Académique Documents

Professionnel Documents

Culture Documents

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Transféré par

Shyam SunderDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

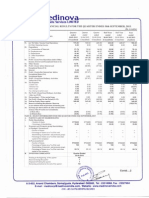

Confidence Finance and Trading Limited

Formerly knowns as Confidence Trading Company Limited

Regd. Off.: Botawala Building, 3rd Floor, 11/13, Horniman Circle, Fort, Mumbai 400 001

SCRIP CODE : 504340

UNAUDITED FINANCIAL RESULTS FOR THE QUARTER ENDED 30.09.2015

Quarter Ended

(Rs. In Lacs )

Half Year Ended

PARTICULARS

Corresponding 3

Preceding 3 months ended in

3 months ended months ended the previous year

30.09.2015

30.06.2015

30.09.2014

Unaudited

Unaudited

Unaudited

Year ended

Corresponding

6 months ended

6 months

in the previous

ended

year

30.09.2015

30.09.2014

Unaudited

Unaudited

Year ended

31.03.2015

Audited

PART-I

Income

Income from Operation

Other Income

Total Income

Expenditure

Purchase of stock in Trade

Changes in Inventories of Finished goods

Operating cost

Operating Profit before Dep. & Tax

Employee Cost

Financial Cost

Depreciation

Other Expenditure

Profit before Taxation

Provision for Tax, Deffered Tax

Net Profit / Loss

382.90

382.9

188.17

188.17

47.19

47.19

568.67

568.67

94.13

94.13

215.47

215.47

362.97

68.17

-48.24

6.51

1.14

13.73

-69.62

-69.62

187.71

-32.35

32.81

7.76

1.04

15.55

8.46

8.46

0.27

0.45

46.47

7.78

1.19

12.11

25.39

25.39

548.33

35.82

-15.48

14.27

2.18

29.22

-61.15

-61.15

48.92

-48.20

93.41

15.55

2.38

28.44

47.04

47.04

117.49

-56.23

154.21

29.39

8.07

68.88

47.87

14.16

33.71

10250.00

10250.00

10250.00

10250.00

10250.00

10250.00

(a) Basic and diluted EPS before Extraordinary

Items for the period for the year to date and for

the previous year (not to be annualized)

(0.07)

0.01

(b) Basic and diluted EPS after Extraordinary

items for the period for the year to date and for the

previous year (not to be annualised)

(0.07)

0.01

Paid-up Equity Share Capital, FV Rs.1/Reserves excluding Revaluation Reserve as per

balance sheet of Previous accounting Year.

578.11

Earning Per share(EPS)

PART-II

A

PARTICULARS OF SHAREHOLDINGS

1 Aggregate of Public Share-holding

(a) No. of Shares

(b) Percentage of Holding

2 Promoters and Promoter Group share holding

(a) Pledged/Encumbered

-Number of shares

-Percentage of shareholding (as a % of the

total shareholding of promoter & promoter group)

-Percentage of shareholding(as a %of the

totalsharecapital of the company)

(b) Non-encumbered

-Number of shares

-Percentage of shareholding(as a %of the total

shareholding of promoter & promoter group

-Percentage of shareholding(as a %of the total

sharecapital of the company)

B

Investor Compliants

Pending at the Beginning of the Quarter

Received during the quarter

Disposed of during the quarter

Remaining unresolved at the end of the quarter

10,06,75,000 10,06,75,000

98.22%

98.22%

0.02

0.02

(0.06)

(0.06)

10,06,75,000 10,06,75,000

98.22%

98.22%

0.05

0.03

0.03

0.03

10,06,75,000

98.22%

10,06,75,000

98.22%

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

Nill

1825000

1825000

1825000

1825000

1825000

1825000

100%

100%

100%

100%

100%

100%

1.78%

1.78%

3 months ended 30.09.2015

Nil

Nil

1.78%

1.78%

1.78%

1.78%

Nil

Nil

Statement of Assets & Liabilities as on 30.09.2015

PARTICULARS

A EQUITY AND LIABILITIES

1 Shareholders fund

(a) Share capital

(b) Reserve & Surplus

( c) Money raised against share warrants

Sub- total- Shareholders' Funds

2 Share application money pending allotment

30-09-2015

3 Minority Interest*

4 Non-current Liabilities

(a) Long-term borrowings

(b) Deffered Tax Liabilities

(c) other Long-term Liabilities

(d) Long Term provisions

Sub-total- Non-current Liabilities

5 Current Liabilities

(a) Short term borrowings

(b) Trade Payables

(c ) Other current Liabilities

(d) Short-term provisions

1,025.00

550.60

515.50

2,091.10

(In Lakhs)

30-09-2014

1,025.00

625.16

1,650.16

515.50

Sub-total- Current Liabilities

TOTAL - EQUITY AND LIABILITIES

50.50

12.77

30.02

93.29

2,184.39

4.25

14.48

18.73

2,184.39

Sub-total-Non-current assets

9.79

235.00

1.74

1,777.27

0.25

2,024.05

17.22

2,010.20

0.72

2,028.14

Sub-total-Current assets

TOTAL-ASSETS

24.01

12.75

123.58

160.34

2,184.39

51.79

2.18

102.28

156.25

2,184.39

B ASSETS

1 Non-current assets

(a) Fixed asstes

(b) Non-current investments

(c ) Deffered tax asstes (net)

(d) Long-term loans and advances

(e) Other non-current asstes

2 Current assets

(a) Current investments

(b) Inventories

(c ) Trade recievables

(d) Cash and cash equivalents

(e) Short- term loans and advances

(f) Other current assets

Notes:

1) The above results have been reviewed by the Audit Committee and approved by the Board Of Directors in their meeting held on 07.11.2015.

2) This result is available on our Website www.ctcl.co.in

3) The figures for the previous quarter/year have been re-grouped/ re-classified / re-stated wherever necessary to confirm to the presentation requirement in terms of

the format as per revised schedule VI under the Companies Act, 1956.

4) Provision for taxation will be made at the end of the year and hence not provided on quarterly basis.

5) The Company has Single Reportable Segment as defined in Accounting Standard 17, Therefore Segment Reporting is not applicable to the Company

For Confidence Finance and Trading Limited

Place : Mumbai

Date : 07.11.2015

Manoj Jain

Director

DIN: 00165280

CHARTERED ACCOUNTANTS

1608, Panchratna,

Opera House,Mumbai - 400 004.

Tblefax: +91-22-66106547 / I

+91-22-33946546 / 7

E-mail : ca.anchaliya@gmail. com

ca@anchaliya.com

Website: www.anchaliya. com

Date:05.11

.2015

To,

TheBoardof Directors,

Confidence

Finance& TradingLtd.,

9, BotawalaBuilding,

3'dFloor, ll/I3,Horniman Circle

Fort,Mumbai- 400001

DearSir,

Re: Limited Review of ProvisionalUnauditedFinancialResult forthe period Ended30.09.2015.

We have reviewed the accompanyingstatementof unauditedfinancial results of Confidence Finance &

Trading Ltd. for the period ended on 30ft September2015 except for the disclosuresregarding 'Public

Shareholding' and 'Promoter and Promoter Group Shareholding' which have been traced from

disclosures made by the management and have not been reviewed by us. This statement is the

responsibility of the Company's Management and has been approved by the Board of Directors/

Committee of Board of Directors. Our responsibility is to issue a report on these financial statements

basedon our review.

We conducted our review in accordance with the Standard on Review Engagement (SRE) z4llReview

of Interiin Financial Information Performed by the Independent Auditor of the Company issued by the

Institute of Chartered Accountants of India. This standard requires that we plan and perform the review

to obtain moderate assuranceas to whether the financial statementsare free of material misstatement. A

review is limited primarily to inquiries of company personnel and analytical procedures applied to

financial data and thus provide less assurance than an audit. We have not performed an audit and

accordingly,we do not exptessan audit opinion.

Based on our review conductedas above, nothing has come to our affention that causesus to believe that

the accompanying statement prepared in accordancewith applicable accounting standard, as notified

under the companies(Accounting Standard)Rules, 2006 read with Rule 7 of the Companies(Accounts)

Rules, 2014 in respect of section 133 of the Companies Act, 2013 and other recognized accounting

practicesand policies has not disclosedthe information required to be disclosed in terms of Clause 41 of

the Listing Agreement including the manner in which it is to be disclosed,or that it contains any material

misstatement.

For SureshAnchaliya & Co.

CharteredAccountants

Firm Reg.No.: 112492W

(Suresh Anchaliya)

Partner

Membership No.: 044960

CertilicateNo.:f3 F

Vous aimerez peut-être aussi

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For September 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For September 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document5 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document7 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Document4 pagesFinancial Results & Auditors Report For March 31, 2015 (Standalone) (Audited) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Al-Habib Bank LTDDocument44 pagesAl-Habib Bank LTD2friendPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document6 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Announces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Document4 pagesAnnounces Q2 Results & Auditors' Report For The Quarter Ended September 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Announces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Document5 pagesAnnounces Q2 Results, Limited Review Report & Results Press Release For The Quarter Ended September 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document3 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document6 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Updates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document7 pagesUpdates Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Consolidated Financial StatementsDocument28 pagesConsolidated Financial Statementsswissbank333Pas encore d'évaluation

- 21St Century Computer Solutions: A Manual Accounting SimulationD'Everand21St Century Computer Solutions: A Manual Accounting SimulationPas encore d'évaluation

- The Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionD'EverandThe Handbook for Reading and Preparing Proxy Statements: A Guide to the SEC Disclosure Rules for Executive and Director Compensation, 6th EditionPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Swiggy Single ItemDocument2 pagesSwiggy Single ItemUsnshsnsPas encore d'évaluation

- Philippine School of Business Administration Accounting 309: Accounting For Business CombinationDocument35 pagesPhilippine School of Business Administration Accounting 309: Accounting For Business CombinationLorraineMartinPas encore d'évaluation

- Tck-In Day 9Document3 pagesTck-In Day 9Julieth RiañoPas encore d'évaluation

- Swot San Miguel CorporationDocument26 pagesSwot San Miguel CorporationMAG MAGPas encore d'évaluation

- 2W Multi Brand Repair StudioDocument26 pages2W Multi Brand Repair StudioShubham BishtPas encore d'évaluation

- E3 Expo Booklet - 2018Document22 pagesE3 Expo Booklet - 2018CoachTinaFJPas encore d'évaluation

- WORKSHOP ON Business AnalyticsDocument2 pagesWORKSHOP ON Business AnalyticssubramonianPas encore d'évaluation

- LIST OF YGC and AYALA COMPANIESDocument3 pagesLIST OF YGC and AYALA COMPANIESJibber JabberPas encore d'évaluation

- Bs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)Document9 pagesBs. Accountancy (Aklan State University) Bs. Accountancy (Aklan State University)JANISCHAJEAN RECTOPas encore d'évaluation

- V1 INE004 Apunte Semana4Document20 pagesV1 INE004 Apunte Semana4Valentina VeraPas encore d'évaluation

- Consultancy Paper FinalDocument20 pagesConsultancy Paper FinalRosemarie McGuirePas encore d'évaluation

- Engg Eco Unit 2 D&SDocument129 pagesEngg Eco Unit 2 D&SSindhu PPas encore d'évaluation

- MIT 1050: Week 2: Overview of Media IndustriesDocument3 pagesMIT 1050: Week 2: Overview of Media IndustriesMar JoPas encore d'évaluation

- 2Document14 pages2romeoremo13Pas encore d'évaluation

- Fedex Label - PL2303002 S&S MartechDocument6 pagesFedex Label - PL2303002 S&S MartechAnh HuynhPas encore d'évaluation

- Syllabus Marketing Management MBA ITBDocument18 pagesSyllabus Marketing Management MBA ITBAndi A Fauzan ParewangiPas encore d'évaluation

- Criticisms of The Ifrs Conceptual FrameworkDocument9 pagesCriticisms of The Ifrs Conceptual FrameworkTHOMAS ANSAHPas encore d'évaluation

- F6zwe 2015 Dec ADocument8 pagesF6zwe 2015 Dec APhebieon MukwenhaPas encore d'évaluation

- Kritika AbstractDocument3 pagesKritika AbstractKritika SinghPas encore d'évaluation

- Mergers and Acquisition and Treatments To IPR Project (8th Semester)Document15 pagesMergers and Acquisition and Treatments To IPR Project (8th Semester)raj vardhan agarwalPas encore d'évaluation

- Distribution Channel of United BiscuitsDocument5 pagesDistribution Channel of United BiscuitsPawan SharmaPas encore d'évaluation

- Preface PDFDocument2 pagesPreface PDFOscar Espinosa BonillaPas encore d'évaluation

- Risk Quantification - ERMDocument20 pagesRisk Quantification - ERMSeth ValdezPas encore d'évaluation

- Extra FactorsDocument6 pagesExtra FactorsannettePas encore d'évaluation

- Indonesian Physician's CompetencyDocument34 pagesIndonesian Physician's CompetencyAdecha DotPas encore d'évaluation

- Deposit Slip ID: 192765 Deposit Slip ID: 192765: Fee Deposit Slip-Candidate Copy Fee Deposit Slip-BankDocument1 pageDeposit Slip ID: 192765 Deposit Slip ID: 192765: Fee Deposit Slip-Candidate Copy Fee Deposit Slip-BankAsim HussainPas encore d'évaluation

- ACC3201Document6 pagesACC3201natlyh100% (1)

- Developing Marketing Strategies and PlansDocument43 pagesDeveloping Marketing Strategies and PlansThaer Abu Odeh100% (1)

- Accounting For Joint Product and by ProductsDocument23 pagesAccounting For Joint Product and by ProductsQwerty UiopPas encore d'évaluation

- 1.pmsby - Scheme in Brief PDFDocument1 page1.pmsby - Scheme in Brief PDFRanjit RjtPas encore d'évaluation