Académique Documents

Professionnel Documents

Culture Documents

Revised Financial Results For Sept 30, 2015 (Result)

Transféré par

Shyam SunderDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Revised Financial Results For Sept 30, 2015 (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

[i] Ai,Yika,a

m Pap.,

Mill, ltd.

(Formerly known as Balkrishna Paper MillsLtd.)

Date: November 05,2015

BSE Limited

Listing Department

PJ. Tower, Dalal Street,

Mumbai- 400 001

Script Code:539251

National Stock Exchange of India Limited

Listing Department

Exchange Plaza, Plot No. CIl,

G-Block, BandraKurla Complex, Sandra

(East), Mumbai - 400 051

Symbol :NIRVIKARA

Dear Sirl Madam,

Sub : Revised Unaudited Financial Results for the quarter Ihalf year ended 30th

September, 2015.

Further to our Letter & email dated 5th November, 2015, we submit herewith Revised

Unaudited Financial Results for the quarter /half year ended 30th September, 2015 duly

signed by the Chairman & Managing Director of the Company along with Limited Review

Report issued by Statutory Auditors, Mis. Jayantilal Thakkar & Co., Chartered Accountants.

There was a typographical error in earlier statement under the head Earning Per Share (EPS)

as on 30109/2015. It was mention (0.21) instead of (3.32). Now we have corrected EPS as

(3.32).

Kindly take the above revised statement on record and acknowledge.

Thanking you,

Yours faithfully,

For Nirvikara Paper Mills Limited

(Omprakash Singh)

Company Secretary and Compliance Officer

End: As above

Corporate & Reg. Office: AI 7. Trade World,Kamala City,Senapati Bapat Marg, Lower Parel (W),Mumbai400 013, INDIA

Tel. : +912261207900 . Fax: +91 2261207999 . Email: bpmho@bpmLin. www.bpmLin. CIN : U21098MH2013PLC244963

--

nilVika,a Pape, mill, Limited

B'

Reed.Office:A/7,TradeWorld,KamalaCity,SenapatlSapat Marc.LowerParel(W),Mumbal-400on, Maharashtra.www.npml.ln,CIN: U21098MH2013PLC244963

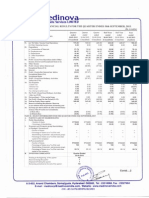

Unaudited 'Stand.alonel Financial Results for the Quarter Ended 30th Seotember 2015

STATEMENT

OFASSETSANDLIABILITIES

(R..Inlies)

(R..Inlies)

HALFVEARENDED

QUARTERENDED

PARTICULARS

30/09/2015 I 30/06/2015

Unaudited

30/09/2015

Unaudited

PARTICULARS

31/03/2015

Audited

1. Income from Operationl

a) NetSalesllncomefromOperations

ASat

VEARENDED

4,102.34

3,900.42

8,002.76

1,965.27

72.46

18.90

91.36

7.70

4,174.80

3,919.32

8,094.12

1,972.97

(Netof ExciseDuty)

TotalIncomefrom Operation(Net)

1. Theaboveunaudited(stand-alone)resultsas

31/03/2015 reviewed by the Auditcommitteehave been

30/09/2015

Audited

Unaudited

A. EQUITYANDLIABILITIES

1. Shareholders' Fundi

a) ShareCapital

b) OtherOperatingIncome

b) Reservesandsurplus

Sub-total. Shareholders' funds

2,481.66

2,348.03

4,829.69

1,261.05

142.01

12.73

154.74

46.23

d) Employee

ElenefllsExpense

200.61

247.26

447.87

104.50

182.07

53.62

333.03

a)Costof materialsconsumed

91.41

e) Depreciation andAmortisation

expense

705.64

ij Power&Fuel

g) OtherExpenses

TotalExpenses

. Profit/(LOSI)from DperatlonlbeforeOtherIncome,Finance(;011I & Exceptional

Kems(1.2)

4. Other Income

. prOIit/(LOSl)from Ordinary Activitiel before Finance (;0111and

90.66

571.40

1,277.04

1,073.98

1073.98

4781.92

5,196.24

2. The Scheme of arrangement (Scheme)

between Balkrishna Industries Ltd (BIL),

BalkrishnaPaperMills Ltd (BPML)and Nirvikara

Paper Mills Ltd (Company)had been approved

3993.86 by the Hon'ble High Court of Bombayand the

977.96 orderwas filed with the Registrarof Companies,

Mumbai. on 10th February, 2015. Pursuantto

3.52 the scheme, (a) BPML was amalgametedwith

(0.68) BILw.e.!.appointeddate, i.e. 1st April, 2013and

(b) the Paper division was demerged to the

4,974.66

Company w.e.f. the effective date. i.e. 10th

February. 2015. Hence the comparative figuras

3259.82 for the quarter ended 3010912014and half year

ended 30109/14 are not given.

2394.34

5,855.90

657.56

657.88

1,315.44

424.47

4,278.89

3,927.96

8,206.85

2,222.90

(104.09)

22.50

(8.64)

7.36

(112.73)

29.86

(249.93)

5.33

Exceptionallteml

(3+4)

. ApplicableNel(Gain)/Losson ForeignCurrencytransactions

andtranslation

.pronU(LoSlJfrOmOrdinaryActivitiesanerfinance(;0111,foreignExchange

181.59)

(1.28)

(82.87)

137.50

273.29

5.05

15.16

(0.88)

(371.32)

(304.21)

/227.49)

(143.83)

(371.32)

(304.21)

15. ReservesexcludingRevaluationRelerve

5.81

129.31

168.78

298.09

f356.80)

(312.61)

(669.41)

(310.02)

(356.80)

(312.61)

(669.41)

(310.02)

1,073.98

1,073.98

1,073.98

1,073.98

b) TradePayables

2,339.50

c)Othercurrentliabils

2,025.07

69.68

2114.96

8,447.21

7,831.63

TOTAL. EQUITYANDLIABILITIES

19,047.27

B.ASSETS

1.Non-c:urrent

aSlets

a) Fixedassets

62.51

18,662.19

(2.91)

(6.23)

(2.89)

d) Longtennloansandadvances

41.7

4,478,969

41.70%

4,478,969

41.70%

14442.73

192.02

292.58

4,478,969

41.70%

100.00

27.76

e) Othernon-current

assets

Sub-totalNon-current

assets

15,482.04

2.Currentalllll

14,835.31

a) Current investments

1658.81

1,673.66

1,427.80

c) Tredereceivables

d)Cashandcashequivalents

4478969

15,162.26

100.00

b) Inventories

(3.32)

A. PARTICULARS

OFSHAREHOLDINGS

- Numberof Shares

4,012.96

a) Short.tennborrowings

c) Deferred tax assets(net)

1.PublicShareholding

. Percentageof Shareholding

3. Current lIabllltiel

b) Non-current

Investments

16.Eamlnglpershare(EPS) (RI.)

. BasicandDiluted(notannualised)

(3.35)

5,403.82

(143.83)

(FaceValueof Rs.10Each)

d) Long-tennprovisions

Sub-total - Non-current liabilities

3. Segmentreportingas raquiradbyA5-17 isnot

applicable as the company operates in one

single business segment i.e. Paper and Paper

Boards.

60.49

(227.49)

11. NetProfit/(LoSl)

from OrdinaryActivities

AfterTax(9-10)

12.ExtraordlnarvKem(NetofIn expenles)

13. NetProfit/(LoSl)

for tIIeDelled (11.12)

14. Paid up Equity ShareCapital

1,276.06

245.43

Sub-totalCurrentliabils

135.79

10.11

8.Exceptional

Kems

9.Profit/(LoSl)

fromOrdlnarvActivitiesbeforeTax(1+8)

3,885.68

b) Deferredtaxliabiles(net)

(244.60)

Fluctuationon BOfrOwingl butbefore Exceptional

Keml(5-6)

10.Taxexpenlel

. Current

Deferred

a) Long.tennborrowings

d) Short-tennprovisions

6. FinanceColli

. InterestandFinanceCharges

2. Non.current liabilitiel

c) Otherlongtennliabilies

approvad by tha Board of Directors at its

meeting held on 5th November, 2015. The

Statutory Auditors of the Company have carried

outthe"UmitedReview"oftheaboveresults.

4,122.26

2. Expenles

b)Purchaseof Stock.in-trade

c) Changesininventories

of FinishedgoodsandWork-in-progress

As at

e) Short.tennloansandadvances

ij Othercurrentassets

Sub-totalCurrentassets

1478.08

25.72

36.49

407.51

628.88

30.54

24.63

3,565.23

3,826.90

19,047.27

18,662.19

4. The Board has approved (subject to approval

of shareholders

and

other appropriate

authoritias) the proposed disinvestment of the

entire shareholding of its wholly owned

subsidiary company viz Balkrishna Synthetics

Umited to Siyaram Silk Mills Umited for a total

considerationof RI. 44.70 crores as determined

by the independent valuer.

5. The Power and fuel cost for the quarter ended

30th Septamber.2015 includesan amountof

RS.101.97

Lacsconsequentto the increaseof

electricityduty on Captivepowerplants by 90

paise per unit with effect from01/0412015

8. The details of number of Investor complaints

forthe quarter,

Beginning - Nil.Received- Nil.

Disposed- Nil,Pending- Nil

7. The previous year's figures have been

wherever considered

regrouped/rearranged

necessary.

2.PromotersandPromoterGroupShareholdlng

a) PledgedlEncumbered

- Numberof Shares

. Percentage of Shares (as a % of the total shareholding of promoters and promoter group)

TOTAL.ASSETS

. Percentage

of Shares(asa % of thetotalshareholdingof promoters

andpromotergroup)

-Percentageof Shares(asa % of thetotalShareCapitaloftheCompany)

6,260,875

100%

58.3

- Percentage

of Shares(asa % of thetotalShareCapitalofthaCompany)

b)Non- Encumbered

. Numberof Shares

\(t\\te

6,260,875

100%

6,260,875

100%

6,260,875

100%

58.30%

58.30%

58.30%

Dated: 5th Noyember, 2015

Place: Mumbal

'.

D2*1t

I;,.

(Yed

e)q,

w

Anurag P. Poddar

(Chalnnan & Managing Director)

..

JA"YANTILAL

CHARTERED

THAKKAR

& CO.

111

ACCOUNTANTS

(A), MAHATMA GANDHI ROAD,

FORT, MUMBAI 400 023.

TELEPHONES

:2265 8800

2265 8900

FAX: (91 22) 2265 8989

E-MAIL:

jtco@vsnl.net

REVIEW REPORT TO THE

BOARD OF DIRECTORS

OF

NIRVIKARA PAPER MILLS LIMITED

We have reviewed the accompanying statement of unaudited financial results of

Nirvikara Paper Mills Limited for the period ended 30thSeptember, 2015 except for the

disclosuresregarding'Public Shareholding'and 'Promoter and Promoter Group Shareholding'

which have been traced from disclosuresmade by the management and have not been

audited by us. This statement is the responsibilityof the Company'sManagementand has

been approved by the Board of Directors. Our responsibilityis to issue a report on these

financialstatementsbasedon our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE)

2410, "Review of Interim Financial Information Performed by the Independent Auditor of the

Entity" issued by the Institute of Chartered Accountants of India. This standard requires that

we plan and perform the review to obtain moderate assurance as to whether the financial

statements are free of material misstatement. A review is limited primarily to inquiries of

company personnel and analytical procedures applied to financial data and thus provides less

assurance than an audit. We have not performed an audit and accordingly, we do not express

an audit opinion.

Based on our review conducted as above and as per the information and explanations given to

us, nothing has come to our attention that causes us to believe that the accompanying

statement of unaudited financial results prepared in accordance with applicable accounting

standards and other recognised accounting practices and policies has not disclosed the

information required to be disclosed in terms of Clause 41 of the Listing Agreement including

the manner in which it is to be disclosed, or that it contains any material misstatement.

For JA YANl1LAL THAKKAR &. CO.

CHARTERED ACCOUNTANTS

(FIRM REG. NO. 104133W)

-vA'~

.,--

., ....-

VIRAL A. MERCHANT

PARTNER

MEMBERSHIP NO. 116279

PLACE: Mumbai

DATE: 05th November,

2015

Vous aimerez peut-être aussi

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018D'EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Pas encore d'évaluation

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- KFA Published Results March 2011Document3 pagesKFA Published Results March 2011Abhay AgarwalPas encore d'évaluation

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document4 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Result)Document4 pagesFinancial Results & Limited Review Report For June 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Company Update)Shyam SunderPas encore d'évaluation

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- FY11 - Investor PresentationDocument11 pagesFY11 - Investor Presentationcooladi$Pas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Document8 pagesStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Document4 pagesAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Mutual Fund Holdings in DHFLDocument7 pagesMutual Fund Holdings in DHFLShyam SunderPas encore d'évaluation

- JUSTDIAL Mutual Fund HoldingsDocument2 pagesJUSTDIAL Mutual Fund HoldingsShyam SunderPas encore d'évaluation

- Settlement Order in Respect of R.R. Corporate Securities LimitedDocument2 pagesSettlement Order in Respect of R.R. Corporate Securities LimitedShyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- PR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Document1 pagePR - Exit Order in Respect of Spice & Oilseeds Exchange Limited (Soel)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2014 (Audited) (Result)Document3 pagesFinancial Results For June 30, 2014 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Settlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedDocument2 pagesSettlement Order in Respect of Bikaner Wooltex Pvt. Limited in The Matter of Sangam Advisors LimitedShyam SunderPas encore d'évaluation

- HINDUNILVR: Hindustan Unilever LimitedDocument1 pageHINDUNILVR: Hindustan Unilever LimitedShyam SunderPas encore d'évaluation

- Order of Hon'ble Supreme Court in The Matter of The SaharasDocument6 pagesOrder of Hon'ble Supreme Court in The Matter of The SaharasShyam SunderPas encore d'évaluation

- Exit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliDocument5 pagesExit Order in Respect of The Spice and Oilseeds Exchange Limited, SangliShyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Document5 pagesStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Mar 31, 2014 (Result)Document2 pagesFinancial Results For Mar 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For June 30, 2013 (Audited) (Result)Document2 pagesFinancial Results For June 30, 2013 (Audited) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For September 30, 2013 (Result)Document2 pagesFinancial Results For September 30, 2013 (Result)Shyam SunderPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2013 (Result)Document4 pagesFinancial Results For Dec 31, 2013 (Result)Shyam Sunder0% (1)

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document2 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Chairman Highlights Strong Performance in Challenging YearDocument106 pagesChairman Highlights Strong Performance in Challenging YearflyingvincePas encore d'évaluation

- Book Value and Earnings Per ShareDocument3 pagesBook Value and Earnings Per ShareAlejandrea LalataPas encore d'évaluation

- Dr. Komal Taneja: Associate ProfessorDocument52 pagesDr. Komal Taneja: Associate Professorlovely devadaPas encore d'évaluation

- Mergers and Acquisitions in India 2020: YEAR 2020Document9 pagesMergers and Acquisitions in India 2020: YEAR 2020Vishvanath JawalePas encore d'évaluation

- Commercial Law Golden NotesDocument390 pagesCommercial Law Golden NotesAnnie Mendes100% (6)

- A SPAC PrimerDocument10 pagesA SPAC PrimerIvyPas encore d'évaluation

- How to Form a Corporation in the PhilippinesDocument2 pagesHow to Form a Corporation in the PhilippinesJeorge Ryan MangubatPas encore d'évaluation

- Tarea 4 - Riesgo y Rendimiento Parte 1Document30 pagesTarea 4 - Riesgo y Rendimiento Parte 1Edgard Alberto Cuellar IriartePas encore d'évaluation

- 02 Per. Invest 26-30Document5 pages02 Per. Invest 26-30Ritu SahaniPas encore d'évaluation

- Chap 1 To 5 Ito Na NgaDocument43 pagesChap 1 To 5 Ito Na NgaFery Ann C. BravoPas encore d'évaluation

- 1000 Companies DatabaseDocument69 pages1000 Companies DatabaseFazila Khan0% (1)

- AE MULTI HOLDINGS BERHAD Annual Report 2013Document84 pagesAE MULTI HOLDINGS BERHAD Annual Report 2013yennyPas encore d'évaluation

- PT PP in Talks to Acquire Krakatau Steel's Water FirmDocument2 pagesPT PP in Talks to Acquire Krakatau Steel's Water Firmazzah hijaiyyahPas encore d'évaluation

- FM 04 StockValuationDocument5 pagesFM 04 StockValuationHafsah AnwarPas encore d'évaluation

- ADIPEC 2022 ExhibitorsDocument86 pagesADIPEC 2022 Exhibitorssahirprojects0% (1)

- Ekuitas-4 Saldo LabaDocument18 pagesEkuitas-4 Saldo LabaDinda AfifahPas encore d'évaluation

- Solved Did A Majority of The Board of Directors Have ADocument1 pageSolved Did A Majority of The Board of Directors Have AAnbu jaromiaPas encore d'évaluation

- Company FormationDocument2 pagesCompany FormationLuqman HakeemPas encore d'évaluation

- Practice Questions For AMFI TestDocument36 pagesPractice Questions For AMFI TestSuraj KumarPas encore d'évaluation

- Essential Elmts of Corprate LawDocument37 pagesEssential Elmts of Corprate Lawyohannis asfachewPas encore d'évaluation

- Hiller 2012 PDFDocument16 pagesHiller 2012 PDFMUHAMMAD AMIR IHSAN B. MOHD AMINUDDIN STUDENTPas encore d'évaluation

- Takeover Project McomDocument58 pagesTakeover Project McomParinShahPas encore d'évaluation

- What is Share Capital? Types and DefinitionsDocument1 pageWhat is Share Capital? Types and DefinitionsJuhaima BayaoPas encore d'évaluation

- DeloitteDocument18 pagesDeloitteHumanshu MalhotraPas encore d'évaluation

- Consolidated Financial StatementDocument24 pagesConsolidated Financial StatementNguyen Dac Thich100% (1)

- 14 Zutter Smart MFBrief 15e Ch14 RevDocument106 pages14 Zutter Smart MFBrief 15e Ch14 RevhaiPas encore d'évaluation

- WTE CompanyListDocument10 pagesWTE CompanyListBassel Imad Al AawarPas encore d'évaluation

- Chapter 3 - Consolidations - Subsequent To The Date of AcquisitionDocument79 pagesChapter 3 - Consolidations - Subsequent To The Date of AcquisitionBLe BerPas encore d'évaluation

- Stifel Europe To Acquire Germany'S Mainfirst: For Immediate ReleaseDocument2 pagesStifel Europe To Acquire Germany'S Mainfirst: For Immediate ReleaseHarley soulPas encore d'évaluation

- Chapter 2Document50 pagesChapter 2junrexPas encore d'évaluation