Académique Documents

Professionnel Documents

Culture Documents

Sept 2015 Pork Exports PDF

Transféré par

rayv7770 évaluation0% ont trouvé ce document utile (0 vote)

10 vues1 pageChina increases pork imports by 17% yoy.

Titre original

Sept 2015 Pork Exports.pdf

Copyright

© © All Rights Reserved

Formats disponibles

PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentChina increases pork imports by 17% yoy.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

10 vues1 pageSept 2015 Pork Exports PDF

Transféré par

rayv777China increases pork imports by 17% yoy.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 1

Sponsored by

Vol. 13, No. 216 / November 5, 2015

The latest trade data conrmed what we already suspected,

export volumes in September were sharply lower, leaving more product

to be absorbed in domes c channels and adding to the downward price

pressures for beef and chicken. There are a number of factors that have

nega vely impacted US exports but we think the primary drivers are: a)

the strong US dollar; b) bird u restric ons; c) weaker demand in emerging markets due to slow or even nega ve growth; d) increased compe on from other supplying countries as well as overall expansion in global

supplies due to lower input costs. Below are the export highlights for

thethree main species:

Beef: Total exports of fresh/frozen and prepared beef in September

were 55,509 MT, 24.1% lower than a year ago. This is the lowest monthly

export volume since January. The slide in US beef exports reects a drama c decline in demand from two key markets: Japan and Hong Kong.

Exports of fresh/frozen and cooked beef to the Japanese market were

just 12,602 MT, 38% lower than a year ago. This follows a 39% decline in

export volume in August. The strong US dollar certainly has been an

impediment but it does not fully explain the erosion in Japanese demand.

A er all, Japan purchases of Australian beef, the other major supplier to

this market, were down 22.5% in August, 8.5% in September and 7.1% in

October. Rather, we think part of the reason is that prices for compe ng

meats have declined drama cally, impac ng beef demand. Beef exports

to Hong Kong were 7,552 MT, down 36% from a year ago. The decline in

shipments to Japan and Hong Kong explains about 2/3 of the overall drop

in US beef exports in September.

Pork: US pork exports rebounded in September, in line with the seasonal

increase in pork supplies. The increase was a bit larger than earlier speculated and we noted a signicant increase in pork exports to China. As

we have noted in the past, it is interes ng to point our that the weekly

pork exports somehow con nue to miss the volume of pork that goes to

China. Total exports of fresh/frozen and processed pork in September

were 138,400 MT, 17.5% higher than a year ago and the largest monthly

export volume since June. Exports to China in September were 10,086

MT compared to just 2,319 MT last year. However, keep in mind that in

September 2013 pork exports to China were 16,882 MT. Pork exports to

Japan were 31,589 MT, 22.5% higher than the same period a year ago but

at about the same level as in September 2013.

Chicken: Resump on of trade with South Korea certainly is welcome

news for the US chicken industry, which has struggled with stunted export markets this past summer. Total exports of fresh/frozen chicken

meat in September were 212,613 MT, down 58,422MT(-21.6%) from a

year ago. At the same me, chicken produc on in September was up

5.4% higher than last year. Exports to China, South Korea and Angola

were down a combined 21,808 MT (-57%) from last year. Bird u bans, a

strong US dollar and higher global output have impacted chicken trade.

US BEEF AND VEAL EXPORTS FRESH/FZ

metric ton

Source: FAS/USDA based on US Census Monthly Data

90,000

85,000

80,000

75,000

70,000

65,000

60,000

55,000

50,000

45,000

2011

2012

2013

2014

2015

40,000

US PORK EXPORTS: FRESH/FZ/PREPARED

metric ton

Source: FAS/USDA based on US Census Monthly Data

180,000

2012

2013

2014

2015

170,000

160,000

150,000

140,000

130,000

120,000

110,000

metric ton

US CHICKEN EXPORTS: FR/FROZ, METRIC TON

Source: FAS/USDA based on US Census Monthly Data

320,000

300,000

280,000

260,000

240,000

220,000

200,000

2012

2013

2014

2015

180,000

The Daily Livestock Report is made possible with support from readers like you. If you enjoy this report, find it valuable

and would like to sustain it going forward, consider becoming a contributor. Just go to www.DailyLivestockReport.com

to contribute by credit card or send your check to The Daily Livestock Report, P.O. Box 4872, Manchester, NH 03018

Thank you for your support!

The Daily Livestock Report is published by Steve Meyer & Len Steiner, Inc., Merrimack, NH. To subscribe, support or unsubscribe visit www.dailylivestockreport.com. Copyright 2015 Steve Meyer

and Len Steiner, Inc. All rights reserved.

The Daily Livestock Report is not owned, controlled, endorsed or sold by CME Group Inc. or its aliates and CME Group Inc. and its aliates disclaim any and all responsibility for the informa on

contained herein. CME Group, CME and the Globe logo are trademarks of Chicago Mercan le Exchange, Inc.

Disclaimer: The Daily Livestock Report is intended solely for informa on purposes and is not to be construed, under any circumstances, by implica on or otherwise, as an oer to sell or a solicitaon to buy or trade any commodi es or securi es whatsoever. Informa on is obtained from sources believed to be reliable, but is in no way guaranteed. No guarantee of any kind is implied or

possible where projec ons of future condi ons are a empted. Futures trading is not suitable for all investors, and involves the risk of loss. Past results are no indica on of future performance.

Futures are a leveraged investment, and because only a percentage of a contracts value is require to trade, it is possible to lose more than the amount of money ini ally deposited for a futures

posi on. Therefore, traders should only use funds that they can aord to lose without aec ng their lifestyle. And only a por on of those funds should be devoted to any one trade because a

trader cannot expect to prot on every trade.

Vous aimerez peut-être aussi

- GrainDocument42 pagesGrainrayv777Pas encore d'évaluation

- John Muir Trail RegulationsDocument2 pagesJohn Muir Trail Regulationsrayv777Pas encore d'évaluation

- U.S. Winter Wheat Condition March 2018Document41 pagesU.S. Winter Wheat Condition March 2018rayv777Pas encore d'évaluation

- DLR 03-21-2014 Pedv Chart HogsDocument1 pageDLR 03-21-2014 Pedv Chart Hogsrayv777Pas encore d'évaluation

- China Bans Pork ExportsDocument1 pageChina Bans Pork ExportsOmar ShamoutPas encore d'évaluation

- Hay and Range Land Values Ranch WyomingDocument40 pagesHay and Range Land Values Ranch Wyomingrayv777Pas encore d'évaluation

- Alfalfa Pasture Conditions 2014Document1 pageAlfalfa Pasture Conditions 2014rayv777Pas encore d'évaluation

- Total Meat & Poultry Production: Sponsored byDocument2 pagesTotal Meat & Poultry Production: Sponsored byrayv777Pas encore d'évaluation

- LakeTahoe BoatingDocument8 pagesLakeTahoe Boatingrayv777Pas encore d'évaluation

- HogslaughtervscutoutDocument1 pageHogslaughtervscutoutrayv777Pas encore d'évaluation

- AugustseasonalityDocument2 pagesAugustseasonalityrayv777Pas encore d'évaluation

- Leaves of Grass by Walt WhitmanDocument324 pagesLeaves of Grass by Walt WhitmanBooks100% (3)

- DLR 11-3-2009Document1 pageDLR 11-3-2009rayv777Pas encore d'évaluation

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Investigatory Project Pesticide From RadishDocument4 pagesInvestigatory Project Pesticide From Radishmax314100% (1)

- Exor EPF-1032 DatasheetDocument2 pagesExor EPF-1032 DatasheetElectromatePas encore d'évaluation

- Furnace ITV Color Camera: Series FK-CF-3712Document2 pagesFurnace ITV Color Camera: Series FK-CF-3712Italo Rodrigues100% (1)

- GIS Arrester PDFDocument0 pageGIS Arrester PDFMrC03Pas encore d'évaluation

- Lecture 1 Family PlanningDocument84 pagesLecture 1 Family PlanningAlfie Adam Ramillano100% (4)

- Paradigm Shift Essay 2Document17 pagesParadigm Shift Essay 2api-607732716Pas encore d'évaluation

- Variable Speed Pump Efficiency Calculation For Fluid Flow Systems With and Without Static HeadDocument10 pagesVariable Speed Pump Efficiency Calculation For Fluid Flow Systems With and Without Static HeadVũ Tuệ MinhPas encore d'évaluation

- ASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsDocument20 pagesASTM D256-10 - Standard Test Methods For Determining The Izod Pendulum Impact Resistance of PlasticsEng. Emílio DechenPas encore d'évaluation

- Diemberger CV 2015Document6 pagesDiemberger CV 2015TimPas encore d'évaluation

- AVANTIZ 2021 LNR125 (B927) EngineDocument16 pagesAVANTIZ 2021 LNR125 (B927) EngineNg Chor TeckPas encore d'évaluation

- Basf Masterseal 725hc TdsDocument2 pagesBasf Masterseal 725hc TdsshashiPas encore d'évaluation

- EnerSys Global Leader in Industrial BatteriesDocument32 pagesEnerSys Global Leader in Industrial BatteriesAshredPas encore d'évaluation

- Planview Innovation Management Maturity Model PDFDocument1 pagePlanview Innovation Management Maturity Model PDFMiguel Alfonso Mercado GarcíaPas encore d'évaluation

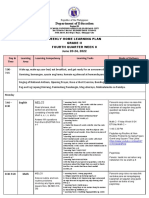

- Department of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Document8 pagesDepartment of Education: Weekly Home Learning Plan Grade Ii Fourth Quarter Week 8Evelyn DEL ROSARIOPas encore d'évaluation

- Product CycleDocument2 pagesProduct CycleoldinaPas encore d'évaluation

- ULN2001, ULN2002 ULN2003, ULN2004: DescriptionDocument21 pagesULN2001, ULN2002 ULN2003, ULN2004: Descriptionjulio montenegroPas encore d'évaluation

- The Sound Collector - The Prepared Piano of John CageDocument12 pagesThe Sound Collector - The Prepared Piano of John CageLuigie VazquezPas encore d'évaluation

- Cold Forging Process TutorialDocument28 pagesCold Forging Process TutorialpanyamnrPas encore d'évaluation

- Drafting TechnologyDocument80 pagesDrafting Technologyong0625Pas encore d'évaluation

- Feasibility StudyDocument47 pagesFeasibility StudyCyril Fragata100% (1)

- Insize Catalogue 2183,2392Document1 pageInsize Catalogue 2183,2392calidadcdokepPas encore d'évaluation

- Symmetry (Planes Of)Document37 pagesSymmetry (Planes Of)carolinethami13Pas encore d'évaluation

- Computer Portfolio (Aashi Singh)Document18 pagesComputer Portfolio (Aashi Singh)aashisingh9315Pas encore d'évaluation

- ROM Flashing Tutorial For MTK Chipset PhonesDocument5 pagesROM Flashing Tutorial For MTK Chipset PhonesAriel RodriguezPas encore d'évaluation

- Lecture 4Document25 pagesLecture 4ptnyagortey91Pas encore d'évaluation

- Weir Stability Analysis Report PDFDocument47 pagesWeir Stability Analysis Report PDFSubodh PoudelPas encore d'évaluation

- CGV 18cs67 Lab ManualDocument45 pagesCGV 18cs67 Lab ManualNagamani DPas encore d'évaluation

- The Learners Demonstrate An Understanding Of: The Learners Should Be Able To: The Learners Should Be Able ToDocument21 pagesThe Learners Demonstrate An Understanding Of: The Learners Should Be Able To: The Learners Should Be Able ToBik Bok50% (2)

- Emerson Park Master Plan 2015 DraftDocument93 pagesEmerson Park Master Plan 2015 DraftRyan DeffenbaughPas encore d'évaluation

- SQL Server 2008 Failover ClusteringDocument176 pagesSQL Server 2008 Failover ClusteringbiplobusaPas encore d'évaluation