1247-1268.

Wernerfelt, B. (1984). A Resource-based View of the Firm, Strategic Management Journal, 5 (2), pp.

171180.

Winter, S. (2003). Understanding dynamic capabilities, Strategic Management Journal, 24 (10), pp.

991995.

Wixom, B. H. and Watson, H. J. (2001). An Empirical Investigation of the Factors Affecting Data

Warehousing Success, MIS Quarterly, 25 (1), pp. 1741.

Work, B. (2002). Patterns of software quality management in TickIT certified firms, European Journal

of Information Systems, 11 (1), pp. 61-73.

Yeoh, W. and Koronios, A. (2010). Critical Success Factors for Business Intelligence Systems,

Journal of Computer Information Systems, Spring 2010 23-32.

Yin, R. K. (2008). Case Study Research: Design and Methods, Sage Publications Ltd.

Twenty-Third European Conference on Information Systems (ECIS), Mnster, Germany, 2015

10

Vous aimerez peut-être aussi

- The Impact of Big Data On Accounting and AuditingDocument14 pagesThe Impact of Big Data On Accounting and AuditingMhmood Al-saadPas encore d'évaluation

- 4.9 Design of Compression Members: L 4.7 UsingDocument22 pages4.9 Design of Compression Members: L 4.7 Usingctc1212100% (1)

- Big Data Research PaperDocument10 pagesBig Data Research PaperMeraj AlamPas encore d'évaluation

- An Introduction To Design Thinking: Corey Ford Cford@stanford - EduDocument34 pagesAn Introduction To Design Thinking: Corey Ford Cford@stanford - EduDanijelBaraPas encore d'évaluation

- By Vaibhav Pandya S R.information Security Consultant M.Tech Solutions (India) PVT - LTDDocument22 pagesBy Vaibhav Pandya S R.information Security Consultant M.Tech Solutions (India) PVT - LTDtsegay.csPas encore d'évaluation

- Information Security Master PlanDocument6 pagesInformation Security Master PlanMarubadi Rudra Shylesh Kumar100% (2)

- Big Data Analytics CapabilitiesDocument34 pagesBig Data Analytics Capabilitieslukman hakimPas encore d'évaluation

- Opportunities and Challenges For Big DataDocument14 pagesOpportunities and Challenges For Big DataAbdulGhaffarPas encore d'évaluation

- Debating Big Data A Literature Review On Re - 2017 - The Journal of Strategic IDocument19 pagesDebating Big Data A Literature Review On Re - 2017 - The Journal of Strategic IJoffily OrbanPas encore d'évaluation

- Data Science: Lesson 2Document6 pagesData Science: Lesson 2lia immie rigoPas encore d'évaluation

- Big Data Analytics A Review On Theoretical Contributions-2017Document27 pagesBig Data Analytics A Review On Theoretical Contributions-2017ramPas encore d'évaluation

- L Iyer Business 2015Document36 pagesL Iyer Business 2015Ahmed ElSangaryPas encore d'évaluation

- Small and Big DataDocument6 pagesSmall and Big DataMohammad AliPas encore d'évaluation

- Matthias MakingSenseOfBigData (AM)Document27 pagesMatthias MakingSenseOfBigData (AM)Renato R. Osores MinayaPas encore d'évaluation

- Enterprise Operations Coursework FinalDocument4 pagesEnterprise Operations Coursework FinalConnorPas encore d'évaluation

- 1 s2.0 S2444883417300268 MainDocument7 pages1 s2.0 S2444883417300268 MainHermanos Sanchez ChavezPas encore d'évaluation

- Harvesting Big Data To Enhance Supply Chain Innovation Capabilities An Analytic Infrastructure Based On Deduction Graph 2015 International Journal ofDocument11 pagesHarvesting Big Data To Enhance Supply Chain Innovation Capabilities An Analytic Infrastructure Based On Deduction Graph 2015 International Journal ofdarksoulg7Pas encore d'évaluation

- Big Data and Business Analytics: Trends, Platforms, Success Factors and ApplicationsDocument32 pagesBig Data and Business Analytics: Trends, Platforms, Success Factors and ApplicationsVanaja PeninsulaPas encore d'évaluation

- Benefits, Challenges and Tools of Big Data Management PDFDocument9 pagesBenefits, Challenges and Tools of Big Data Management PDFFrancisco Javier Medina VillarrealPas encore d'évaluation

- Belajar Bigdata 3Document16 pagesBelajar Bigdata 3Leonardo SihombingPas encore d'évaluation

- Project Description (RP)Document5 pagesProject Description (RP)Zulfiqar KhanPas encore d'évaluation

- The Implications of Big Data Analytics On Business IntelligenceDocument6 pagesThe Implications of Big Data Analytics On Business IntelligenceFernanda RochaPas encore d'évaluation

- Final Big DataDocument17 pagesFinal Big DataDancan OwinoPas encore d'évaluation

- Big Data and Business Analytics Trends, Platforms, Success Factors and ApplicationsDocument34 pagesBig Data and Business Analytics Trends, Platforms, Success Factors and ApplicationsqhidPas encore d'évaluation

- Big Data Opportunities For Accounting and Finance Practice and ResearchDocument11 pagesBig Data Opportunities For Accounting and Finance Practice and ResearchMohammed AbduhulPas encore d'évaluation

- Articol SttintificDocument7 pagesArticol SttintificandrashikPas encore d'évaluation

- BDCC 03 00032 v2 PDFDocument30 pagesBDCC 03 00032 v2 PDFChintuPas encore d'évaluation

- Benifit Big DataDocument10 pagesBenifit Big DataMuhammad Zulvan NizarPas encore d'évaluation

- Big Data Impact AnalysisDocument8 pagesBig Data Impact AnalysisDataScientistGirlPas encore d'évaluation

- Decision Support Systems and Business IntelligenceDocument5 pagesDecision Support Systems and Business IntelligenceZulfiqar KhanPas encore d'évaluation

- 00 Big Data and Business Analytics - Trends, Platforms, Success Factors and ApplicationsDocument31 pages00 Big Data and Business Analytics - Trends, Platforms, Success Factors and ApplicationsFabella Rizky NaumiPas encore d'évaluation

- The Impact of Big Data On YourDocument13 pagesThe Impact of Big Data On YourGundeepPas encore d'évaluation

- Using External Data in A BI Solution To Optimise Waste Management - 2020 - Taylor and Francis LTDDocument17 pagesUsing External Data in A BI Solution To Optimise Waste Management - 2020 - Taylor and Francis LTDLamssarbiPas encore d'évaluation

- 1.gulshan 8000 Words EditedDocument31 pages1.gulshan 8000 Words EditedvinayPas encore d'évaluation

- Big Data Research Papers PDF 2016Document8 pagesBig Data Research Papers PDF 2016gz8te40w100% (1)

- The Opportunities and Challenges Connected With Implementation of The Big Data ConceptDocument19 pagesThe Opportunities and Challenges Connected With Implementation of The Big Data ConceptjjcyooiwvkyailkrwhPas encore d'évaluation

- Big Data For Stock Market by Means of Mining Techniques 55636905Document10 pagesBig Data For Stock Market by Means of Mining Techniques 55636905bneckaPas encore d'évaluation

- Big Data and Analytics: Vincenzo MorabitoDocument202 pagesBig Data and Analytics: Vincenzo MorabitoBhavik SangharPas encore d'évaluation

- SCP BDA Capabilties 2Document91 pagesSCP BDA Capabilties 2Aziz Ibn MusahPas encore d'évaluation

- HTENG418 Part 1 - IntroductionDocument8 pagesHTENG418 Part 1 - IntroductionJabuePas encore d'évaluation

- Understanding The Anatomy of Data-Driven Business Models - Towards An Empirical TaxonomyDocument16 pagesUnderstanding The Anatomy of Data-Driven Business Models - Towards An Empirical TaxonomyMery Citra SondariPas encore d'évaluation

- Big Data To Big Impact: Effect of Big Data in Modern Decision MakingDocument11 pagesBig Data To Big Impact: Effect of Big Data in Modern Decision MakingmaryamPas encore d'évaluation

- Issues in Information Systems: Big Data AnalyticsDocument10 pagesIssues in Information Systems: Big Data AnalyticsLuis Felipe García DiazPas encore d'évaluation

- LN2015 01Document16 pagesLN2015 01Raju KushwahaPas encore d'évaluation

- 1.0 Introduction of Management AccountantDocument3 pages1.0 Introduction of Management AccountantIbrahim Shehata100% (1)

- Project WorkDocument36 pagesProject WorkOrah SeunPas encore d'évaluation

- Big Data, Official Statistics and Some Initiatives by The Australian Bureau of Statistics Tam, ClarkeDocument38 pagesBig Data, Official Statistics and Some Initiatives by The Australian Bureau of Statistics Tam, ClarkeAn RoyPas encore d'évaluation

- Draft Paper Big DataDocument36 pagesDraft Paper Big DataIustinIvascuPas encore d'évaluation

- Eai 6-11-2018 2279366Document5 pagesEai 6-11-2018 2279366Ronald MongePas encore d'évaluation

- Introduction To Big DataDocument5 pagesIntroduction To Big DataAnn Buhat AsilomPas encore d'évaluation

- Big DataDocument52 pagesBig DataUmesh NarayananPas encore d'évaluation

- The Effects of Using Business Intelligence Systems On An Excellence Management and Decision-Making Process by Start-Up Companies: A Case StudyDocument11 pagesThe Effects of Using Business Intelligence Systems On An Excellence Management and Decision-Making Process by Start-Up Companies: A Case StudyLuttpiPas encore d'évaluation

- Literature Review of Business Intelligence: Rasmey Heang and Raghul MohanDocument10 pagesLiterature Review of Business Intelligence: Rasmey Heang and Raghul MohanNaol LamuPas encore d'évaluation

- The Business Technology Challenge of 2014Document3 pagesThe Business Technology Challenge of 2014hugobasilio3Pas encore d'évaluation

- A Seminar Report: Big DataDocument22 pagesA Seminar Report: Big DatalavhackPas encore d'évaluation

- 08 CoreText M6 KTP1-Introduction To Big DataDocument12 pages08 CoreText M6 KTP1-Introduction To Big DataShihabHasanPas encore d'évaluation

- Big Data and The Production of Anticipatory Transparency in International Development: A Governmentality AnalysisDocument8 pagesBig Data and The Production of Anticipatory Transparency in International Development: A Governmentality AnalysisCarlos TuctoPas encore d'évaluation

- Data AnalyticsDocument24 pagesData Analyticsrp9009100% (1)

- The Impact of Business Intelligence Tools On Performance: A User Satisfaction Paradox?Document27 pagesThe Impact of Business Intelligence Tools On Performance: A User Satisfaction Paradox?hobelPas encore d'évaluation

- Big Data: Understanding How Data Powers Big BusinessD'EverandBig Data: Understanding How Data Powers Big BusinessÉvaluation : 2 sur 5 étoiles2/5 (1)

- Navigating Big Data Analytics: Strategies for the Quality Systems AnalystD'EverandNavigating Big Data Analytics: Strategies for the Quality Systems AnalystPas encore d'évaluation

- Building and Operating Data Hubs: Using a practical Framework as ToolsetD'EverandBuilding and Operating Data Hubs: Using a practical Framework as ToolsetPas encore d'évaluation

- Big Data - Challenges for the Hospitality Industry: 2nd EditionD'EverandBig Data - Challenges for the Hospitality Industry: 2nd EditionPas encore d'évaluation

- Ricardo Vargas Simplified Pmbok Flow 6ed CANVAS EN-A3 PDFDocument1 pageRicardo Vargas Simplified Pmbok Flow 6ed CANVAS EN-A3 PDFReginePas encore d'évaluation

- Introduction To Data Mining and Knowledge Discovery, Third EditionDocument40 pagesIntroduction To Data Mining and Knowledge Discovery, Third EditionHernes Puentes VargasPas encore d'évaluation

- Ds Eternus Dx60 s4 WW enDocument6 pagesDs Eternus Dx60 s4 WW enDanijelBaraPas encore d'évaluation

- 7.4 Certifications Dec15Document6 pages7.4 Certifications Dec15DanijelBaraPas encore d'évaluation

- Digital Techzagreb28112017 Carmine Nigro5a1fb8e604d75Document45 pagesDigital Techzagreb28112017 Carmine Nigro5a1fb8e604d75DanijelBaraPas encore d'évaluation

- Databases For Beginners PDFDocument113 pagesDatabases For Beginners PDFDivaPas encore d'évaluation

- 4aa6 8608 PDFDocument4 pages4aa6 8608 PDFDanijelBaraPas encore d'évaluation

- Preparing General Data Protection RegulationDocument8 pagesPreparing General Data Protection RegulationGerman ClementePas encore d'évaluation

- Student Survey of TeacherDocument2 pagesStudent Survey of TeacherBlackSigmaPas encore d'évaluation

- DAM382 Information Systems Management PDFDocument244 pagesDAM382 Information Systems Management PDFDanijelBaraPas encore d'évaluation

- Critical Thinking Ch.1 DR - Robert Todd CarrollDocument27 pagesCritical Thinking Ch.1 DR - Robert Todd CarrollAbraxeses100% (2)

- Basics NarrationDocument23 pagesBasics NarrationDanijelBaraPas encore d'évaluation

- Course Work Hub1504 12 151449223999Document11 pagesCourse Work Hub1504 12 151449223999Fish de PaiePas encore d'évaluation

- Edutopia Student Feedback Survey PDFDocument1 pageEdutopia Student Feedback Survey PDFDanijelBaraPas encore d'évaluation

- HPD RunolistDocument12 pagesHPD RunolistDanijelBaraPas encore d'évaluation

- Design Thinking What It Is Owen Korea05Document17 pagesDesign Thinking What It Is Owen Korea05DanijelBaraPas encore d'évaluation

- Rhul Isg 2017 9 PayneDocument124 pagesRhul Isg 2017 9 PayneDanijelBaraPas encore d'évaluation

- TMT DATA Protection Survival Guide Singles PDFDocument56 pagesTMT DATA Protection Survival Guide Singles PDFDanijelBaraPas encore d'évaluation

- Camillo 2017Document12 pagesCamillo 2017DanijelBaraPas encore d'évaluation

- Bipar Commentary On GDPR - July 2016Document59 pagesBipar Commentary On GDPR - July 2016DanijelBaraPas encore d'évaluation

- Sysstems and Design ThinkingDocument18 pagesSysstems and Design ThinkingDanijelBaraPas encore d'évaluation

- TheWalletProjectB&W2012 PDFDocument7 pagesTheWalletProjectB&W2012 PDFDanijelBaraPas encore d'évaluation

- 02 Embedding DesignDocument4 pages02 Embedding DesignDanijelBaraPas encore d'évaluation

- Horizont 2016 - HPE - Robert Lejnart - Data Protection GDPRDocument39 pagesHorizont 2016 - HPE - Robert Lejnart - Data Protection GDPRDanijelBaraPas encore d'évaluation

- TheGiftGivingProjectB&W2012 PDFDocument6 pagesTheGiftGivingProjectB&W2012 PDFDanijelBaraPas encore d'évaluation

- Critical Thinking Assessment Practice QuizDocument7 pagesCritical Thinking Assessment Practice Quizdale2741830Pas encore d'évaluation

- Wolf TinsmanBarryDavis DesignThinkingWorkshopDocument66 pagesWolf TinsmanBarryDavis DesignThinkingWorkshopDanijelBaraPas encore d'évaluation

- Green Paper - EU GDPR Compliance Guide PDFDocument10 pagesGreen Paper - EU GDPR Compliance Guide PDFDanijelBara0% (1)

- Bird Bird Guide To The General Data Protection Regulation PDFDocument69 pagesBird Bird Guide To The General Data Protection Regulation PDFDanijelBaraPas encore d'évaluation

- Fractional Differential Equations: Bangti JinDocument377 pagesFractional Differential Equations: Bangti JinOmar GuzmanPas encore d'évaluation

- Pharmacy System Project PlanDocument8 pagesPharmacy System Project PlankkumarPas encore d'évaluation

- Venere Jeanne Kaufman: July 6 1947 November 5 2011Document7 pagesVenere Jeanne Kaufman: July 6 1947 November 5 2011eastendedgePas encore d'évaluation

- Cryptocurrency Research PDFDocument59 pagesCryptocurrency Research PDFAnupriyaPas encore d'évaluation

- 20 Ijrerd-C153Document9 pages20 Ijrerd-C153Akmaruddin Bin JofriPas encore d'évaluation

- How To Build Yam Chips Production PlantDocument11 pagesHow To Build Yam Chips Production PlantVu Thieu TuanPas encore d'évaluation

- Service M5X0G SMDocument98 pagesService M5X0G SMbiancocfPas encore d'évaluation

- Promoting The Conservation and Use of Under Utilized and Neglected Crops. 12 - TefDocument52 pagesPromoting The Conservation and Use of Under Utilized and Neglected Crops. 12 - TefEduardo Antonio Molinari NovoaPas encore d'évaluation

- Application of The Ritz Method To The Analysis of Non-Linear Free Vibrations of BeamsDocument12 pagesApplication of The Ritz Method To The Analysis of Non-Linear Free Vibrations of BeamsKuldeep BhattacharjeePas encore d'évaluation

- James KlotzDocument2 pagesJames KlotzMargaret ElwellPas encore d'évaluation

- Narrative FixDocument6 pagesNarrative Fixfitry100% (1)

- Robert Egby - DecreesDocument9 pagesRobert Egby - DecreesmuzickauePas encore d'évaluation

- Discrete Random Variables: 4.1 Definition, Mean and VarianceDocument15 pagesDiscrete Random Variables: 4.1 Definition, Mean and VariancejordyswannPas encore d'évaluation

- EffectivenessDocument13 pagesEffectivenessPhillip MendozaPas encore d'évaluation

- Security Policy 6 E CommerceDocument6 pagesSecurity Policy 6 E CommerceShikha MehtaPas encore d'évaluation

- Communication MethodDocument30 pagesCommunication MethodMisganaw GishenPas encore d'évaluation

- NHD Process PaperDocument2 pagesNHD Process Paperapi-122116050Pas encore d'évaluation

- The Story of An Hour QuestionpoolDocument5 pagesThe Story of An Hour QuestionpoolAKM pro player 2019Pas encore d'évaluation

- 3114 Entrance-Door-Sensor 10 18 18Document5 pages3114 Entrance-Door-Sensor 10 18 18Hamilton Amilcar MirandaPas encore d'évaluation

- CA Level 2Document50 pagesCA Level 2Cikya ComelPas encore d'évaluation

- Introduction To Human MovementDocument5 pagesIntroduction To Human MovementNiema Tejano FloroPas encore d'évaluation

- JSA FormDocument4 pagesJSA Formfinjho839Pas encore d'évaluation

- Sample Paper Book StandardDocument24 pagesSample Paper Book StandardArpana GuptaPas encore d'évaluation

- Cultural AnthropologyDocument12 pagesCultural AnthropologyTRISH BOCAPas encore d'évaluation

- Management of StutteringDocument182 pagesManagement of Stutteringpappu713100% (2)

- Module 17 Building and Enhancing New Literacies Across The Curriculum BADARANDocument10 pagesModule 17 Building and Enhancing New Literacies Across The Curriculum BADARANLance AustriaPas encore d'évaluation

- How Do I Predict Event Timing Saturn Nakshatra PDFDocument5 pagesHow Do I Predict Event Timing Saturn Nakshatra PDFpiyushPas encore d'évaluation