Académique Documents

Professionnel Documents

Culture Documents

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Transféré par

Shyam SunderDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)

Transféré par

Shyam SunderDroits d'auteur :

Formats disponibles

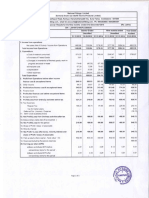

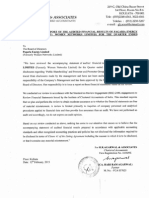

Dynamic Portfolio Management & Services Limited

Regd. Office : 53A, Mirza Ghalib Street, 4th Floor, Kolkata-700 016.

CIN : L74140WB1994PLC063178, Email - dpms.kolkata@gmail.com, Web : www.dynamicwealthservices.com

Statement of Unaudited Results for the Quarter & Nine Months ended 31st December 2014

Rs. in Lacs

Particulars

Sr.

No.

1 Income from Operations

a) Net Sales/Income/(Loss) from Investing Activities

b) Other Operating Income

Total Income from Operations (Net)

2 Expenses

(a) Cost of Material Consumed

(b) Purchases of Stock-in-trade

4

5

6

7

8

9

Corresponding 3 Corresponding 9 Corresponding 9

Months ended

Months ended

Months ended

31.12.2013

31.12.2014

31.12.2013

Un-Audited

Year to date

figures as on

31.03.2014

Un-Audited

27.51

15.97

43.48

46.31

39.16

74.36

(44.15)

1.04

0.11

0.14

(0.02)

1.36

4.79

(39.15)

1.07

0.11

0.17

0.06

0.87

2.29

(33.32)

0.97

0.17

0.25

0.09

1.03

43.55

(98.60)

3.09

0.33

2.11

2.26

4.52

18.67

(33.32)

2.89

0.43

1.37

2.38

3.82

51.93

0.52

0.20

(0.36)

-

(0.07)

-

2.01

0.20

0.59

0.04

1.63

-

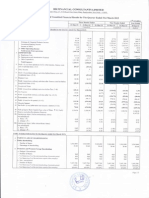

Profit/(Loss) from ordinary activities before finance costs

and exceptional items (3+4)

Finance Costs

0.72

0.25

(0.36)

0.01

(0.07)

-

2.21

0.25

0.63

-

1.63

0.01

Profit/(Loss) from ordinary activities after finance cost but

before exceptional items (3+4)

Exceptional Items

0.47

-

(0.35)

-

(0.07)

-

1.96

-

0.63

-

1.61

-

0.47

-

(0.35)

-

(0.07)

-

1.96

-

0.63

-

1.61

1.16

0.47

0.47

-

(0.35)

(0.35)

-

(0.07)

(0.07)

-

1.96

1.96

-

0.63

0.63

-

0.45

0.45

-

0.47

1,169.18

(0.35)

1,169.18

(0.07)

1,169.18

1.96

1,169.18

0.63

1,169.18

0.45

1,169.18

(d) Employees Benefit Expenses

(e) Depreciation & Amortization Expenses

(f) BSE Revocation, Depository & RTA Fees

(g) Provision for Standard Assets

(h) Other Expenses

Total Expenses

Profit/(Loss) from Operations before other Income, finance

cost and exceptional Expenses (1-2)

Other Income/(Loss)

Profit(+)/Loss(-) from ordinary activites before Tax (7-8)

Net Profit (+)/Loss(-) after tax, minority interest and Share

16 of Profit / (Loss) of Associates (13-14-15)

17 Paid-up Equity Share Capital (Face Value of Rs. 10/- each)

Reserves excluding revaluation Reserves as per last Balance

18 Sheet

104.96

1.89

50.63

52.52

25.58

84.45

110.03

74.36

74.36

20.87

3.85

0.58

1.37

2.15

5.22

108.40

(7.36)

0.00

0.00

(0.00)

(0.00)

(0.00)

(0.00)

0.02

0.02

0.01

0.01

0.00

0.00

0.00

0.00

(0.00)

(0.00)

(0.00)

(0.00)

0.02

0.02

0.01

0.01

0.00

0.00

10,174,800

10,174,800

10,174,800

10,174,800

10,215,800

10,174,800

87.03

87.03

87.03

87.03

87.38

87.03

Earning Per Share (before extra-ordinary items) of Rs. 10/19 each (not annualized)

(i) a) Basic

b) Diluted

Earning Per Share (after extra-ordinary items) of Rs. 10/19 each (not annualized)

(ii) a) Basic

b) Diluted

A PARTICULARS OF SHAREHOLDING

Public Shareholding

- Number of Shares

- Percentage of Share Holding

18 Promoter and Promoter Group Shareholding

a) Pledged/Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

b) None-Encumbered

- Number of Shares

- Percentage of Shares (as a % of the total Shareholding

of Promoter and Promoter Group

- Percentage of Shares (as a % of the total Share Capital

of the Company

B INVESTOR COMPLAINTS

Pending at the beginning of the Quarter

Received during the Quarter

Notes :

(38.81)

59.49

20.68

Audited

(27.86)

29.79

1.93

10 Tax Expenses

Net Profit (+)/Loss(-) from ordinary activites after tax (911 10)

Lac)

12 Extra Ordinary Items (Net of Tax Expense of Rs.

13 Net Profit (+)/Loss(-) for the period (11-12)

14 Share of Profit/(Loss) of Associates*

15 Minority Interest*

1.

2.

3.

4.

Preceeding 3

Months ended

30.09.2014

(15.14)

20.45

5.31

(c) Changes in Inventories of Finished Goods, Work-inProgress and Stock-in-Trade

3 Months

ended

31.12.2014

1,517,000

100.00

1,517,000

100.00

1,517,000

100.00

1,517,000

100.00

1,476,000

100.00

1,517,000

100.00

12.97

12.97

12.97

12.97

12.62

12.97

Nil

Nil

Disposed during the Quarter

Remaining Unresolved at the end of Quarter

Nil

Nil

The Company is operating in single segment vide Finance & Investments, segmental Report for the Quarter as per AS-17 of ICAI is not applicable for the Quarter.

Above resultes were reviewed by Audit Committee taken on record in Board Meeting held on 12th february, 2015.

Provision for Taxation will be made at the end of the Financial Year.

The Statutory Auditors of the Company have carried out "Limited Review" of the above Financial Results.

Place : Kolkata

Date : 12th February, 2015.

For Dynamic Portfolio Management & Services Limited

S/dRavi Kr. Newatia

Managing Director

ffi j ffi,ffffixtrffitrs',w&

&sruqp*$ms*s

**-

**

-e"$

lL,tff tr ffi * ffi

* tt $ ffi "

3,i-u* {.}l*tl*:sEt {- hn$.i}}";,a &v*sr{}&""

"

$riit*

${*l $?**n,

ra,il";$" Xdr:{i{it}:i} -..Tq}{} {$$J

$)ta*nc, : e{i;i*; i.} i"5 f $$

r ; q #.*-1 } ? 3 $ 3,l${r$

*- r * r i i ; :ll-U.h*:&"S*SjjS!lg;1fues.*ur"

$

'{'*i*i'rr

Limited

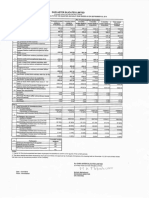

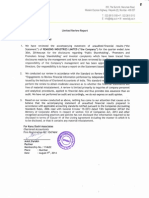

Rer,.iew Report

The Iloard of Direcrors

M/s. Dynamic Portfolio Managemenr & $esyices Liyrcired

We have reviewed the accompanying staterirelri- oi: Lla"*-Audited filancral results of M/s.

Dynamic Portfolio Managemenr & ,gerrrices Limited for the e*art<:r er:ded 31',

Decembet2814 except for the disclosures res;irdins'Irtui:lic Sharr:ho1C.ing'"ancl'Pronroter and

Prornoter Group Shareholditg' rvhich .h;lr.e been traced fri-inr disr:iosurcs madc by the

management and have not been ar-rdited };v ,.-:s" 'I'Liis starenrent is thr: responsii:iliri. oi 1he

Cornpany's Management and has be,en apprt;ved by ilie }Joard of Direct*i,u/ Corlnrittee of

Board of I)irectors. Our responsibility is ro issuc '; rrport on thesc flnancial starenrer:ts based

on our review.

\fi/e conducted" our review in acco;:<.Jat.ice ',.villr thc

'(SRtr)

St;indard on ll.cvit w Frnqagenrerit

2400, engagements to Review I'-inancial St:liijriiciiis t:tsL:ed br. thr: instrtuig r;f (-harLered

Accountants of Indta. 'Ihis standar<i requires rhat rve pian and perfonr: the rer.ic\\; io obtain

moderate assurance as to whether the flnancial state::leiirs are free of'n:aterial rr:isstatement. A

review is iimiteci prirnarily to inquiries o{-cotnp}any ;}ersonilei and an ar:alyrical procedure

applied to financial data and thus provides irss assriritnce rnan an audjr. \\ier jl2ve not

performed an auclit and accordingiy, rve rio rr,:t r..i1)ress ;1-o audit opiniern.

Based on our re'"'ierv conducted as abor'e, nori::;tig iiris (:cilne to oui attential that causes us to

believe that the accompanying state:lent of r-inr.l;iltcc1 iL:a::cial results preparecl in accorclarlce

with applicable accounting standards 1 anci oil,ei: j"e'Lrosirz{-,d accoiintine pra"cices ancj policies

has not disclosed the informadon required Lc, L:e clisr:lcse,j in regn"* ci {llause 41 s:,{ the iJsung

Agreement includlng the manner rn which lt ;s io be ciisciosecl, r-rr that;t i:nntaitis anli. rnaterial

misstatement.

r &{ukesh Ch*udhft qy &. Asscciares

(ih artere,"l A ccountants

Place : I(olkata

Date : February 1-2,2A15

S{elkesh

hary

Partner

tr{c}m arr Claoud

h'Iernbersh!:

1\i

uunlre:: 06209

im

Vous aimerez peut-être aussi

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Result)Document16 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For March 31, 2015 (Result)Document5 pagesFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Result)Document5 pagesFinancial Results & Limited Review For Dec 31, 2014 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results & Limited Review Report For December 31, 2015 (Result)Document3 pagesStandalone Financial Results & Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- PDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Document1 pagePDF - 1369822739 - True - 1369822739 - Annual Results 2012-13Rakesh BalboaPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For December 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For December 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- SEBI Results Mar13Document2 pagesSEBI Results Mar13Mansukh Investment & Trading SolutionsPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- 28 Consolidated Financial Statements 2013Document47 pages28 Consolidated Financial Statements 2013Amrit TejaniPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Document6 pagesStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- PTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDocument3 pagesPTC India Limited: Registered Office:2nd Floor, NBCC Tower, 15 Bhikaji Cama Place New Delhi - 110 066 (CINDeepak GuptaPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For Sept 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2012 (Result)Document3 pagesFinancial Results & Limited Review For Dec 31, 2012 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Document2 pagesFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Document8 pagesFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document6 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- An Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Document1 pageAn Iso 9001:2008 and Iso 22000 Accredited Company Registered Office: D-19-20, Panki Industrial Area, Kanpur - 208 022Muralis MuralisPas encore d'évaluation

- Financial Results, Limited Review Report For December 31, 2015 (Result)Document4 pagesFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Document4 pagesFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review For June 30, 2014 (Standalone) (Result)Document3 pagesFinancial Results & Limited Review For June 30, 2014 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Document5 pagesFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For June 30, 2016 (Result)Document3 pagesStandalone Financial Results For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryD'EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryPas encore d'évaluation

- PDF Processed With Cutepdf Evaluation EditionDocument3 pagesPDF Processed With Cutepdf Evaluation EditionShyam SunderPas encore d'évaluation

- Standalone Financial Results For March 31, 2016 (Result)Document11 pagesStandalone Financial Results For March 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results For September 30, 2016 (Result)Document3 pagesStandalone Financial Results For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Document3 pagesStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderPas encore d'évaluation

- Transcript of The Investors / Analysts Con Call (Company Update)Document15 pagesTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderPas encore d'évaluation

- Investor Presentation For December 31, 2016 (Company Update)Document27 pagesInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderPas encore d'évaluation

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderPas encore d'évaluation

- Ratio ReviewerDocument45 pagesRatio ReviewerEdgar Lay75% (8)

- Tgelf 2023-24 (2) - 1Document15 pagesTgelf 2023-24 (2) - 1fakeking1412Pas encore d'évaluation

- BFI Topic 1 2 3Document17 pagesBFI Topic 1 2 3Arnold LuayonPas encore d'évaluation

- Pertanyaan Pertemuan 4 CG - SceleDocument3 pagesPertanyaan Pertemuan 4 CG - SceleFaris NaharPas encore d'évaluation

- Bajaj Allianz April 2022 Individual FactsheetDocument54 pagesBajaj Allianz April 2022 Individual FactsheetBharat19Pas encore d'évaluation

- Stock Verdict ACC 2021-09-20Document22 pagesStock Verdict ACC 2021-09-20ABCPas encore d'évaluation

- NiftyDocument15 pagesNiftySayali KamblePas encore d'évaluation

- FINS 3616 Tutorial Questions - Week 8.questions.v4Document2 pagesFINS 3616 Tutorial Questions - Week 8.questions.v4Sarthak Garg0% (1)

- Combination of 2 or More Single Propietorship Into PartnershipDocument8 pagesCombination of 2 or More Single Propietorship Into PartnershipABCPas encore d'évaluation

- Dont MindDocument1 pageDont MindAirene Talisic PatunganPas encore d'évaluation

- FinRep SummaryDocument36 pagesFinRep SummaryNikolaPas encore d'évaluation

- US Debt Rating DowngradedDocument3 pagesUS Debt Rating DowngradedmonarchadvisorygroupPas encore d'évaluation

- Capstone Research Paper - Ferrari 2015 Initial Public OfferingDocument9 pagesCapstone Research Paper - Ferrari 2015 Initial Public OfferingJames A. Whitten0% (1)

- 01.an Introduction To Security Valuation I PDFDocument10 pages01.an Introduction To Security Valuation I PDFMaria SyPas encore d'évaluation

- Startup Funding StagesDocument4 pagesStartup Funding StagesSachin KhuranaPas encore d'évaluation

- Worksheet Chapter-Foreign Exchange Rate Class - XIIDocument3 pagesWorksheet Chapter-Foreign Exchange Rate Class - XIIhargun kaur gabaPas encore d'évaluation

- Distribution Management ReviewerDocument11 pagesDistribution Management ReviewerSALEM, JUSTINE WINSTON DS.Pas encore d'évaluation

- Vanguard Funds: Supplement To The ProspectusesDocument45 pagesVanguard Funds: Supplement To The Prospectusesnotmee123Pas encore d'évaluation

- Absolute Return: The Way To Make Money in Emerging Markets?Document26 pagesAbsolute Return: The Way To Make Money in Emerging Markets?Stelu OlarPas encore d'évaluation

- IDX Fact Book 2 0 1 0: Compiled by Research DivisionDocument161 pagesIDX Fact Book 2 0 1 0: Compiled by Research Divisionannisa lahjiePas encore d'évaluation

- Hagar Industrial Systems Company HiscDocument1 pageHagar Industrial Systems Company HiscDoreenPas encore d'évaluation

- LS7&8Document9 pagesLS7&8JOJOPas encore d'évaluation

- Financial Ratio AnalysisDocument8 pagesFinancial Ratio AnalysisrapsisonPas encore d'évaluation

- BondsDocument12 pagesBondsSai Hari Haran100% (1)

- Investing Like Warren Buffett PDFDocument27 pagesInvesting Like Warren Buffett PDFLoni ScottPas encore d'évaluation

- ACCN04B Module 1 - Review of The Accounting Cycle 1Document5 pagesACCN04B Module 1 - Review of The Accounting Cycle 1dumpwey1Pas encore d'évaluation

- Financial Statement Analysis - Puregold Price ClubDocument32 pagesFinancial Statement Analysis - Puregold Price Clubgabrielle do100% (1)

- Super AdxDocument5 pagesSuper AdxpudiwalaPas encore d'évaluation

- Assistant Commissionerof Incometax, Circle 321, New DelhDocument11 pagesAssistant Commissionerof Incometax, Circle 321, New Delhankita tiwariPas encore d'évaluation

- FM MST 3Document2 pagesFM MST 3chuneshphysicsPas encore d'évaluation