Académique Documents

Professionnel Documents

Culture Documents

DPM VN Company Update A Beneficiary of Low Oil Price 05-10-2015

Transféré par

Hạnh CaoDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

DPM VN Company Update A Beneficiary of Low Oil Price 05-10-2015

Transféré par

Hạnh CaoDroits d'auteur :

Formats disponibles

SSI RESEARCH

INSTITUTIONAL RESEARCH & INVESTMENT ADVISORY

Petrovietnam Fertilizer and Chemicals Corporation (DPM: HOSE)

HOLD 1Y Target Price: VND 36,900

Current price: VND 31,600

Kien Tran Nguyen

A beneficiary of low oil price

kiennt1@ssi.com.vn

2Q15s earnings results

+84 4 3936 6321 ext. 679

05 October 2015

MATERIALS - VIETNAM

Key figures

Market cap (USD mn)

534

Market cap (VND bn)

12,006

Outstanding shares (mn)

380

52W high/low (VND 1,000)

33.8/28.5

Average 3M volume (share)

740,152

Average 3M value (USD mn)

1.03

Average 3M value (VND bn)

23.25

Foreign ownership (%)

26.61

State ownership (%)

61.38

Management ownership (%)

In 2Q15, DPM posted VND 2,804bn (+13% YoY) in revenue and VND 372bn

(+16% YoY) in pretax profit. The increase in net sales was mainly contributed

by the increase of 57% YoY in imported products (accounted for approx. 36%

of total net sales) while net sales of domestic produced products declined by 2%

YoY. In regards to DPMs Urea product, 2Q15s Urea sales volume declined

approx. 5.3% YoY due to 26-day maintenance in May and June 2015 while

average selling price increased roughly 5.1% YoY given the shortage supply

during this period.

n.a

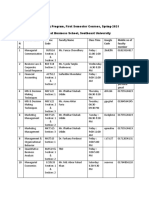

Figure 1: Quarterly revenue contribution by segments, unit VND mn

3,500,000

3,000,000

Domestic produced products

Imported products

Total

2,500,000

2,000,000

Stock performance

1,500,000

1,000,000

500,000

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15

Source: DPM

Source: Bloomberg

Company Snapshot

DPM was established on 28 March 2003 and

is currently one of Vietnam's largest domestic

fertilizer manufacturers. As of today, the

current charter capital is VND 3800 bn ($180

mn). The plant costs $ 397 mn with a design

capacity of 800 thousand tones urea per year.

Besides urea fertilizer manufacturing, DPM

also participates in electricity production,

importing fertilizer and others. However, these

activities only contribute a small percentage

toward net profit and fertilizer manufacturing

remains the largest contributor to net profit.

SSI.COM.VN

Visit SSI Research on Bloomberg at SSIV

<GO>

Page 1

SSI RESEARCH

INSTITUTIONAL RESEARCH & INVESTMENT ADVISORY

Figure 2: Urea and imported fertilizers sales volume by quarter, unit tons

300,000

Urea DPM

Imported fertilizers

250,000

200,000

150,000

100,000

50,000

1Q13 2Q13 3Q13 4Q13 1Q14 2Q14 3Q14 4Q14 1Q15 2Q15

Source: DPM

Prolonged decline in oil prices supported DPMs 2Q15 gross profit margin. 2Q15s gross

profit margin reached 24% compare to 23% in 2Q14. In 2Q15, imported fertilizers contributed

36% to total revenue compared with 18% in 1Q15 which adversely affected 2Q15s gross

margin. Urea contributed the most to DPMs 2Q15 earnings, contributing 93% of total gross

profit.

DPMs 1H15 revenue and pretax profit reached approx. VND 5.128 (+3% YoY), and VND 953bn

(+26% YoY) which were mainly contributed by low oil prices during 1H15. Average natural gas

price in 1Q15 and 2Q15 were approx. USD 4.5/MMTU and USD 5.07/MMBTU, a decline of 33%

YoY, and 32% YoY respectively.

In 2Q15, DPM recorded approx. VND 99bn loss resulted from associated companies which

negatively affected DPMs 2Q15 pretax profit margin compared with a loss of approx. VND 48bn

in 2Q14 (2Q15s pretax profit margin stood at 13.3% compared with 12.9% in 2Q14). In 1H15,

DPM incurred a loss of approx. VND 168bn from associated companies which is higher than

that in 1H14 of approx. VND 112bn. Petrovietnam Petrochemical and Textile Fiber JSC

(PVTEX) and Petrovietnam Urban Development JSC are the two associated companies of of

DPM in which DPM is holding 35.63% and 25.99% stake respectively (or VND 563bn and VND

100bn respectively). PVTEX just started operation in the last 3 years and still facing difficulties in

early stage of the business.

By the end of 2Q15, DPMs total debt reached VND 142bn compared with VND 30bn by the end

of 1Q15. Current debt-to-equity ratio stands at 0.01x.

2Q15s earnings results

(bn VND)

2Q15

2Q14

YoY

QoQ

Net sales

Gross profit

Operating profit

EBIT

EBITDA

Pretax profit

Net income

NI attributable to

shareholders

2,804

673

388

373

439

372

298

2,477

570

269

321

387

321

280

13%

18%

44%

16%

13%

16%

7%

21%

-25%

-36%

-36%

-32%

-36%

-39%

290

269

8%

-39%

Completion

of 2015

target

55%

74%

Margin

2Q15

2Q14

1Q15

2014

24%

14%

13%

16%

13%

11%

23%

11%

13%

16%

13%

11%

38%

26%

25%

28%

25%

21%

25%

13%

13%

16%

13%

12%

10%

11%

21%

11%

Source: DPM

SSI.COM.VN

Visit SSI Research on Bloomberg at SSIV

<GO>

Page 2

SSI RESEARCH

INSTITUTIONAL RESEARCH & INVESTMENT ADVISORY

2H15 and beyond outlook

Natural gas is the key driver of DPMs profit margins, accounting for approx. 56% of total

production cost. If oil prices continue on a downward slope, DPM will invariably stand to benefit.

Average brent oil prices are expected to remain low for the rest of 2015. Given the pressure on

oil supply after the Iran Nuclear deal, we have revised down the base case of FO prices in DPM

valuation from USD 339/ton to USD 316/ton (-43% YoY) in 2015. In our estimate, if FO price

declines 10%, gross profit margin will expand 3%, equivalent to approx. VND 290bn.

Figure 3: Monthly average brent oil price, USD per barrel.

120

100

80

60

40

20

0

Source: Bloomberg

Urea production capacity of domestic producers reachs 2.66mn tons per year since June

2015 including 4 major producers PVFCCo (DPM 800K tons), PVCFC (DCM 800K tons),

Ninh Binh Urea (560K tons), and Ha Bac Urea (500K tons) which will exert pressure on Urea

prices given the total domestic demand of approx. 2.2mn tons per year.

We expect average selling price of Urea in 2015 to be 1% higher than the average of 2014

due to shortage in supply stemmed from maintenance of DPMs plant in May and June, and the

upgrade of Ha Bac Urea plant was accomplished in June.

Earnings estimates & valuation

In 2015, DPMs revenue and net profit are expected at VND 9,691 (+1.5% YoY), and VND

1,848bn (+63% YoY), translating to an EPS of VND 4,139. Our estimates are based on following

assumptions: (1) Sales volume of Urea will decline 3% YoY due to 1-month maintenance in May

2015, (2) Average selling price of Urea will increase 1% YoY, (3) Corporate income tax rate

applied for Urea fertilizer increases to 15% from 7.5% in the previous year due to tax exemption

period ended in 2014, and (4) Natural gas input price at USD 4.5/mmbtu (transportation cost

st

included), a decrease of 34% YoY. (Please note that since 1 April 2014, natural gas prices

offered to DPM is based on market prices instead of scheduled prices).

In 2016, although oil prices are expected to remain on downtrend, given the uncertainty in the

movement of oil prices, 2015 natural gas input price will be used as a based case plus an

increase of 2.2% in transportation cost of natural gas. In addition, Urea sales volume is

expected to increase by 3% YoY in 2016 while average selling price is expected to decline 1.5%

SSI.COM.VN

Visit SSI Research on Bloomberg at SSIV

<GO>

Page 3

SSI RESEARCH

INSTITUTIONAL RESEARCH & INVESTMENT ADVISORY

YoY. DPMs 2016 revenue and net profit are projected at VND 10,065bn (+4 YoY) and VND

1,974 (+7% YoY), translating to an EPS of VND 4,421.

In addition, it should be noted that the original invested value in 2 associated companies of DPM

(Petrovietnam Petrochemical and Textile Fiber JSC (PVTEX) and Petrovietnam Urban

Development JSC) totaled approx. VND 663bn. However, DPM has recorded provision approx.

VND 627bn for the loss stemmed from those two associated companies. The remaining value of

the investment is approx. VND 36bn. According to Circular 202/2014/TT-BTC, if those two

associated companies continue to incur losses in 2H15 and the coming years, DPM has to

record losses from associated companies only at the remaining value of the investment which is

approx. VND 36bn. Therefore, from 4Q15 onwards, DPM will not incur any losses from

associated companies. In 2014 DPM incurred a loss of approx. 131bn from associated

companies, and in 2015 the loss is expected at approx. VND 203bn.

At the price of VND 31,700/share, the stock is being traded at 2015 P/E of 7.7x and 2016 P/E of

7.2x compared with market P/E of 12.6x and 11.38x in 2015 and 2016 respectively. At target

P/E of 8.5x, DPMs 1-year target price is adjusted to VND 36,900/share, (+16.5% compared with

the price of 31,700), equivalent to a HOLD recommendation.

DPM is a value stock with high dividend. 2015s cash dividend is planned at 25% on par,

equivalent to 8.1% dividend yield. DPM typically pays cash dividend in 2 occasions in May and

Sep of the year.

Potential change in industry policy: In 2014 the Ministry of Finance issued Regulation

17709/BTC-TCT, which categorizes fertilizer products under non-VAT bearing goods, and was

st

effective on 1 Jan 2015. Under the new regulation, fertilizer producers could no longer claim

VAT return from input materials for their production.

Nevertheless, fertilizers products have been considered for re-inclusion in the VAT taxable items

such as the previous regulations in 2014 and backwards. If fertilizers are regulated as taxable

items, production costs of fertilizer producers will decline since VAT of production inputs will be

deducted from total production costs.

In July 2015, The Prime Minister has agreed with the proposal by the Ministry of Finance (MoF)

relating to VAT applied on rice, fertilizers, and animal feed products. In regards to fertilizers, the

MoF will incorporate with the Ministry of Agriculture and Rural Development, the Ministry of

Trade and Industry, and related entities to review and assess the impact of new regulation on

VAT and report the findings to the Prime Minister. Based on the assessment, changes and/or

supplement in VAT regulations on fertilizers might be proposed to the National Assembly in the

coming time.

It is noted that, total cost increase in DPMs production cost stemmed from VAT regulation

changes is approx. 400bn.

SSI.COM.VN

Visit SSI Research on Bloomberg at SSIV

<GO>

Page 4

SSI RESEARCH

INSTITUTIONAL RESEARCH & INVESTMENT ADVISORY

APPENDIX 1: ANNUAL FINANCIAL STATEMENTS

VND Billion

Balance Sheet

+ Cash

+ Short-term investments

+ Account receivables

+ Inventories

+ Other current assets

Total Current Assets

+ LT Receivables

+ Net Fixed Assets

+ Investment properties

+ LT Investments

+ Goodwill

+ Other LT Assets

Total Long-Term Assets

Total Assets

+ Current Liabilities

In which: ST debt

+ Non-current Liabilities

In which: LT debt

Total Liabilities

+ Contributed capital

+ Share premium

+ Retained earnings

+ Other capital/fund

Owners' Equity

NCI

Total Liabilities & Equity

2013

2014

2015F

2016F

4,032

1,735

246

1,341

161

7,515

0

2,368

285

541

0

96

3,290

10,805

1,240

65

9

3

1,249

3,800

21

2,036

3,488

9,346

210

10,805

5,078

76

404

1,492

149

7,200

0

2,295

274

232

0

110

2,911

10,111

1,099

94

7

1

1,106

3,800

21

1,470

3,497

8,788

217

10,111

5,790

76

393

1,460

147

7,866

0

2,522

264

210

0

102

3,099

10,965

940

76

334

328

1,274

3,800

21

2,092

3,499

9,413

278

10,965

6,317

76

408

1,489

152

8,443

0

3,682

255

210

0

107

4,254

12,697

1,002

81

1,209

1,203

2,211

3,800

21

2,822

3,499

10,142

343

12,697

Cash Flow

CFO

CFI

CFF

Net increase in cash

Beginning cash

Ending cash

1,529

-1,557

-1,569

-1,597

5,629

4,032

608

1,928

-1,490

1,046

4,032

5,078

1,809

-459

-638

712

5,078

5,790

2,055

-1,457

-71

527

5,790

6,317

Liquidity Ratios

Current ratio

Acid-test ratio

Cash ratio

Net debt / EBITDA

Interest coverage

Days of receivables

Days of payables

Days of inventory

6.06

4.85

4.65

-1.76

749.57

2.66

26.13

65.39

6.55

5.06

4.69

-2.87

439.24

5.35

24.86

72.59

8.37

6.66

6.24

-2.12

714.33

7.12

19.61

84.86

8.42

6.78

6.38

-1.95

64.98

7.52

17.68

79.52

0.86

0.12

0.13

0.01

0.01

0.87

0.11

0.13

0.01

0.01

0.86

0.12

0.14

0.04

0.01

0.80

0.17

0.22

0.13

0.01

Capital Structure

Equity/Total asset

Liabilities/Total Assets

Liabilities/Equity

Debt/Equity

ST Debt/Equity

SSI.COM.VN

VND Billion

Income Statement

Net Sales

COGS

Gross Profit

Financial Income

Financial Expense

Selling Expense

Admin Expense

Income from business operation

Net Other Income

Income from associates

Profit Before Tax

Net Income

Minority interest

NI attributable to shareholders

2013

2014

2015F

2016F

10,363

-7,011

3,352

429

-8

-635

-552

2,586

13

-131

2,468

2,179

37

2,142

9,549

-7,121

2,428

407

-5

-702

-571

1,557

7

-280

1,285

1,134

38

1,096

9,692

-6,349

3,343

387

-5

-743

-616

2,365

9

-200

2,174

1,848

61

1,787

10,072

-6,769

3,303

440

-38

-752

-640

2,313

9

0

2,322

1,974

65

1,909

Basic EPS (VND)

BVPS (VND)

Dividend (VND/share)

EBIT

EBITDA

5,644

24,595

5,000

2,471

2,721

2,885

23,127

3,000

1,288

1,556

4,138

24,771

2,500

2,177

2,441

4,420

26,691

2,500

2,358

2,665

Growth

Sales

EBITDA

EBIT

NI

Equity

Chartered Capital

Total assets

-22.2%

-27.6%

-30.3%

-29.0%

4.3%

0.0%

2.1%

-7.9%

-42.8%

-47.9%

-47.9%

-6.0%

0.0%

-6.4%

1.5%

56.8%

69.1%

62.9%

7.1%

0.0%

8.4%

3.9%

9.2%

8.3%

6.8%

7.8%

0.0%

15.8%

Valuation

PER

PBR

P/Sales

Dividend yield

EV/EBITDA

EV/Sales

7.4

1.7

n.a

12.0%

3.7

1.0

10.7

1.3

n.a

9.7%

4.3

0.7

7.7

1.3

1.2

7.9%

2.9

0.7

7.2

1.2

1.2

7.9%

2.6

0.7

Profitability Ratios

Gross Margin

Operating Margin

Net Margin

Selling exp./Net sales

Admin exp./Net sales

ROE

ROA

ROIC

32.3%

20.9%

21.0%

6.1%

5.3%

23.8%

20.4%

23.7%

25.4%

13.0%

11.9%

7.3%

6.0%

12.5%

10.8%

12.4%

34.5%

20.5%

19.1%

7.7%

6.4%

20.3%

17.5%

19.8%

32.8%

19.0%

19.6%

7.5%

6.4%

20.2%

16.7%

18.9%

Visit SSI Research on Bloomberg at SSIV

<GO>

Page 5

SSI RESEARCH

INSTITUTIONAL RESEARCH & INVESTMENT ADVISORY

APPENDIX 2: QUARTERLY FINANCIAL STATEMENTS

VND Billion

Balance Sheet

+ Cash

+ Short-term investments

+ Account receivables

+ Inventories

+ Other current assets

Total Current Assets

+ LT Receivables

+ Net Fixed Assets

+ Investment properties

+ LT Investments

+ Goodwill

+ Other LT Assets

Total Long-Term Assets

Total Assets

3Q14

4Q14

1Q15

2Q15

4,959

578

550

1,509

227

7,824

0

2,255

277

326

0

84

2,941

10,765

5,078

76

404

1,492

149

7,200

0

2,295

274

231

0

110

2,911

10,110

5,824

0

482

1,285

142

7,734

2

1,994

272

151

0

96

2,513

10,247

5,327

0

613

1,250

140

7,330

19

1,942

269

51

0

73

2,355

9,685

+ Current Liabilities

In which: ST debt

+ Non-current Liabilities

In which: LT debt

Total Liabilities

+ Contributed capital

+ Share premium

+ Retained earnings

+ Other capital/fund

Owners' Equity

NCI

Total Liabilities & Equity

1,328

28

11

5

1,339

3,800

21

1,897

3,489

9,208

218

10,765

1,097

94

7

1

1,104

3,800

21

1,471

3,497

8,789

217

10,110

876

29

281

1

1,157

3,800

21

1,875

3,498

9,194

0

10,351

759

41

205

101

964

3,800

21

1,521

3,498

8,840

0

9,804

135

489

-505

119

4,959

5,078

789

22

-65

746

5,078

5,824

0

0

0

0

0

0

0

0

0

0

0

0

5.89

4.58

4.17

-11.80

547.70

6.56

5.07

4.70

-19.78

176.19

8.83

7.20

6.65

-8.96

789.76

9.66

7.83

7.02

-11.81

601.31

Cash Flow

CFO

CFI

CFF

Net increase in cash

Beginning cash

Ending cash

Liquidity Ratios

Current ratio

Acid-test ratio

Cash ratio

Net debt / EBITDA

Interest coverage

VND Billion

Income Statement

Net Sales

COGS

Gross Profit

Financial Income

Financial Expense

Selling Expense

Admin Expense

Income from business operation

Net Other Income

Income from associates

Profit Before Tax

Net Income

Minority interest

NI attributable to shareholders

3Q14

4Q14

1Q15

2Q15

2,120

-1,611

509

194

-2

-181

-106

414

2

-73

343

296

8

288

2,450

-1,848

602

67

-1

-175

-210

282

-2

-94

185

167

9

158

2,324

-1,431

893

46

-1

-168

-123

648

1

-69

580

487

9

478

2,804

-2,131

673

84

-2

-176

-109

471

1

-99

372

298

8

290

Basic EPS (VND)

BVPS (VND)

EBIT

EBITDA

757

24,231

344

417

415

23,129

186

252

1,259

24,196

581

647

573

23,264

373

439

Growth (YoY)

Sales

EBITDA

EBIT

NI

Equity

Chartered Capital

Total assets

11.4%

-26.9%

-21.1%

-20.3%

-8.2%

0.0%

-5.4%

3.7%

-5.8%

-8.5%

-12.7%

-5.9%

0.0%

-6.4%

-7.1%

29.0%

33.3%

24.2%

5.2%

0.0%

-5.9%

13.2%

13.4%

16.1%

6.7%

-1.7%

0.0%

-6.4%

Profitability Ratios

Gross Margin

Operating Margin

Net Margin

Selling exp./Net sales

Admin exp./Net sales

24.0%

14.3%

14.0%

8.5%

5.0%

24.6%

8.9%

6.8%

7.1%

8.6%

38.4%

26.0%

21.0%

7.2%

5.3%

24.0%

13.8%

10.6%

6.3%

3.9%

Capital Structure

Equity/Total asset

Liabilities/Total Assets

Liabilities/Equity

Debt/Equity

ST Debt/Equity

0.86

0.12

0.15

0.00

0.00

0.87

0.11

0.13

0.01

0.01

0.89

0.11

0.13

0.00

0.00

0.90

0.10

0.11

0.02

0.00

Source: DPM, SSI Research

SSI.COM.VN

Visit SSI Research on Bloomberg at SSIV

<GO>

Page 6

SSI RESEARCH

INSTITUTIONAL RESEARCH & INVESTMENT ADVISORY

1. Analyst Certification

The research analyst(s) on this report certifies that (1) the views expressed in this research report accurately reflect

his/her/our own personal views about the securities and/or the issuers and (2) no part of the research analyst(s)

compensation was, is, or will be directly or indirectly related to the specific recommendation or views contained in this

research report.

2. RATING

Within 12-month horizon, SSIResearch rates stocks as either BUY, HOLD or SELL determined by the stocks expected

return relative to the market required rate of return, which is 18% (*). A BUY rating is given when the security is expected to

deliver absolute returns of 18% or greater. A SELL rating is given when the security is expected to deliver returns below or

equal to -9%, while a HOLD rating implies returns between -9% and 18%.

Besides, SSIResearch also provides Short-term rating where stock price is expected to rise/reduce within three months

because of a stock catalyst or event. Short-term rating may be different from 12-month rating.

Industry Rating: We provide the analyst industry rating as follows:

Overweight: The analyst expects the performance of the industry over the next 6-12 months to be attractive vs. the

relevant broad market

Neutral: The analyst expects the performance of the industry over the next 6-12 months to be in line with the relevant

broad market

Underweight: The analyst expects the performance of the industry over the next 6-12 months with caution vs. the

relevant broad market.

*The market required rate of return is calculated based on 5-year Vietnam government bond yield and market risk premium derived from using

Relative Equity Market Standard Deviations method. Our rating bands are subject to changes at the time of any significant changes in the above

two constituents.

3. DISCLAIMER

The information, statements, forecasts and projections contained herein, including any expression of opinion, are based

upon sources believed to be reliable but their accuracy completeness or correctness are not guaranteed. Expressions of

opinion herein were arrived at after due and careful consideration and they were based upon the best information then

known to us, and in our opinion are fair and reasonable in the circumstances prevailing at the time. Expressions of opinion

contained herein are subject to change without notice. This document is not, and should not be construed as, an offer or the

solicitation of an offer to buy or sell any securities. SSI and other companies in the SSI and/or their officers, directors and

employees may have positions and may affect transactions in securities of companies mentioned herein and may also

perform or seek to perform investment banking services for these companies.

This document is for private circulation only and is not for publication in the press or elsewhere. SSI accepts no liability

whatsoever for any direct or consequential loss arising from any use of this document or its content. The use of any

information, statements forecasts and projections contained herein shall be at the sole discretion and risk of the user.

WWW.SSI.COM.VN

SAIGON SECURITIES INC.

Member of the Ho Chi Minh

Stock Exchange, Regulated

by the State Securities

Commission

HO CHI MINH CITY

72 Nguyen Hue Street,

District 1

Ho Chi Minh City

Tel: (848) 3824 2897

Fax: (848) 3824 2997

Email: info@ssi.com.vn

HANOI

1C Ngo Quyen Street, Ha Noi City

Tel: (844) 3936 6321

Fax: (844) 3936 6311

Email: info@ssi.com.vn

Page 7

SSI RESEARCH

INSTITUTIONAL RESEARCH & INVESTMENT ADVISORY

4. CONTACT INFORMATION

Institutional Research & Investment Advisory

Kien Tran Nguyen

Senior Analyst, Fertilizer

Tel: (844) 3936 6321 ext. 679

kiennt1@ssi.com.vn

Phuong Hoang

Hung Pham

Deputy Managing Director,

Associate Director

Head of Institutional Research & Investment Advisory

hungpl@ssi.com.vn

Giang Nguyen

Associate Director

giangntt@ssi.com.vn

phuonghv@ssi.com.vn

WWW.SSI.COM.VN

SAIGON SECURITIES INC.

Member of the Ho Chi Minh

Stock Exchange, Regulated

by the State Securities

Commission

HO CHI MINH CITY

72 Nguyen Hue Street,

District 1

Ho Chi Minh City

Tel: (848) 3824 2897

Fax: (848) 3824 2997

Email: info@ssi.com.vn

HANOI

1C Ngo Quyen Street, Ha Noi City

Tel: (844) 3936 6321

Fax: (844) 3936 6311

Email: info@ssi.com.vn

Page 8

Vous aimerez peut-être aussi

- India BudgetDocument23 pagesIndia BudgetrachnasworldPas encore d'évaluation

- Forex Gains Boosted Earnings: Ha Tien 1 Cement JSCDocument9 pagesForex Gains Boosted Earnings: Ha Tien 1 Cement JSCMinshinesPas encore d'évaluation

- Equity Note - Padma Oil Company LTDDocument2 pagesEquity Note - Padma Oil Company LTDMd Saiful Islam KhanPas encore d'évaluation

- Third Quarter Report March 31 2014Document36 pagesThird Quarter Report March 31 2014Salman MohiuddinPas encore d'évaluation

- India Union Budget 2010Document19 pagesIndia Union Budget 2010jaguarmcsPas encore d'évaluation

- 153 - File - Directors' Report & Management Discussion & Analysis For The Year Ended 31st March, 2015Document33 pages153 - File - Directors' Report & Management Discussion & Analysis For The Year Ended 31st March, 2015vishald4Pas encore d'évaluation

- DG Khan Cement Company LimitedDocument7 pagesDG Khan Cement Company LimitedhsbkhanPas encore d'évaluation

- LUKY 1st Quarter 2013Document32 pagesLUKY 1st Quarter 2013sikanderjawaidPas encore d'évaluation

- Organics Stock IdeaDocument7 pagesOrganics Stock IdeaMohit KanjwaniPas encore d'évaluation

- 2016-08-24 Kenmare Resources H1 2016 Results PresentationDocument26 pages2016-08-24 Kenmare Resources H1 2016 Results PresentationjohannesgunnellPas encore d'évaluation

- 9-Stocks Sharekhan 040814Document30 pages9-Stocks Sharekhan 040814SUKHSAGAR1969Pas encore d'évaluation

- Result Y15 Doc3Document6 pagesResult Y15 Doc3ashokdb2kPas encore d'évaluation

- Analysis of Financial Stetement PSODocument14 pagesAnalysis of Financial Stetement PSODanish KhalidPas encore d'évaluation

- Balancing Fiscal Consolidation With Growth: Uncertainty Over GAARDocument42 pagesBalancing Fiscal Consolidation With Growth: Uncertainty Over GAARChinmay ShirsatPas encore d'évaluation

- MD Kamrul Hasan Chy Roll 1291 Ustc, FbaDocument17 pagesMD Kamrul Hasan Chy Roll 1291 Ustc, FbaMahbubul Islam KoushickPas encore d'évaluation

- Petroleum: PAKISTAN STATE OIL - Analysis of Financial Statements Financial Year 2003 - 3Q Financial Year 2011Document7 pagesPetroleum: PAKISTAN STATE OIL - Analysis of Financial Statements Financial Year 2003 - 3Q Financial Year 2011Syed Abdur Rahman GillaniPas encore d'évaluation

- SOTRAPIL RAPORT (Mohamed Lahiani)Document9 pagesSOTRAPIL RAPORT (Mohamed Lahiani)mohamed lahianiPas encore d'évaluation

- FGV Draft Pest&5Forces Version1.0Document19 pagesFGV Draft Pest&5Forces Version1.0Zee BPas encore d'évaluation

- Rio Tinto Delivers First Half Underlying Earnings of 2.9 BillionDocument58 pagesRio Tinto Delivers First Half Underlying Earnings of 2.9 BillionBisto MasiloPas encore d'évaluation

- Budget 2012 EconomyDocument19 pagesBudget 2012 EconomynnsriniPas encore d'évaluation

- Horizon Securities: Company Visit NoteDocument5 pagesHorizon Securities: Company Visit Notezorro51Pas encore d'évaluation

- Good Sintext Report by DREDocument4 pagesGood Sintext Report by DREMLastTryPas encore d'évaluation

- Dishman PharmaDocument8 pagesDishman Pharmaapi-234474152Pas encore d'évaluation

- Chambal Fertilisers & Chemicals: Key Financial IndicatorsDocument4 pagesChambal Fertilisers & Chemicals: Key Financial IndicatorsPankaj KumarPas encore d'évaluation

- Bajaj Auto: CMP: INR1,692 TP: INR1,860Document8 pagesBajaj Auto: CMP: INR1,692 TP: INR1,860ameya4010Pas encore d'évaluation

- HSIE Results Daily - 12 Nov 22-202211120745240401459Document18 pagesHSIE Results Daily - 12 Nov 22-202211120745240401459N KhanPas encore d'évaluation

- A Budget That Reveals The Truth About India's Growth Story - The WireDocument8 pagesA Budget That Reveals The Truth About India's Growth Story - The WireRaghaPas encore d'évaluation

- Public Finance: Fiscal Trends-Strategies For Achieving Higher Growth and DevelopmentDocument13 pagesPublic Finance: Fiscal Trends-Strategies For Achieving Higher Growth and DevelopmentNazmul HaquePas encore d'évaluation

- Budget Overvie1Document10 pagesBudget Overvie1farahnaz889Pas encore d'évaluation

- Dear Shareholders,: Future OutlookDocument1 pageDear Shareholders,: Future Outlook.Pas encore d'évaluation

- Analysis of GDP of India From 1990-2010Document21 pagesAnalysis of GDP of India From 1990-2010aditig2267% (6)

- 1 0Document13 pages1 0Abhishek BiswasPas encore d'évaluation

- Fra Assignment 1Document11 pagesFra Assignment 1Ruchi SambhariaPas encore d'évaluation

- Garanti Securities - Company Reports - ÜLKER BISKÜVI (ULKER)Document28 pagesGaranti Securities - Company Reports - ÜLKER BISKÜVI (ULKER)Владимир СуворовPas encore d'évaluation

- Triveni Engineering RatingDocument7 pagesTriveni Engineering RatingGaneshreddy IndireddyPas encore d'évaluation

- RCF - Annual ReportDocument264 pagesRCF - Annual ReportitrrustPas encore d'évaluation

- FY16 Mid CapDocument5 pagesFY16 Mid CapAnonymous W7lVR9qs25Pas encore d'évaluation

- Result Presentation For December 31, 2015 (Result)Document24 pagesResult Presentation For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Case Study - Lucky Cement and OthersDocument16 pagesCase Study - Lucky Cement and OthersKabeer QureshiPas encore d'évaluation

- Price of VN-INDEX Over 63 Months From January 2016 To March 2021 (1,000 VND)Document20 pagesPrice of VN-INDEX Over 63 Months From January 2016 To March 2021 (1,000 VND)Tu Nhi PhamPas encore d'évaluation

- UPL, 30th January 2013Document11 pagesUPL, 30th January 2013Angel BrokingPas encore d'évaluation

- Quarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Document19 pagesQuarterly Release: Klabin Reports Net Profit of R$ 207 Million in 2Q07, and Reaches R$ 372 Million in 1H07Klabin_RIPas encore d'évaluation

- Interim Report Interim ReportDocument34 pagesInterim Report Interim ReportMohammed AbdoPas encore d'évaluation

- Top Textile CompaniesDocument7 pagesTop Textile CompaniesHafizUmarArshadPas encore d'évaluation

- Budget 2010-11 Preview: EmkayDocument33 pagesBudget 2010-11 Preview: EmkayrPas encore d'évaluation

- Union Budget 2011-12Document11 pagesUnion Budget 2011-12rockyj47Pas encore d'évaluation

- Year Ended 53Document24 pagesYear Ended 53ashokdb2kPas encore d'évaluation

- Macroeconomics IssuesDocument7 pagesMacroeconomics IssuesAryan ChaudharyPas encore d'évaluation

- Rs4,895Bn (9% Yoy Higher), With TotalDocument3 pagesRs4,895Bn (9% Yoy Higher), With TotalAsad MuhammadPas encore d'évaluation

- PT United Tractors TBK: Investor Bulletin, First Quarter 2012Document5 pagesPT United Tractors TBK: Investor Bulletin, First Quarter 2012Fadly David WaasPas encore d'évaluation

- Broker Rader - Sugar Industry - Petronet LNG - Saregama Jan 23 2023 JMDocument2 pagesBroker Rader - Sugar Industry - Petronet LNG - Saregama Jan 23 2023 JMPranavPillaiPas encore d'évaluation

- TTK Prestige LTD Visit NoteDocument7 pagesTTK Prestige LTD Visit Notehazrat1Pas encore d'évaluation

- Third Quarter Report MAR 31 2012Document20 pagesThird Quarter Report MAR 31 2012Asad Imran MunawwarPas encore d'évaluation

- EC Greece Forecast Autumn 13 PDFDocument2 pagesEC Greece Forecast Autumn 13 PDFThePressProjectIntlPas encore d'évaluation

- Frieslandcampina Engro Pakistan Limited Financial Results - Quarter 1, 2020Document3 pagesFrieslandcampina Engro Pakistan Limited Financial Results - Quarter 1, 2020Hassan KhanPas encore d'évaluation

- Q1 FY 21 (Consolidated) Key Highlights:: For Immediate ReleaseDocument4 pagesQ1 FY 21 (Consolidated) Key Highlights:: For Immediate Releasesrinivas murthyPas encore d'évaluation

- Vietnam Dairy Products JSC (VNM: HOSE) : OUTPERFORM - 1Y Target Price: VND 116,000Document5 pagesVietnam Dairy Products JSC (VNM: HOSE) : OUTPERFORM - 1Y Target Price: VND 116,000Kao NashiPas encore d'évaluation

- EarningsReleaseQ1 FY19Document5 pagesEarningsReleaseQ1 FY19osama aboualamPas encore d'évaluation

- AnnualReport2015 16Document397 pagesAnnualReport2015 16sandipgargPas encore d'évaluation

- Acquisition of Nepal Bangladesh Bank by Nabil Bank: Bachelor of Business AdministrationDocument16 pagesAcquisition of Nepal Bangladesh Bank by Nabil Bank: Bachelor of Business AdministrationSujan ShahPas encore d'évaluation

- AD Course Handbook-EngDocument68 pagesAD Course Handbook-EngJohn HambreyPas encore d'évaluation

- YouGov International FMCG Report 2021Document58 pagesYouGov International FMCG Report 2021zoya shahidPas encore d'évaluation

- Toc 9708 SyDocument5 pagesToc 9708 SyArShadPas encore d'évaluation

- A Lifetime of OpportunityDocument24 pagesA Lifetime of OpportunityCaleb Newquist100% (1)

- Banking OverviewDocument46 pagesBanking OverviewnisseemkPas encore d'évaluation

- SL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty MemberDocument2 pagesSL N o Course Name Course Code Faculty Name Class Time Google Code Mobile No of Faculty Memberএ.বি.এস. আশিকPas encore d'évaluation

- Dividend Policy Theory PDFDocument14 pagesDividend Policy Theory PDFXael AlvarezPas encore d'évaluation

- Sports and Entertainment Marketing 4th Edition Kaser Test BankDocument8 pagesSports and Entertainment Marketing 4th Edition Kaser Test Bankvernier.decyliclnn4100% (17)

- Cash Flow Statement Format Direct MethodDocument4 pagesCash Flow Statement Format Direct MethodvishalkulthiaPas encore d'évaluation

- The Entrepreneurial ProcessDocument11 pagesThe Entrepreneurial Processainonlela50% (2)

- Logistics Management PJT GLS VS VRJDocument20 pagesLogistics Management PJT GLS VS VRJSHABNAMH HASANPas encore d'évaluation

- Chapter 5Document28 pagesChapter 5abatePas encore d'évaluation

- Challenges Faced and Roles Played by Women Entrepreneurs in India EconomyDocument70 pagesChallenges Faced and Roles Played by Women Entrepreneurs in India Economyacademic researchPas encore d'évaluation

- Offer Letter For Marketing ExecutivesDocument2 pagesOffer Letter For Marketing ExecutivesRahul SinghPas encore d'évaluation

- Effectiveness Analysis of Drone Use For Rice Production in Central ThailandDocument8 pagesEffectiveness Analysis of Drone Use For Rice Production in Central ThailandMuhamad AbdullahPas encore d'évaluation

- Unclaim Deposits 2017Document1 177 pagesUnclaim Deposits 2017Farhan KashifPas encore d'évaluation

- 2 - Appropriate Building Technology (ABT)Document64 pages2 - Appropriate Building Technology (ABT)Yohannes Tesfaye100% (1)

- Interstate Trade and Commerce Under Indian Constitution: K. AnushaDocument6 pagesInterstate Trade and Commerce Under Indian Constitution: K. AnushaTushar GuptaPas encore d'évaluation

- Engineering ManagementDocument2 pagesEngineering ManagementEunice NaagPas encore d'évaluation

- Module Aa2 Lab (Odd 2021-2022) FinalDocument57 pagesModule Aa2 Lab (Odd 2021-2022) FinalDenisse Aretha LeePas encore d'évaluation

- Porter - Overview of The Framework - 12082016Document87 pagesPorter - Overview of The Framework - 12082016FaridPas encore d'évaluation

- CVP AnalysisDocument16 pagesCVP AnalysisNoelJr. AllanaraizPas encore d'évaluation

- Consumer Buying Behaviour of Vikram SeedsDocument27 pagesConsumer Buying Behaviour of Vikram SeedsvorabhaveshPas encore d'évaluation

- How To Power Indonesias Solar PV Growth OpportunitiesDocument10 pagesHow To Power Indonesias Solar PV Growth OpportunitiesDilip79Pas encore d'évaluation

- Ministry of Education: English ExamDocument17 pagesMinistry of Education: English ExamisaPas encore d'évaluation

- 2023 11 30 Reprinted 2023 HandbookDocument80 pages2023 11 30 Reprinted 2023 HandbookKaye LaidPas encore d'évaluation

- TREIT Circular 2010Document110 pagesTREIT Circular 2010sladurantayePas encore d'évaluation

- Solved Nora Transfers To Needle Corporation Depreciable Machinery Originally Costing 18 000Document1 pageSolved Nora Transfers To Needle Corporation Depreciable Machinery Originally Costing 18 000Anbu jaromiaPas encore d'évaluation