Académique Documents

Professionnel Documents

Culture Documents

Banking Lecture

Transféré par

xandercageCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Banking Lecture

Transféré par

xandercageDroits d'auteur :

Formats disponibles

[1]

Banking

Evolution of Banking

It has not so far been decided as to how the word Bank originated. Some authors say that

this word is derived from the words Bancus or Banque which mean a bench. The

explanations of this origin is attributed to the fact that the Jews in Lombardy transacted the

business of money exchange on benches in the market place and when the business failed, the

Banco was destroyed by the people. Other authorities hold the opinion that the word

Bank is derived from the German word Back which means joint stock fund. Later on,

when the Germans occupied major part of Italy, the word Back was italianized into

Bank. It is, therefore, not possible to decide to which of the opinions is correct for no

record is available to ascertain the validity of any of the opinions.

Types of Banks

Primarily all banks gather temporarily idle money for the purpose of lending to others and

investing, which bring gain in the form of return, profit and deviants etc. However, due to the

variety of resources of money and the diversity in lending and investment operations, banks

have been placed in various categories, such as:

Commercial Banks

Savings Banks

Industrial Bank

Mortgage Banks

Agriculture Bank

Investment Banks

Central Banks

Co-operative Bank

1. Commercial Banks

The commercial banks receive deposits from the general public, which are repayable on

demand upon written orders of the depositors. As their most distinctive feature the

commercial banks maintain chequing accounts for the constituents.

The commercial banks are also distinguished for providing short-term finance to trade,

commerce and industry to enable these sectors to expand their productive activities.

Examples: Muslim Commercial Bank, UBL, Citi Bank etc.

[2]

2. Industrial Bank:

The primary functions of these banks is to grant loans to Industrial sector so that

the industries may grow . These are also called specialized financial institutions. They play a

vital role in economic development of a country.

Examples: Industrial Development Bank of Pakistan (IDBP)

3. Savings Bank

The basic purpose of these banks is to inculcate the habit or savings in the people. The

savings bank deposits are not repayable upon only the written orders of the depositors but the

depositors or his agent has to appear personally at the saving bank to make withdrawal, and

for this purpose he must present a pass book, a certificate of deposit or some similar

documents to prove his right to receive payment.

Examples: Post office savings banks and savings account at National Saving organization are

well known operational Savings Banks in Pakistan.

4. Mortgage Banks

These banks mainly deal in loans for the acquisition or construction of real estate against the

security of mortgages. Savings and loans associations and farm loan associations are some

of the well known forms of the mortgage banks.

Examples: House Building Finance Corporation(HBFC)

5. Agriculture Banks

These banks provide loans to agriculturists for purchasing seeds, fertilizers, tractors.

Chemicals etc. In this way, they provide assistance to make the agriculture sector stronger.

Examples: Agricultural Development Bank of Pakistan (ADBP, New name is

Zarai Tarasqiati Bank Ltd.)

6. Investment Banks

The investment banks assist business house and the Governmental bodies to raise money

through the sale of stocks and bonds for usually long term purposes. These banks perform the

usual functions of raising deposits of idle money from the public and finance the business

house and other bodies.

Examples : Investment Corporation of Pakistan(ICP), National Investment Trust

(NIT).

[3]

7. Central banks

Central banks occupy a unique position in the banking structure of a country because they

have been entrusted with the responsibility of controlling the money supply, interest rates and

financial market of the country for the purpose of economic development.

Examples : State Bank of Pakistan, Bank of England and Federal Reserve Bank of USA are

examples of central banks.

COMMERCIAL BANKS

Definition:

A bank is an institution, which deals in money and credit. Banks purely organized for the

purpose of trade and commerce, where the purpose is to maximize profit out of banking

services are known as commercial banks. The primary business of the commercial banks is to

accept deposits and make loans and investments with the object of securing profits for its

clients as well as for itself. In the words of Professor Sayers, Commercial banks are

institutions, whose debts- usually referred to as bank deposits are commonly accepted in final

settlement of other peoples debt. Besides this function, a modern commercial bank renders

a number of services to its customers.

FUNCTIONS OF COMMERCIAL BANKS

A modern commercial bank performs various functions. These functions can be categorized

into two major classifications:

A. Primary functions

B. Secondary functions

A. Primary functions

1. Receiving Deposits

The most important function of a commercial bank is to attract deposits from the people who

cannot profitably use it. A bank generally receives deposits by means of the following

accounts.

a) Current accounts: On current or demand deposits bank pays practically no interest. The

amount can be withdrawn in part or in full, at any time by issuing a cheque.

b) Saving account: In this case, there is a limit to the total weekly withdrawals regarding the

amount and frequency of money drawings. A moderate interest is paid.

[4]

c) Fixed accounts: Such deposits are left with the bank for a certain fixed period before the

expiry of which they cannot be withdrawn. Higher rate of interest is paid on such deposits.

2. Advancing loans

The second major function of a commercial bank is to issue loans and make advances out of

the public deposits. The bank makes provisions by keeping reserves to meet the demand

liabilities of the depositors and advances excess of deposits to earn interest in different

channels. Loans may be:

1) Secured: against which security is demanded or property pledged.

2) Unsecured: advance on personal reputation and goodwill without any security

A bank creates advances in the following ways.

1. Intermediary loans.

2. Short term loans

3. Bank overdrafts.

4. Cash credit

5. By discounting bills

B. Secondary functions:

Secondary functions are further classified into two kinds:

i) Public Utility Services

ii) Agency Services

i) Public Utility Services

1. Discounting bills of exchange

In regards of facilitating trade function and earning interest, this is one of the most important

functions of a commercial bank. For instance, a trader who does not wish to lock up large

funds in trade credit may draw a bill of exchange on his debtor and after it has been accepted

by or on his behalf, the drawer may get it discounted by his banker. This gives him

immediate possession of money. In this regard deduction of interest as commission of bank

has to be borne. On maturation of bills, bank realizes the face value and earns profit. In case

worst happens the bank can rediscount the bills with central bank.

Transfer of funds

Another function of a commercial bank is to act as a middleman and provide facilities for

transfer of money from one person to another or from one place to another at a very low

charge as compared to other institutions. Following are the means of transfer of money:

a) Cheques

b) Bank drafts

[5]

c) Telegraphic transfer

d) Telephonic transfer

e) Letter of credit

f) Travelers cheque

3. Provide safe deposit lockers

Commercial banks also provide lockers for keeping valuable personal belongings. One key of

the locker is handed over to the depositor and the bank retains the other. The depositor may

keep anything in the safe and take it away whenever he desires. The bank charges some fee

for the service.

ii) Agency functions

The bank is an agent and the client is the principal. The bank performs many functions in the

capacity of special agent of the customers like:

1. Purchasing and selling stocks and shares on his behalf.

2. Making payments like rent, insurance premium, on his behalf.

3. Receive money on their behalf e.g. dividend, rent, interest etc.

4. Sale and purchase of securities.

5. Transfer or deposit money from one place or bank to another.

6. Collecting bills on behalf of K.E.S.C, telephone departments etc.

7. Purchase and sale of foreign currency

While going abroad the Central Bank authorizes you legally to carry a limited amount of

respective foreign currency. The commercial banks perform this important function of

converting home currency into foreign currency and vice versa. This is a great facility in

foreign dealing. In Pakistan, the foreign exchange branches of some commercial banks

perform this function unlike other countries where there are separate foreign exchange banks.

8. Miscellaneous Services

In addition to the above functions, banks perform miscellaneous functions like they:

1) Supply information and advice to their clients on matters relating to investment

2) Provide facility to travelers by issuing travelers cheque which are internationally accepted

3) Act as trustees and attorneys of their clients

TYPES OF BANK ACCOUNTS

Current Account

[6]

These are payable to the customer whenever they are demanded. When a banker accepts a

demand deposit, he incurs the obligation of paying all cheques etc. drawn against him to the

extent of the balance in the account. Because of their nature, these deposits are treated as

current liabilities by the banks. Bankers in Pakistan do not allow any profit on these deposits,

and customers are required to maintain a minimum balance, failing which incidental charges

are deducted from such accounts.

Summary:

Withdrawal is made through cheques.

No restrictions on withdrawal

No interest is given

Not subject to zakat deductions

Generally opened by businessmen

Overdraft facility

Savings Account

The main object of the savings deposits is to encourage thrift among people of small means

like children, married and household women, who can deposit only a very small amount at a

time.

Summary:

Withdrawal is made through cheques.

There are certain restrictions on withdrawal of money i.e. the account holder cant make

withdrawal more than 8 times in a month. In practice, this is not followed by the banks.

Small amount of interest is given.

Subject to zakat deduction.

Generally opened by small savers

No overdraft facility is given.

Fixed account:

The deposits that can be withdrawn after a specified period of time are referred to as Fixed or

Term Deposits. The period for which the bank keeps these deposits ordinary varies from

three months to five years in accordance with the agreement made between the customer and

the banker. Interest/ return is paid to the depositors on all Fixed or Time Deposits, and the

rate of interest/ return varies with the duration for which the amount is kept with the banker.

Many depositors keep their money in Fixed Deposits with banks as investment because of the

interest/return paid on them.

Since fixed or term deposits remain with the bank for a specific period, they can be profitably

employed. By lending out or investing these funds, the bank earns more than the

interest/return that it has to pay on them to the depositors.

Summary:

No use of cheques.

Withdrawal is not allowed before maturity

High rate of interest is given.

Subject to zakat deduction.

[7]

No overdraft facility is given.

PROCEDURE FOR OPENING A BANK ACCOUNT

Following are the main steps in opening a bank account:

1. Selection of type of account:

The first step is to select the type of account to be opened . An account may have several

types such as current, saving fixed account. An account can be opened jointly or singly.

2. Selection of bank and branch:

The prospective accountholder should now select the bank . Usually those banks are chosen

which provide high rate of interest or quality of service. Then such a branch is selected to

which the access is easy.

3. Obtaining the account opening form:

An account opening form is obtained from the bank . It should be read carefully and filled in

with utmost care.

4. Obtaining the reference:

One or two reference are obtained by the prospective account holder. The people who give

references sign the form and give their account no. and name and address.

5. Submission of the from:

Now the form should be submitted along with the required documents. These documents vary

from account to account.

6. Giving specimen signature:

Now, the account holder signs on a card called specimen signature card. These signatures are

matched with the cheques of the account holder.

7. Making initial deposit:

The applicant is allotted an account and asked to make initial deposit in his account through a

deposit slip.

8. Account is opened:

As soon as the initial deposit is made, the account is opened.

9. Receiving of cheque book/term deposit certificate:

Finally, a cheque book is issued which bears the applicants account

no. The money can be withdrawn with the help of these cheques.

[8]

Cheque

Defnition: A Cheque is a bill of exchange drawn on a specified banker and not expressed

to be payable otherwise than on demand.

Essentials/ Main feature of a cheque:

It follows from the above definition that cheque is a bill of exchange possessing all the

essential of a bill alongwith two qualifications;

1. A cheque is an order, not a request

2. It is an unconditional order

3. It is always drawn on a banker and

4. It is always payable on demand.

5. It must be in writing.

6. Payee to be certain.

7. It must be signed by the account holder.

8. It must state a certain sum of money.

Parties to a cheque

1. Drawer:

He is the person who signs the cheque and orders bak to pay a certain sum of money.

2. Drawee:

The person to whom the the account holder addresses is called drawee. He is a banker in case

of cheque.

3. Payee:

The person who has to receive the amount of the cheque is called payee.

Kind of cheques

a. Bearer Cheque:

The cheque which contains the phrase or Bearer is called bearer cheque. This is cheque is

payble to any person who bears it.

b. Order cheque:

The cheque which contains the phrase or Order is called order cheque. This is cheque is

payble to a specific person whose name is written as payee or to the order of payee. This is a

safer cheque and in case f lost, it can not be encashed by someone else.

c. Open and cross cheque

[9]

The cheque which does not contain two transverse line across its face called an open cheque.

It means that this cheque can be presented at the counter of the drawee by the bearer for

payment.

On the other hand, a cross cheque bears two transverse lines across it face. Such a cheque can

not be presentd at the counter of the bank but must be presented through a bank.

2. Other Kinds:

a. Marked Cheque:

It is a cheque which is certified by the bank on whom it is drawn to the effect it can be

honoured for payment when presented.

b. Post dated cheque:

The cheque which bears the future date is called Post dated cheque. This cheque cannot be

presented for payment before the date.

c. Stale cheque:

The cheque which remains in circulation and not presented for more than 6 months is called a

stale cheque which is dishonoured if presented.

d. Mutilated cheque:

The cheque which becomes out of shape is called mutilated cheque.

a)The bank does not refuse to pay the cheque provided.

1. There is adequate balance in customers account.

2. Cheque is properly drawn and complete in all respects,

3. Customers signature on the cheque tallies with the specimen

signatures kept in the bank.

4. The cheque is not a crossed one, if presented on the counter for

payment,

5. There is no reason to doubt the bonafide of the holder.

Checking account

A bank account for managing the flow of money into and out of the account.

Transaction:

A banking activity that changes the amount of money in a bank account.

[10]

Deposit:

A transaction that increases a checking account balance; this transaction is

also called a credit.

Credit:

a transaction that increases a checking account balance.

Debit:

A transaction that decreases a checking account balance.

Deposit ticket/slip:

A banking form for recording the details of a deposit.

Bank memo:

A notification of a transaction error.

Credit memo:

A notification of an error that increases the checking account balance.

Debit memo:

A notification of an error that decreases the checking account balance.

Endorsement:

A signature, stamp, or electronic imprint on the back of a check that authorizes payment in

cash or directs payment to a third party or account.

Restricted endorsement:

A type of endorsement that reassigns the check to a different payee or directs the check to be

deposited to a specified account.

Bank statement:

An account record periodically provided by the bank for matching your records with the

banks records.

Service charge:

A fee the bank charges for maintaining the checking account or for other banking services.

Returned check/ Dishonoured check:

A deposited check that was returned because the makers account did not have sufficient

funds.

[11]

Outstanding checks:

Checks that have been written and given to the payee but have not been processed at the bank

or presented for payment.

Outstanding deposits:

Deposits and credits that have been made but have not yet been posted to the makers

account. They may also be called deposits in transit.

Check stub :

A form attached to a check for recording checking account transactions that shows the

account balance.

CASH BOOK

Cash book is a subsidiary book which records the receipts and payment of cash. With the

help of cash book cash and bank balance can be checked at my point of time.

PASS BOOK

Pass Book is a book issued by Bank to an accountholder. It is almost a copy of the account of

the customer in the books of bank. The bank keeps the customer informed of the entries made

in his account through Pass Book. It is the customers duty to check the entries and

immediately inform the bank of any error that he may have noticed.

BANK RECONCILIATION STATEMENT

The cash Book and Pass Book are prepared separately. The Businessman prepares the Cash

Book and the Pass Book is prepared by the Bank (here by cash book we mean three column

cash Book). But as both the books are related to one person and same transactions are

recorded in both the books so the balance of both the books should match i.e. the balance as

per Pass Book should match to balance at bank as per cash book. But many a times these two

balances do not agree then, it becomes necessary to reconcile them by preparing a statement

which is called Bank Reconciliation Statement. A BANK RECONCILIATION

STATEMENT may be defined as a statement showing the items of differences between the

cash Brook balance and the pass book balance, prepared on any day for reconciling the two

balances.

NEED AND IMPORTANCE OF BANK RECONCILIATION STATEMENT

T h e

n e e d

a n d

i m p o r t a n ce

r e c o n cili a tio n

sta te m e n t

m a y

f oll o w s :

of

b e

the

ba n k

gi v e n

as

1.

T h e

r ec o n c ili a ti o n

p r o c ess

help s

b r i n g i n g ou t t h e er r o r s com m i t te d eit h e r

c as h B o o k o r P a ss B o o k .

in

in

[12]

2.

B a n k

rec o n c ili a ti o n

s h o w

a n y u n d u e

dela y

c h e q u es.

st a t e m e n t

m a y

als o

i n

the cle a r a n c e o f

3.

Som e t i m e s

t h e

cas h ier

m a y

h a v e

t h e

te n d e n c y

o f

c h e a ti n g

li k e

he

m a y

m a d e

e n t r ies

i n

t h e

C a s h

B o o k

o n l y

b u t

ne ver

d e p osit t he

cas h

int o b a n k .

T h ese t y p es of

f r a u d s b y t h e en t r e p r e n e u rs sta f f

o r

ba n k

st a f f

m a y

b e

detec te d

o nl y

th r o u g h

b a n k

r e c o n cili a tio n

sta te m e n t.

So

t h is

w a y

ba n k

r e c o n cili a tio n

sta te m e n t

acts

as

a

co n t r o l

tec h n i q u e to o.

CAUSES FOR DIFFERENCES

A transaction relating to bank has to be recorded in both the books i.e. Cash Book and Pass

Book but sometimes it happens that a bank transaction is recorded only in one book and not

recorded simultaneously in other book this causes difference in the two balances. The causes

for difference may be illustrated in detail as follows:

[13]

PROCEDURE FOR PREPARATION OF BANK RECONCILIATION STATEMENT

A

b a n k r e c o n c i l i a t i o n st a t e m e n t is p r e p a r e d

t o re c o n c ile t he tw o

b a l a n c es of C a s h B o o k

[14]

a n d P ass B o o k. S o, w h e n y o u w i ll p r e p a r e a

b a n k r e c o n cili a tio n sta te m e n t y o u

w i l l st a r t

it

w i t h

o n e

bal a n c e m a k e

a d j u st m e n ts a n d

t h e n

y o u

w i ll

re a c h

t o

t h e

ot h e r

b a l a n c e.

T h i s w a y b o t h t h e b a l a n c es w ill a g r e e. T h e

w a y t h e a d j u s t m e n t s sh o u l d b e m a d e m a y b e

ill ust r a te d a s foll o w s :

Balance as per pass book

Xxx

N o t e : I f y o u sta r t t h e q u esti o n w i t h b a l a n c e

as pe r p ass b o o k a ll t h e a d j u s t m e n ts w i ll be

r e v e r se d.

[15]

Example 5

From the following prepare a bank reconciliation statement on 31st March 2005.

1. Balance as per Cash Book 1,80,000

2. Cheques paid into Bank March 2005 but credited by the bank in April 2005 7,900

3. Cheques issued in March 2005 but cashed in April 2005 11,000

4. Cheques entered in the Cash Book in March 2005 but paid into bank in April 2005 1,000

5 Interest allowed by the bank 2500

6 Interest charged by the bank 500

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Formato Cis DanielDocument5 pagesFormato Cis DanielDaniel Toro100% (5)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (74)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- Netflix EthicsDocument8 pagesNetflix EthicsShubham JakhmolaPas encore d'évaluation

- Chapter 8 and 10Document4 pagesChapter 8 and 10Glory CrespoPas encore d'évaluation

- Return of The Quants - Risk-Based InvestingDocument13 pagesReturn of The Quants - Risk-Based InvestingdoncalpePas encore d'évaluation

- Summer Training in CholamandalamDocument66 pagesSummer Training in Cholamandalamvvaryani100% (2)

- Accounting For Banking Institutions PDFDocument45 pagesAccounting For Banking Institutions PDFNchendeh Christian100% (3)

- Investment Banking Preparation Week 1Document12 pagesInvestment Banking Preparation Week 1daniel18ctPas encore d'évaluation

- Judicial ReveiwDocument7 pagesJudicial ReveiwxandercagePas encore d'évaluation

- PolygamyDocument2 pagesPolygamyxandercagePas encore d'évaluation

- D22 04 175 RewriteDocument17 pagesD22 04 175 RewritexandercagePas encore d'évaluation

- 17 74 Supply Clerk Recieving Super WHDocument4 pages17 74 Supply Clerk Recieving Super WHxandercagePas encore d'évaluation

- Omnichannel Marketing: A New Era of Customer EngagementDocument17 pagesOmnichannel Marketing: A New Era of Customer EngagementxandercagePas encore d'évaluation

- Supplier Chain Ustomer IntegrationDocument3 pagesSupplier Chain Ustomer IntegrationxandercagePas encore d'évaluation

- The Effect of Supply Chain Integration and Employee Commitment On Organizational PerformanceDocument2 pagesThe Effect of Supply Chain Integration and Employee Commitment On Organizational PerformancexandercagePas encore d'évaluation

- Field Visit To F-7 & F-8Document3 pagesField Visit To F-7 & F-8xandercagePas encore d'évaluation

- Internal Integration and Organizational PerformanceDocument9 pagesInternal Integration and Organizational PerformancexandercagePas encore d'évaluation

- Supply Chain IntegrationDocument2 pagesSupply Chain IntegrationxandercagePas encore d'évaluation

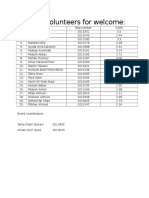

- List of Voulenteer For WelcomeDocument1 pageList of Voulenteer For WelcomexandercagePas encore d'évaluation

- New Microsoft Word DocumentDocument5 pagesNew Microsoft Word DocumentxandercagePas encore d'évaluation

- For Students: Solutions To Odd Numbered End of Chapter ExercisesDocument72 pagesFor Students: Solutions To Odd Numbered End of Chapter Exercisesxandercage100% (1)

- SolutionDocument243 pagesSolutionxandercagePas encore d'évaluation

- Discussion: Aggregate Production PlanningDocument1 pageDiscussion: Aggregate Production PlanningxandercagePas encore d'évaluation

- Production Management QuestionairesDocument6 pagesProduction Management QuestionairesxandercagePas encore d'évaluation

- IJCAS v2 n3 pp263-278Document16 pagesIJCAS v2 n3 pp263-278xandercagePas encore d'évaluation

- Inferential StatisticsDocument35 pagesInferential StatisticsxandercagePas encore d'évaluation

- Exercises Probability and Statistics: Bruno Tuffin Inria, FranceDocument33 pagesExercises Probability and Statistics: Bruno Tuffin Inria, FrancexandercagePas encore d'évaluation

- For Ex Acca Articles 7 SeriesDocument28 pagesFor Ex Acca Articles 7 SerieshunkiePas encore d'évaluation

- Foreign Currency ValuationDocument8 pagesForeign Currency ValuationSai Shravan MadarapuPas encore d'évaluation

- Dr. Samuel Xin Liang Dr. Samuel Xin Liang Fina 110 Spring 2009Document14 pagesDr. Samuel Xin Liang Dr. Samuel Xin Liang Fina 110 Spring 2009jacobCCPas encore d'évaluation

- Study4Success: Banking Abbreviations For ExamsDocument7 pagesStudy4Success: Banking Abbreviations For ExamsSuraj RoyPas encore d'évaluation

- The Primary Market in IndiaDocument34 pagesThe Primary Market in IndiaPINAL100% (1)

- Demonetisation: A Project OnDocument52 pagesDemonetisation: A Project OnSwarnajeet GaekwadPas encore d'évaluation

- Return Risk and SMLDocument3 pagesReturn Risk and SMLspectrum_48Pas encore d'évaluation

- TransCentury Ltd. - Notice of Conversion of Bonds Into Ordinary SharesDocument2 pagesTransCentury Ltd. - Notice of Conversion of Bonds Into Ordinary SharesAnonymous JQZgPmPas encore d'évaluation

- Submitted To: Madam Mehnaz Khan Submitted By: Mian Farrukh Raza Mba Iii (E)Document29 pagesSubmitted To: Madam Mehnaz Khan Submitted By: Mian Farrukh Raza Mba Iii (E)TheAgents107Pas encore d'évaluation

- Real Time Options Greeks Feed BrochureDocument2 pagesReal Time Options Greeks Feed BrochureVijaykumar powarPas encore d'évaluation

- Nism Doce Training Module: HR - L & D Team, HDFC BankDocument213 pagesNism Doce Training Module: HR - L & D Team, HDFC BankPrem PrakashPas encore d'évaluation

- TWSS CFA Level I - Planner and TrackerDocument6 pagesTWSS CFA Level I - Planner and TrackerSai Ranjit TummalapalliPas encore d'évaluation

- International Stock Exchanges WorldwideDocument5 pagesInternational Stock Exchanges WorldwideNilesh MandlikPas encore d'évaluation

- Sec RequirementsDocument11 pagesSec RequirementsAngelica M. CodillaPas encore d'évaluation

- Hyundai Capital Auto Funding Iv Limited: Note Agency AgreementDocument32 pagesHyundai Capital Auto Funding Iv Limited: Note Agency Agreementpaths39Pas encore d'évaluation

- Moving Averages - A Comprehensive Guide !!!Document26 pagesMoving Averages - A Comprehensive Guide !!!Nitin Govind Bhujbal100% (1)

- CCI - Guidelines For ValuationDocument13 pagesCCI - Guidelines For Valuationsujit0577Pas encore d'évaluation

- Information MemorandumDocument1 pageInformation Memorandumapi-143592703Pas encore d'évaluation

- Review of LiteratureDocument4 pagesReview of LiteratureMALLIKARJUNAPas encore d'évaluation

- Andrew Keene - Trading With The Ichimoku CloudDocument28 pagesAndrew Keene - Trading With The Ichimoku CloudJms JmsPas encore d'évaluation

- Corporate DivestitureDocument17 pagesCorporate DivestitureAnonymous VtcAZFuhPas encore d'évaluation

- Commodity Exchanges Best PracticesDocument18 pagesCommodity Exchanges Best PracticesorionthereclusePas encore d'évaluation

- State Bank of India January 2008 Question Paper (Fully Solved)Document1 pageState Bank of India January 2008 Question Paper (Fully Solved)Senthil KumarPas encore d'évaluation