Académique Documents

Professionnel Documents

Culture Documents

United States District Court District of Nebraska

Transféré par

scion.scionDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

United States District Court District of Nebraska

Transféré par

scion.scionDroits d'auteur :

Formats disponibles

8:15-cv-00317-LES-TDT Doc # 74 Filed: 11/09/15 Page 1 of 4 - Page ID # 475

UNITED STATES DISTRICT COURT

DISTRICT OF NEBRASKA

COR CLEARING, LLC, a Delaware limited liability ) Case No. 8:15-cv-00317-LES-FG3

company,

)

)

)

)

Plaintiff,

)

)

vs.

)

)

CALISSSIO RESOURCES, GROUP, INC., a

)

Nevada corporation; ADAM CARTER, an

)

SUPPLEMENTAL REPLY

individual; SIGNATURE STOCK TRANSFER,

)

INC., a Texas corporation; and DOES 1-50.

)

)

)

Defendants.

On November 3, 3015, Plaintiff COR Clearing, LLC (COR Clearing), submitted its

Omnibus Reply in Support of its Expedited Motion to Appoint Receiver. (Dkt. No. 51.)

Subsequent to that filing, a number of individuals lodged objections to the appointment of the

receiver. (See Dkt. Nos. 55, 56, 59-64, 66-68.) In the main, these objectors argue that the

receiver would cause them harm by undoing dividend payments that those shareholders had

already received. COR Clearing briefly supplements its reply, as follows:

First, it is not necessarily the case that the appointment of the receiver will impact

shareholders. Reversing the debit to COR Clearings accounts would unquestionably reverse the

credit of the respective DTCC member firms which previously received an unearned windfall

from COR Clearing; the receiver, standing in the shoes of Calissio, would implicate DTCCmember firm responsibilities. The receiver would not make any direct decisions as to any

dividend received by a shareholder, and it does not necessarily follow that all or any of the

8:15-cv-00317-LES-TDT Doc # 74 Filed: 11/09/15 Page 2 of 4 - Page ID # 476

shareholders will be impacted by the reversal of the member firms credits. In one instance, the

member firm immediately froze its customer accounts pending resolution of this lawsuit. In

another instance, the member firm may choose not to reverse the credit to its customers without a

court order, a possibility acknowledged by TD Ameritrade. (Dkt. No. 42-1 p.4, n.1.) Member

firms understand that by allowing their customers to trade in the speculative penny-stock market

they take on certain risks and responsibilities. If a customer would otherwise be harmed by

undoing a dividend to which she was not entitled, then the member firm may determine that it

cannot undo that transaction because of its legal responsibilities to its customers. In either case,

those decisions are between the member firm and its customers; COR Clearing is not a guarantor

of the member firms responsibilities to their customers. Ultimately, the fact that only one of the

67 member firms which received notice of this motion objected to the relief sought by COR

Clearing undermines the contention that there will be a concomitant harm to shareholders.

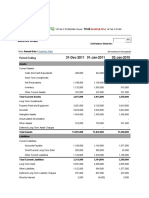

Second, and in any event, shareholders were on notice that the dividend was a windfall,

as the amount of the dividend exceeded the purchase price of the shares, typically by a wide

margin. Each shareholder who purchased a share subject to this action (i.e., shares ineligible to

receive a dividend) did so at less than the amount of the dividend per share. (Hilgers Decl., Ex.

A) (showing the high and low share price over the subject time period). The dividend was fixed

at $.011 per share, and the share price never exceeded that amount during the relevant time

period. Instead, the share price often traded at a bare fraction of the dividend amount. For

example, if a hypothetical buyer purchased $1,500 worth of stock at a price of $0.0015/share

(which is within the real-world share price ranges for Calissio stock during the relevant time

period) from Nobilis or Beaufort, and then (erroneously) received a $0.011/share dividend, that

shareholder would have received a dividend of $11,000 in just a matter of days.

8:15-cv-00317-LES-TDT Doc # 74 Filed: 11/09/15 Page 3 of 4 - Page ID # 477

Third, while the appointment of the receiver might undo this patently erroneous windfall,

it would not undo the purchase of Calisso stock in the first instance. What the shareholders

bargained for were shares of Calissio to which a dividend right did not attach. By reversing the

unearned dividend, the shareholders will still be left with precisely that which they purchased

shares of Calissio to which a dividend right does not attach.

Fourth, and finally, none of the subject shareholders who purchased shares from either

Nobilis or Beaufort have contended, nor could they, that the reversal of dividends would reverse

a payment to which the shareholder would otherwise be entitled. These funds were

inappropriately debited from COR Clearings customers accounts, and neither the DTCC

member firms nor their customers have any legal claim to those monies.

For all of the reasons stated herein and in previous filings with the Court, COR Clearing

respectfully requests that the Court grant the Motion.

Respectfully submitted,

Dated: November 9, 2015

By: s/ _Michael T. Hilgers_________

Michael T. Hilgers (#24483)

Carrie S. Dolton (#24221)

GOBER HILGERS PLLC

14301 FNB Parkway, Suite 100

Omaha, NE 68154

Telephone: 402.218.2106

Facsimile: 877.437.5755

mhilgers@goberhilgers.com

cdolton@goberhilgers.com

ATTORNEYS FOR PLAINTIFF COR

CLEARING, LLC

8:15-cv-00317-LES-TDT Doc # 74 Filed: 11/09/15 Page 4 of 4 - Page ID # 478

CERTIFICATE OF SERVICE

The undersigned hereby certifies that on this 9th day of November 2015, a true and correct

copy of the foregoing was filed via the Courts CM/ECF System, and was served on all counsel of

record.

_s/ Michael T. Hilgers_______________

Vous aimerez peut-être aussi

- 'Ol50C PH: Dist ICDocument9 pages'Ol50C PH: Dist ICscion.scionPas encore d'évaluation

- Order Cert ClassDocument12 pagesOrder Cert Classjmaglich1Pas encore d'évaluation

- Defense of Collection Cases Edelman, (2007)Document43 pagesDefense of Collection Cases Edelman, (2007)Jillian Sheridan100% (2)

- United States Court of Appeals, Tenth CircuitDocument4 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- Goldberg V Malik - Settlement Agreementt in Fraud Ponzi-Related CaseDocument10 pagesGoldberg V Malik - Settlement Agreementt in Fraud Ponzi-Related CaseArchive ItPas encore d'évaluation

- DC v. Commanders ComplaintDocument8 pagesDC v. Commanders ComplaintStephen WhynoPas encore d'évaluation

- PrecedentialDocument17 pagesPrecedentialScribd Government DocsPas encore d'évaluation

- Negotiable Instruments Case DigestDocument6 pagesNegotiable Instruments Case DigestDianne Esidera RosalesPas encore d'évaluation

- Arthur v. Ticor Title Ins. Co. of Florida, 569 F.3d 154, 4th Cir. (2009)Document13 pagesArthur v. Ticor Title Ins. Co. of Florida, 569 F.3d 154, 4th Cir. (2009)Scribd Government DocsPas encore d'évaluation

- Daniel W. Deming, Arthur M. Hill, II v. Kanawha City Company Roxalana Land Company United National Bank, Successor by Merger to the Kanawha Banking & Trust Co., N.A., and I.N. Smith, Jr. W.N. Shearer Frederick L. Thomas, Jr. Junius T. Moore W. Marston Becker Kenneth M. Dunn David M. Giltinan, Jr. William M. Smith Lawson W. Hamilton, Jr. Joseph C. Jefferds D.C. Malcolm John F. McGee Robert B. Orders, Sr. Gerald E. Ray Claud M. Wilcher, Jr. F.M. Winterholler Eliza M. Smith Stuart L. Smith Mary Delle Thomas Charles L. Jarrell Everett C. Call William H. Carter Intermountain Bank-Shares, Inc. Kanawha Company West Virginia Coal Land Company, 852 F.2d 565, 4th Cir. (1988)Document4 pagesDaniel W. Deming, Arthur M. Hill, II v. Kanawha City Company Roxalana Land Company United National Bank, Successor by Merger to the Kanawha Banking & Trust Co., N.A., and I.N. Smith, Jr. W.N. Shearer Frederick L. Thomas, Jr. Junius T. Moore W. Marston Becker Kenneth M. Dunn David M. Giltinan, Jr. William M. Smith Lawson W. Hamilton, Jr. Joseph C. Jefferds D.C. Malcolm John F. McGee Robert B. Orders, Sr. Gerald E. Ray Claud M. Wilcher, Jr. F.M. Winterholler Eliza M. Smith Stuart L. Smith Mary Delle Thomas Charles L. Jarrell Everett C. Call William H. Carter Intermountain Bank-Shares, Inc. Kanawha Company West Virginia Coal Land Company, 852 F.2d 565, 4th Cir. (1988)Scribd Government DocsPas encore d'évaluation

- United States Bankruptcy Court For The District of ColoradoDocument7 pagesUnited States Bankruptcy Court For The District of ColoradoChapter 11 DocketsPas encore d'évaluation

- Case Digests Atty CabochanDocument38 pagesCase Digests Atty CabochanAthena Lajom100% (1)

- Vdocuments - MX - Case Digests Atty CabochanDocument38 pagesVdocuments - MX - Case Digests Atty CabochanRhuejane Gay MaquilingPas encore d'évaluation

- Theofanis Dardaganis, Harry Eagleberg, Martin Geller, Arthur Kotoros, Paul Raphael, Philip Simadiris, as Trustees of the Retirement Fund of the Fur Manufacturing Industry v. Grace Capital Inc. And H. David Grace, 889 F.2d 1237, 2d Cir. (1989)Document12 pagesTheofanis Dardaganis, Harry Eagleberg, Martin Geller, Arthur Kotoros, Paul Raphael, Philip Simadiris, as Trustees of the Retirement Fund of the Fur Manufacturing Industry v. Grace Capital Inc. And H. David Grace, 889 F.2d 1237, 2d Cir. (1989)Scribd Government DocsPas encore d'évaluation

- Chiquita's Opposition To Conrad & Scherer's Motion To Withdraw As CounselDocument11 pagesChiquita's Opposition To Conrad & Scherer's Motion To Withdraw As CounselPaulWolfPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument8 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Ninth CircuitDocument8 pagesUnited States Court of Appeals, Ninth CircuitScribd Government DocsPas encore d'évaluation

- COR Clearing, LLC v. Calissio Resources Group, Inc. Et Al Doc 53 Filed 03 Nov 15Document2 pagesCOR Clearing, LLC v. Calissio Resources Group, Inc. Et Al Doc 53 Filed 03 Nov 15scion.scionPas encore d'évaluation

- Federal Deposit Insurance Corporation, in Its Corporate Capacity v. Ernest P. Jenkins, Lynne Hardin, 888 F.2d 1537, 11th Cir. (1989)Document16 pagesFederal Deposit Insurance Corporation, in Its Corporate Capacity v. Ernest P. Jenkins, Lynne Hardin, 888 F.2d 1537, 11th Cir. (1989)Scribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Eighth CircuitDocument7 pagesUnited States Court of Appeals, Eighth CircuitScribd Government DocsPas encore d'évaluation

- Santos-Rodriguez v. Doral Mortgage Corp, 485 F.3d 12, 1st Cir. (2007)Document10 pagesSantos-Rodriguez v. Doral Mortgage Corp, 485 F.3d 12, 1st Cir. (2007)Scribd Government DocsPas encore d'évaluation

- Filed: Patrick FisherDocument26 pagesFiled: Patrick FisherScribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Fourth CircuitDocument13 pagesUnited States Court of Appeals, Fourth CircuitScribd Government Docs100% (1)

- United States Court of Appeals, Third CircuitDocument7 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsPas encore d'évaluation

- Woods v. City Nat. Bank & Trust Co. of Chicago, 312 U.S. 262 (1941)Document7 pagesWoods v. City Nat. Bank & Trust Co. of Chicago, 312 U.S. 262 (1941)Scribd Government DocsPas encore d'évaluation

- 8 - in Re Uni-Marts, LLCDocument4 pages8 - in Re Uni-Marts, LLCJun MaPas encore d'évaluation

- United States Court of Appeals, Sixth CircuitDocument3 pagesUnited States Court of Appeals, Sixth CircuitScribd Government DocsPas encore d'évaluation

- Fed. Sec. L. Rep. P 95,475 David B. Kusner v. First Pennsylvania Corporation, 531 F.2d 1234, 1st Cir. (1976)Document9 pagesFed. Sec. L. Rep. P 95,475 David B. Kusner v. First Pennsylvania Corporation, 531 F.2d 1234, 1st Cir. (1976)Scribd Government DocsPas encore d'évaluation

- NEGO - Casedigest - 1st - 2nd WeekDocument17 pagesNEGO - Casedigest - 1st - 2nd WeekFrancisco MarvinPas encore d'évaluation

- Osenbach v. Commissioner of Internal Revenue, 198 F.2d 235, 4th Cir. (1952)Document5 pagesOsenbach v. Commissioner of Internal Revenue, 198 F.2d 235, 4th Cir. (1952)Scribd Government DocsPas encore d'évaluation

- Traders Royal Bank v. Court of AppealsDocument13 pagesTraders Royal Bank v. Court of Appealslovekimsohyun89Pas encore d'évaluation

- First American National Bank of Nashville v. United States, 467 F.2d 1098, 1st Cir. (1972)Document6 pagesFirst American National Bank of Nashville v. United States, 467 F.2d 1098, 1st Cir. (1972)Scribd Government DocsPas encore d'évaluation

- Rimstad Court OrderDocument13 pagesRimstad Court OrderStephen DibertPas encore d'évaluation

- Not PrecedentialDocument11 pagesNot PrecedentialScribd Government DocsPas encore d'évaluation

- In Re Walter J. Giller, JR., M.D., Debtor. First National Bank of El Dorado v. Walter J. Giller, JR., M.D., P.A., 962 F.2d 796, 1st Cir. (1992)Document4 pagesIn Re Walter J. Giller, JR., M.D., Debtor. First National Bank of El Dorado v. Walter J. Giller, JR., M.D., P.A., 962 F.2d 796, 1st Cir. (1992)Scribd Government DocsPas encore d'évaluation

- Receivers Second Interim Report Regading Status of ReceivershipDocument26 pagesReceivers Second Interim Report Regading Status of ReceivershipcburnellPas encore d'évaluation

- Demanding A Bill of Particulars in California LitigationDocument3 pagesDemanding A Bill of Particulars in California LitigationStan Burman50% (2)

- United States Court of Appeals, Tenth CircuitDocument8 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States District Court Northern District of Illinois: Usactive 27104550.15Document45 pagesUnited States District Court Northern District of Illinois: Usactive 27104550.15DinSFLAPas encore d'évaluation

- McCarter v. Kovitz Shifrin NesbitDocument18 pagesMcCarter v. Kovitz Shifrin NesbitKennethPas encore d'évaluation

- In Re McGann Mfg. Co., Inc, 188 F.2d 110, 3rd Cir. (1951)Document4 pagesIn Re McGann Mfg. Co., Inc, 188 F.2d 110, 3rd Cir. (1951)Scribd Government DocsPas encore d'évaluation

- Urot - CaseDigest 3Document6 pagesUrot - CaseDigest 3Walpurgis NightPas encore d'évaluation

- Jean T. Terkildsen, Formerly Doing Business Under the Firm Name and Style of Singer and Carlberg, Plaintiff-Appellant-Appellee v. Eric H. Waters, Defendants-Appellees-Appellants, 481 F.2d 201, 2d Cir. (1973)Document7 pagesJean T. Terkildsen, Formerly Doing Business Under the Firm Name and Style of Singer and Carlberg, Plaintiff-Appellant-Appellee v. Eric H. Waters, Defendants-Appellees-Appellants, 481 F.2d 201, 2d Cir. (1973)Scribd Government DocsPas encore d'évaluation

- 01 - Capital Insurance and Surety Co Vs Del Monte WorksDocument24 pages01 - Capital Insurance and Surety Co Vs Del Monte WorksthelawanditscomplexitiesPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument6 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- United States Court of Appeals, Tenth CircuitDocument10 pagesUnited States Court of Appeals, Tenth CircuitScribd Government DocsPas encore d'évaluation

- In the Matter of Seminole Park and Fairgrounds, Inc., Bankrupt. Robert Dyer, Trustee, Seminole Park and Fairgrounds, Inc. v. First National Bank at Orlando, Indenture Trustee, 502 F.2d 1011, 1st Cir. (1974)Document7 pagesIn the Matter of Seminole Park and Fairgrounds, Inc., Bankrupt. Robert Dyer, Trustee, Seminole Park and Fairgrounds, Inc. v. First National Bank at Orlando, Indenture Trustee, 502 F.2d 1011, 1st Cir. (1974)Scribd Government DocsPas encore d'évaluation

- University of Michigan Journal of Law Reform University of Michigan Journal of Law ReformDocument33 pagesUniversity of Michigan Journal of Law Reform University of Michigan Journal of Law ReformMohd FaqrisPas encore d'évaluation

- COR Clearing, LLC v. Calissio Resources Group, Inc. Et Al Doc 76 Filed 09 Nov 15Document1 pageCOR Clearing, LLC v. Calissio Resources Group, Inc. Et Al Doc 76 Filed 09 Nov 15scion.scionPas encore d'évaluation

- Intro Certainty in Chain of Title Debt Paper (2011)Document8 pagesIntro Certainty in Chain of Title Debt Paper (2011)Jillian SheridanPas encore d'évaluation

- Bodzianowski-D's Reply To Their MTD For Lack of Standing, 10-4-11-1Document15 pagesBodzianowski-D's Reply To Their MTD For Lack of Standing, 10-4-11-1Jeremiah HartPas encore d'évaluation

- Second Circuit Ruling in CSX CaseDocument74 pagesSecond Circuit Ruling in CSX CaseDealBookPas encore d'évaluation

- Second Amended PetitionDocument12 pagesSecond Amended PetitionDan PrimackPas encore d'évaluation

- In Re Cross Baking Co., Inc., Debtor. New Hampshire Business Development Corporation v. Cross Baking Company, Inc., 818 F.2d 1027, 1st Cir. (1987)Document11 pagesIn Re Cross Baking Co., Inc., Debtor. New Hampshire Business Development Corporation v. Cross Baking Company, Inc., 818 F.2d 1027, 1st Cir. (1987)Scribd Government DocsPas encore d'évaluation

- Dill Oil Company, LLC v. Stephens, 10th Cir. (2013)Document15 pagesDill Oil Company, LLC v. Stephens, 10th Cir. (2013)Scribd Government DocsPas encore d'évaluation

- Collection Defense Edelman 062407Document40 pagesCollection Defense Edelman 062407jsquitieri100% (1)

- Fresh Produce Bankruptcy MotionDocument32 pagesFresh Produce Bankruptcy MotionMatt SebastianPas encore d'évaluation

- Fight Debt Collectors and Win: Win the Fight With Debt CollectorsD'EverandFight Debt Collectors and Win: Win the Fight With Debt CollectorsÉvaluation : 5 sur 5 étoiles5/5 (12)

- Case 18-11291-LSS Doc 17 Filed 01 Oct 18Document2 pagesCase 18-11291-LSS Doc 17 Filed 01 Oct 18scion.scionPas encore d'évaluation

- Internet Research Agency Indictment PDFDocument37 pagesInternet Research Agency Indictment PDFscion.scionPas encore d'évaluation

- USA v. Cedeno Et Al Doc 3Document1 pageUSA v. Cedeno Et Al Doc 3scion.scionPas encore d'évaluation

- Internet Research Agency Indictment PDFDocument37 pagesInternet Research Agency Indictment PDFscion.scionPas encore d'évaluation

- USA v. Cedeno Et Al Doc 3-1Document24 pagesUSA v. Cedeno Et Al Doc 3-1scion.scionPas encore d'évaluation

- Internet Research Agency Indictment PDFDocument37 pagesInternet Research Agency Indictment PDFscion.scionPas encore d'évaluation

- Case 18-11291-LSS Doc 17-1 Filed 01 Oct 18Document18 pagesCase 18-11291-LSS Doc 17-1 Filed 01 Oct 18scion.scionPas encore d'évaluation

- Samsung Galaxy Smartphone Marketing and Sales Practices Litigation. - Amended ComplaintDocument55 pagesSamsung Galaxy Smartphone Marketing and Sales Practices Litigation. - Amended Complaintscion.scionPas encore d'évaluation

- USA v. Jaclin Doc 1 - Filed 18 May 17Document24 pagesUSA v. Jaclin Doc 1 - Filed 18 May 17scion.scion0% (1)

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.a - Doc 34 Filed 24 Mar 17Document84 pagesPaul Stockinger Et Al v. Toyota Motor Sales, U.S.a - Doc 34 Filed 24 Mar 17scion.scionPas encore d'évaluation

- USA v. Shkreli Et Al Doc 260Document1 pageUSA v. Shkreli Et Al Doc 260scion.scionPas encore d'évaluation

- SEC v. Imran Husain Et Al Doc 48 Filed 15 Mar 17Document14 pagesSEC v. Imran Husain Et Al Doc 48 Filed 15 Mar 17scion.scionPas encore d'évaluation

- USA v. Jaclin Doc 4 - Filed 22 May 17Document1 pageUSA v. Jaclin Doc 4 - Filed 22 May 17scion.scionPas encore d'évaluation

- SEC v. Miller - Doc 1 Filed 13 Mar 17Document9 pagesSEC v. Miller - Doc 1 Filed 13 Mar 17scion.scionPas encore d'évaluation

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28-1 Filed 03 Mar 17Document36 pagesPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28-1 Filed 03 Mar 17scion.scionPas encore d'évaluation

- P10 Industries, Inc. Bankruptcy Petition 17-50635-Cag - Doc 1 Filed 22 Mar 17Document52 pagesP10 Industries, Inc. Bankruptcy Petition 17-50635-Cag - Doc 1 Filed 22 Mar 17scion.scionPas encore d'évaluation

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A., Inc Doc 32 Filed 13 Mar 17 PDFDocument4 pagesPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A., Inc Doc 32 Filed 13 Mar 17 PDFscion.scionPas encore d'évaluation

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A., Inc Doc 32 Filed 13 Mar 17 PDFDocument4 pagesPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A., Inc Doc 32 Filed 13 Mar 17 PDFscion.scionPas encore d'évaluation

- Cor Clearing LLC V Calissio Resources Doc 171 Filed 25 Jan 17Document2 pagesCor Clearing LLC V Calissio Resources Doc 171 Filed 25 Jan 17scion.scionPas encore d'évaluation

- Cemtrex, Inc. v. Pearson Et Al Doc 1 Filed 06 Mar 17Document19 pagesCemtrex, Inc. v. Pearson Et Al Doc 1 Filed 06 Mar 17scion.scionPas encore d'évaluation

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 1 Filed 03 Jan 17Document81 pagesPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 1 Filed 03 Jan 17scion.scionPas encore d'évaluation

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28 Filed 03 Mar 17Document3 pagesPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28 Filed 03 Mar 17scion.scionPas encore d'évaluation

- Paul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28-2 Filed 03 Mar 17Document8 pagesPaul Stockinger Et Al v. Toyota Motor Sales, U.S.A - Doc 28-2 Filed 03 Mar 17scion.scionPas encore d'évaluation

- Cor Clearing LLC V Calissio Resources Doc 171-1 Filed 25 Jan 17Document21 pagesCor Clearing LLC V Calissio Resources Doc 171-1 Filed 25 Jan 17scion.scionPas encore d'évaluation

- USA v. Fernandez Et Al Doc 487 Filed 02 Nov 16Document16 pagesUSA v. Fernandez Et Al Doc 487 Filed 02 Nov 16scion.scionPas encore d'évaluation

- USA v. RaPower-3 Et Al Doc 73 Filed 01 Aug 16 PDFDocument12 pagesUSA v. RaPower-3 Et Al Doc 73 Filed 01 Aug 16 PDFscion.scionPas encore d'évaluation

- Holtzbrinck JudgmentDocument6 pagesHoltzbrinck Judgmentscion.scionPas encore d'évaluation

- SEC v. Imran Husain Et Al Doc 33 Filed 22 Nov 16Document61 pagesSEC v. Imran Husain Et Al Doc 33 Filed 22 Nov 16scion.scionPas encore d'évaluation

- USA v. Fernandez Et Al Doc 484 Filed 03 Oct 16Document1 pageUSA v. Fernandez Et Al Doc 484 Filed 03 Oct 16scion.scionPas encore d'évaluation

- USA v. Affa Et Al Doc 173 Filed 19 Feb 16Document4 pagesUSA v. Affa Et Al Doc 173 Filed 19 Feb 16scion.scionPas encore d'évaluation

- 2.6 Oseen's Improvement For Slow Flow Past A CylinderDocument6 pages2.6 Oseen's Improvement For Slow Flow Past A CylinderRatovoarisoaPas encore d'évaluation

- Redress SchemeDocument164 pagesRedress SchemePhebePas encore d'évaluation

- SSGC Bill JunDocument1 pageSSGC Bill Junshahzaib azamPas encore d'évaluation

- Partnership DeedDocument13 pagesPartnership DeedChintan NaikwadePas encore d'évaluation

- Sept. 2021 INSET Notice and Minutes of MeetingDocument8 pagesSept. 2021 INSET Notice and Minutes of MeetingSonny MatiasPas encore d'évaluation

- 2013 The Spirit of Corporate Law - Core Principles of Corporate Law in Continental Europe PDFDocument3 pages2013 The Spirit of Corporate Law - Core Principles of Corporate Law in Continental Europe PDFbdsrl0% (1)

- Decongestion of PNP Lock-Up Cells DTD August 14, 2012 PDFDocument3 pagesDecongestion of PNP Lock-Up Cells DTD August 14, 2012 PDFjoriliejoyabPas encore d'évaluation

- App3 Flexographic Ink Formulations and StructuresDocument58 pagesApp3 Flexographic Ink Formulations and StructuresMilos Papic100% (2)

- Cbo Score of The Aca - FinalDocument364 pagesCbo Score of The Aca - FinalruttegurPas encore d'évaluation

- Libcompiler Rt-ExtrasDocument2 pagesLibcompiler Rt-ExtrasNehal AhmedPas encore d'évaluation

- Critical CriminologyDocument20 pagesCritical CriminologyJashan100% (1)

- United States Court of Appeals Fourth CircuitDocument5 pagesUnited States Court of Appeals Fourth CircuitScribd Government DocsPas encore d'évaluation

- Document - 2019-12-20T133208.945 PDFDocument2 pagesDocument - 2019-12-20T133208.945 PDFMina JoonPas encore d'évaluation

- Land Tits Digest Republic V MendozaDocument2 pagesLand Tits Digest Republic V MendozaJustineMaeMadroñal67% (3)

- AptitudeDocument2 pagesAptitudedodaf78186Pas encore d'évaluation

- Questions and Every Right Explained in Simple Words in A Dialect or Language Known To The Person Under InvestigationDocument2 pagesQuestions and Every Right Explained in Simple Words in A Dialect or Language Known To The Person Under InvestigationMark MlsPas encore d'évaluation

- The Seven Ignored Messages of JesusDocument4 pagesThe Seven Ignored Messages of JesusBarry OpsethPas encore d'évaluation

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaPas encore d'évaluation

- Portrayal of Women in Outdoor Advertising.Document33 pagesPortrayal of Women in Outdoor Advertising.Ali ChaganiPas encore d'évaluation

- Edgar Cokaliong Shipping Lines vs. UCPB General InsuranceDocument6 pagesEdgar Cokaliong Shipping Lines vs. UCPB General InsuranceVincent BernardoPas encore d'évaluation

- Part List Ms 840Document32 pagesPart List Ms 840ZANDY ARIALDO VELANDIAPas encore d'évaluation

- WHO COVID-19 SITUATION REPORT FOR July 13, 2020Document16 pagesWHO COVID-19 SITUATION REPORT FOR July 13, 2020CityNewsTorontoPas encore d'évaluation

- Top Ten IT FailuresDocument1 pageTop Ten IT Failuresjason_carter_33Pas encore d'évaluation

- Affinity (Medieval) : OriginsDocument4 pagesAffinity (Medieval) : OriginsNatia SaginashviliPas encore d'évaluation

- Retraction of Dr. Jose Rizal (UNIT 4 WEEK 12)Document2 pagesRetraction of Dr. Jose Rizal (UNIT 4 WEEK 12)Marestel SivesindPas encore d'évaluation

- Assignment - The Universal Declaration of Human RightsDocument5 pagesAssignment - The Universal Declaration of Human RightsMarina PavlovaPas encore d'évaluation

- Applicti9n of Tcs - NQT - V1 - Bundle PackDocument17 pagesApplicti9n of Tcs - NQT - V1 - Bundle PackGopal Jee MishraPas encore d'évaluation

- CISCO NEXUS 3000 Command ReferencesDocument168 pagesCISCO NEXUS 3000 Command ReferencesLion Oxo TsaQif100% (1)

- The Transfer of Property Act 1882Document7 pagesThe Transfer of Property Act 1882harshad nickPas encore d'évaluation

- Core ScientificDocument8 pagesCore ScientificRob PortPas encore d'évaluation