Académique Documents

Professionnel Documents

Culture Documents

HUD-HECM Reverse Mortgage Telephonic Counseling Session TRANSCRIPT

Transféré par

Neil GillespieCopyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

HUD-HECM Reverse Mortgage Telephonic Counseling Session TRANSCRIPT

Transféré par

Neil GillespieDroits d'auteur :

Formats disponibles

IN RE: HUD-HECM Reverse Mortgage

Telephonic Counseling Session

of Neil J. Gillespie and

Penelope M. Gillespie with

Susan Gray, CCCS MMI.

--------------------------/

RECEIVED AT:

Home Office Telephone Extension

of Neil J. Gillespie

DATE & TIME:

April 22, 2008

TRANSCRIBED BY: Michael J. Borseth

Court Reporter

Michael J. Borseth

Court Reporter/Legal Transcription

(813) 598-2703

* * * * * * * * * * * *

NOTE: Calls on home office telephone

extension (352)854-7807 are recorded for

quality assurance purposes pursuant to the use

exemption of Florida Statutes chapter 934,

section 934.02(4)(a)(1) and the holding of

Royal Health Care Servs., Inc. v.

Jefferson-Pilot Life Ins. Co., 924 F.2d 215

(11th Cir. 1991)

10

11

12

* * * * * * * * * *

AUTOMATED OPERATOR: This call is being

recorded.

13

MR. GILLESPIE: Hello.

14

MS. GRAY: Hi, may I speak to Penelope

15

Gillespie?

16

MR. GILLESPIE: Yes, hold on.

17

MS. GRAY: Thank you.

18

MR. GILLESPIE: You want to pick it up, mom.

19

MRS. GILLESPIE: Hello.

20

MS. GRAY: Hi, Ms. Gillespie.

21

MRS. GILLESPIE: Yes.

22

MS. GRAY: This is Susan Gray. I'm with Money

23

Management International. And I'm contacting you

24

this afternoon to provide the reverse mortgage

25

counseling for you.

MRS. GILLESPIE: Yes.

MS. GRAY: Okay. How did you hear about the

3

4

5

6

reverse mortgage?

MR. GILLESPIE: From our bank, Park Avenue

Bank.

MS. GRAY: Park Avenue, okay. And what are

some of your goals in obtaining a reverse mortgage?

MR. GILLESPIE: We want to eliminate our

9

10

11

12

monthly payment and have whatever equity is

possible.

MS. GRAY: Okay. And how much do you owe on

the existing mortgage?

13

MR. GILLESPIE: About 77,000.

14

MS. GRAY: Okay. And what is the approximate

15

value of the home?

16

MR. GILLESPIE: 140,000.

17

MS. GRAY: Okay. And Ms. Gillespie, I have

18

got you on the line and who the gentleman I am

19

speaking with?

20

MRS. GILLESPIE: It's my son.

21

MS. GRAY: Okay. And what is your name?

22

MR. GILLESPIE: My name is Neil Gillespie.

23

MS. GRAY: Neil. Is that N-e-i-l?

24

MR. GILLESPIE: Yes, it is.

25

MS. GRAY: Okay. And Gillespie is

G-i-l-l-e-s-p-i-e?

MRS. GILLESPIE: That's right.

MS. GRAY: Okay. And Ms. Gillespie, did you

have a middle initial?

MRS. GILLESPIE: M.

MS. GRAY: N as in Nancy?

MR. GILLESPIE: No.

MRS. GILLESPIE: M as in --

MR. GILLESPIE: Your middle name, mom. Marie.

10

MRS. GILLESPIE: Marie.

11

MS. GRAY: Okay. Okay. Neil, do you use a

12

middle initial?

13

MR. GILLESPIE: J.

14

MS. GRAY: K?

15

MR. GILLESPIE: J. J as in Joseph.

16

MS. GRAY: Okay. And what is your date of

17

birth, Neil?

18

MR. GILLESPIE: March 19th, 1956.

19

MS. GRAY: Okay. And Ms. Gillespie, I need

20

your highest level on education completed.

21

MRS. GILLESPIE: Just high school.

22

MS. GRAY: Okay. And Neil, your highest level

23

of education completed?

24

MR. GILLESPIE: Bachelors Degree.

25

MS. GRAY: Okay. All right. There is a note

in the file that -- let's see, bear with me just

one second. Okay. That you have a lender ID

number.

4

5

MR. GILLESPIE: No, we don't have a lender ID

number.

MS. GRAY: Okay.

MR. GILLESPIE: I believe the bank called you

8

9

about that issue yesterday.

MS. GRAY: Okay. Okay. Do you have anyone in

10

particular that you would like your certificate

11

faxed to?

12

MR. GILLESPIE: Yes, Park Avenue Bank.

13

MS. GRAY: Okay. Whose attention should I

14

15

16

address this to?

MR. GILLESPIE: You would address that to Liz

Baize. L-i-z B-a-i-z-e.

17

MS. GRAY: Okay.

18

MR. GILLESPIE: Do you want the fax number?

19

MS. GRAY: Certainly.

20

MR. GILLESPIE: It's area code (352) 854-0112.

21

MS. GRAY: Okay. And is this a single family

22

residence, condominium or townhome?

23

MR. GILLESPIE: Single family.

24

MS. GRAY: Okay. And I have the address is

25

8092 Southwest 115th Loop; is that correct?

MRS. GILLESPIE: Yes, yes.

MS. GRAY: Okay.

MR. GILLESPIE: Mom, you will have to speak up

louder, it's hard to hear you.

MS. GRAY: And that is Ocala, Florida 34481?

MRS. GILLESPIE: Yes.

MR. GILLESPIE: Yes.

MS. GRAY: Okay. Would you like for me to

provide any household budget counseling for you

10

today or would you just like the presentation on

11

the reverse mortgage?

12

13

14

MR. GILLESPIE: Just the presentation on the

reverse mortgage.

MS. GRAY: Okay. Do you plan to use any of

15

the funds that you receive from the reverse

16

mortgage to obtain an annuity?

17

MR. GILLESPIE: No.

18

MRS. GILLESPIE: No.

19

MS. GRAY: Okay. Do you plan to sign a

20

contract on an agreement with an estate planning

21

firm to obtain a reverse mortgage?

22

MR. GILLESPIE: No.

23

MRS. GILLESPIE: No.

24

MS. GRAY: All right. Can you both hear me

25

pretty good?

MRS. GILLESPIE: Yes.

MS. GRAY: All right. I need to take just a

couple of minutes and read our disclosure in order

to obtain permission to counsel you today. Okay?

MR. GILLESPIE: All right.

MRS. GILLESPIE: Okay.

MS. GRAY: Before providing counseling we

disclosed and received your agreement to the

following: Money Management International,

10

Incorporated is a non-profit, HUD approved housing

11

counseling agency. We provide reverse mortgage

12

counseling to help you make an informed choice

13

about use of a reverse mortgage product. Your

14

counselor will try to help you make an informed

15

choice, but the decision whether to apply for a

16

reverse mortgage is completely yours. Your

17

counselor will not specifically recommend for or

18

against using a specific loan product or a specific

19

lender.

20

Client privacy is important to us and the

21

counseling services we provide are confidential.

22

At your request we may provide verification of

23

counseling to the lender of your choice, but no

24

personal financial information will be disclosed.

25

As part of this counseling interview you will

be asked to provide information about estimated

income and expenses. We do this to help you

develop a clear overall financial picture of your

own day-to-day budget, to help you decide whether a

particular reverse mortgage meets your needs. This

information is held in strictest confidence and

will never be disclosed to your lender.

Information from your file may be released for

quality assurance purposes to a credible third

10

party such as program review staff from the U.S.

11

Department of Housing and Urban Development, who

12

will also ensure confidentiality. Our privacy

13

notice is available on our website at

14

www.moneymanagement.org. You will not be charged a

15

fee for a reverse mortgage counseling session.

16

However, to help offset our cost we may request a

17

contribution from your mortgage lender. This

18

request may include your name and the date when you

19

spoke with a counselor. We will not refuse service

20

if your lender declines to make this contribution.

21

By providing us with your mother's maiden name you

22

will authorize us to provide the counseling for

23

you. Do you understand the provisions outlined?

24

25

MR. GILLESPIE: Well, I heard what you said,

yes, uh-huh.

MRS. GILLESPIE: Yes.

MS. GRAY: All right, and may I have each of

3

4

5

your mother's maiden names, please?

MR. GILLESPIE: I'm not sure why you need

that.

MS. GRAY: Okay.

MR. GILLESPIE: Well, let me ask you this,

could we refuse the maiden names?

MS. GRAY: You sure can. You can use

10

something else. Do you want me to give you some

11

other ideas?

12

13

14

15

MR. GILLESPIE: We will use our pet name; how

is that?

MS. GRAY: That will be fine. As long as you

each have something different.

16

MR. GILLESPIE: My pet name is Fluffy.

17

MS. GRAY: Okay.

18

MR. GILLESPIE: And my mother's is Ginger.

19

MS. GRAY: Okay. That will work just fine.

20

MR. GILLESPIE: All right.

21

MRS. GILLESPIE: Okay.

22

MS. GRAY: Just something that is unique to

23

you. Okay. All right. Now, today we're going to

24

be talking about mostly the HECM Reverse Mortgage.

25

This is the most popular and widely available.

10

However, I want to mention to you that there are

other reverse mortgages that share similar

characteristics, one of these being the Home

Keeper, which is underwritten by Fannie Mae. And

there are some lender specific reverse mortgage

products that are offered by several large learning

institutions. Now, these reverse mortgages are not

insured by FHA and are most commonly used by

borrowers with home values exceeding 500,000.

10

The HECM is a HUD FHA reverse mortgage that

11

allows you to convert some of the equity in the

12

home into usable cash that has no restrictions on

13

use. All homeowners on the deed must be at least

14

62 years old and living in the home as primary

15

residence. The home must meet FHA standards and an

16

appraisal will be required. The proceeds from the

17

reverse mortgage must be sufficient to pay off all

18

liens against the property. Homeowners must keep

19

their property taxes and insurance current and

20

continue to maintain the property in good

21

condition. Any questions on the material so far?

22

MR. GILLESPIE: No.

23

MRS. GILLESPIE: No.

24

MS. GRAY: Okay. With the reverse mortgage

25

you will retain all rights and privileges of home

11

ownership without having to make a monthly mortgage

payment. The money that you receive from the

reverse mortgage is nontaxable, it need not be

reported as income. There are no restrictions on

how the funds are used and you need no income to

qualify. You can continue to receive your regular

Social Security payments and your Medicare

benefits.

It's important to remember that the HECM may

10

have an impact on your estate and the heirs;

11

meaning there may be little or no equity left in

12

the home at the end of the loan time.

13

The closing costs associated with the HECM are

14

typically high. And the interest that will be

15

added to your loan balance each month is deferred

16

and cannot be deducted from income taxes until the

17

house is sold.

18

A reverse mortgage may effect your eligibility

19

to receive assistance under Federal and State

20

income or asset-based programs. If you are

21

receiving any public assistance such as Medicaid,

22

SSI or Food Stamps, be careful not to jeopardize

23

these benefits by receiving more cash from the HECM

24

loan in a given month than you plan to spend in

25

that same month. Any questions so far?

12

MR. GILLESPIE: No.

MRS. GILLESPIE: No.

MS. GRAY: Okay. There are some different

payment options available with the reverse mortgage

HECM, and I want to go over those with you. You

will notice it's very flexible as far as ways you

can access the fund. You can take out a lump sum

at closing to meet an immediate need, such as

paying off an existing mortgage. Or if you need

10

extra money on a monthly basis you could elect to

11

receive a 10 year payment for as long as you live

12

in the home. Or there is the term payment. The

13

term payment allows you to receive a larger monthly

14

payment than a 10 year. The shorter the term the

15

larger the payment. However, when the term expires

16

you would no longer receive that monthly payment.

17

You also have what is called the HECM Line of

18

Credit. The line of credit is a holding account

19

for the funds that you can draw from in any amount

20

at any time. And it even allows for automatic

21

credit line growth, so that you can end up with

22

more available cash. You can combine these options

23

and you can always make changes later for usually a

24

twenty dollar fee. Any questions on that?

25

MR. GILLESPIE: No.

13

MRS. GILLESPIE: No.

MS. GRAY: All right. Now, the longer you

have this loan, the more the debt owed increases.

And that's due to the interest, fees and

disbursements being added to your loan balance.

And at some point in time this loan will have to be

repaid. And the repayment can either be the heirs

can either sell the home and pay back what has been

borrowed, or if they wish to keep the home they can

10

use funds from another source, or take out a

11

different loan and pay back the reverse mortgage.

12

However, no repayment is necessary unless you

13

permanently move from the home, sell the home or

14

pass away.

15

If the loan balance at the same time exceeds

16

the home value, FHA will pay the difference to the

17

lender. This is called the Non-Recourse Limit. In

18

other words, neither the borrower nor the heirs

19

will ever be held accountable for more than the

20

value of the home.

21

Okay. Have you seen some analysis for the

22

reverse mortgage as far as how much you would

23

receive and the different costs and fees associated

24

with it?

25

MR. GILLESPIE: Yes.

14

MS. GRAY: Okay. I am going to put your

information in right quick and then I'm going to go

through this with you so that we can go over those

costs and fees with you and see if you have

questions on those.

6

7

Neil, I just want to be sure I have your name

as N-i-e-l, right?

MR. GILLESPIE: No. It's N-e-i-l.

MS. GRAY: N-e-i-l. Okay. Let me fix that

10

really quick.

11

MR. GILLESPIE: All right.

12

MS. GRAY: And for some reason I was thinking

13

that didn't look right to me. There we go.

14

That's in Marion County?

15

MR. GILLESPIE: Yes.

16

MS. GRAY: Okay. Now, I'm going to use a home

17

value of 140; is that what they used when they did

18

your analysis for you?

19

MR. GILLESPIE: Yeah, I believe so.

20

MS. GRAY: Okay. And a payoff of 77,000?

21

MR. GILLESPIE: Yes.

22

MS. GRAY: Okay. I am trying to get my

23

numbers close to what they have so -- now, with

24

this reverse mortgage you're going to hear the term

25

Principal Limit. The principal limit is the

15

maximum amount that HUD will allow you to borrow.

And to determine this amount they use a formula

which consists of the age of the youngest borrower,

the appraised value of the home, and the expected

interest rate.

So, for Ms. Gillespie your, your principal

limit would be -- now I'm going to use a 1 and a

half percent lender's margin which, is the higher,

so that I can -- let's see. And assuming a

10

35-dollar monthly fee for service, that would have

11

a principal limit of $106,000, is what you will

12

have available for the principal limit.

13

Now, what the lender typically does with this

14

loan is they roll the closing costs back into the

15

loan, so that you should not have any out of pocket

16

expenses. So from that principal limit they're

17

going to deduct your monthly service fee set aside.

18

Do you see that on your comparison that you have

19

there, does it say service fee?

20

MR. GILLESPIE: Well, I don't have a

21

comparison per se. What I have is 2 percent of

22

the -- 2 percent for the bank and 2 percent for the

23

FHA mortgage.

24

MS. GRAY: Uh-huh.

25

MR. GILLESPIE: 3,700 in closing costs and

16

1

2

3

about 5000 for the projected set aside.

MS. GRAY: Okay. That's very close to what I

have.

MR. GILLESPIE: Uh-huh.

MS. GRAY: That's what I am coming up with.

6

7

So -MR. GILLESPIE: I mean, the bottom line is it

would be about an 83,000 dollar lump sum payment,

or 83,000 available for disbursement.

10

MS. GRAY: What is the -- what did they --

11

what is your expected interest rate on that, Neil?

12

MR. GILLESPIE: I think it was 5 percent,

13

14

15

five-point something.

MS. GRAY: Okay. And date of birth is

10/29/30?

16

MR. GILLESPIE: Yes.

17

MRS. GILLESPIE: Yes.

18

MS. GRAY: Okay. And they used 140 home

19

value. I'm coming up with -- now, after they take

20

out the service fee set aside, which that fee can

21

vary between lenders.

22

MR. GILLESPIE: Uh-huh.

23

MS. GRAY: The most that it can be is $35 per

24

25

month.

MR. GILLESPIE: Okay.

17

1

2

MS. GRAY: That fee could vary. And using $35

a month I am showing around $5,300 taken out.

MR. GILLESPIE: Yes, uh-huh.

MS. GRAY: What are they showing her principal

limit to be before anything is taken out?

MR. GILLESPIE: I don't have that figure.

MS. GRAY: You don't? Okay. If they take

that out that leaves you available principal limit

of about 100,000. And then from that they're going

10

11

to deduct your mortgage insurance premium.

Now, that particular cost is set by HUD. So

12

it's going to be the same from one lender to

13

another. And that is 2 percent of your home

14

appraised value. And then your origination fee,

15

now this is the lender's fee for making the loan.

16

The maximum the lender can charge is 2 percent of

17

the home's appraised value. Some lenders charge

18

the full 2 percent and some do not. So that fee

19

can vary from one lender to another. And now let's

20

see, you have your other costs; I'm coming up with

21

about 4,100, but that's your third party costs.

22

Now, after all those are taken out I show a

23

net principal limit of around 91,000. And from

24

that they will deduct your 77,000 dollar payoff on

25

your mortgage. Which leaves you about 14,000 on

18

the table, that you can have to do whatever you

want to.

MR. GILLESPIE: Uh-huh.

MS. GRAY: Now, my numbers are just estimates

for illustrative purposes. Your lender will give

you your actual figures, but it sounds like ours

are fairly close.

MR. GILLESPIE: Yeah, uh-huh.

MS. GRAY: Okay. Any questions on the cost or

10

fees, interest? The interest rate, let me go back

11

and tell you that there is two types of HECM's.

12

You have a Monthly Adjustable HECM, which usually

13

gives you the most cash, because you have a lower

14

lender's margin. And then there is a Annually

15

Adjustable HECM. Now, some lenders now are

16

offering a Fixed Rate HECM if you want to take all

17

the money out in one lump sum. So those are your

18

different choices on the interest part.

19

20

21

MR. GILLESPIE: There is a monthly adjustable,

a annual adjustable and a fixed rate?

MS. GRAY: Right. The only thing about the

22

fixed rate is there is no monthly, 10 year or line

23

of credit, it's just a lump sum option.

24

All right, any questions on this?

25

MR. GILLESPIE: Well, on the interest rate,

19

what is the interest rate multiplied against? Is

it the principal lending limit?

3

4

5

6

7

MS. GRAY: The interest rate is going to be

applied to whatever you have actually borrowed.

MR. GILLESPIE: And that is the principal

lending limit?

MS. GRAY: That is -- well, that's going to be

how much ever -- for her it's going to be the net

principal limit, if she takes it out in a lump sum.

10

If not, it's going to be the payoff on her existing

11

mortgage plus the closing costs. And then let's

12

say she takes that extra 14,000 and she puts it in

13

a line of credit, then that will actually grow, but

14

the interest won't be charged on that amount, just

15

on what she actually takes out.

16

MR. GILLESPIE: All right, so the net

17

principal lending limit in this example that you

18

said is about 91,000?

19

MS. GRAY: Exactly, uh-huh.

20

MR. GILLESPIE: So the interest would be

21

22

23

24

25

charged on that 91,000?

MS. GRAY: Well, if she takes it all out at

one time.

MR. GILLESPIE: Let's say she takes, just for

the sake of illustration, that she takes it all

20

out.

MS. GRAY: Then, yes, that would be correct.

MR. GILLESPIE: And what is the current

interest rate?

MS. GRAY: Right now the expected interest

rate -- now this is based on HECM monthly 150. And

that would be 5.17, that's what it is right now.

8

9

10

MR. GILLESPIE: Okay. So that's roughly 4,700

a year?

MS. GRAY: Yeah -- well, and it compounds, so

11

it's going to -- it's going to -- let me do an

12

amortization real quick, Neil. I'll send you an

13

amortization, too, so you can see how it --

14

15

MR. GILLESPIE: All right. So that 4,700 is

going to be added to the balance; is that right?

16

MS. GRAY: Uh-huh.

17

MR. GILLESPIE: Every year, like you say, it

18

compounds.

19

MS. GRAY: It compounds, exactly.

20

MR. GILLESPIE: So how does that ever -- how

21

22

23

does the house ever increase more than that amount?

MS. GRAY: Well, your house, you know -- you

mean the value of the home?

24

MR. GILLESPIE: Yes.

25

MS. GRAY: Well, what we do when we do an

21

amortization is we use a 4 percent appreciation

rate.

MR. GILLESPIE: Yes.

MS. GRAY: Which could be more than that some

years. You look at the past year or two in the

mortgage industry, might be less than that.

7

8

9

MR. GILLESPIE: Well, even using 4 percent,

that's still a 1 percent -- 1.17 percent loss.

MS. GRAY: Uh-huh. She's looking at -- hang

10

with me now just a second, I'm doing an

11

amortization. Okay. Now this is using, like I

12

say, 4 percent appreciation on the home value of

13

140. Okay. She should -- even with assuming she

14

takes the whole amount out in a lump sum -- now why

15

didn't I -- she should maintain positive equity in

16

the home for quite sometime because keep in mind,

17

her beginning balance is going to be around 91,000,

18

but her home value is around 140.

19

MR. GILLESPIE: I see.

20

MS. GRAY: So even with interest being accrued

21

and compounding, she's got a larger amount for her

22

home value that's going to be adjust -- you know,

23

adjusted, whatever the factor is, 4 percent. Could

24

be 6 percent one year and 2 the next, it's just

25

going to, you know, it's hard to say. We usually

22

use 4 percent.

2

3

MR. GILLESPIE: Thank you for pointing that

out.

4

5

MS. GRAY: But I think that might be why, it

does maintain positive equity.

6

7

8

9

MR. GILLESPIE: Thank you for pointing that

out.

MS. GRAY: Sure. Sure. Matter of fact, in -let me see something right quick. Okay. Let's

10

look at year 10. Okay. In year 10 her balance on

11

this loan will be around $150,000. And her home

12

value will be 207,000.

13

MR. GILLESPIE: 207 minus 150.

14

MS. GRAY: Uh-huh.

15

MR. GILLESPIE: Equity of 57.

16

MS. GRAY: Uh-huh.

17

MR. GILLESPIE: Okay.

18

MS. GRAY: Yeah. That part -- I'll send you a

19

printout of that.

20

MR. GILLESPIE: Okay.

21

MS. GRAY: Okay. Any other questions for me,

22

Neil?

23

MR. GILLESPIE: No, no, I don't think so.

24

MS. GRAY: Okay. Penelope, did you have any

25

questions?

23

MRS. GILLESPIE: No, I don't.

MS. GRAY: Okay. All right. The next part of

this session will address other options and

resources that may be useful when considering a

reverse mortgage. Some State and Local government

agencies offer low cost reverse mortgages to

seniors. Eligibility criteria may vary. These

loans are usually for low to moderate income.

These are called Public Sector Reverse Mortgages.

10

Although these loans usually cost less than a

11

regular reverse mortgage, they are very restrictive

12

in terms of what the funds can be used for, and

13

they are not available in all areas. Some examples

14

of Public Sector Loans would be the deferred

15

payment loan for home improvements and repairs, the

16

property tax deferral loans for repayment of

17

property taxes, and long, excuse me, single purpose

18

state offer reverse mortgages, for longterm care

19

and medical costs. For more information on these

20

loans please contact your Local or State Housing

21

Authority.

22

Many homeowners are eligible for Local, State

23

or Federal programs that may allow them to save

24

money on expenses. The Area Agency on Aging is a

25

resource to help find health, financial and social

24

service programs. For more information on the Area

Agency on Aging you can contact them toll free at

1-800-677-1116, or by visiting their website at

www.eldercare.gov.

Homeowners who have access to the internet can

use a quick, easy, confidential service from the

National Counsel on Aging, which uses a

questionnaire to help instantly identify programs

for which they may be eligible. That website is

10

11

www.benefitscheckup.org.

And finally, you have the Sale Leaseback and

12

the Time Sale option. This is where the buyer

13

provides the seller a lease to remain in the home,

14

either for life or until the lease is terminated by

15

the seller. These arrangements are not very common

16

and they can be complex. For more information on a

17

Sale Leaseback or a Time Sale, please consult a

18

real estate attorney or specialist.

19

Homeowners should not pay a fee to the lender

20

to obtain information. Some companies under the

21

guise of estate planning charge 10 percent of the

22

amount borrowed for these services. These costs

23

are in addition to the traditional costs associated

24

with obtaining a HECM loan.

25

After the mortgage closing you will have three

25

business days to reconsider your decision. This is

called the Right of Recision Period. If for any

reason you change your mind and you decide you do

not want the loan, you can make a written request

to cancel. Only HUD approved lenders are able to

offer the FHA insured HECM. We do not endorse any

particular lender or loan product.

I'm going to send you some loan comparison

examples. Please note these are to be used for

10

education and illustrative purposes only. These

11

will provide you an estimation of the likely loan

12

proceeds and costs. However, only a HECM lender

13

can give you your accurate loan offer details.

14

If you would like to learn more about the

15

reverse mortgage I do recommend that you obtain a

16

copy of AARP's 52 page publication: Homemade

17

Money. It is available by calling toll free

18

1-800-209-8085. Or by visiting their website at

19

www.aarp.org.

20

And that concludes the reverse mortgage

21

presentation as required by HUD. Did you have any

22

questions for me or anything you would like for me

23

to go over in more detail with me?

24

25

MR. GILLESPIE: Mom, do you have any

questions?

26

MRS. GILLESPIE: No, I don't. Sorry.

MR. GILLESPIE: Well, it sounded pretty good

to me. What was your name again, ma'am?

MS. GRAY: My name is Susan Gray.

MR. GILLESPIE: Susan Gray.

MS. GRAY: Yes. Would you like my toll free

number and extension?

MR. GILLESPIE: Yes, yes, uh-huh.

MS. GRAY: It is 1-800-873-2227.

10

MR. GILLESPIE: 2227.

11

MS. GRAY: Yes, sir. And my extension is

12

13

14

6636.

MR. GILLESPIE: 6636. And that's Susan

S-u-s-a-n.

15

MS. GRAY: Uh-huh.

16

MR. GILLESPIE: Gray, G-r-a-y.

17

MS. GRAY: That's correct, uh-huh.

18

MR. GILLESPIE: And if we have any questions

19

can we call you at this number?

20

MS. GRAY: You certainly can. If you get my

21

voice mail, just leave me a message and I'll call

22

you back. And I usually try to return calls during

23

that business day.

24

25

MR. GILLESPIE: All right. I think you have

answered all the questions. You helped me

27

understand the interest, how that was added back to

the principal and how that related to the annual

projected property value increase.

MS. GRAY: Okay.

MR. GILLESPIE: Because I don't think I had a

6

7

clear understanding of that prior.

MS. GRAY: That was a really good question,

observation about the property value increase and

the interest rate. But it's just you got a -- a

10

lower principal limit, so your home should maintain

11

positive equity for a long time.

12

13

MR. GILLESPIE: Uh-huh. All right. I think

then that is everything.

14

MS. GRAY: Okay. Well, I sure hope things go

15

well for both of you and I will make sure we get a

16

copy of this faxed over to Liz. I'll send that to

17

her in just a few minutes. And then, now, the

18

originals, I will be mailing those to your home.

19

Once you get those originals you will both need to

20

sign those. And then your lender is going to ask

21

you for those originals.

22

MR. GILLESPIE: All right.

23

MRS. GILLESPIE: Okay.

24

MS. GRAY: Okay. Anything else I can do for

25

you today?

28

MR. GILLESPIE: I guess the only other

question I have about the interest rate was over,

you know, the last 10 years or so has it been about

that same amount or has it gone lower or higher?

MS. GRAY: You know, Neil, I have had -- I

have not pulled a history of the T-bill rates.

It's the one year T-bill rate.

MR. GILLESPIE: Uh-huh.

MS. GRAY: And I -- but I have been told that

10

it has remained fairly constant. It's probably one

11

of the more stable indexes. But I don't have a

12

history of it. I think you can probably pull that

13

off the internet.

14

MR. GILLESPIE: Yes.

15

MS. GRAY: A history of the T-bill rate. And

16

I keep saying I'm going to do that and I just

17

never, never do it, but I believe back in the 80's

18

it may have had some pretty -- a lot bigger

19

changes, but I would say the past 10 years it's

20

probably remained pretty constant.

21

22

MR. GILLESPIE: I see. All right. Well, it's

the T-bill rate and that is what I will look for.

23

MS. GRAY: Right. It's the one year.

24

MR. GILLESPIE: One year T-bill rate.

25

MS. GRAY: Uh-huh.

29

MR. GILLESPIE: Okay. Sounds good.

MS. GRAY: And I don't have the information on

the fixed rate. That is still a relatively new

option and we don't have the information on that at

this time.

MR. GILLESPIE: Because under this it will be

this rate at 5.1, you know, approximately. That

will be adjusted in a monthly or annually?

MS. GRAY: That's going to be up to you how

10

you want to set that up. They can set it up, but

11

you can choose either option.

12

13

MR. GILLESPIE: But a fixed rate for the life

of the loan, that gives you more predicability.

14

MS. GRAY: It does. But I don't know what the

15

lender's margin, I don't know how they determine or

16

what they use to base the fixed rate on. We

17

haven't been given a lot of information other than

18

it is out there now.

19

MR. GILLESPIE: Okay.

20

MS. GRAY: But I am sure your lender can

21

advise you on that option and at least make you

22

aware of it so that you can, you know, decide if

23

that will help you or not. I just don't know too

24

much about it.

25

MR. GILLESPIE: All right.

30

1

2

MS. GRAY: Other than it's, you know, it's out

there now.

MR. GILLESPIE: Uh-huh.

MS. GRAY: I know the annually adjustable HECM

you're going to have a higher lender's margin,

which at the end of the day gives you less money

out of your reverse mortgage than would a monthly

adjustable option. Which you will see that when I

send you these comparisons. I have the Fannie Mae

10

Home Keeper, the Monthly Adjustable and the

11

Annually Adjustable all next to each other, so you

12

can compare them and you can see the differences.

13

MR. GILLESPIE: All right. And what is this

14

15

margin you're talking about?

MS. GRAY: Okay. They're -- the lender is

16

allowed to charge a lender's margin, which is an

17

index that they attach to that one year T-bill

18

rate.

19

MR. GILLESPIE: And how much does that run?

20

MS. GRAY: The lender's margin can be as high

21

as 1 and a half percent. There may be a 2 percent

22

now. I really -- but I haven't been -- I don't

23

know a lot about it yet. But as far as I know 1

24

and a half percent is what we show as being the

25

highest.

31

MR. GILLESPIE: Uh-huh.

MS. GRAY: And it has been the case -- and let

me do something real quick here. That -- the 1 and

a half percent lender's margin actually netted you

more money at the end of the day. Let me do

something real quick and I'll tell you. If you

look at a HECM 1 percent lender's margin your -- I

believe that's the 14,000 was your -- based on

these numbers I have was what you would have on the

10

table.

11

MR. GILLESPIE: Yes, that's what you said.

12

MS. GRAY: Okay, if we look at a 1 percent

13

lender's margin, you would have around 13,000 --

14

well, 13,800 versus the 1 and a half percent. And

15

I am going to tell you why here in just a second,

16

why it's like that. The first time it's ever been

17

that way. The 150 gives you 14,073. So the

18

lender's margin in this example, the higher

19

lender's margin actually gives you more cash. And

20

I don't know that it wouldn't even be more with the

21

2 percent. I don't have a 2 percent, if they can

22

even do a 2 percent.

23

MR. GILLESPIE: Well, why would that be?

24

MS. GRAY: I'm fixing to tell you. I'm fixing

25

to tell you. Hang with me just one second. I'm

32

trying to find my information on that. Okay. The

fact is that the expected interest rate has now

dropped so low that it is even below the floor that

was established for the factor table used in the

HUD formulas. This means that the HECM 150 has the

same or slightly higher principal limit than the

100. So --

8

9

MR. GILLESPIE: So the HECM 100 is really a

buyer's margin of 1 point?

10

MS. GRAY: 1 point.

11

MR. GILLESPIE: And a HECM 150 is a buyer's

12

margin of 1.1 and a half points.

13

MS. GRAY: That is right.

14

MR. GILLESPIE: And this 1 and a half points

15

is added to the interest rate.

16

MS. GRAY: To the T-bill rate.

17

MR. GILLESPIE: T-bill rate, uh-huh. I still

18

don't see how a higher interest rate leads to a

19

higher amount of money being able to take out.

20

MS. GRAY: And I'll be honest with you, Neil,

21

I don't understand the mathematical reasoning

22

either, other than it has something to do with the

23

floor that was used when they made up these factor

24

tables.

25

MR. GILLESPIE: And you said something

33

about -- well, what do you mean by the floor?

MS. GRAY: Like I say, to get you really

detailed information I don't -- I don't have the

mathematical -- I just don't, I'm being honest with

you, I don't know. I just know that it's coming

out -- I would imagine if your lender could

probably give you more insight as to that

particular reason.

9

10

MR. GILLESPIE: Well, what do you mean by

floor?

11

12

MS. GRAY: It's just -- it just says the floor

that these factor tables have. I guess --

13

14

MR. GILLESPIE: In other words, you don't

really know what the floor is.

15

MS. GRAY: No, I do not know. I'm sorry.

16

MR. GILLESPIE: It's not the thing that's

17

covered with wall to wall carpet.

18

MS. GRAY: Yeah, yeah. I don't know what the

19

floor was when they developed the formula for this

20

program that we use, I don't know.

21

MR. GILLESPIE: And what did you -- you

22

mentioned something about these rates are lower

23

than what they had projected historically sometime

24

ago.

25

MS. GRAY: No, that the variance in the 150

34

giving you more money than a 100 is something that

has -- it was never like that until around the

latter part of last year --

MR. GILLESPIE: I see.

MS. GRAY: -- when the interest rate dropped.

MR. GILLESPIE: The interest rate dropped?

MS. GRAY: Yeah. I guess the T-bill rate

dropped lower than what they had built into the

formula. I really don't understand it. I just

10

know that whenever you factor a 150 up against a

11

100 you're getting more cash out.

12

MR. GILLESPIE: And the T --

13

MS. GRAY: It was never like that before.

14

MR. GILLESPIE: And the T-bill rate dropped

15

16

17

last year?

MS. GRAY: It dropped -- I mean, it goes up

and down every week.

18

MR. GILLESPIE: I see.

19

MS. GRAY: It changes from week to week.

20

MR. GILLESPIE: I need to do a historical

21

search on that.

22

MS. GRAY: Yeah, check that out. Because, in

23

fact, I'll probably do that when we hang up today.

24

I'll probably check it out myself because I don't

25

have that information. I know that it's out there

35

on the web, I just never pulled it up. I know it's

published ever week in the Wall Street Journal.

MR. GILLESPIE: All right.

MS. GRAY: If you go to their website, and I

believe it's on Wednesdays that they publish that

T-bill rate.

MR. GILLESPIE: All right, I'll look for that.

MS. GRAY: So you can kind of, if you want to

9

10

11

follow it you can.

MR. GILLESPIE: All right. Did you have any

other questions, mom?

12

MRS. GILLESPIE: No, I don't, no.

13

MR. GILLESPIE: All right, well, we will look

14

15

for this stuff you're going to mail us.

MS. GRAY: Okay. I'll send you some things in

16

the mail. And like I say, be sure to hold on to

17

those certificates for your lender.

18

MR. GILLESPIE: We will.

19

MS. GRAY: Okay.

20

MR. GILLESPIE: All right. Thank you for

21

calling.

22

MS. GRAY: Sure. Thank you.

23

MRS. GILLESPIE: Thank you.

24

MS. GRAY: Thank you.

25

MR. GILLESPIE: Goodbye.

36

MS. GRAY: Bye-bye.

(Whereupon, the above recording was

concluded.)

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

37

C-E-R-T-I-F-I-C-A-T-E

1

2

STATE OF FLORIDA

COUNTY OF HILLSBOROUGH

I, Michael J. Borseth, Court Reporter

for the Circuit Court of the Thirteenth Judicial

Circuit of the State of Florida, in and for

Hillsborough County, DO HEREBY CERTIFY, that I was

authorized to and did transcribe a tape/CD recording of

10

the proceedings and evidence in the above-styled cause,

11

as stated in the caption hereto, and that the foregoing

12

pages constitute an accurate transcription of the tape

13

recording of said proceedings and evidence, to the best

14

of my ability.

15

IN WITNESS WHEREOF, I have hereunto set my hand

16

in the City of Tampa, County of Hillsborough, State of

17

Florida, this 14 April 2013.

18

19

20

21

22

23

24

25

MICHAEL J. BORSETH, Court Reporter

Vous aimerez peut-être aussi

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Neil Gillespie Kar Kingdom Bucks County Courier TimesDocument8 pagesNeil Gillespie Kar Kingdom Bucks County Courier TimesNeil GillespiePas encore d'évaluation

- Appeal Order Denying Motion To Withdraw Plea 5D23-2005Document180 pagesAppeal Order Denying Motion To Withdraw Plea 5D23-2005Neil GillespiePas encore d'évaluation

- Petition To Remove Judge Peter Brigham 5D23-0814Document44 pagesPetition To Remove Judge Peter Brigham 5D23-0814Neil GillespiePas encore d'évaluation

- Habeas Petition 5D23-0913 Judge Peter BrighamDocument146 pagesHabeas Petition 5D23-0913 Judge Peter BrighamNeil GillespiePas encore d'évaluation

- Neil Gillespie United Nations Fight Against CorruptionDocument13 pagesNeil Gillespie United Nations Fight Against CorruptionNeil GillespiePas encore d'évaluation

- Habeas Petition Re Judge Peter Brigham 5d23-1176Document168 pagesHabeas Petition Re Judge Peter Brigham 5d23-1176Neil GillespiePas encore d'évaluation

- Appendix B Google Complaint For Replevin (Verizon)Document7 pagesAppendix B Google Complaint For Replevin (Verizon)Neil GillespiePas encore d'évaluation

- Gillespie V Google Amended Motion For Writ of ReplevinDocument23 pagesGillespie V Google Amended Motion For Writ of ReplevinNeil GillespiePas encore d'évaluation

- Letter of Martin Levine Realtor For Neil GillespieDocument7 pagesLetter of Martin Levine Realtor For Neil GillespieNeil GillespiePas encore d'évaluation

- Gillespie V Google, Verified Motion For ReplevinDocument33 pagesGillespie V Google, Verified Motion For ReplevinNeil GillespiePas encore d'évaluation

- Offer To Settle Google Lawsuit Neil Gillespie AffidavitDocument2 pagesOffer To Settle Google Lawsuit Neil Gillespie AffidavitNeil GillespiePas encore d'évaluation

- Verified Notice of Nolle Prosequi in Case 2020-CF-2417Document31 pagesVerified Notice of Nolle Prosequi in Case 2020-CF-2417Neil GillespiePas encore d'évaluation

- Gillespie V Google Remanded, Pending Motion For Writ of ReplevinDocument37 pagesGillespie V Google Remanded, Pending Motion For Writ of ReplevinNeil GillespiePas encore d'évaluation

- Appendix C, Google Complaint For Replevin (Trump V Anderson, No. 23-719)Document83 pagesAppendix C, Google Complaint For Replevin (Trump V Anderson, No. 23-719)Neil GillespiePas encore d'évaluation

- Defendants Motion To Waive Confidentiality For Psychological EvaluationDocument18 pagesDefendants Motion To Waive Confidentiality For Psychological EvaluationNeil GillespiePas encore d'évaluation

- Gillespie V Google, Verified Motion For ReplevinDocument33 pagesGillespie V Google, Verified Motion For ReplevinNeil GillespiePas encore d'évaluation

- Appendix A Google Complaint For RepelvinDocument87 pagesAppendix A Google Complaint For RepelvinNeil GillespiePas encore d'évaluation

- Psychological Evaluation of Neil GillespieDocument5 pagesPsychological Evaluation of Neil GillespieNeil GillespiePas encore d'évaluation

- TRUMP V ANDERSON No. 23-719 USSC Response To Amicus EOTDocument97 pagesTRUMP V ANDERSON No. 23-719 USSC Response To Amicus EOTNeil GillespiePas encore d'évaluation

- Gillespie V Google, Complaint For Replevin, 2024-CA-0209Document238 pagesGillespie V Google, Complaint For Replevin, 2024-CA-0209Neil GillespiePas encore d'évaluation

- Appendix Prosecutorial Misconduct 2022-Cf-1143Document187 pagesAppendix Prosecutorial Misconduct 2022-Cf-1143Neil GillespiePas encore d'évaluation

- Notice of Prosecutorial Misconduct Case 2022-Cf-1143Document43 pagesNotice of Prosecutorial Misconduct Case 2022-Cf-1143Neil GillespiePas encore d'évaluation

- Notice of Filing Love Letters From Sarah ThompsonDocument11 pagesNotice of Filing Love Letters From Sarah ThompsonNeil GillespiePas encore d'évaluation

- Gillespie V Google, Complaint For ReplevinDocument61 pagesGillespie V Google, Complaint For ReplevinNeil GillespiePas encore d'évaluation

- Order Granting Motion To Waive Confidentiality For Psychological EvaluationDocument7 pagesOrder Granting Motion To Waive Confidentiality For Psychological EvaluationNeil GillespiePas encore d'évaluation

- Jailhouse Federal Habeas Corpus Petition From The Marion County Jail, Ocala FloridaDocument116 pagesJailhouse Federal Habeas Corpus Petition From The Marion County Jail, Ocala FloridaNeil GillespiePas encore d'évaluation

- Notice of Prosecutorial Misconduct Case 2021-Cf-0286Document79 pagesNotice of Prosecutorial Misconduct Case 2021-Cf-0286Neil GillespiePas encore d'évaluation

- Notice of Claim of Immunity Under Section 776.032 Florida StatutesDocument1 pageNotice of Claim of Immunity Under Section 776.032 Florida StatutesNeil GillespiePas encore d'évaluation

- Jailhouse Amended Verified Motion To Dismiss Charges Against DefendantDocument19 pagesJailhouse Amended Verified Motion To Dismiss Charges Against DefendantNeil GillespiePas encore d'évaluation

- Jailhouse Constitutional Challenge To Florida One-Party Consent Telephone RecordingDocument198 pagesJailhouse Constitutional Challenge To Florida One-Party Consent Telephone RecordingNeil GillespiePas encore d'évaluation

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- S 101-01 - PDF - User Interface - Computer MonitorDocument130 pagesS 101-01 - PDF - User Interface - Computer Monitormborghesi1Pas encore d'évaluation

- The Voice of The Villages - December 2014Document48 pagesThe Voice of The Villages - December 2014The Gayton Group of ParishesPas encore d'évaluation

- Hoja Tecnica Item 2 DRC-9-04X12-D-H-D UV BK LSZH - F904804Q6B PDFDocument2 pagesHoja Tecnica Item 2 DRC-9-04X12-D-H-D UV BK LSZH - F904804Q6B PDFMarco Antonio Gutierrez PulchaPas encore d'évaluation

- Reading TPO 49 Used June 17 To 20 10am To 12pm Small Group Tutoring1Document27 pagesReading TPO 49 Used June 17 To 20 10am To 12pm Small Group Tutoring1shehla khanPas encore d'évaluation

- Safety Inspection Checklist Project: Location: Inspector: DateDocument2 pagesSafety Inspection Checklist Project: Location: Inspector: Dateyono DaryonoPas encore d'évaluation

- TRX Documentation20130403 PDFDocument49 pagesTRX Documentation20130403 PDFakasamePas encore d'évaluation

- Yamaha F200 Maintenance ScheduleDocument2 pagesYamaha F200 Maintenance ScheduleGrady SandersPas encore d'évaluation

- R 18 Model B Installation of TC Auxiliary Lights and WingletsDocument29 pagesR 18 Model B Installation of TC Auxiliary Lights and WingletsAlejandro RodríguezPas encore d'évaluation

- SPIE Oil & Gas Services: Pressure VesselsDocument56 pagesSPIE Oil & Gas Services: Pressure VesselsSadashiw PatilPas encore d'évaluation

- Cara Membuat Motivation LetterDocument5 pagesCara Membuat Motivation LetterBayu Ade Krisna0% (1)

- Computer Vision and Action Recognition A Guide For Image Processing and Computer Vision Community For Action UnderstandingDocument228 pagesComputer Vision and Action Recognition A Guide For Image Processing and Computer Vision Community For Action UnderstandingWilfredo MolinaPas encore d'évaluation

- Criminal Law I Green Notes PDFDocument105 pagesCriminal Law I Green Notes PDFNewCovenantChurchPas encore d'évaluation

- Completed NGC3 ReportDocument4 pagesCompleted NGC3 ReportTiCu Constantin100% (1)

- I5386-Bulk SigmaDocument1 pageI5386-Bulk SigmaCleaver BrightPas encore d'évaluation

- Two 2 Page Quality ManualDocument2 pagesTwo 2 Page Quality Manualtony sPas encore d'évaluation

- Sem 4 - Minor 2Document6 pagesSem 4 - Minor 2Shashank Mani TripathiPas encore d'évaluation

- Central Banking and Monetary PolicyDocument13 pagesCentral Banking and Monetary PolicyLuisaPas encore d'évaluation

- Fortigate Fortiwifi 40F Series: Data SheetDocument6 pagesFortigate Fortiwifi 40F Series: Data SheetDiego Carrasco DíazPas encore d'évaluation

- CC Anbcc FD 002 Enr0Document5 pagesCC Anbcc FD 002 Enr0ssierroPas encore d'évaluation

- Fin 3 - Exam1Document12 pagesFin 3 - Exam1DONNA MAE FUENTESPas encore d'évaluation

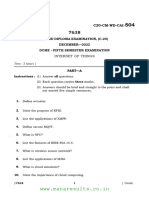

- WWW - Manaresults.co - In: Internet of ThingsDocument3 pagesWWW - Manaresults.co - In: Internet of Thingsbabudurga700Pas encore d'évaluation

- Press Release - INTRODUCING THE NEW LAND ROVER DEFENDER PDFDocument6 pagesPress Release - INTRODUCING THE NEW LAND ROVER DEFENDER PDFJay ShahPas encore d'évaluation

- Perhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020Document6 pagesPerhitungan Manual Metode Correlated Naïve Bayes Classifier: December 2020andreas evanPas encore d'évaluation

- Process Synchronization: Silberschatz, Galvin and Gagne ©2013 Operating System Concepts - 9 EditionDocument26 pagesProcess Synchronization: Silberschatz, Galvin and Gagne ©2013 Operating System Concepts - 9 EditionKizifiPas encore d'évaluation

- SVPWM PDFDocument5 pagesSVPWM PDFmauricetappaPas encore d'évaluation

- Lps - Config Doc of Fm-BcsDocument37 pagesLps - Config Doc of Fm-Bcsraj01072007Pas encore d'évaluation

- Resources and Courses: Moocs (Massive Open Online Courses)Document8 pagesResources and Courses: Moocs (Massive Open Online Courses)Jump SkillPas encore d'évaluation

- MNO Manuale Centrifughe IngleseDocument52 pagesMNO Manuale Centrifughe IngleseChrist Rodney MAKANAPas encore d'évaluation

- Coursework For ResumeDocument7 pagesCoursework For Resumeafjwdxrctmsmwf100% (2)

- QuestionDocument7 pagesQuestionNgọc LuânPas encore d'évaluation