Académique Documents

Professionnel Documents

Culture Documents

Vat Online (Registration)

Transféré par

Tarun GuptaCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Vat Online (Registration)

Transféré par

Tarun GuptaDroits d'auteur :

Formats disponibles

NOTE:

NO NEED TO VISIT THE DEPARTMENT.

DEALER SHALL BE REGISTRED WITH THE DEPARTMENT ONLY ON

SUBMISSION OF ONLINE APPLICATION AND ATTACHING SELF

ATTESTED REQUISITE DOCUMENTS.

DEALER MUST ATTACH THE GENUINE MANDATORY SUPPORTING

DOCUMENTS

WITH

THE

APPLICATION.

IN

CASE,

ANY

INCONSISTENCY IS FOUND IN THE ATTACHED DOCUMENT(S) AT

THE TIME OF VERIFICATION/SCRUTITNY OF THE REGISTRATION,

THE SAME IS LIABLE TO BE CANCELED W.E.F. FROM THE DATE

OF REGISTRATION ITSELF. (PLEASE REFER TO CHECK LIST OF

SUPPORING DOCUMENTS IN FORM DVAT-04).

THE ATTACHED DOCUMENTS MUST BE SELF ATTESTED BY THE

PROPRIETOR/PARTNER/DIRECTOR/AUTHORISED SIGNATORY OF

THE FIRM.

ENSURE THAT THE SOFT COPY OF THE DOCUMENTS ARE READY FOR

UPLOADING BEFORE FILLING THE ONLINE DVAT -04.

GO THROUGH THE DETAILED INSTRUCTIONS BEFORE FILING UP THE

ONLINE FORM DVAT 04.

IN CASE OF ANY ASSISTANCE, PLEASE CONTACT THE DVAT

HELPDESK.

Note:

The Regular Registrations and TAN Registration are in fully automation

mode.

The Casual Registration shall continue in manual mode since the applicant

need to deposit security as may be fixed by the Commissioner which shall

not exceed estimated liability to pay tax for seven days or such lesser

period for which the casual trader is conducting the business in Delhi.

REGISTRATION:-

How to apply Online Registration:-

A) Pre-Verification

1.

Applicant is required to apply online through NEW REGISTRATION

link on the website http://dvat.gov.in.

2.

The basic details of dealer seeking registration viz PAN and UID / EID

of one Authorized representative / person having stake in business,

shall need to be furnished. After the submission of the same a

receipt shall be generated and sent on the registered mobile/E-mail

of the applicant.

3.

The applicant must ensure that while filling the forms, they MUST

furnish the valid and active E-mail IDs and mobile number as the

department will use electronic mode of communication while

contacting with them on the said registered e-mail IDs and mobile

number.

4.

On online-pre-verification of the same from the concerned agencies,

which may take upto 2-3 working days from the date of application.

On verification, subsequent SMS/email shall be sent to the applicant

for filling up of online DVAT-04 form.

5.

In case of non-verification an alert shall be pushed to the dealer for

entering the correct particulars.

B) Preparing Scan Documents and Photographs

1.

Before starting filling up of online application, the applicant must

have his/her/their photographs(s) and requisite scanned documents

in the .jpeg/.pdf format in such manner that each file should not

exceed 40 KB. However, it must not be less than 25 KB in size for the

photograph and 10 KB for the documents (also see guidelines for

uploading photograph and documents image)

2.

Photograph of all the persons involved in the business including

partners, directors, karta, authorized signatory, etc needs to be

uploaded, in the document link.

3.

The scanned copy of self attested documents regarding the business

premises viz ownership proof/ rent agreement, telephone bill,

electricity bill etc as applicable, needs to be uploaded.

4.

The scanned copy of self attested documents related to the

constitution of the firm in cases of partnership concern/ company

etc.

a. In case of partnership concern complete partnership deed

in single file.

b. In case of company - Certificate of incorporation and list of

directors in single file. The complete MOA (Memorandum

of Association) of the company is need not to be scanned

with the application, since, the VAT Inspector would collect it

separately, at the time of post registration visit.

5.

In case of mandatory registration

a. on account of Central Sales - scanned copy of self attested

first sale bill vide which central sale has been made and its

corresponding documents in support of movement of goods,

in a single file.

b. on account of crossing the threshold limit for registration scanned copy of self attested Trading Account as on date.

c. on sale of an imported goods (including interstate purchase)

- scanned copy of self attested purchase invoices and its

corresponding first sale invoice, in a single file.

6.

The scanned copy of self attested proof of identity of and all persons

having stake in the business and also of the authorized signatory

(if any) shall need to be attached separately . The proof of identity

would be any one of the following:

a. Voters registration,

b. Aadhar card

c. Passport etc.

7.

The scanned copy of self attested PAN card of all the persons

involved in the business.

C) Digital Signature

1.

The authorized signatory can sign the registration form digitally.

2.

In initial stage the same is made optional.

D) How to make payment

1.

Initially, the applicant shall pay the fees as per the manual procedure

by court fee mode.

The same shall be submitted to the VAT

Inspector at the time of his post registration visit.

E) Online Filing of Application

1.

Before start filling up of online application, the applicant must have

his/her/their photograph(s) and requisite scanned documents in

the .jpeg / .pdf format in such manner that each file should not

exceed 40 KB. However, it must not be less than 25 KB in size for the

photograph and 10 KB for the documents (also see guidelines for

uploading photograph and documents image).

2.

The applicant will be required to complete the online Application

For, the instructions of which are detailed below. The time cap to

fill / complete online application will be 120 minutes.

3.

The applicants must ensure that while filling their application

forms, they are providing their valid and active E-mail IDs and

mobile number as the department will use electronic mode of

communication while contacting with them on the said registered email IDs and mobile number.

4.

The applicant shall fill up DVAT-04 including Part A, Part B, Part C and

Part D.

5.

If the application opts for the composition scheme (at serial no 5 of

DVAT-04 Part-A) then the system will automatically show him Form

DVAT-01 / WC-01 / DM-01 / BU-01 to select any one of the form to

fill up as per his applicability and submit online.

6.

In case the applicant opts for (Local + Central registration), furnishing

of online Form A is compulsory.

7.

After furnishing all details, the applicant shall approve the data filled,

in approval link.

8.

On submitting the same, the department shall intimate the applicant

TIN allocated to him, a message shall be sent to the registered E-mail

Id/ mobile number.

F) Online DVAT-06

1.

The Registration order shall be sent online informing the TIN

number, password of its login etc.

2.

The DVAT-06, duly signed digitally, shall be pushed to the dealers

login after the verification report of the VAT Inspector. (within 15

days of the registration)

G) Validity of the Online Registration

1.

The online registration shall be granted to all applicants immediately

after submitting the application in this regard. All the columns of

the application are mandatory. The VAT Inspector concerned shall

carry out field verification of the business premises and additional

places of business premises after the grant of registration. The VAT

Inspector concerned shall verify all the particulars filled up by the

applicant and the documents attached there with. If the official

concerned finds any discrepancy viz a viz the documents attached

and the online information filled the registration granted is liable to

be cancelled. Therefore, all applicants are requested to fill up the

requisite and valid details in the respective columns. The registration

granted shall be blocked if the online verification report is not

updated in the system within 15 days of the grant of registration.

Vous aimerez peut-être aussi

- Factors Influencing Indian Iron and Steel IndustryDocument2 pagesFactors Influencing Indian Iron and Steel IndustrySmaran Pathak100% (1)

- Iron and Steel Industry in India PDFDocument15 pagesIron and Steel Industry in India PDFJyoti PannuPas encore d'évaluation

- Amazon PDFDocument14 pagesAmazon PDFTarun GuptaPas encore d'évaluation

- Financial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDocument30 pagesFinancial Statement Analysis: Presenter's Name Presenter's Title DD Month YyyyDammika MadusankaPas encore d'évaluation

- Account Transfer FormDocument2 pagesAccount Transfer FormTarun GuptaPas encore d'évaluation

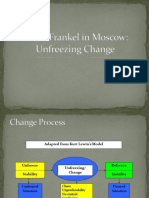

- Pierre Frankel in Moscow UnfreezingDocument14 pagesPierre Frankel in Moscow UnfreezingTarun Gupta100% (1)

- A Comprehensive Determination of Stock MovementsDocument16 pagesA Comprehensive Determination of Stock MovementsTarun GuptaPas encore d'évaluation

- C 0131421Document8 pagesC 0131421Tarun GuptaPas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5782)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- T. E. Audit Course ReportDocument17 pagesT. E. Audit Course ReportHarshalPas encore d'évaluation

- CDR Voluntary Application For ACR I-CardDocument1 pageCDR Voluntary Application For ACR I-CardFrodina Mafoxci RafananPas encore d'évaluation

- En CADCAM Bedienungsanleitung V1.4 WebDocument106 pagesEn CADCAM Bedienungsanleitung V1.4 WebDonghan Cho100% (1)

- Essential guide to operating and maintaining your vehicleDocument324 pagesEssential guide to operating and maintaining your vehiclezawhtetPas encore d'évaluation

- 46 XxsettingsDocument79 pages46 XxsettingsSabat CaPas encore d'évaluation

- Operator's Manual For Arc Welding: Motoman XRC 2001 ControllerDocument436 pagesOperator's Manual For Arc Welding: Motoman XRC 2001 ControllerAnonymous oTrMzaPas encore d'évaluation

- Free Software Guide-30.6Document36 pagesFree Software Guide-30.6Private InfringerPas encore d'évaluation

- Sample CodeDocument29 pagesSample CodeJERIN JOSEPas encore d'évaluation

- CIPP:A Blueprint PDFDocument2 pagesCIPP:A Blueprint PDFroruangPas encore d'évaluation

- ESE 2020 Notes Basics of Energy and EnvironmentDocument133 pagesESE 2020 Notes Basics of Energy and EnvironmentsubhajitPas encore d'évaluation

- West Bengal Municipal Service Commission 149, Acharya Jagadish Chandra Bose Road, Kolkata-700014 Admit CardDocument1 pageWest Bengal Municipal Service Commission 149, Acharya Jagadish Chandra Bose Road, Kolkata-700014 Admit CardArindam SarkarPas encore d'évaluation

- MG 42 Semi ManualDocument50 pagesMG 42 Semi Manualscout50100% (7)

- Rtu SpecificationsDocument12 pagesRtu SpecificationsSwat Guratai by javed Javed iqbalPas encore d'évaluation

- Hn-Mrn1U: 4G Mobile Router & Access Point 150 Mbps Wireless-N W/ USB Port Technical SupportDocument2 pagesHn-Mrn1U: 4G Mobile Router & Access Point 150 Mbps Wireless-N W/ USB Port Technical SupportalaaalmarashlyPas encore d'évaluation

- Juniper SRX IKEv2 EAP MD5 ConfigDocument57 pagesJuniper SRX IKEv2 EAP MD5 ConfigJohn SimonPas encore d'évaluation

- Instructions Attestration Auth Doc Cert Regional CommissionerDocument6 pagesInstructions Attestration Auth Doc Cert Regional CommissioneramdidgurPas encore d'évaluation

- Changing Paper Documentation To Electronic in Healthcare Name Institution DateDocument7 pagesChanging Paper Documentation To Electronic in Healthcare Name Institution DateSammy ChegePas encore d'évaluation

- Determining Unsupported Generalization and ExaggerationDocument13 pagesDetermining Unsupported Generalization and ExaggerationVenus Vedad Lamadrid80% (10)

- Dev OpsDocument11 pagesDev OpsKiran Wadeyar100% (1)

- Online Voting System SRSDocument9 pagesOnline Voting System SRSKamal chaudharyPas encore d'évaluation

- Library Management System SRSDocument9 pagesLibrary Management System SRSPraveen Kumar Verma100% (2)

- Authentication HandlerDocument5 pagesAuthentication HandlerSarah KaroriPas encore d'évaluation

- Image Steganography Using Mid Position Value TechniqueDocument7 pagesImage Steganography Using Mid Position Value TechniqueIhsan SabahPas encore d'évaluation

- Selection Table Type 2 CoordinationDocument7 pagesSelection Table Type 2 CoordinationVishal Patel100% (1)

- Daemon Process - Inetd and XinetdDocument7 pagesDaemon Process - Inetd and XinetdGeetRSBPas encore d'évaluation

- MOP TemplateDocument5 pagesMOP TemplateJamsheed Ali Khan100% (1)

- Autocom CDP Pro For Trucks Workable Trucks Models EngDocument624 pagesAutocom CDP Pro For Trucks Workable Trucks Models Engsausalp1998Pas encore d'évaluation

- NASA Cybersecurity Expert ProfileDocument2 pagesNASA Cybersecurity Expert ProfileBrie O'ConnorPas encore d'évaluation

- SAP LandscapeDocument3 pagesSAP LandscapekarunaduPas encore d'évaluation

- AwsDocument8 pagesAwskiranPas encore d'évaluation