Académique Documents

Professionnel Documents

Culture Documents

BO in Finacle

Transféré par

Shailendra Mishra0 évaluation0% ont trouvé ce document utile (0 vote)

70 vues9 pagesBRANCH office TRANSACTIONS in DOP Fiancle Posted by Admin Labels: BO Finacle, Fiancle. BO SB Deposit at Account Office on receipt of Pay-In-Slip from BO, PA of Account office should follow the following process.

Description originale:

Titre original

BO in Finacle.docx

Copyright

© © All Rights Reserved

Formats disponibles

DOCX, PDF, TXT ou lisez en ligne sur Scribd

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentBRANCH office TRANSACTIONS in DOP Fiancle Posted by Admin Labels: BO Finacle, Fiancle. BO SB Deposit at Account Office on receipt of Pay-In-Slip from BO, PA of Account office should follow the following process.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

0 évaluation0% ont trouvé ce document utile (0 vote)

70 vues9 pagesBO in Finacle

Transféré par

Shailendra MishraBRANCH office TRANSACTIONS in DOP Fiancle Posted by Admin Labels: BO Finacle, Fiancle. BO SB Deposit at Account Office on receipt of Pay-In-Slip from BO, PA of Account office should follow the following process.

Droits d'auteur :

© All Rights Reserved

Formats disponibles

Téléchargez comme DOCX, PDF, TXT ou lisez en ligne sur Scribd

Vous êtes sur la page 1sur 9

an 7, 2015

BRANCH OFFICE TRANSACTIONS IN DOP

FINACLE

Posted by Admin Labels: BO Finacle, Fiancle

(I) New Account Opening At BOs

When new account is opened at any BO and Account Opening Form

is received at Account Office, User has to Select Branch Office name

in the field Branch Office ID. For this, User should Go to Account

opening screen of concerned scheme and click on Branch Office

Code. List of BOs with BO code will appear. Select BO from where

Account Opening Form is received for opening of account.

(Ii) A/C Opening Date (Branch Office Date)

While opening of account, Value date should be transaction date at

Branch Office.Other procedure for opening of account will be same

as prescribed for account opening at SO/HO. Only difference is that

value date for opening of account should be BO Date and while

funding the account, BO Settlement Account (0339) is to be debited.

Savings Account is to be funded after opening of account and RD or

TD Account is to be funded while opening the account.

(Iii) B.O SB Deposit At Account Office

On receipt of Pay-In-Slip from BO, PA of Account office should follow

the following process:a) Invoke CXFER menu.

b) Select the Function Add

c) Select the Transaction Type / Subtype T/BI-Bank Induced

d) DEBIT BRANCH SETTLEMENT ACCOUNT (SOLID0339) and CREDIT

Customer SB Account

e) Enter the BO Name in the Transfer Particulars column by

removing the word BY TRANSFER

f) Enter the amount of Deposit

g) Enter the BO date in the Value Date column

h) Click on Post

System will generate Transaction ID on posting the same. PA should

note down TRAN ID number on Pay-In-Slip in red ink (example:TRAN ID SB-34567) and will hand over the same to Supervisor who

should verify the transaction by using same menu. Only after

verification, the transaction will appear in LOT and Consolidation.

(Iv) BO SB Withdrawal At Account Office

For withdrawals above Rs.5000/-, when SB7 is received from BO in

Account Office, PA and Supervisor will go to HACLI menu and see

balance in the account. Signature of depositor should also be

compared with the available signatures in Finacle and PA as well as

Supervisor will follow the same procedure as being followed now and

sanction will be sent to BO

On receipt of SB7 from BO after payment (either up to Rs.5000/- or

above Rs.5000/-) PA of Account Office should follow the following

procedure:Invoke CXFER menu.

ii) Select the Function Add

iii) Select the Transaction Type / Subtype T/BI-Bank Induced

DEBIT Customer SB Account and CREDIT BRANCH SETTLEMENT

ACCOUNT (SOLID0339)

Enter the BO Name in the Transfer Particulars column by removing

the word BY TRANSFER

Enter the amount of Deposit

Enter the BO date in the Value Date column

Click on Post

System will generate Transaction ID on posting the same. PA should

note down TRAN ID number on SB7 in red ink (example:- TRAN ID

SB-34567) and will hand over the same to Supervisor who should

verify the transaction by using same menu. Only after verification,

the transaction will appear in LOT and Consolidation.

(V) Procedure For BO SB Account Closure

When SB7A alongwith Passbook is received from BO, User will

Invoke the menu HACACCR

Enter the details in field Report To as PM

Select INR in CCY field

Enter the BO SB account number in the From A/c ID

Enter the same BO SB account number in the To A/c ID

Click on Submit

A message Batch program successfully lodged is displayed

A report Accrual Interest report is available in the queue . Go to

HPR and select the report to print.

Click on the Print screen for viewing the Interest accrual report

The total amount accrued as interest till date is displayed at the

end of the report.

Interest amount shown in the report should be added to the

balance in the account noted On WARRANT OF PAYMENT of SB7A.

This should be sent to Branch Office for closure of SB account with

direction that this is valid up to last working day of the month. Other

procedure for sending sanction to BO should be followed.

On receipt of SB7A from BO after closure, invoke the menu HCAAC

for account closure.

Select the function CLOSE

Enter the BO SB account number to close

Click on the check box Transfer in Balance field

Enter the BO Settlement account in the Transfer A/c ID field

Click on Go

The balance amount in the account will be displayed in the A/c

Information tab

Click on the Closure tab to select the reason code and click on

Submit

On clicking Submit, total amount along with interest will be

displayed. BO SB account will be closed and amount adjusted in

BRANCH SETTLEMENT ACCOUNT. Transaction ID generated should be

noted on SB7A and submitted to Supervisor for verification. After

verification, transaction will appear in LOT and consolidation.

(Vi) B.O RD DEPOSIT At Account Office

On receipt of Pay-In-Slip from BO, PA of Account office should follow

the following process: Invoke CRDP menu.

ii) Select the Function Add

iii) Select the Transaction Type T/BI-Transfer Bank Induced

Enter the RD account Number

Enter the amount of Deposit

Enter the BO date in the Value Date column

Mode of Payment - Click on the Transfer Radio button

Enter the BRANCH SETTLEMENT ACCOUNT (SOLID0339)

Click on Submit

System will generate Transaction ID on posting the same. PA should

note down TRAN ID number on Pay-In-Slip in red ink (example:TRAN ID RD-34567) and will hand over the same to Supervisor who

should verify the transaction by using same menu. Only after

verification, the transaction will appear in LOT and Consolidation.

(Vii) BO RD CLOSURE At Account Office

On receipt of SB7A and Passbook from BO, PA should first invoke

Trial Closure for issue of closing sanction. Same procedure should be

followed as being followed for Trial Closure of RD Accounts standing

at SO/HO in Finacle. Enter closing amount in SB7A and after

following laid down process of sanction of BO W/D, Passbook and

SB7A should be sent to BO with the direction that sanction is valid

only up to last working day of the month. If customer does not

attend BO up to that date, a fresh sanction is to be obtained by BO

for which fresh Trail closure should be invoked. Once paid SB7A

signed by customer duly entered in BO daily Account is received at

Account office, following process to be followed by counter PA:-

Invoke CRDCAAC menu.

ii) Enter the RD account number

iii) Enter the BO date in the Value Date column

Closure details will be displayed.

Select the repayment mode as Transfer

Enter the BRANCH SETTLEMENT ACCOUNT (SOLID0339) as

Repayment ID

Click on Submit

Transaction ID will be generated and PA should note that Tran ID on

SB7A and hand over to Supervisor for verification. Supervisor should

verify transaction using same menu and option Verify. Once,

transaction is verified by Supervisor, transaction will appear in LOT

and consolidation.

(Viii) B.O Interest Payment Of 2,3 & 5 Years TD Accounts At Account

Office

When SB7 is received from BO for sanction of interest, PA at Account

Office (SO/HO). First Invoke the menu HTDTRAN or HIOT to check the

interest accrued for the said TD account. Following procedure should

be followed:

Enter the SOL ID

Select the scheme type as None

Enter the TD Sundry account Number

Enter the period wherein the TD interest has accrued (Start

date and end date)

Enter the TD account number in the Ref No. field

Click on Submit

Accrued TD interest is displayed.

The interest accrued can be viewed in the HPR report. The interest

accrued should be written in the Payment Warrant (SB7) and after

signature of Supervisor, send back SB-7 to BO concerned after

following the laid down procedure for sending sanction to BO. On

receipt of TD SB7 after payment from BO, the following procedure

has to be followed by PA for entering the Interest paid on TD account

in case of 2/3/5 TD through HTM

Counter PA to invoke HTM menu

Select the Function Add

Select the Transaction type Cash/Cash Transfer

Select the Transaction Type as Debit and enter the SUNDRY

DEPOSIT TD account number (0335)

Enter the amount of TD interest paid

Enter the BO TD account number in the reference column

Click on GO

Enter the BO TD account number in the Ref. No. field

Click on GO

Click on the required row which contains the unpaid TD interest

for the said BO TD account.

Click on Accept

Click on the Credit Radio Button Credit and enter the

BRANCH SETTLEMENT ACCOUNT (SOLID 0339) and in Ref No. field,

enter TD Account number.

Click on Submit. Interest paid with respect to BO TD account in

case of TD 2/3/5 is completed.

(Ix) CLOSURE OF BO TD ACCOUNT At Account Office

When SB7A is received from BO for sanction of TD closure, Invoke

TD Trial closure for the required BO TD account and send SB7A to BO

concerned by filling closure amount on Warrant by following the laid

down procedure for sending sanction to BO. Before doing Trial

Closure, unpaid TD interest if any should be checked by using

HTDTRAN or HIOT menu. Total amount to be paid alongwith unpaid

interest should be mentioned on the SB7A on the Warrant of

Payment Side with signatures of Supervisor. It should also be

mentioned that sanction is valid up to last working day of the month

and if customer does not come for closure up to that day, fresh

sanction should be obtained. All other provisions mentioned in the

rules should be followed. On receipt of closed voucher from BO, the

following procedure to be followed

Invoke the menu HCAACTD.

Select the Function (Z Close) select closure

Enter the BO TD account which was closed at Branch Office

based on the sanction of SO/HO.

Enter the BO Date in the Closure Value Date field

Click on SVS (Signature Verification System) icon to verify the

signature in the BO withdrawal voucher.

Click on GO

BO TD account details will be displayed. Check the amount of

principal.

Click on Closure Details Tab

Select the R-Repayment A/c only option for BO Accounts

Enter the BRANCH SETTLEMENT ACCOUNT (SOLD ID 0339) in

the Repayment A/c ID field

Click on Closure Exceptions Tab

Enter the Branch Office Settlement Account (SOLID 0339)

Select the Closure Reason Code as NORMAL from the Searcher

Closure details detailing the principal, interest adjustment and

actual Booked Interest (Rs.10,000 + Rs.405.94) paid as maturity

proceeds to the BO TD account to be verified with the voucher.

Click on Submit. BO TD account closed at Branch Office is

closed at Account Office. Transaction ID Generated by the system

has to be noted on the SB7A and handed over to Supervisor for

verification. After verification, transaction would appear in LOT

and Consolidation.

google+

Get Latest Updates For Free!

Enter your e

SignUp

Your email address will not be shared with anyone

DO

YOU

LIKE

THIS

ARTICLE?

Branch Office Transactions in DOP Finacle

Finacle : Inward Clearing FAQ Documents

No comments:

Vous aimerez peut-être aussi

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyD'EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyPas encore d'évaluation

- Multiple Form 26QB For Multiple Buyers, Sellers & Other FAQSDocument5 pagesMultiple Form 26QB For Multiple Buyers, Sellers & Other FAQSprashantgeminiPas encore d'évaluation

- How To e File ReturnDocument7 pagesHow To e File ReturnAbdul Basit AminPas encore d'évaluation

- SLL Logistics Doubts On BooksDocument5 pagesSLL Logistics Doubts On BooksNaga Ravi Thej KasibhatlaPas encore d'évaluation

- 01.20 Government BusinessDocument48 pages01.20 Government Businessmevrick_guyPas encore d'évaluation

- ITR1 - Part 4 (Let Us File The Return)Document2 pagesITR1 - Part 4 (Let Us File The Return)gaurav gargPas encore d'évaluation

- Andhra Bank Internet Banking Login, Accounts, Payments, Fund Transfers, Requests & Mail FeaturesDocument8 pagesAndhra Bank Internet Banking Login, Accounts, Payments, Fund Transfers, Requests & Mail FeaturesSrinivas RaoPas encore d'évaluation

- Generate Multiple Demand Drafts from Deposit AccountDocument40 pagesGenerate Multiple Demand Drafts from Deposit Accountmevrick_guyPas encore d'évaluation

- Cheque Clearing in HODocument4 pagesCheque Clearing in HOKumar GyaniPas encore d'évaluation

- Deaf 22.01.2018Document38 pagesDeaf 22.01.2018shubhamPas encore d'évaluation

- SAP Automatic Payment Program (APP)Document86 pagesSAP Automatic Payment Program (APP)nageswara kuchipudiPas encore d'évaluation

- Franchise Payment Collection: Excel Sheet NameDocument8 pagesFranchise Payment Collection: Excel Sheet NameSrinath SwamiPas encore d'évaluation

- VCB-ib@nking User Guide PDFDocument34 pagesVCB-ib@nking User Guide PDFThông Hà ThúcPas encore d'évaluation

- Bureau of Internal Revenue Quezon CityDocument6 pagesBureau of Internal Revenue Quezon CityPeggy SalazarPas encore d'évaluation

- Features of All Types of AccountsDocument113 pagesFeatures of All Types of AccountsNahid HossainPas encore d'évaluation

- GST Payment - Step by Step ProcessDocument5 pagesGST Payment - Step by Step Processnilesh nayeePas encore d'évaluation

- Bank Reconciliation Statement in SAP - BRS: Last Updated On May 9, 2014 byDocument8 pagesBank Reconciliation Statement in SAP - BRS: Last Updated On May 9, 2014 byRahulPas encore d'évaluation

- Tax. 23Document18 pagesTax. 23RahulPas encore d'évaluation

- Manual Bank Reconciliation Using Excel UploadDocument25 pagesManual Bank Reconciliation Using Excel UploadGavin MonteiroPas encore d'évaluation

- Bill Tracking SystemDocument15 pagesBill Tracking SystemSachin JangidPas encore d'évaluation

- Issuing Official Receipt: Take Note: You Cannot Issue The Official Receipt If The Cash and Check That Attached by TheDocument10 pagesIssuing Official Receipt: Take Note: You Cannot Issue The Official Receipt If The Cash and Check That Attached by TheMaregel AgootPas encore d'évaluation

- Guidelines For TDS Deduction On Purchase of Immovable PropertyDocument4 pagesGuidelines For TDS Deduction On Purchase of Immovable Propertymib_santoshPas encore d'évaluation

- TDS Awareness Programme SummaryDocument60 pagesTDS Awareness Programme SummarymahadevavrPas encore d'évaluation

- Inbound 8444811727727021917Document10 pagesInbound 8444811727727021917RishiPas encore d'évaluation

- Mobile Banking Service FeaturesDocument14 pagesMobile Banking Service FeaturesMalay RanjanPas encore d'évaluation

- CDSL EASIEST GuidelinesDocument8 pagesCDSL EASIEST Guidelinessudhakar_nellaiPas encore d'évaluation

- Vendor Invoice Booking and PaymentDocument24 pagesVendor Invoice Booking and Paymentafzal47Pas encore d'évaluation

- Bill Tracking System For VendorsDocument13 pagesBill Tracking System For Vendorsvivek jayswalPas encore d'évaluation

- User Manual For Online Submission of Investment ProofsDocument10 pagesUser Manual For Online Submission of Investment ProofsAbc123Pas encore d'évaluation

- Funding Your COL Account PDFDocument11 pagesFunding Your COL Account PDFNAi IAnPas encore d'évaluation

- VConnect User ManualDocument28 pagesVConnect User Manualbhawani27Pas encore d'évaluation

- TDS at A Glance 2013-14 BookDocument34 pagesTDS at A Glance 2013-14 Bookajad babuPas encore d'évaluation

- Kargo Payment Policy GuideDocument5 pagesKargo Payment Policy GuideRichard WijayaPas encore d'évaluation

- SOP Accounts ReceivablesDocument5 pagesSOP Accounts ReceivablesOsmanMehmoodPas encore d'évaluation

- USR Manaul For CIVIL Invoice Flow in VIMSDocument13 pagesUSR Manaul For CIVIL Invoice Flow in VIMSgovind chandra singhPas encore d'évaluation

- DISBURSEMENT MODULE RevisedDocument7 pagesDISBURSEMENT MODULE RevisedJames PeraterPas encore d'évaluation

- RR 16-02Document2 pagesRR 16-02saintkarriPas encore d'évaluation

- Frequently Asked Questions on Finacle Core Banking SolutionDocument76 pagesFrequently Asked Questions on Finacle Core Banking Solutionbalraj0% (1)

- Online TISSForm Instruction Revenue GatewayDocument7 pagesOnline TISSForm Instruction Revenue GatewayisayaPas encore d'évaluation

- Procure To Pay Business Process StepsDocument4 pagesProcure To Pay Business Process Stepsdvnprasad2Pas encore d'évaluation

- GIRO Application Form FAQsDocument2 pagesGIRO Application Form FAQsSuresh ThevanindrianPas encore d'évaluation

- Income Tax Law & Practice Unit 4Document8 pagesIncome Tax Law & Practice Unit 4MuskanPas encore d'évaluation

- ITR1 - Part 3 (How To Download 26AS)Document8 pagesITR1 - Part 3 (How To Download 26AS)gaurav gargPas encore d'évaluation

- Process Vendor TDS Remittance Challan 194QDocument7 pagesProcess Vendor TDS Remittance Challan 194QSHARADPas encore d'évaluation

- Online Neft Bidding LatestDocument20 pagesOnline Neft Bidding Latestathulya_atsPas encore d'évaluation

- How To File TDS On The Sale of PropertyDocument12 pagesHow To File TDS On The Sale of PropertyManjukesanPas encore d'évaluation

- Bills of ExchangeDocument16 pagesBills of ExchangeswayamPas encore d'évaluation

- Rahul's Info About RBI's RoleDocument3 pagesRahul's Info About RBI's RolegandhidisharPas encore d'évaluation

- SEPA Implementation Guide for HSBC (CELDocument9 pagesSEPA Implementation Guide for HSBC (CELRajendra PilludaPas encore d'évaluation

- Goods and Services TaxDocument79 pagesGoods and Services TaxhatimPas encore d'évaluation

- Mobile Banking Service FeaturesDocument15 pagesMobile Banking Service Featuressalomi_barlaPas encore d'évaluation

- Opening of Loan AccountDocument11 pagesOpening of Loan AccountkumarrajeevatscribdPas encore d'évaluation

- Esic Online ChallanDocument26 pagesEsic Online ChallanahtradaPas encore d'évaluation

- E-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyDocument38 pagesE-Tutorial - Online Correction - Pay 220I, LP, LD, Interest, Late Filing, LevyRaj Kumar M0% (2)

- Billing DocumentsDocument13 pagesBilling Documentsramesh_nethas_935794Pas encore d'évaluation

- Year Closing 2010 FSIBLDocument5 pagesYear Closing 2010 FSIBLHasanul HoquePas encore d'évaluation

- April 2013 EbriefDocument2 pagesApril 2013 EbriefkyliemkaPas encore d'évaluation

- Hsbcuk Account Closure FormDocument8 pagesHsbcuk Account Closure FormgaetanopetiPas encore d'évaluation

- Liquidity and Profitability Study of Nepal BankDocument46 pagesLiquidity and Profitability Study of Nepal BankBirgunj Online CyberPas encore d'évaluation

- Canara Bank Clerk 2010 Challan FormDocument1 pageCanara Bank Clerk 2010 Challan FormApurve PatilPas encore d'évaluation

- ListDocument4 pagesList76xzv4kk5vPas encore d'évaluation

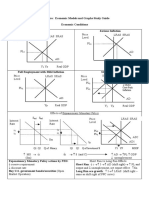

- AP Macroeconomic Models and Graphs Study GuideDocument23 pagesAP Macroeconomic Models and Graphs Study GuideGabriel Jimenez100% (7)

- (03A) Cash Quiz ANSWER KEYDocument11 pages(03A) Cash Quiz ANSWER KEYGabriel Adrian ObungenPas encore d'évaluation

- Retotalling 12030022191Document2 pagesRetotalling 12030022191Afaq KhanPas encore d'évaluation

- Trust Account HandbookDocument104 pagesTrust Account HandbookDhulkifl Bey100% (2)

- 3Q14 CIMB Group Financial Statements PDFDocument50 pages3Q14 CIMB Group Financial Statements PDFleong2007Pas encore d'évaluation

- A Study Asset Liability Management at Vijaya Bank, Nitte UdupiDocument79 pagesA Study Asset Liability Management at Vijaya Bank, Nitte UdupiP RajuPas encore d'évaluation

- LONG TERM FINANCING OPTIONSDocument10 pagesLONG TERM FINANCING OPTIONSmeenasarathaPas encore d'évaluation

- TD Bank Statement USA PDFDocument7 pagesTD Bank Statement USA PDFrichards emmanuel100% (1)

- Origin and Development of Banking in IndiaDocument71 pagesOrigin and Development of Banking in IndiacyndrellaPas encore d'évaluation

- Financial Policy and Procedure Manual TemplateDocument30 pagesFinancial Policy and Procedure Manual TemplateJanani shree JanuPas encore d'évaluation

- Banking-Theory-Law and PracticeDocument258 pagesBanking-Theory-Law and PracticeRahul Sharma100% (1)

- Current Statistics: EPW Research FoundationDocument1 pageCurrent Statistics: EPW Research FoundationshefalijnPas encore d'évaluation

- Aud ProbDocument9 pagesAud ProbKulet AkoPas encore d'évaluation

- NEW Handbook On Debt RecoveryDocument173 pagesNEW Handbook On Debt RecoveryRAJALAKSHMI HARIHARAN100% (5)

- KASB Institute of Technology (PVT.) Ltd. Kasbit KASB Institute of Technology (PVT.) Ltd. Kasbit KASB Institute of Technology (PVT.) Ltd. KasbitDocument2 pagesKASB Institute of Technology (PVT.) Ltd. Kasbit KASB Institute of Technology (PVT.) Ltd. Kasbit KASB Institute of Technology (PVT.) Ltd. KasbitAsadullah KhanPas encore d'évaluation

- Banking Quiz on Assets, Liabilities, Basel Accords & MoreDocument5 pagesBanking Quiz on Assets, Liabilities, Basel Accords & Morenatasha100% (1)

- Electronic Banking in India Innovations Challenges and Opportunities IJERTCONV5IS11011Document8 pagesElectronic Banking in India Innovations Challenges and Opportunities IJERTCONV5IS11011Pavan PaviPas encore d'évaluation

- Pearls MonographDocument32 pagesPearls MonographArch Henry Delantar CarboPas encore d'évaluation

- DepositsDocument10 pagesDepositsJeremy Kuizon Pacuan100% (1)

- A Customer Services and Satisfaction Level of HDFC BankDocument66 pagesA Customer Services and Satisfaction Level of HDFC BankAMIT K SINGH100% (1)

- FINAL NPA PROJECT FOR SIP 9423erq PDFDocument55 pagesFINAL NPA PROJECT FOR SIP 9423erq PDFMayurPas encore d'évaluation

- Liquidity Management Strategies & PoliciesDocument40 pagesLiquidity Management Strategies & PoliciesPhuc Hoang DuongPas encore d'évaluation

- Opening & Operation of Accounts IBPDocument136 pagesOpening & Operation of Accounts IBPasifafaiz100% (4)

- Covid-19 Impact on Philippine Banking IndustryDocument6 pagesCovid-19 Impact on Philippine Banking IndustryHiyakishu SanPas encore d'évaluation

- Econ 379Document4 pagesEcon 379Sijo VMPas encore d'évaluation

- Askari Bank's 18-Year History and VisionDocument77 pagesAskari Bank's 18-Year History and VisionShafaq Khurram50% (2)

- e-TDR/e-STDR (MOD) Frequently Asked QuestionsDocument2 pagese-TDR/e-STDR (MOD) Frequently Asked Questions44abcPas encore d'évaluation