Académique Documents

Professionnel Documents

Culture Documents

BraveheartsBest (C) Mar31 14

Transféré par

PraveenTitre original

Copyright

Formats disponibles

Partager ce document

Partager ou intégrer le document

Avez-vous trouvé ce document utile ?

Ce contenu est-il inapproprié ?

Signaler ce documentDroits d'auteur :

Formats disponibles

BraveheartsBest (C) Mar31 14

Transféré par

PraveenDroits d'auteur :

Formats disponibles

March 31, 2014

A Sharekhan commodity research newsletter

Gold: near strong support

KST

5

4

3

2

1

0

-1

-2

-3

-4

Weekly close: $1,293.50

Gold in the last few months had fallen down in a threewave manner. It reached near lower end of the mediumterm falling channel as well as near the previous low of

$1,180. At that level the bulls rushed in to provide support

to the yellow metal. Thus, gold formed a double-bottom

pattern-a bullish pattern. Consequently, the yellow metal

moved up sharply. It broke out from the medium-term

falling channel and retraced till the 78.6% retracement

mark. The rise is also unfolding in a channelised manner.

Recently gold has done a minor degree correction and is

trading near the crucial Fibonacci retracement level. From

here the bulls can take the charge once again. Unless the

level of $1,264 (the 61.8% retracement level) breaks on a

closing basis gold can move up to test the high of $1,392.

Trend

Trend

Reversal

Supports

Up

$1,264.0

$1,288/1,264

Resistances

$1,337/1,392

GOLD [CASH], Parabolic SAR

1460

1450

1440

1430

1420

1410

1400

1392

0.0%

1390

1380

1370

1360

1350

1340

1330

1320

1310

1300

1290

50.0%

1280

1270

61.8%

1260

1264

1250

1240

1230

1220

1210

1200

1190

100.0%

1180

1170

1160

19

26

2

9

16

September

23

30

7

Oc tober

14

21

28

4

11

November

18

25

2

9

16

December

23

30

6

2014

13

20

27

3

10

February

17

24

3

10

March

17

24

31

7

April

14

21

28

5

May

Target

$1,392.0

Silver: at a crucial juncture

KST

8

7

6

5

4

3

2

1

0

-1

-2

-3

-4

-5

-6

Weekly close: $19.770

Silver was falling in a medium-term falling channel since

the last few months. It found support near the lower

channel line. The bulls provided support to the white metal

near the channel line. As a result silver broke out from the

upper channel line. It reached its initial target of $21.98

ie the 50% retracement mark. From there the commodity

is forming a minor degree correction, which can be used

as a buying opportunity. The correction has retraced 78.6%

of the previous rise. Unless the medium-term rising trend

line ie $19.00 breaks on a closing basis, silver is expected

to head up to test the high of $22.16.

Trend

Up

Trend

Reversal

Supports

Resistances

Target

$19.00

$19.54/19.00

$20.66/21.76

$22.16

SILVER [CASH], Parabolic SAR

23.0

22.5

22.16

0 .0%

22.0

21.5

21.0

20.5

20.0

7 8.6%

19.5

19.0

19.00

1 00.0%

18.5

9

ember

16

23

30

6

2014

13

20

27

3

10

February

17

24

3

Marc h

10

17

24

31

April

14

21

28

5

May

For Private Circulation only

Sharekhan Ltd, Regd Add: 10th Floor, Beta Building, Lodha iThink Techno Campus, Off. JVLR, Opp. Kanjurmarg Railway Station, Kanjurmarg (East),

Mumbai 400042, Maharashtra. Tel: 022 - 61150000. Sharekhan Ltd.: SEBI Regn. Nos. BSE-Cash-INB011073351 ; F&O-INF011073351 ; NSE INB/

INF231073330; CD - INE231073330 ; MCX Stock Exchange: INB/INF-261073333 ; CD - INE261073330 ; United Stock Exchange: CD - INE271073350 ; DPNSDL-IN-DP-NSDL-233-2003 ; CDSL-IN-DP-CDSL-271-2004 ; PMS-INP000000662 ; Mutual Fund-ARN 20669 ; Commodity trading through Sharekhan

Commodities Pvt. Ltd.: MCX-10080 ; (MCX/TCM/CORP/0425) ; NCDEX -00132 ; (NCDEX/TCM/CORP/0142) ; For any complaints email at igc@sharekhan.com

; Disclaimer: Client should read the Risk Disclosure Document issued by SEBI & relevant exchanges and Dos & Donts by MCX & NCDEX and the T & C

on www.sharekhan.com before investing.

Sharekhan

Bravehearts Best (Commodities)

Copper: bearish potential intact

10

KST

Weekly close: $3.0415

-5

-10

HG COPPER CONTINUOUS 25000 LBS [COMEX]

Copper is in a downtrend from the medium-term

perspective. The fall is breaking up into lower degree

waves. The weekly momentum indicator has started a new

cycle on the downside from the equilibrium line. As a result

the price has fallen below multiple supports. However,

the red metal can attempt a minor degree bounce till

$3.00-$3.05. Our sense is that it is retesting the trend

line. Unless the level of $3.10 is crossed on a closing basis

the overall bearish potential remains intact. The

subsequent target on the downside is $2.73 ie the lower

end of the medium-term falling channel.

Trend

Trend

Reversal

Supports

Resistances

Target

Down

$3.100

$2.87/2.73

$3.10/3.32

$2.730

4.05

4.00

3.95

3.90

3.85

3.80

3.75

3.70

3.65

3.60

3.55

3.50

3.45

3.40

3.35

3.30

3.25

3.20

3 .1 0

3.15

3.10

3.05

3.00

2.95

2.90

2.85

2.80

2.75

2 .7 3

2.70

2.65

2.60

2012 Feb

Mar

Apr

May

J un

Jul

Aug

Sep

Oc t

Nov

Dec

2013 Feb

Mar

Apr

May

Jun

J ul

Aug

Sep

Oc t

Nov

Dec

2014

Feb

Mar

Apr

May

Jun

J ul

Aug

Sep

Crude oil: Bears Warming up

KST

4

3

Weekly close: $101.67

2

1

0

-1

-2

-3

-4

NYMEX crude oil recently formed a sharp pull-back. It

retraced 61.8% of the previous fall. We expect crude oil

to face resistance at this crucial Fibonacci retracement

level ($101.25). The momentum indicator has completed

its pullback cycle to the equilibrium line. Overall, crude

oil is expected to test the previous low of $91.24. The

reversal can be placed at $105.22 on a closing basis.

-5

LIGHT CRUDE CONTINUOUS 1000 BARRELS [NYMEX], Parabolic SAR

106.5

106.0

105.5

105.0

104.5

104.0

103.5

103.0

102.5

102.0

101.5

101.0

100.5

100.0

99.5

99.0

98.5

98.0

97.5

97.0

96.5

96.0

95.5

95.0

94.5

105.22

1 00.0%

6 1.8%

0 .0 %

94.0

93.5

93.0

92.5

92.0

91.5

91.25

91.0

90.5

90.0

Trend

Down

Trend

Reversal

Supports

$105.22

$97.3/91.24

Resistances

89.5

89.0

Target

88.5

9

ecember

For Private Circulation only

$102.4/103

16

23

30

6

2014

13

21

27

3

10

February

18

24

3

Marc h

10

17

24

31

April

14

21

28

5

May

$91.24

Bravehearts Best

(Commodities)

March 31, 2014

Home

Sharekhan

Bravehearts Best (Commodities)

Jeera: finds support

70

65

60

55

50

45

40

35

30

25

20

Relativ e Strength Index

Weekly close: Rs10,065

JEERA QUINTAL - 1 MONTH

1 61 .8 %

The adjoining is a weekly chart of NCDEX jeera April 2014

contract. Jeera has been in a medium-term downtrend.

Last week we observed jeera found support near the 9800

levels and has closed positively for the week. On the lower

degree time frame ie on the daily charts it is still trading

below the 20 and 40-daily moving averages. The daily

Bollinger Bands are contracting, which indicates that we

might witness sideways consolidation price actions in the

coming trading sessions. If the low of 9785 is broken on

the downside then we can see a further sell-off in the

agri-commodity. The weekly momentum indicator has a

negative crossover. We expect jeera to trade weak and

target on the downside is placed at 9255, which is the

161.8% extension level of the previous wave. Traders can

go short on jeera when the low of 9785 is broken on the

downside. The stop-loss should be placed at 10,832, which

is the 40-day exponential moving average.

Trend

Trend

Reversal

Down

Rs10,832

Supports

Rs9,785/

Rs9,255

Resistances

Target

Rs10,310/

Rs10,832

Rs9,255

19500

19000

18500

18000

17500

17000

1 00 .0 %

16500

16000

15500

15000

14500

14000

13500

13000

0 .0 %

12500

12000

11500

11000

10500

10000

9500

9 25 5

9000

Aug

Sep Oct

Nov Dec

2012

Mar

Apr

May Jun

Jul

Aug Sep

Oc t Nov Dec

2013

Soya bean: stuck in a range

Volume

Mar

Apr

May J un

J ul

Aug

Sep Oc t

Nov

Dec 2014

Mar

Apr

May

J un

Jul

Aug

Sep

KST

15

10

Weekly close: Rs4,314

5

0

-5

-10

The adjoining chart is a weekly chart of NCDEX soya bean

April contract. We can observe that for the past one month

soya bean has been trading in a range. Last week the agri

commodity took support near the lower end of the range

and closed in positive. We expect this range to break on

the upside. The weekly momentum indicator has a positive

cross-over and it is trading along the weekly upper Bollinger

Band, which is expanding. It indicates that the positive

momentum in the agri commodity can continue on the

upside. Traders should hold on to the long positions with a

stop loss placed at Rs4,163, which is the lower end of the

range. The targets on the upside are placed at Rs4,500,

which is the highest ever closing for soya bean.

Trend

Up

Trend

Reversal

Supports

Resistances

Target

Rs4,163

Rs4,163/

Rs4,022

Rs4,345/

Rs4,500

Rs4,500

For Private Circulation only

Bravehearts Best

(Commodities)

-15

4600

SOYBEAN QUINTAL - 1 MONTH, Parabolic SAR

4500

4400

4300

4200

4100

4000

3900

3800

3700

3600

3500

3400

3300

3200

3100

3000

2900

2800

June

July

August

September

March 31, 2014

October

November

December

2014

Volume

February

March

April

May

June

July

August

September

Home

Sharekhan

Bravehearts Best (Commodities)

For Private Circulation only

Visit us at www.sharekhan.com

Home

"This document has been prepared by Sharekhan Commodities Pvt. Ltd. and is intended only for the person or entity to which it is addressed to and may contain

confidential and/or privileged material and is not for any type of circulation. Any review, retransmission, or any other use is prohibited. Kindly note that this document

does not constitute an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. If you have received this

in error, please contact the sender and delete the material immediately from your computer/mailbox. The information contained herein is from sources believed

reliable. We do not represent that it is accurate or complete and it should not be relied upon as such. We may from time to time have positions in, or options on, and buy

March

31, 2014

and sell

securities

referred to herein.

to time solicit Best

from, or4 perform

investment

banking, or other services for, any company mentioned. Any

For

Private

Circulation

only We may from time Bravehearts

Home

comments or statements made herein do not necessarily reflect

those of Sharekhan Commodities Pvt. Ltd."

(Commodities)

Vous aimerez peut-être aussi

- Comparison of NDA Vote Share 2016 & 2011 Respectively in KeralaDocument3 pagesComparison of NDA Vote Share 2016 & 2011 Respectively in KeralaPraveenPas encore d'évaluation

- Broader Market Gaining Momentum: Punter's CallDocument4 pagesBroader Market Gaining Momentum: Punter's CallPraveenPas encore d'évaluation

- Soybean Near Key Retracement Level: Punter's CallDocument3 pagesSoybean Near Key Retracement Level: Punter's CallPraveen100% (1)

- Here's The RAV4 XLE FWD 2.5L 4-Cyl.: Starting MSRPDocument8 pagesHere's The RAV4 XLE FWD 2.5L 4-Cyl.: Starting MSRPPraveenPas encore d'évaluation

- Bulls and Bears On Rest: Punter's CallDocument6 pagesBulls and Bears On Rest: Punter's CallPraveenPas encore d'évaluation

- CurrencyInfoKit 110714Document2 pagesCurrencyInfoKit 110714PraveenPas encore d'évaluation

- EagleEye-Sep30 15 (E)Document5 pagesEagleEye-Sep30 15 (E)PraveenPas encore d'évaluation

- Bull Positions Cut On Rate Cut: Punter's CallDocument4 pagesBull Positions Cut On Rate Cut: Punter's CallPraveenPas encore d'évaluation

- A Quiet Session: Punter's CallDocument4 pagesA Quiet Session: Punter's CallPraveenPas encore d'évaluation

- Bulls Eye RBI: Punter's CallDocument4 pagesBulls Eye RBI: Punter's CallPraveenPas encore d'évaluation

- Tough Fight For Weekly Close: Punter's CallDocument3 pagesTough Fight For Weekly Close: Punter's CallPraveenPas encore d'évaluation

- BraveheartsBest (C) May05 14Document4 pagesBraveheartsBest (C) May05 14PraveenPas encore d'évaluation

- BraveheartsBest (C) Mar25 13Document4 pagesBraveheartsBest (C) Mar25 13Praveen100% (1)

- The Yellow House: A Memoir (2019 National Book Award Winner)D'EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Évaluation : 4 sur 5 étoiles4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceD'EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceÉvaluation : 4 sur 5 étoiles4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeD'EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeÉvaluation : 4 sur 5 étoiles4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingD'EverandThe Little Book of Hygge: Danish Secrets to Happy LivingÉvaluation : 3.5 sur 5 étoiles3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaD'EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaÉvaluation : 4.5 sur 5 étoiles4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeD'EverandShoe Dog: A Memoir by the Creator of NikeÉvaluation : 4.5 sur 5 étoiles4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureD'EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureÉvaluation : 4.5 sur 5 étoiles4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItD'EverandNever Split the Difference: Negotiating As If Your Life Depended On ItÉvaluation : 4.5 sur 5 étoiles4.5/5 (838)

- Grit: The Power of Passion and PerseveranceD'EverandGrit: The Power of Passion and PerseveranceÉvaluation : 4 sur 5 étoiles4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryD'EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryÉvaluation : 3.5 sur 5 étoiles3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerD'EverandThe Emperor of All Maladies: A Biography of CancerÉvaluation : 4.5 sur 5 étoiles4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyD'EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyÉvaluation : 3.5 sur 5 étoiles3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealD'EverandOn Fire: The (Burning) Case for a Green New DealÉvaluation : 4 sur 5 étoiles4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersD'EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersÉvaluation : 4.5 sur 5 étoiles4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnD'EverandTeam of Rivals: The Political Genius of Abraham LincolnÉvaluation : 4.5 sur 5 étoiles4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaD'EverandThe Unwinding: An Inner History of the New AmericaÉvaluation : 4 sur 5 étoiles4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreD'EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreÉvaluation : 4 sur 5 étoiles4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)D'EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Évaluation : 4.5 sur 5 étoiles4.5/5 (121)

- Her Body and Other Parties: StoriesD'EverandHer Body and Other Parties: StoriesÉvaluation : 4 sur 5 étoiles4/5 (821)

- 5 - Perception and Individual Decision Making in Organizational BehaviorDocument25 pages5 - Perception and Individual Decision Making in Organizational BehaviorJanaVrsalovićPas encore d'évaluation

- NCDC-2 Physical Health Inventory Form A4Document6 pagesNCDC-2 Physical Health Inventory Form A4knock medinaPas encore d'évaluation

- 2008 Kershaw CatalogDocument38 pages2008 Kershaw CatalogDANILA MARECHEKPas encore d'évaluation

- Performance Evaluation of The KVM Hypervisor Running On Arm-Based Single-Board ComputersDocument18 pagesPerformance Evaluation of The KVM Hypervisor Running On Arm-Based Single-Board ComputersAIRCC - IJCNCPas encore d'évaluation

- Catch Up RPHDocument6 pagesCatch Up RPHபிரதீபன் இராதேPas encore d'évaluation

- Marine-Derived Biomaterials For Tissue Engineering ApplicationsDocument553 pagesMarine-Derived Biomaterials For Tissue Engineering ApplicationsDobby ElfoPas encore d'évaluation

- Subject: PSCP (15-10-19) : Syllabus ContentDocument4 pagesSubject: PSCP (15-10-19) : Syllabus ContentNikunjBhattPas encore d'évaluation

- Chapter I. Scope of Distributive Trade StatisticsDocument11 pagesChapter I. Scope of Distributive Trade StatisticsNguyễn Hà Diệu LinhPas encore d'évaluation

- Text Extraction From Image: Team Members CH - Suneetha (19mcmb22) Mohit Sharma (19mcmb13)Document20 pagesText Extraction From Image: Team Members CH - Suneetha (19mcmb22) Mohit Sharma (19mcmb13)suneethaPas encore d'évaluation

- Transformational LeadershipDocument75 pagesTransformational LeadershipvincentpalaniPas encore d'évaluation

- Ebook Stackoverflow For ItextDocument336 pagesEbook Stackoverflow For ItextAnonymous cZTeTlkag9Pas encore d'évaluation

- Under Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisDocument13 pagesUnder Suitable Conditions, Butane, C: © OCR 2022. You May Photocopy ThisMahmud RahmanPas encore d'évaluation

- MMB & DFT 2012 Workshop ProceedingsDocument44 pagesMMB & DFT 2012 Workshop ProceedingsFelipe ToroPas encore d'évaluation

- Nuttall Gear CatalogDocument275 pagesNuttall Gear Catalogjose huertasPas encore d'évaluation

- Volvo Catalog Part2Document360 pagesVolvo Catalog Part2Denis Konovalov71% (7)

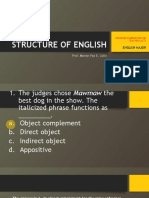

- LET-English-Structure of English-ExamDocument57 pagesLET-English-Structure of English-ExamMarian Paz E Callo80% (5)

- YhhjjDocument52 pagesYhhjjSam CunananPas encore d'évaluation

- USTH Algorithm RecursionDocument73 pagesUSTH Algorithm Recursionnhng2421Pas encore d'évaluation

- Eaai S 23 02045 PDFDocument28 pagesEaai S 23 02045 PDFAnjali JainPas encore d'évaluation

- Lugam Annex Elementary School Second Quarter Second Periodical Test in EPP 6 H.EDocument4 pagesLugam Annex Elementary School Second Quarter Second Periodical Test in EPP 6 H.Ejess amielPas encore d'évaluation

- PRINCIPLES OF TEACHING NotesDocument24 pagesPRINCIPLES OF TEACHING NotesHOLLY MARIE PALANGAN100% (2)

- 2022 NEDA Annual Report Pre PubDocument68 pages2022 NEDA Annual Report Pre PubfrancessantiagoPas encore d'évaluation

- Bugatti Type 57SCDocument10 pagesBugatti Type 57SCjorge Angel Lope100% (1)

- Alto Hotel Melbourne GreenDocument2 pagesAlto Hotel Melbourne GreenShubham GuptaPas encore d'évaluation

- Case Study in Architectural Structures: A-7E Avionics System - ADocument36 pagesCase Study in Architectural Structures: A-7E Avionics System - Ajckz8Pas encore d'évaluation

- Translations Telugu To English A ClassifDocument111 pagesTranslations Telugu To English A ClassifGummadi Vijaya KumarPas encore d'évaluation

- Ace 2Document184 pagesAce 2Raju LaxmipathiPas encore d'évaluation

- EvolutionCombatMedic 2022Document17 pagesEvolutionCombatMedic 2022smith.kevin1420344100% (1)

- MARTELINO Vs Alejandro DigestDocument1 pageMARTELINO Vs Alejandro Digestheirarchy100% (2)

- Retail Operations ManualDocument44 pagesRetail Operations ManualKamran Siddiqui100% (2)