Académique Documents

Professionnel Documents

Culture Documents

McDonald V Onewest CMP PDF

Transféré par

drattyDescription originale:

Titre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

McDonald V Onewest CMP PDF

Transféré par

drattyDroits d'auteur :

Formats disponibles

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 1 of 21

IN THE UNITED STATES DISTRICT COURT

FOR THE DISTRICT OF COLORADO

Case No.

Bruce C. McDonald, an individual,

Plaintiff,

vs.

ONEWEST BANK, F.S.B.; John and Jane Does, 1-100 inclusive; ABC

CORPORATIONS, entities of unknown form, 1-20, inclusive,

Defendants.

COMPLAINT AND JURY DEMAND

COMES NOW the Plaintiff, Bruce C. McDonald, by and through counsel, Gary D.

Fielder, Attorney at Law, and institutes this action for actual damages, statutory

damages, treble, and compensatory damages including his reasonable attorneys fees

and costs for this action against the Defendants.

FOR HIS COMPLAINT AND JURY DEMAND MR. MCDONALD STATES AS

FOLLOWS:

PARTIES

1.

The Plaintiff, Bruce C. McDonald (Mr. McDonald) is a natural person.

2.

At all times material hereto, Mr. McDonald was a domiciliary, resident and Citizen

of the state of Colorado, a state within the United States of America.

3.

At all times material hereto, Defendant, ONEWEST BANK, F.S.B. (ONEWEST)

is a federally chartered savings bank with its principal office located at 888 E.

Walnut St., Pasadena, California.

1

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 2 of 21

4.

Mr. McDonald is ignorant of the true names and capacities of Defendants sued

herein as JOHN and JANE DOES 1-100, inclusive, and ABC CORPORATIONS 120, inclusive, and therefore sues said Defendants by such fictitious names.

5.

Mr. McDonald will seek leave of this Court to amend this Complaint to insert their

true names and capacities when the same have been ascertained.

JURISDICTION AND VENUE

6.

This Court has jurisdiction over the subject matter and the parties pursuant to the

Fair Debt Collection Practices Act (FDCPA), 15 U.S.C. 1692(k)(d), and 28

U.S.C. 1331, 1337 and 1367.

7.

This Court has jurisdiction over this matter and the parties pursuant to the

Racketeer Influenced and Corrupt Organization Act (RICO), 18 U.S.C. 1961, et

seq.

8.

This Court has jurisdiction over this matter and ONEWEST in diversity jurisdiction

pursuant to 28 U.S.C. 1332(a)(3).

9.

This Court has supplemental jurisdiction over Plaintiffs state-based and commonlaw claims pursuant to 28 U.S.C 1367.

10. Venue and personal jurisdiction is proper in this District as ONEWESTs collection

actions and communications with Mr. McDonald were transmitted and received by

the parties, respectively, in this District.

11. Venue and personal jurisdiction is proper in this District, as ONEWEST has

transacted business within the District.

12. Venue and personal jurisdiction is proper in this District as the action against Mr.

McDonald and his property, which is the ultimate subject of this lawsuit, are

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 3 of 21

situated in this District.

13. Venue and personal jurisdiction is proper in this District as the original Note and

Deed of Trust, which are also the subject of this lawsuit, where originally executed

by Mr. McDonald in this District.

FACTUAL ALLEGATIONS AND BACKGROUND

14. Plaintiff, Mr. McDonald, incorporates by reference Paragraphs 1-13 of this

Complaint, as though fully contained herein, insofar as they may be applicable.

15. On or about May 27, 2003, Mr. McDonald entered into a written agreement with an

entity named INDYMAC BANK, F.S.B. (INDYMAC BANK), wherein Mr. McDonald

was to receive a check from INDYMAC BANK in the amount of One Hundred and

Ninety-Eight Thousand Dollars ($198,000).

16. Said written agreement required Mr. McDonald to repay INDYMAC BANK for the

funds received, and said agreement was memorialized on the above referenced

date in a document entitled ADJUSTABLE RATE NOTE (Note). Said Note is

attached hereto as Plaintiffs Exhibit A, as though fully contained herein.

17. Said Note was secured by a residential property purchased and owned by Mr.

McDonald, located at 4434 Rarity Court, Crestone, Colorado.

18. Said security was in the form of a Deed of Trust, (Deed of Trust) executed on

May 27, 2003, by Mr. McDonald in favor of INDYMAC BANK, which is attached

hereto as Plaintiffs Exhibit B, as though fully contained herein.

19.

Thereafter, Mr. McDonald was in compliance with the agreement for repayment

under the terms of the said Note, up to and including April 2009.

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 4 of 21

20. On or about July 11, 2008, INDYMAC BANK was closed by the OFFICE OF

THRIFT SUPERVISION (OTS), an agency of the United States Government.

21. After said closure, INDYMAC BANK went into bankruptcy and the FEDERAL

DEPOSIT INSURANCE CORPORATION (FDIC) was named as the banks

conservator.

22. FDIC reopened INDYMAC BANK under the name of INDYMAC FEDERAL BANK.

23. FDIC operated said INDYMAC FEDERAL BANK in receivership for approximately

8 months.

24. In March 2009, FDIC sold INDYMAC FEDERAL BANK to a Pasadena, California

holding company, IBM HOLDCO, LLC.

25. At all material times hereto, IBM HOLDCO, LLC was owned and controlled by IBM

MANAGEMENT HOLDINGS, LP.

26. After said purchase, the bank, INDYMAC FEDERAL BANK, reopened as

ONEWEST BANK, F.S.B. (ONEWEST), as referenced above in paragraph 3.

27. As a part of the purchase of the assets of INDYMAC, and/or INDYMAC FEDERAL

BANK, ONEWEST purchased the servicing rights to said Note involving Mr.

McDonald.

28. Said Note purports to be a simple and straightforward mortgage.

29. On or about April 10, 2009, Mr. McDonald received a letter from ONEWEST, which

stated:

You are hereby notified that, effective March 19, 2009, the servicing of

your mortgage loan, that is, the right to collect payments from you, was

assigned, sold or transferred from IndyMac Federal Bank, FSB to

IndyMac Mortgage Services, a division of OneWest Bank, FSB.

Said letter dated April 10, 2009, is attached hereto as Plaintiffs Exhibit C, as

though fully contained herein.

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 5 of 21

30. After receipt of said letter, on or about April 12, 2009, Mr. McDonald called

ONEWEST to inquire who they were, and what obligations he had to them.

31. Upon information and belief, ONEWEST refused to disclose the status of

ONEWESTs position related to its ownership of said Note and Deed of Trust.

32. ONEWEST, through its representatives, did insist, however, that Mr. McDonald

now owed ONEWEST the same monthly mortgage payments as he had previously

paid to INDYMAC BANK.

33. On or after said letter dated April 10, 2009, ONEWEST did not provide Mr.

McDonald with the instrument or reasonable evidence of authority to make such a

presentment.

34. On or after April 12, 2009, Mr. McDonald refused payment.

35. Thereafter, ONEWEST retained the services of a law firm to represent its interest,

namely: ARONOWITZ & MECKLENBURG, L.L.P. (ARONOWITZ).

36. At all times material hereto, ARONOWITZ was acting under the authority of

ONEWEST.

37. Said agreement between ARONOWITZ and ONEWEST created an attorney/client

relationship.

38. By said agreement, an agency was created between ARONOWITZ and

ONEWEST, wherein ARONOWITZ agreed to become the agent and act for, or in

the place of, ONEWEST, the principal.

39. At all times material hereto, ARONOWITZ acted as the agent(s) of ONEWEST.

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 6 of 21

40. On or about August 4, 2009, ONEWEST, through ARONOWITZ, mailed a letter to

Mr.McDonald which stated, in bold: Notice under Fair Debt Collection

Practices Act 15 U.S.C. 1962, et seq. Said letter dated August 4, 2009, is

attached hereto as Plaintiffs Exhibit D, as though fully contained herein.

41. Said letter of August 4, 2009, also stated in all capital letters and in bold:

THE LAW FIRM OF ARONOWITZ & MECKLENBURG, L.L.P. IS ACTING AS A

DEBT COLLECTOR AND IS ATTEMPTING TO COLLECT A DEBT.

42. ONEWEST and ARONOWITZ, each and individually, used: the mail; interstate

telephone systems; and, online, interstate computer systems to conduct its

business, including, but not limited to, collection of debt acquired from INDYMAC

BANK and INDYMAC FEDERAL BANK.

43. ARONOWITZ are debt collectors as defined by FDCPA and the Colorado Fair

Debt Collection Practices Act (CFDCPA).

44. ONEWEST are debt collectors as defined by FDCPA and the CFDCPA.

45. Mr. McDonald is a consumer as defined by FDCPA and CFDCPA.

46. Said letter dated August 4, 2009, stated in bold:

IF YOU NOTIFY US IN WRITING WITHIN THIRTY (30) DAYS AFTER RECEIPT

OF THIS NOTICE, THAT THE DEBT OR ANY PORTION THEREOF IS

DISPUTED, WE WILL OBTAIN VERIFICATION OF THE DEBT AND A COPY

OF SUCH VERIFICATION WILL BE MAILED TO YOU.

47. On or about August 4, 2009, ONEWEST through its attorneys, ARONOWITZ, filed

a CERTIFICATION BY QUALIFIED HOLDER PURSUANT TO 38-38-101, C.R.S.

with the Public Trustee of Saguache County (Public Trustee). Attached hereto as

Plaintiffs Exhibit E is a copy of said Certification, as though fully contained

herein.

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 7 of 21

48. Said Certification was signed under oath by an attorney from ARONOWITZ.

49. In said Certificate, ARONOWITZ certified that ONEWEST was a Qualified Holder

pursuant to Colorado Revised Statute, 38-38-101, et.seq.

50. Said Certificate certified that ONEWEST bank was the holder of the original

evidence of debt and was the current beneficiary of the Deed of Trust executed by

Mr. McDonald on May 27, 2003.

51. At all material times hereto, ONEWEST was not, and is not, the Holder In Due

Course of the original Note, executed by Mr. McDonald on May 27, 2003.

52. At all material times hereto, ONEWEST was not, and is not, the beneficiary of said

Deed of Trust, executed by Mr. McDonald on May 27, 2003.

53. On or about August 10, 2009, Mr. McDonald received a COMBINED NOTICE

SAGUACHE COUNTY PUBLIC TRUSTEE SALE NO. 22-2009. Attached hereto

as Plaintiffs Exhibit F is a copy of said Notice dated August 10, 2009, as though

fully contained herein.

54. Said Notice from the Public Trustee stated that Mr. McDonalds home had been

scheduled for sale to the highest bidder on December 3, 2009, at 10:00 a.m., at

the Saguache County Courthouse.

55. On or about August 17, 2009, Mr. McDonald responded to ONEWEST, by certified

mail addressed to its agent ARONOWITZ, disputing the validity of the alleged debt.

Attached hereto as Plaintiffs Exhibit G is said letter dated August 17, 2009, as

though fully contained herein.

56. In said letter of August 17, 2009, Mr. McDonald specifically requested that

ONEWEST and/or ARONOWITZ provide proof that ONEWEST had acquired a

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 8 of 21

valid security interest in Mr. McDonalds property.

57. On or about August 22, 2010, ONEWEST, through ARONOWITZ, responded to

Mr. McDonalds letter, and indicated therein that ARONOWITZ in fact represented

ONEWEST, and enclosed a copy of the above-referenced Note and Deed of Trust.

Attached hereto as Plaintiffs Exhibit H is said letter and attachments dated

August 22, 2009, as though fully contained herein.

58. Said letter of August 22, 2009, containing the attached Note, clearly states that

INDYMAC BANK, FSB is the Lender, not ONEWEST BANK.

59. Said letter of August 22, 2009, Deed of Trust clearly states the beneficiary to be

INDYMAC BANK FSB, not ONEWEST BANK.

60. No notation(s), mark(s), stamp(s), endorsement(s) or assignment(s) on the Note or

Deed of Trust indicated or, in any way, demonstrated that the Note and/or Deed of

Trust was transferred, endorsed, sold, assigned or conveyed to ONEWEST.

61. Said letter dated August 22, 2009, from ONEWEST, through ARONOWITZ, also

stated: Our office [ARONOWITZ] represents ONEWEST BANK, FSB who is the

servicer and holder of the loan which was originated by INDYMAC BANK F.S.B.

62. No other documentation was attached, mailed, or delivered to Mr. McDonald that

demonstrated that the Note and/or Deed of Trust had been transferred, endorsed,

sold, assigned or conveyed to ONEWEST.

63. Said letter dated August 22, 2009, did not indicate that ONEWEST was the Holder

In Due Course.

64. As of August 22, 2009, ONEWEST was not the Holder In Due Course.

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 9 of 21

65. Upon information and belief, up to and including the date of the filing of this

Complaint, ONEWEST has never been the Holder In Due Course of said Note

and Deed of Trust.

66. Said letter of August 22, 2009, stated: The Adjustable Rate Note and Deed of Trust

gives our client a secured interest in the property at 4434 Rarity Court, Crestone,

CO 81131.

67. As of August 22, 2009, ONEWEST knew, or should have known, that it did not

have a secured interest in said property, Note or Deed of Trust.

68. As of August 22, 2009, ONEWEST knew, or should have known, that it was not the

Holder in Due Course.

69. At all times material hereto, ONEWEST had purchased only the servicing rights to

said Note.

70. At all material times, ONEWEST never ceased collection efforts against Mr.

McDonald.

71. At sometime previous to the bankruptcy of INDYMAC BANK, as referenced above,

another entity entitled FEDERAL HOME LOAN MORTGAGE CORPORATION

(FREDDIE MAC) had purchased said Note and Deed of Trust executed by Mr.

McDonald on May 27, 2003.

72. The FDIC has confirmed that FREDDIE MAC purchased and owns the Note and

Deed of Trust executed by Mr. McDonald on May 27, 2003. Attached hereto as

Plaintiffs Exhibit I is a letter from the FDIC drafted March 1, 2010, as though fully

contained herein.

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 10 of 21

73. Upon information and belief, FREDDIE MAC purchased said Note and Deed of

Trust in September 2004. Attached hereto as Plaintiffs Exhibit J is a printout

dated March 1, 2009, of the computer screen of INDY MAC MORTGAGE

SERVICES, a division of ONEWEST, in reference of Mr. McDonalds account as

though fully contained herein.

74. At all material times, ONEWEST knew that FREDDIE MAC had purchased the

Note and Deed of Trust executed by Mr. McDonald on May 27, 2003.

75. On or about February 26, 2010, INDY MORTGAGE SERVICES, a division of

ONEWEST, sent Mr. McDonald a letter which stated:

Please accept this letter as confirmation that the investor on your loan

is Federal Home Loan Mtg. Co[ONEWEST is] responsible for the

servicing of this loan.

Attached hereto as Plaintiffs Exhibit K is a copy of said letter dated February 26,

2010, as though fully contained herein.

76. On or about September 10, 2009, Mr. McDonald filed a independent action in

Saguache County District Court, referenced under case number 09 CV 41, entitled

Motion for Temporary Injunction, to stop the sale of his property, compel

ONEWEST to validate the debt, and to determine the real party in interest.

77. On or about September 10, 2009, ONEWEST filed for a Rule 120 Hearing in order

to obtain an Order Authorizing Sale of Mr. McDonalds property, through the Public

Trustee.

78. On or about October 14, 2009, the Saguache County District Court (Colorado

District Court) ordered ONEWEST to produce the original Note and Deed of Trust.

10

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 11 of 21

79. ONEWEST did not produce the original Note and Deed of Trust by the deadline

imposed, and the Colorado District Court denied ONEWEST an Order Authorizing

Sale, and administratively closed both cases.

80. Soon thereafter, ONEWEST filed a Motion to Reconsider and produced an alleged

original Note and Deed of Trust.

81. The Colorado District Court then ordered ONEWEST to produce a sales contract

proving that Mr. McDonalds loan was an asset that ONEWEST acquired when

they originally bought the assets of INDYMAC BANK and INDYMAC FEDERAL

BANK.

82. ONEWEST produced a Master Sales Agreement between ONEWEST and the

FDIC.

83. Said Master Sales Agreement did not indicate any individual assets that were

purchased by ONEWEST.

84. On February 4, 2010, the Colorado District Court, issued an Order allowing the

sale of Mr. McDonalds property to commence pursuant to Colorado Rules of Civil

Procedure 120, which set the sale at public auction for March 4, 2010.

85. On or about March 2, 2010, Mr. McDonald, through counsel, filed a Motion to

Vacate the Order Authorizing Sale, which contained the March 1, 2009, letter from

the FDIC, referenced above as Plaintiffs Exhibit I.

86. On March 4, 2010, ONEWEST, the only bidder, purchased Mr. McDonalds

property with a deficiency bid in the amount of one hundred and seventy-one

thousand, two dollars and seventy-four cents ($171,002.74).

11

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 12 of 21

87. Thereafter, ONEWEST claimed a balance owed of forty-eight thousand, three

hundred and thirty-two dollars and eighty-two cents ($48,332.82).

88. On or about March 17, 2010, ONEWEST filed a response, through ARONOWITZ,

to said Motion to Vacate, stating in pertinent part:

The original note and deed of trust were transferred to ONEWEST.

89. ONEWESTs statement to the District Court that the original Note and Deed of

Trust were transferred to ONEWEST was and is false, misleading and untrue

90. On or about March 25, 2010, ONEWEST assigned its interest in said property to

FREDDIE MAC in consideration of ten dollars ($10).

91. On or about April 10, 2010, said Colorado District Court denied Mr. McDonalds

Motion to Vacate Order Authorizing Sale.

92. On or about June 29, 2010, FREDDIE MAC initiated a Forcible Entry and Unlawful

Detainer action (FED), in Saguache County Court, against Mr. McDonald.

93. A trial date for the FED action has been set for July 30, 2010.

FIRST CAUSE OF ACTION

CIVIL RICO

94. As and for the first cause of action for violating RICO, pursuant to 18 U.S.C.

1961, et seq., against Defendant, ONEWEST, and John and Jane Does 1-100 and

ABC Corporation, 1-20, inclusive; Plaintiff, Mr. McDonald, alleges as follows.

95. Mr. McDonald incorporates by reference paragraphs 1-94 of this Complaint as

though fully contained herein, and so far as they may be applicable.

96.

At all times material hereto, Mr. McDonald was a member of the persons within

the meaning and definition of RICO, pursuant to 18 U.S.C. 1961(3) and 1964(c).

12

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 13 of 21

97. At all material times hereto, ONEWEST and other unnamed conspirators were

persons within the meaning of RICO, 18 U.S.C. 1961(3) and 1962(c).

98. At all material times hereto, ONEWEST and other conspirators formed an

association-in-fact for the purpose of defrauding individuals, such as Mr.

McDonald, by foreclosing on property such as the property owned by Mr.

McDonald, in which ONEWEST has servicing rights, but was not the holder in

due course, and thus, did not have the capacity or standing to enforce the rights

and/or claims incumbent to such notes and deeds of trust.

99. This association-in-fact was an enterprise within the meaning of RICO, 18 U.S.C.

1961(4).

100. At all material times hereto, this enterprise was engaged in, and its activities

affected, interstate and foreign commerce, within the meaning of RICO, 18 U.S.C.

1962 (c).

101. At all material times hereto, ONEWEST and other as yet unknown conspirators

associated with this enterprise conducted or participated, directly or indirectly, in

the conduct of the enterprises affairs through a pattern of racketeering activity

within the meaning of RICO, 18 U.S.C. 1961(5), or the collection of an unlawful

debt in violation of RICO, 18 U.S.C. 1962(c).

102. At all material times hereto, ONEWEST and other as yet unknown conspirators

engaged in racketeering activity within the meaning of 18 U.S.C. 1961(1) by

engaging in the acts set forth above.

13

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 14 of 21

103. Said acts set forth above constitutes a violation of one or more of the following

statutes including but not limited to: 18 U.S.C. 1341 (Mail Fraud); 18 U.S.C.

1341 (Wire Fraud); 18 U.S.C. 1344 (Financial Institution Fraud); 18 U.S.C.

1951 (Interference with Commerce, Robbery or Extortion); 18 U.S.C. 1956

(Laundering of Monetary Instruments); 18 U.S.C. 1957 (Monetary Transactions

and Property Derived from Specified Unlawful Activity); and, actions by ONEWEST

and other as yet unknown conspirators which committed, and/or aided, and/or

abetted the commission of two or more of these acts of racketeering activity which

constitute interstate commerce.

104. The acts of racketeering activity referred to in the previous paragraph, constituted

a pattern of racketeering activity within the meaning of 18 U.S.C. 1961(5),

and/or the collection of an illegal debt.

105. The acts alleged were related to each other by virtue of common participants, a

common victim, a common method of commission, and a common purpose and

common result of defrauding the Plaintiff and other similarly situated individuals of

millions of dollars, enriching ONEWEST and other conspirators at the Plaintiffs

expense while concealing the fraudulent activities of ONEWEST and other

conspirators.

106. This fraudulent scheme has continued for over a year and threatens to continue

despite the institution of this Complaint.

107. As a result of ONEWEST and other conspirators violations of 18 U.S.C. 1962(c),

Mr. McDonald has suffered the loss of his home, property, and other damages,

including, but not limited to, economic losses, attorneys fees, past, present and

14

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 15 of 21

future mental pain and suffering.

108. As a result of the above-referenced misconduct, ONEWEST is liable to Mr.

McDonald for his loss in an amount to be determined at trial.

109. Pursuant to RICO, 18 U.S.C. 1964(c), Mr. McDonald is entitled to recover threefold his damages, plus costs and attorneys fees from ONEWEST.

WHEREFORE, Plaintiff prays following his final cause of action.

SECOND CAUSE OF ACTION

PATTERN OF RACKETEERING ACTIVITY

110. As and for a second cause of action for RICO conspiracy, pursuant to 18 USC

1962(a) et seq., against Defendant, ONEWEST, and John and Jane Does 1-100

and ABC Corporation, 1-20, inclusive; Plaintiff, Mr. McDonald, alleges as follows.

111. Plaintiff incorporates by reference paragraphs 1-110 of this Complaint as though

fully contained herein.

112. As set forth in Mr. McDonalds First Cause of Action, ONEWEST and other

conspirators associated with this enterprise conducted or participated, directly or

indirectly in the conduct of the enterprises affairs through a pattern of racketeering

activity within the meaning of RICO, 18 U.S.C. 1961(5), in violation of RICO, 18

U.S.C. 1962(c).

113. At all material times hereto, ONEWEST and other as yet known conspirators each

were associated with this enterprise and agreed and conspired to violate 18 U.S.C.

1962(c), that is, agreed to conduct and participate, directly and indirectly, in the

conduct of the affairs of the enterprise through a pattern of racketeering activity, in

violation of 18 U.S.C. 1962(d).

15

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 16 of 21

114. At all material times hereto, ONEWEST and other as yet known conspirators each

were associated with this enterprise and derived income from a pattern of

racketeering activity or the collection of illegal debts directly and indirectly, in the

conduct of the affairs of the enterprise through a pattern of racketeering activity,

and the collection of illegal debts in violation of 18 U.S.C. 1962(a).

115. At all material times hereto, ONEWEST and other as yet known conspirators each

were associated with this enterprise and derived income from a pattern of

racketeering activity or the collection of illegal debts directly and indirectly, in the

conduct of the affairs of the enterprise through a pattern of racketeering activity or

the collection of illegal debts, in violation of 18 U.S.C. 1962(a) and that some part

of that income was used in acquiring an interest in, or operating, the enterprise.

116. Said acts as set forth above constitutes a violation of one or more of the following

statutes: 18 U.S.C. 1341 (Mail Fraud); 18 U.S.C. 1341 (Wire Fraud); 18 U.S.C.

1344 (Financial Institution Fraud); 18 U.S.C. 1951 (Interference with

Commerce, Robbery or Extortion); 18 U.S.C. 1956 (Laundering of Monetary

Instruments); 18 U.S.C. 1957 (Monetary Transactions and Property Derived from

Specified Unlawful Activity); and, actions by ONEWEST and other as yet unknown

conspirators which committed, and/or aided, and/or abetted the commission of two

or more of these acts of racketeering activity which constitute interstate commerce.

117. ONEWEST and other conspirators committed and caused to be committed a

series of over acts in furtherance of the conspiracy and to affect the objects

thereof, including but not limited to the acts set forth above.

16

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 17 of 21

118. As a result of ONEWESTs and other conspirators violations of 18 U.S.C.

1962(d), Mr. McDonald has lost his home, property, and suffered economic and

general damages in the fraudulent scheme that ONEWEST created, organized,

serviced and continued to operate and run.

119. As a result of said conspiracy, ONEWEST is liable to Mr. McDonald for his losses

in an amount to be determined at trial.

120. Pursuant to RICO, 18 U.S.C. 1964(c), Mr. McDonald is entitled to recover threefold his damages, plus costs and attorneys fees from ONEWEST.

WHEREFORE, Plaintiff prays following his final cause of action.

THIRD CAUSE OF ACTION

VIOLATIONS OF THE FAIR DEBT COLLECTION PRACTICES ACT

121. As and for the third cause of action for violating the Fair Debt Collection Practices

Act (FDCPA), pursuant to 15 U.S. C. 1692, against Defendant, ONEWEST,

and John and Jane Does 1-100 and ABC Corporation, 1-20, inclusive, Plaintiff,

Mr. McDonald, alleges as follows.

122. Mr. McDonald incorporates by reference paragraphs 1-121 of this Complaint as

though fully contained herein, and so far as they may be applicable.

123. ONEWEST violated the FDCPA, 15 U.S.C. 1692 et. seq., by:

a.

Using false, deceptive, and/or misleading representations with regard

to the character, amount and/or legal status of an alleged debt owed

by Mr. McDonald to ONEWEST;

b.

Using unfair and unconscionable means to collect and attempt to

collect a debt by fraudulently claiming to be the holder in due course,

and thus the real party in interest in Mr. McDonalds Note and Deed

17

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 18 of 21

of Trust;

c.

Using unfair and unconscionable means to collect and attempt to

collect a debt by fraudulently advising a District Court in the State of

Colorado that ONEWEST owned Mr. McDonalds Note and Deed of

Trust, when in fact they did not; and,

d.

Failing to provide notice with regard to the true name of the creditor

to whom the debt is owed in violation of 15 USC 1692(g).

WHEREFORE, Plaintiff prays following his final cause of action.

FOURTH CAUSE OF ACTION

FRAUD

124. As and for the fourth cause of action for Common Law Fraud against Defendant,

ONEWEST, and John and Jane Does 1-100 and ABC Corporation, 1-20, inclusive;

Plaintiff, Mr. McDonald, alleges as follows:

125. Mr. McDonald incorporates by reference paragraphs 1-124 of this Complaint as

though fully contained herein, and so far as they may be applicable.

126. ONEWEST expressly and/or impliedly represented to Mr. McDonald, and the

Saguache County District Court, that it was the holder in due course, and thus

the real party in interest to Mr. McDonalds Note and Deed of Trust; and, as such,

had certain rights under said documents to foreclose on Mr. McDonalds property

and request that said Court authorize the sale of said property.

127. ONEWEST continually made false statements of material fact by claiming in

letters, pleadings, and in open court on the record that it was the holder in due

course of Mr. McDonalds Note and Deed of Trust.

18

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 19 of 21

128. Defendant ONEWEST specifically made several false statements that Mr.

McDonalds Note and Deed of Trust were purchased, transferred, or otherwise

assigned to ONEWEST, none of which were true.

129. Mr. McDonalds Note and Deed of Trust were never transferred to, assigned to,

purchased by, or in any way acquired by ONEWEST.

130. At all material times hereto, ONEWEST only acquired the servicing rights to the

note.

131. The facts indicate that FREDDIE MAC purchased Mr. McDonalds Note and Deed

of Trust many years ago.

132. Upon information and belief, FREDDIE MAC has sold Mr. McDonalds Note and

Deed of Trust.

133. ONEWEST concealed material facts that if known to the Colorado District Court

would have materially affected the judicial findings.

134. The false and fraudulent statements of ownership were made for the purposes of

securing an interest in Plaintiffs property that ONEWEST had no right to claim.

135. ONEWESTs false statements of ownership and/or concealment of facts caused an

injury to Plaintiff.

136. As a direct and proximate cause of ONEWESTs fraud, Mr. McDonald has

suffered, and continues to suffer, considerable economic and non-economic

damages in an amount provable at trial including, but not limited to, the loss of his

home.

WHEREFORE, Plaintiff prays following his final cause of action .

19

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 20 of 21

FIFTH CAUSE OF ACTION

VIOLATION OF COLORADO CONSUMER PROTECTION ACT

137. As and for the fifth cause of action for violating the Colorado Consumer Protection

Act, against Defendant, ONEWEST, and John and Jane Does 1-100 and ABC

Corporation, 1-20, inclusive. Plaintiff, Mr. McDonald, alleges as follows:

138. Mr. McDonald incorporates by reference paragraphs 1- 137 of this Complaint as

though fully contained herein, and so far as they may be applicable.

139. ONEWEST engaged in deceptive trade practices, which occurred in the course of

ONEWESTS business.

140. The deceptive trade practice significantly impacted the public as actual or potential

consumers of ONEWESTS services.

141. As a direct and proximate cause of ONEWESTs deceptive trade practices, Mr.

McDonald has suffered, and continues to suffer considerable economic and noneconomic damages, in an amount provable at trial including but not limited to the

loss of his home.

WHEREFORE, AS TO ALL CAUSES OF ACTION, PLAINTIFF PRAYS FOR THE

FOLLOWING RELIEF:

a) Damages to be proven at time of trial including but not limited to economic

damages for the loss of Plaintiffs home;

b) General damages for Plaintiffs mental anguish and pain and suffering;

c) Treble damages and reasonable attorneys fees and costs pursuant to 18

USC 1964(c);

d) For such further and necessary relief the Court deems just and proper.

20

Case 1:10-cv-01749-RPM Document 1 Filed 07/22/10 USDC Colorado Page 21 of 21

PLAINTIFF DEMANDS A TRIAL BY JURY

Respectfully submitted on 7/22/2010 by:

S/GARY FIELDER

Attorney for Plaintiff

Gary Fielder, Attorney at Law

5777 Olde Wadsworth Boulevard, Suite R700

Arvada, Colorado 80003

(303) 650-1505

(303) 650-1705 FAX

Criminaldefense@fielderlaw.net

21

Vous aimerez peut-être aussi

- Opinion - Ast - 12-08-02 Renz Attempt To Void Claim Against Chase - With Laws and Rules PDFDocument16 pagesOpinion - Ast - 12-08-02 Renz Attempt To Void Claim Against Chase - With Laws and Rules PDFdrattyPas encore d'évaluation

- Cruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFDocument7 pagesCruz V Jpmorgan No Standing Paa and Fdic Assignment Does Not Prove Ownership PDFdrattyPas encore d'évaluation

- Chapter 20 Lien StrippingDocument4 pagesChapter 20 Lien StrippingdrattyPas encore d'évaluation

- Is Chapter 20 Available Post BAPCPA PDFDocument13 pagesIs Chapter 20 Available Post BAPCPA PDFdrattyPas encore d'évaluation

- Creating Perfect Security Interests A PremirDocument19 pagesCreating Perfect Security Interests A Premirdratty100% (1)

- Balch v. LaSalle Bank, N.A., - So. 3d - (Fla. 4th DCA 2015)Document3 pagesBalch v. LaSalle Bank, N.A., - So. 3d - (Fla. 4th DCA 2015)FloridaLegalBlogPas encore d'évaluation

- Acidello V Jpmorgan Complaint PDFDocument64 pagesAcidello V Jpmorgan Complaint PDFdrattyPas encore d'évaluation

- Fed CA Opp Motion Refief From Aut Stay 08 CaporaleDocument4 pagesFed CA Opp Motion Refief From Aut Stay 08 Caporalesbhasin1Pas encore d'évaluation

- BANK OF NY AS TRUSTEE vs. MCQUEEN JADE Pages From The AFFIDAVIT OF BERNARD JAY PATTERSON PDFDocument4 pagesBANK OF NY AS TRUSTEE vs. MCQUEEN JADE Pages From The AFFIDAVIT OF BERNARD JAY PATTERSON PDFdrattyPas encore d'évaluation

- Nunez V JPMorgan Chase RESPA Violation by ChaseDocument9 pagesNunez V JPMorgan Chase RESPA Violation by ChasedrattyPas encore d'évaluation

- A New Look at US Foreclosure Crisis PDFDocument47 pagesA New Look at US Foreclosure Crisis PDFdrattyPas encore d'évaluation

- Mers by Its Construction Separates The Deed From The Mortgage Note - Wilhelm Decision - Lack of StandingDocument25 pagesMers by Its Construction Separates The Deed From The Mortgage Note - Wilhelm Decision - Lack of Standing83jjmackPas encore d'évaluation

- Bank Failed To Produce Evidence of Adequate Protection On Lost Note PDFDocument4 pagesBank Failed To Produce Evidence of Adequate Protection On Lost Note PDFdrattyPas encore d'évaluation

- Busted - Us Trustee Asks For Sanctions Against ChaseDocument2 pagesBusted - Us Trustee Asks For Sanctions Against Chase83jjmackPas encore d'évaluation

- Pred Lending Faq PDFDocument3 pagesPred Lending Faq PDFdrattyPas encore d'évaluation

- Abubo - 10172013 V The Bank of New York PDFDocument36 pagesAbubo - 10172013 V The Bank of New York PDFdrattyPas encore d'évaluation

- Section ADocument9 pagesSection AForeclosure Fraud75% (4)

- 67 - JBD - How To Defend Avoidance Actions in Bankruptcy Litigation - 00104494 - PDFDocument11 pages67 - JBD - How To Defend Avoidance Actions in Bankruptcy Litigation - 00104494 - PDFdrattyPas encore d'évaluation

- BAC Home Loans Servicing L.P. v. BlytheDocument13 pagesBAC Home Loans Servicing L.P. v. BlytheGlenn AugensteinPas encore d'évaluation

- BANK-OF-NEW-YORK-MELLON-v.-LEMAY and Dermabelle Gary Dubin PDFDocument8 pagesBANK-OF-NEW-YORK-MELLON-v.-LEMAY and Dermabelle Gary Dubin PDFdrattyPas encore d'évaluation

- D C O A O T S O F: Connie Yang and Frank RomeoDocument6 pagesD C O A O T S O F: Connie Yang and Frank RomeoForeclosure Fraud100% (1)

- Assignee Liability: Through The MinefieldDocument28 pagesAssignee Liability: Through The MinefieldlanehoukPas encore d'évaluation

- Section CDocument16 pagesSection CForeclosure Fraud100% (3)

- Hammer V Residential Credit Solution Memo Opinion and Two Million Award PDFDocument36 pagesHammer V Residential Credit Solution Memo Opinion and Two Million Award PDFdrattyPas encore d'évaluation

- Slorp V Lerner Sampson BA MERS Robo RICO 9 14Document28 pagesSlorp V Lerner Sampson BA MERS Robo RICO 9 14knownpersonPas encore d'évaluation

- Bank of New York V RomeroDocument19 pagesBank of New York V RomeroMortgage Compliance InvestigatorsPas encore d'évaluation

- Chavez-v.-JPhase Did Not Purchase Loans From FDIC Morgan-Chase-Bank-N.A.-AMENDED-COUNTERCLAIM-OF-JPMORGAN-CHASE-BANK-N.A PDFDocument4 pagesChavez-v.-JPhase Did Not Purchase Loans From FDIC Morgan-Chase-Bank-N.A.-AMENDED-COUNTERCLAIM-OF-JPMORGAN-CHASE-BANK-N.A PDFdrattyPas encore d'évaluation

- FDIC V Citibank PDFDocument44 pagesFDIC V Citibank PDFdrattyPas encore d'évaluation

- 11th Cir Refuses To Hold Assignee Liable Under TILA For Failing To Provide Payoff StatementDocument4 pages11th Cir Refuses To Hold Assignee Liable Under TILA For Failing To Provide Payoff StatementdrattyPas encore d'évaluation

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (120)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- Turkish Leasing MarketDocument16 pagesTurkish Leasing Marketlévai_gáborPas encore d'évaluation

- Fraud Expert Identifies Fraudulent Mortgage Assignments Tied To Troubling MA Foreclosure Case.Document1 pageFraud Expert Identifies Fraudulent Mortgage Assignments Tied To Troubling MA Foreclosure Case.Mohan Harihar100% (1)

- JD - Financial Analyst-XL Dynamics India Pvt. Ltd.Document2 pagesJD - Financial Analyst-XL Dynamics India Pvt. Ltd.shaileshbhoi100% (1)

- Performance Evaluation of PNB and HDFC BankDocument58 pagesPerformance Evaluation of PNB and HDFC BankEkam Jot100% (1)

- Tutorial 1: 1. What Is The Basic Functions of Financial Markets?Document6 pagesTutorial 1: 1. What Is The Basic Functions of Financial Markets?Ramsha ShafeelPas encore d'évaluation

- Jutic v. CaDocument8 pagesJutic v. CaYang AlcoranPas encore d'évaluation

- Long-Run Trends in Housing Price Growth - RBADocument10 pagesLong-Run Trends in Housing Price Growth - RBAjHexstPas encore d'évaluation

- Pennock v. Coe, 64 U.S. 117 (1860)Document15 pagesPennock v. Coe, 64 U.S. 117 (1860)Scribd Government DocsPas encore d'évaluation

- Tax Planning Strategies and Wealth Management Unit 2Document47 pagesTax Planning Strategies and Wealth Management Unit 2ANAM AFTAB 22GSOB2010404Pas encore d'évaluation

- Acme Shoe V CaDocument2 pagesAcme Shoe V CaCatherine MerillenoPas encore d'évaluation

- Unit 2 Financial MarketDocument20 pagesUnit 2 Financial MarketChristine Kaye Damolo0% (1)

- Finance - Mortgage Lab Reflective WritingDocument3 pagesFinance - Mortgage Lab Reflective Writingapi-272876382Pas encore d'évaluation

- Non - Bank Financial Institutions and Economic Growth in NigeriaDocument57 pagesNon - Bank Financial Institutions and Economic Growth in Nigeriajayeoba oluwaseyi100% (1)

- Bank of America REO Purchase AddendumDocument16 pagesBank of America REO Purchase AddendumBradPas encore d'évaluation

- TIH Financial Freedom EbookDocument15 pagesTIH Financial Freedom EbookRajeev Kumar PandeyPas encore d'évaluation

- JPM Brazil Real EstateDocument286 pagesJPM Brazil Real EstatePedro FerreiraPas encore d'évaluation

- LESSON PLAN 10 - The Danger of Debt - Avoiding Financial PitfallsDocument8 pagesLESSON PLAN 10 - The Danger of Debt - Avoiding Financial PitfallsKyla AcyatanPas encore d'évaluation

- Tablas Caso Examen HHCDocument12 pagesTablas Caso Examen HHCCristian MuñozPas encore d'évaluation

- ACCTG 028 - MOD 5 Corporate LiquidationDocument4 pagesACCTG 028 - MOD 5 Corporate LiquidationAlliah Nicole RamosPas encore d'évaluation

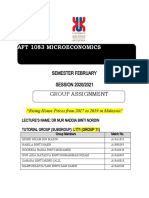

- Aft 1083 Microeconomics: Group AssignmentDocument10 pagesAft 1083 Microeconomics: Group AssignmentFauzan MananPas encore d'évaluation

- Ferrel L. Agard,: DebtorDocument20 pagesFerrel L. Agard,: DebtorJfresearch06100% (1)

- PledgeDocument6 pagesPledgeGlen Mervin EsguerraPas encore d'évaluation

- Inside Job The Documentary That Cost 20 000 000 000 000 To ProduceDocument30 pagesInside Job The Documentary That Cost 20 000 000 000 000 To ProducePedro José ZapataPas encore d'évaluation

- Rural Vs CADocument2 pagesRural Vs CALA AIPas encore d'évaluation

- BML 211 Money & BankingDocument103 pagesBML 211 Money & BankingWesleyPas encore d'évaluation

- Integrated Reaty Corp. Vs PNBDocument8 pagesIntegrated Reaty Corp. Vs PNBaudreyracelaPas encore d'évaluation

- Contract of Sales 2Document88 pagesContract of Sales 2Desiree100% (2)

- Disability Allowance: Application Form ForDocument36 pagesDisability Allowance: Application Form ForVlad BelovPas encore d'évaluation

- Use Case StudyDocument4 pagesUse Case StudyDustin ShepherdPas encore d'évaluation

- DPC Problems 2023 PDFDocument5 pagesDPC Problems 2023 PDFAkshay KumarPas encore d'évaluation