Académique Documents

Professionnel Documents

Culture Documents

Pa. Pension Reform Bill Summary

Transféré par

PennLive0 évaluation0% ont trouvé ce document utile (0 vote)

16K vues4 pagesHighlights of SB 1071, as amended Tuesday by the House State Government Committee.

Titre original

Pa. pension reform bill summary

Copyright

© © All Rights Reserved

Formats disponibles

PDF ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentHighlights of SB 1071, as amended Tuesday by the House State Government Committee.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

16K vues4 pagesPa. Pension Reform Bill Summary

Transféré par

PennLiveHighlights of SB 1071, as amended Tuesday by the House State Government Committee.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme PDF ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 4

SENATE BILL 1071 as amended by nso! -

The amendment the language of Senate Bill 1082, PN 1460 with 3 changes

1. Elimination pet that reduce the employer contribution rate collars for SERS

and PSERS for the 2016-17 fiscal year. ’ :

2, Elimination of the provision which suspends the applicability of the actuarial note

requirement of the Public Employee Retirement Commission Act to the bill and its

amendments. ;

3. Elimination provisions which makes Protecting Pennsylvania's Investments Act in

applicable to the DC plan,

A. SYNOPSIS:

© Establishes a hybrid defined contribution (DC) /defined benefit (DB) retirement benefit

plan for future state and school employees; The plan applies to state employees first hired

on or after January 1, 2018 and school employees first hired on or after July 1, 2017; and

© Applies various retirement benefit changes to current state and school members for

benefits earned prospectively on or after the above mentioned dates.

B. BILL SUMMARY:

The proposal amends the State Employees” Retirement Code and the Public School Employees’

Retirement Code to establish a hybrid DC/DB plan, applicable to future state and school

employees who begin service as follows:

7/1/2017 for PSERS members

© 1/1/1018 for SERS members.

Asa side by side hybrid, this plan provides for both employee and employer contributions to the

DC and DB plans from day 1.

Future hazardous duty employees, listed are exempt from mandatory participation in

the hybrid plan and will ha

Features of the hybrid plan include:

1B Component

PSERS employee contribution is 4%

SERS employee contribution is 3%

Final average salary (FAS) for PSERS and SERS is 5 highest years

Vesting for PSERS is 5 years; vesting for SERS is10 years oe

Shared risk/shared gain employee contributions, which are calculated every 3 years bas

on a 10-year history of investment returns. For each 1% return realized above/below

assumed rate of retum, contribution will be decreased increased by 5%, up to max of 2

percentage points.

© Lump sum withdrawals will be permitted in an actuarially neutral manner.

‘© The benefit accrual rate/multiplier is 1% (benefit formula will be 1% x FAS x years of

service)

PSERS — Employee contribution = 3.5%; employer contribution = 2.5%

SERS — Employee contribution of 3.25%; employer contribution = 2.5%

Immediate vesting of employee contributions and earnings.

3-year “cliff vesting” of employer contributions. Employer contributions and earnings

vest 100% upon accrual of 3 years of service.

‘* Voluntary contributions permitted, including roll overs, trustee-to trustee transfers and

after tax salary deductions.

Elected Officers

¢ Current elected officers, who are members of SERS and who are reelected to a term that

begins after 12/31/17, will go into the hybrid plan for future service.

Future elected officers, who are first elected to a term of office that begins after 12/31/17,

will be placed in the hybrid plan (some elected officers are optional members and may

choose no benefits or the hybrid plan under this bill).

e Anelected officer is:

© An individual who is elected or re-elected to a term of office that begins after

12/31/17, as a statewide office-holder or member of the legislature.

© An individual who is of office that begins after 12/31/17 as a

. z ly held the office to which the

of SERS before 1/1/18 will havea

id plan for their future service, before

on for use by the Republican Members and stro

‘of the Pennsylvania House of Represenarivs

istory. For each 1%

Shared risk/shared gain. Calculated every 3 years based on ioe pi

return realized aboverbelow assumed rate of return, contribution

ecreased/increased by .5%, up to max of 2 percentage points:

Actuarially Neutral Option 4— Pre-Act 120 Members i Bi aa

© Applicable to SERS and PSERS members for service earned/ contributions made

6/30/16

re imi a pre-Act 120 members to take out lump sum,

DOES NOT eliminate the ability of pre~ nb 1k opie

‘© Makes the portion of the Option 4 lump sum withdray h Tata

future service actuarially neutral. Interest applied to reduce annuity will be assumed.

of return instead of 4% under current law.

Actuarially Neutral Option 4— Post Act 120 Members

© These members will gain the ability to withdraw the lump sum

© Actuarial neutrality applied to all service/contributions.

Shared Gain -- Post- Act 120 Members Only

@ Post-Act 120 members have shared risk. The bill grants shared gain as well.

Anti-Spiking Provisions/Prospective Service — Pre/Post-Act 120 Members of SERS

© 3 highest years without overtime or 5 highest with overtime, whichever is highest.

‘Applicable only to the portion of benefits earned prospectively.

«Applies to pre and post Act 120 employees, except for Troopers covered by DiLauro

award (with, l-year highest salary applied to benefit calculation).

The bill establishes parameters for school district administration of 403(b) savings plans for

school employees. The financial institution/organization that administers the PSERS DC plan

may also offer a 403(b) plan to school employees. However, the institution or organization must

offer the DC plan and the 403(b) plan under separate contracts. Also the bill requires a school

district to contract with at least four other financial institutions or organizations to offer 403(b)

plans to employees. A 403(b) plan is a type of retirement savings plan that may be provided to

public school employees.

‘The bill establishes a Pub on an vestment Review Commission for each system.

‘The commissions regarding investment performance and

mn will include 5 members appointed by

the Minority Leader of the Senate,

and the Governor. Each

‘Versus passive investment strategies

and the PSERS Board will serve

Assembly and the Attorney

Effective date:

y Provisions of the bill making legal counsel independent of OGC, the General Assembly

and the Attorney General ~ 365 days.

‘© Remainder of the bill ~ Immediately

le 24 Part IV) established PSERS as a

lan, PSERS currently provides a DB

1 employers in the Commonwealth.

‘The Public School Employees’ Retirement Code (Titl

governmental, cost-sharing, multi-employer pension p

retirement plan to employees of approximately 773 school

established SERS as a governmental, cost-

‘The State Employees’ Retirement Code (Title 71)

‘ly provides a DB retirement plan to

sharing, multi-employer pension plan. SERS current!

‘employees of the Commonwealth of Pennsylvania.

Title 51 (Military Affairs), Chapter 73 provides for military leaves of absence. Section 7306(a)

establishes that members of certain retirement systems may continue to make payments toward

retirement benefits during a military leave of absence.

USERRA (38 U.S.C. Ch. 43) establishes special employment and benefit rights to individuals

who leave employment to perform qualified military service.

Section 401(a) of the IRC sets forth requirements for qualification for qualified pension, profit-

sharing and stock bonus plans.

Section 403(b) of the IRC sets forth requirements relating to retirement savings plans for certain

public school employees and employees of nonprofits.

SB/db

House of |

Vous aimerez peut-être aussi

- Quinn's Resignation LetterDocument2 pagesQuinn's Resignation LetterPennLivePas encore d'évaluation

- Regan Response To Cumberland County GOP ChairmanDocument1 pageRegan Response To Cumberland County GOP ChairmanPennLivePas encore d'évaluation

- Correspondence From Conference To Institution Dated Nov 10 2023Document13 pagesCorrespondence From Conference To Institution Dated Nov 10 2023Ken Haddad100% (2)

- Letter Regarding PASS ProgramDocument3 pagesLetter Regarding PASS ProgramPennLive100% (1)

- Letter To Senator ReganDocument2 pagesLetter To Senator ReganPennLivePas encore d'évaluation

- Letter To FettermanDocument1 pageLetter To FettermanPennLivePas encore d'évaluation

- Do Democrats Hold The Majority in The Pa. House of Representatives?Document12 pagesDo Democrats Hold The Majority in The Pa. House of Representatives?PennLivePas encore d'évaluation

- Calling For Rep. Zabel To ResignDocument2 pagesCalling For Rep. Zabel To ResignPennLivePas encore d'évaluation

- Senate Subpoena To Norfolk Southern CEODocument1 pageSenate Subpoena To Norfolk Southern CEOPennLivePas encore d'évaluation

- Atlantic Seaboard Wine Association 2022 WinnersDocument11 pagesAtlantic Seaboard Wine Association 2022 WinnersPennLivePas encore d'évaluation

- Letter To Chapman Regarding The ElectionDocument2 pagesLetter To Chapman Regarding The ElectionPennLivePas encore d'évaluation

- 2022 Team of 20 GridDocument1 page2022 Team of 20 GridPennLivePas encore d'évaluation

- Wheeler's Letter To LeadersDocument2 pagesWheeler's Letter To LeadersPennLivePas encore d'évaluation

- 23 PA Semifinalists-NatlMeritProgramDocument5 pages23 PA Semifinalists-NatlMeritProgramPennLivePas encore d'évaluation

- Description of Extraordinary OccurrenceDocument1 pageDescription of Extraordinary OccurrencePennLivePas encore d'évaluation

- Ishmail Thompson Death FindingsDocument1 pageIshmail Thompson Death FindingsPennLivePas encore d'évaluation

- Corman Letter Response, 2.25.22Document3 pagesCorman Letter Response, 2.25.22George StockburgerPas encore d'évaluation

- Project Milton in Hershey, 2022Document2 pagesProject Milton in Hershey, 2022PennLivePas encore d'évaluation

- Jake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoDocument5 pagesJake Corman's Call For DA To Investigate Fellow GOP Gubernatorial Candidate Doug MastrianoPennLivePas encore d'évaluation

- Letter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyDocument1 pageLetter From Pa. Education Secretary To House Speaker Cutler and House Education Committee Chairman SonneyPennLivePas encore d'évaluation

- Letter Regarding PPE and UkraineDocument2 pagesLetter Regarding PPE and UkrainePennLivePas encore d'évaluation

- Letter To Auditor General Timothy DeFoorDocument2 pagesLetter To Auditor General Timothy DeFoorPennLivePas encore d'évaluation

- TWW PLCB LetterDocument1 pageTWW PLCB LetterPennLivePas encore d'évaluation

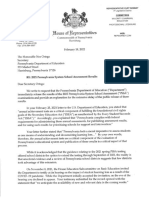

- Pa. House Leaders' Letter Requesting Release of PSSA ResultsDocument3 pagesPa. House Leaders' Letter Requesting Release of PSSA ResultsPennLivePas encore d'évaluation

- Cumberland County Resolution Opposing I-83/South Bridge TollingDocument2 pagesCumberland County Resolution Opposing I-83/South Bridge TollingPennLivePas encore d'évaluation

- Greene-Criminal Complaint and AffidavitDocument6 pagesGreene-Criminal Complaint and AffidavitPennLivePas encore d'évaluation

- Redistricting ResolutionsDocument4 pagesRedistricting ResolutionsPennLivePas encore d'évaluation

- Envoy Sage ContractDocument36 pagesEnvoy Sage ContractPennLivePas encore d'évaluation

- Gov. Tom Wolf's LetterDocument1 pageGov. Tom Wolf's LetterPennLivePas encore d'évaluation

- James Franklin Penn State Contract 2021Document3 pagesJames Franklin Penn State Contract 2021PennLivePas encore d'évaluation

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (119)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)