Académique Documents

Professionnel Documents

Culture Documents

Third-Quarter Report To 30 September 2003

Transféré par

dds70Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Third-Quarter Report To 30 September 2003

Transféré par

dds70Droits d'auteur :

Formats disponibles

Third-quarter report to 30 September 2003

Tiscali Group

Directors and Auditors

Board of Directors

Chairman

Renato Soru

Directors

Franco Bernab

Victor Bischoff

Tomaso Barbini

Gabriel Pretre

Mario Rosso

Board of Auditors

Chairman

Aldo Pavan

Statutory Auditors

Piero Maccioni

Massimo Giaconia

Deputy Auditors

Andrea Zini

Rita Casu

External Auditors

Deloitte & Touche SpA

Third-quarter report to 30 September 2003

Highlights

Total consolidated revenues stood at EUR 222.2 million in 3Q03, up 24% on

3Q02 and 2% on 2Q03. Revenues for the first nine months stood at EUR 652

million, an increase of 19% on the same period of 2002;

The number of ADSL users continued to rise: the total at 30 September

2003 was 602,000, up 43% on the 420,000 customers registered in 1H03. The

total number of active users was stable at 7.6 million, mainly because of the

seasonal nature of narrowband use;

EBITDA, also affected by seasonal factors, was EUR 14.1 million (6.3% of

revenues) compared with a loss of EUR 3.7 million in 3Q02. The figure for the

first nine months was EUR 47.1 million, compared with a negative result of EUR

12.2 million in the same period of last year;

EBIT was negative in 3Q03, at EUR 52.4 million, a sharp improvement on the

EUR 84.4 million loss recorded in 3Q02;

Net debt was EUR 233.4 million at 30 September, while cash and cash

equivalents stood at EUR 447 million.

Tiscali Group

Report on operations

Tiscali shares

Tiscali shares are listed on both the Milan Nuovo Mercato (TIS) and the Paris Nouveau

March (005773). In the third quarter Tiscali once again had the highest capitalisation

of any company on both the Nuovo Mercato and the Nouveau March: EUR 1.93 billion

at end-September, following a peak of EUR 2.16 billion in August. In the first nine

months, the total number of shares rose from 366,114,338 at 30 June to 368,920,427

at 30 September.

The table below lists the capital increases carried out during the third quarter:

Date

Description

Shares issued

Share capital

31.07.2003

Capital increase subscribed by Telenor Business

Solution Holdings AS

643,950

368,920,427

31.07.2003

Capital increase subscribed by Airtelnet Movil SA

2,162,139

368,276,477

The chart below shows Tiscalis shareholder base at 30 September 2003:

Market

47.6%

Renato Soru

29.3%

Sandoz Family

Foundation

16.5%

Kingfisher

International

3.3%

Europatweb

NV 3.3%

Source: Tiscali

Third-quarter report to 30 September 2003

Tiscalis share price performed very positively from August, in line with other internet

stocks and the stock market as a whole, thanks to good half-year results and to

investors renewed interest and confidence in technology stocks and the equity market

in general.

160%

140%

120%

100%

80%

60%

40%

20%

0%

Jul-03

Jul-03

NUMTEL

Jul-03

Aug-03

Aug-03

Bloomberg European Internet Index

Sep-03

Sep-03

Tiscali

An average of 3.9 million Tiscali shares were traded daily in the period, an increase on

the average for the first six months. The average daily value of trades was EUR 20.6

million. Tiscali posted the highest monthly value of trades, at EUR 517.6 million in

September, an increase of 52% on June, making Tiscali the most liquid stock on the

Italian Nuovo Mercato and one of the most frequently traded internet stocks in Europe.

Above-average daily volumes were recorded towards the end of August, with a peak of

20.5 million shares traded on 29 August 2003. The highest price of the year to date

(EUR 6.13) was registered on 26 August, while the lowest (EUR 3.40) came on 12

March.

Tiscali Group

7.0

Price

25

Volume m

6.0

20

5.0

15

4.0

3.0

10

2.0

5

1.0

0.0

0

Jul-03

Jul-03

Aug-03

Sep-03

Sep-03

The Nuovo Mercato remains Tiscalis main market, accounting for 99.76% of total

trades.

Average daily trades of Tiscali shares on its two markets.

Number of shares

Nuovo Mercato

Date

Jan-03

No. of shares

3,056,821

%

99.87%

Nouveau March

Total

No. of shares

No. of shares

3,872

%

0.13%

3,060,692

%

100%

Feb-03

2,305,031

99.72%

6,410

0.28%

2,311,440

100%

Mar-03

2,719,402

99.72%

7,761

0.28%

2,727,163

100%

Apr-03

2,500,580

99.76%

5,907

0.24%

2,506,487

100%

May-03

1,988,456

99.56%

8,713

0.44%

1,997,168

100%

Jun-03

3,387,675

99.89%

3,580

0.11%

3,391,255

100%

Jul-03

2,514,171

99.70%

7,480

0.30%

2,521,652

100%

Aug-03

5,463,499

99.82%

9,819

0.18%

5,473,318

100%

Sep-03

4,042,548

99.78%

8,740

0.22%

4,051,288

100%

Daily average

3,108,687

99.76%

0.24%

3,115,607

100.00%

6,920

Source: Tiscali Finanza

Third-quarter report to 30 September 2003

Tiscali group: key figures

At 30 September 2003 Tiscalis consolidated revenues stood at EUR 652 million, an

increase of 19% on the EUR 547.5 million posted in the same period of 2002. Thirdquarter revenues were EUR 222.2 million, broadly flat on the previous quarter, but up

24% on the EUR 179.9 million generated in the same period of last year. The results

confirm the companys growth trend, despite the seasonal dip in activity during July and

August which was largely offset by a good performance in September.

The company had 7.65 million active users at end-September. An increasing number of

these were broadband customers: the number stood at 602,000, a rise of 132,000 on

the previous quarter.

m

700

600

500

400

300

200

100

0

-

Revenues

Gross profit

Sep 2002 YTD

EBITDA

Sep 2003 YTD

With 12.4 million unique visitors to its portal in September 2003 (source

Nielsen@ratings), Tiscali once again confirmed its ranking as one of Europes biggest

web properties, thanks to a significant presence in 15 countries and its leadership

7

Tiscali Group

position in Europes five main markets.

Despite a change in the mix of access revenues due to broadband growth and a

seasonal dip in high-margin dial-up revenues, gross profit stood at 49.5% of revenues.

Third-quarter EBITDA stood at EUR 14.1 million, a sharp improvement on 3Q02, when

the figure was negative at EUR 3.7 million, but a slight drop on 2Q03 owing to normal

seasonal factors. In the first nine months of 2003 EBITDA was a positive EUR 47.1

million, compared with a loss of EUR 12.2 million in the same period of 2002.

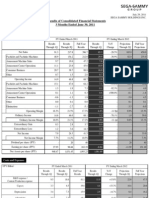

Consolidated Profit and Loss Account

(figures in thousand euro)

09.2003

9 months

09.2002

09.2003

9 months

09.2002

3 months

3 months

Revenues

651,905

547,571

222,218

179,854

Value of production

651,905

547,571

222,218

179,854

Cost of goods sold

(499,970)

(440,073)

(172,197)

(145,939)

Personnel costs

(104,813)

(119,679)

(35,920)

(37,537)

47,122

(12,181)

14,101

(3,622)

EBITDA

Depreciation and amortisation

(100,441)

(114,619)

(32,819)

(30,727)

Goodwill amortisation

(75,925)

(188,156)

(25,528)

(46,968)

Other provisions

(21,925)

(122,486)

(8,144)

(3,126)

(151,169)

(437,442)

(52,390)

(84,443)

Financial charges

(15,658)

(36,931)

(5,241)

(13,946)

Extraordinary items

(48,449)

(46,944)

(16,011)

(16,887)

(215,276)

(521,317)

(73,642)

(115,276)

13,704

n.a.

807

n.a.

(201,572)

(521,317)

(72,835)

(115,276)

EBIT

Gross profit

Minority interests

Pre-tax profit

The access business remains Tiscalis main revenue driver thanks to increasing

demand for ADSL broadband services, which brought in EUR 44 million, or 30% of

total access revenues, in 3Q03, and EUR 104 million in the first nine months of the

8

Third-quarter report to 30 September 2003

year. Total access revenues stood at EUR 150.5 million in the quarter, or 68% of total

revenues. The figure was up 24% on 3Q02, and broadly flat on the previous quarter.

Access revenues in the first nine months stood at EUR 449.2 million (69% of the total),

an increase of 18% on the same period of 2002.

Revenues from business services grew steadily throughout 2003, thanks to both

organic growth brought about by a sharper commercial focus, and external growth

following the acquisition of Cable & Wireless in France (consolidated from July) and

Eunet in Austria. Business services revenues in the third quarter stood at EUR 41.6

million (19% of total revenues), up 37% on 3Q02, and 18% on the previous quarter. In

the first nine months, the figure rose by 49% on the same period of 2002, to EUR 111

million.

Portal revenues in 3Q03 came in at EUR 10.9 million, or 5% of total revenues. The

slight dip on 2Q03 was due to continuing stagnation in the advertising market, which

also affected the online segment, and to normal seasonal factors. In the first nine

months of the year portal revenues stood at EUR 34.9 million.

Voice revenues stood at EUR 16.8 million in 3Q03, or 8% of the total. They remained

broadly flat on 2Q03 but were up 31% on 3Q02. In the first nine months, voice

revenues were up 33% on the same period of last year, at EUR 49.3 million.

Consolidated revenues

(figures in thousand euro)

Access

09.2003

09.2002

9 months

09.2003

9 months

09.2002

3 months

3 months

449,329

380,214

150,628

121,690

49,206

37,239

16,689

12,807

111,061

74,340

41,624

30,365

34,849

36,616

10,944

9,386

Other revenues

7,460

19,162

2,333

5,606

Total revenues

651,905

547,571

222,218

179,854

Voice

Business

Portal

Tiscali Group

Revenues by region

Benelux

10%

Spain

2%

Switz.

2%

Czech Rep.

2%

Ti-Net

3%

Italy

19%

Austria

2%

S. Africa

3%

Germany

9%

Nordic

6%

France

21%

UK

21%

The breakdown of revenues by region above shows that 80% of revenues are

generated in Europes five main markets. Interestingly, the share generated by the UK

grew in the third quarter, from 18% in 1Q03 to 21% in 3Q03. This was due to both an

increase in broadband revenues and the acquisition of npowers telephony business on

4 September.

10

Third-quarter report to 30 September 2003

Gross margin and operating costs

As proof of its solid level of business efficiency, Tiscalis gross margin stood at 49.5%

in 3Q03, broadly flat on the figure at 3Q02 and slightly down on 2Q03.

In the first nine months of the year the gross margin stood at 50%, slightly up on the

48% posted in the same period of 2002.

Third-quarter gross profit stood at EUR 110.1 million, compared with EUR 327 million

in the first half of the year.

Gross Margin

m

350

60%

300

50%

250

200

40%

150

30%

100

20%

50

10%

0

Sep 2002 YTD

Gross profit

Sep 2003 YTD

Gross margin (%)

The access business generated gross profit of EUR 80.9 million in 3Q03, and a gross

margin on revenues of 54%. This was a slight fall on the 56% figure posted in the

previous quarter, owing to a greater contribution from ADSL revenues, but was up on

the 3Q02 margin of 52%.

Third-quarter gross profit in the portal business was EUR 5.5 million51% of

revenues. This was an improvement on both the previous quarter (49%) and the figure

at 3Q02 (50%).

Business services generated gross profit of EUR 21.4 million, and a gross margin of

51%. This figure has remained stable throughout 2003, but is an improvement on the

same period of 2002.

Gross profit from voice services stood at EUR 3.8 million in the quarter, or 23% of

revenues; this is higher than both the previous quarter (22%) and 3Q02 (20%).

Marketing and sales costs in 3Q03 were EUR 35.9 million, or 16% of revenues. The

figure was broadly flat on the previous quarter (16% of revenues), but better than the

3Q02 figure (18% of revenues).

11

Tiscali Group

In the first nine months of the year, marketing and sales costs came in at EUR 102.3

million, or 16% of revenues. This percentage was also broadly stable on the same

period of last year.

Personnel costs totalled EUR 35.9 million in 3Q03, in line with the previous quarter and

with 3Q02. They fell as a percentage of sales, from 20% in 2Q02 to 16%, owing mainly

to restructuring activities carried out in 2002. In the first nine months of this year

personnel costs were EUR 104.9 million, or 16% of total revenues; this was a sharp

drop on the same period of 2002, when costs stood at EUR 106.5 million, or 19% of

revenues.

At 30 September 2003 Tiscali had 3,111 employees, compared with 3,036 at end-June.

This increase was mainly due to the consolidation of Cable & Wireless in France, which

was bought at end-June and consolidated from 20 July. The new acquisition is

currently undergoing a staff rationalisation programme, which will be completed by the

end of this year.

G&A costs, at EUR 24.2 million, were slightly up on the previous quarter, but remained

flat as a percentage of revenues, at 11%. However, they were sharply down on the

EUR 26.9 million (15% of revenues) posted in 3Q02. G&A costs in the first nine months

were EUR 72.7 million, or 11% of revenues, a decline on the EUR 76.8 million (14%)

registered in the same period of 2002.

Operating costs came in at EUR 279.8 million in the first nine months, or 43% of total

revenues. Last year, the figure was EUR 274.3 million, or 50% of revenues. This

reduction in costs as a percentage of revenues followed the rationalisation process

completed in 2002.

The reduction in operating costs in the first nine months produced a positive EBITDA of

EUR 47.1 million, compared with a loss of EUR 12.2 million at September 2002.

This result was achieved thanks to the intensive restructuring and rationalisation of the

group completed in 2002, following the aggressive acquisitions campaign that turned

the company into the European player it is today.

12

Third-quarter report to 30 September 2003

EBITDA

m

8%

60

50

6%

40

4%

30

2%

20

10

0%

0

-10

Sep 2002 YTD

Sep 2003 YTD

-2%

-4%

-20

EBITDA

EBITDA (%)

In the third quarter, the group posted EBITDA of EUR 14.1 million, a sharp

improvement on the loss of EUR 3.7 million recorded in 3Q02.

EBIT was negative, at EUR 52.4 million in the third quarter, compared with the loss of

EUR 84.4 million recorded in 3Q02. Depreciation and amortisation charges were higher

than in the second quarter of 2003, chiefly owing to investments in unbundled networks

in countries where the group has a large share of ADSL users.

The group posted an EBIT loss of EUR 151.1 million for the first nine months,

compared with a loss of EUR 437.4 million at the end of September 2002. EBITA was

negative to the tune of EUR 76 million.

The group registered a consolidated pre-tax loss of EUR 201 million for the first nine

months of the year, compared with a loss of EUR 521.3 million at 30 September 2002.

13

Tiscali Group

Extraordinary operations

In July 2003, Tiscali completed the acquisition of the domestic internet access and

business services activities of Cable & Wireless in France (annualised sales of EUR 35

million), through its French subsidiary Liberty Surf Group SA. The operation is part of

Tiscalis drive to increase its range of services to SMEs on the French market, and will

take sales of business services at Tiscali France to EUR 50 million.

The company was consolidated from 20 July 2003, and generated revenues of EUR

4.8 million to 30 September.

The acquisition cost of EUR 5.6 million will be paid in two tranches, in cash. The first

tranche was paid in the third quarter of 2003.

The integration of the Cable & Wireless internet business will bring Tiscali a highly

prestigious client base, and generate substantial synergies and improvements in the

profitability of its French business.

The acquisition will enable the company to broaden its portfolio of products and

services significantly (particularly in VPN/IP and VISP), extend its network in France

and improve its efficiency. This will be achieved thanks to the integration of Cable &

Wireless national transmission network (24 regional POPs, plus a metropolitan

network in Paris connecting the various nodes) and value-added services platforms

(VISP, VPN/IP, firewalls).

In September, Tiscali acquired the telephony business of UK group npower, through its

subsidiary Tiscali UK, for a price between GBP 6 and 7 million. The final amount will be

paid in December 2003 upon completion of the customer migration process in midNovember.

The operation strengthens Tiscalis UK telephony business, thanks to npowers

database totalling over 200,000 customers. Tiscali expects the business to generate

revenues of over GBP 25 million a year, before synergies.

The business was consolidated from 1 September 2003, and generated revenues of

EUR 3 million to 30 September.

14

Third-quarter report to 30 September 2003

The acquisition represents a significant opportunity for Tiscali, which aims to make

telephony one of its core businesses. It will be able to offer its new customers a wide

range of voice services, as well as dial-up and broadband connections. The acquisition

is part of the groups strategy to strengthen its presence on the UK market.

On 5 September 2003, Tiscali announced the launch of a EUR 209.5 million equitylinked bond issue due 2006.

The bonds were issued by Luxembourg subsidiary Tiscali Finance SA and backed by

Tiscali SpA.

The redemption price was set at EUR 7.57, which offered a premium of 32% on the

price of Tiscali shares at issue. The coupon was set at 4.25%.

From September 2004, holders will have the option to redeem their bonds for a cash

amount linked to the performance of Tiscali shares (equity-linked redemption).

If the bondholders decide to exercise this redemption right, Tiscali Finance SA will have

the option to repay the bonds in ordinary Tiscali shares.

At maturity, or in certain other circumstances, the bonds will be redeemed at par in

cash, or at the issuers discretion, in a combination of Tiscali shares and cash.

Tiscali SpA may launch a capital increase if the bonds are redeemed in shares.

The issue will allow Tiscali to refinance part of its existing debt under better conditions.

15

Tiscali Group

Financial position

Consolidated balance sheet

09.2003

06.2003

12.2002

(figures in thousand euro)

Current assets

800,354

566,235

639,335

Non-current assets

971,547

1,019,966

1,052,170

1,771,901

1,586,201

1,691,505

Short-term liabilities

581,762

583,638

522,098

Consolidated liabilities

738,166

522,737

523,379

Shareholders equity

451,973

479,826

616,028

1,771,901

1,586,201

1,661,505

Total assets

Total liabilities

At 30 September 2003, the groups non-current assets were worth EUR 972 million.

Consolidated shareholders equity, excluding minorities, stood at EUR 452 million.

This is a lower figure than at 30 September 2002, as the group made a net loss of EUR

73 million in the first nine months of the year.

The groups cash resources totalled EUR 447 million at the end of the third quarter of

2003, including short-term investments (other securities). Net debtexcluding

payables to other financial institutions of EUR 50.8 millionstood at EUR 233 million,

compared with EUR 188 million at 30 June 2003.

16

Third-quarter report to 30 September 2003

Financial position

09.2003

06.2003

03.2003

12.2002

(figures in thousand euro)

Cash and cash equivalents

447,074

284,516

314,636

333,757

Short-term bank debt

(37,443)

(39,276)

(52,876)

(56,057)

Short-term cash position

409,631

245,240

261,760

277,700

Medium-/long-term debt

(643,003) (433,503) (420,488) (412,460)

Net debt

(233,372) (188,263) (158,728) (134,760)

Net debt rose EUR 45.1 million over the third quarter.

The group generated operating cash flow of EUR 31 million in 3Q03. Cash outlay

mainly related to the building of the Tiscali Campus in Cagliari, interest paid on bonds

over the period, the npower and Cable & Wireless acquisitions and other one-off

payments.

Investment

Gross investment in the quarter totalled EUR 35.2 million, and mainly related to the

installation of network infrastructure required to provide unbundled broadband services.

Around EUR 17 million was spent on the new headquarters in Cagliari.

17

Tiscali Group

Significant events since the end of the period

On 17 October 2003, Tiscali announced plans to launch a buy-back on all bonds

issued in July 2002 and due July 2004 by subsidiary Tiscali Finance SA, for a total of

EUR 150 million.

The operation will allow Tiscali to restructure its debt under better conditions, both in

terms of cost and maturity, following the strategy it announced to the market at the

launch of the equity-linked bond issue in September.

Outlook

Tiscalis main objective in 2003 is to capture market share in the European broadband

market, particularly in ADSL.

Selective investment in unbundled ADSL and voice network infrastructure should

support growth and improve margins on Tiscalis broadband services.

Revenues are expected to grow by over 20% YoY in 2003, and the EBITDA margin is

forecast in the region of 8%.

18

Third-quarter report to 30 September 2003

Parent company: key figures

Parent company: profit and loss account

Profit and Loss Account

09.2003

09.2002

09.2003

09.2002

(figures in thousand euro)

9 months

9 months

3 months

3 months

Revenues

123,534

96,432

38,543

31,925

Value of production

123,534

96,432

38,543

31,925

Cost of goods sold

(114,653)

(107,564)

(40,643)

(35,097)

Personnel costs

(23,236)

(19,971)

(8,341)

(6,615)

EBITDA

(14,355)

(31,103)

(10,441)

(9,787)

Depreciation and amortisation

(19,591)

(10,263)

(7,523)

(3,480)

(1,030)

(190,911)

(612)

(124)

(34,976)

(223,277)

(18,576)

(13,391)

Financial charges

(4,983)

(15,843)

(742)

(26,378)

Extraordinary items

(9,220)

(12,722)

(25,206)

(49,179)

(260,842)

(19,318)

(64,975)

Other provisions

EBIT

Gross profit

At 30 September 2003, EBITDA was negative to the tune of EUR 14.3 million, including

holding costs. The EBITDA loss in the third quarter was EUR 10.4 million. The ninemonth result net of adjustments made pursuant to IAS 17 was EUR 7.5 million.

The main costs in the first nine months related to line and port rentals (EUR 23.6

million, or 20% of revenues), the purchase of traffic (EUR 29 million, or 24% of

revenues) and advertising and promotions (EUR 12.1 million, or 10% of revenues).

19

Tiscali Group

Personnel costs rose 21% from EUR 19.9 million at 30 September 2002 to EUR 23.2

million at 30 September 2003. Over the quarter, these costs were up 17% compared

with 3Q02. The headcount rose from 794 at 30 September 2002 to 836 at 30

September 2003.

In the first nine months of 2003, the parent companys investments totalled EUR 42.7

million (of which EUR 30.3 million was spent in the third quarter). This breaks down into

spending of EUR 11.3 million on intangible assets and EUR 31.4 million on tangible

assets. Investment in tangible assets mainly related to the building of the groups new

headquarters in Cagliari, and the purchase of equipment to expand the fibre-optic

network acquired in 2002 and to cover the increase in ADSL users. Spending on

intangible assets related to the purchase and development of software, as well as work

on new POP servers following the expansion of the network.

Parent company: financial position

Financial position

09.2003

06.2003

03.2003

(figures in thousand euro.)

Cash and cash equivalents

3,157

6,989

4,722

Short-term bank debt

(30,461)

(31,003)

(34,933)

Short-term debt

(27,304)

(24,014)

(30,211)

Medium-/long-term debt

(33,503)

(33,503)

(5,463)

Net debt

(60,807)

(57,517)

(35,674)

20

Third-quarter report to 30 September 2003

Parent company: revenue breakdown

Revenues

09.2003

09.2002

09.2003

09.2002

(figures in thousand euro.)

9 months

9 months

3 months

3 months

Access

69,346

49,007

23,480

15,579

Voice

21,972

14,603

8,040

6,268

6,113

3,533

1,623

1,022

Portal

10,327

12,533

3,133

3,266

Other revenues

15,776

16,756

2,267

5,790

Total revenues

123,534

96,432

38,543

31,925

Business

Parent company revenues totalled EUR 123.5 million in the first nine months of 2003,

an increase of 29% on the same period of 2002.

Growth was largely driven by higher access and voice revenues. Access revenues rose

on the back of the launch of the ADSL service and growth in reverse interconnection

traffic; voice revenues rose from EUR 14.6 million in 3Q02 to EUR 21.9 million in 3Q03,

following significant growth in traffic minutes, particularly among business customers.

Third-quarter revenues stood at EUR 38.5 million, an increase of 21% on the EUR 31.9

million posted in 3Q02. Access revenues came in at EUR 23.4 million, up 50.7% from

EUR 15.6 million in 3Q02. The change was mainly due to the huge rise in ADSL

customers (who numbered 83,000 at 30 September 2003, a 294% increase on the

figure at 30 September 2002) and the introduction of the decade 7 access service,

which generates higher revenues per minute than reverse interconnection. Dial-up

minutes fell slightly from 2 billion in the third quarter of 2002 to 1.8 billion, owing to

cannibalisation by ADSL. The number of active users was flat at 1.3 million. Voice

revenues rose from EUR 6.2 million in 3Q02 to EUR 8 million in the same period this

year.

This increase was chiefly driven by higher sales of wholesale services. B2B services

generated revenues of EUR 1.6 million in the third quarter, compared with EUR 1

million in 3Q02.

21

Vous aimerez peut-être aussi

- Martin Engegren Sony Ericsson q1 2009Document9 pagesMartin Engegren Sony Ericsson q1 2009martin_engegrenPas encore d'évaluation

- 23KODocument3 pages23KOHatim BaraPas encore d'évaluation

- Q3 2017 Press ReleaseDocument18 pagesQ3 2017 Press ReleaseGrace StylesPas encore d'évaluation

- Martin Engegren Sony Ericsson q4 2009Document11 pagesMartin Engegren Sony Ericsson q4 2009martin_engegrenPas encore d'évaluation

- HSBC Luxury ConferenceDocument38 pagesHSBC Luxury Conferencesl7789Pas encore d'évaluation

- 4Q2013 DefDocument24 pages4Q2013 DefcoccobillerPas encore d'évaluation

- 1st Half Report - June 30, 2010Document75 pages1st Half Report - June 30, 2010PiaggiogroupPas encore d'évaluation

- Press Release Sony Ericsson Reports Second Quarter Results: July 16, 2009Document11 pagesPress Release Sony Ericsson Reports Second Quarter Results: July 16, 2009it4728Pas encore d'évaluation

- Opcom: JANUARY 2013 Monthly Market ReportDocument4 pagesOpcom: JANUARY 2013 Monthly Market ReportioanitescumihaiPas encore d'évaluation

- Opcom: February 2013 Monthly Market ReportDocument4 pagesOpcom: February 2013 Monthly Market ReportioanitescumihaiPas encore d'évaluation

- DHL Group Quarterly Statement Q3 2023Document16 pagesDHL Group Quarterly Statement Q3 20232121002151Pas encore d'évaluation

- En Randco 2023 Hy FRDocument60 pagesEn Randco 2023 Hy FRxoyix69619Pas encore d'évaluation

- Cash Generation Reaches R$ 613 Million in 2002: July/September 2002Document15 pagesCash Generation Reaches R$ 613 Million in 2002: July/September 2002Klabin_RIPas encore d'évaluation

- Bittium Corporation Half Year Financial Report 1H2023Document29 pagesBittium Corporation Half Year Financial Report 1H2023robertlinonPas encore d'évaluation

- Interim+Financial+Report+at+30+september+2017 ENGDocument24 pagesInterim+Financial+Report+at+30+september+2017 ENGnicolae adrian DincaPas encore d'évaluation

- Klabin Reduces Debt: April/June 2003Document16 pagesKlabin Reduces Debt: April/June 2003Klabin_RIPas encore d'évaluation

- Pressemitteilung H1 2021 enDocument5 pagesPressemitteilung H1 2021 enM StarPas encore d'évaluation

- Soitec Announces Full Year Results For 2011-2012Document11 pagesSoitec Announces Full Year Results For 2011-2012Lachlan MarkayPas encore d'évaluation

- Results Announcement Q3 2018 PDFDocument42 pagesResults Announcement Q3 2018 PDFJaswanthPas encore d'évaluation

- Maruti Suzuki: Performance HighlightsDocument13 pagesMaruti Suzuki: Performance HighlightsAngel BrokingPas encore d'évaluation

- Nokia in 2006 ReportDocument92 pagesNokia in 2006 ReportammanfadiaPas encore d'évaluation

- Bulgari 2008Document46 pagesBulgari 2008Milena Marijanović IlićPas encore d'évaluation

- VNI Monthly Report Mar 2013Document4 pagesVNI Monthly Report Mar 2013haiquanngPas encore d'évaluation

- Ucb (Report)Document3 pagesUcb (Report)Shruti VasudevaPas encore d'évaluation

- English Edition - 11 December, 2020, 09:02 PM ISTDocument7 pagesEnglish Edition - 11 December, 2020, 09:02 PM ISTRANAJAY PALPas encore d'évaluation

- Press Release Vallourec Reports Third Quarter and First Nine Months 2020 ResultsDocument16 pagesPress Release Vallourec Reports Third Quarter and First Nine Months 2020 ResultsShambavaPas encore d'évaluation

- Report On Economy of ItalyDocument9 pagesReport On Economy of ItalySHIVAKUMARPas encore d'évaluation

- Directors Report Year End: Mar '10: Explore Tata Steel ConnectionsDocument15 pagesDirectors Report Year End: Mar '10: Explore Tata Steel ConnectionsChetan PatelPas encore d'évaluation

- Game Manager Report I.1 Overall View Market Model LENDING && DEPOSIT BUSINESSDocument42 pagesGame Manager Report I.1 Overall View Market Model LENDING && DEPOSIT BUSINESSena_luca6893Pas encore d'évaluation

- PR Continental q3 enDocument4 pagesPR Continental q3 enThomasPas encore d'évaluation

- NTC 4Q17 Earnings ReportDocument4 pagesNTC 4Q17 Earnings ReportJuhie GuptaPas encore d'évaluation

- PHP WKPF BKDocument5 pagesPHP WKPF BKfred607Pas encore d'évaluation

- PR Eng 2701 0 3q08 07 08 08 Eng With Tables - EngDocument9 pagesPR Eng 2701 0 3q08 07 08 08 Eng With Tables - EngBachtiar HerdiantoPas encore d'évaluation

- Bulgari Group Q1 2011 Results: May 10th 2011Document10 pagesBulgari Group Q1 2011 Results: May 10th 2011sl7789Pas encore d'évaluation

- Fact Sheet Qu1 2006Document8 pagesFact Sheet Qu1 2006javierdb2012Pas encore d'évaluation

- Alicorp Earnings Report 3Q23 EN VFDocument23 pagesAlicorp Earnings Report 3Q23 EN VFADRIAN ANIBAL ENCISO ARKPas encore d'évaluation

- 14 May 2013 PR Icade's Q1 2013 ActivityDocument11 pages14 May 2013 PR Icade's Q1 2013 ActivityIcadePas encore d'évaluation

- Fact SheetDocument8 pagesFact SheetRude KingPas encore d'évaluation

- Burelle, A Growing Euro For 50 CentsDocument8 pagesBurelle, A Growing Euro For 50 CentsAlex VzquezPas encore d'évaluation

- Argentina: Economic Activity and EmploymentDocument4 pagesArgentina: Economic Activity and EmploymentBelen GuevaraPas encore d'évaluation

- Tcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Document18 pagesTcl Multimedia Technology Holdings Limited TCL 多 媒 體 科 技 控 股 有 限 公 司Cipar ClauPas encore d'évaluation

- Annual Report 2004Document60 pagesAnnual Report 2004scribdaccount67Pas encore d'évaluation

- Rezultate OTP BankDocument55 pagesRezultate OTP BankCiocoiu Vlad AndreiPas encore d'évaluation

- Business Results (April 1, 2008 - March 31, 2009) : (1) Sales and IncomeDocument21 pagesBusiness Results (April 1, 2008 - March 31, 2009) : (1) Sales and IncomeIhsanPas encore d'évaluation

- 3Q09 Results: October 28, 2009Document10 pages3Q09 Results: October 28, 2009Klabin_RIPas encore d'évaluation

- MMH SGXnet 03 12 FinalDocument16 pagesMMH SGXnet 03 12 FinalJosephine ChewPas encore d'évaluation

- Klabin Reports A Net Profit of R$ 940 Million Up To September 2003Document16 pagesKlabin Reports A Net Profit of R$ 940 Million Up To September 2003Klabin_RIPas encore d'évaluation

- Static Files99811264 94ac 4767 b4b8 A9ca45f1629aDocument10 pagesStatic Files99811264 94ac 4767 b4b8 A9ca45f1629arrroloPas encore d'évaluation

- 2006 - Quart02 - Soi SamgungDocument2 pages2006 - Quart02 - Soi SamgungGurpreet Singh SainiPas encore d'évaluation

- Country Responses To The Financial Crisis KosovoDocument39 pagesCountry Responses To The Financial Crisis KosovoInternational Consortium on Governmental Financial Management50% (2)

- PR - 2014 Half-Year Results Resilient Cash-Flows in A Still-Strained MarketDocument11 pagesPR - 2014 Half-Year Results Resilient Cash-Flows in A Still-Strained MarketIcadePas encore d'évaluation

- Kotak Mahindra 2011Document55 pagesKotak Mahindra 2011Pdr RaooPas encore d'évaluation

- Signify Third Quarter Results 2022 ReportDocument19 pagesSignify Third Quarter Results 2022 Reportsumanthsumi2023Pas encore d'évaluation

- Preliminary Q1 2016Document5 pagesPreliminary Q1 2016mathez11Pas encore d'évaluation

- Hosoku e FinalDocument6 pagesHosoku e FinalSaberSama620Pas encore d'évaluation

- Analyst Presentation 9M 2011Document18 pagesAnalyst Presentation 9M 2011gupakosPas encore d'évaluation

- Number Crunching File For Markstrat ProjectDocument35 pagesNumber Crunching File For Markstrat ProjectNishant Kumar100% (1)

- Tata Annual Report 2012Document6 pagesTata Annual Report 2012Vaibhav BindrooPas encore d'évaluation

- The Smart Card ReportD'EverandThe Smart Card ReportWendy AtkinsÉvaluation : 4 sur 5 étoiles4/5 (4)

- Financial Markets for CommoditiesD'EverandFinancial Markets for CommoditiesJoel PriolonPas encore d'évaluation

- 200 Ways To Revive A Hard DriveDocument74 pages200 Ways To Revive A Hard Driveapi-3738643100% (1)

- Afaleia YpologistonDocument172 pagesAfaleia Ypologistondds70Pas encore d'évaluation

- Adventure in Prolog - AmziDocument171 pagesAdventure in Prolog - AmzijoiePas encore d'évaluation

- IHealth Infrared Thermometer With LED Screen enDocument6 pagesIHealth Infrared Thermometer With LED Screen enFabián StollePas encore d'évaluation

- Prolog ProgrammingDocument197 pagesProlog ProgrammingkkatichaPas encore d'évaluation

- 10 Tools To Make A Bootable USB From An ISO FileDocument10 pages10 Tools To Make A Bootable USB From An ISO Filedds70Pas encore d'évaluation

- Electronic Signature and PKI Standardisation in Europe: Work-Plan & Current StatusDocument27 pagesElectronic Signature and PKI Standardisation in Europe: Work-Plan & Current Statusdds70Pas encore d'évaluation

- The Data Link LayerDocument4 pagesThe Data Link Layerdds70Pas encore d'évaluation

- All About CroppingDocument4 pagesAll About Croppingdds70Pas encore d'évaluation

- Quality of Service: Improving QOS in IP NetworksDocument7 pagesQuality of Service: Improving QOS in IP Networksdds70Pas encore d'évaluation

- Anti AliasDocument17 pagesAnti Aliasdds70Pas encore d'évaluation

- M9Document89 pagesM9dds70100% (1)

- Actfax Manual enDocument120 pagesActfax Manual enPanos BriniasPas encore d'évaluation

- Estimating Web-Based Application Development TasscDocument5 pagesEstimating Web-Based Application Development TasscBalasubramaniam SkPas encore d'évaluation

- Anti Ali ADocument17 pagesAnti Ali Asaske969Pas encore d'évaluation

- Charter Communications Inc (CHTR US) - GAAP HighlightsDocument38 pagesCharter Communications Inc (CHTR US) - GAAP HighlightsRahil VermaPas encore d'évaluation

- European Exchange Report 2015Document29 pagesEuropean Exchange Report 2015mariaPas encore d'évaluation

- Geothermal Economics 101 - Glacier PartnersDocument9 pagesGeothermal Economics 101 - Glacier Partnershendra_yuPas encore d'évaluation

- Burkenroad GuiaDocument24 pagesBurkenroad GuiacoricorpPas encore d'évaluation

- MAVI Investor Presentation - DecemberDocument34 pagesMAVI Investor Presentation - DecemberSarah Princess RahmanPas encore d'évaluation

- Q1FY2020 - Financials & Fact SheetDocument4 pagesQ1FY2020 - Financials & Fact SheetChirag LaxmanPas encore d'évaluation

- North America Equity ResearchDocument8 pagesNorth America Equity ResearchshamashmPas encore d'évaluation

- Bud07 Annual ReportDocument72 pagesBud07 Annual ReportrossrileyPas encore d'évaluation

- JPM MCPDocument11 pagesJPM MCPmmmansfiPas encore d'évaluation

- DuPont PDFDocument5 pagesDuPont PDFMadhur100% (1)

- LeverageDocument16 pagesLeverageanshuldcePas encore d'évaluation

- Estado Financiero CamposolDocument22 pagesEstado Financiero CamposolRosario Atencio ManyariPas encore d'évaluation

- 15down - Ar 2006 07Document140 pages15down - Ar 2006 07Jupe JonesPas encore d'évaluation

- WOOD - Annual Report - 2017 (Data Kurang) PDFDocument260 pagesWOOD - Annual Report - 2017 (Data Kurang) PDFbuwat donlotPas encore d'évaluation

- Assignment 2Document1 pageAssignment 2Sumbal JameelPas encore d'évaluation

- Event Management Workshop Handbook PDFDocument99 pagesEvent Management Workshop Handbook PDFshan raoPas encore d'évaluation

- Lowland Heights RoadhouseDocument32 pagesLowland Heights Roadhousesasamil93Pas encore d'évaluation

- LBO Modeling Test Example - Street of WallsDocument18 pagesLBO Modeling Test Example - Street of WallsVineetPas encore d'évaluation

- JSW SteelsDocument41 pagesJSW SteelsAthiraPas encore d'évaluation

- Organic Food Store Business PlanDocument27 pagesOrganic Food Store Business PlanGaurav SachanPas encore d'évaluation

- Finance Lafargeholcim 2017 Annual Report enDocument256 pagesFinance Lafargeholcim 2017 Annual Report enAlezNgPas encore d'évaluation

- Collectibles Spreadsheet AnswerDocument26 pagesCollectibles Spreadsheet Answeremre8506Pas encore d'évaluation

- TATA Annual Report 2011 12Document252 pagesTATA Annual Report 2011 12Uhrin ImrePas encore d'évaluation

- JSW Steel (JSTL In) : Q4FY19 Result UpdateDocument6 pagesJSW Steel (JSTL In) : Q4FY19 Result UpdatePraveen KumarPas encore d'évaluation

- News Release: Aryzta AgDocument3 pagesNews Release: Aryzta AgaceradicaPas encore d'évaluation

- KSL - Ushdev International Limited (IC) - 25 Jan 2013Document12 pagesKSL - Ushdev International Limited (IC) - 25 Jan 2013Rajesh KatarePas encore d'évaluation

- ADF Foods Limited - Report - 17th June 2008 - DhananjayanDocument2 pagesADF Foods Limited - Report - 17th June 2008 - Dhananjayanapi-3702531Pas encore d'évaluation

- Zorbas ExcelDocument23 pagesZorbas ExcelRoderick Jackson Jr100% (5)

- CFA Level 1 Financial Ratios SheetDocument3 pagesCFA Level 1 Financial Ratios SheetVineet Kumar100% (1)

- Annual Report 2003 04Document52 pagesAnnual Report 2003 04Kiran VishuPas encore d'évaluation